Market Overview:

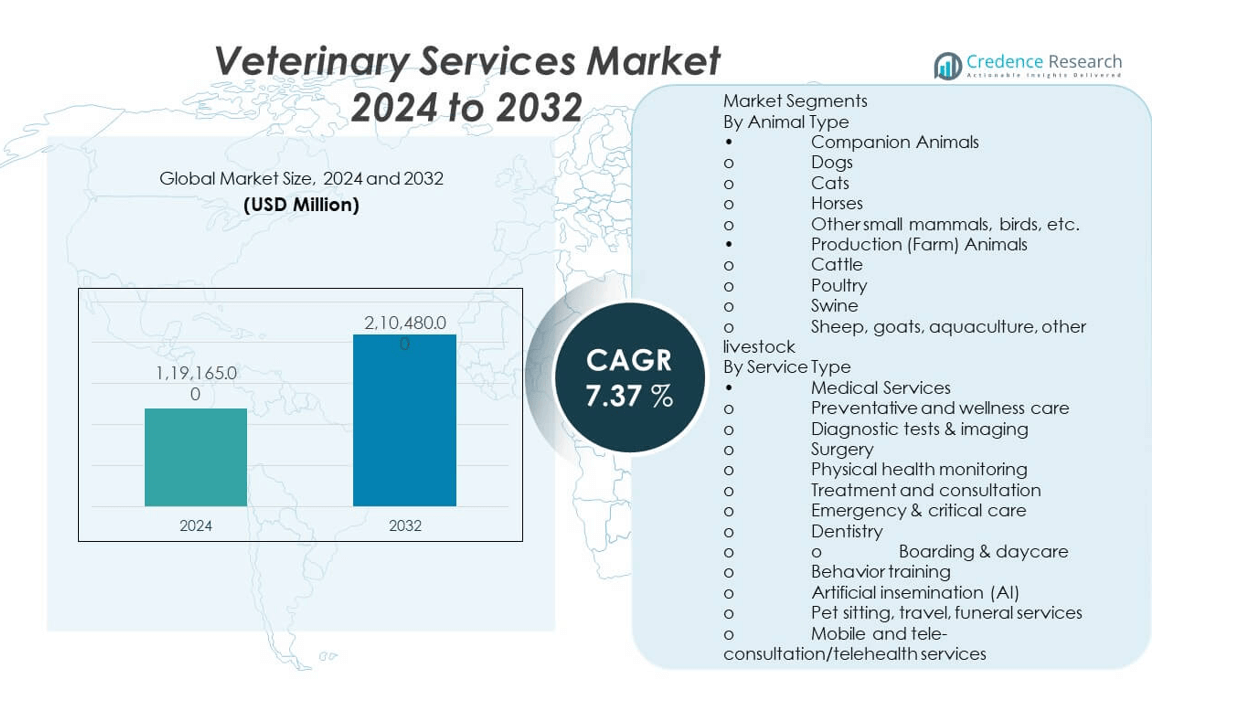

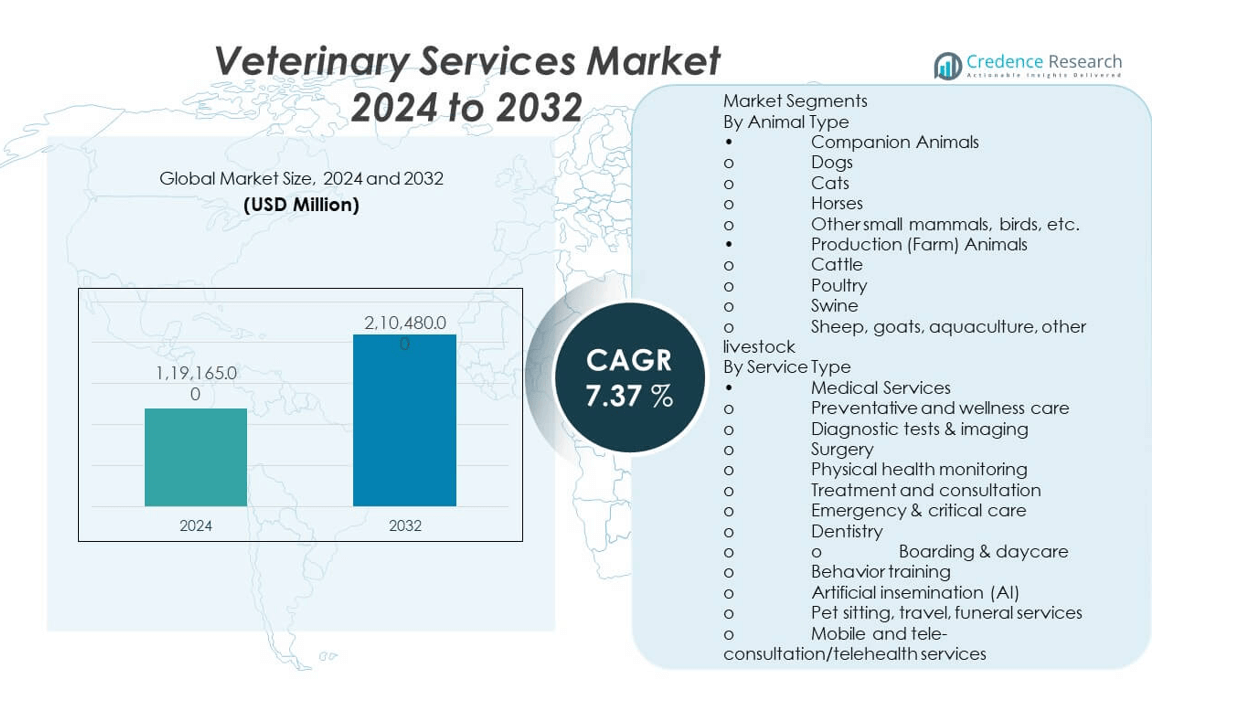

The veterinary services market is projected to grow from USD 119,165 million in 2024 to an estimated USD 210,480 million by 2032, with a compound annual growth rate (CAGR) of 7.37% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Services Market Size 2024 |

USD 119,165 million |

| Veterinary Services Market, CAGR |

7.73% |

| Veterinary Services Market Size 2032 |

USD 210,480 million |

Growth in the veterinary services market is driven by rising pet ownership, increasing expenditure on animal healthcare, and advancements in diagnostic and treatment technologies. The demand for preventive care, including vaccinations, dental care, and wellness check-ups, is expanding alongside growing awareness of pet health and nutrition. In livestock management, improved animal husbandry practices and disease control measures are boosting the need for professional veterinary services.

North America leads the veterinary services market, supported by high pet adoption rates, advanced veterinary infrastructure, and strong consumer spending on animal health. Europe follows, driven by stringent animal welfare regulations and widespread insurance coverage for pets. Asia-Pacific is emerging as the fastest-growing region due to a rising middle class, growing awareness of animal health, and rapid urbanization, particularly in countries such as China, India, and Southeast Asian nations.

Market Insights:

- The veterinary services market was valued at USD 119,165 million in 2024 and is projected to reach USD 210,480 million by 2032, growing at a CAGR of 37% during the forecast period.

- Rising pet ownership, coupled with higher spending on preventive, specialty, and emergency care, is driving sustained demand for veterinary services globally.

