Market Overview

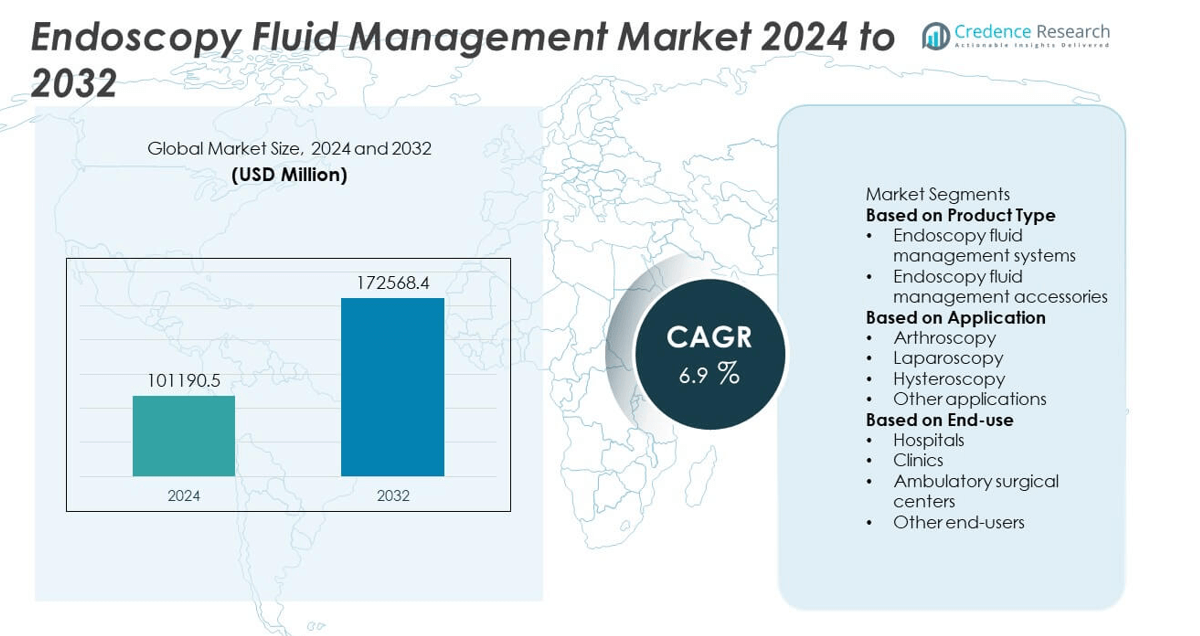

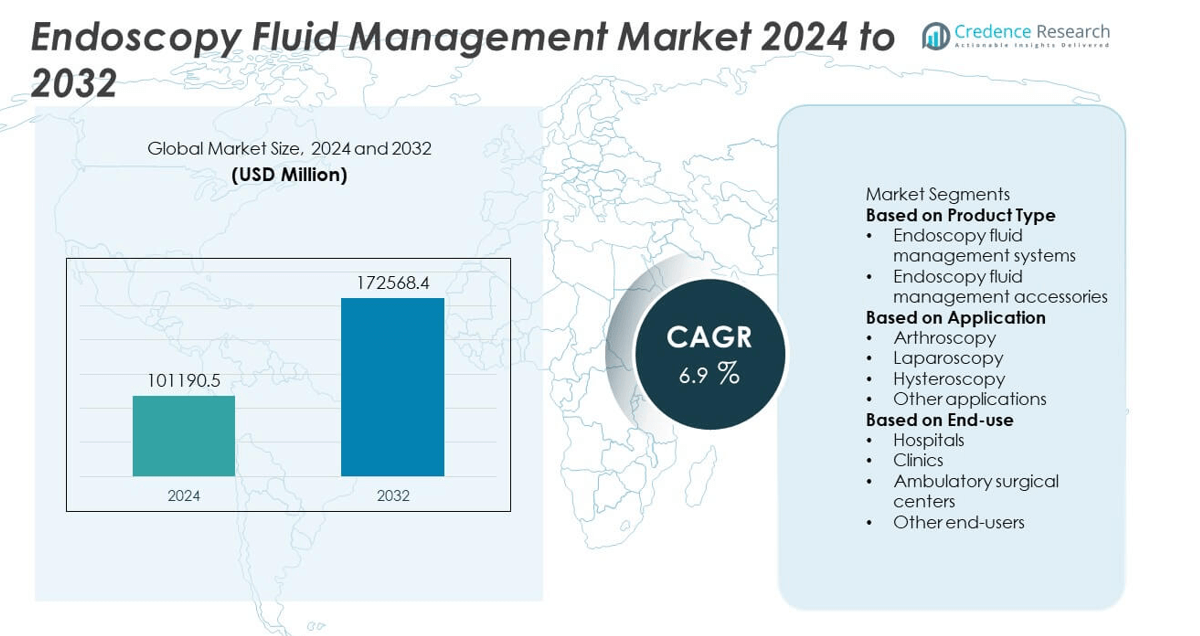

Endoscopy Fluid Management Market was valued at USD 101,190.5 million in 2024 and is projected to reach USD 172,568.4 million by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endoscopy Fluid Management Market Size 2024 |

USD 101,190.5 million |

| Endoscopy Fluid Management Market, CAGR |

6.9% |

| Endoscopy Fluid Management Market Size 2032 |

USD 172,568.4 million |

The Endoscopy Fluid Management Market grows steadily, driven by rising demand for minimally invasive surgeries and advancements in smart fluid management technologies. Increasing adoption of real-time monitoring systems enhances procedural safety and efficiency. Growing numbers of endoscopic procedures worldwide, supported by expanding healthcare infrastructure, further fuel market expansion. The trend toward disposable and single-use components aims to reduce infection risks, while digital integration improves workflow and data accuracy.

The Endoscopy Fluid Management Market exhibits strong growth across key regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced healthcare infrastructure and high adoption of minimally invasive procedures, while Europe follows due to increasing healthcare investments and aging populations. The Asia-Pacific region shows rapid expansion driven by improving healthcare access and rising patient awareness. Market players focus on regional partnerships and tailored solutions to capture these diverse opportunities. Leading companies in this market include Olympus Corporation, Medtronic plc, KARL STORZ SE & Co. KG, and Johnson & Johnson. These players drive innovation by developing advanced fluid management systems with smart features, emphasizing safety, efficiency, and ease of use.

Market Insights

- The Endoscopy Fluid Management Market was valued at USD 101,190.5 million in 2024 and is projected to reach USD 172,568.4 million by 2032, growing at a CAGR of 6.9% during the forecast period.

