Market Overview:

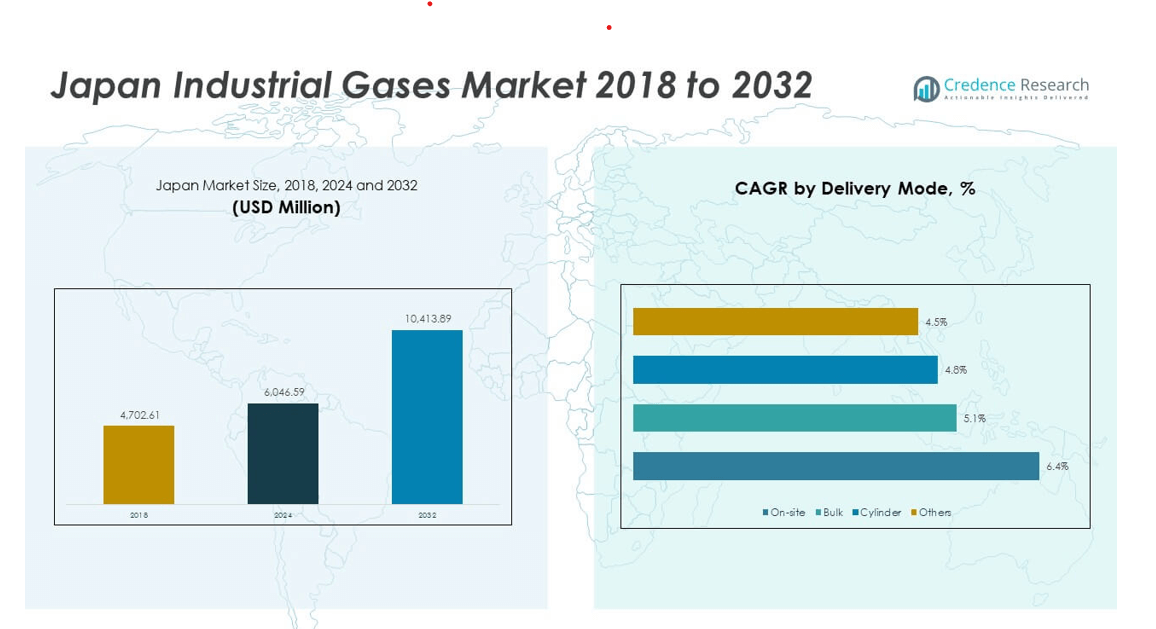

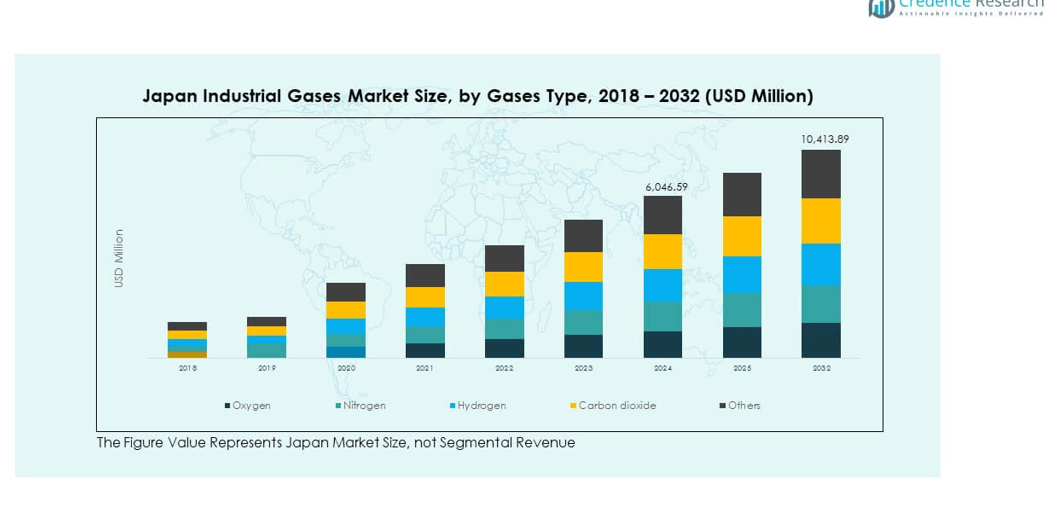

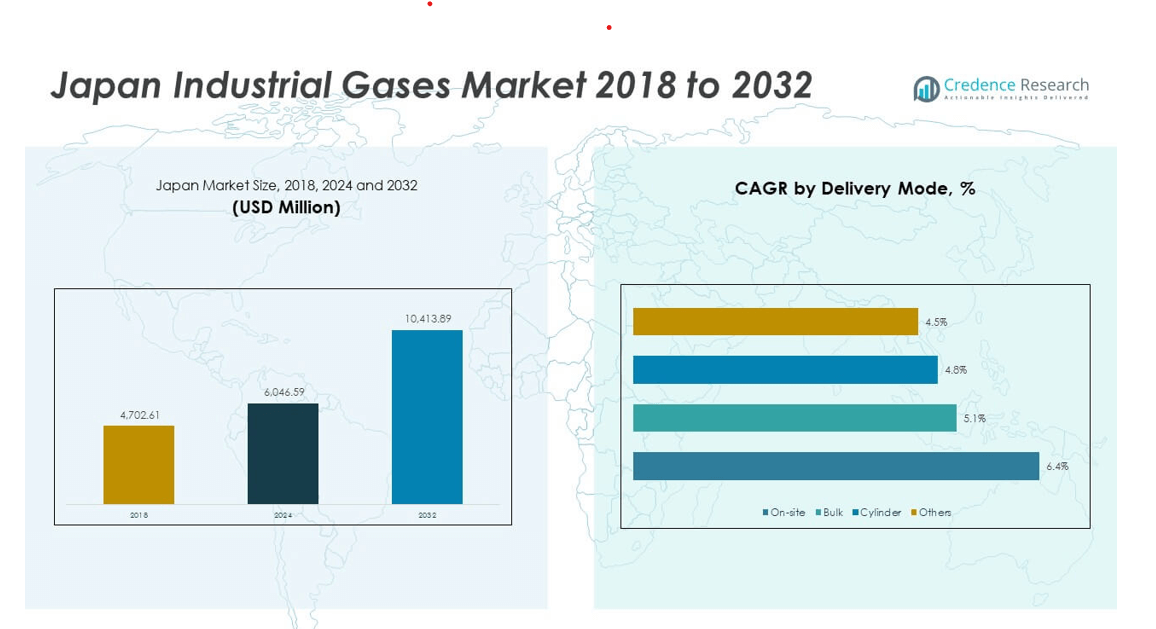

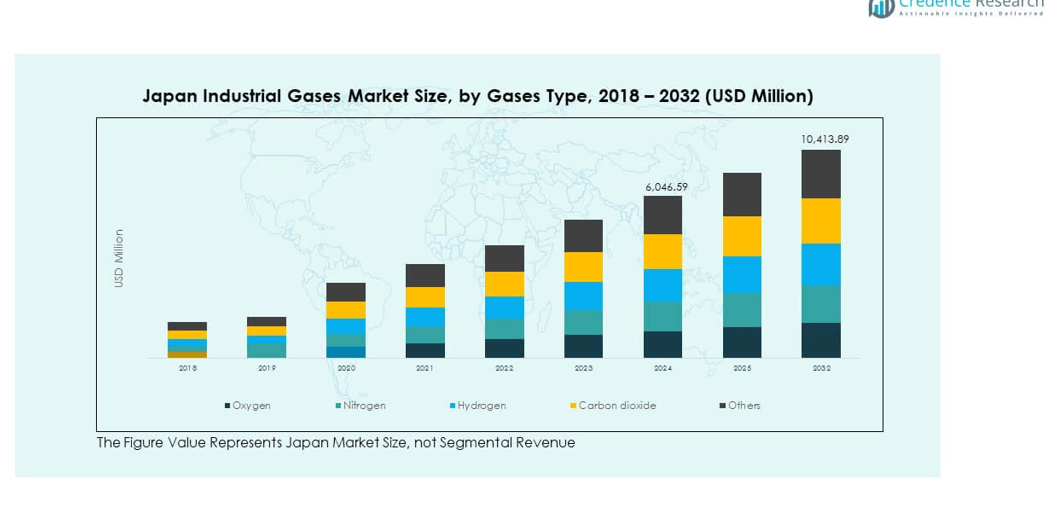

The Japan Industrial Gases Market size was valued at USD 4,702.61 million in 2018 to USD 6,046.59 million in 2024 and is anticipated to reach USD 10,413.89 million by 2032, at a CAGR of 7.03% during the forecast period. The market growth is driven by expanding industrial activities, increasing healthcare demand, and the rapid adoption of clean energy technologies. Industrial gases play a critical role in supporting Japan’s manufacturing, semiconductor, and healthcare industries.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Industrial Gases Market Size 2024 |

