Market Overview

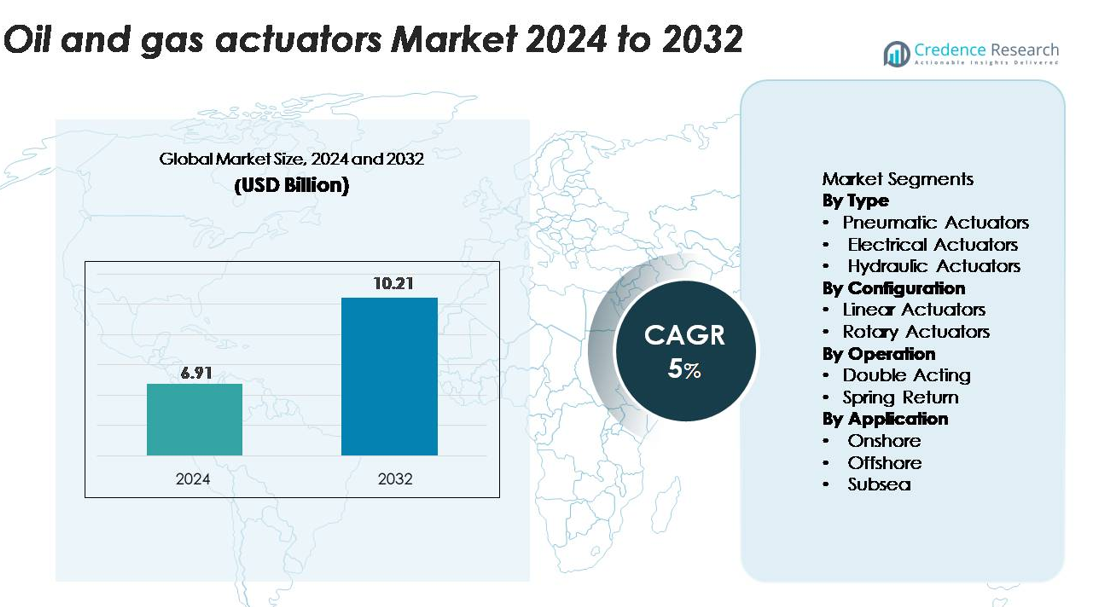

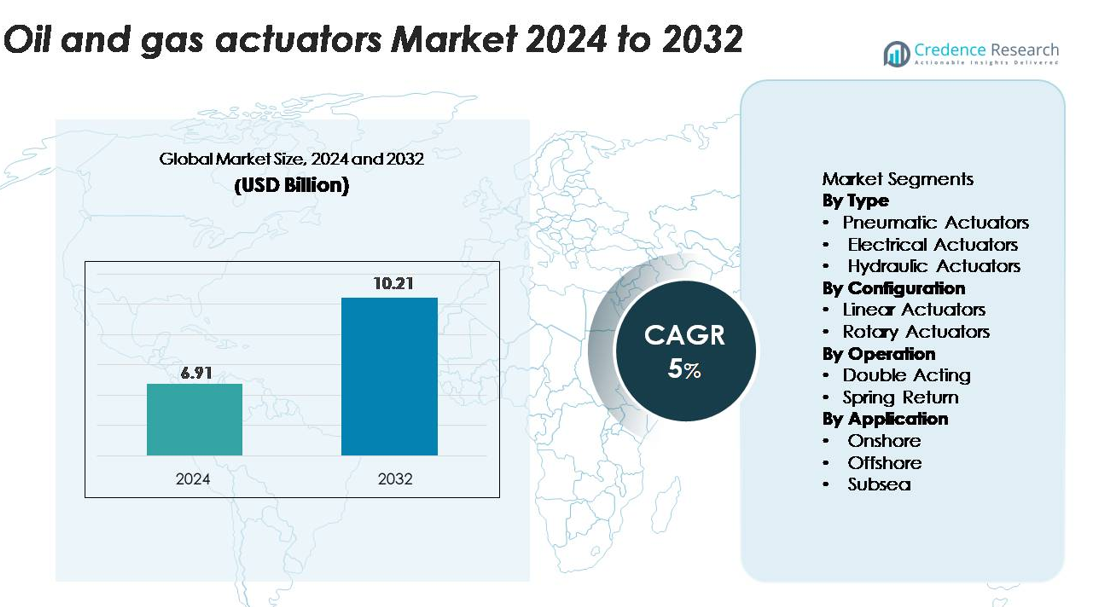

The oil and gas actuators market was valued at USD 6.91 billion in 2024 and is projected to reach USD 10.21 billion by 2032, registering a CAGR of 5% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil and Gas Actuators Market Size 2024 |

