Market Overview:

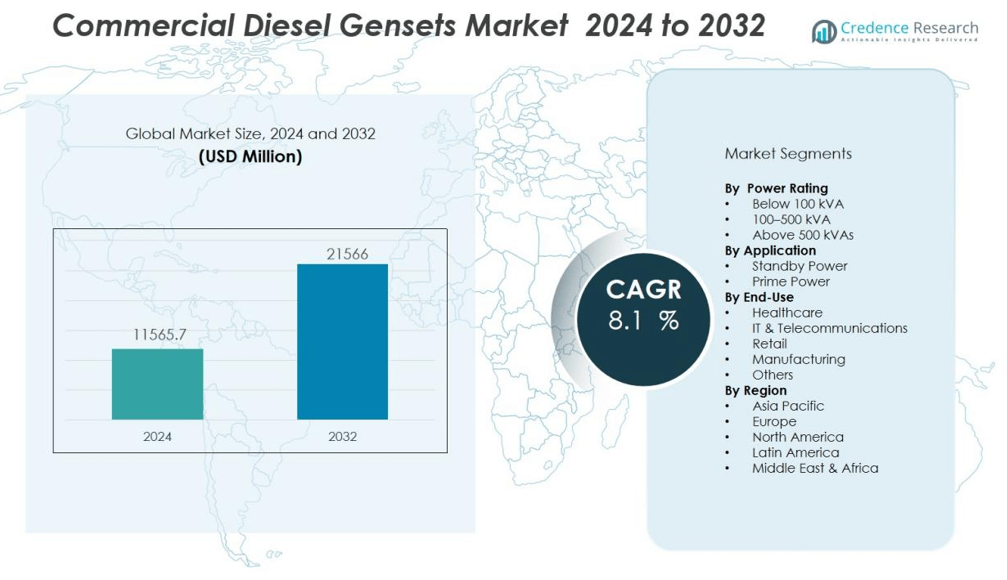

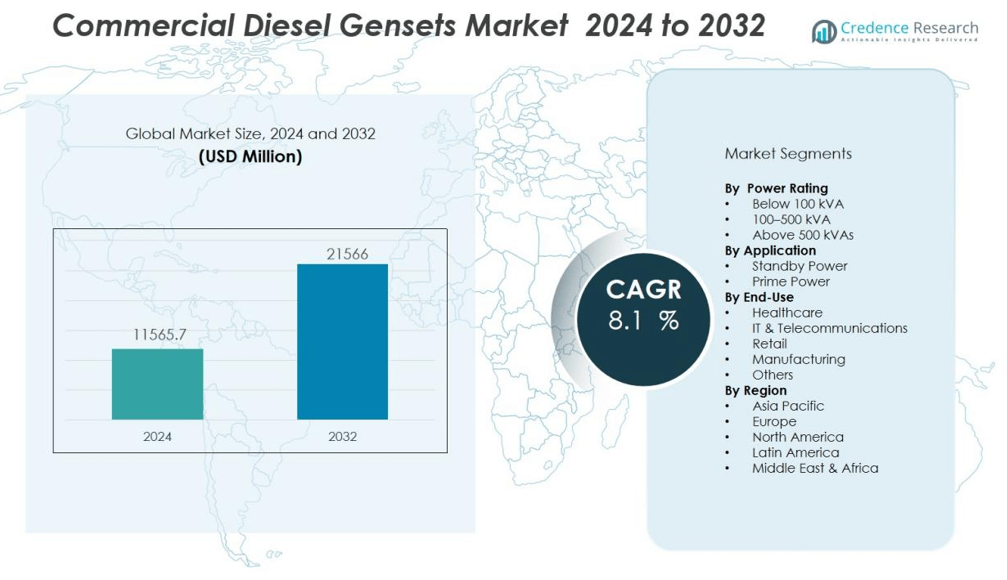

The Commercial diesel gensets market size was valued at USD 11565.7 million in 2024 and is anticipated to reach USD 21566 million by 2032, at a CAGR of 8.1 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Diesel Gensets Market Size 2024 |