USD 6,046.59 million |

| Japan Industrial Gases Market, CAGR |

7.03% |

| Japan Industrial Gases Market Size 2032 |

USD 10,413.89 million |

Japan’s industrial gases market is driven by rising applications in steel, electronics, and chemical sectors. The country’s focus on semiconductor fabrication and precision manufacturing boosts demand for ultra-high-purity gases. Growing investments in hydrogen energy and carbon capture technologies also accelerate market growth. The healthcare sector further drives demand due to the increasing need for medical oxygen and nitrogen. Strong innovation and government support for sustainable energy transitions continue to strengthen overall industry performance.

Regionally, major industrial gas consumption centers are concentrated in key manufacturing hubs such as the Kanto, Kansai, and Chubu regions. These areas house dense clusters of automotive, electronics, and chemical industries. Northern and southern regions, including Hokkaido and Kyushu, are emerging markets due to growing energy and healthcare infrastructure projects. The country’s balanced industrial distribution and continuous technological upgrades ensure steady demand across all major regions.

Market Insights:

- The Japan Industrial Gases Market was valued at USD 4,702.61 million in 2018, reached USD 6,046.59 million in 2024, and is projected to attain USD 10,413.89 million by 2032, growing at a CAGR of 7.03% during the forecast period.

- The Kanto region led with 34% share, supported by a dense concentration of electronics, manufacturing, and healthcare industries. The Kansai region followed with 27%, driven by steel and automotive production, while Chubu captured 21%, strengthened by its automotive and machinery hubs.

- The Kyushu–Hokkaido region, holding 18% share, is the fastest-growing area, propelled by healthcare expansion, renewable energy projects, and investments in hydrogen infrastructure.

- By gas type, oxygen accounted for 32% of the total volume in 2024, supported by demand in healthcare and steel manufacturing sectors.

- Nitrogen held 26% share, driven by applications in electronics, food preservation, and metal processing, reflecting stable industrial dependence across Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expanding Manufacturing and Electronics Sectors Fuel Gas Demand

The Japan Industrial Gases Market benefits from the country’s strong manufacturing foundation. The electronics, automotive, and semiconductor industries are major consumers of industrial gases such as nitrogen, oxygen, and argon. The growth of chip fabrication plants and advanced manufacturing facilities boosts consumption across the supply chain. Japan’s ongoing investment in microelectronics and precision engineering strengthens demand for high-purity gases. The market also gains from the production of specialty materials and 3D printing applications. Growing automation in factories further amplifies the need for controlled atmospheric gases. It continues to thrive under Japan’s industrial modernization initiatives.

- For instance, Tokyo Electron completed a new development building at its Miyagi Technology Innovation Center in April 2025, and construction on a new production building began in the summer of 2025, with completion scheduled for 2027. The expansion supports Japan’s industry-wide push into advanced chipmaking technologies.

Rising Healthcare Demand and Medical Gas Applications

Japan’s aging population and expanding healthcare infrastructure create a steady demand for medical gases. Hospitals and diagnostic centers use oxygen, nitrous oxide, and carbon dioxide in various treatments and surgical procedures. The market’s healthcare segment grows with the adoption of advanced respiratory therapies and home healthcare systems. It supports patient care through reliable medical gas supply networks and automated cylinder management. Rising chronic respiratory diseases increase oxygen usage across healthcare facilities. Pharmaceutical production also depends heavily on purified gases for sterile environments. The medical gas industry plays a vital role in sustaining Japan’s healthcare reliability.

- For instance, Air Water Inc. highlighted the increasing supply of medical oxygen as critical to supporting the nation’s healthcare sector and has provided details on expanding medical gas business segments in its annual report.

