Market Overview:

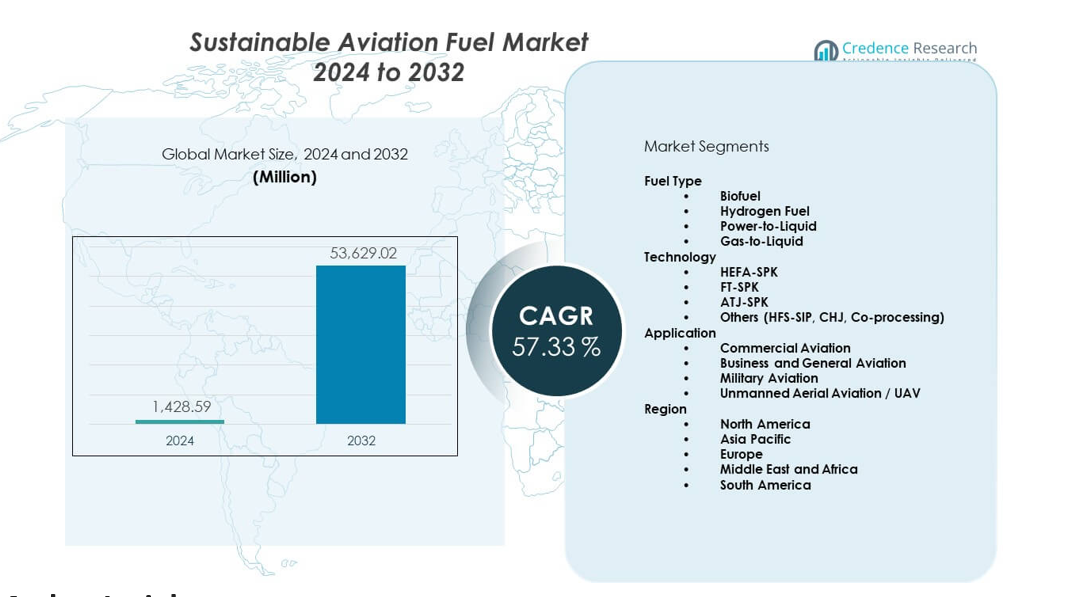

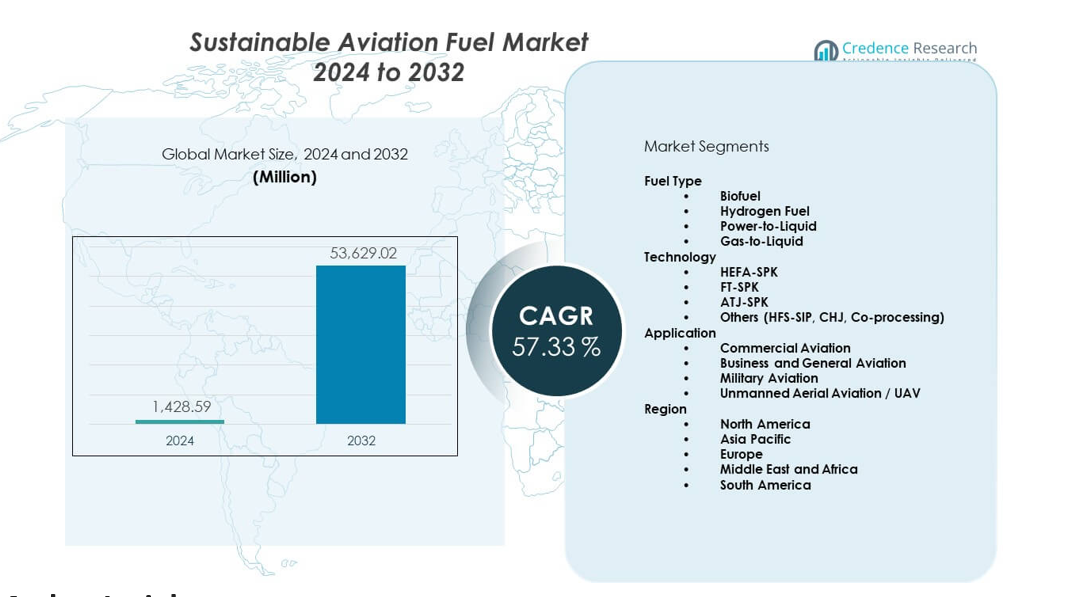

The Sustainable Aviation Fuel Market is projected to grow from USD 1428.59 million in 2024 to an estimated USD 53629.02 million by 2032, with a compound annual growth rate (CAGR) of 57.33% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable Aviation Fuel Market Size 2024 |

USD 1428.59 million |

| Sustainable Aviation Fuel Market, CAGR |

57.33% |

| Sustainable Aviation Fuel Market Size 2032 |

USD 53629.02 million |

Growing climate commitments drive rapid demand for SAF across global fleets. Airlines invest in certified blends that reduce lifecycle emissions while maintaining engine compatibility. Governments support the shift through mandates, tax incentives, and carbon-credit frameworks. Fuel developers scale advanced pathways such as HEFA, alcohol-to-jet, and gasification to supply stable volumes. Many carriers sign long-term offtake deals to secure supply and meet net-zero plans. Strong innovation pushes efficiency gains that strengthen the Sustainable Aviation Fuel Market.

