Market Overview

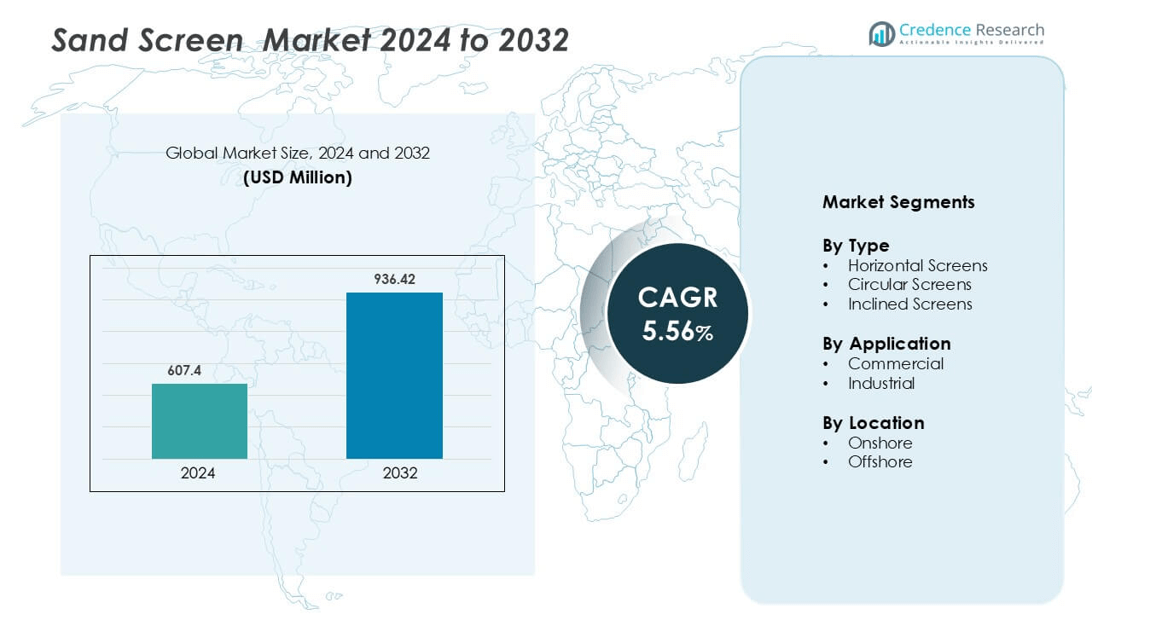

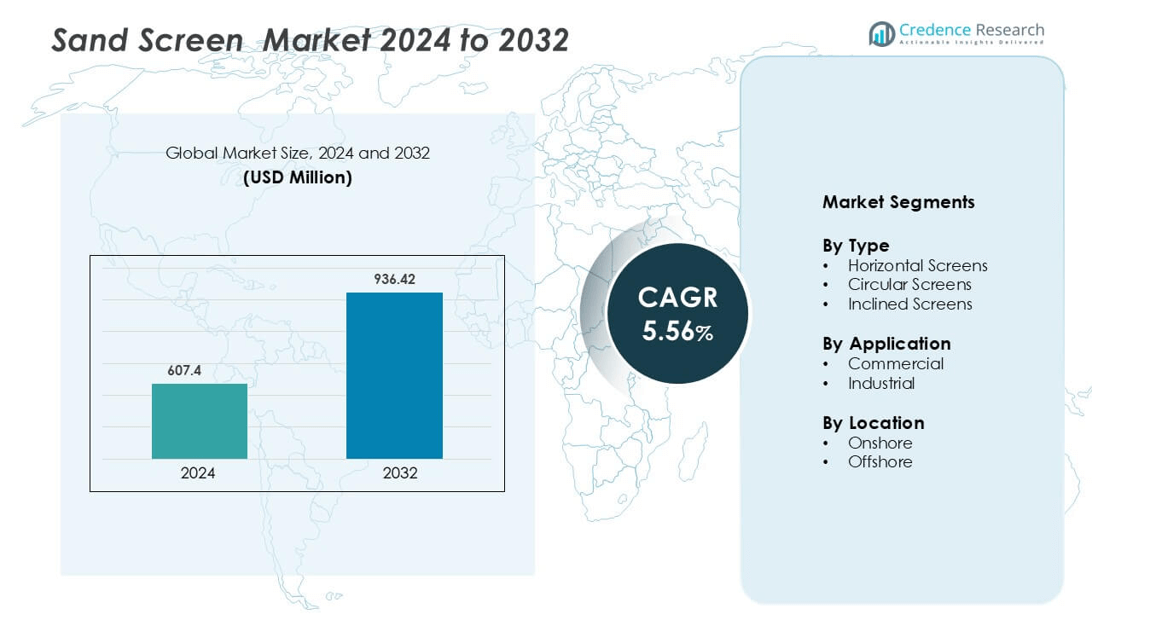

Sand screen Market was valued at USD 607.4 million in 2024 and is anticipated to reach USD 936.42 million by 2032, growing at a CAGR of 5.56 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sand Screen Market Size 2024 |

USD 607.4 million |

| Sand Screen Market, CAGR |

5.56% |

| Sand Screen Market Size 2032 |

USD 936.42 million |

The sand screen market is highly competitive, with key players such as Terex Corporation, Sandvik AB, Komatsu Ltd., Deister Machine Company, SIEBTECHNIK GmbH, RHEWUM GmbH, SWECO, SCREEN MACHINE INDUSTRIES, S&F GmbH Siebmaschinen & Fördertechnik, John Deere, and Cosmos Construction Machinery leading global operations. These companies focus on durable design, precision screening efficiency, and advanced vibration control technologies. Terex and Sandvik dominate in mobile screening equipment, while Deister and RHEWUM specialize in customized industrial screens for mining and aggregates. The integration of smart monitoring systems and energy-efficient components defines the next phase of competition. Asia-Pacific leads the global market, holding a market share of 38.4%, driven by rapid infrastructure development, quarrying expansion, and rising demand for construction materials. North America and Europe follow, supported by modernization of aggregate processing and strong replacement demand in mature economies.

Market Insights

- The Sand Screen Market was valued at USD 607.4 million in 2024 and is projected to reach USD 936.42 million by 2032, growing at a CAGR of 5.56% during the forecast period.

- Growing demand from mining, oil and gas, and construction sectors drives steady adoption of advanced screening equipment.

- Technological trends like automation, AI-based monitoring, and modular design improve screening accuracy and energy efficiency.

