Market Overview

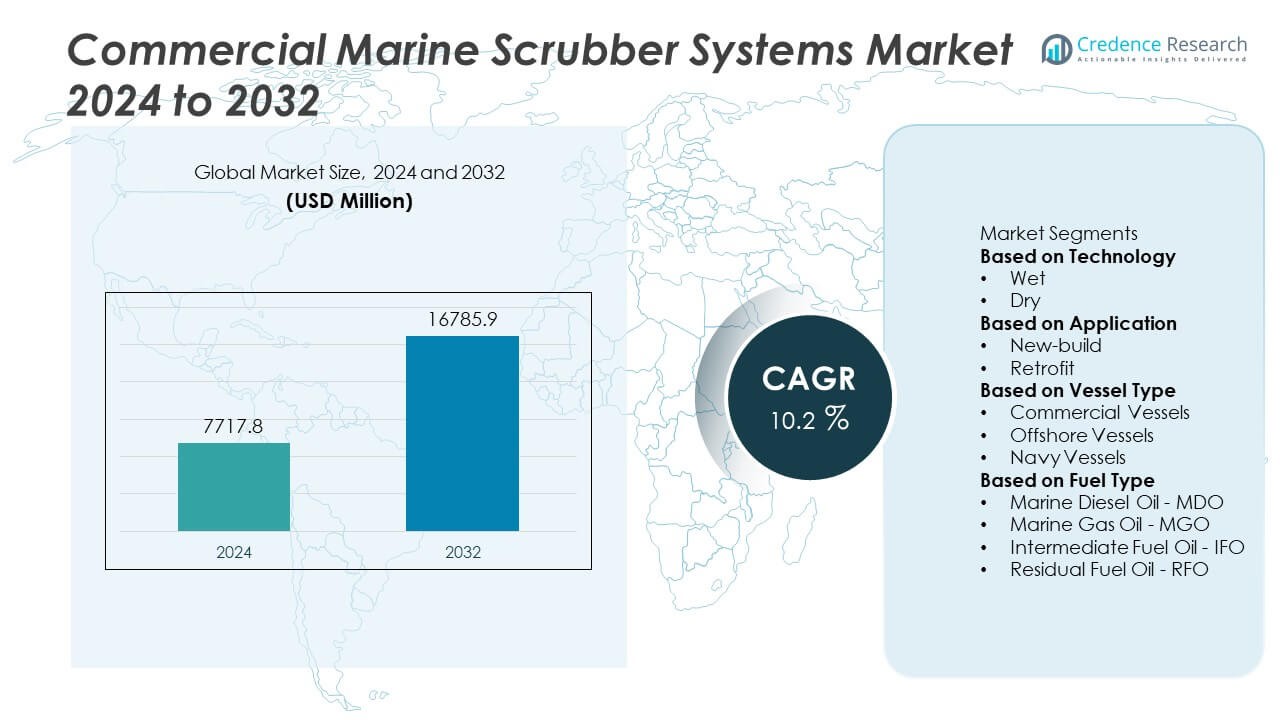

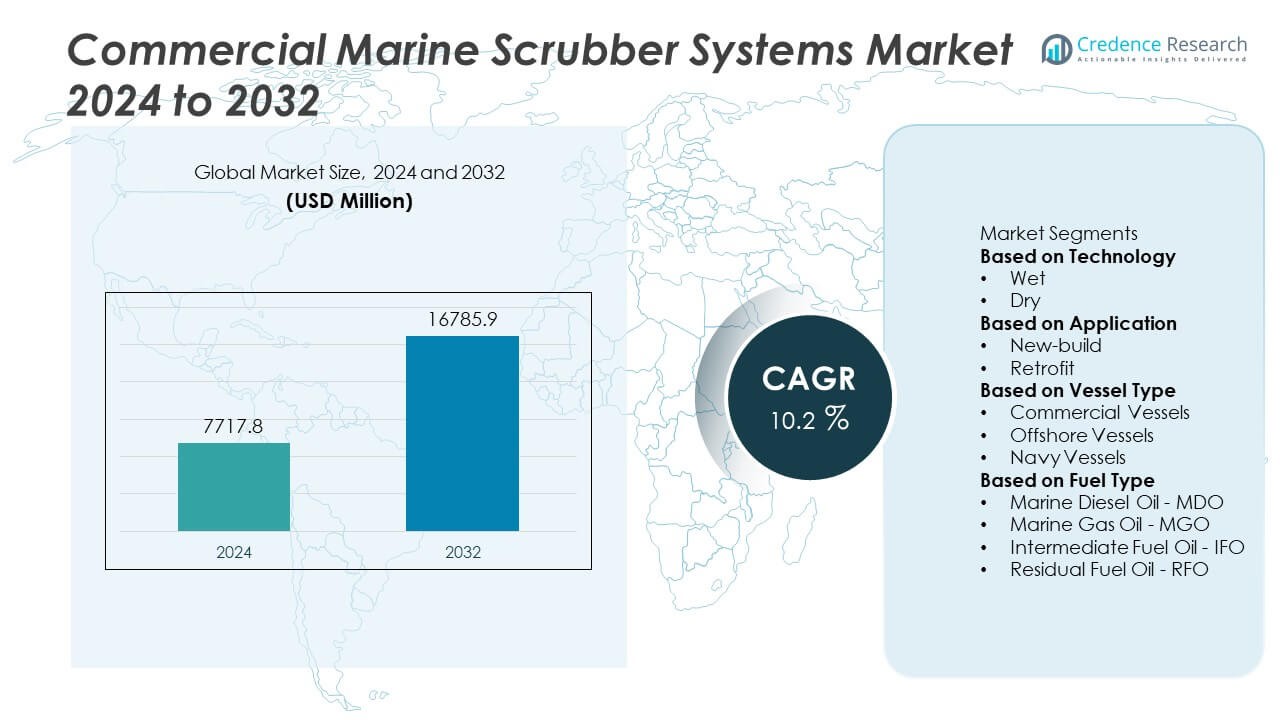

The Commercial Marine Scrubber Systems Market was valued at USD 7,717.8 million in 2024 and is projected to reach USD 16,785.9 million by 2032, growing at a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Marine Scrubber Systems Market Size 2024 |

USD 7,717.8 Million |

| Commercial Marine Scrubber Systems Market, CAGR |

10.2% |

| Commercial Marine Scrubber Systems Market Size 2032 |

USD 16,785.9 Million |

The Commercial Marine Scrubber Systems Market grows steadily due to strict international regulations limiting sulfur emissions from ships, compelling vessel operators to adopt effective emission control technologies. Increasing environmental awareness and demand for cleaner maritime operations accelerate scrubber installations across global fleets. Technological advancements, such as hybrid and closed-loop scrubbers, enhance system efficiency and regulatory compliance.

The Commercial Marine Scrubber Systems Market shows strong geographical diversity, driven by major shipping hubs and stringent environmental regulations across regions. Asia-Pacific leads with significant activity in shipbuilding and fleet retrofitting, supported by countries such as China, South Korea, and Japan. Europe follows with rigorous emission control policies, especially in designated sulfur emission control areas, encouraging adoption of advanced scrubber technologies. North America also contributes through regulatory initiatives focused on coastal emissions and fleet upgrades. Key players driving innovation and market growth include Hyundai Heavy Industries, known for integrating scrubber systems in new builds; VDL AEC Maritime, offering versatile scrubber solutions; CR Ocean Engineering, LLC, recognized for advanced open and closed-loop systems; and Pacific Green Marine Technologies Inc., specializing in eco-friendly scrubber designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Marine Scrubber Systems Market was valued at USD 7,717.8 million in 2024 and is projected to reach USD 16,785.9 million by 2032, growing at a CAGR of 10.2% during the forecast period.