- Increasing preference for minimally invasive surgeries drives demand for efficient and reliable fluid management systems in healthcare facilities worldwide.

- Adoption of smart and digitally integrated fluid management technologies enhances procedural accuracy, safety, and workflow efficiency across hospitals and surgical centers.

- Growing use of disposable and single-use fluid management components aims to reduce infection risks and aligns with stricter hygiene standards globally.

- Competitive landscape features key players such as Olympus Corporation, Medtronic plc, KARL STORZ SE & Co. KG, and Johnson & Johnson, focusing on innovation and expanding global reach.

- High initial costs and complex system requirements limit adoption in cost-sensitive markets, while stringent regulatory frameworks create challenges for new product development and market entry.

- North America and Europe dominate the market with well-established healthcare infrastructures, while Asia-Pacific shows the fastest growth fueled by rising healthcare investments and increasing endoscopic procedure volumes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Minimally Invasive Surgeries Increasing Demand for Efficient Fluid Management Solutions

The growing preference for minimally invasive surgical procedures fuels the demand for advanced fluid management systems. These procedures require precise control and monitoring of irrigation fluids to enhance patient safety and procedural outcomes. Hospitals and surgical centers seek reliable endoscopy fluid management systems to reduce complications such as fluid overload and electrolyte imbalance. It helps improve operational efficiency and shortens recovery times. Increasing awareness among healthcare professionals about the benefits of fluid management solutions supports market growth. The Endoscopy Fluid Management Market benefits from this shift toward less invasive techniques, which drive adoption globally.

