Market Overview:

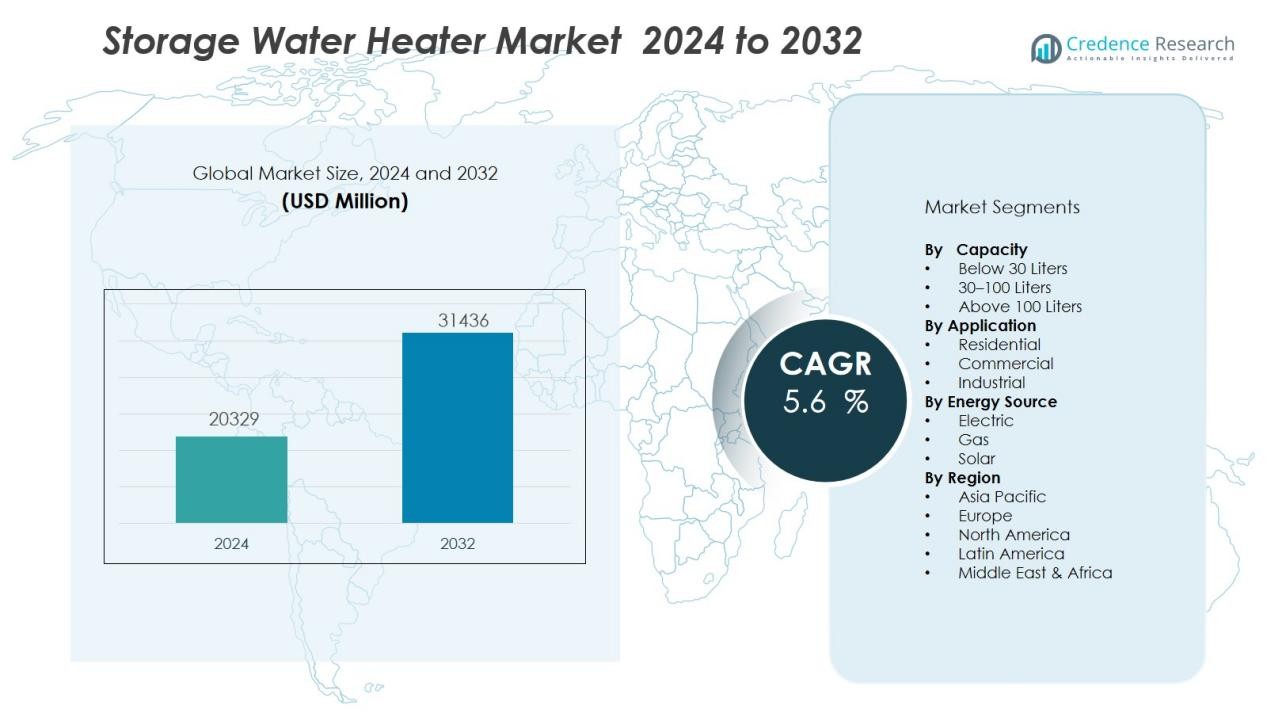

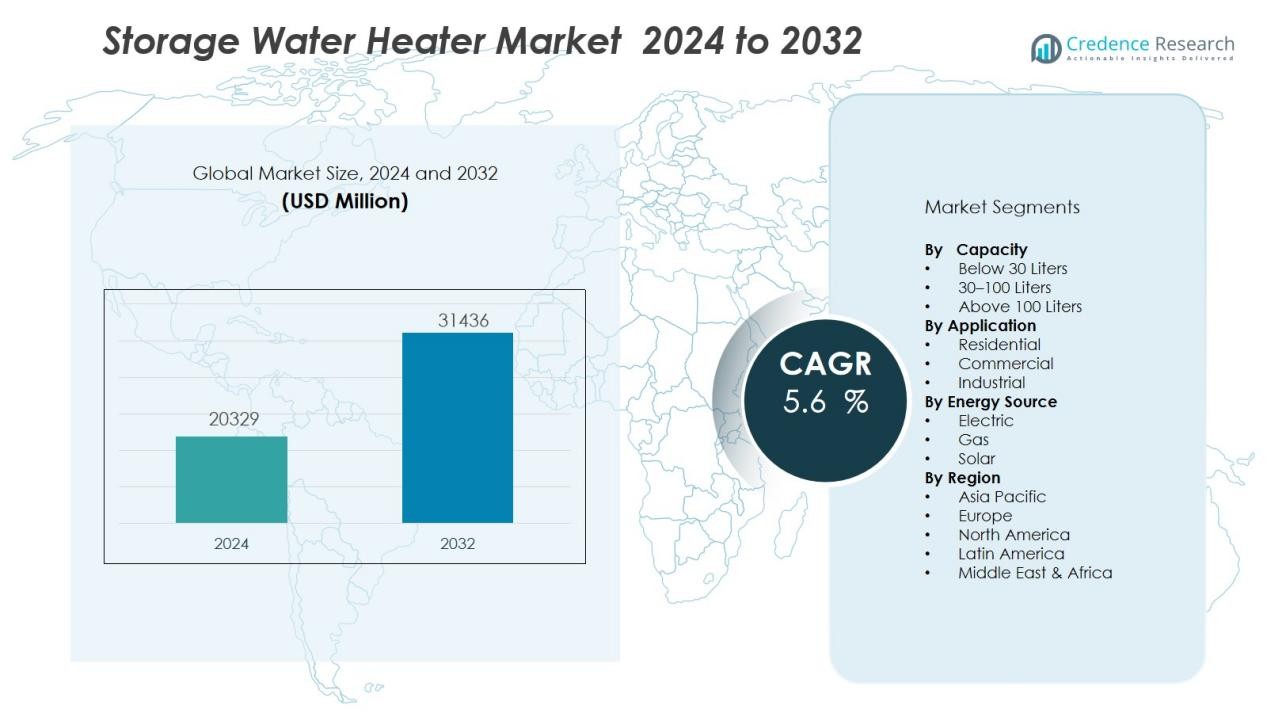

The Storage water heater market size was valued at USD 20329 million in 2024 and is anticipated to reach USD 31436 million by 2032, at a CAGR of 5.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Storage Water Heater Market Size 2024 |

USD 20329 Million |

| Storage Water Heater Market, CAGR |

5.6 % |

| Storage Water Heater Market Size 2032 |

USD 31436 Million |

Market growth is fueled by advancements in insulation technology, improved heating elements, and the integration of smart controls that enhance energy efficiency and user convenience. Rising disposable incomes, government incentives for energy-efficient products, and the replacement of aging water heating systems are accelerating adoption. The hospitality, healthcare, and real estate sectors are also contributing significantly to demand, as hot water access becomes an essential utility standard.

Regionally, Asia-Pacific dominates the storage water heater market, supported by rapid urban growth, large-scale housing projects, and increasing electrification in emerging economies such as China and India. North America and Europe hold substantial shares, driven by technological adoption, stringent energy-efficiency regulations, and established infrastructure. The Middle East & Africa and Latin America are emerging markets, with growth fueled by improving living standards and expanding construction activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The storage water heater market was valued at USD 20,329 million in 2024 and is projected to reach USD 31,436 million by 2032, growing at a CAGR of 5.6% during 2024–2032.

- Advancements in insulation, heating elements, and smart control integration are improving energy efficiency, user convenience, and operational lifespan.

- Rising urbanization, government-backed housing projects, and modern lifestyle demands are driving adoption in residential and commercial sectors.

- High-capacity models are seeing increased demand from hospitality, healthcare, and educational institutions requiring consistent hot water supply.

- Challenges include high energy consumption, operational costs, and competition from tankless, solar, and heat pump water heaters.

- Asia-Pacific leads with 45% market share, followed by North America at 25% and Europe at 20%, reflecting regional strengths in infrastructure, policy support, and consumer adoption.

- Emerging markets in the Middle East, Africa, and Latin America are poised for growth due to improving living standards, construction expansion, and rising electrification rates.

Market Drivers:

Rising Urbanization and Housing Development Driving Product Demand:

Rapid urbanization and large-scale residential construction projects are significantly boosting the demand for storage water heaters. Growing populations in urban centers create a higher need for reliable hot water solutions in both new and renovated housing units. The storage water heater market benefits from rising consumer expectations for modern amenities in homes. Government-backed housing schemes in emerging economies are further stimulating market expansion. Developers and homeowners are increasingly opting for efficient and durable water heating systems to meet lifestyle standards.