- Technological advancements in diagnostics, imaging, and treatment are enabling faster, more accurate interventions and expanding the scope of specialty care.

- High service costs, limited access in rural areas, and veterinary workforce shortages remain key restraints affecting service availability and affordability.

- North America leads the market with a 37% share, supported by advanced infrastructure, high insurance penetration, and strong spending per visit.

- Europe holds around 30% share, benefiting from strict animal welfare regulations, high clinical standards, and consolidated multi-site networks.

- Asia-Pacific, with 24% share, is the fastest-growing region, driven by urbanization, rising incomes, and growing awareness of animal health in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Pet Ownership and Increasing Demand for Preventive Care Services:

The veterinary services market is benefiting from a global rise in pet ownership, driven by changing lifestyles and the growing human-animal bond. Owners are seeking preventive services such as vaccinations, dental care, wellness examinations, and nutritional guidance to maintain long-term pet health. It is witnessing higher demand for early disease detection through advanced diagnostic tools, enabling timely treatment. Increased awareness campaigns by veterinary associations and pet care brands are also influencing service adoption. Urbanization and higher disposable incomes are allowing more households to invest in premium veterinary services. The sector is further supported by the expansion of pet insurance, making care more affordable. Rapid growth in companion animal adoption among younger generations is shaping service delivery models. Preventive care emphasis is reducing long-term treatment costs while boosting clinic visits.

