Market Overview

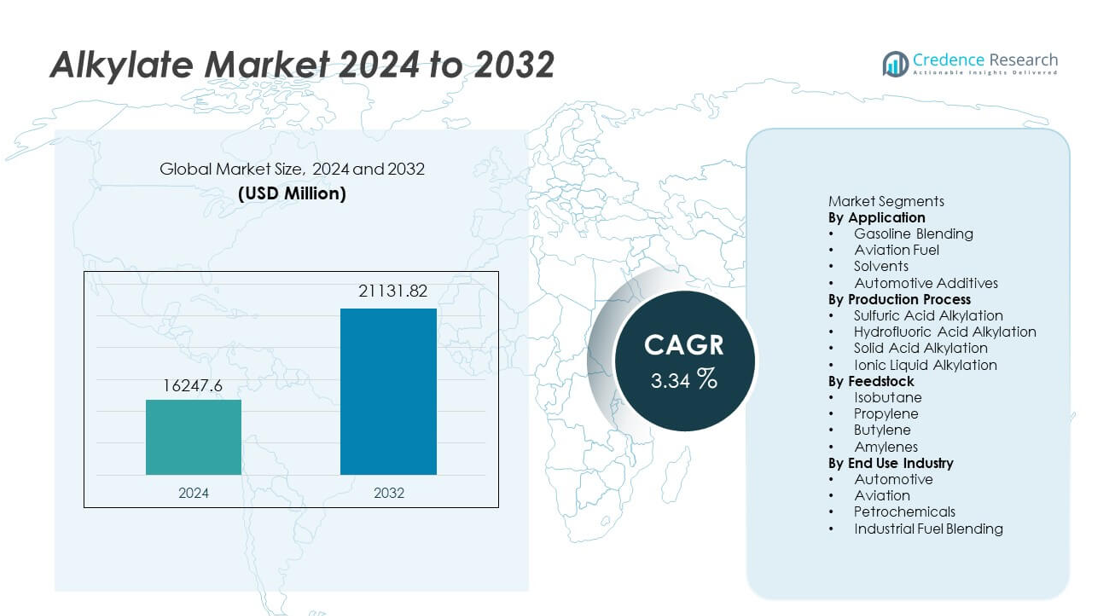

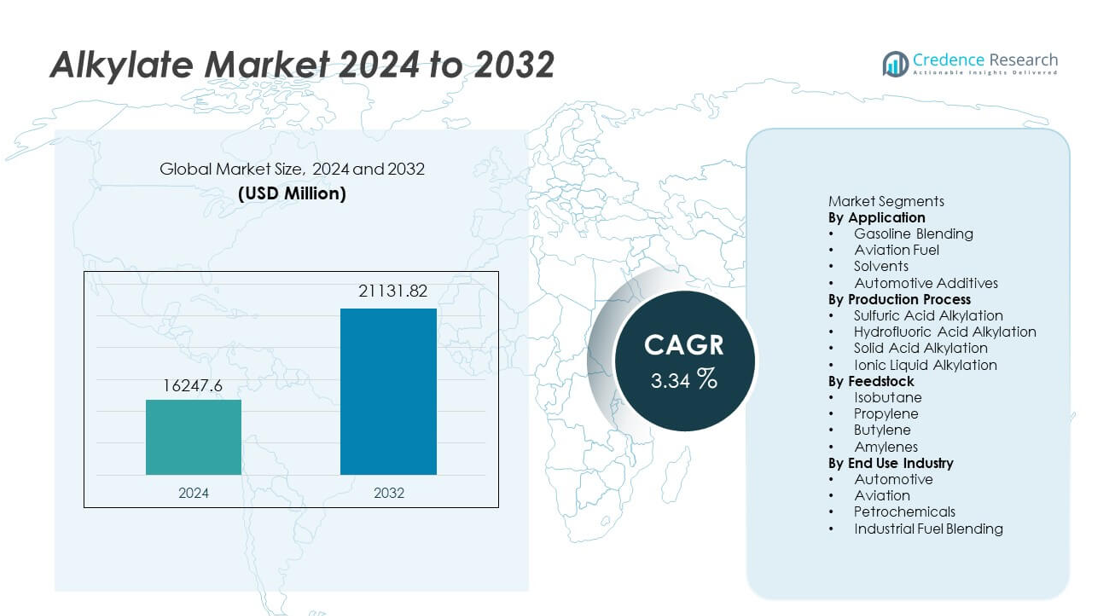

The Alkylate Market was valued at USD 16,247.6 million in 2024 and is projected to reach USD 21,131.82 million by 2032, registering a CAGR of 3.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alkylate Market Size 2024 |

