Market Overview

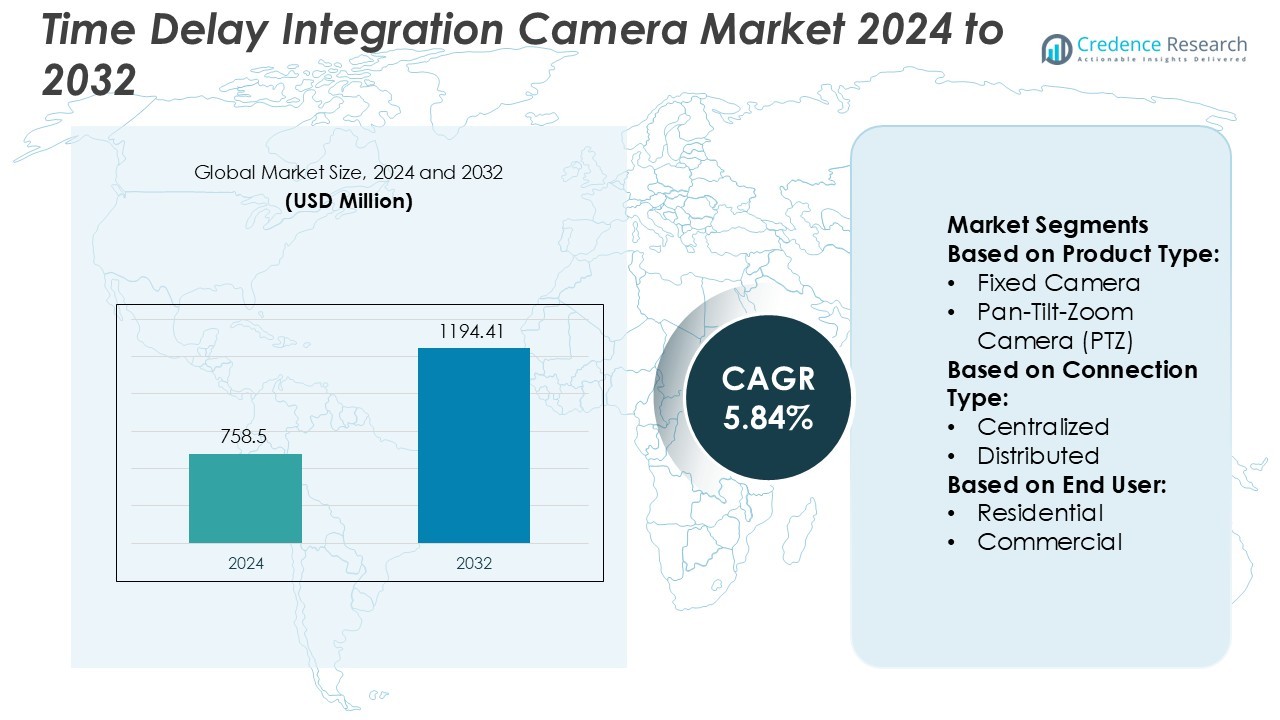

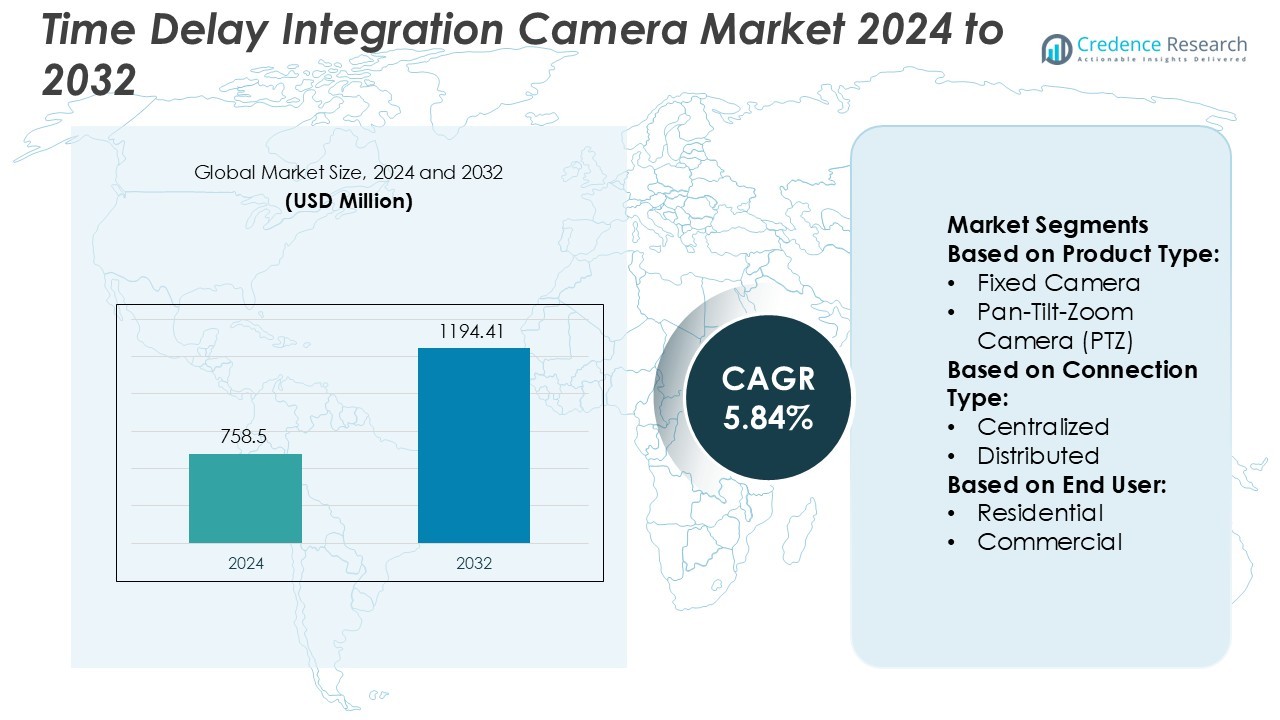

Time Delay Integration Camera Market size was valued USD 758.5 million in 2024 and is anticipated to reach USD 1194.41 million by 2032, at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Time Delay Integration Camera Market Size 2024 |

USD 758.5 Million |

| Time Delay Integration Camera Market, CAGR |

5.84% |

| Time Delay Integration Camera Market Size 2032 |

USD 1194.41 Million |

The Time Delay Integration camera market includes major players such as Sony Corporation, Johnson Controls, Hangzhou Hikvision Digital Technology Co. Ltd., Schneider Electric SE, Samsung Electronics Co. Ltd., Bosch Security Systems GmbH, Arecont Vision Costar LLC, Panasonic Corporation, Honeywell International Inc., and Avigilon Corporation. These companies compete through advancements in sensitivity, faster readout speeds, and AI-enabled image processing to support high-speed inspection, medical diagnostics, and security applications. North America remains the leading regional market, holding 34% of global share due to strong investments in semiconductor manufacturing, defense imaging, and life-science research. Continuous R&D and industrial automation trends will maintain competitive pressure and support market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Time Delay Integration Camera Market was valued at USD 758.5 million in 2024 and is projected to reach USD 1194.41 million by 2032, registering a CAGR of 5.84%.

- Growth is driven by rising demand for high-speed industrial inspection, semiconductor manufacturing, and medical imaging, where motion blur reduction and high sensitivity offer strong benefits.

- Key players compete through advanced sensors, faster readout speeds, low-light capabilities, and AI-enabled processing, with companies focusing on compact designs for automation systems.

- North America leads the market with a 34% share due to strong investment in defense imaging, life-science research, and high-precision semiconductor production, while Asia-Pacific grows rapidly with expanding electronics manufacturing.

- Market restraints include high ownership costs and competition from advanced CMOS and line-scan cameras, yet the industrial segment holds the dominant share as factories shift toward zero-defect production and automated inspection.

