Market Overview

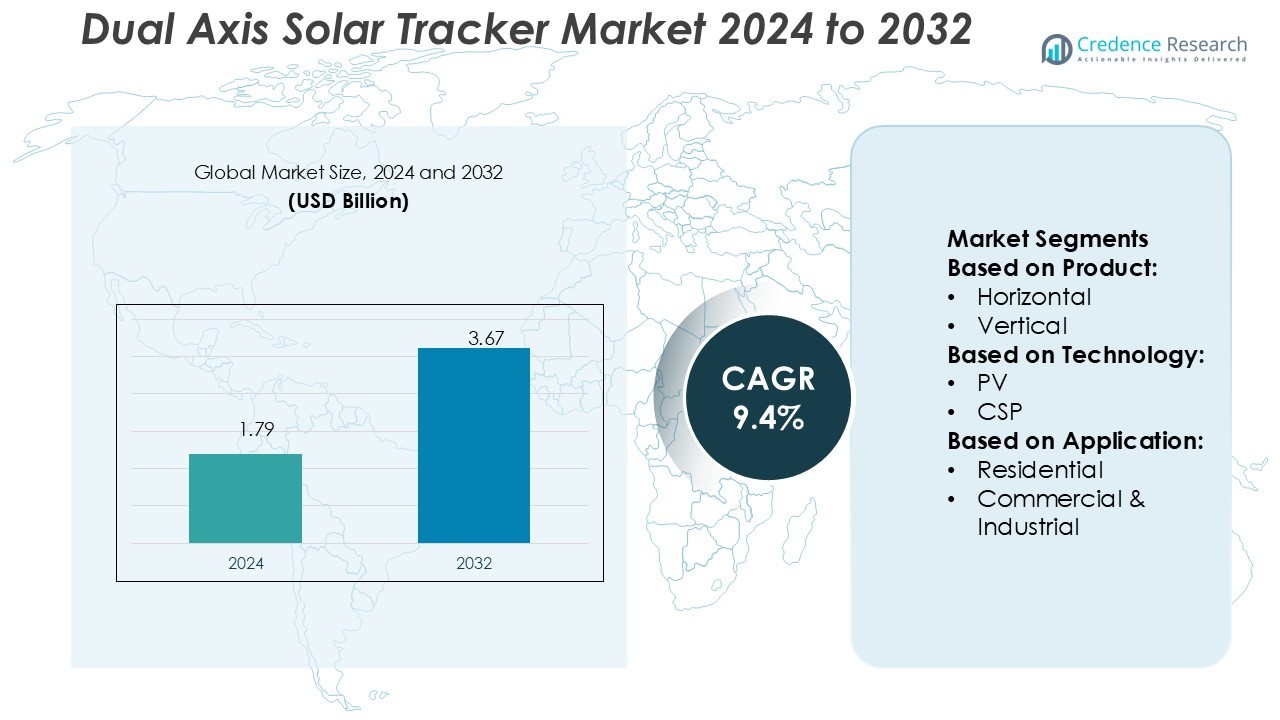

Dual Axis Solar Tracker Market size was valued USD 1.79 billion in 2024 and is anticipated to reach USD 3.67 billion by 2032, at a CAGR of 9.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dual Axis Solar Tracker Market Size 2024 |

USD 1.79 Billion |

| Dual Axis Solar Tracker Market, CAGR |

9.4% |

| Dual Axis Solar Tracker Market Size 2032 |

USD 3.67 Billion |

The Dual Axis Solar Tracker Market is shaped by major players such as Solar CenTex, PARU, Abengoa, Mechatron Solar, DEGERENERGIE GMBH & CO. KG, Stracker Incorporated, Sun Action Trackers, Haosolar Co. Ltd, All Earth Renewables, and Array Technologies, Inc. These companies focus on high-precision tracking technologies, advanced control systems, and strong project execution capabilities to enhance energy yield. Asia Pacific leads the global market with a 36% share, supported by large-scale solar investments, favorable government policies, and rapid project deployment. Strong manufacturing capacity and increasing renewable energy targets position the region as the dominant hub for dual axis tracker installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dual Axis Solar Tracker Market was valued at USD 1.79 billion in 2024 and is expected to reach USD 3.67 billion by 2032, growing at a CAGR of 9.4%.