North America leads due to early policy support, strong airline commitments, and rapid biorefinery development. Europe follows with strict emission laws and major airport adoption of SAF supply chains. Asia Pacific emerges as a fast-growing region as airlines expand fleets and governments push green aviation goals. The Middle East invests in SAF to align with long-term energy diversification plans. Latin America strengthens its position through strong feedstock availability and rising interest in bio-jet production.

Market Insights:

- The Sustainable Aviation Fuel Market is projected to grow from USD 1428.59 million in 2024 to USD 53629.02 million by 2032, registering a 33% CAGR, driven by rising airline adoption and expanding biorefinery capacity.

- North America (45%), Europe (30%), and Asia Pacific (20%) lead the market due to firm emission mandates, strong airline commitments, and rapid infrastructure development.

- The Middle East & Africa (3%) emerges as the fastest-growing region, supported by large energy investments and long-term aviation diversification strategies.

- Biofuel holds the dominant share at over 90%, supported by HEFA technology and broad feedstock access.

- Commercial aviation accounts for the largest application share, driven by high fuel consumption and strict decarbonization targets across major fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Global Push for Clean Aviation Fuel Adoption Driven by Regulatory Pressure

The Sustainable Aviation Fuel Market gains strong momentum due to strict emission rules worldwide. Governments set firm reduction targets that push airlines to shift toward cleaner blends. Aviation bodies encourage fuel switching to meet long-term climate goals. Airlines commit to multi-year procurement plans to support wider availability. Producers respond with scaled biorefinery investments that raise production capacity. Technology providers refine pathways that strengthen fuel quality and safety. Global carriers test multiple feedstocks to secure reliable supply. It gains support through stronger alignment between policy frameworks and airline strategies. The Sustainable Aviation Fuel Market reflects expanding collaborations across the aviation supply chain.

- For instance, Neste’s SAF delivers up to 80% lower lifecycle emissions, confirmed through ISCC-certified pathways. It gains support through stronger alignment between policy frameworks and airline strategies.

Rapid Growth in Airline Commitments Toward Net-Zero Carbon Goals Across Global Fleets

Airlines accelerate zero-carbon plans that rely heavily on sustainable fuels. Carrier alliances create shared targets to raise SAF usage each year. Fuel developers design certified blends that support engine performance without hardware change. Many airports integrate fueling setups to support consistent supply. Governments create incentives that reduce cost barriers for producers. Feedstock suppliers expand agricultural and waste-based inputs to stabilize production cycles. Energy firms enter aviation fuel partnerships to broaden their low-carbon portfolio. Airlines work on long-term contracts to secure stable volumes. The Sustainable Aviation Fuel Market gains strong visibility through rising global climate commitments.

- For instance, United Airlines committed to purchase up to 1.5 billion gallons of SAF through partnerships with suppliers like Fulcrum BioEnergy and World Energy. The Sustainable Aviation Fuel Market gains strong visibility through rising global climate commitments.

Expansion of Advanced Fuel Production Pathways Supporting Large-Scale Commercial Deployment

Emerging pathways boost output and reduce lifecycle emissions. HEFA remains dominant due to proven reliability and wide feedstock availability. Alcohol-to-jet gains traction through improved conversion efficiency. Gasification platforms strengthen supply for long-haul aviation. Producers innovate with next-generation catalysts that cut energy use. Investment groups back scalable designs that raise total production. Many firms explore municipal waste and algae to diversify inputs. Airlines value these technologies to meet stricter emission baselines. The Sustainable Aviation Fuel Market benefits from higher-quality fuel pathways across regions.

Growing Public and Private Investment Strengthening the Long-Term Supply Pipeline

Capital flow into SAF accelerates through government grants and private equity interest. Investors support new plants that reduce dependence on fossil-based jet fuel. Renewable energy groups link production with green hydrogen and power-to-liquid systems. Countries pursue joint ventures that secure regional fuel hubs. Airlines join multi-partner funding programs to lock long-term access. Refiners upgrade infrastructure to expand blending and distribution. Technology firms support process automation that improves yield. Global climate policies increase the appeal of low-carbon aviation solutions. The Sustainable Aviation Fuel Market gains steady backing through rising investment confidence.