USD 11565.7 million |

| Commercial Diesel Gensets Market, CAGR |

8.1% |

| Commercial Diesel Gensets Market Size 2032 |

USD 21566 million |

Key drivers propelling the commercial diesel gensets market include escalating power outages and grid unreliability in emerging economies, which prompt businesses to invest in autonomous power generation. Stringent regulatory frameworks encouraging low emissions and fuel-efficient technologies further stimulate product innovation and adoption. The expanding commercial infrastructure, particularly in sectors such as healthcare, data centers, and retail, intensifies the need for dependable power solutions. Additionally, advancements in genset technology that enhance operational efficiency and reduce maintenance costs drive market demand.

Regionally, North America dominates the commercial diesel gensets market due to its mature industrial base, well-established power infrastructure, and stringent regulatory environment favoring clean diesel technology. Europe follows closely, supported by investments in energy resilience and sustainability initiatives. The Asia-Pacific region is expected to register the fastest growth, fueled by rapid urbanization, expanding commercial activities, and frequent power supply challenges in countries like India, China, and Southeast Asia. Other regions such as Latin America and the Middle East also present significant growth opportunities driven by infrastructure development and industrial expansion.

Market Insights:

- The Commercial diesel gensets market was valued at USD 11,565.7 million in 2024 and is projected to reach USD 21,566 million by 2032, driven by strong growth factors.

- Escalating power outages and unreliable grids in emerging economies push businesses to invest heavily in autonomous and reliable power generation solutions.

- Stringent regulatory frameworks promoting low emissions and fuel-efficient technologies accelerate innovation and market adoption.

- Rapid expansion of commercial infrastructure, especially in healthcare, data centers, and retail sectors, intensifies demand for dependable power backup systems.

- North America leads the market with nearly 35% revenue share, supported by mature industry, advanced infrastructure, and strict environmental regulations.

- Europe holds approximately 28% market revenue, driven by strong emission standards and investments in hybrid genset technologies.

- Asia-Pacific shows the fastest growth due to rapid urbanization, frequent power interruptions, and rising infrastructure projects in countries like India, China, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Reliable Backup Power in Commercial Sectors:

The Commercial diesel gensets market experiences strong growth driven by the increasing need for reliable backup power in commercial establishments. Frequent power outages and unstable electricity supply in emerging economies compel businesses to invest in dependable gensets. It ensures uninterrupted operations in critical sectors such as healthcare, data centers, and retail, where power reliability directly impacts productivity and safety. The ability to provide consistent power during grid failures makes diesel gensets a preferred choice for commercial users.

- For instance, St. Luke’s Cedar Rapids Hospital employed three Cat® 3512C diesel generator sets delivering 4.5 MW of standby power, maintaining 100% uptime for 48 hours during the August 2020 derecho.

Expansion of Commercial Infrastructure and Industrialization:

Rapid industrialization and expansion of commercial infrastructure significantly fuel the market growth. Growing urbanization in developing regions drives demand for new commercial buildings, manufacturing units, and service facilities requiring dependable power sources. The Commercial diesel gensets market benefits from this trend by catering to the increasing number of power backup requirements in these growing commercial spaces. This surge in construction and industrial activities translates into higher genset adoption for both prime and standby power applications.

- For instance, Caterpillar delivered four new C32 diesel generator sets, each rated at 1MW, for a North American technology park expansion in 2024, enabling continuous operation and zero downtime for critical server rooms.

Technological Advancements Enhancing Efficiency and Compliance:

Ongoing technological advancements enhance the fuel efficiency and emission compliance of diesel gensets, boosting market adoption. Innovations focus on optimizing engine performance while meeting stricter environmental regulations and emission standards worldwide. It enables manufacturers to produce gensets that offer lower operating costs and reduced environmental impact, addressing customer demand for sustainable yet reliable power solutions. This focus on cleaner technology sustains market momentum amid tightening regulatory landscapes.

