Market Overview

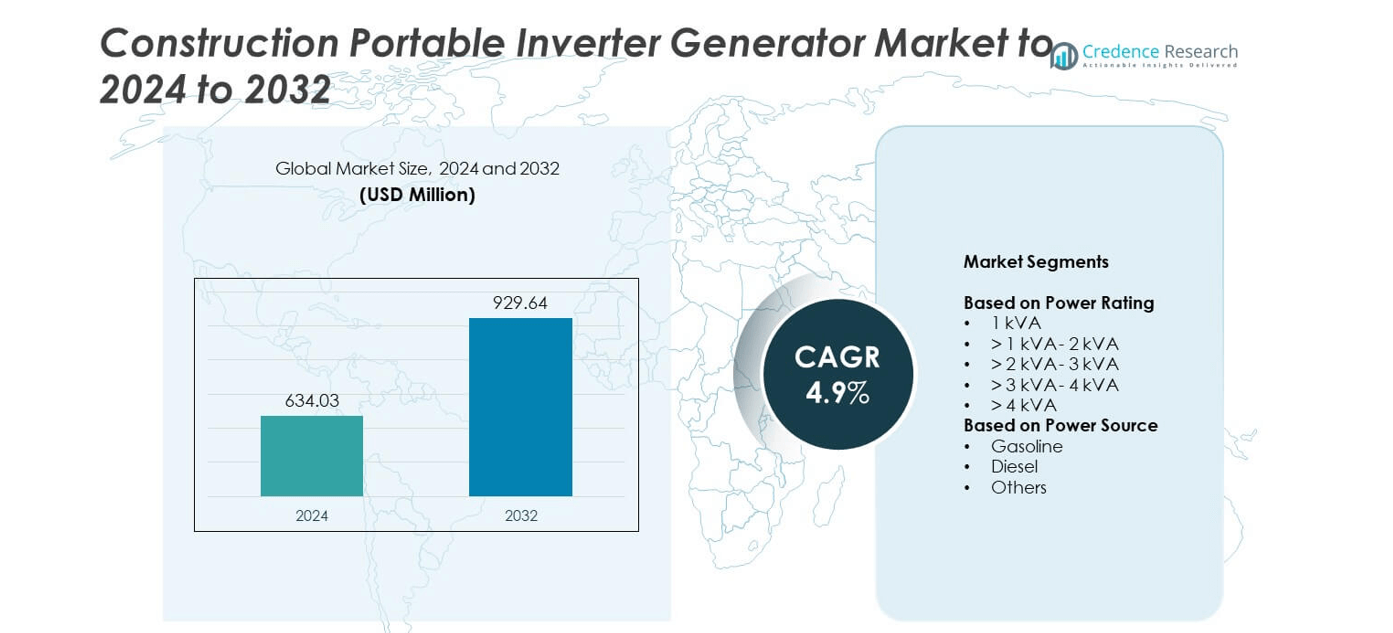

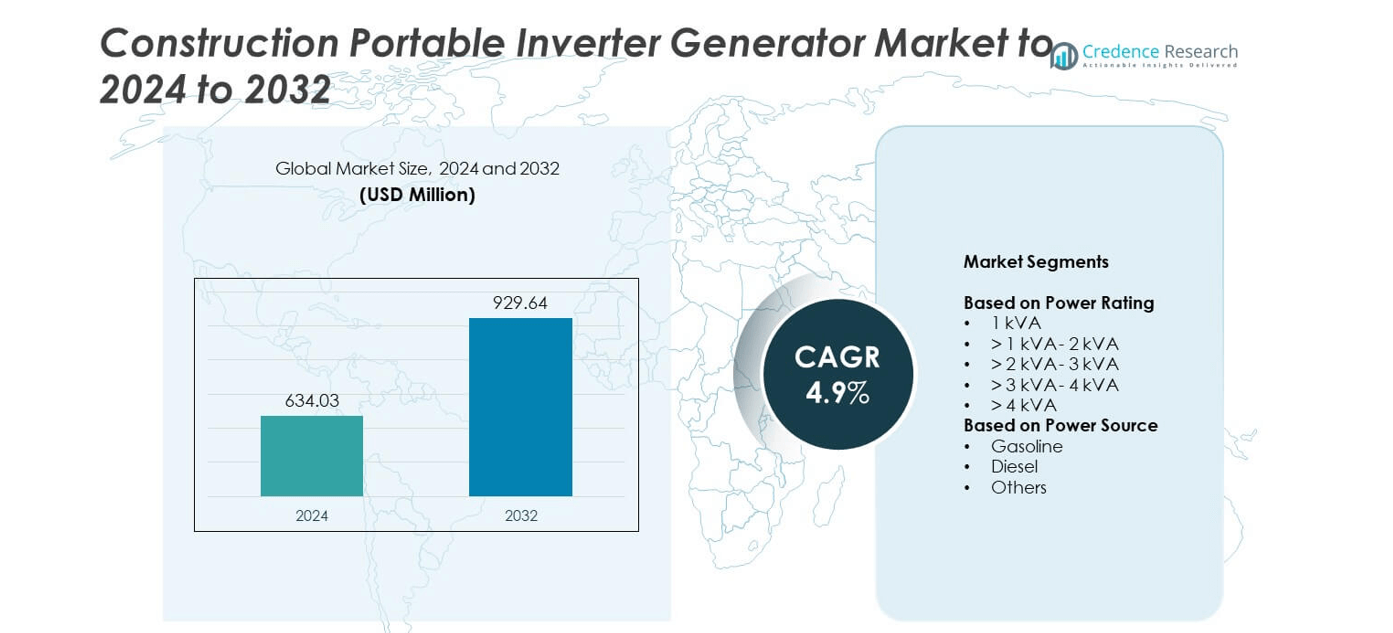

Construction Portable Inverter Generator market size was valued USD 634.03 million in 2024 and is anticipated to reach USD 929.64 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Portable Inverter Generator Market Size 2024 |

USD 634.03 million |

| Construction Portable Inverter Generator Market, CAGR |

4.9% |

| Construction Portable Inverter Generator Market Size 2032 |

USD 929.64 million |

The Construction Portable Inverter Generator market is dominated by major players such as Yamaha Motor, Cummins, Kohler, Atlas Copco, Honda Motor, Generac Power Systems, Caterpillar, Champion Power Equipment, WEN Products, and Briggs & Stratton. These companies focus on product innovation, efficiency enhancement, and noise reduction to strengthen their market presence. Strategic collaborations and technological integration, including hybrid and smart inverter systems, are key competitive strategies. North America leads the global market with a 34% share in 2024, driven by strong infrastructure development, rising energy efficiency standards, and widespread adoption of portable power solutions across construction sites.

Market Insights

- The Construction Portable Inverter Generator market was valued at USD 634.03 million in 2024 and is projected to reach USD 929.64 million by 2032, growing at a CAGR of 4.9%.

- Rising demand for reliable and efficient on-site power solutions drives market growth, supported by increasing construction activity and adoption of energy-efficient technologies.

- The >2 kVA–3 kVA segment dominated with a 37% share in 2024, driven by its balance of power output, portability, and fuel efficiency.

- Market competition remains strong, with leading manufacturers focusing on hybrid innovations, product durability, and noise reduction to enhance brand competitiveness.

