Market Overview

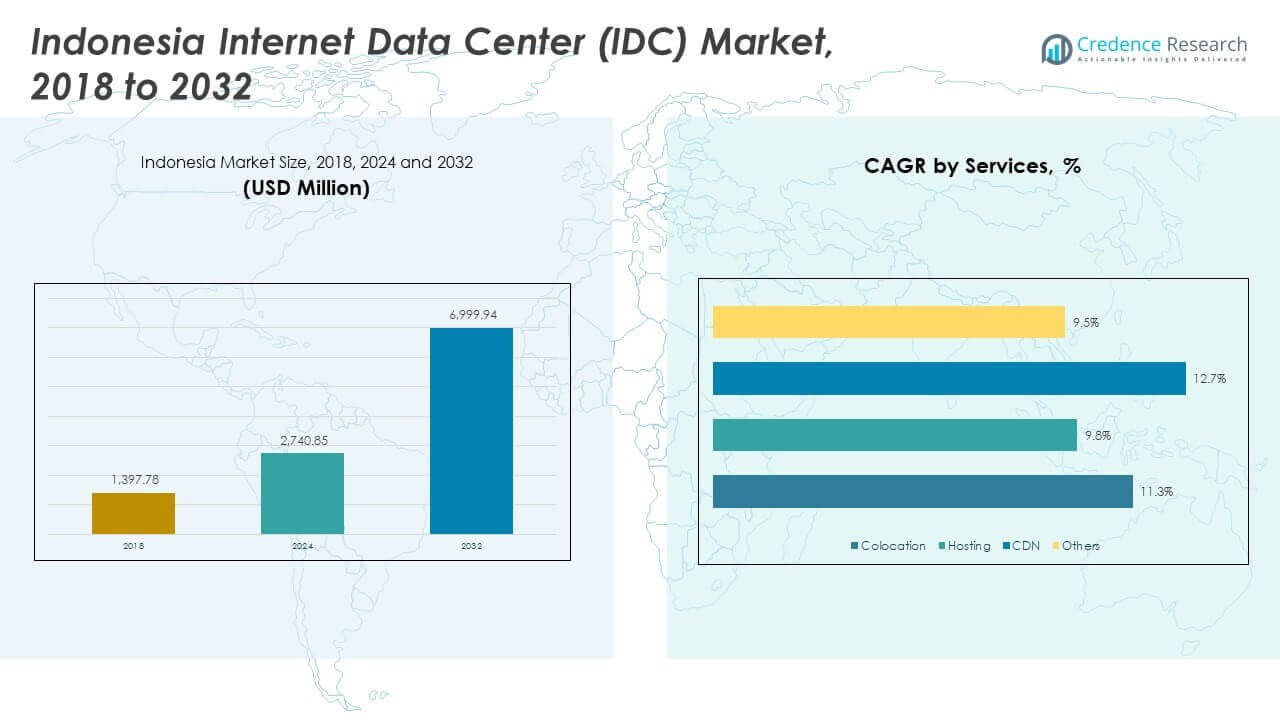

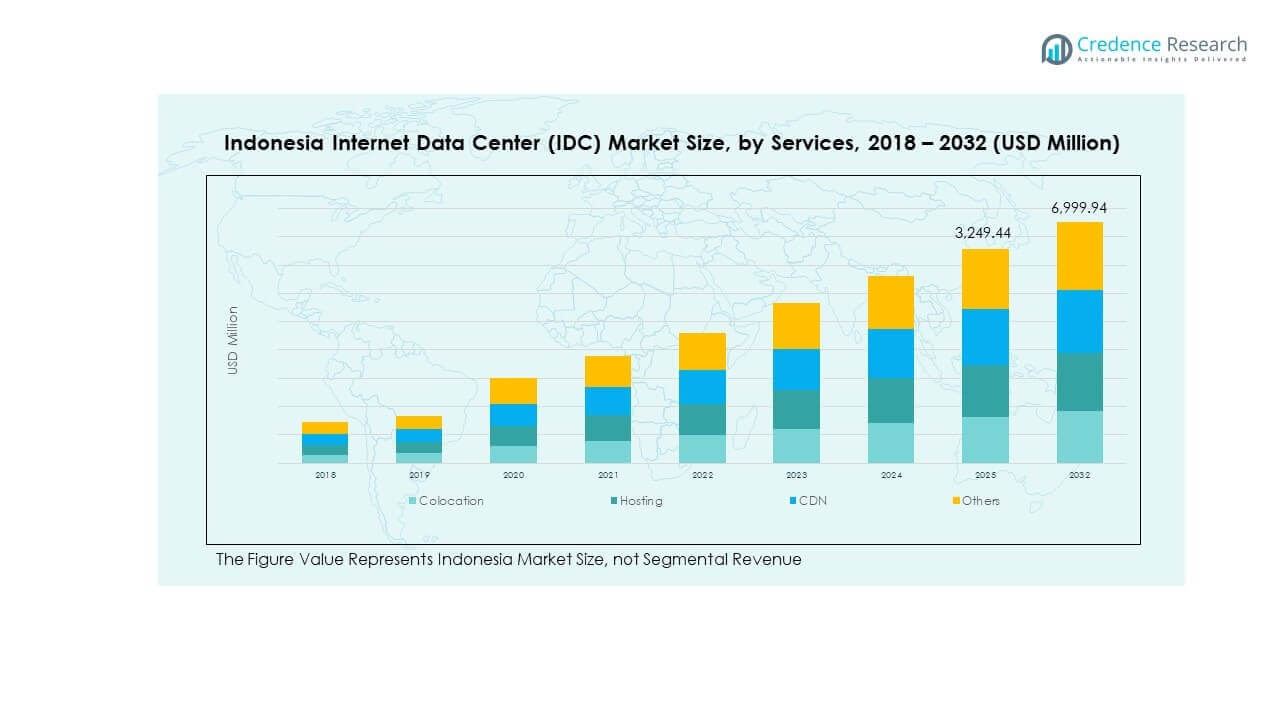

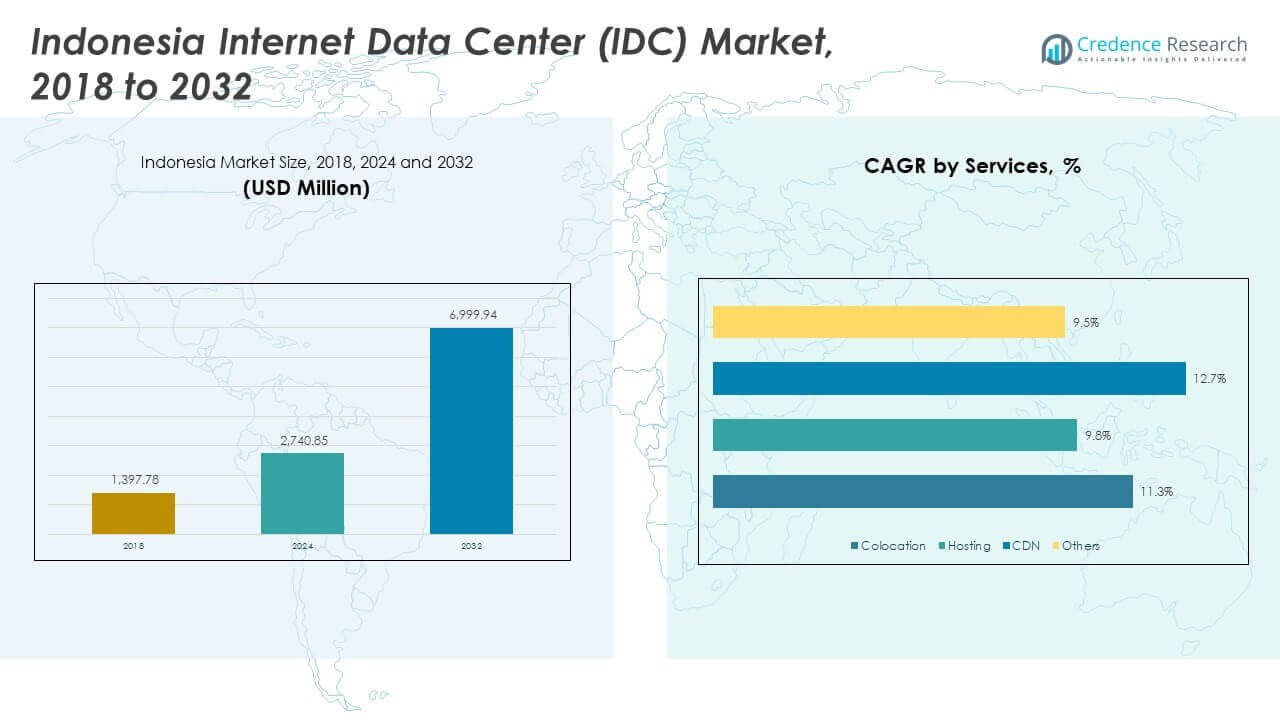

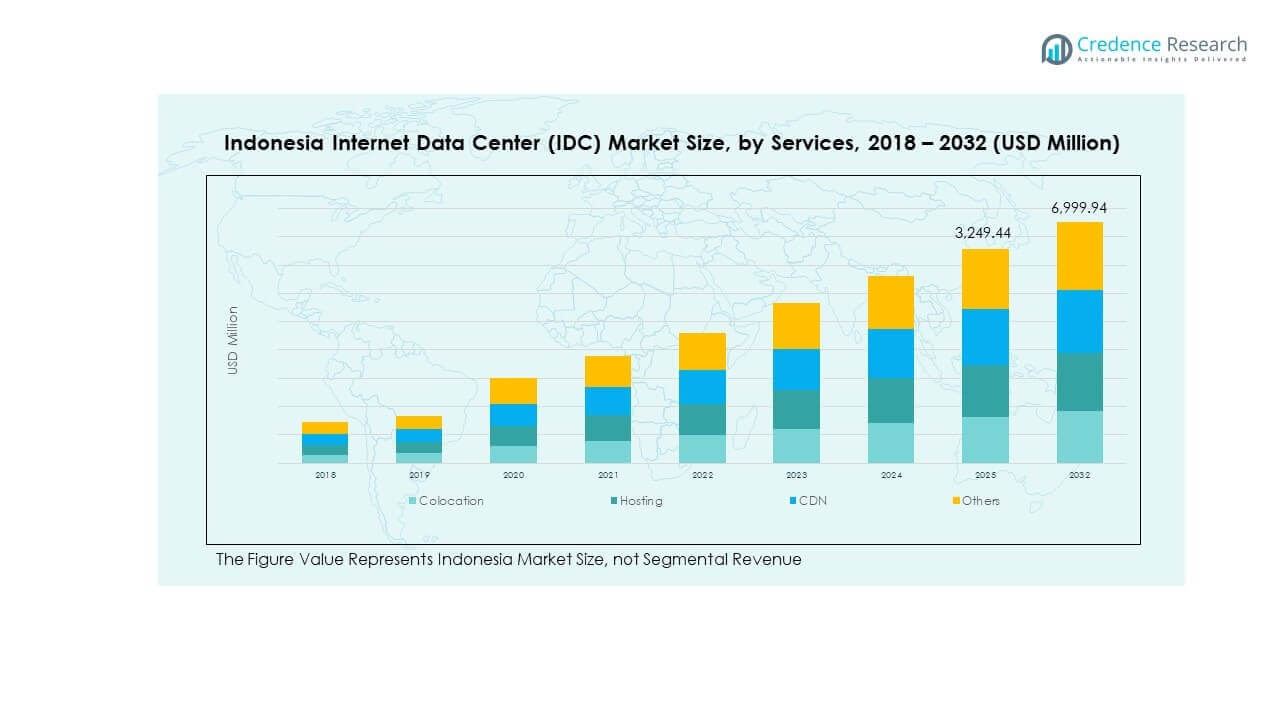

The Indonesia Internet Data Center (IDC) Market size was valued at USD 1,397.78 million in 2018, growing to USD 2,740.85 million in 2024, and is anticipated to reach USD 6,999.94 million by 2032, at a CAGR of 11.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Internet Data Center (IDC) Market Size 2024 |

