Market Overview:

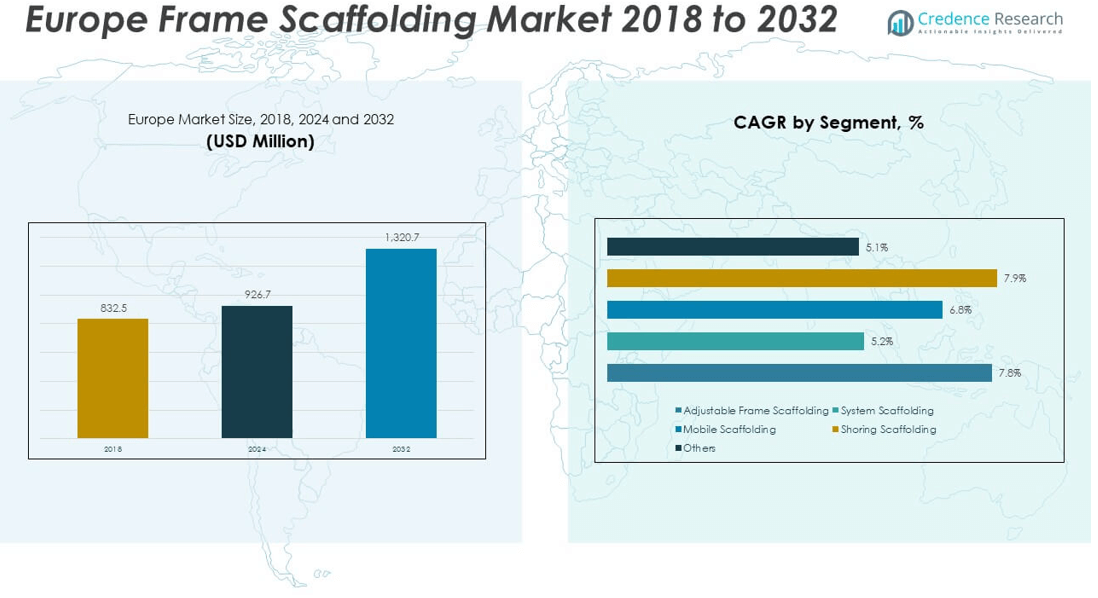

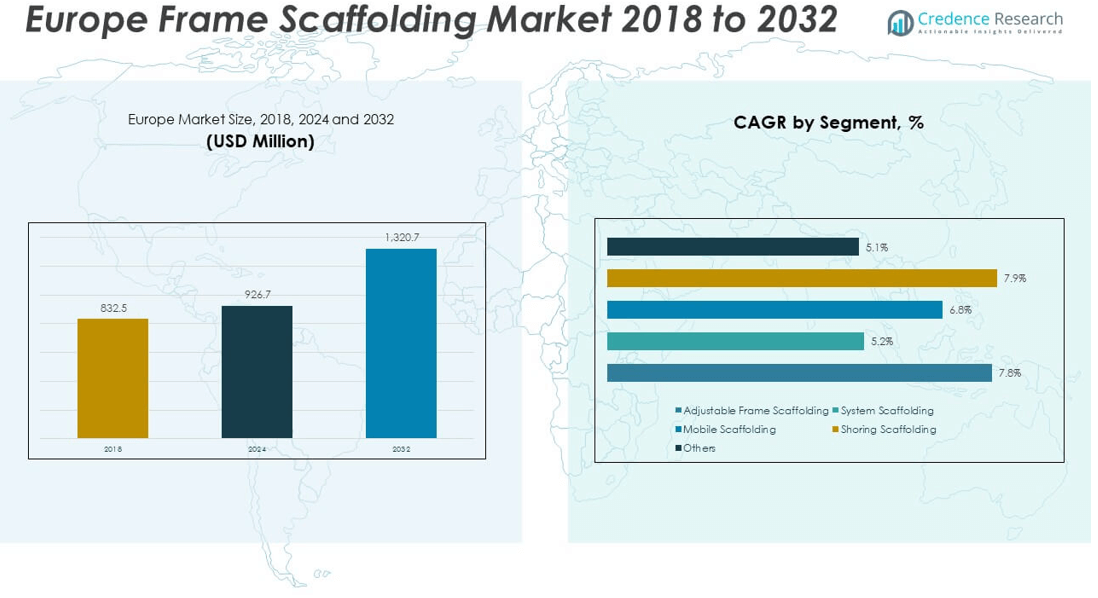

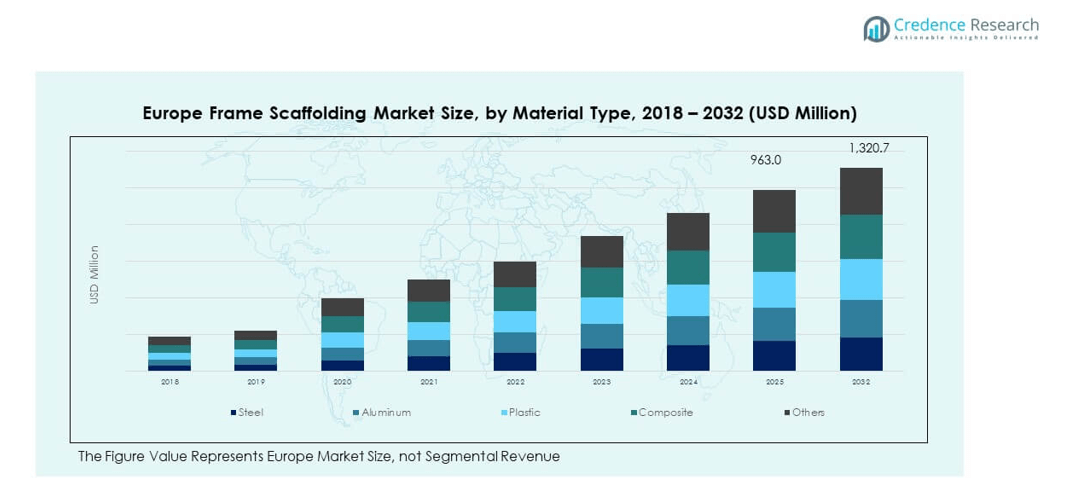

The Europe Frame Scaffolding Market size was valued at USD 832.5 million in 2018 to USD 926.7 million in 2024 and is anticipated to reach USD 1,320.7 million by 2032, at a CAGR of 4.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Frame Scaffolding Market Size 2024 |

USD 926.7 million |

| Europe Frame Scaffolding Market, CAGR |

4.60% |

| Europe Frame Scaffolding Market Size 2032 |

USD 1,320.7 million |

The growth of the Europe Frame Scaffolding Market is driven by rising infrastructure development, renovation activities, and strict worker safety regulations across the construction sector. Urban expansion and commercial projects across Western and Eastern Europe are boosting demand for frame scaffolding due to its modularity, cost-effectiveness, and ease of assembly. Governments are also investing in transport infrastructure upgrades, further supporting scaffold adoption. The need for reliable and efficient temporary support structures in both public and private projects continues to drive product demand across residential, industrial, and commercial construction.

Regionally, Western Europe leads the frame scaffolding market, with countries like Germany, the United Kingdom, and France showing strong adoption due to mature construction industries and stringent safety standards. Germany, with its engineering and construction precision, stands out as a key market. Emerging growth is evident in Central and Eastern Europe, where rising urbanization, increasing foreign investments, and development programs are stimulating construction activities. Countries such as Poland and Romania are witnessing accelerating demand, supported by EU infrastructure funding and industrial expansion.

Market Insights:

- The Europe Frame Scaffolding Market was valued at USD 926.7 million in 2024 and is expected to reach USD 1,320.7 million by 2032, growing at a CAGR of 4.60%.

- The Global Frame Scaffolding Market size was valued at USD 3,890.0 million in 2018 to USD 4,547.9 million in 2024 and is anticipated to reach USD 6,958.9 million by 2032, at a CAGR of 5.54% during the forecast period.

- Rising demand for modular and reusable scaffolding systems across infrastructure, housing, and industrial projects is driving consistent market growth.

- Regulatory pressure from EU safety standards is encouraging the adoption of certified, high-load-bearing frame scaffolding solutions.

- High costs of installation and compliance, along with labor shortages in skilled assembly, are limiting market penetration in cost-sensitive regions.

- Western Europe dominates the market with a 58.3% share, supported by mature construction industries and strong investment in public infrastructure.

- Central and Eastern Europe are emerging as high-growth regions due to EU-funded development and increasing urbanization.