- Rising demand for renewable energy and increased utility-scale solar installations are driving market expansion across key regions.

- Major players focus on advanced tracking technologies, control systems, and strategic partnerships to strengthen competitiveness.

- High initial costs and complex installation processes remain key restraints for wider adoption in emerging markets.

- Asia Pacific leads with a 36% market share, supported by strong policy frameworks, while dual axis systems hold a significant segment share due to their high energy efficiency and performance benefits.

Market Segmentation Analysis:

By Product

Dual axis trackers hold the dominant share in the market due to their higher energy yield. These trackers follow the sun both horizontally and vertically, maximizing panel exposure throughout the day. Their use improves energy generation efficiency by 25–35% compared to fixed systems. Growing adoption in large-scale solar farms drives this segment’s leadership. For instance, NEXTracker has deployed thousands of dual-axis units, optimizing production in utility-scale projects. The segment benefits from government-backed renewable targets and rapid solar expansion in emerging markets.

- For instance, PARU claims over 1.5 GW of total installed tracking capacity across global projects (company LinkedIn). PARU also builds dual-axis modules that endure snow loads and wind speeds with “automatic safety control mode” as part of their structural design (PARU website).

By Technology

Photovoltaic (PV) technology accounts for the largest market share, supported by widespread adoption in utility and commercial projects. PV modules are easy to integrate with single and dual-axis trackers, offering cost-effective and scalable deployment. Continuous advancements in bifacial PV modules enhance energy capture when paired with tracking systems. For example, Trina Solar has developed PV solutions designed for dual-axis compatibility, improving performance under variable sunlight conditions. This technology’s low installation cost and growing efficiency make it the preferred choice over CSP systems.

- For instance, Trina Solar’s 620 W Vertex N module reaches ~23 % efficiency and is tested against hail up to 65 mm at a 60° impact angle, making it robust under severe outdoor conditions.

By Application

Utility-scale projects dominate the application segment, driven by the need for high-capacity renewable energy generation. These projects leverage dual-axis tracking to achieve optimal power output and lower levelized cost of energy. Large solar farms often exceed 50 MW capacity and are integrated into national grids. Leading developers such as Array Technologies supply advanced tracking solutions for utility applications across North America, Europe, and Asia. Supportive regulatory frameworks and rising demand for clean energy accelerate adoption in this segment, reinforcing its dominant market share.

Key Growth Drivers

Rising Focus on Maximizing Solar Power Output

The demand for dual axis solar trackers is growing as they improve energy generation efficiency. These systems follow the sun’s movement on both vertical and horizontal axes, increasing energy capture by 25–35% compared to fixed systems. This higher output improves project ROI and shortens payback periods for utility developers. Governments and private investors favor these trackers for large-scale solar farms. Their deployment supports net-zero emission goals and enhances the overall grid contribution of renewable energy.

- For instance, Napa Valley winery, Mechatron installed 4 M18KD units, each supporting 90 panels, providing over 43 kW per mast, and rated to withstand 115 mph gusts and 35 psf snow load.

Expanding Utility-Scale Solar Installations

Utility projects are the primary adopters of dual axis solar trackers due to their performance advantage. Large solar farms benefit from their ability to sustain high energy yields throughout the day. Countries such as the U.S., China, India, and Spain are accelerating capacity additions through national renewable targets. Investments from public-private partnerships are fueling the installation of tracker-based farms. This expansion is creating strong market pull for advanced tracker solutions with automated control systems.

- For instance, DEGER claims its MLD (Maximum Light Detection) sensor approach can yield, on average, up to 45% more energy compared to fixed systems. This is supported by a 2013 Fraunhofer study that certified a 42.9% higher energy yield for DEGER’s dual-axis tracking systems.