- For instance, Hologic’s Fluent Pro Fluid Management System reported processing over 12,000 procedures worldwide within its first year of launch, demonstrating rapid adoption due to its precise fluid control and enhanced safety features.

Technological Advancements Enhancing Accuracy and Safety of Fluid Management Systems

Innovations in endoscopy fluid management technologies contribute significantly to market expansion. Modern systems incorporate features such as real-time fluid monitoring, automated pressure regulation, and advanced sensors to optimize fluid delivery. These improvements reduce human error and minimize the risk of procedural complications. Companies invest heavily in research and development to introduce smarter, user-friendly devices that integrate seamlessly with existing surgical workflows. The market experiences steady growth as healthcare providers prioritize patient safety and operational precision through such technological enhancements.

- For instance, Olympus Corporation’s HysteroFlow/HysteroBalance II Fluid Management System achieves real-time fluid deficit measurements with an accuracy margin of ±5 milliliters, providing clinicians with reliable data to manage patient safety effectively during procedures.

Growing Number of Endoscopic Procedures and Expanding Healthcare Infrastructure Worldwide

The volume of diagnostic and therapeutic endoscopic procedures continues to rise globally, driving the need for effective fluid management solutions. Increasing patient awareness, aging populations, and a surge in chronic diseases support this trend. Expanding healthcare infrastructure, especially in emerging economies, enables broader access to advanced surgical tools. This expansion fuels the demand for efficient endoscopy fluid management systems that ensure procedural success and safety. The Endoscopy Fluid Management Market capitalizes on these factors to strengthen its position across diverse geographic regions.

Stringent Regulatory Standards and Increasing Focus on Patient Safety in Healthcare Settings

Regulatory bodies enforce strict guidelines on fluid management during endoscopic procedures to prevent adverse events and enhance patient outcomes. Healthcare facilities comply by adopting advanced fluid management systems that meet safety and quality standards. It enables better documentation, traceability, and control over fluid use during surgeries. The increasing emphasis on reducing surgical complications and improving care quality supports market growth. Manufacturers continuously adapt their products to align with evolving regulations, which helps sustain demand for endoscopy fluid management solutions.

Market Trends

Integration of Digital Technologies and Smart Systems to Improve Fluid Management Efficiency

The Endoscopy Fluid Management Market experiences a shift toward digital integration and smart technology adoption. Manufacturers develop systems with real-time data analytics, automated controls, and connectivity features that enhance surgical precision. These smart systems provide surgeons with accurate feedback on fluid usage, improving safety and reducing waste. Integration with hospital information systems streamlines documentation and compliance with regulatory standards. Healthcare providers favor solutions that simplify workflows and enable remote monitoring during procedures. The trend reflects a broader move toward digital transformation in surgical environments.

- For instance, Medtronic’s GI Genius™ platform integrates AI-driven analytics that process over 1,000 data points per second during endoscopic procedures, allowing precise fluid management adjustments in real time.

Growing Adoption of Single-Use and Disposable Fluid Management Components to Prevent Cross-Contamination

Healthcare facilities increasingly prefer single-use and disposable fluid management products to reduce infection risks and improve patient safety. The Endoscopy Fluid Management Market adapts to this demand by offering disposable tubing sets, connectors, and reservoirs designed for one-time use. This trend aligns with stricter hygiene protocols and infection control policies in hospitals worldwide. It helps minimize maintenance costs and reduces downtime between procedures. Suppliers focus on developing cost-effective and environmentally sustainable disposable options to meet market expectations. This shift contributes to the widespread acceptance of fluid management systems across diverse clinical settings.

Expansion of Emerging Markets Due to Improved Healthcare Access and Infrastructure Development

Emerging economies display rapid growth in endoscopic procedures driven by rising healthcare investments and increasing patient awareness. The Endoscopy Fluid Management Market capitalizes on this expansion by targeting regions with growing hospital networks and upgraded surgical facilities. Improving healthcare access in these areas encourages adoption of modern fluid management solutions. Market players establish partnerships and local manufacturing to reduce costs and enhance availability. This trend supports the broader global penetration of advanced endoscopy technologies, creating new revenue streams for manufacturers and suppliers.

