Market Overview

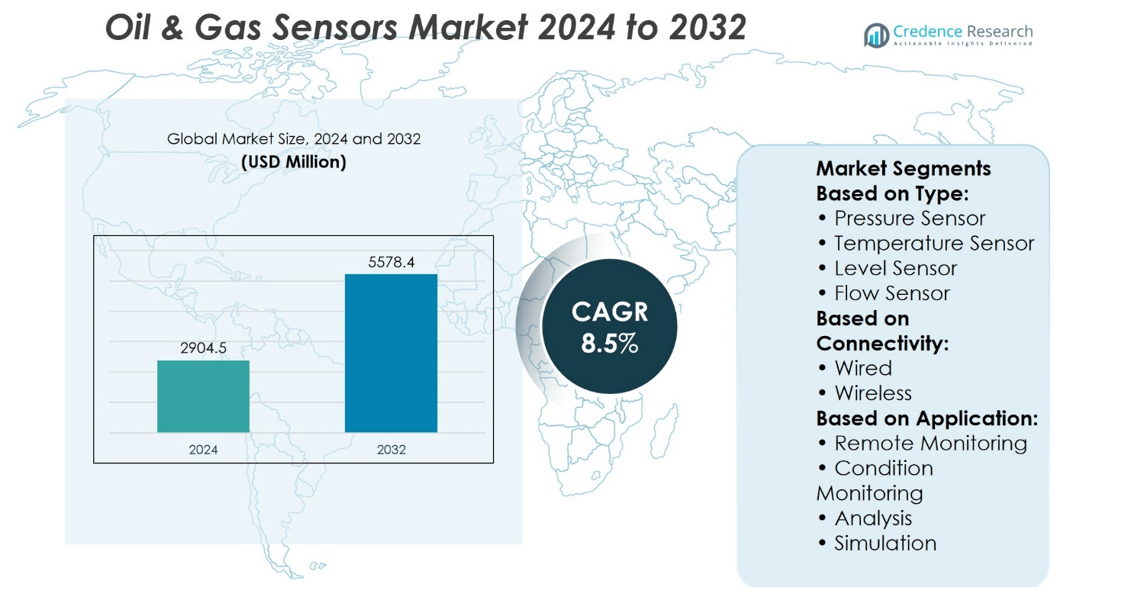

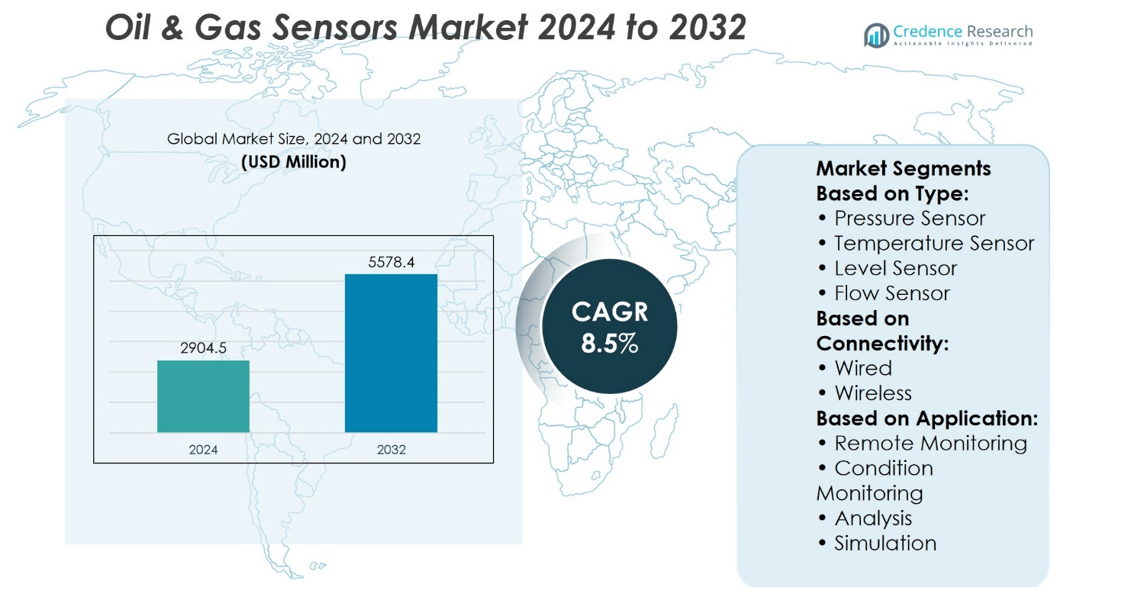

Oil & Gas Sensors Market was valued at USD 2904.5 million in 2024 and is anticipated to reach USD 5578.4 million by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil & Gas Sensors Market Size 2024 |

USD 2904.5 million |

| Oil & Gas Sensors Market, CAGR |

8.5% |

| Oil & Gas Sensors Market Size 2032 |

USD 5578.4 million |

The Oil & Gas Sensors Market grows due to increasing demand for automation and real-time monitoring across the industry. Rising safety regulations and environmental compliance drive adoption of advanced sensor technologies for accurate detection and control. Integration with IoT and digital platforms enhances operational efficiency and predictive maintenance capabilities. Trends include the development of wireless sensors, miniaturization, and multifunctional devices that support remote asset management. Growing exploration activities in emerging regions further propel market expansion. Industry focus on sustainability and reducing emissions fosters innovation in sensor design and application, reinforcing the market’s steady growth trajectory.

The Oil & Gas Sensors Market shows strong presence in North America and Europe, driven by advanced infrastructure and stringent safety regulations. Asia-Pacific exhibits rapid growth due to expanding exploration and production activities. Key players include Honeywell International Inc., Emerson Electric Co., ABB Ltd., Siemens AG, Rockwell Automation, Fortive Corporation, General Electric (GE), MTS Sensor Technology GmbH & Co. KG, and Lord Corporation. These companies focus on technological innovation and regional expansion to capture growing market opportunities globally.

Market Insights

- The Oil & Gas Sensors Market was valued at USD 2904.5 million in 2024 and is projected to reach USD 5578.4 million by 2032, growing at a CAGR of 8.5%.

- Increasing demand for automation and real-time monitoring drives market growth.

- Rising safety regulations and environmental compliance boost adoption of advanced sensor technologies.

- Integration with IoT and digital platforms improves operational efficiency and supports predictive maintenance.