- For instance, Royal Canin’s “Take Your Pet To The Vet” campaign has driven increased awareness and regular veterinary check-ups among pet owners, emphasizing the importance of preventive care and recommending a minimum of twice-yearly visits for improved pet health. This initiative includes educational outreach and a free consultation voucher for first-time clinic visits, helping to establish preventive healthcare habits in major urban centers like Mumbai.

Advancements in Veterinary Diagnostic and Treatment Technologies:

Technological progress in diagnostics, imaging, and treatment is a key driver for the veterinary services market. High-resolution imaging systems, advanced blood analysis equipment, and molecular diagnostics are enabling veterinarians to detect conditions with greater accuracy. It is experiencing rising integration of telemedicine for remote consultations, expanding accessibility to underserved areas. Minimally invasive surgeries and regenerative medicine are enhancing recovery outcomes for animals. AI-powered diagnostic platforms are improving decision-making and treatment efficiency. These innovations are not only improving patient outcomes but also increasing client trust in veterinary services. Adoption of wearable health monitoring devices for pets is providing real-time data to clinics. Technology adoption is also helping reduce operational costs while maintaining high-quality care standards.

- For instance, Zoetis has introduced the Vetscan OptiCell™, a cartridge-based, AI-powered hematology analyzer. This technology delivers advanced Complete Blood Count (CBC) analysis at the point of care, providing reference lab–quality accuracy in a compact format.

Growing Focus on Livestock Health and Food Safety Standards:

The veterinary services market is witnessing rising demand from livestock sectors due to the need for better disease management and food safety compliance. Governments are enforcing stringent regulations on livestock health monitoring to prevent disease outbreaks and ensure safe meat, milk, and egg production. It is benefiting from investments in herd health programs that focus on vaccination, parasite control, and reproductive management. Rising global consumption of animal protein is increasing the pressure on livestock producers to maintain healthy herds. International trade requirements are pushing farms to adopt certified veterinary health checks. Integrated farm health monitoring systems are gaining traction for real-time tracking of livestock well-being. Training programs for farmers in animal health practices are enhancing service demand. Veterinary services are becoming integral to sustainable livestock production.

Expansion of Pet Insurance and Increased Veterinary Spending:

Wider adoption of pet insurance is making high-quality veterinary care more accessible and affordable, driving the veterinary services market forward. Insurance coverage is encouraging owners to opt for comprehensive treatments, including surgeries and long-term therapies, without financial constraints. It is leading to increased demand for specialty services such as oncology, cardiology, and orthopedics in veterinary medicine. Rising disposable incomes in emerging economies are enabling owners to allocate more funds toward pet healthcare. Marketing initiatives by insurers are increasing awareness of coverage benefits. Clinics are forming partnerships with insurers to offer tailored plans and simplify claims processing. Higher spending on premium and specialized veterinary services is improving profitability for providers. This financial support structure is reshaping consumer behavior toward proactive animal healthcare.

Market Trends:

Integration of Telehealth and Virtual Veterinary Consultations:

The veterinary services market is adopting telehealth solutions to improve accessibility and convenience for pet owners. Remote consultations are becoming popular for follow-up visits, minor illnesses, and behavioral guidance. It is reducing the need for travel, especially in rural areas where veterinary access is limited. Digital platforms are integrating video consultations, prescription refills, and appointment scheduling in one interface. Clinics are leveraging telemedicine to expand client reach and provide 24/7 support. The trend is improving client engagement while optimizing clinic resource allocation. Data from wearable pet devices is being used to enhance virtual assessments. Telehealth adoption is expected to remain strong as technology costs decrease and regulatory frameworks evolve.