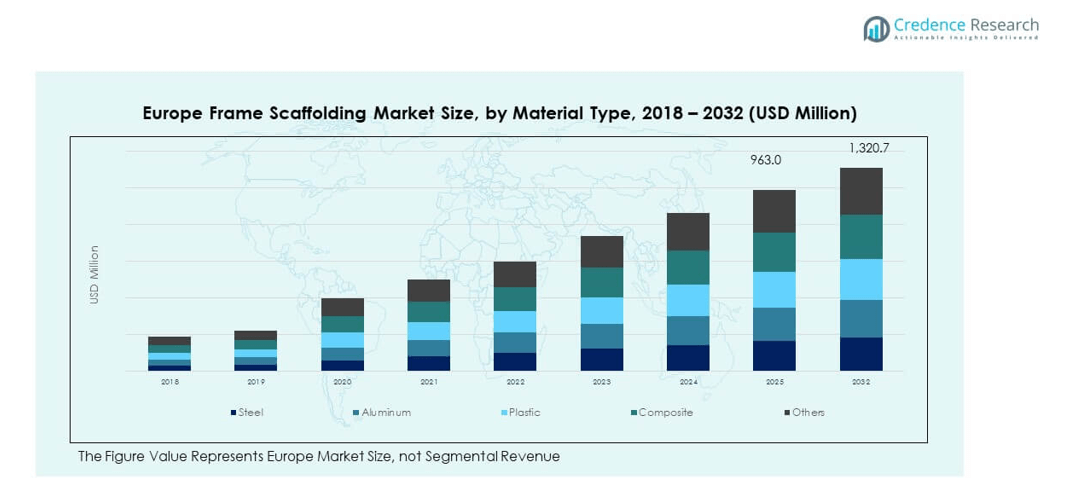

- Growing emphasis on sustainability and circular construction is accelerating demand for aluminum and recyclable frame scaffolding materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Infrastructure and Commercial Construction Across Europe

The Europe Frame Scaffolding Market benefits significantly from the continent’s expanding infrastructure and commercial construction activities. Governments and private developers are investing in transport, energy, and smart city projects, increasing the need for durable scaffolding systems. Frame scaffolding offers safety, speed, and adaptability, making it a preferred choice in high-volume construction environments. Demand is growing in urban development zones and infrastructure upgrades, particularly in roadways, railways, and bridges. Contractors favor frame scaffolding for its cost-efficiency in large-scale vertical projects. It supports faster execution timelines while maintaining compliance with EU safety standards. The market aligns with Europe’s green building initiatives that promote modular and reusable systems. This alignment supports broader adoption and long-term growth.

- For instance, Layher, a leading German scaffolding manufacturer, has supplied its Allround modular scaffolding system to major infrastructure projects like the Berlin Brandenburg Airport, where crews installed over 200,000m² of scaffolding across terminals and structural components, ensuring continuous workflow and rapid assembly.

Strict Worker Safety Regulations and EU Scaffolding Standards

he Europe Frame Scaffolding Market is reinforced by stringent occupational safety regulations enforced by EU authorities. Compliance with EN 12810 and EN 12811 standards drives the adoption of standardized frame scaffolding systems across construction sites. Governments prioritize worker safety, and site inspections ensure proper usage of certified scaffolding. This regulatory environment discourages the use of unsafe or non-compliant alternatives. Manufacturers benefit from stable demand for certified systems, especially those offering superior stability and load-bearing features. It also creates opportunities for premium products equipped with safety locking mechanisms and fall protection features. These regulations elevate the importance of quality over price in procurement decisions. Scaffolding providers who meet or exceed standards maintain a competitive edge.

- For instance, PERI Group’s scaffolding systems are manufactured and certified to comply with EN 12810 and EN 12811 standards, ensuring that their systems can withstand loads up to 600kg/m², supporting multiple workers and heavy materials on high-rise construction projects.

Urban Renovation and Retrofitting Initiatives in Major Cities

Urban renovation programs across aging cities drive the Europe Frame Scaffolding Market by requiring access systems for façade repairs and building upgrades. Governments are funding energy-efficient retrofitting and restoration of historical structures, where frame scaffolding is essential for safe vertical mobility. The modularity of these systems allows easy installation in dense, constrained urban environments. Contractors use them to minimize disruption while performing complex tasks at height. The demand is particularly high in metropolitan areas like Paris, Milan, and Berlin, where building preservation is prioritized. It serves as a reliable support system in both modern upgrades and heritage projects. The ability to assemble and disassemble scaffolding quickly supports project timelines. These dynamics fuel consistent demand across the residential and institutional sectors.