Market Segmentation Analysis:

By Product Type

Fixed cameras hold the largest share in the time delay integration (TDI) camera market due to their reliability, affordability, and suitability for continuous imaging. Industries such as manufacturing, electronics, and semiconductor inspection use fixed TDI cameras for high-precision line scanning and defect detection. Their compact design and stable setup reduce calibration needs, which helps lower operational cost. Pan-tilt-zoom (PTZ) and infrared cameras are growing segments as security agencies and industrial automation adopt long-range scanning and thermal monitoring for harsh or low-light environments.

By Connection Type

Centralized systems account for the dominant market share because industries prefer unified control and data processing for quality inspection and surveillance. A centralized architecture supports high-resolution data flow from multiple TDI cameras to one control unit, enabling faster analysis and reduced latency. This setup is widely used in semiconductor fabrication, logistics scanning, and aerospace component inspection. Distributed systems are expanding in edge-based automation, where localized processing helps reduce bandwidth load and improves response time for remote facilities.

By End User

Commercial users represent the largest share due to high demand for precision scanning in semiconductor production, pharmaceuticals, electronics assembly, and logistics. TDI cameras enable accurate surface inspection, barcode reading, and defect detection at high conveyor speeds, which increases operational efficiency. Government and public agencies use TDI systems for border security, aerospace imaging, and satellite surveillance, benefitting from higher sensitivity and low-noise performance. Residential adoption remains minimal, limited to niche security and research use cases.

Key Growth Drivers

- Rising Demand for High-Precision Imaging in Industrial Inspection

Time Delay Integration (TDI) cameras are increasingly used in semiconductor fabrication, food sorting, and PCB inspection due to their ability to capture high-speed motion with enhanced clarity. Manufacturers prefer TDI systems over standard area or line-scan cameras because they reduce motion blur while maintaining high resolution. Growing automation in factories and the move toward zero-defect production boost adoption. Continuous investments in advanced manufacturing, especially electronics and automotive, further increase demand for superior defect detection and precision imaging.

- For instance, Sony’s IMX487 global-shutter CMOS sensor (part of the Pregius S family) delivers a resolution of 2856 × 2848 pixels with a pixel size of 2.74 µm. It enables highly accurate defect detection in high-speed inspection lines due to its high frame rate (up to 194 fps) and UV sensitivity, capturing undistorted images of moving objects.

- Expansion of Medical and Life-Science Imaging Applications

Healthcare and biomedical research create strong demand for TDI cameras due to their ability to capture low-light, high-speed images without sacrificing quality. These systems support cell analysis, digital pathology, and fluorescence microscopy, where clarity and sensitivity are critical. Hospitals and research facilities are shifting from conventional imaging sensors to TDI technology to achieve faster diagnosis and better imaging throughput. Rising investments in medical imaging equipment, laboratory automation, and life-science research strengthen market growth.

- For instance, Hikrobot’s CMOS-based machine-vision cameras, such as the MV-CH120-20UM, integrate a 4096 × 3072 resolution sensor with a pixel size of 3.2 µm × 3.2 µm. It utilizes a USB3.0 interface, which enables high-speed image acquisition suitable for applications like biomedical inspection and digital pathology workflows.

- Adoption of TDI Cameras in Defense and Space-Based Remote Sensing

Defense agencies and space organizations use TDI cameras in satellite imaging, border surveillance, and reconnaissance systems. The technology enables high-resolution imaging of moving targets and terrain, even in low-light or high-altitude conditions. Growing global investment in Earth observation satellites and intelligence systems supports the deployment of TDI-based imaging payloads. National security programs and climate monitoring missions further increase adoption, driving strategic collaborations between sensor manufacturers and aerospace firms.

Key Trends & Opportunities

- Integration of TDI Cameras with AI and Advanced Image Processing

Manufacturers are integrating artificial intelligence, deep learning, and enhanced processing software into TDI cameras to detect defects automatically and deliver real-time analytics. This trend increases accuracy in industrial inspection and speeds up decision-making. AI-enabled TDI platforms help industries reduce waste and improve product quality without manual supervision. The rising use of smart factories and predictive maintenance creates a major opportunity for intelligent imaging systems.

