Market Overview

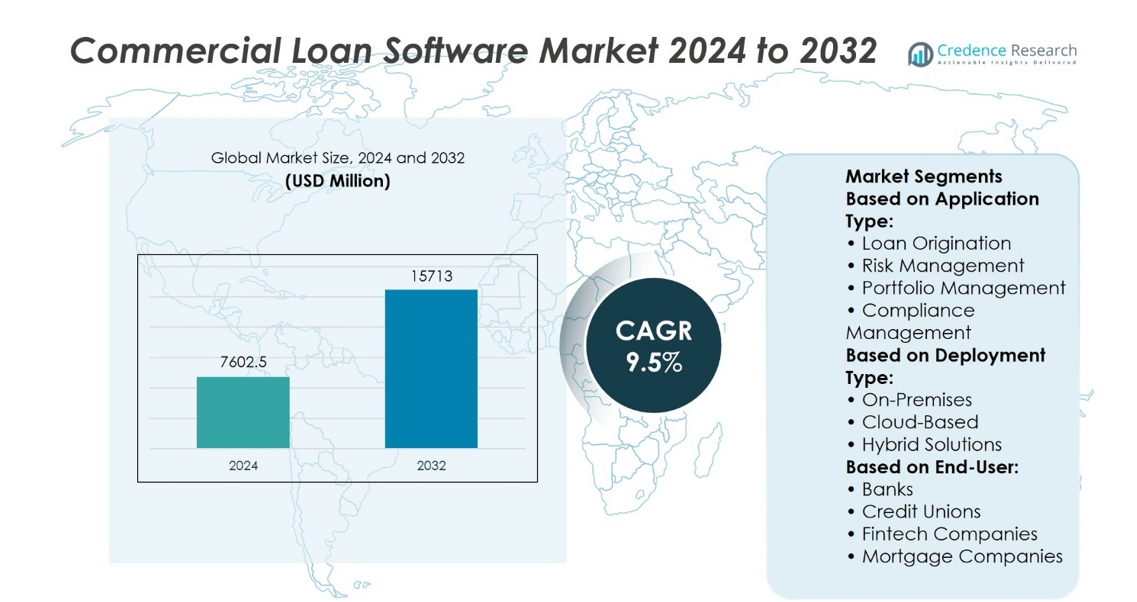

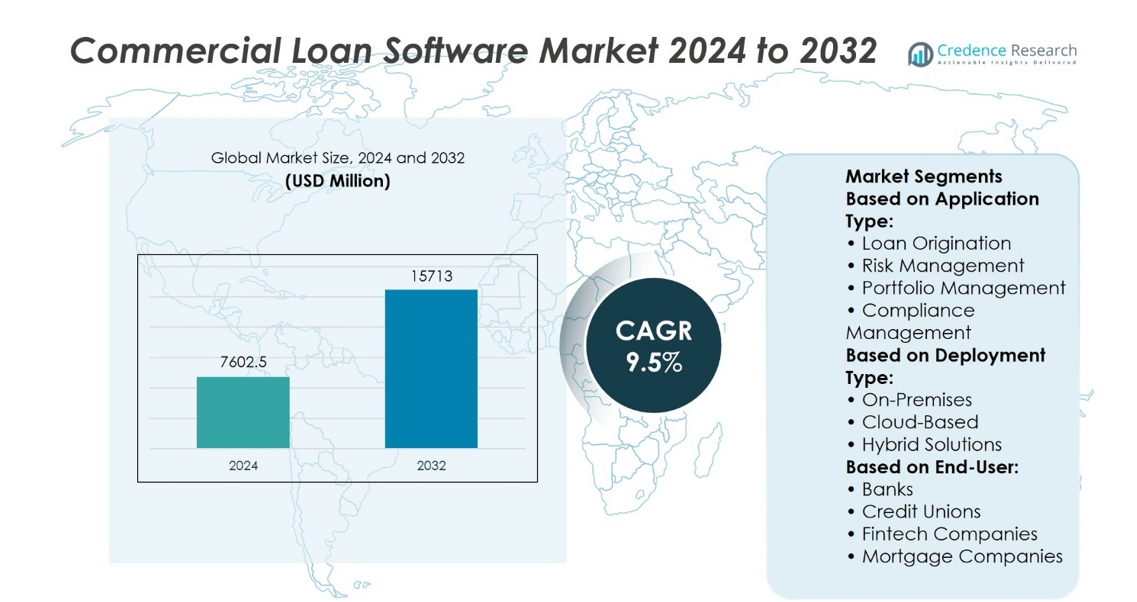

Commercial Loan Software Market size was valued at USD 7602.5 million in 2024 and is anticipated to reach USD 15713 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Loan Software Market Size 2024 |