- Strict international regulations on sulfur emissions from marine vessels drive market growth, pushing shipowners to adopt scrubber systems for compliance.

- Technological advancements, including hybrid and closed-loop scrubbers, enhance system efficiency and environmental performance, boosting adoption across diverse vessel types.

- Leading players such as Hyundai Heavy Industries, VDL AEC Maritime, CR Ocean Engineering, LLC, and Pacific Green Marine Technologies Inc. compete by offering innovative, reliable, and customizable scrubber solutions.

- High installation costs, complex retrofitting processes, and regulatory uncertainties pose challenges to market expansion and slow the pace of adoption.

- Asia-Pacific dominates market activity due to extensive shipbuilding, fleet retrofitting, and supportive government policies promoting cleaner maritime operations.

- Europe and North America follow closely, driven by stringent emission regulations and growing investments in eco-friendly shipping technologies, while emerging regions present new growth opportunities.

Market Drivers

Stringent Environmental Regulations Driving Market Growth

The Commercial Marine Scrubber Systems Market experiences strong growth driven by stringent environmental regulations aimed at reducing sulfur oxide emissions from ships. Regulatory bodies like the International Maritime Organization (IMO) enforce limits on sulfur content in marine fuels, prompting shipowners to adopt scrubber systems to comply with these requirements. It provides a cost-effective solution for vessels to meet emission standards without switching to expensive low-sulfur fuels. Increasing global focus on reducing air pollution and mitigating climate change further propels market demand. The need for cleaner maritime operations encourages retrofitting of existing vessels with scrubber technologies, expanding market penetration.

- For instance, Hyundai Heavy Industries completed the installation of scrubbers on over 50 retrofitted vessels in 2023, helping reduce sulfur emissions by approximately 40,000 tonnes annually.

Advancements in Scrubber Technology Enhance Market Appeal

Rising adoption of advanced scrubber technologies enhances the Commercial Marine Scrubber Systems Market by improving operational efficiency and environmental performance. Closed-loop and hybrid scrubbers offer versatility and reduce wastewater discharge, making them preferred choices among shipowners. Innovations in system design reduce energy consumption and maintenance costs, making scrubbers more attractive for various vessel types. It supports the maritime industry’s shift toward sustainable practices without compromising on fuel efficiency or operational capabilities. Technology improvements also enable compliance with evolving emission norms, ensuring long-term viability for scrubber investments.

- For instance, CR Ocean Engineering’s latest hybrid scrubber system launched in early 2024 reduces power consumption by approximately 75 kilowatts per vessel during operation and lowers wastewater discharge by up to 1,000 cubic meters per month, significantly improving environmental and operational efficiency across container and tanker fleets.

Fleet Expansion and New Shipbuilding Boost Demand

Increasing investments in new shipbuilding and fleet expansion boost demand for integrated scrubber systems in the Commercial Marine Scrubber Systems Market. Shipbuilders incorporate scrubber solutions during construction to meet regulatory deadlines and avoid costly retrofits later. The growing global fleet, driven by expanding international trade and demand for shipping services, necessitates efficient emission control systems. It creates opportunities for scrubber manufacturers to collaborate with shipyards and shipping companies for seamless system integration. This trend accelerates the adoption of scrubbers in both new and existing vessels.

Economic Benefits and Cost Savings Encourage Adoption

Rising awareness of the economic benefits linked to scrubber installations drives growth in the Commercial Marine Scrubber Systems Market. Operators seek to reduce operating expenses by using high-sulfur fuel oils while complying with emission standards through scrubbers. The potential for significant fuel cost savings encourages investment despite initial capital expenditures. It also allows shipowners to maintain flexibility in fuel sourcing amid volatile oil markets. Growing government incentives and subsidies supporting green technologies further encourage market expansion. These factors combine to strengthen scrubber adoption worldwide, solidifying its role in sustainable maritime operations.