- Trends include wireless sensors, miniaturization, and multifunctional devices for remote asset management.

- North America and Europe lead due to strong infrastructure and strict safety standards, while Asia-Pacific grows rapidly with expanding exploration activities.

- Competitive landscape features key players focusing on innovation and geographic expansion to capture emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Emphasis on Safety and Regulatory Compliance in Exploration and Production

Oil & Gas Sensors Market gains momentum from stringent safety regulations governing exploration and production activities. It supports real-time monitoring of critical parameters such as pressure, temperature, and gas composition to prevent hazardous incidents. Advanced sensor systems enable early detection of leaks, equipment malfunctions, and environmental hazards. Compliance with international safety standards drives adoption across upstream, midstream, and downstream operations. Companies invest in high-accuracy, explosion-proof sensors to meet operational safety benchmarks. The focus on worker protection and environmental stewardship accelerates deployment across onshore and offshore facilities.

- For instance, Siemens Energy has produced over 14,000 WEPS-style subsea pressure and temperature sensors, each valued at approximately 1 million, tailored for deepwater oil and gas exploration to enhance safety and operational control.

Advancement in Sensor Technologies for Harsh and Remote Environments

Continuous innovation in sensor design and materials strengthens the performance of the Oil & Gas Sensors Market. It incorporates ruggedized components, corrosion-resistant housings, and high-temperature endurance to operate reliably in extreme conditions. Wireless connectivity and IoT integration improve data transmission from remote locations. Optical, ultrasonic, and MEMS-based sensors enhance precision while reducing maintenance needs. These advancements extend operational life and reduce downtime in offshore platforms, pipelines, and refineries. The ability to withstand challenging field conditions encourages widespread industry adoption.