- Major players such as Sandvik, Terex, Komatsu, and RHEWUM GmbH dominate through innovation, durability, and global distribution networks.

- Asia-Pacific leads with a 38.4% market share, followed by North America at 27.6%, while the mining segment holds a dominant 42.1% share, supported by infrastructure growth and material handling needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Horizontal screens dominate the Sand Screen Market with a market share of 46%. These screens are preferred for their high capacity, continuous operation, and efficient sand control performance. They enable effective solids separation and enhanced flow distribution, which is vital for maximizing oil and gas production rates. Their easy installation and low maintenance requirements also support widespread adoption in upstream applications. Increasing demand for advanced sand control systems in unconventional reservoirs and mature fields continues to strengthen the dominance of horizontal screens across both onshore and offshore operations.

- For instance, Baker Hughes’s BEADSCREEN system is engineered for highly erosive environments where conventional wire-wrapped screens often fail, enabling sand control in challenging horizontal wells with elevated flow regimes.

By Application

The industrial segment leads the Sand Screen Market, accounting for 58% of total market share. Industries such as oil and gas, mining, and construction use sand screens for filtration, sand retention, and material separation. Industrial users prefer durable, corrosion-resistant screens capable of performing under high-pressure and temperature conditions. The rise in drilling and extraction activities globally drives demand for efficient sand screening systems. Additionally, manufacturers are focusing on developing high-strength, wear-resistant screen materials to enhance operational life and reliability in industrial applications.

