Market Overview

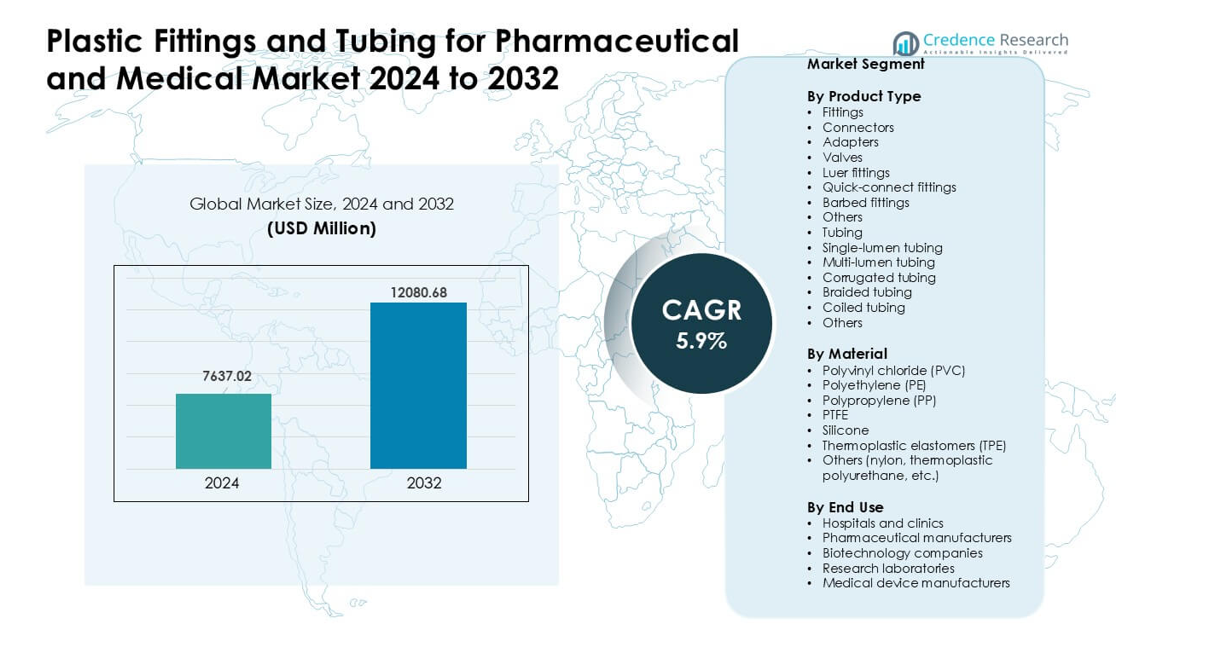

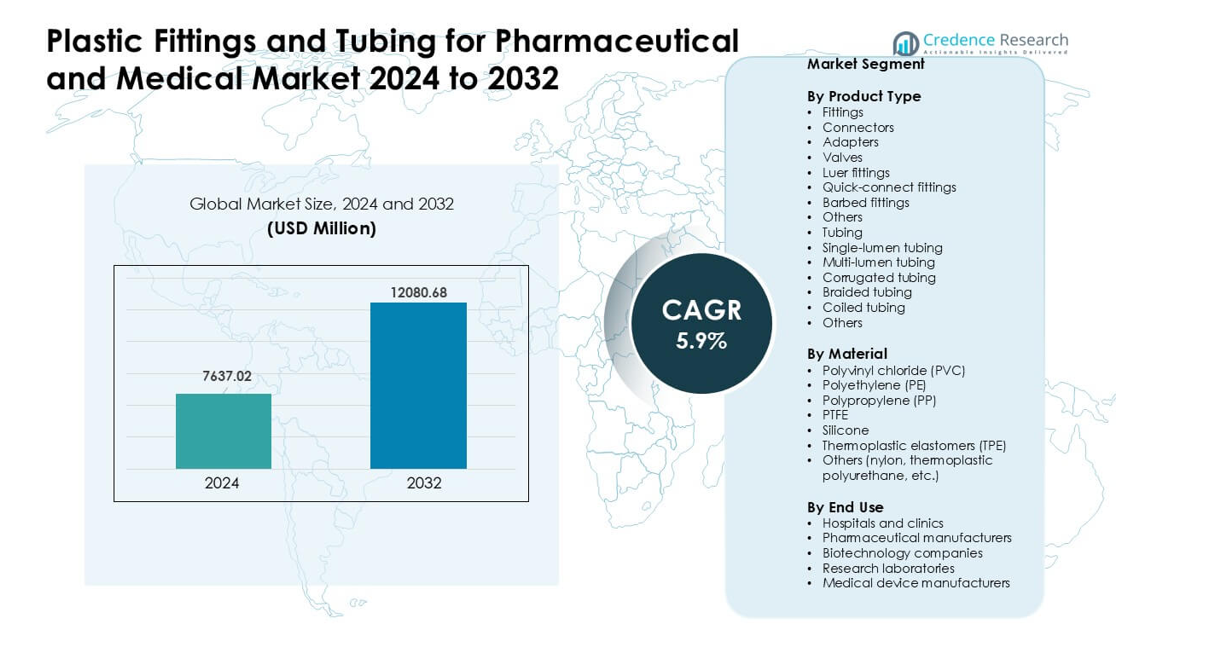

Plastic Fittings and Tubing for Pharmaceutical and Medical Market was valued at USD 7637.02 million in 2024 and is anticipated to reach USD 12080.68 million by 2032, growing at a CAGR of 5.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size 2024 |

USD 7637.02 million |

| Plastic Fittings and Tubing for Pharmaceutical and Medical Market, CAGR |

5.9% |

| Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size 2032 |

USD 12080.68 million |

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market is shaped by major players including Parker Hannifin, Freudenberg Medical, Qosina, Nordson, New Age Industries, AP Extrusion, Atlas Copco, Navtar, Polymer Solutions, and Eldon James. These companies focus on high-purity tubing, sterile connectors, and advanced materials that support infusion therapy, bioprocessing, and medical device production. North America remained the leading region in 2024 with about 38% share, driven by strong pharmaceutical manufacturing capacity, extensive hospital infrastructure, and rapid adoption of single-use systems. This dominance continued as regional firms invested in regulatory-compliant materials and precision-engineered components.

Market Insights

- The Plastic Fittings and Tubing for Pharmaceutical and Medical Market reached USD 02 million in 2024 and is projected to hit USD 12080.68 million by 2032, growing at a CAGR of 5.9%.

- Strong drivers include rising use of single-use systems, higher infusion and respiratory care demand, and increased adoption of biocompatible materials across hospitals and drug manufacturers.