- For instance, VCA Animal Hospitals has implemented a virtual teletriage system connecting all clinics nationwide, which processes an average of 13,000–14,000 teletriage chats per month. Of these, roughly 25% of inquiries are resolved remotely, reducing unnecessary in-person visits, while about 17% are escalated to emergency care—demonstrating how digital consultations can optimize both resource allocation and client engagement across over 4.5 million unique annual visits.

Rising Demand for Specialty and Advanced Care Services:

Specialty veterinary services, including oncology, cardiology, neurology, and advanced surgical procedures, are gaining momentum in the veterinary services market. Pet owners are increasingly seeking specialists for complex conditions. It is leading to the establishment of referral centers with cutting-edge equipment and expert teams. The growth of companion animal lifespan due to better preventive care is increasing the need for age-related treatments. Training programs are equipping veterinarians with advanced clinical skills. Hospitals are expanding in-house diagnostic and surgical capabilities to retain more cases. Specialized rehabilitation and physiotherapy services are also becoming popular. This shift is elevating the overall standard of veterinary care.

Sustainable and Eco-Friendly Veterinary Practices:

Environmental responsibility is becoming an emerging trend in the veterinary services market. Clinics are adopting eco-friendly waste disposal systems and reducing the use of single-use plastics. It is influencing clinic design, with energy-efficient lighting and equipment becoming standard. Suppliers are offering biodegradable medical consumables to meet sustainability goals. Awareness among clients is pushing service providers to adopt greener practices. Veterinary schools are including sustainability modules in their curriculum. Clinics are also partnering with eco-conscious suppliers for pharmaceuticals and pet products. This trend is aligning veterinary services with broader global sustainability objectives.

Corporate Consolidation and Expansion of Veterinary Clinic Chains:

The veterinary services market is witnessing increased consolidation, with large corporations acquiring independent practices to form expansive networks. Corporate groups are leveraging economies of scale to invest in advanced technologies and training. It is enabling standardized care protocols across locations, improving service consistency. Mergers and acquisitions are also enhancing market penetration in underserved regions. Franchise models are expanding the reach of branded veterinary services. Centralized procurement is reducing costs for clinic chains. This consolidation trend is reshaping competition dynamics, with independent clinics adopting niche specialization to remain competitive.

Market Challenges Analysis:

Regulatory scrutiny, cost pressures, and workforce constraints that tighten operating levers across providers:

The veterinary services market faces heightened oversight on pricing transparency and medicine mark-ups. It must respond to inquiries from competition authorities and consumer bodies, which raises compliance costs. Practices are absorbing wage inflation for veterinarians, nurses, and support staff. It narrows margins when pay scales rise faster than fee increases. Staffing shortages create longer wait times and reduce appointment availability. Clinic owners struggle to balance capital spending with debt and cash flow needs. It limits expansion plans when interest rates elevate financing costs. Client sensitivity to price pushes clinics to justify value at every visit.

Fragmented systems, uneven access, and digital interoperability gaps that complicate care delivery and client experience:

The veterinary services market contends with disparate practice management systems and siloed medical records. It hinders continuity when referral hospitals and primary clinics cannot exchange data seamlessly. Rural areas still lack adequate specialty and emergency coverage. Mobile units help, yet coverage remains patchy on weekends and nights. Cybersecurity risks grow with telehealth and online payments. Insurance claim workflows vary by carrier and slow reimbursement. Inventory and pharmacy controls demand tighter stewardship to prevent shortages. It must align teams on protocols to reduce variability in diagnosis and care pathways.

Market Opportunities:

Preventive wellness, senior-pet care, and chronic disease programs that expand recurring revenue:

The veterinary services market can scale subscription wellness plans that bundle exams, vaccines, diagnostics, and dental care. It can design senior-care bundles for arthritis, cardiac health, and endocrinology. Home monitoring and nurse-led follow-ups raise adherence. Nutrition consults create add-on value. Rehab and physiotherapy strengthen recovery. Oncology and cardiology pathways deepen specialty lines. It lifts lifetime client value and steadies cash flows. Partnerships with insurers can boost plan uptake.

Digital expansion, data services, and integrated care networks that unlock operating leverage:

Telehealth triage smooths demand peaks. Remote Rx management streamlines refills. Interoperable records improve referrals. AI triage tools cut admin load. Centralized procurement lowers unit costs. Green clinic upgrades reduce utilities. Corporate networks can incubate training academies. It scales best practices across multi-site footprints.