USD 7602.5 million |

| Commercial Loan Software Market, CAGR |

9.5% |

| Commercial Loan Software Market Size 2032 |

USD 15713 million |

The Commercial Loan Software Market experiences strong growth driven by the increasing need for automation and efficiency in loan processing. Financial institutions prioritize software that reduces manual tasks, accelerates approvals, and enhances accuracy. Cloud-based platforms gain popularity due to their scalability and integration capabilities. Regulatory compliance requirements push demand for built-in risk management and reporting features. The rise of artificial intelligence and data analytics improves credit decision-making and portfolio management. Growing adoption in emerging markets and the shift toward digital banking further fuel market expansion. These trends collectively drive innovation and adoption across the commercial lending ecosystem.

The Commercial Loan Software Market shows significant regional variation, with North America holding the largest share due to its advanced financial infrastructure and strict regulatory environment. Europe follows, driven by strong compliance demands and digital transformation initiatives. The Asia-Pacific region represents the fastest-growing market, fueled by expanding banking sectors and increasing fintech adoption. Key players maintain competitive advantages by localizing solutions, forming strategic partnerships, and investing in regional support. Their focus on innovation and regulatory alignment enables strong positioning across these diverse geographic markets.

Market Insights

- The Commercial Loan Software Market size was valued at USD 7602.5 million in 2024 and is expected to reach USD 15713 million by 2032, growing at a CAGR of 9.5% during the forecast period.

- Increasing demand for automation in loan processing drives market growth by reducing manual tasks and accelerating approval times.

- Cloud-based platforms gain traction due to their scalability and seamless integration with existing financial systems.

- Regulatory compliance requirements boost the need for software with embedded risk management and reporting functionalities.

- Advances in artificial intelligence and data analytics enhance credit decision-making accuracy and portfolio management efficiency.

- Expansion in emerging markets and the rising shift toward digital banking support further market development.

- North America holds the largest market share owing to advanced financial infrastructure, followed by Europe with strong regulatory focus, while Asia-Pacific emerges as the fastest-growing region driven by fintech adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Surging Demand for End-to-End Automation Across Commercial Lending Lifecycle

Commercial lending institutions face mounting pressure to reduce operational inefficiencies and improve loan turnaround times without compromising accuracy. Manual processing, document verification, and compliance checks often lead to delays, inconsistencies, and customer dissatisfaction. The Commercial Loan Software Market addresses these inefficiencies by delivering robust, end-to-end automation across origination, underwriting, approval, disbursement, and servicing stages. It enables lenders to digitize complex workflows, automate credit decisions, and eliminate redundant data entry tasks. Institutions gain improved visibility, auditability, and process control, which enhances both internal performance and customer outcomes. Automation also supports real-time credit assessments, faster approvals, and seamless customer onboarding, all of which are critical for lenders aiming to stay competitive in a digital-first environment.

- For instance, account-linking API provider Plaid connect to about 12,000 financial institutions and has enabled applications.

Heightened Regulatory Pressures and Demand for Built-In Compliance Mechanisms

Banks and financial institutions are operating in an increasingly complex regulatory environment driven by evolving global standards, such as Basel III, CECL, and GDPR, as well as jurisdiction-specific requirements. These regulations demand accurate reporting, enhanced risk visibility, and timely audit responses. The Commercial Loan Software Market plays a central role by integrating compliance functionalities directly into the lending process. It supports automated generation of regulatory reports, enables real-time monitoring of risk thresholds, and provides full audit trails for every transaction. Built-in compliance tools reduce the reliance on manual intervention and ensure alignment with regulatory expectations. As penalties for non-compliance become more severe and reputational risks grow, institutions prioritize software solutions that proactively manage evolving compliance obligations.

- For instance, digital lending platform Blend processed $1.2 trillion in loans on its platform in 2024, illustrating how API-centric origination stacks can scale loan throughput for large financial institutions.