- Key trends involve growth in DEHP-free tubing, wider uptake of multi-lumen and braided designs, and fast expansion of high-purity components for biologics and sterile drug production.

- The market features active competition among Parker Hannifin, Freudenberg Medical, Qosina, Nordson, New Age Industries, AP Extrusion, Atlas Copco, Navtar, Polymer Solutions, and Eldon James, with fittings holding the largest product share at about 41%.

- North America led the market with roughly 38% share in 2024, followed by Europe near 30% and Asia Pacific at about 26%, supported by strong pharma capacity and rising hospital use

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Fittings led this segment in 2024 with about 41% share. Hospitals and drug makers used these parts to support safe fluid transfer in IV sets, sampling lines, and bioprocess systems. Growth came from rising use of luer and quick-connect fittings that reduce leak risk and speed setup in sterile spaces. Tubing types such as single-lumen and braided designs also grew due to wider adoption in infusion pumps and vent circuits. Demand rose as care centers pushed for lightweight, chemical-resistant parts that support strict hygiene rules.

- For instance, ICU Medical, Inc. a major global supplier of IV sets and needle‑free connectors reports that its proprietary Clave™ connector technology (a luer‑compatible needle‑free connector) enables a dead space (residual fluid volume) as low as 0.06 mL and supports flow rates up to 185 mL/min, helping reduce the risk of contamination and speeding up fluid transfer in infusion systems.