Growing Emphasis on Energy Security and Operational Continuity:

Businesses increasingly prioritize energy security and operational continuity to safeguard their assets and reputation. The Commercial diesel gensets market plays a crucial role by offering resilient power solutions that minimize downtime risks. It provides businesses with control over power availability, independent of external grid conditions. This strategic importance of gensets in maintaining uninterrupted commercial operations continues to drive steady demand globally.

Market Trends:

Increasing Integration of Digital Monitoring and Smart Control Technologies:

The Commercial diesel gensets market is witnessing a growing trend toward the integration of digital monitoring systems and smart controls. It enables real-time tracking of operational parameters such as fuel consumption, engine health, and performance efficiency. These technologies enhance predictive maintenance capabilities, reducing downtime and operational costs for end users. Remote monitoring and automation allow seamless management of genset operations, improving reliability and responsiveness. Manufacturers are investing in advanced IoT-enabled solutions to meet customer demands for smarter, data-driven power management. This shift toward digitalization transforms traditional gensets into more intelligent and user-friendly systems, supporting business continuity in commercial applications.

- For instance, Cummins offers PowerCommand 500 monitoring systems capable of tracking key parameters (like alternator and engine data) and allowing remote operational control of up to two generators or transfer switches from any location with network connectivity.

Shift Toward Cleaner and More Fuel-Efficient Diesel Engines:

The market is moving toward cleaner and more fuel-efficient diesel gensets driven by stringent environmental regulations and rising awareness of sustainability. Manufacturers are developing low-emission engines compliant with global standards such as Tier 4 and Stage V. It improves air quality while maintaining the high power output and durability required by commercial users. The adoption of advanced combustion technologies and after-treatment systems helps reduce pollutants and noise levels. This trend reflects the industry’s commitment to minimizing environmental impact without compromising performance. Growing preference for hybrid solutions combining diesel gensets with renewable energy sources further underscores the market’s evolution toward sustainable power generation.

- For instance, Cummins and other major manufacturers have achieved Tier 4 compliance by reducing particulate matter (PM) and nitrogen oxides (NOx) emissions by about 90% compared to previous standards, utilizing advanced exhaust aftertreatment technologies.

Market Challenges Analysis:

Stringent Environmental Regulations Restricting Market Growth:

The Commercial diesel gensets market faces significant challenges due to increasingly stringent environmental regulations worldwide. Governments enforce strict emission norms to reduce air pollution, which raises compliance costs for manufacturers and end users. It compels the adoption of advanced after-treatment technologies and cleaner fuels, increasing the overall system complexity and price. Some regions impose restrictions or bans on diesel-powered equipment in urban and environmentally sensitive areas, limiting market expansion. This regulatory pressure forces the market to innovate rapidly while managing cost pressures, creating a challenging landscape for stakeholders.

Rising Fuel Costs and Increasing Competition from Alternative Technologies:

Volatility in diesel fuel prices presents a major hurdle for the Commercial diesel gensets market, affecting operational expenses and customer willingness to invest. It challenges businesses to maintain cost-effective power generation without sacrificing reliability. Simultaneously, the market faces growing competition from alternative power sources such as natural gas gensets, solar hybrid systems, and battery storage solutions. These alternatives offer lower emissions and operating costs, attracting environmentally conscious commercial users. The need to balance performance, cost, and sustainability intensifies competitive pressure on diesel genset manufacturers.

Market Opportunities:

Expansion into Emerging Markets with Growing Infrastructure Needs:

The Commercial diesel gensets market holds substantial opportunities in emerging economies undergoing rapid urbanization and industrial growth. Increasing investments in infrastructure development, commercial buildings, and manufacturing units drive demand for reliable power backup solutions. It benefits from frequent power outages and underdeveloped grid infrastructure prevalent in regions such as Southeast Asia, Africa, and Latin America. Rising government initiatives to improve energy access and resilience create a favorable environment for genset adoption. Market players can capitalize on these trends by offering tailored, cost-effective solutions designed for local conditions. Expanding distribution networks and after-sales services in these markets further enhance growth potential.