UUSD 2,740.85 million |

| Indonesia Internet Data Center (IDC) Market, CAGR |

11.59% |

| Indonesia Internet Data Center (IDC) Market Size 2032 |

USD 6,999.94 million |

The market growth is driven by accelerating cloud adoption, digital transformation, and increasing demand for secure data storage. Technological advancements such as AI integration, automation, and edge computing are enhancing operational efficiency and reducing latency. It plays a strategic role in supporting businesses and investors focused on scalable, energy-efficient infrastructure and expanding Indonesia’s digital economy across industries like telecom, BFSI, and e-commerce.

Jakarta dominates the Indonesia Internet Data Center (IDC) Market due to its advanced connectivity, strong enterprise presence, and reliable power infrastructure. Emerging regions such as Surabaya, Batam, and Medan are developing rapidly with new data center investments supported by government-led digitalization initiatives. These regions are attracting investors seeking lower operational costs and improved connectivity for expanding Indonesia’s nationwide digital infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Dynamics:

Market Drivers

Rapid Digital Transformation and Cloud Expansion Accelerating Market Adoption

The Indonesia Internet Data Center (IDC) Market is expanding rapidly due to growing cloud migration across industries. Enterprises are adopting hybrid and multi-cloud strategies to ensure scalability and agility. Government initiatives supporting digital transformation, such as Indonesia’s Digital Roadmap 2021–2024, have boosted infrastructure investments. Telecom operators and hyperscalers are constructing large-scale facilities to meet data localization laws. It has become essential for supporting digital services, fintech, and e-commerce platforms. The rise in social media usage and streaming demand requires higher storage capacity. Local enterprises increasingly prefer domestic data hosting. These combined forces strengthen Indonesia’s position in Southeast Asia’s digital economy.

Adoption of Advanced Technologies Enhancing Data Efficiency and Resilience

Artificial intelligence, big data analytics, and IoT adoption are transforming Indonesia’s data center landscape. These technologies demand low-latency connectivity and high computing power. Operators are deploying advanced cooling systems and automation for energy efficiency. Green data center initiatives focus on renewable power integration and optimized resource management. The market’s infrastructure modernization supports enterprise workloads across multiple sectors. It also attracts investments from global tech firms seeking strategic regional hubs. Sustainable technology adoption reduces operational costs and improves uptime reliability. Businesses view this transformation as a competitive advantage and a long-term investment opportunity.

- For instance, in June 2025, DCI Indonesia inaugurated the JK6 AI-ready data center at its H1 Campus in Cibitung. JK6 provides 36 MW of IT capacity and features state-of-the-art liquid cooling technology to support high-density AI workloads. This facility brings DCI’s total installed capacity to 119 MW—currently a national record. It is already serving several major global cloud providers and stands as a new national benchmark for energy-efficient infrastructure and digital transformation.

Rising Enterprise Data Generation Driving Infrastructure Modernization

Indonesia’s enterprises are generating vast amounts of structured and unstructured data. Financial services, healthcare, and e-commerce industries require high data processing speeds. Modernized infrastructure supports real-time analytics, ensuring faster decision-making and better user experiences. Colocation facilities help reduce capital expenditure and improve operational flexibility. It allows organizations to manage workloads efficiently through scalable storage and power distribution. The integration of edge computing reduces latency for critical applications. Data sovereignty regulations further push enterprises toward local data hosting. These developments collectively enhance Indonesia’s capacity to handle future digital demand.

- For instance, Biznet Data Center Bali operates a Tier-2 green data center located in Jimbaran, Bali, featuring 2N power and N+1 cooling redundancy. The facility supports enterprise-grade reliability and serves as part of Biznet’s national data infrastructure network connecting major Indonesian cities.