- For instance, Baker Hughes’s BEADSCREEN system was field-deployed in less than two hours via slickline, reducing rig time in a remote Malaysia location while delivering high erosion-resistance for the sand control string.

By Location

Onshore operations hold the dominant market share of 64% in the Sand Screen Market. The segment benefits from easier accessibility, lower setup costs, and rapid deployment of sand control systems. Onshore fields across North America, the Middle East, and Asia Pacific contribute significantly due to large-scale drilling and well completion activities. The adoption of premium screen technologies, such as wire-wrap and premium mesh designs, further supports onshore performance efficiency. Continuous exploration in shale and tight reservoirs also boosts the need for high-performance sand screens in onshore applications.

Key Growth Drivers

Rising Oil and Gas Exploration Activities

The growing demand for oil and gas globally is a primary driver for the Sand Screen Market. Increased drilling in conventional and unconventional reservoirs has created strong demand for reliable sand control solutions. Sand screens play a crucial role in maintaining well integrity by preventing sand production and optimizing flow efficiency. The adoption of horizontal and directional drilling techniques further enhances their need in complex well architectures. For instance, the expansion of deepwater and shale projects in regions such as the Middle East and North America has significantly boosted investments in advanced screen technologies, including premium mesh and wire-wrap designs, to improve production rates and reduce downtime.

- For instance, Halliburton’s Endurance Hydraulic Screen® system demonstrated mechanical collapse strength beyond 5,000 psi, enabling horizontal well completions to withstand high geo-mechanical loads and sustain sand control integrity in challenging reservoir environments.

Technological Advancements in Screen Design and Materials

Continuous innovation in materials and manufacturing processes is fueling market expansion. Companies are developing screens made from stainless steel, nickel alloys, and composite materials that provide superior corrosion resistance and mechanical strength. Enhanced designs, such as expandable and multi-layer screens, improve filtration accuracy and operational reliability in high-pressure environments. For instance, Baker Hughes introduced its premium sand screen portfolio featuring sintered mesh structures that withstand harsh downhole conditions and extend service life. These advancements reduce maintenance costs, prevent formation damage, and enhance production efficiency, making modern sand screens indispensable in challenging geological formations and deepwater operations.

- For instance, the MeshSlot XL variant uses three or four mesh layers and supports tensile ratings up to 417,000 lbf at base-pipe size 6.625 in, demonstrating enhanced mechanical resilience under demanding conditions.

Increasing Focus on Well Efficiency and Production Optimization

Operators are increasingly focusing on maximizing hydrocarbon recovery while minimizing operational risks, driving demand for high-performance sand screens. Advanced completion techniques require precise sand control mechanisms to ensure steady production flow and reduced equipment wear. The integration of digital monitoring and predictive analytics in screen systems allows for real-time data tracking and proactive maintenance. For instance, Schlumberger’s digital sand control systems combine intelligent sensors with robust screen technology, enhancing production uptime and reservoir management. Such integrated solutions contribute to improved well performance, longer operational lifespans, and cost-effective field operations, particularly in mature and high-depletion reservoirs.

Key Trends & Opportunities

Shift Toward Smart and Autonomous Sand Control Systems

The integration of automation and IoT technologies in sand control equipment is emerging as a major trend. Smart sand screens equipped with sensors and telemetry systems allow operators to monitor well conditions, pressure changes, and particle retention remotely. These systems provide real-time feedback for predictive maintenance and performance optimization. For instance, Halliburton’s autonomous completion systems enable automated sand management and adaptive control in dynamic well conditions. This digital transformation presents significant opportunities for enhanced efficiency, reduced intervention costs, and improved reservoir productivity, positioning smart sand screens as a future standard in high-value drilling operations.