Expansion of Residential Construction Driven by Population Growth

The growth of residential construction supports the Europe Frame Scaffolding Market as demand increases for multi-family units, student housing, and affordable housing developments. Population growth in urban centers pushes the need for vertical housing, driving scaffold usage. Contractors use frame scaffolding for façade work, window installation, and painting. Its safety and adaptability make it ideal for large apartment complexes and mixed-use developments. It meets the technical and logistical needs of residential builders working under tight timelines. Governments supporting social housing initiatives create consistent procurement opportunities for scaffolding suppliers. This expansion fuels recurring demand in both new builds and residential renovation. It strengthens the market’s base and supports steady growth beyond commercial segments.

Market Trends:

Adoption of Lightweight and High-Strength Materials in Scaffolding

Manufacturers in the Europe Frame Scaffolding Market are increasingly using lightweight yet durable materials like aluminum and advanced steel alloys. These materials improve transportability, reduce labor effort, and allow faster assembly and disassembly. Contractors prefer these systems for multi-phase projects with tight timelines and frequent structure modifications. The trend supports sustainability by reducing emissions during transport and handling. Material innovation enables safer, stronger, and lighter scaffolding with extended service life. It aligns with customer preferences for low-maintenance, reusable equipment. Lightweight frame scaffolding also reduces injury risk during handling. This design trend enhances job site productivity and lowers overall project costs.

- For instance, Altrad’s ALTRALIGHT system features frames weighing only 9–12kg depending on size, dramatically reducing manual handling fatigue and allowing assembly/disassembly at a faster pace. Their aluminum beams offer an excellent strength-to-weight ratio and are resistant to corrosion, supporting safer and longer-lasting platforms

Integration of Digital Tools and Scaffold Management Platforms

Digitalization is reshaping the Europe Frame Scaffolding Market through the integration of scaffold management software and IoT-based monitoring tools. Construction companies are adopting digital platforms to plan scaffold layouts, track asset inventory, and schedule maintenance. These tools improve operational efficiency and reduce delays caused by logistical errors. IoT-enabled scaffolding systems allow real-time monitoring of structural stability and load conditions. Digital tracking reduces losses from misplaced or stolen components. It also ensures compliance with safety regulations through automated inspection logs. This trend reflects a broader shift toward smart construction solutions. It enables companies to enhance transparency and accountability across job sites.

- Layher’s SIM platform, for example, leverages 3D digital modeling to plan, assemble, and manage scaffolding structures, facilitating real-time tracking of materials and automated compliance with project-specific safety regulations

Rental Model Expansion Supporting Flexible Project Demands

The rental-based business model continues to gain traction in the Europe Frame Scaffolding Market, especially among small to mid-sized contractors. Renting scaffolding reduces upfront capital costs and provides access to well-maintained, certified systems. This model supports flexibility for short-term or irregular project cycles. Rental providers offer delivery, assembly, and dismantling services, reducing operational burdens for construction firms. Market players are expanding rental fleets to include modular, high-capacity frame systems. This allows customers to scale up or down according to project complexity. The trend supports resource optimization and budget control. It strengthens supplier-client relationships through recurring contracts and service offerings.

Design Customization to Meet Diverse Project Requirements

The Europe Frame Scaffolding Market is witnessing increased demand for customized scaffolding configurations to match project-specific needs. Contractors request adjustable bay widths, stair access modules, and platform extensions. Manufacturers respond by offering scalable systems with modular add-ons. This customization improves on-site efficiency and worker mobility. The trend addresses the diverse requirements of commercial, industrial, and residential segments. It also supports compliance with regional construction codes and project-specific safety standards. Tailored solutions allow scaffolding providers to differentiate their offerings. Custom-built systems are particularly in demand for projects with irregular structures or restricted access zones.

Market Challenges Analysis:

High Cost of Certified Scaffolding Systems and Installation Services

The Europe Frame Scaffolding Market faces challenges related to the high cost of certified scaffolding systems and associated labor. Meeting EU safety and design standards often increases material and production expenses. Small and medium-sized enterprises struggle with budget limitations when procuring top-tier frame scaffolding. Installation and dismantling services also contribute significantly to total project costs. These costs limit adoption, especially in low-margin construction segments. Competitive pricing from uncertified or imported alternatives creates downward pressure on premium offerings. It forces manufacturers to balance quality with affordability. These constraints impact market penetration in cost-sensitive regions or small-scale projects.