Strategic Importance for Investors and Global Connectivity Enhancement

Indonesia’s geographic position makes it a strategic data connectivity hub in Southeast Asia. The country’s submarine cable projects improve global network integration. International cloud providers are partnering with local firms to expand their regional presence. It provides investors access to a rapidly growing digital infrastructure market. The market’s strategic role in supporting cloud ecosystems attracts global funding. Businesses benefit from improved connectivity, security, and access to local customer bases. This alignment of infrastructure and investment priorities supports long-term sustainability. Continuous innovation ensures Indonesia’s competitiveness in the regional data economy.

Market Trends

Shift Toward Edge Computing and Distributed Architecture Models

The Indonesia Internet Data Center (IDC) Market is witnessing a strong shift toward edge computing. Enterprises are deploying micro data centers near end-users to enhance real-time processing. This approach supports 5G rollouts, IoT networks, and smart city applications. Distributed infrastructure reduces latency and improves operational efficiency. It also enables enterprises to process data locally while maintaining security compliance. The expansion of digital ecosystems drives the need for localized storage. Businesses adopt edge architectures for predictive analytics and automation. These trends reinforce Indonesia’s ambition to build an intelligent and responsive network infrastructure.

Growing Demand for Sustainable and Energy-Efficient Data Centers

Environmental awareness is reshaping the country’s data center operations. Operators are implementing liquid cooling, modular UPS, and renewable energy solutions. It enhances energy efficiency while reducing carbon emissions across facilities. Global players emphasize green certification and carbon-neutral operations. Indonesia’s abundant renewable resources strengthen the shift toward sustainable infrastructure. Cloud providers and telecom firms are exploring power purchase agreements for solar energy. These green initiatives attract ESG-focused investors and global technology leaders. Energy-efficient infrastructure also ensures long-term cost competitiveness and compliance with future regulations.

Integration of Artificial Intelligence for Infrastructure Optimization

AI-driven automation is becoming central to data center management and monitoring. It improves operational accuracy through predictive maintenance and energy forecasting. The Indonesia Internet Data Center (IDC) Market benefits from AI-based analytics for workload balancing. These systems optimize resource allocation, reducing downtime risks. AI-enabled platforms enhance cooling efficiency and detect hardware issues in real time. This automation lowers operational expenses while improving scalability. It ensures consistent service reliability for enterprises using mission-critical applications. The integration of AI aligns with Indonesia’s growing focus on technological self-reliance.

Rising Investments from Global Cloud and Hyperscale Providers

International hyperscalers are accelerating investments across Indonesia’s metro and regional locations. They aim to meet rising demand from digital-first enterprises and consumers. It enhances the country’s global connectivity and network resilience. Strategic collaborations between local providers and global tech giants fuel infrastructure growth. Indonesia’s improving power grid and connectivity attract hyperscale projects. Multinational companies view the country as a key entry point to the ASEAN market. The construction of large campuses ensures scalability and high-performance computing. These investments position Indonesia among the top regional data center destinations.

Market Challenges

Power Supply Constraints and Infrastructure Limitations Affecting Expansion

The Indonesia Internet Data Center (IDC) Market faces power infrastructure challenges limiting large-scale deployment. Many regions still experience inconsistent power supply, increasing operational risks. Developing advanced facilities requires stable electricity and efficient cooling systems. It raises costs for providers seeking to maintain high uptime standards. Limited access to renewable sources restricts sustainable energy use. Grid inefficiencies can delay hyperscale investments and project timelines. Businesses must balance power demand with environmental responsibility. Strengthening grid reliability is essential for ensuring long-term operational continuity and investor confidence.