- North America led the market with a 34% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, reflecting rising construction investments and growing preference for low-emission, portable power equipment across both developed and emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The >2 kVA–3 kVA segment dominated the Construction Portable Inverter Generator market in 2024 with a 37% share. This range offers an optimal balance between portability, fuel efficiency, and power output, making it ideal for operating construction tools such as drills, saws, and lighting equipment. Its compact size and lower noise levels make it suitable for both small and mid-scale sites. Growing demand for lightweight yet high-performance generators in temporary construction setups and outdoor operations continues to drive the segment’s leadership across developing infrastructure projects.

- For instance, Honda’s EU2200i lists 1800 W rated, 8.1 h at ¼-load, and 48–57 dB(A).

By Power Source

The gasoline-powered segment held the largest share of nearly 59% in 2024, driven by easy fuel availability and low maintenance requirements. Gasoline inverter generators are preferred for their quick start-up, stable output, and reduced emissions compared to conventional models. These units are widely adopted across construction sites that require flexible, portable, and cleaner power alternatives. Increasing adoption of hybrid and fuel-efficient gasoline engines, along with stricter emission norms, further strengthens the segment’s position as construction firms prioritize sustainable and cost-effective power solutions.

- For instance, Briggs & Stratton’s P2500 inverter generator posts a run time of up to 8 hours at 25% load. The unit’s noise level is 58 dB(A) at 7 meters and 25% load, and its running wattage is 1,800 W. The generator is also equipped with technology that allows it to operate more quietly and efficiently.