- For instance, Ariston’s Nuos A+ 80-110 WH heat pump model delivers energy savings of up to 70% compared to a standard electric water heater, making it ideal for sustainable housing developments

Increasing Adoption in Commercial and Institutional Sectors:

Expanding hospitality, healthcare, and educational infrastructure is fueling the demand for high-capacity storage water heaters. Hotels, hospitals, and schools require consistent hot water supply to meet operational needs. The storage water heater market is gaining traction in these segments due to its ability to deliver large volumes of heated water efficiently. Facility managers are prioritizing systems that balance performance with energy savings. This trend supports steady sales in both developed and developing regions.

- For instance, Veolia’s HeatSan 400 system delivers a high-capacity solution with a 380-litre hot water storage, actively used for disinfection in hospital renal dialysis wards with multiple loops.

Technological Advancements Enhancing Energy Efficiency:

Continuous innovations in heating elements, tank insulation, and control systems are transforming storage water heaters into more energy-efficient appliances. Manufacturers are integrating smart thermostats and IoT-enabled controls to optimize energy use and enhance user convenience. The market is benefiting from stricter energy efficiency standards that encourage adoption of advanced models. It is driving replacement demand as consumers upgrade from older, less efficient systems. These improvements help reduce operating costs and environmental impact.

Rising Disposable Incomes and Shifting Consumer Preferences:

Higher disposable incomes are enabling consumers to invest in premium water heating solutions with enhanced features. The storage water heater market is experiencing growth as buyers prioritize comfort, convenience, and product longevity. Brand reputation, warranty coverage, and design aesthetics are becoming key purchase influencers. Consumers in both residential and commercial sectors are increasingly willing to pay more for reliable and efficient hot water systems. This shift is reinforcing the market’s long-term growth trajectory.

Market Trends:

Integration of Smart Technologies and IoT-Enabled Features:

The storage water heater market is witnessing a notable shift toward smart technology integration, enhancing user control and operational efficiency. Manufacturers are introducing IoT-enabled systems that allow remote temperature adjustments, usage monitoring, and predictive maintenance alerts through mobile applications. These features not only improve user convenience but also help optimize energy consumption, aligning with sustainability goals. Smart diagnostics are enabling quicker identification of performance issues, reducing downtime and maintenance costs. Consumers are showing growing interest in connected appliances that integrate seamlessly with smart home ecosystems. This trend is particularly strong in developed markets, where technology adoption rates are higher and energy management is a priority.

- For instance, Rheem’s ProTerra Hybrid Electric Water Heater—connected via the EcoNet IoT platform—delivers a Uniform Energy Factor of 4.07, translating to up to 75% less energy use compared to standard electric models.

Growing Preference for Energy-Efficient and Eco-Friendly Solutions:

Heightened environmental awareness and stricter energy regulations are driving demand for storage water heaters with improved efficiency ratings. Manufacturers are focusing on advanced insulation materials, corrosion-resistant tanks, and high-performance heating elements to reduce energy loss. The market is also seeing an increase in hybrid models that combine traditional storage systems with heat pump technology to lower operating costs and emissions. It is encouraging replacement of older units with eco-friendly alternatives, supported by government incentives in several regions. This trend is gaining traction in both residential and commercial sectors, as users seek long-term cost savings and compliance with environmental standards. The emphasis on sustainability is expected to shape product development and purchasing decisions over the coming years.

- For instance, Noritz’s NRC661-DV indoor direct-vent tankless heater achieves an energy factor of 0.91, boosting overall system efficiency by more than 30 percent. 0.91

Market Challenges Analysis:

High Energy Consumption and Operational Costs:

The storage water heater market faces challenges related to high energy consumption, which impacts operational costs for both residential and commercial users. Prolonged heating cycles and standby heat losses increase electricity or fuel bills, making these systems less attractive in cost-sensitive markets. It is prompting consumers to explore alternative technologies such as tankless water heaters and solar-powered systems. Regulatory pressures to meet stringent energy efficiency standards are compelling manufacturers to invest in advanced designs, raising production costs. These factors can slow adoption in regions with limited purchasing power.