By Material

Polyvinyl chloride (PVC) held the dominant share in 2024 with nearly 38%. PVC stayed popular due to strong flexibility, low cost, and proven performance in infusion sets, drainage lines, and respiratory devices. Silicone and PTFE also grew because of strong heat resistance and biocompatibility in high-purity drug processing tasks. Thermoplastic elastomers gained traction as users shifted toward DEHP-free options. This shift came from strict rules on patient safety and rising interest in recyclable and medical-grade polymers that support cleaner production.

- For instance, Baxter International Inc. refers to decades of clinical use of its PVC-based infusion bags and tubing supported by more than eight billion patient‑days of exposure without reported significant adverse effects underscoring PVC’s established safety and performance credentials in IV applications.

By End Use

Hospitals and clinics led the market in 2024 with roughly 44% share. Demand rose due to high use of fittings and tubing in infusion therapy, respiratory care, drug delivery, and patient monitoring. Pharmaceutical manufacturers and biotech firms also increased purchases as sterile processing, single-use systems, and cleanroom production expanded. Medical device manufacturers adopted advanced tubing for pump systems and diagnostic units. Growth across all groups came from rising chronic disease cases, infection-control needs, and wider use of single-use sterile components.

Key Growth Drivers

Rising Adoption of Single-Use Systems in Pharma and Biotech

Single-use systems drove strong demand for plastic fittings and tubing as drug makers shifted from stainless steel to disposable, contamination-free assemblies. This shift reduced cleaning time, cut validation costs, and improved production speed during biologics and vaccine manufacturing. Growing investment in monoclonal antibodies, cell therapy, and gene therapy also increased the need for sterile connectors, multi-lumen tubing, and high-purity polymers. Many companies selected PTFE, silicone, and TPE tubing to support harsh chemicals and high-flow filtration setups. Rising global capacity expansion in bioprocessing supported higher purchases from leading pharma and biotech facilities.

- For instance, EMD Millipore introduced its Mobius 2000 L Single‑Use Bioreactor, a 2000‑liter capacity reactor, offering a 5:1 turndown ratio and self‑inflating single‑use Flexware assembly that significantly simplified installation and reduced operator intervention compared with traditional stainless-steel bioreactors.

Growth in Hospital Procedures and Home-Based Care

Increasing chronic disease cases raised the use of IV therapy, enteral feeding, respiratory care, and drug-delivery lines in hospitals and clinics. This need supported higher demand for luer fittings, quick-connect components, and flexible tubing used in infusion pumps and ventilators. Home-based care also grew, pushing demand for lightweight, kink-resistant tubing that supports safe and easy patient use. Aging populations in major regions added further growth across long-term therapy systems. Many device makers adopted advanced polymers for improved clarity, flow control, and biocompatibility, which strengthened market expansion.

- For instance, adoption of needleless connectors and disposable single‑use tubing by home‑care device providers has increased thanks to lightweight, flexible materials (like medical‑grade TPE or silicone), which make infusion lines more manageable for patients and caregivers, reducing infection risk and improving ease-of‑use compared to rigid reusable lines.

Shift Toward High-Performance and Biocompatible Materials

Manufacturers adopted medical-grade PVC, silicone, PTFE, and TPE as users required better chemical resistance, purity, and heat stability for critical drug and fluid pathways. Increased investment in aseptic processing led to wider acceptance of DEHP-free and non-leachable materials that support patient safety. Regulatory pressure pushed developers to replace older materials with cleaner and more transparent tubing options suited for sensitive formulations. Biocompatible polymers enabled safer infusion, dialysis, and ventilation applications. This shift supported innovation in braided, corrugated, and multi-lumen tubing designed for higher durability and flow accuracy in clinical use.

Key Trends & Opportunities

Expansion of Advanced Bioprocessing and High-Purity Flow Paths

Growth in biologics, mRNA platforms, and next-generation therapies created strong need for high-purity flow paths supported by advanced fittings and tubing. Companies scaled production of sterile, gamma-stable connectors and multi-layer tubing to meet cleanroom and GMP requirements. Automation in drug manufacturing encouraged adoption of leak-proof quick-connect fittings for safe transfer and sampling. New opportunities appeared in closed bioreactor systems and disposable assemblies that support flexible, modular plants. This shift positioned high-performance materials as a major area for product upgrades and specialized supply partnerships.