Key Growth Drivers

Rising Demand for Reliable On-Site Power Supply

The growing number of construction projects worldwide is boosting demand for reliable on-site power sources. Portable inverter generators ensure continuous electricity for tools, lighting, and digital monitoring systems in remote or temporary sites. Their ability to deliver stable and clean power supports modern, electronically controlled construction equipment. Increasing adoption in small and mid-scale construction activities, coupled with the trend toward flexible and mobile power systems, reinforces market growth. Rapid urbanization and expanding infrastructure projects further sustain demand across developing economies.

- For instance, WEN’s 56380i inverter generator delivers 3,400 W rated power and 3,800 W surge power. The unit operates at an extremely quiet 57 dB at a quarter-load and can run for up to 8.5 hours at a half-load. This performance is powered by a 212cc 4-stroke OHV engine.

Shift Toward Energy-Efficient and Low-Emission Solutions

Environmental regulations and rising awareness of sustainable construction practices are driving the shift toward energy-efficient inverter generators. Manufacturers are adopting technologies that reduce fuel consumption and emissions while improving power stability. Advanced inverter systems offer better efficiency compared to conventional generators, aligning with green building initiatives and carbon reduction targets. Growing use of eco-friendly materials in construction projects and the introduction of hybrid models strengthen this trend, positioning energy-efficient inverter generators as a preferred power source.

- For instance, Champion’s 4500-W dual-fuel runs up to 14 h gasoline or 21 h propane.

Technological Advancements and Product Innovation

Continuous innovation in inverter technology is fueling market expansion. New models integrate smart control panels, digital monitoring, and parallel operation features for increased efficiency and user convenience. Advancements in noise reduction and lightweight materials enhance usability at construction sites. Integration of lithium-ion batteries in hybrid inverter systems supports cleaner, quieter, and longer operations. These innovations attract both small contractors and large construction firms seeking portable yet high-performance equipment to meet the growing need for uninterrupted power supply.

Key Trends and Opportunities

Adoption of Hybrid and Solar-Integrated Systems

Hybrid portable inverter generators combining gasoline or diesel engines with solar modules are gaining traction. These systems reduce fuel dependency, enhance runtime, and support sustainability goals. Construction companies prefer hybrid systems for extended field operations where grid access is limited. Growing investment in renewable-powered equipment and advances in solar charging efficiency present new opportunities for manufacturers. The trend aligns with the global shift toward cleaner energy in the construction equipment sector.

- For instance, Generac’s MBE30 provides 30 kVA/24 kW and 90 kWh for hybrid setups.

Growing Preference for Smart and Connected Generators

Integration of IoT and telematics into inverter generators is transforming operational efficiency. Smart models allow real-time monitoring of fuel consumption, performance, and maintenance schedules through mobile applications. These connected systems reduce downtime and optimize fleet management for contractors managing multiple sites. Rising digitalization of construction workflows encourages the use of such intelligent power solutions. The trend offers manufacturers opportunities to deliver advanced, value-added generator models suited for future-ready job sites.

- For instance, EcoFlow’s Smart Generator outputs 1600–1800 W, with 5.4 kWh gas or 20 kWh LPG.

Key Challenges

High Initial Cost and Limited Power Output

Despite their efficiency, inverter generators face adoption barriers due to higher upfront costs compared to traditional units. Their compact design and electronic circuitry limit output for heavy-duty applications, making them less suitable for large-scale sites. Contractors often balance between cost, capacity, and performance when selecting power systems. The challenge lies in achieving affordability without compromising efficiency or durability. Manufacturers are investing in modular and scalable inverter systems to address these limitations and attract cost-sensitive buyers.

Fuel Supply and Maintenance Constraints

Construction sites in remote regions often face challenges in maintaining consistent fuel supply for portable generators. Fluctuating fuel prices and limited refueling infrastructure affect continuous operation. Additionally, inverter systems require periodic maintenance to sustain power quality, which may strain small contractors lacking technical expertise. Manufacturers are responding by developing multi-fuel models and longer-maintenance-interval engines. However, fuel logistics and servicing complexities remain key hurdles to widespread adoption, particularly in developing construction markets.

Regional Analysis

North America

North America held the largest share of about 34% in the Construction Portable Inverter Generator market in 2024. The region’s dominance is driven by widespread infrastructure modernization, residential remodeling, and road construction projects. The U.S. leads the market, supported by high adoption of low-emission and energy-efficient generators. Rising demand for backup power in remote construction sites and frequent weather-related outages further encourage use. Strong presence of key manufacturers and advanced distribution networks enhance product availability, while increasing focus on clean power technologies continues to boost regional demand.