Market Trends

Increasing Shift Toward Hybrid and Closed-Loop Scrubber Technologies

The Commercial Marine Scrubber Systems Market witnesses a growing preference for hybrid and closed-loop scrubbers due to their environmental advantages and operational flexibility. These systems reduce wastewater discharge and comply with stricter emission regulations in emission control areas (ECAs). It allows shipowners to switch between open-loop and closed-loop modes depending on regional regulations and environmental conditions. This adaptability drives demand among shipping companies looking to optimize compliance while minimizing environmental impact. Technological enhancements improve system efficiency and durability, making these scrubbers more cost-effective over their lifecycle. The shift toward these advanced scrubber types reflects industry efforts to balance regulatory adherence with sustainable operations.

- For instance, CR Ocean Engineering’s hybrid scrubber system installed on container vessels has demonstrated a reduction in wastewater discharge by up to 25%, treating approximately 500 cubic meters of washwater per day with system uptime exceeding 99%.

Integration of Scrubbers with Vessel Design and Automation Systems

Shipbuilders increasingly integrate scrubber systems during vessel construction to streamline installation and improve overall performance. The Commercial Marine Scrubber Systems Market benefits from collaborations between scrubber manufacturers and shipyards focused on seamless integration. It enables optimized space utilization and reduces retrofit costs compared to after-market installations. Integration with automated control and monitoring systems enhances operational reliability and reduces maintenance requirements. These innovations facilitate real-time emission monitoring and adaptive system management, aligning with the maritime sector’s digital transformation goals. Integration efforts improve system interoperability with existing shipboard technologies, supporting efficient and compliant marine operations.

- For instance, Hyundai Heavy Industries integrated scrubber systems with vessel automation on 27 newbuilds in 2024, reducing installation time by 15% and enabling continuous emission monitoring with data accuracy within 0.5% margins.

Rising Focus on Sustainable Shipping and Carbon Emission Reduction

The Commercial Marine Scrubber Systems Market aligns with the global push toward sustainable shipping and reducing the carbon footprint of maritime transport. It plays a critical role in enabling vessels to meet stringent environmental targets set by international bodies like the IMO and regional governments. Increased adoption of scrubbers helps shipping companies reduce sulfur oxide emissions while continuing to use cost-effective fuels. This trend promotes investment in cleaner technologies that support long-term environmental and operational goals. Market players emphasize developing eco-friendly scrubber designs that minimize environmental impact without compromising vessel performance. Growing stakeholder pressure for transparency and sustainability drives innovation in emission control technologies.

Expanding Adoption Driven by Fleet Modernization and Regulatory Enforcement

Fleet modernization initiatives and stricter regulatory enforcement accelerate the adoption of commercial marine scrubber systems worldwide. The Commercial Marine Scrubber Systems Market benefits from shipping companies upgrading or retrofitting vessels to comply with evolving emissions standards. It supports diverse vessel types, including tankers, container ships, and bulk carriers, reflecting broad market applicability. Enhanced government monitoring and penalties for non-compliance increase demand for reliable scrubber solutions. Market growth also stems from expanding maritime trade and increased investments in eco-compliant shipping fleets. These factors collectively encourage widespread scrubber system deployment to ensure regulatory adherence and sustainable operations.

Market Challenges Analysis

Complex Installation Processes and High Initial Investment Limit Market Growth

The Commercial Marine Scrubber Systems Market faces challenges from the complexity and cost associated with installing scrubber units on existing vessels. Retrofitting ships requires significant downtime, specialized labor, and structural modifications, which can disrupt shipping schedules and increase operational expenses. It demands careful planning and coordination between shipowners, shipyards, and system providers to minimize impact. The high capital expenditure involved in purchasing and installing scrubbers deters smaller operators and those with tight budget constraints. Limited availability of skilled technicians further complicates installation and maintenance, impacting market penetration. These factors collectively slow the pace of widespread adoption despite regulatory pressures.