Labor Shortages and Inconsistent Training Across Job Sites

A skilled labor shortage poses a major challenge for the Europe Frame Scaffolding Market, particularly during peak construction seasons. The assembly and safe use of scaffolding require trained personnel, but inconsistent training programs across countries create operational risks. Untrained workers increase the likelihood of accidents and non-compliance with EU safety standards. This challenge affects project timelines and insurance liabilities. Companies must invest in on-site training or partner with certified service providers, adding to overhead. It also leads to dependency on a limited pool of qualified workers. The lack of standardized certification across Europe further complicates workforce mobility.

Market Opportunities:

Increased Demand for Sustainable and Reusable Scaffolding Systems

The Europe Frame Scaffolding Market presents opportunities through the rising demand for eco-friendly and reusable systems. Builders are aligning with EU carbon reduction goals and prefer scaffolding solutions that minimize environmental impact. Manufacturers offering recyclable materials and modular designs gain an advantage. Clients now evaluate products based on life-cycle value and sustainability certifications. This opens doors for innovations in circular scaffolding systems. It supports long-term leasing contracts and green building initiatives. Market participants investing in R&D for low-carbon material integration stand to capture a growing environmentally conscious customer base. Sustainability-driven procurement in public projects further reinforces this opportunity.

Growth in Public Infrastructure Projects Across Emerging European Markets

Emerging economies in Central and Eastern Europe offer strong growth potential for the Europe Frame Scaffolding Market. Governments are investing in roads, bridges, and institutional facilities under EU funding programs. These projects demand high volumes of frame scaffolding. Suppliers can expand their presence through strategic partnerships and regional distribution. It creates sustained demand from both public and private sector clients. Ongoing industrialization and urbanization efforts further expand scaffolding applications across commercial and utility sectors. The acceleration of cross-border infrastructure connectivity in the EU enhances long-term market scalability in these emerging regions.

Market Segmentation Analysis:

The Europe Frame Scaffolding Market is segmented by product type, material, and end-use industry, each playing a critical role in shaping market dynamics.

By product type, adjustable frame scaffolding holds a significant share due to its flexibility across varied construction environments. System scaffolding follows closely, favored for its high load-bearing capacity in complex industrial and infrastructure projects. Mobile scaffolding finds traction in maintenance and interior work, while shoring scaffolding supports temporary structural stability during repairs and excavation. The “others” category includes specialized configurations tailored for niche applications.

- For example, Speedy frame scaffolding systems, widely used in Europe, feature standard heights of 2m or 1m and widths of 0.73m—optimized for facade and renovation projects in tight urban spaces.

By material, steel dominates the market owing to its strength, durability, and widespread use in high-rise and heavy-duty projects. Aluminum scaffolding is gaining preference for its lightweight properties and corrosion resistance, making it ideal for quick assembly and disassembly. Plastic and composite materials are emerging as sustainable alternatives in specific low-load applications, offering environmental and safety benefits. Other materials account for a minor share but support customization and innovation in scaffold design.

- Aluminum scaffolds, such as those from Euroscaffold, are increasingly selected for rapid assembly/disassembly. With platform load capacities up to 250kg and compliant to EN 1004, they strike a balance between strength and a significant reduction in transport and labor costs, particularly for time-critical maintenance and multi-storey projects.

By end-use industry, the construction sector leads the Europe Frame Scaffolding Market due to continuous residential, commercial, and infrastructure development. The oil & gas industry relies on scaffold systems for refinery maintenance and structural access. Mining operations demand sturdy systems in underground and open-pit environments. Renewable energy projects, particularly wind and solar, use scaffolding during equipment installation and tower construction. The “others” segment includes industrial manufacturing, shipbuilding, and utility maintenance, contributing to steady market demand.

Segmentation:

By Product Type:

- Adjustable Frame Scaffolding

- System Scaffolding

- Mobile Scaffolding

- Shoring Scaffolding

- Others

By Material:

- Steel

- Aluminum

- Plastic

- Composite

- Other Materials

By End-Use Industry:

- Construction

- Oil & Gas

- Mining

- Renewable Energy

- Others

Regional Analysis:

Western Europe dominates the Europe Frame Scaffolding Market with a market share of 58.3% in 2024, driven by high construction activity in Germany, France, and the United Kingdom. Germany leads the region with robust demand for scaffolding in infrastructure upgrades, industrial projects, and urban housing. The UK construction sector emphasizes modular, safety-compliant systems in high-rise and commercial development. France supports growth through investments in residential retrofitting and public infrastructure. The region benefits from strong regulatory enforcement and established scaffold rental networks. It continues to attract innovation in lightweight and high-load scaffolding designs. The market in Western Europe remains mature yet highly competitive, led by both international and domestic players.