Europe

Europe accounted for nearly 28% of the market share in 2024, driven by rapid adoption of sustainable and low-noise inverter generators. Countries such as Germany, the U.K., and France lead due to strict emission norms and energy efficiency regulations. Construction projects emphasizing green building certification are increasing demand for eco-friendly portable power solutions. The region also benefits from strong adoption in urban development and infrastructure renovation projects. Technological innovation and integration of hybrid power systems further strengthen Europe’s position in the market.

Asia Pacific

Asia Pacific captured around 25% of the total market share in 2024, fueled by rapid urbanization and expanding infrastructure investments. Countries such as China, India, and Japan are major contributors due to large-scale residential and commercial construction. Growing adoption of compact and affordable inverter generators supports small and mid-size contractors. Increasing government initiatives toward smart city development and energy-efficient construction practices enhance regional growth. The availability of low-cost manufacturing and favorable trade conditions also attract major players to expand production capacities across Asia Pacific.

Latin America

Latin America accounted for roughly 8% of the market share in 2024, supported by rising construction and industrial activities. Brazil and Mexico remain key markets, driven by growing demand for portable and reliable power sources in infrastructure development. Frequent power outages and limited grid access in remote regions further drive the use of inverter generators. Government projects for road expansion and residential housing construction contribute to market expansion. However, price sensitivity and limited product awareness among smaller contractors restrain faster adoption.

Middle East and Africa

The Middle East and Africa held a 5% share of the market in 2024, primarily driven by ongoing infrastructure and oil sector projects. The region’s demand is concentrated in countries such as the UAE, Saudi Arabia, and South Africa, where large-scale construction and energy diversification initiatives are active. Harsh environmental conditions increase reliance on portable power solutions for continuous operation. Growing investment in smart and sustainable urban projects supports future adoption. However, limited product availability and higher import costs slightly constrain market penetration in rural construction zones.

Market Segmentations:

By Power Rating

- 1 kVA

- > 1 kVA – 2 kVA

- > 2 kVA – 3 kVA

- > 3 kVA – 4 kVA

- > 4 kVA

By Power Source

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Construction Portable Inverter Generator market features prominent players such as Yamaha Motor, Cummins, Kohler, Atlas Copco, Honda Motor, WEN Products, Deere & Company, Generac Power Systems, DuroMax Power Equipment, Champion Power Equipment, HIMOINSA, Caterpillar, Westinghouse Electric Corporation, Kirloskar, Ha-Ko Industries, Briggs & Stratton, Wacker Neuson SE, and A-iPower. The market is highly competitive, driven by constant innovation and technological advancement. Companies focus on improving fuel efficiency, power stability, and operational durability to meet evolving construction site requirements. Strategic partnerships and distribution expansions enhance market penetration across regions. Firms are also investing in hybrid and low-emission inverter models to align with sustainability goals. Product differentiation through digital features, noise reduction, and portability plays a crucial role in maintaining brand competitiveness. Continuous R&D, coupled with customer-centric design improvements, supports long-term growth and enables manufacturers to adapt to dynamic construction industry power demands.

Key Player Analysis

- Yamaha Motor

- Cummins

- Kohler

- Atlas Copco

- Honda Motor

- WEN Products

- Deere & Company

- Generac Power Systems

- DuroMax Power Equipment

- Champion Power Equipment

- HIMOINSA

- Caterpillar

- Westinghouse Electric Corporation

- Kirloskar

- Ha-Ko Industries

- Briggs & Stratton

- Wacker Neuson SE

- A-iPower

Recent Developments

- In 2025, Cummins Announced an Extended Warranty Program for its generators and power systems.

- In 2025, Atlas Copco Launched the EPH series of modular hybrid power generators.

- In 2024, Caterpillar introduced its G3500K series of gas generator sets, featuring built-in Internet of Things (IoT) connectivity for advanced energy management and remote monitoring

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for compact and efficient power solutions will continue to rise in small construction projects.

- Manufacturers will focus on integrating smart control and remote monitoring features in new models.

- Hybrid inverter generators combining fuel and solar power will gain wider acceptance.

- Government initiatives promoting low-emission equipment will boost eco-friendly generator adoption.

- Advances in battery technology will improve generator efficiency and operational duration.

- Rental and leasing services for inverter generators will expand across developing markets.

- Growing use in disaster recovery and emergency construction sites will support market growth.

- Manufacturers will invest in noise reduction and lightweight material technologies.

- Expanding construction activity in emerging economies will create strong regional growth opportunities.

- Partnerships between equipment manufacturers and construction firms will strengthen distribution and service networks.