- For instance, Halliburton’s SmartWell® intelligent completion system collected down-hole data and transmitted it in real-time across multiple zones in a field trial, enabling remote control of eight reservoir zones simultaneously with live feedback.

Growing Adoption in Offshore and Deepwater Projects

The increasing number of offshore and deepwater exploration projects provides strong growth potential for the Sand Screen Market. Offshore environments demand screens with superior durability, anti-corrosion properties, and the ability to withstand extreme pressure and temperature conditions. For instance, Weatherford’s premium metal mesh screens are designed for subsea completions, ensuring reliable sand control and flow assurance. The expansion of offshore projects in regions like the Gulf of Mexico and West Africa drives investments in advanced screen technologies. This trend offers long-term opportunities for manufacturers to develop customized, high-performance solutions tailored for offshore drilling challenges.

- For instance, Weatherford’s ESS® Expandable Sand Screen system was installed in 54 offshore wells and achieved zero recordable sand-control failures through deployment and expansion in approximately 10 hours each.

Sustainability and Recyclable Materials in Screen Manufacturing

Manufacturers are focusing on sustainability through the use of recyclable materials and energy-efficient production techniques. The shift toward eco-friendly materials, such as corrosion-resistant composites and low-emission alloys, aligns with global environmental standards. For instance, NOV introduced recyclable stainless-steel screen frameworks that minimize waste while maintaining operational strength. This move supports operators’ sustainability commitments and regulatory compliance. The trend toward green manufacturing not only enhances environmental performance but also offers opportunities for brand differentiation and cost optimization through extended product life and reduced maintenance frequency.

Key Challenges

High Operational and Maintenance Costs

The high cost associated with sand screen installation, maintenance, and replacement poses a significant challenge to market growth. Offshore and deepwater projects, in particular, require expensive materials and precision-engineered components that increase overall capital expenditure. For instance, multi-zone completion screens can cost several times more than standard wire-wrap models due to complex manufacturing and testing requirements. Frequent maintenance, driven by clogging, erosion, or corrosion, adds to the operational burden. These cost factors often discourage small and mid-scale operators from investing in premium systems, limiting adoption in price-sensitive markets.

Technical Failures and Harsh Operating Environments

Sand screen performance can be severely affected by harsh downhole conditions, including high pressure, temperature, and corrosive fluids. Failures such as screen plugging, erosion, or collapse can lead to reduced production and expensive remediation operations. For instance, studies in offshore fields have shown that improper screen selection or installation can result in up to 30% production loss due to sand influx. Ensuring durability and compatibility in such demanding conditions remains a key engineering challenge. Manufacturers must focus on improving material resilience, precision design, and testing protocols to minimize failure rates and ensure consistent well performance.

Regional Analysis

North America

North America dominates the Sand Screen Market with a market share of 34%. The region’s leadership is driven by extensive oil and gas drilling operations across the U.S. and Canada. Growth in shale gas extraction and horizontal drilling further strengthens product adoption. Manufacturers are investing in advanced screen technologies to support complex well completions. For instance, Baker Hughes and Halliburton continue to develop high-performance screens for unconventional reservoirs. Government support for energy independence and continuous exploration in deepwater zones also boosts the regional market’s expansion and technological advancement.

Europe

Europe accounts for 22% of the Sand Screen Market, supported by growing offshore exploration in the North Sea and renewable energy integration in oilfield operations. The UK, Norway, and the Netherlands are leading contributors to regional demand. Companies such as Schlumberger and Weatherford supply durable and corrosion-resistant screens designed for harsh offshore conditions. Ongoing upgrades to mature fields and focus on emission reduction drive the use of sustainable materials. The rising shift toward energy-efficient extraction and compliance with EU environmental standards reinforces Europe’s position as a key innovation hub.