Focus on Sustainability and Eco-Friendly Solutions Influencing Product Development and Market Offerings

Environmental concerns and regulatory pressures motivate manufacturers to develop sustainable fluid management products. The Endoscopy Fluid Management Market witnesses an increase in eco-friendly materials, recyclable components, and energy-efficient device designs. Companies aim to reduce the environmental footprint of their products without compromising performance or safety. Hospitals increasingly prioritize suppliers that demonstrate commitment to sustainability. This trend drives innovation and reshapes market strategies to align with growing global demands for green healthcare technologies.

Market Challenges Analysis

High Initial Costs and Complexity of Advanced Fluid Management Systems Limit Adoption in Cost-Sensitive Markets

The Endoscopy Fluid Management Market faces challenges due to the high upfront investment required for advanced fluid management technologies. Many healthcare providers, especially in developing regions, hesitate to adopt these systems because of budget constraints and limited access to capital. Complex system designs may require extensive staff training, increasing operational burdens and delaying integration into existing workflows. Smaller clinics and outpatient centers often rely on traditional or manual methods due to cost-effectiveness, limiting market penetration. Suppliers encounter difficulties balancing advanced functionality with affordability. This barrier slows widespread adoption, particularly in price-sensitive segments of the healthcare industry.

Stringent Regulatory Requirements and Need for Standardization Create Barriers to Market Entry and Product Development

Regulatory compliance remains a significant challenge for companies operating in the Endoscopy Fluid Management Market. Manufacturers must meet diverse standards across different countries, increasing product development time and costs. Lack of global standardization in fluid management protocols complicates the design and approval processes. Hospitals may hesitate to invest in new systems until regulatory clarity improves. Frequent updates to safety and quality requirements force ongoing modifications to existing products. It also limits smaller players’ ability to enter the market due to compliance burdens. These regulatory hurdles create delays and increase costs throughout the product lifecycle, impacting overall market growth.

Market Opportunities

Expansion into Emerging Markets Fueled by Increasing Healthcare Investments and Rising Demand for Minimally Invasive Procedures

The Endoscopy Fluid Management Market holds significant growth potential in emerging economies where healthcare infrastructure undergoes rapid development. Governments and private sectors increase funding to modernize hospitals and surgical centers, creating demand for advanced fluid management solutions. Rising patient awareness and preference for minimally invasive procedures support higher adoption rates. Market players can capitalize on these trends by establishing local partnerships and tailoring products to regional needs. Introducing cost-effective systems designed for resource-limited settings opens new revenue streams. Expanding presence in these markets offers long-term growth and diversification opportunities.

Innovation in Smart Fluid Management Systems and Integration with Digital Healthcare Platforms Creating New Value Propositions

Technological advancements provide the Endoscopy Fluid Management Market with opportunities to enhance system capabilities through smart features and connectivity. Integration with hospital information systems and surgical devices improves workflow efficiency and data accuracy. Developing solutions with artificial intelligence and machine learning enables predictive analytics and proactive risk management during procedures. Offering customizable and user-friendly interfaces attracts healthcare providers focused on precision and patient safety. Collaborations with digital health companies create pathways for continuous innovation. These developments position companies to meet evolving clinical demands and strengthen competitive advantage.

Market Segmentation Analysis:

By Product Type

The Endoscopy Fluid Management Market divides into fluid management systems, irrigation pumps, suction devices, and accessories such as tubing sets and reservoirs. Fluid management systems dominate due to their comprehensive control over fluid delivery and retrieval during endoscopic procedures. Irrigation pumps hold a significant share by providing precise fluid flow, critical for maintaining clear visibility in surgical fields. Suction devices support efficient removal of excess fluids and debris, enhancing procedural safety. Accessories complement these core products and see growing demand with increasing procedure volumes.

- For instance, Arthrex’s Continuous Wave™ 4 arthroscopy pump delivers up to 300 milliliters per minute with integrated pressure sensors maintaining intra-articular pressure within 5 mmHg accuracy, ensuring consistent irrigation and suction control during procedures.