Increasing Focus on Hydrogen Energy and Decarbonization

Japan’s commitment to a carbon-neutral economy strengthens hydrogen gas development. The government’s hydrogen roadmap promotes green hydrogen projects and clean fuel technologies. This transition creates new growth areas for industrial gas suppliers. The Japan Industrial Gases Market benefits from collaborations between gas manufacturers and energy companies. Hydrogen is used for fuel cells, mobility, and power generation, supporting energy diversification. Strong regulatory frameworks and subsidies encourage private investments in hydrogen infrastructure. The push toward low-emission technologies secures long-term demand for clean industrial gases.

Technological Advancements and Automation in Production Processes

Technological progress drives innovation across gas production, storage, and delivery systems. Advanced cryogenic and membrane separation technologies improve purity levels and energy efficiency. The integration of IoT and AI-based monitoring enhances operational safety and real-time performance tracking. The Japan Industrial Gases Market leverages automation to optimize plant productivity and reduce downtime. Robotics and sensor-driven systems enhance precision during gas blending and filling. Continuous R&D by leading firms strengthens process optimization and digitalization. It ensures higher reliability, sustainability, and compliance with industrial standards.

Market Trends:

Shift Toward Sustainable and Low-Carbon Gas Solutions

Sustainability has become a defining trend across industrial gas production in Japan. Companies are transitioning toward renewable hydrogen, bio-based carbon dioxide, and recycled gases. The Japan Industrial Gases Market experiences a growing preference for eco-friendly products across industries. Industrial clients prioritize suppliers with verified carbon reduction initiatives. Gas producers invest in carbon capture, utilization, and storage (CCUS) to minimize emissions. The use of clean energy in liquefaction and distribution also improves environmental performance. The trend reinforces Japan’s broader commitment to green transformation and circular economy goals.

- For instance, Kawasaki Heavy Industries commenced operations of Japan’s first 30%-hydrogen co-firing gas engine in Kobe in 2024, aimed at reducing carbon emissions through advanced hydrogen utilization

Growing Role of Semiconductor and Electronics Manufacturing

The semiconductor sector continues to influence industrial gas consumption trends. Ultra-high-purity gases like nitrogen and argon are essential for wafer fabrication. The Japan Industrial Gases Market aligns with semiconductor expansion plans by global and domestic players. Industry collaborations are forming to enhance local supply chain resilience. Increased investment in photolithography and etching processes accelerates demand for specialty gases. Japan’s focus on domestic chip production also strengthens local gas capacity development. The trend drives consistent revenue growth and technological upgrades in precision gas systems.

- For instance, Rapidus, a major new Japanese foundry, achieved prototyping of leading-edge 2nm GAA transistors using advanced EUV lithography equipment at its Chitose facility in 2025, representing significant industry progress and an associated rise in demand for ultra-high-purity gases required in semiconductor fabrication.

Integration of Smart Supply and Digital Distribution Systems

Digitalization reshapes the industrial gas supply chain across Japan. Gas suppliers adopt smart cylinders, telemetry systems, and predictive analytics for seamless monitoring. The Japan Industrial Gases Market gains from automation in logistics and real-time delivery tracking. Smart refilling stations enhance efficiency and reduce downtime for industrial users. Cloud-based gas management platforms improve traceability and client control. Advanced software systems allow optimization of distribution routes and energy consumption. These innovations increase safety, transparency, and operational reliability across end-user industries.

Expanding Use of Specialty and High-Performance Gases

Demand for specialty gases is growing across Japan’s electronics, healthcare, and chemical sectors. The Japan Industrial Gases Market benefits from rising use in analytical instruments, laser applications, and precision coatings. High-purity gases enable critical functions in biotechnology and environmental testing. Industries require consistent purity and stability for process integrity. Gas producers are diversifying product portfolios with innovative blends and advanced packaging. The growing adoption of new materials in semiconductors and automotive systems supports specialty gas consumption. This trend elevates product differentiation and strengthens market competitiveness.

Market Challenges Analysis:

High Production Costs and Energy-Intensive Operations

The production of industrial gases involves high energy consumption and infrastructure costs. The Japan Industrial Gases Market faces profitability pressure from rising electricity rates and carbon taxes. Maintaining ultra-high purity standards requires advanced purification systems and constant monitoring. Volatile energy prices can disrupt production planning and cost control. Gas liquefaction and cryogenic storage demand significant investment in safety and maintenance. Limited access to renewable energy sources increases dependency on conventional fuels. The high capital intensity restricts small players from scaling effectively within the competitive landscape.