USD 6.91 billion |

| Oil and Gas Actuators Market, CAGR |

5% |

| Oil and Gas Actuators Market Size 2032 |

USD 10.21 billion |

Major players in the oil and gas actuators market include Emerson Electric Co., Rotork Plc, Parker Hannifin Corporation, Schlumberger, Honeywell International, and KITZ Corporation, each offering advanced pneumatic, hydraulic, and electric actuation systems designed for harsh upstream, midstream, and downstream environments. These companies focus on reliability, precision control, and digital integration to support automation and asset integrity across global operations. North America leads the market with nearly 33% share, driven by extensive shale activity, pipeline expansion, and strong adoption of smart actuator technologies, followed by Asia-Pacific and Europe as key high-growth regions.

Market Insights

- The oil and gas actuators market was valued at USD 6.91 billion in 2024 and is projected to reach USD 10.21 billion by 2032, registering a CAGR of 5%.

- Rising automation in upstream and midstream operations, along with increased exploration activities and safety compliance requirements, drives strong demand for pneumatic, electric, and hydraulic actuators.

- Smart and digitally integrated actuators are gaining traction as operators adopt remote monitoring, predictive maintenance, and IIoT-enabled control systems across offshore, subsea, and pipeline assets.

- The market is highly competitive, led by Emerson, Rotork, Parker Hannifin, Honeywell, and Schlumberger, with pneumatic actuators holding the largest 45–50% segment share, driven by reliability and cost efficiency.

- Regionally, North America leads with ~33% share, followed by Asia-Pacific at 26–28% and Europe at 22–24%, while Middle East & Africa and Latin America collectively account for the remaining market share due to ongoing upstream expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Pneumatic actuators dominate the oil and gas actuator market, accounting for an estimated 45–50% share due to their reliability, cost-effectiveness, and ability to operate safely in hazardous and remote environments. Their simple design, rapid response time, and suitability for high-cycle operations make them the preferred choice in upstream and midstream processes, including wellhead control, valve automation, and pipeline flow management. Electrical actuators continue to gain traction with the expansion of digital oilfields, while hydraulic actuators remain essential for high-force applications such as drilling and subsea operations.

- For instance, Rotork’s GP pneumatic actuator series is engineered for severe-service oil and gas applications and delivers output torque up to 600,000 Nm, enabling dependable control of large-diameter pipeline valves during high-pressure flow events.

By Configuration

Linear actuators hold the largest share of the market, representing approximately 55% of demand, driven by their widespread use in gate valves, choke valves, and safety-critical shutdown systems. Their high thrust capability, precision positioning, and compatibility with both surface and subsea installations make them a fundamental configuration across exploration, production, and transportation activities. Rotary actuators follow closely, supported by rising deployment in ball and butterfly valves, particularly in offshore and high-pressure pipeline systems where compact design and high torque output are essential.

- For instance, AUMA’s LE series linear actuators deliver a thrust of up to 217,000 N, enabling reliable operation of large-bore shutdown and control valves in high-pressure oilfield environments

By Operation

Double-acting actuators lead the segment with roughly 60% market share, as operators prioritize systems that deliver consistent force in both extension and retraction cycles—critical for maintaining control in high-pressure flow environments. Their superior reliability and adaptability across hydraulic, pneumatic, and electric systems strengthen their adoption in drilling rigs, compressor stations, and emergency shutdown mechanisms. Spring-return actuators remain vital in safety applications, offering fail-safe performance for critical isolation valves, particularly in offshore and hazardous zones where automatic closure during power or pressure loss is mandatory.

