Market Overview

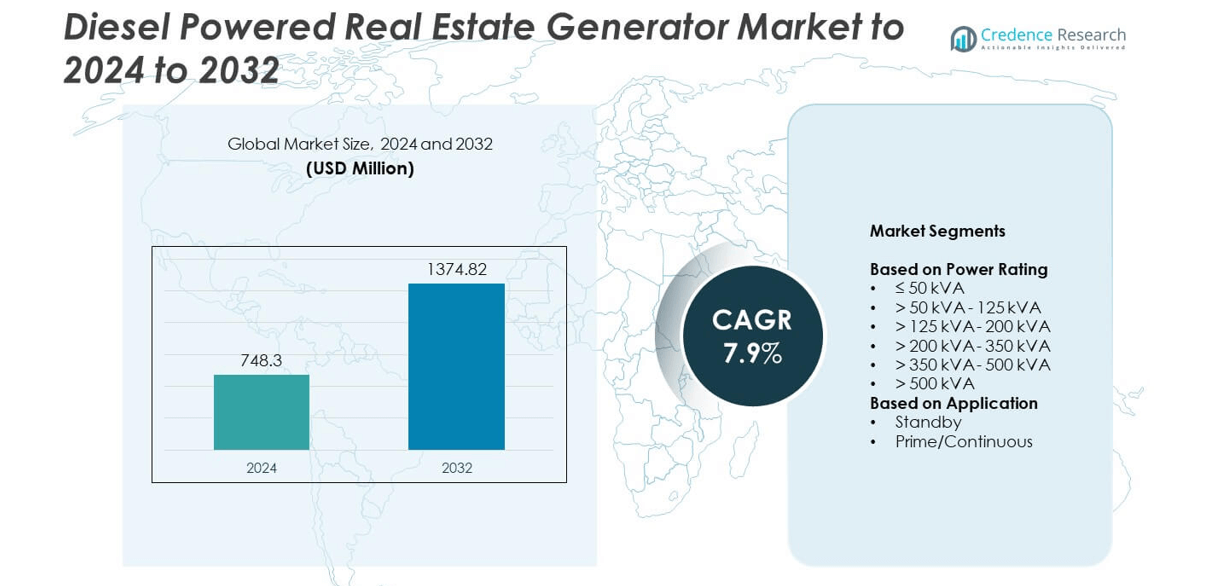

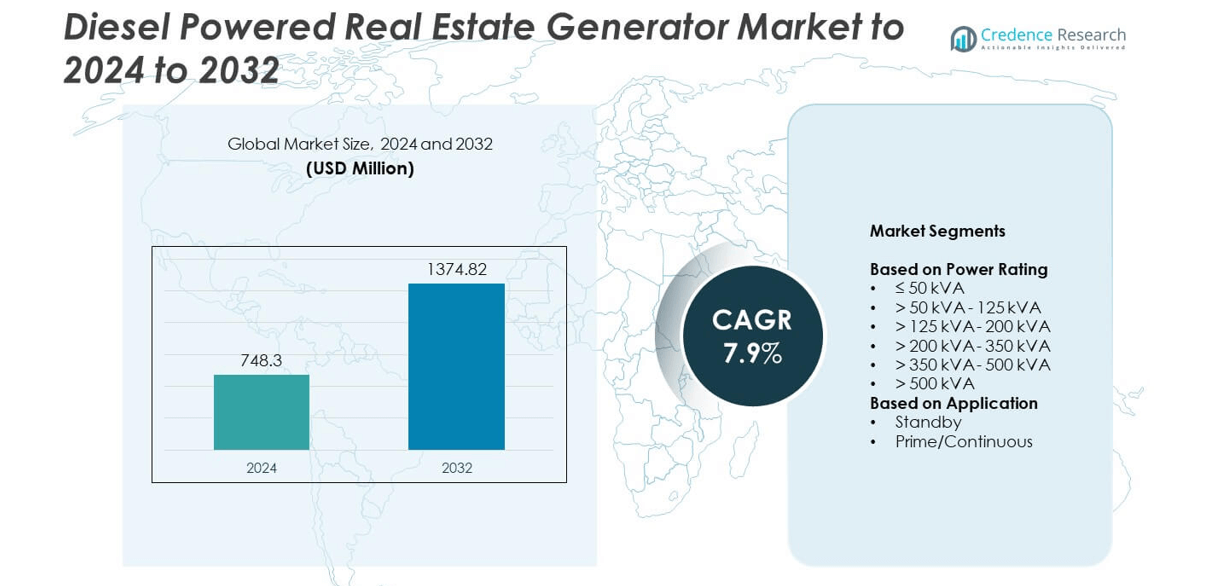

Diesel Powered Real Estate Generator Market size was valued at USD 748.3 million in 2024 and is anticipated to reach USD 1,374.82 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Powered Real Estate Generator Market Size 2024 |

USD 748.3 million |

| Diesel Powered Real Estate Generator Market, CAGR |

7.9% |

| Diesel Powered Real Estate Generator Market Size 2032 |

USD 1,374.82 million |

The Diesel Powered Real Estate Generator market is led by key players such as Cummins, Caterpillar, Kohler, Atlas Copco, Generac Power Systems, HIMOINSA, and Rolls-Royce. These companies focus on advanced power solutions, integrating digital control systems, low-emission engines, and hybrid-compatible models to enhance operational reliability in real estate applications. Continuous innovation in fuel efficiency and emission compliance drives competitive differentiation among global manufacturers. Asia Pacific emerged as the leading region, accounting for 36% of the total market share in 2024, driven by rapid urbanization, infrastructure growth, and increasing construction activities across China, India, and Southeast Asia.

Market Insights

- The diesel powered real estate generator market was valued at USD 748.3 million in 2024 and is projected to reach USD 1,374.82 million by 2032, growing at a CAGR of 7.9%.

- Rapid construction expansion and increased demand for reliable power backup in residential and commercial real estate drive market growth.

- Key trends include rising adoption of hybrid diesel systems, IoT-enabled monitoring, and emission-compliant technologies to improve efficiency and sustainability.

- Competition is strong, with manufacturers focusing on innovation, cost optimization, and aftersales service expansion to strengthen global presence.

- Asia Pacific dominated with a 36% share in 2024, followed by North America at 28% and Europe at 23%, while the >125 kVA – 200 kVA segment led among power ratings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The >125 kVA – 200 kVA segment dominated the diesel powered real estate generator market in 2024 with a 31% share. This