Supportive Policies and Incentives for Renewable Energy

Global governments are introducing favorable policies to accelerate solar power adoption. Tax credits, subsidies, and renewable purchase obligations are making tracker investments more attractive. The U.S. Inflation Reduction Act and EU Green Deal are prime examples supporting capital-intensive solar projects. These measures reduce upfront costs and improve project economics. As countries aim to meet clean energy targets, tracker installations are becoming integral to utility-scale projects.

Key Trends & Opportunities

Integration of Smart and Automated Tracking Systems

Manufacturers are integrating advanced sensors, AI-driven algorithms, and IoT modules to optimize solar panel positioning. These smart trackers can respond to weather changes and real-time irradiance data. Automation improves energy output and reduces operational downtime. The adoption of predictive maintenance systems further lowers lifecycle costs. These advancements create new opportunities for suppliers to differentiate through performance optimization and reduced O&M costs.

- For instance, Stracker Solar advertises its systems as “IoT Ready” and rated for 120 mph wind loads, supporting real-time connectivity and remote diagnostics.

Growing Demand from Emerging Markets

Developing countries in Asia-Pacific, the Middle East, and Africa are increasing solar capacity installations. Falling solar PV costs and rising energy demand are driving this growth. Governments in these regions are launching incentive programs to attract foreign investment. This creates new opportunities for tracker manufacturers to establish partnerships and expand their global footprint. Suppliers offering cost-effective, durable solutions are likely to benefit the most.

- For instance, Array Technologies’ DuraTrack® and OmniTrack™ tracker lines are now verified for 2,000-volt compatibility by Intertek, confirming they meet UL 3703 and UL 2703 standards.

Hybridization with Energy Storage Systems

The integration of dual axis trackers with battery storage is gaining traction. This hybrid model ensures continuous energy supply and grid stability. Developers are adopting such systems to meet peak-hour demand and improve capacity utilization. As storage costs decline, hybrid solar-storage projects present a strong growth opportunity. This trend aligns with the global push toward decentralized and resilient power generation.

Key Challenges

High Initial Investment Costs

Dual axis trackers are costlier to install than fixed or single axis systems. Their complex design, additional components, and advanced control systems increase upfront capital requirements. This can discourage small-scale project developers and residential users. High initial costs may also affect adoption in price-sensitive markets. Companies are focusing on design optimization and modular solutions to lower costs.

Maintenance Complexity and Reliability Issues

The moving components of dual axis trackers make them more prone to wear and operational failures. Regular maintenance and specialized technical support are required to ensure long-term performance. Downtime due to mechanical failures can affect project profitability. Harsh environmental conditions also pose durability challenges. Addressing reliability concerns through robust materials and predictive maintenance solutions is critical for sustained market growth.

Regional Analysis

North America

North America holds a 33% share in the Dual Axis Solar Tracker Market, driven by rapid clean energy adoption. The U.S. and Canada are investing in utility-scale solar projects to meet renewable energy targets. Dual axis systems improve energy output by 30–40%, which makes them ideal for large-scale installations. Supportive policies such as the U.S. Investment Tax Credit strengthen adoption. Leading companies like NEXTracker and Array Technologies deploy advanced tracking solutions with integrated software to optimize yield. Strong technological infrastructure and favorable regulatory frameworks position North America as a key market leader in solar tracker deployment.

Europe

Europe accounts for a 27% share, supported by the European Green Deal and rising solar PV integration. Countries like Spain, Italy, and Germany are major adopters of dual axis solar trackers for grid-connected power plants. These trackers enhance energy efficiency in regions with variable sunlight angles. Governments provide strong incentives, such as feed-in tariffs and auction programs. Companies like Soltec and IDEEMATEC focus on advanced tracking technologies to support large-scale renewable projects. The region’s strict emission goals and growing grid modernization investments further accelerate solar tracker demand.