Integration of Hybrid and Renewable Energy Systems for Sustainable Solutions:

There is a growing opportunity for the Commercial diesel gensets market to integrate hybrid systems combining diesel gensets with renewable energy sources like solar and wind. It allows businesses to reduce fuel consumption, lower emissions, and achieve sustainability goals without compromising power reliability. Advances in energy storage and smart control technologies facilitate the effective operation of such hybrid configurations. Market players investing in research and development to offer flexible, hybrid-enabled gensets can differentiate themselves competitively. This trend aligns with increasing corporate focus on environmental responsibility and regulatory compliance, presenting a strategic avenue for long-term growth.

Market Segmentation Analysis:

By Power Rating:

The Commercial diesel gensets market segments its offerings based on power rating, application, and end-use industries to address diverse customer requirements. By power rating, it classifies gensets into categories such as below 100 kVA, 100–500 kVA, and above 500 kVA. The below 100 kVA segment dominates due to its suitability for small to medium commercial establishments requiring compact and cost-effective backup power. Higher power ratings serve larger facilities like industrial plants and data centers that demand substantial and continuous power supply.

- For instance, Triton Power’s TP-JD500-T4F diesel generator delivers 500kVA of reliable backup power, powered by the John Deere 6136CG550 engine, ensuring critical operations remain uninterrupted for industrial clients.

By Application:

By application, the market divides into standby power and prime power segments. Standby power gensets hold a significant share by providing emergency backup during grid failures in critical sectors. Prime power gensets gain traction in remote locations or industries where grid access remains unreliable, supporting continuous operations.

- For instance, Cummins’ C3500 D5e genset supplies 3125 kVA of prime power at 50 Hz, ensuring sustained output in off-grid environments.

By End-Use:

The market further segments by end-use into healthcare, IT & telecommunications, retail, manufacturing, and others. Healthcare and data centers represent prominent end-users, driven by the critical need for uninterrupted power to ensure operational safety and data integrity. Retail and manufacturing sectors also contribute substantially due to their dependence on stable power for daily operations and productivity. This segmentation allows market players to develop specialized genset solutions aligned with the specific demands of each category, enhancing customer satisfaction and market penetration.

Segmentations:

By Power Rating:

- Below 100 kVA

- 100–500 kVA

- Above 500 kVA

By Application:

- Standby Power

- Prime Power

By End-Use:

- Healthcare

- IT & Telecommunications

- Retail

- Manufacturing

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America accounts for nearly 35% of the global Commercial diesel gensets market revenue, maintaining a strong position due to its mature industrial sector and advanced power infrastructure. The region benefits from stringent emission regulations that drive innovation in cleaner diesel genset technologies. It supports diverse applications including healthcare, data centers, and commercial buildings, where uninterrupted power is critical. High adoption rates of digital monitoring and smart control systems further strengthen market demand. The United States dominates regional growth, supported by well-established distribution channels and comprehensive after-sales services. Investments in upgrading aging power grids and increasing focus on energy resilience sustain consistent genset deployment across commercial sectors.

Europe :

Europe contributes approximately 28% to the Commercial diesel gensets market revenue, supported by strong regulatory frameworks and sustainability commitments. The region enforces strict emission standards like Stage V, compelling manufacturers to innovate low-emission diesel genset solutions. It serves commercial applications ranging from retail and hospitality to industrial parks, with a focus on energy efficiency and reliability. Germany, the United Kingdom, and France lead in demand due to ongoing infrastructure modernization and power backup requirements. The region’s push toward hybrid systems combining diesel gensets with renewable energy sources increases market potential. Enhanced government incentives for clean technologies further encourage commercial adoption.