USD 16,247.6 million |

| Alkylate Market, CAGR |

3.34% |

| Alkylate Market Size 2032 |

USD 21,131.82 million |

The alkylate market includes leading players such as ExxonMobil, Chevron, Valero Energy, Marathon Petroleum, Phillips 66, PDVSA, Reliance Industries, Sinopec, Royal Dutch Shell, and Honeywell UOP, all of which focus on high-purity fuel components and advanced alkylation technologies to meet global emission standards. These companies invest in refinery modernization and process innovation to enhance octane production and reduce environmental impact. Asia Pacific leads the market with a 30% share, driven by expanding refining capacities and rising fuel demand, while North America follows with a 34% share, supported by strict fuel regulations and strong adoption of cleaner gasoline blends.

Market Insights

- The market recorded USD 16,247.6 million in 2024 and will reach USD 21,131.82 million by 2032 at a CAGR of 3.34%, indicating steady long-term expansion.

- Strong demand for high-octane, low-emission gasoline drives growth, with gasoline blending leading the application segment at a 72% share due to its essential role in meeting fuel standards.

- Trends highlight increased adoption of safer alkylation technologies such as solid acid and ionic liquid systems as refiners shift toward environmentally compliant processes.

- Competition intensifies as major players invest in refinery upgrades, advanced catalysts, and process optimization to strengthen production efficiency and reduce operational risks.

- Asia Pacific holds a 30% regional share, followed by North America at 34% and Europe at 28%, reflecting strong refining capabilities and rising demand for cleaner gasoline components across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Gasoline blending leads the application segment with a 72% share, driven by rising global demand for high-octane, low-emission fuels. Alkylate enhances fuel stability and reduces engine knocking, making it essential for meeting strict environmental regulations. Aviation fuel also gains traction as airlines seek cleaner-burning components to improve performance. Solvent and automotive additive applications expand steadily due to the need for high-purity hydrocarbons in specialty formulations. Growing emphasis on cleaner transportation fuels continues to strengthen the role of alkylate in premium gasoline production across major refining hubs.

- For instance, ExxonMobil’s Baytown refinery includes an alkylation unit that produces high-octane alkylate for gasoline blending using proprietary sulfuric acid alkylation technology.

By Production Process

Sulfuric acid alkylation dominates the production process segment with a 58% share, supported by its long-established use, high octane output, and reliable performance in large-scale refineries. Hydrofluoric acid alkylation remains important for facilities prioritizing efficient catalyst regeneration. Solid acid alkylation gains momentum due to improved safety profiles and reduced handling risks. Ionic liquid alkylation emerges as a cleaner alternative, offering low corrosion and enhanced catalyst stability. Refiners increasingly invest in process upgrades as regulations push the industry toward safer and more sustainable alkylation technologies.

- For instance, Honeywell UOP’s ISOALKY™ ionic liquid process was deployed at Chevron’s Salt Lake City refinery with a 6,000-barrels-per-day capacity. The unit replaces traditional HF alkylation and operates at pressures below 300 psi.

By Feedstock

Isobutane holds the leading position in the feedstock segment with a 64% share, driven by its essential role in producing high-octane alkylate with strong combustion properties. Refineries secure steady supply through integration with upstream isomerization units, ensuring efficient processing. Butylene also contributes significantly as a preferred olefin for high-quality alkylation reactions. Propylene usage increases in facilities with flexible feedstock systems, while amylenes remain a niche choice for specialty alkylate grades. Growing demand for cleaner gasoline encourages refineries to optimize feedstock availability, strengthening reliance on isobutane-rich streams.

Key Growth Driver

Rising Demand for Cleaner and High-Octane Fuels

Growing emphasis on fuel quality standards drives strong demand for alkylate, a premium blending component known for low sulfur, low aromatics, and high octane value. Refineries use alkylate to meet tightening emissions rules and improve gasoline performance without relying on harmful additives. Increased vehicle efficiency requirements further support market expansion. As governments push for cleaner transportation fuels, alkylate becomes essential for producing environmentally compliant gasoline, strengthening its role in global refinery output.

- For instance, Phillips 66 upgraded process equipment and optimized operations at its Borger refinery to generally increase efficiency and accommodate more variability in the types of crude processed.

Expansion of Refinery Upgrades and Capacity Additions

Refineries invest in alkylation units to enhance product quality and shift toward cleaner fuel formulations. Upgrades focus on improving octane yield, catalyst efficiency, and safety compliance. New capacity additions in Asia Pacific and the Middle East help meet rising regional fuel demand. Modernization initiatives include integrating advanced isomerization and olefin recovery systems to boost alkylate production. These investments enable refineries to optimize feedstock use and expand high-value product portfolios, supporting long-term market growth.