Operational and Environmental Concerns Affecting Market Adoption

Operational challenges such as scrubber system maintenance, energy consumption, and disposal of wastewater restrict the Commercial Marine Scrubber Systems Market’s expansion. Maintaining scrubbers requires regular monitoring and skilled technical support to ensure optimal performance and regulatory compliance. It consumes additional power from the vessel’s engine, potentially reducing overall fuel efficiency. Environmental concerns surrounding discharge water quality and potential marine pollution create regulatory uncertainties in some regions, impacting market acceptance. Differing international regulations on scrubber usage complicate compliance efforts for global shipping fleets. Addressing these operational and environmental issues remains critical for broader market growth and acceptance.

Market Opportunities

Expanding Demand for Retrofitting Existing Vessels Offers Significant Growth Potential

The Commercial Marine Scrubber Systems Market presents substantial opportunities in retrofitting older vessels to comply with evolving emission regulations. Many ships currently operate with conventional fuel systems, creating a large addressable market for scrubber upgrades. It allows shipowners to extend vessel lifespans while meeting stringent environmental standards without the need for costly new builds. The increasing enforcement of global and regional emission norms encourages fleet operators to invest in retrofits. Technological advancements that simplify installation and reduce downtime further stimulate market growth. Partnerships between scrubber manufacturers and shipyards enhance retrofit efficiency and broaden accessibility. This segment remains a key growth driver for the market in the coming years.

Growing Focus on Sustainable Shipping Drives Adoption of Next-Generation Scrubber Solutions

Sustainability initiatives and the push toward carbon-neutral maritime operations create promising opportunities for the Commercial Marine Scrubber Systems Market. It supports shipping companies seeking cost-effective methods to reduce sulfur oxide emissions while using traditional fuels. Development of energy-efficient, low-maintenance scrubbers addresses operational concerns and appeals to environmentally conscious operators. Integration with digital monitoring and automation systems enhances performance and regulatory compliance. Expanding government incentives and green financing options further encourage investment in scrubber technologies. The increasing global emphasis on cleaner shipping fuels demand innovation and adoption of advanced scrubber solutions, fueling market expansion.

Market Segmentation Analysis:

By Technology

The Commercial Marine Scrubber Systems Market segments by technology into open-loop, closed-loop, and hybrid scrubbers. Open-loop scrubbers dominate the market due to their cost-effectiveness and simpler design, utilizing seawater to clean exhaust gases before discharge. Closed-loop scrubbers, which recycle wash water and minimize environmental impact, gain traction in emission control areas with stricter regulations. Hybrid scrubbers offer operational flexibility, enabling shipowners to switch between open and closed modes based on regulatory requirements and environmental conditions. It supports diverse operational needs by combining the advantages of both systems, driving adoption in various maritime sectors. Technological advancements focus on enhancing system efficiency, reducing energy consumption, and minimizing maintenance, expanding the market potential for all scrubber types.

- For instance, CR Ocean Engineering’s hybrid scrubber system launched in Q1 2024 reduces energy consumption by 75 kilowatts per hour compared to previous models and lowers wastewater discharge by 1,000 cubic meters per month, boosting operational efficiency across container and tanker fleets.

By Application

By application, the Commercial Marine Scrubber Systems Market caters to new shipbuilding and retrofit projects. Retrofitting holds a significant share due to the high number of existing vessels requiring compliance with updated emission standards. Shipowners prefer retrofitting over new builds to reduce capital expenditure and extend vessel life. New shipbuilding integrates scrubber systems during construction to meet emission norms from the outset and avoid costly retrofits. It supports a proactive approach in fleet modernization while addressing environmental concerns. Market demand in both segments reflects the urgency of meeting regulatory deadlines and maintaining operational efficiency.

- For instance, Hyundai Heavy Industries retrofitted 55 vessels with scrubber systems in 2023, reducing installation time by 20% compared to previous years, while integrating scrubbers into 30 newbuild projects, enabling compliance from delivery.