Asia Pacific

Asia Pacific holds a 26% market share, fueled by expanding drilling activities in China, India, Indonesia, and Australia. Rapid industrialization and growing energy demand increase investments in upstream oil and gas projects. Local manufacturers are enhancing production capabilities for cost-effective and durable sand screens. For instance, companies in China are producing multi-layered mesh designs for improved sand control in onshore wells. Rising offshore developments in Southeast Asia also contribute significantly. Government policies promoting domestic energy production further strengthen market growth across the region’s emerging economies.

Middle East & Africa

The Middle East & Africa region captures 12% of the Sand Screen Market, driven by extensive onshore and offshore oilfield projects. Major producers such as Saudi Arabia, the UAE, and Nigeria invest heavily in sand control technologies to maintain well productivity. Companies like Saudi Aramco adopt premium metal mesh and wire-wrap screens for long-term performance. The region’s high reservoir complexity and demand for reliable filtration solutions stimulate continuous product innovation. Ongoing capacity expansion and national energy diversification programs further enhance market opportunities in both mature and developing fields.

Latin America

Latin America represents 6% of the Sand Screen Market, with Brazil, Mexico, and Argentina leading regional adoption. Expanding deepwater and shale projects, especially in Brazil’s pre-salt fields, create strong demand for durable sand control systems. International partnerships and government-backed investments support exploration growth. For instance, Petrobras utilizes high-strength composite screens for improved well integrity in deepwater operations. The region’s focus on energy security and modernization of mature assets sustains the demand for advanced screen technologies, contributing to gradual but steady market development across key oil-producing nations.

Market Segmentations:

By Type

- Horizontal Screens

- Circular Screens

- Inclined Screens

By Application

By Location

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sand screen market is moderately consolidated, with global players emphasizing product durability, precision screening, and integration of automation technologies. Sandvik and Komatsu lead the market with advanced screening systems featuring wear-resistant alloys and intelligent vibration control for high-throughput operations in mining and construction. Terex Corporation and John Deere expand their portfolios with mobile and modular screening units designed for flexibility and rapid deployment. European manufacturers such as RHEWUM GmbH, SIEBTECHNIK GmbH, and S&F GmbH Siebmaschinen & Fördertechnik focus on fine screening efficiency and energy-optimized designs for industrial minerals and aggregates. SCREEN MACHINE INDUSTRIES and Deister Machine Company, Inc. strengthen North American presence through customizable heavy-duty screening equipment tailored to diverse site conditions. Hewitt Robins International continues to deliver robust linear motion screens engineered for long service life. Companies are prioritizing digital monitoring systems, predictive maintenance, and eco-efficient materials to enhance performance and reduce operational costs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sandvik

- Komatsu

- Terex Corporation

- John Deere

- SCREEN MACHINE INDUSTRIES

- Deister Machine Company, Inc.

- RHEWUM GmbH

- SIEBTECHNIK GmbH

- S&F GmbH Siebmaschinen & Fördertechnik

- Hewitt Robins International

Recent Developments

- In February 2022, Saudi Arabia-based oilfield services company, TAQA, acquired energy services firm Tendeka. The acquisition is estimated to enable TAQA to become a leading international player in offering well services and equipment. The acquisition of Tendeka is expected to complete TAQA’s portfolio.

- In March 2022, Baker Hughes signed an agreement to acquire Altus Intervention to strengthen its oil & gas integrated well intervention solutions

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Location and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation and AI-based screening systems will enhance operational accuracy and reduce downtime.

- Demand for eco-friendly and low-emission screening equipment will increase with stricter environmental norms.

- Modular and mobile screening units will gain adoption in mining and construction sectors.

- Digital monitoring and predictive maintenance solutions will improve equipment efficiency.

- Rising infrastructure investments in Asia-Pacific will drive strong market expansion.

- Advancements in wear-resistant materials will extend equipment life cycles.

- Integration of IoT and smart sensors will enable real-time performance tracking.

- Replacement demand in developed markets will boost aftermarket service revenues.

- Manufacturers will focus on energy-efficient designs to reduce operational costs.

- Growing use of sand screens in oil and gas wells will support long-term industry growth.