- For instance, Honeywell manufactures more than 300 gas sensor products that detect 28 different gases, with a standard range of 400–2,000 ppm and an extended range up to 10,000 ppm, providing critical data for safety systems in exploration and production environments.

Expansion of Digitalization and Predictive Maintenance Strategies

Oil & Gas Sensors Market benefits from the industry’s move toward digital transformation and predictive maintenance frameworks. It enables continuous equipment health monitoring, supporting early fault detection and proactive repair scheduling. Integration with AI-driven analytics platforms improves operational efficiency and resource allocation. Real-time sensor data assists operators in optimizing production processes and reducing unplanned outages. Cloud-based monitoring systems enhance data accessibility for centralized control rooms. The shift toward predictive maintenance reduces operational risks and lowers total lifecycle costs.

Rising Demand for Energy Efficiency and Emission Control

Oil & Gas Sensors Market experiences growth from the need to improve energy efficiency and control emissions. It monitors fuel consumption, process efficiency, and pollutant output in real time. Advanced emission detection sensors support compliance with environmental regulations and corporate sustainability goals. Accurate measurement of greenhouse gases aids in implementing corrective actions quickly. Energy optimization initiatives in refineries and processing plants rely on high-precision sensors. Growing emphasis on sustainability drives investments in sensor solutions that align with cleaner energy strategies.

Market Trends

Integration of IoT and Wireless Connectivity in Sensor Networks

Oil & Gas Sensors Market advances with the widespread adoption of IoT-enabled and wireless communication systems. It allows seamless data transmission from remote drilling sites, offshore platforms, and pipeline networks to centralized control centers. Low-power wide-area networks (LPWAN) and 5G technology enhance real-time monitoring capabilities. Wireless sensors reduce installation complexity and maintenance requirements in hazardous zones. Enhanced connectivity supports predictive analytics and faster decision-making. The integration of IoT platforms strengthens operational transparency and improves overall asset management efficiency.

Shift Toward Advanced Materials and Miniaturized Sensor Designs

Manufacturers in the Oil & Gas Sensors Market invest in advanced materials and compact designs to improve durability and performance. It incorporates corrosion-resistant alloys, high-temperature ceramics, and protective coatings to withstand harsh operating conditions. Miniaturized sensors provide precise measurements without adding bulk to equipment. Smaller form factors enable integration into constrained spaces within drilling rigs and processing units. These innovations support higher accuracy while extending operational life. Material science advancements continue to redefine sensor capabilities in challenging environments.

- For instance, Honeywell’s gas sensing solutions division, which includes over 300 products detecting 28 different gases.

Expansion of Multi-Parameter Sensing and Smart Sensor Technologies

Oil & Gas Sensors Market witnesses a shift toward multi-parameter sensing devices capable of measuring multiple variables simultaneously. It streamlines operations by reducing the number of individual sensors required on-site. Smart sensors combine embedded processing capabilities with self-calibration features to minimize downtime. Integration with SCADA systems and cloud-based platforms improves data accessibility and operational control. These technologies enhance process optimization and safety compliance. The trend toward smart, multifunctional devices supports higher operational efficiency in complex oil and gas infrastructures.

- For instance, Siemens Energy’s WEPS-100 subsea pressure and temperature sensors have been produced in over 14,000 units, providing critical data for well flow management in offshore exploration and production activities.

Growing Adoption of Environmentally Focused Monitoring Solutions

Oil & Gas Sensors Market aligns with increasing emphasis on environmental monitoring and sustainability. It includes advanced emission detection sensors for methane, carbon dioxide, and volatile organic compounds. Deployment in refineries, storage facilities, and pipelines aids in meeting strict environmental standards. Real-time pollutant tracking allows operators to implement corrective measures quickly. Integration with environmental compliance software improves reporting accuracy. This trend reinforces the sector’s commitment to responsible resource management and reduced ecological impact.