- For instance, Thermo Fisher Scientific offers its single‑use systems line (e.g., the HyPerforma™ DynaDrive product family) which uses high‑quality films and pre‑sterilized components. Their single-use systems including bags, tubing, and connectors allow companies to eliminate CIP/SIP validation entirely between batches, enabling significantly faster changeovers and reducing downtime.

Material Innovation Toward Sustainability and Compliance

Manufacturers explored recyclable polymers, DEHP-free PVC, and bio-based materials to meet global rules on patient safety and environmental performance. This trend opened opportunities for suppliers offering low-extractable tubing and advanced elastomers that maintain strength without harmful additives. Hospitals and drug makers preferred components that supported clean disposal, reduced toxic exposure, and met new recycling guidelines. Strong regulatory focus on material transparency and purity encouraged companies to redesign fittings and tubing with compliant formulations. This shift enabled premium product segments with higher margins and stronger long-term demand.

- For instance, Baxter International did receive U.S. FDA 510(k) clearance for its Novum IQ large-volume infusion pump (LVP) and its Dose IQ Safety Software in April 2024.

Growth of Digital Health and Portable Medical Devices

Portable infusion pumps, wearable drug-delivery units, and home-care respiratory devices expanded the need for compact, kink-resistant tubing and micro-fittings. Demand increased for lighter materials that improve patient comfort while maintaining strong flow accuracy. Digital health tools and remote monitoring systems required standardized connectors that support safe and easy replacement by non-clinical users. Manufacturers responded with ergonomic luer systems and thin-wall tubing tailored for small devices. This shift created steady opportunities for suppliers in chronic care, diabetes management, and ambulatory therapy equipment.

Key Challenges

Compliance Pressure from Strict Regulatory Standards

Stringent global rules on material purity, extractables, leachables, and biocompatibility created high certification costs for manufacturers. Meeting standards from FDA, EMA, and ISO required extensive testing of tubing and fittings, which slowed product launches. Any change in resin, colorant, or processing conditions triggered new validation cycles, adding delays and expenses. Limited global harmonization of regulations forced companies to manage multiple compliance pathways. Smaller firms found it difficult to compete due to high documentation needs and rising scrutiny around chemical additives and sterilization compatibility.

Supply Chain Disruptions and Volatile Polymer Prices

The market faced pressure from unstable raw material costs, resin shortages, and transportation delays. High reliance on medical-grade PVC, PP, and TPE created challenges when global petrochemical supply chains experienced disruptions. Manufacturers dealt with rising production costs, longer lead times, and unpredictable supplier availability. Healthcare buyers demanded stable pricing, which added strain on margins. Dependence on specialized resins for high-purity tubing made rapid scaling difficult during sudden surges in demand, such as public-health emergencies or sharp increases in hospital procedure volumes.

Regional Analysis

North America

North America led the Plastic Fittings and Tubing for Pharmaceutical and Medical Market in 2024 with about 38% share. Strong demand came from advanced hospitals, mature biotech hubs, and high spending on infusion therapy, respiratory care, and drug manufacturing. The U.S. expanded its biologics and vaccine production capacity, which increased the need for sterile connectors, luer systems, and high-purity tubing. Canada supported growth through rising investments in medical device assembly and cleanroom production. Strict regulatory standards also pushed adoption of high-performance polymers designed for safety and consistent clinical performance.

Europe

Europe held nearly 30% share in 2024, supported by strong pharmaceutical production, well-regulated healthcare systems, and significant medical device manufacturing. Germany, France, and the U.K. drove demand for advanced tubing, multi-lumen designs, and DEHP-free materials used in infusion and respiratory products. Bioprocessing expansion in Switzerland and Ireland further increased purchases of sterile fittings and single-use components. Sustainability rules accelerated the shift toward recyclable polymers and compliant elastomers. Broad adoption of precision drug-delivery systems and increased ICU capacity strengthened the region’s steady demand profile.

Asia Pacific

Asia Pacific accounted for roughly 26% share in 2024 and remained the fastest-growing regional market. China and India expanded pharmaceutical manufacturing, boosting demand for high-purity tubing and connectors used in sterile drug production. Japan and South Korea advanced medical device output, which increased the need for reliable fittings and heat-resistant materials. Rising hospital infrastructure and chronic disease cases raised consumption of IV and respiratory components. Growing investment in biologics and single-use systems positioned the region as a high-potential destination for global suppliers.