Widespread Shift Toward Cloud-Based Platforms and Interoperable Technology Ecosystems

Legacy on-premise lending systems are increasingly viewed as rigid, costly, and difficult to scale in the face of rapid digital transformation. Financial institutions are now favoring cloud-native commercial loan software solutions that offer agility, modular design, and enhanced integration capabilities. The Commercial Loan Software Market is evolving to support API-first architectures that seamlessly connect with core banking systems, third-party data providers, credit bureaus, and digital onboarding tools. It allows institutions to build flexible ecosystems that support rapid deployment of new features, remote access for decentralized teams, and real-time collaboration across departments. Cloud platforms also provide robust data security, disaster recovery, and scalability that traditional infrastructures cannot match. This architectural shift positions cloud-based loan platforms as foundational to long-term digital innovation strategies within the financial sector.

Increased Demand for Hyper-Personalized and Digitally-Driven Lending Experiences

Today’s business borrowers, particularly small and mid-sized enterprises, expect financial solutions tailored to their unique circumstances, delivered with the same speed and personalization found in consumer banking. Traditional commercial lending processes often lack the agility to support nuanced risk assessments, dynamic pricing models, or contextual engagement. The Commercial Loan Software Market is adapting by enabling data-driven personalization at scale through AI-based credit scoring, behavior-based segmentation, and adaptive loan structuring. It supports integration with CRM systems, customer portals, and advanced analytics to create lending journeys that are responsive, transparent, and client-centric. Personalization improves borrower satisfaction and loyalty while enabling lenders to optimize risk-adjusted returns across diverse portfolios. This shift from static, product-centric models to flexible, customer-focused lending strategies continues to accelerate adoption across institutions aiming to enhance their value proposition in a competitive market.

Market Trends

Adoption of AI and Machine Learning to Enhance Credit Decisioning and Risk Assessment

Lenders are increasingly adopting artificial intelligence and machine learning to refine their credit risk models and automate loan evaluations. These technologies analyze large volumes of historical and real-time data to identify borrower patterns, improve accuracy, and reduce default risk. The Commercial Loan Software Market is seeing vendors integrate AI-driven tools that enable predictive analytics, automated scoring, and portfolio monitoring. It allows lenders to process applications faster while maintaining tighter control over risk exposure. Institutions benefit from continuous model learning, which supports dynamic adjustments to changing borrower behavior and market conditions. These advancements support data-driven decisions and elevate the precision of underwriting strategies.

- For instance, Avant, a Chicago-based fintech firm, has issued over 1 billion dollars in loans via its machine-learning-driven platform since.

Expansion of Embedded Finance and API-Centric Loan Origination Models

Digital ecosystems across financial services increasingly demand open, interconnected platforms. Lenders now prioritize software that offers robust API capabilities to embed loan offerings within third-party channels, fintech platforms, or business software suites. The Commercial Loan Software Market reflects this shift through API-first product strategies that support seamless integration with external data providers, payment systems, and client-facing portals. It enables faster loan origination, real-time eligibility checks, and better collaboration across digital ecosystems. Embedded finance models drive accessibility, allowing lenders to reach new customer segments with minimal operational friction. This trend strengthens the importance of interoperability and ecosystem readiness in modern software solutions.

- For instance, cloud-native core provider Mambu reports its platform supports 114 million end clients and handles nearly 114 million API calls per day.

Growth in Demand for Real-Time Data Access and Advanced Analytics Dashboards

Timely access to data is now a critical requirement for loan officers, risk managers, and compliance teams. Modern commercial loan platforms offer centralized dashboards with real-time reporting, risk scoring, and portfolio insights. The Commercial Loan Software Market is evolving to include built-in business intelligence tools and customizable dashboards for proactive decision-making. It supports monitoring of loan health, borrower behavior, and regulatory triggers from a single interface. Institutions gain visibility into performance trends and operational bottlenecks without relying on separate reporting systems. This emphasis on transparency and data centralization is reshaping expectations for how loan data is consumed and used.

Increased Focus on User-Centric Design and Omnichannel Loan Experiences

Financial institutions are re-evaluating legacy user interfaces and workflows to align with evolving customer expectations. Lenders now seek commercial loan platforms that provide consistent user experiences across digital channels, including web portals, mobile apps, and integrated CRM systems. The Commercial Loan Software Market is responding with solutions that prioritize intuitive design, guided workflows, and self-service capabilities. It improves borrower engagement and streamlines interactions across the loan lifecycle. Frontline staff also benefit from simplified dashboards and configurable screens that adapt to varied loan products. This trend drives adoption among institutions aiming to modernize engagement without sacrificing functionality.