- For instance, Schneider Electric’s factory in Plovdiv uses the Cognex In-Sight D900 system embedded in its EcoStruxure platform, which leverages AI and deep learning for quality inspection tasks where traditional vision systems are insufficient.

- Miniaturization and Growth of Compact TDI Solutions

A key trend is the development of smaller, lightweight TDI cameras that provide high sensitivity while fitting into limited machine space. Compact systems are gaining adoption in food sorting, pharmaceuticals, and robotic inspection lines where equipment size is critical. Manufacturers are focusing on power-efficient designs and improved sensor materials, making TDI technology easier to integrate into automation equipment. This trend opens growth opportunities in portable diagnostic devices and mobile inspection platforms.

- For instance, Samsung’s ISOCELL HP3 image sensor packs 200 million pixels (200 MP) in a 1/1.4-inch optical format with 0.56 µm-sized pixels, enabling a reduced camera module surface area by up to 20 %.

- Increasing Shift Toward Hyperspectral and Multispectral Imaging

TDI cameras are being adapted for hyperspectral and multispectral imaging to support precision agriculture, mineral mapping, and environmental monitoring. These systems collect detailed wavelength data and identify chemical properties with high accuracy. Governments and research institutions invest in spectral imaging for crop health analysis, soil testing, and pollution detection. This shift expands the use of TDI imaging beyond manufacturing into scientific and environmental applications.

Key Challenges

- High Cost of Advanced TDI Camera Systems

TDI cameras require complex sensor architecture, specialized processing electronics, and precise calibration, which raise production costs. Small and medium-scale industries often prefer cheaper line-scan cameras, limiting adoption. Maintenance and integration expenses add to total ownership costs, making the technology less accessible in price-sensitive markets. As a result, cost remains a barrier in emerging economies and smaller factories with limited automation budgets.

- Competition from Alternative High-Resolution Imaging Technologies

Advances in CMOS sensors, line-scan imaging, and high-speed area cameras create strong competition for TDI systems. Many industries choose these alternatives due to ease of integration and lower setup complexity. Continuous improvements in sensor sensitivity and processing speed narrow the performance gap, forcing TDI manufacturers to innovate rapidly. This challenge pressures suppliers to reduce pricing and differentiate through specialized applications.

Regional Analysis

North America

North America holds the largest share of the Time Delay Integration camera market, accounting for 34% of global revenue. The region benefits from advanced semiconductor manufacturing, strong automation adoption, and a well-established aerospace and defense sector. U.S. companies invest heavily in industrial inspection systems and satellite imaging technologies, driving continuous demand for TDI cameras. Growth is further supported by innovation in life-science research and medical diagnostics, where high-precision imaging plays a critical role. Strong funding for space programs, remote sensing projects, and digital manufacturing also reinforces North America’s leadership in market expansion.

Europe

Europe commands 29% of the Time Delay Integration camera market due to growing industrial automation, strict product quality standards, and technological innovation in automotive and electronics manufacturing. Germany, France, and the U.K. lead adoption across smart factories and high-speed inspection systems. The region also benefits from major aerospace programs, defense contracts, and scientific research projects that require advanced imaging sensors. Expanding investments in medical device production and pharmaceutical quality control further support market growth. Strong government funding for environmental monitoring and precision agriculture strengthens the demand for TDI-enabled imaging platforms across European industries.

Asia-Pacific

The Asia-Pacific region holds 23% of the market, supported by rapid manufacturing expansion, rising electronics production, and increasing factory automation. China, Japan, and South Korea are key contributors, driven by semiconductor fabrication, PCB inspection, and food sorting applications. Affordable labor, extensive industrial output, and growing adoption of robotics boost TDI camera integration across production lines. Government investments in satellite imaging and hyperspectral remote sensing also expand opportunities. As major electronics exporters, APAC manufacturers deploy TDI cameras to maintain product quality and reduce defects, making the region one of the fastest-growing markets.