Intense Competition from Alternative Water Heating Technologies:

Growing awareness of energy-efficient alternatives is intensifying competition for storage water heaters. Tankless, heat pump, and solar water heaters offer benefits such as reduced energy usage, lower environmental impact, and space savings. The storage water heater market must address these competitive pressures by focusing on innovation and feature differentiation. Price-sensitive consumers may opt for lower-cost or more efficient solutions, especially in regions with supportive renewable energy policies. This competitive landscape demands strategic marketing and continuous product development to maintain market share.

Market Opportunities:

Rising Demand in Emerging Economies:

Expanding residential and commercial construction in emerging economies presents a significant growth avenue for the storage water heater market. Rapid urbanization, improving living standards, and increased electrification are creating strong demand for modern water heating solutions. Government initiatives to enhance housing infrastructure and promote energy-efficient appliances are further boosting adoption. It is opening opportunities for manufacturers to introduce affordable yet high-performance models tailored to local needs. The untapped rural and semi-urban segments also hold potential for market penetration through targeted distribution strategies.

Advancements in Energy-Efficient and Hybrid Technologies:

Technological innovation offers scope for differentiation and market expansion. Hybrid storage water heaters that combine traditional heating with heat pump or solar assistance are gaining traction for their cost-saving and eco-friendly benefits. The storage water heater market can leverage this trend by developing models that meet evolving energy regulations and consumer expectations. Smart controls, advanced insulation, and corrosion-resistant materials can enhance product value and lifespan. Partnerships with smart home solution providers can create new revenue streams. These advancements position manufacturers to capture a larger share in both premium and mid-range product categories.

Market Segmentation Analysis:

By Capacity:

The storage water heater market is segmented by capacity into below 30 liters, 30–100 liters, and above 100 liters. Below 30-liter units dominate the residential segment, catering to small households and limited-space installations. The 30–100 liter category holds significant demand in mid-sized homes and small commercial facilities. Above 100-liter models are preferred in large residences, hotels, hospitals, and institutional setups requiring continuous hot water supply.

- For instance, Rheem’s EHG50 classic electric storage heater delivers 50 L of hot water and reaches 60 °C in 40 minutes at an inlet temperature of 25 °C.

By Application:

Applications span residential, commercial, and industrial sectors. The residential segment leads due to growing housing construction, renovation projects, and rising living standards. Commercial demand comes from hospitality, healthcare, and educational institutions, where consistent hot water is essential for operations. Industrial adoption, though smaller in volume, focuses on specialized processes and staff facilities.

- For instance, Chromalox’s CHS horizontal steam boiler series provides up to 4,882 lbs/hr of steam capacity at pressures up to 135 psig, meeting high-volume process heating requirements with reliable industrial durability.

By Energy Source:

The market is classified by energy source into electric, gas, and solar-powered storage water heaters. Electric models dominate due to ease of installation, availability, and low upfront costs. Gas-powered units are gaining traction in regions with robust natural gas infrastructure, offering faster heating and lower operational costs. Solar-powered storage water heaters are emerging as a sustainable alternative, supported by government incentives and environmental regulations promoting renewable energy adoption.

Segmentations:

By Capacity:

- Below 30 Liters

- 30–100 Liters

- Above 100 Liters

By Application:

- Residential

- Commercial

- Industrial

By Energy Source:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific holds 45% market share in the global storage water heater market, driven by rapid urbanization and infrastructure expansion. China, India, and Southeast Asian nations are experiencing strong demand due to rising middle-class populations and widespread electrification. The housing sector’s growth, combined with government incentives for energy-efficient appliances, is creating a favorable market environment. It is also benefiting from increased adoption in commercial facilities such as hotels, hospitals, and educational institutions. Rising consumer awareness regarding modern water heating technologies is pushing manufacturers to introduce affordable yet feature-rich models. Strong distribution networks and localized manufacturing are further supporting regional dominance.

North America:

North America accounts for 25% market share, supported by stringent energy efficiency regulations and high consumer adoption of smart home technologies. The United States leads regional demand, followed by Canada, due to advanced infrastructure and widespread use of premium water heating systems. It is witnessing significant replacement demand as consumers upgrade older units to meet updated performance standards. The hospitality, healthcare, and real estate sectors are contributing to steady market growth. Cold climate conditions further sustain year-round demand for reliable storage water heaters. Product innovation, particularly in hybrid and Wi-Fi-enabled models, is strengthening market penetration in this region.