By Vessel Type

The market also segments by vessel type, including container ships, tankers, bulk carriers, passenger vessels, and others such as offshore and fishing vessels. Container ships and tankers represent a major portion of demand due to their significant fuel consumption and wide global operations. Bulk carriers also contribute substantially, driven by their large fleet size and operational scope. Passenger vessels increasingly adopt scrubber systems to ensure compliance with coastal emission regulations and enhance sustainability credentials. The Commercial Marine Scrubber Systems Market addresses the varied needs of these vessel types through customized solutions tailored to vessel size, operational routes, and emission requirements. This segmentation enables targeted product development and strategic market penetration across different maritime sectors.

Segments:

Based on Technology

Based on Application

Based on Vessel Type

- Commercial Vessels

- Offshore Vessels

- Navy Vessels

Based on Fuel Type

- Marine Diesel Oil – MDO

- Marine Gas Oil – MGO

- Intermediate Fuel Oil – IFO

- Residual Fuel Oil – RFO

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia-Pacific

The Asia-Pacific region holds the largest market share in the Commercial Marine Scrubber Systems Market, accounting for approximately 38% of the global demand. Rapid industrialization, expanding maritime trade routes, and the presence of major shipbuilding hubs such as China, South Korea, and Japan drive this dominance. The region’s large fleet size and increasing retrofitting activities contribute significantly to market growth. Strict enforcement of environmental regulations in coastal nations and growing investments in green shipping initiatives also support demand. It serves as a strategic hub for scrubber manufacturers due to its extensive maritime infrastructure and favorable government policies promoting sustainable shipping technologies.

Europe

Europe commands the second-largest market share, representing around 27% of the global Commercial Marine Scrubber Systems Market. The region’s stringent environmental regulations, including the European Union’s sulfur emission control areas (SECAs), necessitate the adoption of advanced scrubber systems. European shipping companies actively invest in emission control technologies to comply with strict emission caps and maintain operational efficiency. The presence of leading scrubber manufacturers and established shipyards facilitates rapid deployment of scrubber systems in both new builds and retrofit projects. It benefits from continuous technological innovation and supportive regulatory frameworks aimed at reducing maritime pollution.

North America

North America contributes approximately 18% of the global market share in the Commercial Marine Scrubber Systems Market. The region witnesses steady demand driven by increasing awareness of environmental sustainability and compliance with the U.S. Environmental Protection Agency (EPA) regulations. Ports on the West Coast and Gulf of Mexico adopt scrubber systems to meet local emission standards. The region’s focus on upgrading aging fleets and integrating emission reduction technologies fuels market growth. It also benefits from government incentives that encourage the deployment of environmentally friendly maritime technologies, driving broader adoption of scrubbers.

Middle East and Africa

The Middle East and Africa account for nearly 10% of the market share, supported by the region’s strategic position along major shipping routes like the Suez Canal and Red Sea. Growing maritime trade activities and fleet expansion stimulate demand for scrubber systems. Regional governments increasingly enforce environmental standards aligned with international regulations, prompting shipowners to invest in emission control solutions. It offers opportunities for scrubber suppliers to collaborate with shipping companies and ports to retrofit vessels and meet compliance requirements.

Latin America

Latin America holds about 7% of the global market share in the Commercial Marine Scrubber Systems Market. The region’s expanding maritime trade, coupled with tightening environmental regulations in ports and coastal areas, drives demand for scrubber installations. Emerging economies invest in port infrastructure modernization and cleaner shipping solutions to reduce pollution and improve air quality. It also sees increased retrofit activities in existing fleets to comply with global and regional emission standards. Growing environmental awareness among shipping operators and regulatory bodies promotes further market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CR Ocean Engineering, LLC

- VDL AEC Maritime

- PANASIA Co., Ltd.

- Hyundai Heavy Industries

- Pacific Green Marine Technologies Inc.

- Feen Marine Scrubbers Inc.

- Valmet Corporation

- Shanghai Bluesoul Environmental Technology Co., Ltd.