Key Growth Drivers

Expansion of Oil & Gas Exploration and Production Activities

Growing upstream investments and renewed exploration in both conventional and unconventional reservoirs significantly drive demand for actuators. Operators increasingly automate critical processes such as wellhead control, pressure management, and flow regulation to enhance operational efficiency and minimize downtime. Rising global energy consumption, coupled with the push to maximize recovery from mature fields, encourages companies to deploy advanced actuator systems capable of enduring high pressure, temperature, and corrosive conditions. Additionally, large-scale offshore projects and deepwater developments require reliable actuator technologies to ensure continuous production and safety compliance. The shift toward digital and automated rigs further reinforces actuator adoption, as automated valve operations improve precision, reduce manual intervention, and lower operational risk. Together, these factors create sustained demand for robust, high-performance actuators across upstream, midstream, and downstream sectors.

- For instance, Emerson’s Bettis™ G-Series hydraulic actuators are rated for a broad output torque range, with double-acting models providing up to 678,000 Nm and spring-return models providing guaranteed minimums in excess of 339,000 Nm. This substantial power enables reliable control of large subsea and offshore valves operating under extreme

Increasing Adoption of Automation and Remote Monitoring Technologies

Automation has become central to modern oilfield operations, driving the need for intelligent actuators equipped with sensors, positioners, and digital communication capabilities. Operators seek solutions that enable real-time monitoring, predictive maintenance, and remote actuation—crucial for reducing safety hazards and improving system reliability in harsh environments. Digital oilfields, Industrial IoT (IIoT), and SCADA integration contribute to wider deployment of electric and smart pneumatic actuators capable of supporting data-driven decision-making. These technologies enable automated shutdowns, performance optimization, and early anomaly detection, reducing operational costs and unplanned outages. Furthermore, the shift toward unmanned platforms and automated pipeline networks strengthens demand for actuators that function autonomously with high precision. This trend enhances asset integrity, ensures regulatory compliance, and supports greater operational continuity across the oil and gas value chain.

- For instance, Rotork’s IQ3 Pro intelligent electric actuator features onboard data logging with a storage capacity of 3,000 events and supports Modbus, Profibus, and Foundation Fieldbus communication for seamless remote monitoring.

Heightened Focus on Safety, Reliability, and Regulatory Compliance

Stringent safety standards and regulatory frameworks accelerate the uptake of high-integrity actuators built to operate under extreme conditions and support emergency shutdown processes. Governments and industry bodies mandate the use of certified actuators, particularly in offshore, subsea, and high-risk onshore facilities where equipment failure can result in environmental damage, operational disruption, or safety incidents. This regulatory pressure encourages adoption of double-acting and spring-return actuators designed to deliver reliable fail-safe performance. Operators also prioritize technologies that reduce leakage, withstand corrosive media, and maintain continuous accuracy in high-pressure systems. As environmental protection, emissions control, and facility integrity gain higher importance, investment in durable, certified actuators becomes essential. The growing emphasis on risk mitigation and operational resilience further boosts replacement cycles and upgrades of legacy actuation systems.

Key Trends & Opportunities

Rapid Shift Toward Smart and Digital Actuator Solutions

Digital transformation in the oil and gas sector opens significant opportunities for advanced actuator solutions integrated with sensors, diagnostics, and communication modules. Smart actuators enable operators to monitor valve position, torque, vibration, temperature, and cycle count in real time, supporting predictive maintenance strategies that extend equipment life. As companies adopt AI-driven analytics and cloud-based monitoring platforms, smart actuators play a crucial role in optimizing operations and reducing downtime. The demand for remote operations—especially in offshore, subsea, and unmanned facilities—creates strong potential for electric and intelligent pneumatic actuators. These systems support automated workflows, enhance data accuracy, and align with Industry 4.0 initiatives. Vendors capitalizing on this trend by offering digital-ready, interoperable actuators are likely to see robust growth.