Market Segmentation Analysis:

By Animal Type

In the veterinary services market, animal type segmentation includes companion animals and production (farm) animals. Companion animals—dogs, cats, horses, and other small mammals, birds, and exotic pets—account for the largest share, driven by high ownership rates and a strong focus on preventive, emergency, and specialty care. Dogs and cats dominate due to frequent wellness visits, vaccinations, and advanced treatments. Horses form a smaller but high-value niche, requiring orthopedic, reproductive, and performance-focused services. Production animals, including cattle, poultry, swine, sheep, goats, aquaculture, and other livestock, generate demand for herd health management, biosecurity programs, vaccination schedules, and compliance with food safety regulations to sustain productivity and meet market requirements.

- For instance, IDEXX Laboratories supports companion animal clinics with a global network of more than 160 board-certified telemedicine specialists. These experts deliver high-quality, actionable radiology and specialty reports in as little as 60 minutes, allowing rapid, expert diagnostics for both dogs and cats, while also providing veterinary solutions for horses and production animals through herd health management and regulatory compliance testing.

By Service Type

The veterinary services market is segmented into medical and non-medical services. Medical services include preventive and wellness care, diagnostic testing and imaging, surgeries, physical health monitoring, treatment and consultation, emergency and critical care, dentistry, pharmacy and prescription management, rehabilitation, and specialty disciplines such as cardiology, oncology, and ophthalmology. These services form the core of clinical operations and benefit from technology integration and growing specialization. Non-medical services—grooming, boarding, daycare, behavior training, artificial insemination, pet sitting, travel, funeral services, and mobile or telehealth consultations—supplement medical care and foster long-term client relationships. It gains strategic value when providers bundle medical and non-medical offerings, creating comprehensive solutions that improve animal well-being and customer retention.

- For instance, Hill’s Pet Nutrition—in partnership with AGL—launched Vetrax, a wearable pet monitoring system providing veterinarians with 24/7 behavioral and health data (including sleep quality, walking, running, scratching, and head shaking). This objective, quantifiable data feeds into treatment decisions and supports trend tracking, integrating with Hill’s SmartCare platform to improve compliance and long-term outcomes for both medical and non-medical veterinary service bundles.

Segmentation:

By Animal Type

- Companion Animals

- Dogs

- Cats

- Horses

- Other small mammals, birds, etc.

- Production (Farm) Animals

- Cattle

- Poultry

- Swine

- Sheep, goats, aquaculture, other livestock

By Service Type

- Medical Services

- Preventative and wellness care

- Diagnostic tests & imaging (including in-vitro/in-vivo diagnosis)

- Surgery

- Physical health monitoring

- Treatment and consultation

- Emergency & critical care

- Dentistry

- Pharmacy & prescription management

- Rehabilitation & physiotherapy

- Specialty (e.g., cardiology, oncology, ophthalmology)

- Non-Medical Services

- Grooming

- Boarding & daycare

- Behavior training

- Artificial insemination (AI)

- Pet sitting, travel, funeral services

- Mobile and tele-consultation/telehealth services

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Market Leadership Driven by High Spending and Advanced Infrastructure (37% share)

North America holds the largest share of the veterinary services market, accounting for around 37% of global revenue. The region benefits from high pet ownership rates, well-established veterinary networks, and strong spending on animal health. Pet insurance penetration supports access to advanced diagnostics, specialty surgeries, and emergency care. Corporate consolidators operate multi-site networks with standardized protocols, enhancing quality and consistency. It continues to see growth in telehealth adoption, e-pharmacy integration, and preventive wellness programs. Expansion into secondary cities is supported by suburban pet ownership growth and increasing demand for specialized services.

Europe: Strong Welfare Regulations and Consolidation Driving Growth (30% share)

Europe commands approximately 30% of the veterinary services market, supported by stringent animal welfare regulations and high clinical standards. Widespread pet insurance adoption in several countries enables comprehensive care and advanced treatment options. Large corporate groups are expanding through acquisitions and cross-border networks, allowing economies of scale and standardized care delivery. It benefits from robust specialty care infrastructure, particularly in oncology, orthopedics, and cardiology. Urban centers show high demand for premium veterinary services, while rural areas rely on mobile units and regional referral centers. Regulatory oversight on pricing and competition influences consolidation strategies and service models.