Europe :

Europe holds 20% market share, driven by environmental regulations and the integration of renewable energy in water heating systems. Countries such as Germany, the UK, and France are leading adoption, supported by subsidies and incentives for energy-efficient products. It is focusing on hybrid systems that combine storage technology with solar or heat pump solutions. The region benefits from established infrastructure and strong aftersales service networks, enhancing consumer confidence. Increasing demand in residential retrofitting projects is adding to market momentum. Manufacturers are aligning product offerings with EU directives on energy labeling and emissions reduction to maintain competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- A.O. Smith

- Hubbell Heaters

- Haier Inc.

- Havells India Ltd.

- Jaquar India

- Ariston Holding N.V.

- Essency

- Ferroli S.p.A

- Nihon Itomic Co., Ltd.

- Bosch Thermotechnology Ltd.

- Bradford White Corporation, USA

- Groupe Atlantic

- Linuo Ritter International Co., Ltd.

Competitive Analysis:

The storage water heater market is characterized by strong competition among established global brands and regional players. Key companies include A.O. Smith, Hubbell Heaters, Haier Inc., Havells India Ltd., Jaquar India, Ariston Holding N.V., Essency, Ferroli S.p.A, and Nihon Itomic Co., Ltd. These players compete on product performance, energy efficiency, technological innovation, and pricing strategies. It is witnessing growing investment in smart and hybrid water heating solutions to meet rising consumer demand for energy savings and convenience. Leading manufacturers leverage extensive distribution networks, strong aftersales support, and brand reputation to maintain market leadership. Strategic partnerships with real estate developers and institutional buyers are expanding their reach in both developed and emerging markets. Continuous product differentiation through advanced insulation, corrosion-resistant materials, and compact designs is enhancing competitiveness. The market’s structure favors companies that can adapt quickly to evolving energy regulations and shifting consumer preferences.

Recent Developments:

- In August, 2025, A.O. Smith launched the Cyclone FLEX, a high-efficiency commercial gas water heater designed for commercial applications.

- In January 2024, Hubbell Electric Heater Holdings LLC acquired RECO USA, a company that expands their production capabilities, including large-capacity hot water storage tanks, enhancing their presence strategically across North America.

- In October 2024, Haier Smart Home completed the acquisition of Carrier Commercial Refrigeration from Carrier Global Corporation for about $775 million, expanding its presence from home refrigeration into commercial refrigeration markets globally.

Market Concentration & Characteristics:

The storage water heater market exhibits moderate to high concentration, with a mix of global manufacturers and strong regional players competing for market share. Leading companies dominate through extensive distribution networks, brand recognition, and continuous innovation in energy efficiency and smart technologies. It is characterized by steady demand across residential, commercial, and industrial sectors, driven by replacement needs and infrastructure development. Product differentiation often focuses on capacity, energy performance, and durability, while regulatory compliance remains a key competitive factor. Emerging players are targeting niche segments with affordable and localized solutions to gain entry into competitive markets.

Report Coverage:

The research report offers an in-depth analysis based on Capacity, Application, Energy Source and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising demand for energy-efficient and eco-friendly models will drive product innovation across residential and commercial segments.

- Integration of IoT-enabled controls and smart home compatibility will enhance user convenience and operational efficiency.

- Hybrid storage water heaters combining heat pump or solar technology will gain wider adoption for cost savings and sustainability benefits.

- Replacement of aging systems in developed markets will create steady revenue streams for established manufacturers.

- Expansion in emerging economies will accelerate due to urbanization, infrastructure growth, and improving living standards.

- Government incentives and regulatory mandates for energy-efficient appliances will influence purchasing decisions.

- Advances in insulation materials and corrosion-resistant tank designs will extend product life and reduce maintenance needs.

- Competitive differentiation will increasingly rely on design aesthetics, compact configurations, and premium features.

- Strategic partnerships with real estate developers and hospitality chains will open new distribution channels.

- Evolving consumer preferences toward low-maintenance, high-performance water heating solutions will shape future market strategies.