range is widely adopted in medium to large-scale residential and commercial developments due to its balance between fuel efficiency and high output capacity. These generators are suitable for elevators, HVAC systems, and lighting in multi-story buildings. Their strong reliability and capability to handle extended loads make them preferred for continuous backup operations. Growing real estate construction in urban centers further drives demand for this power range.

- For instance, the fuel consumption for the Atlas Copco QAS 150 varies depending on the specific model and regional specifications. According to a product reference sheet for the 50 Hz model sold in the United States, it uses 26.9 L/h at 100% load and 21.9 L/h at 75% load.

By Application

The standby segment held a 58% share of the diesel powered real estate generator market in 2024, emerging as the dominant application. Standby generators are crucial in ensuring uninterrupted power supply during outages, particularly in luxury residential complexes and commercial towers. Developers favor diesel standby systems for their fast start-up, long lifespan, and cost-effective maintenance. Increasing grid instability and the growing emphasis on power reliability in real estate projects strengthen the adoption of standby generators across developed and emerging economies.

- For instance, Generac specifies a programmable start delay from 2 to 1,500 seconds on standby models.

Key Growth Drivers

Rising Real Estate Construction Activities

Expanding real estate construction across urban and semi-urban regions is a primary driver for diesel-powered generators. Developers rely on these systems to maintain continuous power during site operations and post-construction occupancy. The growing number of high-rise residential and commercial buildings demands reliable backup solutions to ensure safety and operational stability. Increasing urbanization and large-scale infrastructure investments continue to strengthen generator deployment in both private and public real estate projects.

- For instance, HIMOINSA offers a rental generator set, model HRYW-1275 D5/6, which produces a Prime Power of 1,278 kVA at 50Hz and 1,305 kVA at 60Hz.