Central Europe holds a 25.6% share in the Europe Frame Scaffolding Market, supported by construction growth in Poland, Austria, and Hungary. Poland emerges as a major contributor due to EU-backed infrastructure development and urbanization. Demand for frame scaffolding rises across rail, road, and energy sectors. The region favors cost-efficient, easy-to-assemble systems to support rapid project execution. It also shows growing interest in rental-based scaffolding models for budget-conscious contractors. Austria and Hungary follow with steady demand in the residential and institutional construction sectors. The market here is evolving, creating opportunities for mid-tier suppliers and region-focused manufacturers.

Eastern Europe accounts for 16.1% of the Europe Frame Scaffolding Market in 2024, with growth prospects driven by modernization and construction policy reforms. Countries like Romania, Bulgaria, and Ukraine are focusing on affordable housing, public facilities, and industrial expansion. It provides rising demand for durable and mobile scaffolding structures. Market penetration remains lower compared to Western Europe but continues to improve with EU integration and foreign direct investment. Local manufacturers compete on cost, while international brands are gaining traction by offering certified and scalable systems. The region’s transition toward quality-focused infrastructure creates a long-term opportunity for scaffold solution providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Layher GmbH

- PERI Group

- Altrad Group

- ULMA Construction

- BrandSafway

- Waco International

- KHK Scaffolding & Formwork LLC

- AT-PAC

- ADTO Group

- Sunshine Enterprise

- Rapid Scaffolding (Engineering) Co., Ltd.

- Pacific Scaffold

- Turbo Scaffolding

Competitive Analysis:

The Europe Frame Scaffolding Market is highly competitive, with key players such as Layher GmbH, PERI Group, Altrad Group, and ULMA Construction leading in innovation, safety standards, and geographic reach. These companies invest in modular systems, lightweight materials, and digital integration to strengthen their market position. BrandSafway and Waco International maintain strong rental and service networks across Europe, supporting large-scale construction and infrastructure projects. Regional players focus on cost-effective solutions and country-specific compliance to capture local demand. The market favors companies that offer certified systems, rapid delivery, and tailored scaffolding packages. Strategic mergers, product launches, and regional expansions drive competitive momentum.

Recent Developments:

- In April 2025, PERI, a leading provider in the European frame scaffolding market, unveiled its innovative product, the Vario Box, at the Bauma 2025 construction trade fair. This new offering is designed specifically for scaffolding construction companies and contractors, serving as a comprehensive storage and logistics solution to enhance on-site efficiency and safety.

Market Concentration & Characteristics:

The Europe Frame Scaffolding Market exhibits moderate to high concentration, with a few dominant global players holding significant market share. It is characterized by strong compliance requirements, high product standardization, and demand for rental-based models. Buyers value safety certifications, quick turnaround times, and technical support. Innovation in design, sustainability, and digital tools shapes competition, while localized service offerings give smaller firms an operational edge. The market is both price- and value-driven, creating space for premium and economy-tier products. Companies that offer integrated services, including delivery, assembly, and inspection, secure long-term contracts. Market leaders continuously expand their geographic footprint to tap emerging construction hubs across Central and Eastern Europe.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Type and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising infrastructure investments across Europe will sustain long-term demand for modular frame scaffolding systems.

- Growth in residential and commercial construction will drive continuous adoption across both urban and semi-urban areas.

- Increasing preference for lightweight and high-strength materials will push innovation in scaffold design and production.

- Regulatory alignment with EU safety standards will reinforce demand for certified, compliant scaffolding products.

- Expansion of the rental model will attract small and mid-sized contractors seeking flexible and cost-effective solutions.

- Technological integration, including digital scaffold planning and IoT-enabled monitoring, will enhance operational efficiency.

- Public sector retrofitting initiatives and heritage restoration projects will boost scaffolding demand in Western Europe.

- Market penetration will rise in Central and Eastern Europe due to urbanization, EU funding, and foreign investments.

- Sustainability requirements will favor recyclable and reusable scaffolding materials, creating product differentiation.

- Strategic mergers and regional expansions by leading companies will intensify competition and broaden service coverage.