- For instance, Emerson’s Bettis™ XTE3000 smart electric actuator incorporates an onboard diagnostic suite capable of recording up to 250,000 data points and supports HART and Modbus communication for high-accuracy digital monitoring.

Growing Opportunities in Subsea and Harsh-Environment Operations

Increasing investments in deepwater and ultra-deepwater projects create a strong opportunity for actuators engineered for extreme environments. Subsea production systems require actuators capable of withstanding high hydrostatic pressure, corrosive seawater, and continuous load cycles, offering suppliers a high-value segment with strong long-term demand. The transition toward subsea factories and all-electric production systems further expands the market for specialized electric and hydraulic actuators. Additionally, the development of Arctic oilfields, high-temperature reservoirs, and sour-gas environments strengthens demand for actuators with advanced materials, enhanced sealing technologies, and extended reliability. As operators focus on reducing maintenance costs and ensuring uninterrupted production, robust and corrosion-resistant actuators become a critical enabler of field performance.

- For instance, Rotork’s Subsea hydraulic actuators are qualified for operation at depths up to 3,000 meters and deliver output torque levels reaching 25,000 Nm, ensuring consistent valve control in high-pressure subsea manifolds.

Key Challenges

High Installation and Maintenance Costs in Harsh Operating Conditions

Oil and gas environments impose severe mechanical and thermal stresses on actuator systems, making installation and maintenance both costly and complex. Operators must frequently service actuators exposed to extreme temperatures, corrosive chemicals, sand abrasion, and high-pressure cycles, driving up long-term operational expenses. Offshore and subsea deployments add further complications due to accessibility constraints, requiring specialized equipment and high-skilled labor for maintenance. These high lifecycle costs often delay modernization and replacement cycles, particularly in cost-sensitive projects. Manufacturers face the challenge of developing robust actuators that balance performance with extended service intervals, while operators must manage the financial burden of maintaining critical infrastructure in demanding environments.

Technical Complexity and Integration Challenges with Digital Systems

As the industry shifts toward automation and smart infrastructure, integrating actuators with digital control systems poses significant challenges. Many brownfield installations rely on legacy equipment that lacks compatibility with modern SCADA, DCS, or IIoT platforms, making upgrades complex and costly. Ensuring cybersecurity, data precision, and seamless communication across multi-vendor systems adds further difficulty. Operators also require skilled personnel to manage advanced actuator technologies, yet talent shortages in digital oilfield operations persist. These issues slow the adoption of smart actuators and increase project implementation times. Manufacturers must invest in interoperable, standardized, and cybersecurity-ready solutions to overcome these barriers and support broader digital adoption.

Regional Analysis

North America

North America holds the largest share of the oil and gas actuators market, accounting for roughly 32–34% of global demand. Strong investments in shale production, enhanced recovery operations, and pipeline modernization drive actuator deployment across upstream and midstream assets. The U.S. leads in adoption of advanced electric and pneumatic actuators integrated with digital monitoring systems, supporting remote operations and predictive maintenance. Ongoing development in the Permian, Bakken, and Eagle Ford basins, coupled with stringent safety regulations, further accelerates actuator upgrades. Canada’s oil sands and LNG export projects also strengthen long-term regional demand.

Europe

Europe represents approximately 22–24% of the market, driven by mature offshore operations in the North Sea, adherence to strict environmental regulations, and high adoption of automation technologies. The region’s focus on asset integrity, safety compliance, and emissions reduction supports the deployment of high-reliability hydraulic and pneumatic actuators. Norway and the U.K. remain key contributors due to ongoing redevelopment of existing offshore fields and investments in subsea infrastructure. Additionally, Europe’s transition toward digitalized energy operations increases demand for smart actuators capable of advanced diagnostics and remote performance monitoring.

Asia-Pacific

Asia-Pacific accounts for nearly 26–28% of the global market, supported by expanding exploration activities, refinery capacity additions, and infrastructure build-outs across China, India, Indonesia, and Australia. Growing investment in LNG terminals, petrochemical complexes, and offshore fields in Southeast Asia boosts demand for robust linear and rotary actuators. China leads regional growth with automation upgrades in its refining and pipeline networks, while India accelerates adoption through national energy expansion programs. The region’s rapid industrialization, rising energy consumption, and increasing focus on operational efficiency make it one of the fastest-growing actuator markets.