Need for Uninterrupted Power Supply

Frequent power interruptions and unreliable grid connectivity in developing nations have increased reliance on diesel-powered generators. Real estate projects, particularly in tier-2 and tier-3 cities, require continuous energy to operate heavy construction machinery, elevators, and safety systems. Diesel generators offer immediate backup power and stable voltage output, supporting round-the-clock activities. Their ability to function efficiently under variable load conditions further drives preference across the real estate industry.

- For instance, mtu Series 4000 sets accept >50% first-step load and meet 100% block-load per NFPA 110.

Expansion of Commercial and Industrial Spaces

The rapid development of shopping complexes, business parks, and industrial estates is fueling generator demand. Diesel generators ensure operational continuity for HVAC systems, security, and lighting infrastructure in commercial real estate. Rising investments in industrial zones and logistics facilities have also strengthened the market’s industrial application base. The segment benefits from growing adoption in large properties that require high-capacity, long-duration backup systems.

Key Trends and Opportunities

Shift Toward Hybrid and Fuel-Efficient Models

Manufacturers are introducing hybrid diesel generators that combine traditional diesel engines with renewable inputs like solar or battery storage. These systems reduce fuel consumption, emissions, and operational costs while meeting sustainability standards. The shift aligns with global real estate developers’ focus on energy-efficient and eco-compliant solutions, creating new growth opportunities for advanced hybrid models in high-end projects and green-certified buildings.

- For instance, Aggreko’s containerized BESS is rated 250 kW/575 kWh and is deployed to trim generator runtime.

Integration of Smart Monitoring and IoT Controls

The adoption of IoT-enabled monitoring systems in diesel generators is transforming operational management. Real estate operators now deploy smart control units for predictive maintenance, performance analytics, and fuel optimization. This trend enhances system reliability, reduces downtime, and lowers overall maintenance costs. The growing acceptance of digitalized energy solutions presents a strong opportunity for manufacturers to expand their technological offerings.

- For instance, Deep Sea Electronics’ DSE8610 synchronizes and load-shares up to 32 generator sets in one system.

Key Challenges

Environmental Regulations and Emission Standards

Strict emission norms imposed by governments pose a major challenge to diesel generator manufacturers. Regulations targeting NOx and particulate matter emissions have forced companies to redesign engines and adopt cleaner technologies. These changes increase production costs and limit market accessibility in regions prioritizing renewable and low-emission power systems. Compliance requirements also delay product approvals, restricting rapid market expansion.

High Operational and Maintenance Costs

Diesel generators involve higher fuel and maintenance expenses compared to gas or hybrid alternatives. Frequent servicing, fuel price fluctuations, and replacement of engine components elevate ownership costs for real estate operators. These expenses often deter adoption among smaller developers or low-budget projects. The increasing focus on cost-efficient and sustainable energy systems further challenges diesel generator adoption in future developments.

Regional Analysis

North America

North America held a 28% share of the diesel powered real estate generator market in 2024. The region benefits from strong commercial construction, data centers, and mixed-use developments requiring reliable standby power. The United States leads due to frequent weather-related outages and the need for emergency backup systems in residential complexes. Real estate developers prefer diesel systems for their durability and long service life. Technological innovation, including emission-compliant and fuel-efficient models, further supports market growth across the U.S. and Canada.

Europe

Europe accounted for a 23% share of the diesel powered real estate generator market in 2024. Demand is supported by modern urban infrastructure projects and high standards for power reliability. Countries such as Germany, the United Kingdom, and France deploy diesel generators for construction sites and commercial real estate developments. The ongoing shift toward low-emission generators aligns with the region’s sustainability goals. Manufacturers are focusing on hybrid-ready systems to meet strict EU environmental regulations, maintaining market stability amid rising clean energy adoption.

Asia Pacific

Asia Pacific dominated the diesel powered real estate generator market with a 36% share in 2024. Rapid urbanization, industrial expansion, and large-scale real estate development in China, India, and Southeast Asia are key growth drivers. Frequent grid instability and power shortages enhance reliance on diesel generators for construction and standby use. Rising infrastructure investments, including housing and commercial projects, further boost demand. The market also benefits from cost-effective manufacturing and increasing government support for industrialization, positioning Asia Pacific as the leading regional contributor.