Stringent Regulations and Complex Distribution Frameworks

Japan enforces strict safety and environmental standards on gas production and distribution. The Japan Industrial Gases Market must comply with detailed protocols under the High Pressure Gas Safety Act. Regulatory approvals for new facilities and transportation routes can delay expansion projects. Managing logistics across densely populated regions poses challenges for timely delivery. Gas suppliers must maintain specialized fleets and storage systems to ensure compliance. The industry also faces constraints from limited land availability for production units. Meeting evolving sustainability and traceability mandates further adds to operational complexity.

Market Opportunities:

Growing Potential in Hydrogen and Clean Energy Applications

The shift toward hydrogen energy presents significant growth opportunities for gas manufacturers. The Japan Industrial Gases Market gains from government initiatives supporting hydrogen mobility and fuel cell deployment. Gas producers can expand through partnerships in renewable energy and refueling infrastructure. The transition toward decarbonization opens new value streams in green hydrogen and ammonia. Investments in hydrogen storage and transport systems enhance scalability and profitability. Japan’s leadership in hydrogen innovation positions it as a key global hub for sustainable gas development.

Rising Adoption of Automation and Digital Solutions

Automation and digital monitoring systems create new opportunities for operational excellence. The Japan Industrial Gases Market can leverage data analytics and IoT to improve efficiency and safety. Smart sensors and automated control systems reduce production errors and resource waste. Gas producers are integrating AI-driven optimization tools to forecast demand and plan logistics. These technologies improve customer experience and sustainability compliance. Digital transformation strengthens competitiveness by cutting costs and enhancing service reliability. The ongoing adoption of Industry 4.0 ensures continued innovation and growth.

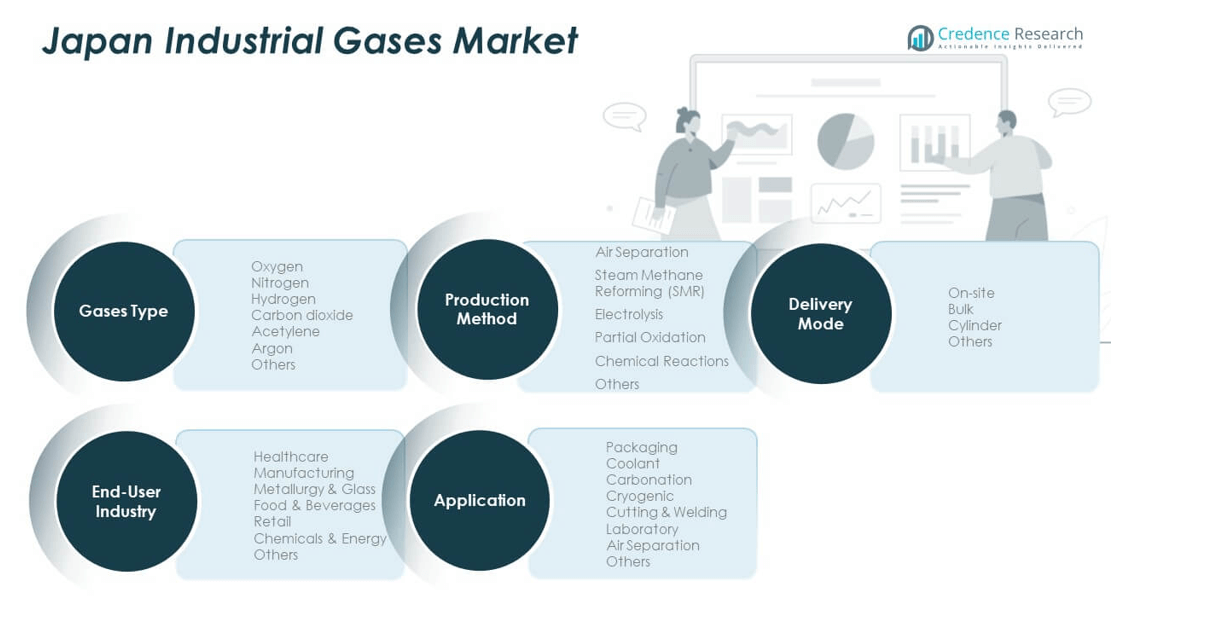

Market Segmentation Analysis:

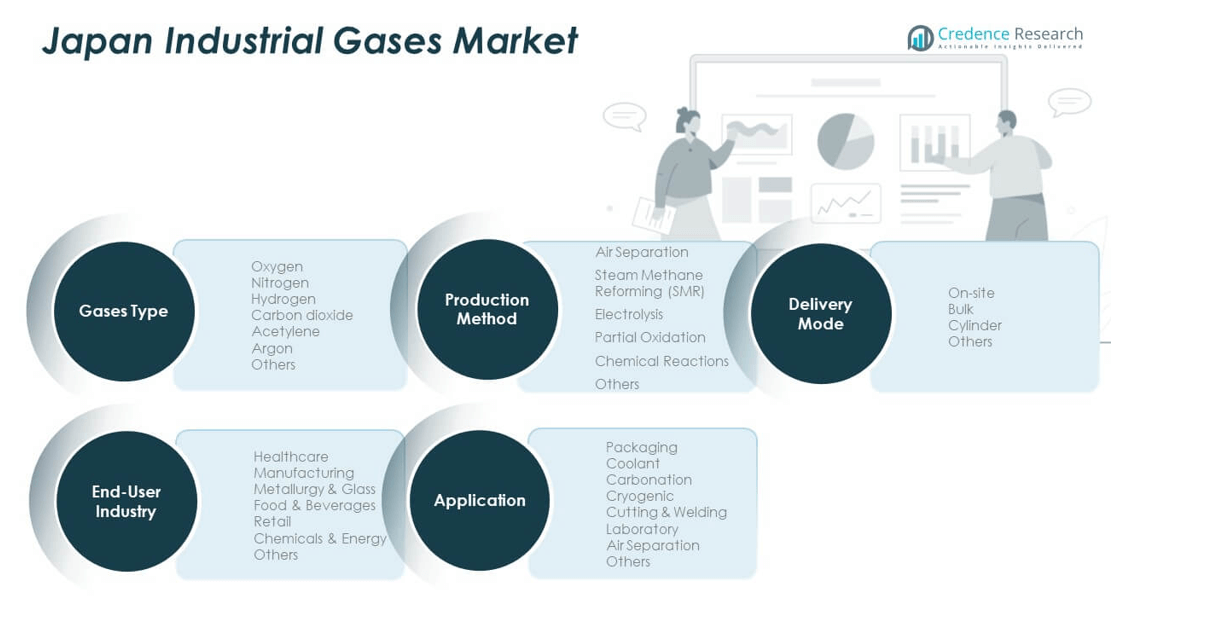

By Gases Type

The Japan Industrial Gases Market is segmented into oxygen, nitrogen, hydrogen, carbon dioxide, acetylene, argon, and others. Oxygen and nitrogen hold the largest shares due to extensive use in steelmaking, healthcare, and electronics. Hydrogen is gaining traction through its growing role in clean energy and fuel cell applications. Argon supports the metal fabrication and semiconductor sectors due to its inert characteristics. Carbon dioxide remains vital for food processing and carbonation. The diversified use of gases across multiple industries sustains consistent market expansion.

- For instance, Nippon Sanso Holdings highlighted continued price management and productivity improvements to offset mixed demand for industrial and electronics gases in its integrated report. The company’s performance varied regionally, with weaker demand in Japan, but overall consolidated revenue grew due to factors including M&A activities. The company maintains that its core industrial gases, like oxygen and nitrogen, remain important to its business.

By Application

Key applications include packaging, coolant, carbonation, cryogenic, cutting and welding, laboratory, and air separation. Cutting and welding dominate due to high industrial demand in automotive and machinery manufacturing. Cryogenic applications grow rapidly with the adoption of advanced refrigeration systems. The packaging and carbonation segments support the expanding food and beverage industry. Laboratory and air separation processes contribute to technological precision and industrial research.

- For instance, Air Water Inc. reported investment into new cryogenic gas and medical supply chains to meet evolving industry needs, supporting a diversified application profile for industrial gases in Japan.

By End-User Industry, Production Method, and Delivery Mode

Major end users include healthcare, manufacturing, metallurgy and glass, food and beverages, retail, and chemicals and energy. Healthcare demand grows with rising oxygen use and pharmaceutical expansion. The market’s production methods include air separation, steam methane reforming, electrolysis, partial oxidation, and chemical reactions. Air separation leads due to efficiency and scalability. Delivery modes comprise on-site, bulk, and cylinder, with on-site supply dominating large industrial operations for continuous and cost-effective gas distribution.