Middle East & Africa

The Middle East & Africa region captures about 12–14% of the market, driven by large-scale oil production, extensive pipeline networks, and continuous development in offshore and onshore fields. Countries such as Saudi Arabia, UAE, and Qatar invest heavily in automation and high-reliability actuators to support upstream expansion and downstream modernization. Harsh operating environments and high-pressure applications accelerate demand for corrosion-resistant hydraulic and pneumatic actuators. In Africa, growth is supported by offshore discoveries in Nigeria, Angola, and Mozambique. The region’s emphasis on safety, production stability, and advanced control systems sustains steady market expansion.

Latin America

Latin America holds roughly 8–10% of the oil and gas actuators market, with growth driven by offshore activities in Brazil, deepwater projects, and revitalization of mature fields in Mexico and Argentina. Brazil’s pre-salt developments generate strong demand for high-performance hydraulic and electric actuators suited for deepwater conditions. Mexico’s ongoing pipeline and refinery upgrades support midstream and downstream deployments. The region also benefits from increased investment in digitalized field operations, which encourages adoption of smart actuators with remote monitoring capabilities. Despite economic fluctuations, long-term E&P activities maintain stable regional demand.

Market Segmentations:

By Type

- Pneumatic Actuators

- Electrical Actuators

- Hydraulic Actuators

By Configuration

- Linear Actuators

- Rotary Actuators

By Operation

- Double Acting

- Spring Return

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the oil and gas actuators market features a mix of global automation leaders and specialized valve control manufacturers competing through technological innovation, product reliability, and strong service networks. Companies such as Emerson Electric Co., Rotork Plc, Parker Hannifin, Honeywell International, and Schlumberger maintain leading positions by offering comprehensive portfolios of pneumatic, hydraulic, and electric actuators engineered for harsh upstream, midstream, and downstream environments. These players prioritize digital integration, enabling real-time monitoring, predictive maintenance, and seamless connectivity with SCADA and DCS systems. Competitive strategies also focus on expanding subsea-ready and fail-safe actuator solutions to meet stringent safety and regulatory standards. Regional manufacturers strengthen competition by offering cost-efficient products tailored to local operating conditions. Partnerships, aftermarket services, and continuous investments in automation and IIoT-enabled technologies further intensify rivalry, as operators increasingly demand high-performance, low-maintenance actuation systems that enhance reliability and operational efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Habonim unveiled its Fire Block Valve (FBV) system for LNG emergency shutdown (ESD) applications, highlighting actuation solutions for critical isolation in cryogenic and LNG environments.

- In July 2024, REXA opened its new Gulf Coast office to strengthen local service and support for its Electraulic™ actuators in oil & gas downstream refining operations.

- In January 2024, the company Emerson Electric Co. introduced the Fisher™ easy-Drive 200R electric actuator designed for butterfly and ball valves in oil & gas installations in cold, remote environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Configuration, Operation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced actuators will rise as operators expand automation across upstream, midstream, and downstream facilities.

- Adoption of smart and digitally connected actuators will accelerate with wider use of IIoT, analytics, and predictive maintenance.

- Electric actuators will gain stronger momentum as energy-efficient and environmentally safer alternatives to hydraulic systems.

- Subsea developments will drive growth for high-reliability actuators engineered for extreme pressure and corrosive environments.

- Replacement of aging infrastructure will increase demand for retrofittable and modernized actuator solutions.

- Safety and regulatory compliance will continue to shape investments in fail-safe and high-integrity actuator designs.

- Remote and unmanned operations will boost deployment of autonomous and self-diagnostic actuator systems.

- Material innovations will enhance actuator performance in high-temperature and high-pressure operating conditions.

- Regional expansion in Asia-Pacific and the Middle East will drive long-term installation activity across new oil and gas projects.

- Competition will intensify as global players invest in digital capabilities, service offerings, and localized manufacturing to meet evolving operator requirements.