Market Challenges Analysis

Operational Limitations in Harsh and Remote Environments

Oil & Gas Sensors Market faces significant challenges in ensuring consistent performance under extreme operational conditions. It must function reliably in environments with high pressure, extreme temperatures, and corrosive substances. Sensors deployed in offshore platforms and deep drilling operations require frequent maintenance to prevent performance degradation. Harsh conditions increase the risk of calibration drift and signal interference, which can impact data accuracy. Limited accessibility to remote sites complicates repair schedules and replacement logistics. The need for specialized materials and protective housings raises production costs, affecting affordability for large-scale deployment.

High Costs and Integration Complexities in Digital Transformation

Transitioning to advanced sensor systems in the Oil & Gas Sensors Market often demands substantial investment in infrastructure upgrades and integration. It involves compatibility issues with legacy systems that are still prevalent in many facilities. Complex installation processes in hazardous areas increase downtime during system transitions. Cybersecurity risks in connected sensor networks require robust protective measures, adding to operational expenses. Skilled personnel are essential for configuring, maintaining, and troubleshooting modern sensor systems, yet availability remains limited in some regions. The combination of high initial investment and integration challenges slows the adoption rate among cost-sensitive operators.

Market Opportunities

Expansion of Offshore Exploration and Deepwater Projects

Oil & Gas Sensors Market holds strong potential with the increasing number of offshore and deepwater exploration projects. It requires highly reliable and precise sensors to monitor pressure, temperature, and flow in challenging subsea environments. Growth in offshore investments by major energy companies creates opportunities for specialized sensor solutions with enhanced durability. Advanced subsea sensing technologies enable real-time monitoring, improving operational safety and efficiency. Manufacturers offering corrosion-resistant, high-pressure-rated sensors can secure significant contracts in these projects. The rising demand for remote monitoring systems in deepwater operations further strengthens the market’s growth prospects.

Adoption of Digital Oilfield Technologies and Automation

Oil & Gas Sensors Market benefits from the industry’s shift toward digital oilfield strategies and process automation. It supports integration with AI, machine learning, and predictive analytics platforms for optimized asset performance. Smart sensors capable of multi-parameter measurement and self-diagnostics align with these initiatives. Automation in drilling, production, and refining processes drives the need for high-accuracy, low-maintenance sensors. Demand for wireless and IoT-enabled devices is growing as operators seek faster decision-making capabilities. Companies that deliver scalable, secure, and data-rich sensor solutions will find expanding opportunities in digitally advanced oil and gas operations.

Market Segmentation Analysis:

By Type

Oil & Gas Sensors Market includes a diverse range of sensor types, each serving critical operational needs. Pressure sensors hold a significant role in monitoring wellbore pressure, pipeline operations, and refining processes, ensuring system integrity and safety. Temperature sensors track thermal variations in drilling fluids, machinery, and processing units, enabling optimal performance and preventing overheating. Level sensors manage fluid levels in storage tanks, separators, and reservoirs to maintain operational balance. Flow sensors measure and control the movement of oil, gas, and water within pipelines and processing systems. Other sensors, including gas detection and vibration sensors, enhance safety and predictive maintenance strategies. It integrates these varied technologies to deliver comprehensive operational control in demanding environments.

- For instance, Honeywell’s Model MIPCG1 pressure transducer operates reliably up to 175,000 psi and supports oilfield applications where extreme pressure monitoring is required. Honeywell has produced over 2 million units of this model globally, highlighting its wide adoption in the industry.

By Connectivity

Market segmentation by connectivity highlights the distinction between wired and wireless solutions. Wired sensors remain widely used due to their reliability, high data accuracy, and resistance to interference, making them suitable for critical infrastructure where uninterrupted performance is essential. Wireless sensors are gaining traction due to their ease of installation, lower infrastructure requirements, and ability to transmit data from remote or hazardous locations. Integration of wireless networks supports real-time monitoring and reduces physical cabling costs, especially in offshore and large-scale facilities. It allows operators to expand monitoring capabilities without extensive retrofitting of legacy systems. The balance between wired stability and wireless flexibility shapes investment decisions in new projects.

- For instance, Honeywell has manufactured over 1.5 million wired gas sensors specifically designed for industrial safety and exploration environments, supporting continuous, interference-free monitoring in critical pipelines and facilities.