- I. du Pont de Nemours and Company

- Kwangsung Co., Ltd

Competitive Analysis

Leading players in the Commercial Marine Scrubber Systems Market include Hyundai Heavy Industries, VDL AEC Maritime, CR Ocean Engineering, LLC, Pacific Green Marine Technologies Inc., Feen Marine Scrubbers Inc., Valmet Corporation, PANASIA Co., Ltd., Shanghai Bluesoul Environmental Technology Co., Ltd., Kwangsung Co., Ltd., and E. I. du Pont de Nemours and Company. These companies compete by focusing on technological innovation, system reliability, and customized solutions tailored to diverse vessel requirements. Hyundai Heavy Industries leverages its shipbuilding expertise to integrate scrubber systems efficiently during vessel construction, reducing installation time and costs. VDL AEC Maritime offers versatile scrubber technologies that cater to different regulatory environments, enhancing operational flexibility. CR Ocean Engineering, LLC emphasizes advanced closed-loop and hybrid scrubbers that minimize environmental impact and energy consumption. Pacific Green Marine Technologies Inc. develops eco-friendly scrubbers optimized for both open and closed-loop modes. Key players invest heavily in research and development to improve system efficiency, reduce maintenance, and comply with evolving standards. Strategic partnerships with shipyards and shipping companies enhance market reach and support large-scale deployments. Competitive pricing and comprehensive after-sales services differentiate leading companies in this dynamic and growing market.

Recent Developments

- In November 2024, Pacific Green Marine Technologies has installed its ENVI-Marine™ scrubber system on over 120 ships, capturing an estimated 60,000 tonnes of sulfur emissions, demonstrating its commitment to sustainable maritime solutions

- In October 2024, Hyundai Heavy Industries (HHI) completed class approval testing for its HiMSEN Ammonia Dual-Fuel Engine. This engine, specifically the H22CDF-LA model, is designed for marine propulsion and onboard power generation applications.

- In July 2024, CR Ocean Engineering (CROE) and Oberlin Filter Company announced a partnership to integrate Oberlin’s Maritime Scrubber Washwater Systems with CROE’s scrubber systems. This collaboration aims to provide automatic, low-maintenance filtration for the washwater produced by marine scrubbers, which are used to remove sulfur from exhaust gases.

Market Concentration & Characteristics

The Commercial Marine Scrubber Systems Market exhibits a moderately concentrated structure, with a handful of key players dominating the landscape through technological innovation, strategic partnerships, and extensive manufacturing capabilities. It features a mix of established multinational corporations and specialized companies focusing on emission control solutions tailored to the maritime industry. Market leaders invest heavily in research and development to enhance scrubber efficiency, reduce installation complexity, and comply with evolving environmental regulations. The competitive environment encourages continuous product differentiation, with companies offering open-loop, closed-loop, and hybrid scrubber systems to meet diverse vessel requirements and regulatory standards. Smaller and regional players contribute by addressing niche markets and providing cost-effective retrofit options. It experiences steady growth driven by stringent international emission norms and increasing demand for sustainable shipping solutions. The market’s characteristics reflect a balance between high capital expenditure barriers and growing environmental compliance needs, shaping strategic decision-making among shipping companies and manufacturers. This concentration fosters innovation but also requires companies to maintain strong customer support and after-sales services to retain market share and build long-term client relationships.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Vessel Type, Fuel Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding due to tightening global emission regulations.

- Retrofitting existing vessels will remain a significant growth segment.

- Hybrid scrubber systems will gain preference for their operational flexibility.

- Technological advancements will focus on reducing energy consumption and maintenance costs.

- Integration with digital monitoring systems will improve scrubber performance and compliance.

- Demand will increase from emerging maritime markets seeking sustainable shipping solutions.

- Collaborations between scrubber manufacturers and shipbuilders will streamline installations.

- Environmental concerns will drive innovation in eco-friendly and low-impact scrubber designs.

- Government incentives and green financing will encourage wider adoption of scrubber systems.

- The market will see increased competition, pushing companies to enhance product offerings and customer support.