By Application

The market covers gastrointestinal endoscopy, urology, gynecology, and other surgical specialties. Gastrointestinal endoscopy represents the largest segment, driven by the high frequency of diagnostic and therapeutic procedures in this field. Urology follows closely with increasing adoption of minimally invasive treatments requiring effective fluid control. Gynecological applications expand steadily due to rising awareness of less invasive surgery options. Other specialties, including arthroscopy and ENT procedures, contribute to niche but growing market segments, broadening the overall scope.

- For instance, Olympus Corporation’s EndoTherapy irrigation pump supports over 15,000 gastrointestinal procedures monthly worldwide, delivering fluid flow rates from 0 to 500 milliliters per minute with precise pressure modulation to optimize visibility and safety during endoscopic interventions.

By End-Use

The market serves hospitals, ambulatory surgical centers (ASCs), and specialized clinics. Hospitals lead the market, supported by large procedural volumes, advanced infrastructure, and higher budgets for technology adoption. ASCs grow rapidly due to convenience and cost-effectiveness for outpatient procedures, increasing demand for portable and easy-to-use fluid management solutions. Specialized clinics, including gastroenterology and urology centers, adopt fluid management systems to improve patient outcomes and procedural efficiency. The rise in outpatient care models encourages suppliers to develop compact, flexible products tailored to these settings.

Segments:

Based on Product Type

- Endoscopy fluid management systems

- Endoscopy fluid management accessories

Based on Application

- Arthroscopy

- Laparoscopy

- Hysteroscopy

- Other applications

Based on End-use

- Hospitals

- Clinics

- Ambulatory surgical centers

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Endoscopy Fluid Management Market shows a varied regional distribution, with North America leading the global landscape by holding approximately 38% of the market share in 2024. This dominance reflects the region’s advanced healthcare infrastructure, high adoption rate of minimally invasive procedures, and strong presence of key market players. The United States drives this leadership due to substantial investments in healthcare technology, extensive research and development activities, and favorable reimbursement policies. Canada also contributes with increasing demand for endoscopic surgeries and fluid management solutions. North America’s focus on technological innovation and stringent regulatory frameworks ensures continuous market growth and introduction of cutting-edge fluid management systems.

Europe

Europe holds the second-largest market share at around 27%, driven by growing healthcare expenditure, rising geriatric population, and increasing prevalence of chronic diseases requiring endoscopic interventions. Countries like Germany, France, and the United Kingdom lead the region with well-established healthcare systems and rising demand for advanced surgical technologies. The European market benefits from supportive government initiatives promoting minimally invasive surgeries and enhanced patient safety. Expanding hospital infrastructure and rising awareness among healthcare professionals encourage adoption of fluid management solutions. Manufacturers invest in regional partnerships and local production to strengthen their foothold across Europe.

Asia-Pacific

The Asia-Pacific region accounts for approximately 22% of the Endoscopy Fluid Management Market share, exhibiting the highest growth rate globally. Rapid urbanization, expanding healthcare infrastructure, and increasing patient awareness fuel demand in countries such as China, India, Japan, and South Korea. Governments emphasize improving healthcare accessibility and modernizing surgical facilities, leading to higher adoption of endoscopic procedures and fluid management systems. The rising middle-class population and increasing private healthcare investments further contribute to market expansion. Market players focus on offering cost-effective solutions tailored to regional requirements to capitalize on this growing opportunity.

Latin America

Latin America holds about 7% of the market share, supported by gradual improvements in healthcare infrastructure and increasing demand for minimally invasive surgeries. Countries like Brazil, Mexico, and Argentina lead the regional market with investments in upgrading surgical facilities and growing awareness of advanced medical technologies. Although adoption rates remain lower than in developed regions, government initiatives to improve healthcare standards drive the market forward. The Endoscopy Fluid Management Market in Latin America benefits from collaborations between global suppliers and local distributors to enhance product availability and training.

Middle East and Africa (MEA)

The Middle East and Africa (MEA) region represents around 6% of the market share, driven by increasing healthcare investments, rising prevalence of lifestyle diseases, and expanding private healthcare sector. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa lead the regional market by adopting advanced medical technologies and improving hospital infrastructure. Despite challenges related to economic disparities and limited healthcare access in some areas, MEA shows promising growth potential. Market players focus on raising awareness and providing affordable solutions to penetrate this developing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KARL STORZ SE & Co. KG

- Hologic Inc.