Regulatory Compliance and Data Sovereignty Barriers Hindering Scalability

Stringent data localization and compliance laws create complexities for global firms. The requirement to store and process data within national borders increases infrastructure costs. The Indonesia Internet Data Center (IDC) Market must navigate evolving government frameworks. It demands transparent policies to ensure cross-border data exchange and privacy. Regulatory uncertainty can deter potential investors and limit service flexibility. Local operators need advanced compliance systems to meet new security standards. Slow approval processes can delay new data center builds. Regulatory clarity will remain key to unlocking Indonesia’s full data hosting potential.

Market Opportunities

Expansion of Cloud Ecosystems and Digital Integration Across Industries

The Indonesia Internet Data Center (IDC) Market offers strong potential through cloud ecosystem development. Businesses are shifting workloads to hybrid and cloud-based environments for scalability. Local and international cloud providers can form strategic alliances to boost regional presence. It strengthens Indonesia’s position as a digital hub for ASEAN enterprises. The growing digital economy promotes cloud-native application growth. Financial and retail sectors increasingly demand low-latency, secure storage. Opportunities exist for managed service providers to offer value-added cloud support. This expansion creates a sustainable growth path for investors and technology partners.

Emergence of Smart Cities and Edge Connectivity Solutions

Indonesia’s government-driven smart city programs are accelerating data infrastructure needs. Edge computing plays a vital role in powering IoT, surveillance, and traffic systems. It creates opportunities for colocation and micro data center developers. Enhanced connectivity fosters innovation and data democratization across urban regions. The Indonesia Internet Data Center (IDC) Market benefits from high-speed fiber and 5G network integration. Growing public-private partnerships drive long-term digital resilience. This infrastructure growth supports innovation in public services and local enterprises. Smart city integration ensures inclusive, future-ready data ecosystems across Indonesia.

Market Segmentation

By Services Segment

In the Indonesia Internet Data Center (IDC) Market, the colocation segment holds the dominant share, driven by rising enterprise outsourcing and demand for scalable infrastructure. Businesses prefer colocation to lower capital costs while maintaining operational efficiency and secure connectivity. The hosting and CDN services segments are expanding due to rapid growth in e-commerce, media streaming, and cloud-based applications. It benefits from the surge in data traffic, requiring improved latency management and network optimization. Continuous investment in advanced data delivery systems strengthens Indonesia’s overall digital ecosystem.

By Deployment Segment

The hybrid deployment segment leads the Indonesia Internet Data Center (IDC) Market, favored for its balance between data control and cloud flexibility. Enterprises adopt hybrid systems to manage critical workloads on private servers while leveraging public clouds for scalability. Public deployment models are growing rapidly due to digital transformation in startups and SMEs. Private deployments remain vital for organizations with strict compliance requirements. It gains momentum as companies pursue cost-effective, secure, and scalable solutions. The hybrid model’s adaptability ensures resilience and efficiency in Indonesia’s evolving digital environment.

By Data Center Size Segment

Large enterprises dominate the Indonesia Internet Data Center (IDC) Market, holding a significant share due to extensive data storage and computing needs. These organizations require high-performance infrastructure for AI, analytics, and cloud integration. SMEs are increasingly contributing through managed hosting and hybrid adoption to reduce IT costs. It benefits from Indonesia’s expanding digital economy and government-led digitalization programs. The rising number of enterprises embracing automation and real-time data solutions fuels ongoing infrastructure investment across both large and small business segments.

By End User Segment

The cloud service providers segment leads the Indonesia Internet Data Center (IDC) Market, driven by hyperscale expansion and cloud-first strategies among enterprises. Telecom operators follow closely, supporting 5G rollout and edge computing networks. BFSI and e-commerce sectors contribute significantly, demanding secure, high-speed, and compliant infrastructure. Government initiatives toward digital governance strengthen the public sector’s adoption. Media and entertainment industries increasingly rely on data centers for streaming and content delivery. It continues to expand as diverse sectors embrace cloud connectivity and data-driven business operations.