Latin America

Latin America captured an 8% share of the diesel powered real estate generator market in 2024. The region’s growing commercial real estate and infrastructure activities in Brazil and Mexico are driving adoption. Developers rely on diesel generators to maintain construction timelines amid inconsistent grid supply. Government initiatives for urban development and tourism infrastructure also support market growth. Although renewable alternatives are emerging, diesel generators remain preferred for their affordability, robust performance, and easy maintenance across mid-sized and large real estate projects.

Middle East & Africa

The Middle East and Africa region held a 5% share of the diesel powered real estate generator market in 2024. Rising investments in smart cities, real estate complexes, and hospitality projects across the UAE, Saudi Arabia, and South Africa are major contributors. Unstable power grids and extreme climate conditions necessitate dependable backup systems. Diesel generators are widely used for both temporary and permanent power solutions in large property developments. Increasing construction of luxury and mixed-use facilities continues to strengthen regional demand.

Market Segmentations:

By Power Rating

- ≤ 50 kVA

- > 50 kVA – 125 kVA

- > 125 kVA – 200 kVA

- > 200 kVA – 350 kVA

- > 350 kVA – 500 kVA

- > 500 kVA

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Diesel Powered Real Estate Generator market features key players such as Cummins, HIMOINSA, Kohler, Atlas Copco, Kirloskar, Rolls-Royce, Greaves Cotton, J C Bamford Excavators, Mahindra Powerol, DEUTZ Power Center, Cooper, Rehlko, Aggreko, Generac Power Systems, Caterpillar, and YANMAR HOLDINGS. The competitive environment is characterized by technological innovation, product reliability, and a focus on emission compliance. Manufacturers are investing in hybrid generator technologies that combine diesel engines with renewable energy inputs to meet sustainability goals. Companies are enhancing product efficiency through digital monitoring systems and automated controls, improving operational performance in large real estate projects. Strategic collaborations with construction developers and service providers are expanding aftersales support and rental offerings. The market competition is further driven by continuous product upgrades, cost optimization, and compliance with regional emission standards. Rising demand for fuel-efficient and long-runtime generators is prompting established manufacturers to strengthen their global distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cummins

- HIMOINSA

- Kohler

- Atlas Copco

- Kirloskar

- Rolls-Royce

- Greaves Cotton

- J C Bamford Excavators

- Mahindra Powerol

- DEUTZ Power Center

- Cooper

- Rehlko

- Aggreko

- Generac Power Systems

- Caterpillar

- YANMAR HOLDINGS

Recent Developments

- In 2024, Generac launched the PWRcell 2 series of residential home energy storage systems, including the PWRcell 2 and PWRcell 2 MAX, which are modular batteries designed for whole-home power during outages and are compatible with Generac home generators and smart thermostats

- In 2024, Kohler introduced ultra-low-noise generators designed for urban environments.

- In 2023, Cummins launched its CPCB IV+ compliant genset series for the Delhi NCR market in partnership with Sudhir Power Limited

- In 2023, Kohler Co. unveiled its 26kW air-cooled home standby generator, the model 26RCA, at the Consumer Electronics Show. This high-capacity generator was a notable development in the real estate market because it addressed the growing demand for reliable, whole-house backup power among residential users

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising urban development will increase the demand for reliable backup power in real estate projects.

- Hybrid diesel generators integrating renewable energy sources will gain wider adoption.

- IoT-enabled monitoring systems will enhance operational efficiency and predictive maintenance.

- Manufacturers will focus on developing low-emission and fuel-efficient generator models.

- Growing infrastructure investments in Asia Pacific will continue to drive market expansion.

- Stricter emission regulations will encourage innovation in cleaner diesel technologies.

- Standby generator applications will remain dominant in residential and commercial buildings.

- Emerging economies will witness increased adoption due to unstable power grids.

- Rental generator services will expand to support temporary construction power needs.

- Integration of smart controls and automation will improve generator performance and lifespan.