By Application

Application segmentation in the Oil & Gas Sensors Market covers remote monitoring, condition monitoring, and analysis & simulation. Remote monitoring uses sensor networks to track operational parameters from centralized locations, improving oversight in offshore rigs and remote pipelines. Condition monitoring detects early signs of equipment wear, leaks, or performance drops, enabling timely interventions and reducing unplanned downtime. Analysis & simulation applications use sensor data to create operational models, optimize production strategies, and test scenarios without physical risk. It empowers operators to improve safety, efficiency, and decision-making accuracy through actionable insights derived from sensor data. Growing demand for integrated solutions across these applications underscores the importance of advanced sensing technologies in modern oil and gas operations.

Segments:

Based on Type:

- Pressure Sensor

- Temperature Sensor

- Level Sensor

- Flow Sensor

Based on Connectivity:

Based on Application:

- Remote Monitoring

- Condition Monitoring

- Analysis

- Simulation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 35% of the Oil & Gas Sensors Market, making it the largest regional contributor. It benefits from advanced oilfield technology, strong infrastructure, and a well-developed energy sector. The U.S. and Canada have extensive offshore platforms, shale oil operations, and refining facilities that require accurate and reliable sensor systems. It uses pressure, temperature, and gas detection sensors for both operational efficiency and strict safety compliance. Many facilities deploy rugged, explosion-proof designs that can handle extreme environments such as deepwater drilling sites and cold-weather operations in Alaska and northern Canada. Real-time monitoring systems are widely used to detect performance issues early and prevent downtime. The combination of innovation, regulatory compliance, and high production volumes sustains North America’s leadership position in the market.

Europe

Europe accounts for 30% of the global Oil & Gas Sensors Market. The region places strong emphasis on emission monitoring, energy efficiency, and meeting strict European Union environmental regulations. Countries such as the UK, Norway, and Germany are key centers for sensor manufacturing and development. It invests in high-accuracy sensors with low power consumption for both offshore platforms and onshore refineries. Mature oilfields in the North Sea and other areas require condition monitoring systems to extend asset life and maintain safety. Europe is also integrating sensors into smart digital oilfield systems to reduce methane leaks and optimize production. Continuous modernization of facilities and the push for cleaner operations maintain strong demand for advanced sensing technologies.

Asia-Pacific

Asia-Pacific holds 25% of the Oil & Gas Sensors Market, driven by rapid energy infrastructure growth in China, India, and Southeast Asia. It is a major hub for new pipelines, LNG terminals, offshore platforms, and refineries. The region uses both wired and wireless sensors for pressure, flow, and level control in these facilities. Harsh conditions, including high humidity, corrosive environments, and high temperatures, require specially engineered sensor materials. Operators are increasingly adopting IoT-enabled and cloud-connected monitoring systems to modernize older installations. Significant investments from both governments and private companies ensure steady growth in sensor deployment across exploration, production, and refining activities.

Middle East & Africa

Middle East & Africa hold 5% of the market share, supported by large oil reserves and major refining capacity. Saudi Arabia, UAE, and Nigeria are key markets for sensor deployment in upstream, midstream, and downstream operations. It uses corrosion-resistant, high-temperature-rated sensors to withstand extreme desert conditions. Monitoring solutions are critical for pipeline integrity, drilling equipment performance, and storage facility safety. The region is expanding enhanced oil recovery projects and modernizing older infrastructure, which creates more opportunities for advanced sensor installations. Focus on operational efficiency and production optimization continues to drive demand.

Latin America

Latin America accounts for 5% of the Oil & Gas Sensors Market, with Brazil, Argentina, and Colombia leading in adoption. Offshore operations in Brazil’s pre-salt fields require high-performance sensors for flow monitoring, gas detection, and subsea condition tracking. Onshore refineries and processing plants in the region use sensors to improve operational reliability and safety standards. Humid, saline, and corrosive environments demand specialized sensor designs for long-term performance. The expansion of exploration and production projects, coupled with efforts to improve energy efficiency, is increasing the region’s use of advanced sensing technologies. It continues to see steady growth as countries invest in infrastructure upgrades and modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rockwell