- For instance, Reliance Industries commissioned an advanced alkylation train at the Jamnagar complex equipped with continuous catalytic regeneration technology that processes 56,000 barrels of feedstock daily. The system includes an olefin recovery unit capable of separating 1,200 metric tons of propylene per day.

Increasing Adoption of Low-Emission Gasoline Blends

Stricter environmental policies accelerate the adoption of low-emission gasoline blends that rely heavily on alkylate. Its clean-burning properties and ability to reduce particulate matter make it preferred compared with traditional blendstocks. Automakers’ push for engines requiring high-octane fuels further drives consumption. Refiners adopt alkylate to replace components like reformate and MTBE, improving compliance with air-quality standards. Expanding consumer awareness of eco-friendly fuels also contributes to market momentum.

Key Trend & Opportunity

Shift Toward Safer and Sustainable Alkylation Technologies

Refineries explore advanced alkylation technologies such as solid acid and ionic liquid systems to reduce handling risks associated with sulfuric and hydrofluoric acids. These alternatives offer improved catalyst life, lower corrosion, and enhanced environmental performance. Adoption rises as operators prioritize worker safety and regulatory compliance. The trend supports opportunities for technology providers to license safer, modular alkylation units. Growing interest in greener processing solutions encourages long-term investment in next-generation alkylation methods.

- For instance, Chevron installed Honeywell UOP’s ISOALKY™ ionic liquid unit at its Salt Lake City refinery, enabling a production capacity of 6,000 barrels per day. The process uses a recyclable ionic liquid catalyst that operates below 300 psi and cuts hazardous acid consumption to under 0.1 kilograms per barrel.

Rising Demand in Aviation and High-Performance Fuel Applications

Increasing aviation traffic and stricter aviation fuel standards create strong prospects for alkylate as a performance-enhancing blending component. Its high thermal stability and clean-burning attributes make it suitable for premium aviation formulations. High-performance automotive fuels also drive additional demand. As air travel and luxury vehicle usage expand across emerging markets, opportunities strengthen for refiners to supply alkylate-based blends. Growth in specialty fuels further widens the market for high-purity hydrocarbon components.

- For instance, BP is transforming its Lingen refinery to produce sustainable aviation fuel from renewable feedstocks such as used cooking oil. The facility uses a co-processing method, which involves modifying existing infrastructure and connecting the storage tanks for the renewable raw materials to the hydrocracker plant.

Key Challenge

High Capital Costs Associated with Alkylation Units

Alkylation units require significant investment for installation, catalyst handling, safety systems, and process infrastructure. High upfront costs limit adoption among small and mid-sized refineries. Maintenance expenses and regulatory compliance add further financial pressure. Operators may delay modernization efforts or rely on lower-quality blendstocks to control costs. These factors slow expansion in price-sensitive regions and restrict broader adoption of advanced alkylation technologies.

Safety and Environmental Risks Linked to Acid-Based Processes

Traditional sulfuric and hydrofluoric acid alkylation units involve handling hazardous chemicals, creating operational risks. HF alkylation, in particular, faces strict scrutiny due to toxicity and potential leakage hazards. Regulatory authorities enforce strong safety protocols, increasing operational complexity. Refineries must invest heavily in containment, monitoring systems, and worker protection. These challenges push operators to seek safer alternatives but also create transitional hurdles that affect operational flexibility and cost efficiency.

Regional Analysis

North America

North America holds the leading position in the alkylate market with a 34% share, driven by strict fuel quality regulations requiring low-sulfur and high-octane gasoline blends. The region benefits from advanced refinery infrastructure and significant adoption of alkylation units across major petroleum companies. Rising demand for cleaner-burning gasoline supports consistent consumption of alkylate in blending operations. Growth in premium automotive fuels further strengthens regional demand. Investments in refinery modernization and strong regulatory pressure for emission control continue to reinforce North America’s dominance in the global market.

Europe

Europe accounts for a 28% share, supported by stringent environmental standards and widespread implementation of low-emission fuel policies. The region relies heavily on alkylate to meet Euro 6 and related fuel-quality directives. Refiners integrate alkylation units to reduce aromatics and achieve high-octane gasoline performance. Demand also rises due to an aging vehicle fleet requiring cleaner combustion fuels. Ongoing sustainability initiatives encourage the transition from traditional blendstocks to cleaner components. European refiners continue enhancing operational efficiency to meet rising alkylate demand across key markets such as Germany, France, and the United Kingdom.