- Smith & Nephew

- Medtronic plc

- Arthrex, Inc.

- Johnson & Johnson

- Richard Wolf GmbH

- Olympus Corporation

- CONMED Corporation

- Braun SE

Competitive Analysis

The Endoscopy Fluid Management Market features intense competition among leading global players such as Olympus Corporation, Medtronic plc, KARL STORZ SE & Co. KG, Johnson & Johnson, Arthrex, Inc., and B. Braun SE. These companies maintain strong market positions through continuous innovation, strategic partnerships, and extensive distribution networks. They focus on developing advanced fluid management systems that offer improved precision, safety, and ease of use to meet evolving clinical demands. R&D investments play a critical role, enabling the introduction of smart technologies like real-time fluid monitoring, automated controls, and integration with digital healthcare platforms. Market leaders differentiate themselves by expanding product portfolios to include both reusable and disposable components, addressing the growing demand for infection control and operational efficiency. They also emphasize global presence by strengthening footprints in emerging markets through collaborations and localized manufacturing. Competitive pricing strategies and customized solutions further enhance their appeal across diverse healthcare settings, from large hospitals to ambulatory surgical centers. The dynamic nature of this market pushes companies to adapt quickly to regulatory changes and customer preferences. Sustained focus on quality, compliance, and innovation ensures that leading players retain their competitive edge and continue to drive growth in the Endoscopy Fluid Management Market.

Recent Developments

- In November 2024, Olympus showcased a broad range of solutions in gynecology at the AAGL Annual Meeting, including the HysteroFlow/HysteroBalance II Fluid Management System, designed to provide accurate and easy measurement of fluid loss and intrauterine pressure.

- In April 2024 Genius Summit, Medtronic unveiled AI-driven solutions and strategic alliances aimed at enhancing the efficiency and effectiveness of endoscopic care, including fluid management systems.

- In January 2024, Olympus Corporation announced that it has entered into an agreement to acquire Quest Photonic Devices B.V. for up to EUR50 million including milestone payments to strengthen its surgical endoscopy capabilities.

Market Concentration & Characteristics

The Endoscopy Fluid Management Market exhibits a moderately concentrated structure dominated by a few key global players such as Olympus Corporation, Medtronic plc, KARL STORZ SE & Co. KG, and Johnson & Johnson. These companies leverage extensive research and development capabilities to innovate and introduce advanced fluid management systems that meet the evolving demands of minimally invasive surgeries. It benefits from strong distribution networks and established relationships with healthcare providers worldwide. The market features a mix of reusable and disposable product offerings, addressing diverse clinical needs and infection control protocols. It faces challenges from high entry barriers, including stringent regulatory requirements and the need for technological expertise, which limit the influx of new competitors. Despite this, smaller specialized firms contribute niche solutions that foster competitive dynamics. The market’s growth is driven by increasing adoption of smart, automated fluid management technologies that enhance surgical precision and patient safety. It also reflects a trend toward integrated systems capable of real-time monitoring and data connectivity, supporting digital healthcare transformation. Geographic diversification, especially expanding presence in emerging economies, shapes competitive strategies. Overall, the market’s concentration supports sustained innovation and product quality, while its characteristics ensure adaptability to changing healthcare landscapes and technological advancements.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing due to increased demand for minimally invasive surgical procedures.

- Adoption of smart fluid management systems with real-time monitoring will rise.

- Integration with hospital information systems will improve workflow efficiency.

- Disposable and single-use fluid management products will gain wider acceptance.

- Emerging markets will show rapid expansion driven by healthcare infrastructure development.

- Technological innovations will focus on enhancing patient safety and reducing procedural complications.

- Regulatory standards will become more stringent, influencing product design and compliance.

- Collaborations between medical device companies and technology firms will accelerate innovation.

- Growing awareness of infection control will drive adoption of advanced fluid management solutions.

- Market competition will intensify, prompting companies to offer customized and cost-effective products.