- General Electric (GE)

- MTS Sensor Technology GmbH & Co. Kg

- BD Sensors

- Indutrade

- Fortive

- Siemens

- Emerson

- ABB Ltd

- Honeywell

Competitive Analysis

The Oil & Gas Sensors Market players include Honeywell, Emerson, Siemens, ABB Ltd, Fortive, Rockwell, Indutrade, MTS Sensor Technology GmbH & Co. Kg, General Electric (GE), and BD Sensors. The Oil & Gas Sensors Market is characterized by rapid technological advancements and increasing adoption of automation across upstream, midstream, and downstream operations. Rising demand for real-time monitoring, predictive maintenance, and enhanced safety protocols drives market growth. Innovations in sensor technology focus on improving accuracy, durability, and integration with IoT and digital platforms to enable efficient data analytics and remote asset management. Additionally, stringent environmental regulations compel the development of sensors capable of precise emissions monitoring and compliance reporting. The market is also witnessing a shift toward smart sensors that support predictive analytics and operational efficiency, reducing downtime and optimizing resource utilization. As industries prioritize safety and environmental sustainability, sensor solutions are evolving to meet these challenges while delivering cost-effective performance and reliability in harsh operating conditions.

Recent Developments

- In May 2025, Rockwell reported strong operating performance for Q2 2025, highlighting continued advances in industrial automation technology.

- In October 2024, AlphaSense introduced PIDX, a new PID (Photoionization Detector) sensor technology designed to improve gas detection capabilities.

- In March 2023, The Ministry of Electronics and Information Technology announced the launch of three IoT sensor-based products, which include a Smart Digital Thermometer, IoT Enabled Environmental Monitoring System, and a Multichannel Data Acquisition System in the CoE in IoT Sensors.

- In March 2023, Sensorix GmbH revealed its new range of sensors for toxic gases at Sensor + Test 2023. The showcase features the company’s variety of gas sensors that are highly prevalent in various industries.

Market Concentration & Characteristics

The Oil & Gas Sensors Market demonstrates a moderately concentrated competitive landscape, dominated by a select group of multinational corporations with strong technological capabilities and extensive industry experience. These key players leverage robust R&D investments to innovate sensor technologies that meet stringent industry standards for safety, accuracy, and durability under extreme conditions. The market structure favors companies that can provide integrated solutions combining sensor hardware with advanced digital platforms, including IoT and predictive analytics, to enhance operational efficiency and asset management. Market participants focus on strategic collaborations and partnerships to expand their product portfolios and geographic reach, targeting both established oil and gas regions and emerging markets. It faces challenges from high entry barriers due to regulatory compliance, significant capital requirements, and the need for continuous innovation. Demand concentrates primarily on sensors for pressure, temperature, gas detection, and flow measurement, which are critical for optimizing production processes and maintaining safety standards. The market experiences steady growth driven by industry-wide digital transformation and increasing adoption of automated monitoring systems. Customers prioritize reliability, accuracy, and real-time data integration when selecting sensor solutions. This concentration encourages innovation while maintaining high standards of quality and performance. Overall, it reflects a market where technological expertise and strategic positioning determine competitive advantage, supporting long-term growth prospects.

Report Coverage

The research report offers an in-depth analysis based on Type, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Oil & Gas Sensors Market will expand with increasing automation across upstream, midstream, and downstream sectors.

- Companies will prioritize development of sensors with enhanced accuracy and durability for harsh environments.

- Integration of sensors with IoT and digital platforms will become standard for real-time monitoring and data analytics.

- Demand will grow for advanced gas detection sensors to support stricter environmental and safety regulations.

- Predictive maintenance using sensor data will reduce downtime and operational costs.

- Emerging markets will drive sensor adoption due to expanding oil and gas exploration activities.

- Collaboration between sensor manufacturers and technology firms will accelerate innovation.

- Wireless and remote sensor technologies will gain traction for improved accessibility and efficiency.

- Focus on energy efficiency and sustainability will push development of eco-friendly sensor solutions.

- Continuous advancements in sensor miniaturization and multifunctionality will meet evolving industry needs.