Market Challenges Analysis

Complex Security Risks and Regulatory Compliance Burden Restrain Market Progress

The Commercial Loan Software Market faces growing challenges related to data security and regulatory compliance. Financial institutions handle highly sensitive borrower and transactional data, making robust cybersecurity measures imperative. It must continually adapt to counter increasingly sophisticated cyber threats, including ransomware and data breaches that can jeopardize customer trust and invite severe penalties. Regulatory frameworks such as GDPR, Basel III, and various local privacy laws impose stringent requirements that differ across regions. The software needs built-in flexibility to support jurisdiction-specific compliance, increasing development complexity and deployment timelines. It requires significant financial and technical resources to maintain compliance while ensuring operational efficiency. Balancing these security demands with user-friendly systems proves difficult and limits rapid market expansion. Maintaining comprehensive audit trails, real-time risk monitoring, and automated regulatory reporting remains critical but resource-intensive.

Legacy System Integration and Organizational Resistance Hinder Seamless Adoption

Integrating modern commercial loan software solutions with legacy banking infrastructure presents persistent technical and operational hurdles. Many financial institutions continue to rely on outdated systems that lack interoperability with new cloud-native or modular platforms. This incompatibility creates data silos and increases the risk of manual errors during data transfers, complicating loan processing workflows. Transitioning to new software often disrupts day-to-day operations and requires extensive training, leading to employee resistance and slowed adoption. It demands coordinated change management strategies and investment in workforce upskilling. The Commercial Loan Software Market must overcome these integration complexities to deliver seamless, scalable solutions that align with institutional IT environments. Without addressing both technological and human factors, market penetration and long-term client satisfaction may remain limited.

Market Opportunities

Expanding Demand for Digital Transformation in Financial Services Drives Growth Opportunities

The Commercial Loan Software Market stands to benefit significantly from the ongoing digital transformation within the financial services industry. Institutions prioritize enhancing customer experience and operational efficiency by adopting advanced loan management technologies. It offers lenders capabilities to automate loan origination, underwriting, and servicing processes, reducing turnaround times and operational costs. Growing interest in cloud-based solutions further enables scalable and flexible deployment, appealing to both large banks and smaller community lenders. The increasing adoption of AI and machine learning technologies creates opportunities to improve credit risk assessment and fraud detection. The market can capitalize on rising demand for seamless integration with core banking systems and third-party fintech platforms. Continuous innovation in software functionalities positions the market to address evolving lender requirements and regulatory landscapes effectively.

Emerging Markets and Niche Segments Present Untapped Growth Potential

Emerging economies undergoing rapid financial sector modernization represent a substantial opportunity for the Commercial Loan Software Market. It can support the growing number of financial institutions seeking digital tools to streamline loan processing and expand credit access. Microfinance and small business lending segments show strong potential for customized software solutions designed to manage unique risk profiles and regulatory needs. The increasing penetration of mobile banking and digital platforms in these regions accelerates software adoption. Focus on sustainability and green financing introduces new demand for specialized loan management features aligned with environmental, social, and governance (ESG) criteria. By tailoring offerings to regional market conditions and niche sectors, the Commercial Loan Software Market can drive broad-based growth and enhance its competitive position globally.

Market Segmentation Analysis:

By Application:

The Commercial Loan Software Market segments into loan origination, risk management, portfolio management, and compliance management, each serving critical roles within lending institutions. Loan origination software automates the entire loan lifecycle from application intake to credit evaluation and final approval, reducing manual errors and accelerating processing times. Risk management solutions provide advanced analytics, credit scoring, and scenario modeling to help lenders mitigate exposure and improve decision accuracy. Portfolio management tools allow institutions to monitor loan performance, diversify risk, and optimize asset allocation across varied loan types. Compliance management is increasingly important, equipping financial institutions with tools to stay abreast of evolving regulations, generate accurate reports, and maintain audit readiness. These integrated applications work in tandem to address the operational complexities and regulatory challenges within commercial lending, ensuring greater efficiency and risk control.

- For instance, nCino’s platform currently supports over 2,700 financial institutions globally, providing unified capabilities across origination, portfolio monitoring, and compliance tracking on a single system.

By Deployment Type:

The Commercial Loan Software Market divides into on-premises, cloud-based, and hybrid models, each with distinct advantages aligned to institutional priorities. On-premises deployments offer full control over sensitive data and infrastructure, favored by institutions with rigorous compliance demands or legacy system dependencies. Cloud-based solutions enable rapid scalability, lower upfront costs, and seamless integration with other digital platforms, supporting remote work environments and real-time collaboration. Hybrid deployments combine the strengths of both approaches, allowing sensitive data to remain on-premises while leveraging cloud capabilities for enhanced flexibility and business continuity. The growing preference for cloud and hybrid solutions reflects a broader digital transformation trend within financial services, emphasizing agility, security, and operational efficiency in software deployment.