Asia-Pacific, Latin America, Middle East & Africa: Rapid Growth from Expanding Access (APAC 24%, LATAM 5%, MEA 4%)

Asia-Pacific holds around 24% of the veterinary services market, with rapid growth driven by urbanization, rising incomes, and increasing awareness of animal health. Modern clinics, grooming centers, and specialty hospitals are expanding in metropolitan areas. Latin America, with a 5% share, is seeing growth through franchise clinics, mobile services, and improved financing options for pet care. The Middle East & Africa region, representing 4% share, is developing referral hospitals and veterinary training programs to build capacity. It benefits from digital booking platforms, telehealth services, and growing partnerships with insurers. These regions remain key opportunities for global and regional operators aiming to expand service coverage and meet rising demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mars Inc. (including Banfield Pet Hospital, BluePearl, VCA, AniCura)

- National Veterinary Associates (NVA)

- IVC Evidensia

- CVS Group PLC

- Greencross Vets

- Fetch! Pet Care

- PetSmart LLC

- Petco

- VetPartners

- Pets at Home Group PLC

- Airpets International

- Abaxis

- IDEXX Laboratories, Inc.

Competitive Analysis:

The Veterinary services market features a mix of corporate consolidators, specialty hospitals, and independent clinics competing on access, capability, and client experience. Large groups such as Mars Veterinary Health (Banfield, VCA, BluePearl), IVC Evidensia, CVS Group, National Veterinary Associates, VetPartners, and Southern Veterinary Partners leverage scale for procurement, training, and technology. It pursues hub-and-spoke models that route complex cases to specialty centers while maintaining community practices for wellness and routine care. Independents defend share with personalized service, niche specialties, and community ties. Digital players extend reach through teletriage, e-pharmacy, and home-visit models. Competitive focus centers on clinician recruitment, insurer partnerships, transparent pricing, and consistent clinical pathways

Recent Developments:

- On 9 Jan 2025, Mars Petcare significantly expanded its European production capability by launching two new production lines at its French facility dedicated to Royal Canin wet food. This €120million investment increases the site’s output capacity by 44,000 tons per year, nearly doubling prior potential and enabling the facility to produce up to 600,000 boxes and 1million pouches daily. This move is part of Mars’ broader global growth and innovation strategy for veterinary nutrition.

- In March 2025, IVC Evidensia announced the opening of two state-of-the-art veterinary training centers in the UK. These centers will deliver 20,000 hours of continuing professional development (CPD) for IVC Evidensia colleagues in 2025, featuring wet labs and classroom facilities for hands-on and theoretical training to enhance veterinary clinical skills. The centers will open to the broader veterinary community by late 2025.

Market Concentration & Characteristics:

The Veterinary services market shows rising concentration as multi-site corporates expand through acquisitions and de-novo builds. It blends hub-and-spoke referral models with standardized protocols, centralized procurement, and shared services to improve efficiency. Independent clinics remain numerous yet face wage inflation, equipment costs, and recruiting challenges. It displays steady demand anchored in preventive care, with cyclical resilience versus discretionary retail. Specialty and emergency hospitals capture higher acuity and margin. Digital access, telehealth, and e-pharmacy integrate into workflows. Regulatory focus on pricing and competition shapes M&A pacing and transparency standards.

Report Coverage:

The research report offers an in-depth analysis based on animal type and service type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Preventive wellness plans deepen recurring revenue.

- Specialty and emergency hubs expand regional coverage.

- Telehealth triage becomes an embedded front door.

- AI decision support accelerates diagnostics and case routing.

- Cross-border consolidators standardize protocols and training.

- Staffing pipelines improve via academies and flexible roles.

- Transparency tools and price menus enhance trust.

- Green clinic retrofits lower utilities and waste.

- Insurer partnerships broaden access to advanced care.

- Data interoperability lifts referral speed and outcomes.