Segmentation:

- By Gases Type:

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

- By Application:

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

- By End-User Industry:

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

- By Production Method:

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

- By Delivery Mode:

- On-site

- Bulk

- Cylinder

- Others

Regional Analysis:

Dominance of Kanto Region in Industrial Gas Consumption

The Kanto region holds the largest share of the Japan Industrial Gases Market, accounting for 34% of total revenue in 2024. This dominance is driven by the high concentration of manufacturing, electronics, and healthcare industries in Tokyo, Kanagawa, and Saitama. It benefits from advanced infrastructure and strong distribution networks supporting large-scale gas demand. Semiconductor fabrication and precision manufacturing industries create continuous consumption of high-purity gases. The presence of major industrial clusters and research facilities strengthens the regional supply chain. Strong government initiatives promoting hydrogen and renewable energy projects further enhance Kanto’s industrial gas production capacity.

Kansai Region’s Strong Industrial and Technological Backbone

The Kansai region represents 27% of the national market share, supported by key industrial cities such as Osaka, Kyoto, and Hyogo. It serves as a major base for steel, chemical, and automotive manufacturing, which rely heavily on nitrogen, oxygen, and argon. The Japan Industrial Gases Market benefits from Kansai’s integration of smart manufacturing and clean energy systems. Growing adoption of hydrogen technologies and fuel cell applications reinforces gas utilization in the region. The well-established port infrastructure facilitates the efficient import and export of liquefied gases. Regional R&D investments in sustainable manufacturing strengthen long-term demand stability.

Emerging Growth from Chubu, Kyushu, and Hokkaido Regions

The Chubu region accounts for 21% of market share, driven by its dominance in automotive and machinery industries centered in Aichi and Shizuoka. It experiences rising demand for gases used in welding, cooling, and energy production. The Kyushu and Hokkaido regions collectively hold 18% of the market and are witnessing strong growth in healthcare, food processing, and renewable energy sectors. These regions are attracting investments in hydrogen infrastructure and cryogenic gas storage facilities. Expanding industrial diversification and local manufacturing developments are stimulating new opportunities for gas producers. It continues to experience balanced expansion supported by nationwide energy transition and technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Industrial Gases Market is characterized by the presence of major domestic and global players competing through innovation, technology, and long-term supply contracts. Key participants include Taiyo Nippon Sanso Corporation, Iwatani Corporation, Air Liquide Japan Ltd., Air Water Inc., Showa Denko K.K., and Linde Japan. The market is defined by strong product diversification and strategic partnerships with manufacturing and healthcare sectors. It emphasizes technological advancement in gas purification, liquefaction, and hydrogen solutions. Continuous R&D investments strengthen product reliability and environmental performance. It remains competitive with players expanding production facilities and digital monitoring capabilities.

Recent Developments:

- In August 2025, Taiyo Nippon Sanso Corporation launched “Green Liquid Nitrogen,” Japan’s first CO2-free liquid nitrogen product to obtain third-party certification, marking a major step towards sustainable industrial gas solutions in the region.

- In August 2025, Air Water Inc. executed an agreement to split its industrial gas business, establishing Air Water Gas Products Inc., with the transaction taking effect on October 1, 2025, as part of a streamlined business focus and anticipated future growth.

- In June 2025, Linde Japan, through its parent company, played a prominent role at the Japan Energy Summit & Exhibition, highlighting continued partnerships and investments in clean hydrogen technologies and next-generation infrastructure for industrial growth in Japan.

Report Coverage:

The research report offers an in-depth analysis based on gases type, application, end-user industry, production method, and delivery mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Hydrogen adoption will expand across mobility, energy, and industrial applications.

- Healthcare gas demand will rise with an aging population and advanced medical systems.

- Automation and IoT integration will enhance gas production and distribution efficiency.

- Sustainable production and carbon-neutral initiatives will gain stronger government support.

- Semiconductor and electronics manufacturing will remain key revenue drivers.

- Localized production units will strengthen supply chain resilience and reliability.

- R&D investments will focus on clean energy gases and high-purity solutions.

- Strategic alliances between energy and gas companies will accelerate hydrogen deployment.

- Digital monitoring systems will optimize plant operations and resource utilization.

- Export potential will grow through regional collaborations and advanced liquefaction technologies.