- For instance, Finastra’s Fusion Fabric cloud platform empowers its clients with 61 new APIs available in its catalog, enabling seamless connectivity while maintaining data sovereignty and facilitating modern interoperability.

By End User

The Commercial Loan Software Market encompasses banks, credit unions, fintech companies, and mortgage companies, each driving demand with unique operational needs. Banks and credit unions continue to be primary adopters, focusing on solutions that improve workflow automation, customer experience, and compliance management. Fintech companies accelerate innovation by delivering cloud-native, user-centric platforms that cater to digitally savvy borrowers and provide rapid loan decisioning. Mortgage companies utilize commercial loan software to manage complex residential and commercial loan portfolios, streamline document processing, and ensure regulatory adherence. These end users require adaptable software tailored to their specific market segments, regulatory landscapes, and customer expectations, fueling ongoing enhancements in product features and capabilities.

Segments:

Based on Application Type:

- Loan Origination

- Risk Management

- Portfolio Management

- Compliance Management

Based on Deployment Type:

- On-Premises

- Cloud-Based

- Hybrid Solutions

Based on End-User:

- Banks

- Credit Unions

- Fintech Companies

- Mortgage Companies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Commercial Loan Software Market with a commanding market share near 40%, reflecting the region’s advanced financial infrastructure and high technology adoption rate. The United States serves as the primary driver, with its large base of banks, credit unions, and fintech companies investing heavily in digital transformation initiatives. American financial institutions increasingly deploy commercial loan software to streamline loan origination, enhance risk management, and ensure compliance with rigorous regulatory frameworks such as the Dodd-Frank Act. Canada also contributes significantly, with institutions prioritizing software solutions that provide seamless integration and automated compliance reporting. The region’s mature market environment encourages continuous innovation, pushing software providers to introduce AI-powered analytics and cloud-based platforms that improve operational efficiency. Regulatory complexity and the demand for improved customer experiences reinforce North America’s leadership position in this sector.

Europe

Europe secures the second-largest market share, estimated at 25%, driven by stringent regulatory standards and a strong banking sector emphasis on digital modernization. Key countries like the United Kingdom, Germany, and France lead the adoption of commercial loan software, particularly emphasizing compliance management features due to directives such as GDPR and Basel III. European financial institutions face pressure to maintain transparent, auditable loan processes and manage credit risks more effectively, which increases reliance on sophisticated software solutions. Cloud-based deployments gain traction in this region, offering banks flexibility and scalability amid evolving business models. The integration of real-time risk analytics and compliance automation in lending software responds to both regulatory demands and competitive pressures. Europe’s mature banking industry fosters a progressive environment for advanced commercial loan software adoption.

Asia-Pacific

The Asia-Pacific region commands roughly 20% of the global Commercial Loan Software Market, emerging as the fastest-growing regional segment due to rapid urbanization and expanding financial services penetration. Major economies such as China, India, Japan, and Australia actively implement loan software to address the increasing volume and complexity of commercial lending. Fintech innovation and government digital initiatives accelerate adoption, particularly in cloud-native platforms that support seamless integration across various financial products. Asia-Pacific lenders prioritize automation and analytics capabilities to manage risk and speed decision-making processes. Expanding SME financing and infrastructure development projects further propel demand for efficient, compliant loan processing systems. Despite diverse regulatory environments, regional institutions progressively adopt interoperable, scalable solutions to remain competitive and compliant.

Latin America

Latin America holds an estimated 8% share of the Commercial Loan Software Market, reflecting steady growth driven by modernization efforts within financial sectors of Brazil, Mexico, and Argentina. Banks and credit unions confront challenges from legacy systems and regulatory complexity, prompting investment in comprehensive loan management platforms. Institutions focus on enhancing operational efficiency, reducing loan processing time, and improving risk mitigation through automation. The region faces unique infrastructural and regulatory challenges; however, increased demand for digital financial services and government support for financial inclusion accelerate software adoption. Market players tailor solutions to address regional compliance frameworks and diverse loan products, supporting gradual expansion in Latin America’s commercial loan software landscape.