Asia Pacific

Asia Pacific holds the largest market share at 36%, led by China, India, and Australia. High solar potential and expanding utility-scale projects drive rapid deployment of dual axis trackers. National renewable energy targets and declining tracker costs support market expansion. Chinese manufacturers like Arctech Solar supply large-scale systems for high-yield PV plants. India’s solar mission is boosting tracker adoption across new installations. Favorable government initiatives, rapid urbanization, and large project pipelines make Asia Pacific the fastest-growing regional market in this sector.

Latin America

Latin America captures a 2% share, driven by increasing investments in utility-scale solar farms. Brazil and Chile are emerging leaders, adopting dual axis trackers to maximize energy yield in areas with high solar irradiation. Policies like long-term power purchase agreements support market development. Global players like NEXTracker are expanding in this region through strategic partnerships and local manufacturing. While adoption is at an early stage, the region offers strong growth potential due to favorable climate conditions and rising renewable energy commitments.

Middle East & Africa

The Middle East & Africa region holds a 2% share, supported by rising investments in solar infrastructure. Countries like the UAE, Saudi Arabia, and South Africa are deploying dual axis trackers in large-scale solar farms. These trackers help maximize generation efficiency in high-irradiance zones. National energy transition plans, such as Saudi Vision 2030, support renewable energy expansion. Companies like NEXTracker and Arctech Solar are actively supplying advanced tracking solutions to these markets. High solar potential and government-backed projects are expected to accelerate regional market growth over the coming years.

Market Segmentations:

By Product:

By Technology:

By Application:

- Residential

- Commercial & Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dual Axis Solar Tracker Market is shaped by key players including Solar CenTex, PARU, Abengoa, Mechatron Solar, DEGERENERGIE GMBH & CO. KG, Stracker Incorporated, Sun Action Trackers, Haosolar Co. Ltd, All Earth Renewables, and Array Technologies, Inc. The Dual Axis Solar Tracker Market is defined by continuous innovation and strategic expansion. Companies are focusing on developing advanced tracking systems with higher accuracy, improved durability, and lower maintenance costs. Integration of AI and IoT technologies is enhancing performance monitoring and real-time control, improving overall energy yield. Strategic partnerships with EPC contractors and utility-scale developers are enabling faster deployment of large solar projects. Many manufacturers are expanding their production capacities to meet rising global demand. Competitive differentiation is also driven by product reliability, long-term performance warranties, and efficient after-sales support, which strengthen customer trust and market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, PV Hardware (PVH) announced the launch of DeepTrack™ by PVH, an ecosystem designed to optimize photovoltaic plant performance using advanced technology and cutting-edge intelligence.

- In February 2025, Grenergy raised for phase 4 of the ‘world’s largest’ solar-plus-storage project in Chile. The financing will be used towards the deployment of 269MW solar PV generation capacity and 1.1GWh of battery energy storage systems (BESS), at Gabriela, the fourth phase of Grenergy’s Oasis de Atacama project in northern Chile.

- In September 2024, Arctech, a solar tracking and racking solution provider, introduced the new SkyLight solar tracker. This boosts efficiency, reduces cost, and offers significant ecological benefits.

- In March 2024, Electricity Generating Authority of Thailand (EGAT) has announced the start of commercial operations for a hybrid hydro-floating solar power project at the Ubol Ratana Dam. This innovative project combines hydroelectric power with floating solar panels, aiming to enhance energy efficiency and sustainability.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing investments in utility-scale solar projects.

- Technological innovation will improve energy yield and tracking precision.

- Integration with AI and IoT systems will enhance operational efficiency.

- Governments will support adoption through renewable energy targets and incentives.

- Cost reductions in tracker components will boost installation rates.

- Manufacturers will focus on scalable and low-maintenance system designs.

- Demand will rise across regions with high solar irradiation.

- Strategic partnerships will accelerate project execution and global reach.

- Hybrid solutions combining trackers with storage systems will gain traction.

- Long-term performance guarantees will become a key competitive factor.