Latin America

Latin America accounts for 7% of market share, led by Brazil, Argentina, and Chile. Industrial modernization and automation in food processing, mining inspection, and agricultural analysis support TDI camera adoption. The region is gradually shifting from conventional inspection systems toward high-speed cameras to improve productivity and reduce operational losses. Investments in research institutions, environmental monitoring, and hyperspectral imaging for crop management also contribute to demand. Although economic fluctuations and limited manufacturing infrastructure constrain large-scale deployment, rising awareness of quality assurance technologies is expected to drive gradual market expansion.

Middle East & Africa

The Middle East & Africa region represents 7% of the Time Delay Integration camera market, driven by emerging adoption of advanced inspection systems in oil & gas, industrial manufacturing, and food processing. Countries such as the UAE and Saudi Arabia invest in automation and quality control technologies as part of economic diversification strategies. Growing research initiatives in agriculture, mineral exploration, and environmental monitoring support demand for high-resolution spectral imaging. Although adoption remains at an early stage, increasing government spending and industrial modernization are creating new growth opportunities across the region.

Market Segmentations:

By Product Type:

- Fixed Camera

- Pan-Tilt-Zoom Camera (PTZ)

By Connection Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Time Delay Integration camera market players such as Sony Corporation, Johnson Controls, Hangzhou Hikvision Digital Technology Co. Ltd., Schneider Electric SE, Samsung Electronics Co. Ltd., Bosch Security Systems GmbH, Arecont Vision Costar LLC, Panasonic Corporation, Honeywell International Inc., and Avigilon Corporation. The Time Delay Integration camera market features strong competition among global imaging, automation, and semiconductor solution providers. Companies focus on developing high-speed sensors with superior sensitivity, low noise, and improved line rates to support industrial inspection, medical imaging, and security systems. R&D investment remains a core strategy, particularly in AI-driven image processing, hyperspectral imaging, and compact camera architectures. Partnerships with electronics manufacturers and automation equipment suppliers help vendors expand their market presence. Competitive strategies also include customized camera solutions for semiconductor fabrication, food sorting, and aerospace applications. As demand for precision imaging increases, vendors differentiate through advanced calibration, better heat management, and software-enabled performance optimization, driving continuous innovation across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Genetec partnered with Axis Communications and Convergint to present integrated security solutions at The Security Event 2025. This collaboration shows a unified approach to advanced security technologies, combining expertise in video surveillance, access control, and system integration. The initiative highlights the companies’ commitment to innovation in the security sector.

- In March 2025, Konica Minolta announced the sale of all shares and loans receivable by its subsidiary, MOBOTIX AG, to Certina Software Investments AG. MOBOTIX, known for its decentralized processing IP camera systems, will transition to new ownership as part of this deal. The divestiture aligns with Konica Minolta’s strategic restructuring efforts.

- In February 2025, Alarm.com acquired a majority stake in CHeKT, a Louisiana-based cloud platform specializing in remote video monitoring. This acquisition strengthens Alarm.com’s proactive video surveillance capabilities, offering improved security solutions for businesses and consumers. The move aligns with Alarm.com’s strategy to expand its presence in the intelligent monitoring industry.

- In February 2025, Hikvision introduced its latest Pro Series Network Cameras featuring ColorVu 3.0 technology, significantly improving low-light imaging performance. This advancement enhances visibility in dark environments, making the cameras ideal for round-the-clock surveillance. The new technology aims to set a higher standard for security imaging solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Connection Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as industries demand faster and clearer imaging for inspection.

- TDI cameras will see wider use in semiconductor fabrication and electronics testing.

- Medical imaging and biotech labs will adopt TDI sensors for high-precision diagnostics.

- Aerospace and defense agencies will increase investments in satellite and surveillance imaging.

- AI-based image processing will become a standard feature to automate defect detection.

- Compact and lightweight TDI designs will support integration in robotic and portable systems.

- Hyperspectral and multispectral imaging will expand opportunities in farming and environment tracking.

- Manufacturers will innovate low-noise, high-sensitivity sensors for low-light conditions.

- Partnerships between camera makers and automation companies will boost adoption in smart factories.

- Developing regions will slowly adopt TDI solutions as automation spending increases across industries.