Middle East and Africa

The Middle East and Africa (MEA) region accounts for nearly 7% of the market, characterized by significant investments in financial sector digitalization across countries like the UAE, Saudi Arabia, South Africa, and Nigeria. MEA financial institutions prioritize cloud-based and hybrid deployment models to enhance scalability and support evolving regulatory requirements. The region shows strong interest in solutions that integrate comprehensive risk analytics, compliance management, and workflow automation to mitigate operational risks and improve lending efficiencies. Collaborative efforts between governments and global technology providers bolster the adoption of commercial loan software. Ongoing initiatives to digitize banking and extend financial services to underserved populations create substantial opportunities for software vendors. The MEA market remains dynamic, with continuous technological upgrades driving growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FIS

- Calyx Software

- Q2 Software

- LoanPro

- ICE Mortgage Technology

- Finastra

- nCino

- Linedata

- Fiserv

- Automated Financial System

Competitive Analysis

The Commercial Loan Software Market include Calyx Software, Finastra, FIS, Fiserv, ICE Mortgage Technology, Linedata, LoanPro, nCino, Q2 Software, and Automated Financial Systems. The Commercial Loan Software Market is characterized by intense competition driven by innovation and the demand for comprehensive, automated solutions that streamline the entire lending lifecycle. Market participants focus on enhancing software capabilities to improve loan origination, risk management, compliance, and portfolio monitoring. The shift toward cloud-based platforms enables greater scalability and integration with other financial systems, while advanced analytics and AI improve decision-making accuracy and operational efficiency. Companies invest heavily in developing compliance modules that adapt quickly to evolving regulatory requirements, reducing risks for financial institutions. Interoperability with third-party tools and customizable features cater to diverse client needs across different loan types and industries. The market also sees a growing emphasis on user experience, with intuitive interfaces and real-time reporting becoming standard. As digital transformation accelerates, providers strive to offer flexible, secure, and efficient platforms that reduce loan processing times and enhance overall productivity, positioning themselves for sustained growth in a competitive environment.

Recent Developments

- In November 2024, China published an extensive action plan to boost the digitalization of the financial sector with a goal of having a highly adaptive system.

- In October 2024, Navigant Credit Union partnered with Baker Hill to enhance its commercial loan operations. By integrating Baker Hill’s Commercial Lending solution with its Fiserv DNA core, Navigant aims to streamline loan origination and underwriting.

- In June 2024, Salesforce said it would launch its ‘Digital Lending for India’ platform focused at improving the loan origination functions for banks and lenders in India. This initiative seeks to solve the specific problems of the Indian lending landscape through India’s strong digital public infrastructure.

- In August 2023, Qarar teamed up with Biz2X to develop what has been hailed as the ‘first cloud-based SME lending platform in Saudi Arabia.’ The aim is to help solve the funding problems small and medium enterprises encounter in that part of the world.

Market Concentration & Characteristics

The Commercial Loan Software Market exhibits a moderately concentrated structure, with a few key players holding significant market shares while numerous smaller vendors compete in niche segments. It demonstrates high entry barriers due to the complex regulatory environment, the need for advanced technological capabilities, and the critical importance of data security. The market emphasizes innovation in automation, cloud adoption, and AI-driven analytics to meet evolving customer demands and regulatory requirements. Financial institutions prioritize software that delivers seamless integration across origination, underwriting, compliance, and portfolio management functions. Customization and scalability remain essential characteristics, enabling providers to serve a broad spectrum of clients ranging from small credit unions to large multinational banks. Regional variations influence market dynamics, with North America and Europe leading due to well-established financial sectors and stringent compliance mandates. Emerging economies in Asia-Pacific show growing adoption driven by expanding banking infrastructure and digital transformation initiatives. The market maintains a strong focus on reducing loan processing times, improving risk assessment accuracy, and enhancing customer experience. It fosters ongoing technological advancement, ensuring solutions remain adaptable to the rapid changes in lending practices and regulatory landscapes. This concentration and characteristic mix shape a competitive yet opportunity-rich environment, compelling players to continuously innovate and align with client priorities.

Report Coverage

The research report offers an in-depth analysis based on Application Type, Deployment Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Commercial Loan Software Market will expand with increased adoption of cloud-based solutions.

- Automation will streamline loan processing and reduce operational costs.

- Integration of artificial intelligence will enhance credit risk assessment accuracy.

- Regulatory compliance tools will become more advanced and integral to software platforms.

- Demand for real-time data analytics will drive improvements in portfolio management.

- Mobile and remote access capabilities will grow to support decentralized work environments.

- Customizable solutions will gain traction to meet diverse lending requirements.

- Emerging markets will contribute significantly to market growth due to digital banking expansion.

- Collaboration between software providers and financial institutions will increase innovation speed.

- Security features will strengthen to address rising cyber threats and data privacy concerns.