Asia Pacific

Asia Pacific holds a 30% share, reflecting rapid industrial growth, expanding vehicle ownership, and modernization of refining capacity across China, India, and Southeast Asia. Governments enforce tighter emission norms, prompting refiners to increase alkylate production for cleaner gasoline blending. Growing aviation activity and rising consumption of premium fuels further boost regional demand. Investment in new alkylation units accelerates as energy demand climbs. Local refiners also adopt advanced technologies such as ionic liquid and solid acid alkylation to improve safety and output. Strong economic expansion supports Asia Pacific’s continued rise in the global alkylate market.

Latin America

Latin America captures a 5% share, driven by increasing demand for high-octane gasoline in countries such as Brazil and Mexico. Refinery upgrades improve the region’s ability to produce cleaner fuels that meet evolving emission standards. Adoption remains moderate due to economic fluctuations, yet premium fuel consumption continues to rise in urban areas. Growing vehicle ownership and modernization initiatives encourage greater use of alkylate in gasoline blending. Regional dependency on imports persists, creating opportunities for investment in new alkylation capacity to meet future demand.

Middle East & Africa

The Middle East & Africa region holds a 3% share, supported by refinery expansion projects in the UAE, Saudi Arabia, and South Africa. As these countries diversify fuel production and align with global emission standards, demand for alkylate increases. Refineries integrate advanced alkylation units to produce high-purity gasoline components for domestic use and export. Growth remains steady due to rising transportation fuel consumption and infrastructure development. However, slower adoption in low-income regions limits broader regional expansion. Continued investment in refining capabilities will strengthen long-term demand for alkylate across the region.

Market Segmentations:

By Application

- Gasoline Blending

- Aviation Fuel

- Solvents

- Automotive Additives

By Production Process

- Sulfuric Acid Alkylation

- Hydrofluoric Acid Alkylation

- Solid Acid Alkylation

- Ionic Liquid Alkylation

By Feedstock

- Isobutane

- Propylene

- Butylene

- Amylenes

By End Use Industry

- Automotive

- Aviation

- Petrochemicals

- Industrial Fuel Blending

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as ExxonMobil Corporation, Chevron Corporation, Valero Energy Corporation, Marathon Petroleum Corporation, Phillips 66, PDVSA, Reliance Industries Limited, Sinopec, Royal Dutch Shell, and Honeywell UOP. These companies strengthen their market position through continuous investment in refinery upgrades, advanced alkylation technologies, and strategic capacity expansions. Many operators focus on producing high-purity alkylate to meet tightening global fuel regulations and rising demand for low-emission gasoline. Technology licensors such as Honeywell UOP support the market with innovative solid acid and ionic liquid alkylation processes. Leading refiners also adopt integrated feedstock optimization strategies to improve alkylate yields and operational efficiency. As environmental standards become stricter, competition shifts toward safer, energy-efficient, and cost-effective alkylation systems, driving long-term innovation across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ExxonMobil Corporation

- Chevron Corporation

- Valero Energy Corporation

- Marathon Petroleum Corporation

- Phillips 66

- Petroleos de Venezuela (PDVSA)

- Reliance Industries Limited

- China Petroleum & Chemical Corporation (Sinopec)

- Royal Dutch Shell

- Honeywell UOP

Recent Developments

- In September 2025, Petroleos de Venezuela (PDVSA) continued focusing on heavy oil production at the Orinoco Belt using a blending strategy of extra-heavy crude with diluents like naphtha and condensate to optimize output amid long-standing challenges with upgrader reliability and U.S. sanctions.

- In September 2025, Valero Energy Corporation shut down its 12,000 bpd alkylation unit (along with a 65,000 bpd FCCU) at its Tennessee refinery for an overhaul.

- In August 2025, the state-owned Petróleos de Venezuela (PDVSA) indeed had only three operational refineries—Amuay, Cardón, and Puerto La Cruz—out of a total of six. These facilities were operating at sub-optimal utilization rates due to years of underinvestment and a lack of regular maintenance

Report Coverage

The research report offers an in-depth analysis based on Application, Production Process, Feedstock, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cleaner gasoline components will continue to drive alkylate consumption.

- Refineries will adopt safer alkylation technologies to meet regulatory requirements.

- Investments in refinery modernization will strengthen production capacity worldwide.

- Solid acid and ionic liquid alkylation systems will gain wider commercial adoption.

- Growth in premium fuel consumption will boost high-octane alkylate demand.

- Expanding vehicle fleets in emerging markets will support long-term fuel blending needs.

- Aviation fuel applications will rise with increasing global air traffic.

- Technology licensors will introduce more energy-efficient and low-emission alkylation solutions.

- Regional refiners will improve feedstock optimization to maximize alkylate yield.

- Environmental policies will accelerate the shift toward low-aromatic and low-sulfur gasoline blends.