Asia-Pacific :

Asia-Pacific accounts for nearly 30% of the global Commercial diesel gensets market revenue and demonstrates the fastest growth trajectory due to accelerating urbanization and industrialization. Frequent power interruptions and insufficient grid infrastructure in countries such as India, China, and Indonesia create high demand for dependable backup power solutions. It benefits from expanding commercial construction and infrastructure projects requiring flexible and robust genset systems. Government initiatives targeting rural electrification and energy access further stimulate market expansion. Increasing awareness of emission regulations prompts gradual adoption of cleaner and more efficient diesel gensets. Growing investments in hybrid power configurations combining diesel and renewable sources enhance regional opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ashok Leyland

- Atlas Copco

- Cummins

- Aggreko

- Wartsila

- FG Wilson

- Caterpillar

- Powerica

- Rolls-Royce

- Deere & Company

- Huu Toan

- J C Bamford Excavators

- Generac Power Systems

- HIMOINSA

- Mahindra Powerol

Competitive Analysis:

The Commercial diesel gensets market features intense competition among leading global manufacturers striving to enhance product performance and market reach. Key players include Ashok Leyland, Atlas Copco, Cummins, Aggreko, Wartsila, FG Wilson, Caterpillar, Powerica, Rolls-Royce, and Deere & Company. These companies focus on technological innovation, fuel efficiency, and compliance with stringent emission regulations to differentiate their offerings. It leverages extensive distribution networks and strong after-sales service to maintain customer loyalty and expand presence in emerging and established markets. Strategic partnerships, product launches, and regional expansions characterize competitive strategies. The market’s dynamic environment encourages continuous improvement in genset durability, digital integration, and hybrid solutions. This competitive landscape ensures steady advancements and drives the adoption of reliable, sustainable diesel genset systems across commercial sectors globally.

Recent Developments:

- In May 2025 Announced commercial availability of a breakthrough carbon capture solution for the maritime sector.

- In October 2024, Powerica received Letter of Award (LoA) for a 50 MW wind project under SECI ISTS Tranche XVII.

- In November 2024, Marked 20th anniversary of partnership with Mitsubishi Heavy Industries Aero Engines.

Market Concentration & Characteristics:

The Commercial diesel gensets market demonstrates a moderately concentrated structure, with a handful of leading companies commanding significant shares through strong brand presence and extensive global distribution networks. It features established manufacturers that prioritize continuous innovation to meet stringent emission standards and enhance fuel efficiency. The market serves diverse commercial sectors, balancing demand between large enterprises and small to medium-sized businesses requiring dependable power backup. It also experiences competitive pressure from emerging players focusing on niche applications and cost-effective solutions. Customer emphasis on durability, reliability, and low maintenance shapes product development and service strategies. Investments in digital technologies and hybrid power integration enable key players to differentiate offerings and expand market reach. This blend of innovation, strong customer relationships, and strategic partnerships sustains competition while allowing dominant firms to maintain leadership in the market.

Report Coverage:

The research report offers an in-depth analysis based on Power Rating, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Commercial diesel gensets market will increasingly integrate hybrid systems combining diesel engines with renewable energy sources to reduce emissions and fuel costs.

- Manufacturers will focus on developing advanced low-emission engines to comply with tightening environmental regulations globally.

- Adoption of digital monitoring and predictive maintenance technologies will rise, improving operational efficiency and reducing downtime.

- Expanding infrastructure development and urbanization in emerging markets will drive demand for reliable power backup solutions.

- Businesses will prioritize energy security and uninterrupted operations, boosting investments in autonomous and resilient genset systems.

- Customized genset solutions tailored to specific commercial applications and regional requirements will gain prominence.

- Fuel efficiency improvements and noise reduction technologies will enable wider acceptance in noise-sensitive urban areas.

- Collaborations between genset manufacturers and technology firms will accelerate innovation and market penetration.

- The market will see growth in turnkey offerings that combine gensets with energy storage and intelligent control systems.

- Commercial diesel gensets will maintain their role as critical power solutions by balancing durability, performance, and evolving sustainability standards.