Regional Insights

Jakarta Leading with Strong Infrastructure and High Market Concentration

Jakarta holds a dominant 62% share of the Indonesia Internet Data Center (IDC) Market. The city’s advanced connectivity, reliable power grid, and major enterprise presence fuel growth. It hosts most hyperscale and colocation facilities due to high bandwidth availability. The capital’s strategic role in finance and digital services strengthens its leadership. It attracts foreign investments seeking immediate access to Indonesia’s digital ecosystem. The strong concentration of enterprises ensures high utilization rates. Jakarta remains the country’s data hub for national and regional connectivity.

- For instance, PT DCI Indonesia Tbk launched the JK6 AI-ready data center in Jakarta with 36 MW of IT capacity in June 2025, adding to its total campus capacity exceeding 70 MW and setting a new industry benchmark with Tier IV Gold Certification for operational sustainability.

Surabaya and Batam Emerging as Secondary Growth Hubs

Surabaya and Batam collectively represent 23% of the market, driven by infrastructure expansion. Surabaya benefits from its proximity to Java’s industrial corridor and undersea cables. Batam’s location near Singapore enhances its cross-border data flow advantage. These regions are attracting new colocation and cloud investments. It reflects a strategic diversification away from Jakarta’s congestion. Lower operational costs and government support foster rapid development. The emerging role of secondary hubs ensures Indonesia’s balanced regional digital growth.

- For instance, Princeton Digital Group (PDG) is developing a data center campus in Batam with a planned capacity of up to 96 MW, and its Jakarta JC2 hyperscale facility officially launched in September 2023 with 22 MW, supporting PDG’s regional SG+ strategy for under 5 ms connectivity to Singapore.

Medan and Other Regions Supporting Future Market Expansion

Medan and other regional centers account for 15% of the Indonesia Internet Data Center (IDC) Market. They are becoming vital in reducing regional latency and improving network coverage. Local governments are promoting smart city projects and digital inclusion. It encourages private investment in micro and edge data centers. These efforts support decentralized data processing and disaster recovery solutions. Growing enterprise presence in these cities enhances service accessibility. Regional diversification ensures Indonesia’s digital infrastructure remains resilient and future-ready.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Competitive Insights:

The Indonesia Internet Data Center (IDC) Market is defined by strong competition among domestic providers focusing on capacity expansion and service diversification. Telkom Indonesia and PT DCI Indonesia Tbk lead the market with extensive infrastructure and cloud integration capabilities. SpaceDC strengthens regional connectivity through high-efficiency modular data centers. NeuCentrIX and Biznet Data Center emphasize nationwide reach and carrier-neutral facilities to support enterprise growth. Exabytes Indonesia delivers managed hosting and cloud solutions tailored for SMEs. Elitery focuses on hybrid cloud integration and IT resilience services. It remains highly competitive, with firms investing in sustainability, automation, and advanced interconnection to meet rising digital demand.

Recent Developments:

- In October 2025, Digital Edge secured a US$325 million financing facility from Bank Central Asia (BCA), aimed at supporting Digital Edge’s new build expansion in the Jakarta metro region and refinancing its existing BCA facility. This expansion emphasizes the company’s commitment to bringing advanced colocation and interconnect options to Indonesia’s digital infrastructure landscape, aligning with national digital transformation priorities.

- In September 2025, Telkom Indonesia launched its AI Centre of Excellence, supported by joint product development and strategic partnerships, including a collaboration with Feedloop AI signed at BATIC 2025 in Bali. This initiative is designed to accelerate Indonesia’s digital transformation and support the national AI ecosystem.

- In June 2025, Edgnex announced the acquisition of a site in Jakarta for the construction of a new $2.3 billion AI data center, with the initial phase expected to go live by December 2026. This facility is designed for high-density AI workloads and marks part of Edgnex’s larger regional investment strategy worth more than $3 billion across Southeast Asia.

- In October 2024, NeuCentrIX, a division of Telkom Indonesia, launched its 25th data center in Yogyakarta, strengthening digital infrastructure for SMEs and the public sector in the region. This facility integrates with NeuCentrIX Semarang for extended digital services and is part of a broader initiative that includes AI-driven data centers in Batam, with operations expected to commence in late 2025