Latin America

Latin America captured about 4% share in 2024, driven by steady growth in hospital procedures and expanding pharmaceutical packaging and production. Brazil and Mexico led demand for PVC and TPE tubing used in infusion therapy and diagnostic devices. Efforts to modernize public healthcare improved adoption of sterile connectors and luer fittings. However, supply chain gaps and limited local manufacturing slowed wider penetration of advanced materials. Partnerships with global device makers and rising private healthcare spending continued to support moderate regional growth.

Middle East & Africa

Middle East & Africa held nearly 2% share in 2024, supported by rising hospital investments in the Gulf region and expanding medical imports. Saudi Arabia and the UAE increased adoption of high-quality tubing and fittings for critical care, surgery, and patient monitoring. Africa saw gradual growth as donor-funded programs improved access to infusion and respiratory equipment. Limited local production kept dependence on imported components high. Growing interest in building regional pharma and device manufacturing hubs may create long-term opportunities for sterile connectors and specialized tubing.

Market Segmentations:

By Product Type

- Fittings

- Connectors

- Adapters

- Valves

- Luer fittings

- Quick-connect fittings

- Barbed fittings

- Others

- Tubing

- Single-lumen tubing

- Multi-lumen tubing

- Corrugated tubing

- Braided tubing

- Coiled tubing

- Others

By Material

- Polyvinyl chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

- PTFE

- Silicone

- Thermoplastic elastomers (TPE)

- Others (nylon, thermoplastic polyurethane, etc.)

By End Use

- Hospitals and clinics

- Pharmaceutical manufacturers

- Biotechnology companies

- Research laboratories

- Medical device manufacturers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market features key players such as Parker Hannifin, Freudenberg Medical, Qosina, Nordson, New Age Industries, AP Extrusion, Atlas Copco, Navtar, Polymer Solutions, and Eldon James. These companies compete through advanced polymer engineering, sterile single-use assemblies, precision-molded fittings, and high-purity tubing designed for drug delivery, bioprocessing, and critical-care equipment. Many suppliers expand portfolios with DEHP-free PVC, silicone, PTFE, and TPE materials that support global compliance and biocompatibility needs. Firms also invest in cleanroom molding, extrusion upgrades, and automated quality control to secure strong partnerships with pharma, biotech, and medical device manufacturers. Growing demand for customized connectors, multi-lumen tubing, and quick-connect systems continues to shape competitive strategies across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Parker Hannifin: showcased new medical/bioprocess fluidics (advanced pumps, valves and integrated fluidic systems suitable for diagnostics and bioprocessing) at COMPAMED 2025, emphasising lower fluid waste and tighter fluid control for medical devices and analytical equipment.

- In September 2025, Nordson (Nordson MEDICAL): completed a strategic divestiture of select contract-manufacturing product lines to narrow focus toward proprietary medical fluid-handling components, while promoting high-flow bioprocess tube fittings and other fluid-management components for scale-up in biologics production.

- In July 2025, Qosina: expanded its medical/bioprocess portfolio aggressively announcing 250+ new component releases in the first half of 2025 (with plans for ~500 additional releases by year-end) and broadened its Saint-Gobain tubing distribution offering, increasing available tubing SKUs and technical documentation for OEMs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as single-use systems become standard in pharma and biotech production.

- Hospitals will adopt more sterile connectors to support higher infusion and respiratory care needs.

- Bioprocessing growth will increase use of high-purity tubing for advanced therapy manufacturing.

- Material innovation will expand, with stronger interest in DEHP-free and recyclable polymers.

- Portable and home-care devices will drive demand for lightweight and flexible tubing.

- Automation in drug manufacturing will boost adoption of leak-proof quick-connect fittings.

- Regulatory pressure will push suppliers toward cleaner, more transparent material formulations.

- Custom extrusion and multi-lumen designs will grow as device makers seek higher precision.

- Supply chain localization will expand as regions build domestic medical manufacturing capacity.

- Partnerships between tubing suppliers and medical device firms will intensify to support integrated system design.