Market Trends:

Shift Toward Multi-Feedstock Fuel Models Ensuring Stability Across Global Supply Chains

The Sustainable Aviation Fuel Market observes strong movement toward diverse feedstock models. Producers integrate waste oils, residues, bio-based sugars, and CO₂-derived inputs. Multi-feedstock plants reduce supply disruptions during seasonal shortages. Airlines support this shift to secure year-round availability. Airports work with suppliers to ensure flexible blending options. Many developers explore synthetic fuels that reduce reliance on crops. Waste-to-jet platforms gain traction as cities seek cleaner waste management routes. Investors show interest in feedstock diversity to limit volatility. It strengthens resilience across the wider aviation fuel ecosystem.

- For instance, Velocys’ waste-to-jet technology converts municipal and commercial solid waste into synthetic crude, enabling its commercial-scale plants (like the proposed Altalto facility in the UK) to process over 500,000 tonnes of waste per year. This strengthens resilience across the wider aviation fuel ecosystem by diversifying feedstock and significantly reducing greenhouse gas emissions.

Rise of Long-Term Offtake Agreements Signed Between Airlines and Fuel Producers

Airlines commit to multi-year agreements to secure steady SAF volumes. These contracts encourage producers to expand capacity with lower financial risk. Airports align storage facilities to support consistent supply. Energy majors sign agreements with carriers to widen their renewable portfolio. Fleet operators use these deals to support net-zero compliance. Governments recognize these commitments and refine policy support. Producers lock predictable revenue streams that speed project approvals. It reinforces strategic partnerships across the fuel supply chain. The Sustainable Aviation Fuel Market tracks strong growth in long-term agreements.

- For instance, Lufthansa signed a long-term SAF agreement with Shell enabling supply volumes of up to 1.8 million metric tons between 2024 and 2034. It reinforces strategic partnerships across the fuel supply chain.

Integration of Digital Tools and Carbon Tracking Platforms Across Fuel Networks

Digital platforms track carbon intensity across each production stage. Airlines use real-time dashboards to verify emission savings. Fuel suppliers streamline logistics with automated monitoring tools. Airports adopt digital blending systems that improve fuel consistency. Blockchain platforms certify feedstock sources for sustainability compliance. Producers use AI tools to optimize conversion yields. Carbon scoring tools help carriers disclose verified reductions to regulators. It improves transparency across the entire fuel lifecycle. The Sustainable Aviation Fuel Market benefits from accurate reporting and digital insight.

Development of Regional Fuel Hubs Supporting Collective Supply and Distribution Networks

Countries invest in regional hubs designed to centralize fuel production. These hubs support shared pipelines, storage, and distribution systems. Airlines benefit from reduced logistics cost and stable supply. Governments encourage cluster development to improve industrial efficiency. Ports integrate renewable energy to power large-scale operations. Energy companies expand joint ventures inside these hubs. Airports position fueling stations near high-traffic routes to support continuous supply. It aligns regional infrastructure with long-term aviation goals. The Sustainable Aviation Fuel Market reflects stronger regionalization across global networks.

Market Challenges Analysis:

High Production Cost and Limited Commercial Scale Slowing Wider Market Transformation

The Sustainable Aviation Fuel Market faces high production costs that restrict broader adoption. Many plants still depend on expensive feedstocks that limit price competitiveness. Airlines struggle to balance fuel budgets with sustainability mandates. Producers work to streamline conversion efficiency to lower costs. Government programs reduce some financial pressure but gaps remain. Infrastructure constraints slow the shift toward mass deployment. Many regions lack large-scale plants that support continuous output. It creates supply uncertainty for carriers planning wide SAF usage. Stakeholders collaborate to align cost, scale, and supply needs across the sector.

Feedstock Scarcity, Policy Uncertainty, and Logistical Gaps Limiting Global Fuel Availability

The Sustainable Aviation Fuel Market encounters feedstock shortages that reduce output stability. Agricultural residues face seasonal fluctuation that weakens supply flow. Waste-based inputs depend on local collection networks that vary widely. Policy gaps delay new plant approvals across several regions. Airports lack uniform blending rules that support smooth adoption. Logistics networks require upgrades to handle SAF distribution. Producers face difficulty securing long-term feedstock at stable prices. It increases pressure on new technologies to diversify fuel inputs. Sector-wide cooperation aims to stabilize supply chains and reduce uncertainty.

Market Opportunities:

Expansion of Synthetic Fuel Technologies and New Biorefinery Models Enabling Global Scale-Up

The Sustainable Aviation Fuel Market gains fresh opportunities through synthetic pathways that rely on CO₂ and green hydrogen. Power-to-liquid systems open new routes that reduce dependence on traditional feedstocks. Governments support early projects to strengthen industrial learning. Investors back modular plant designs that speed deployment. Airlines explore synthetic blends to meet future emission limits. Technology firms refine catalysts that raise conversion output. Airports plan hubs that link renewable power with fuel production. It creates a long-term growth path for next-generation aviation fuels.

Growing Cross-Sector Partnerships Accelerating Deployment Across Regional Aviation Networks

The Sustainable Aviation Fuel Market benefits from broader partnerships across energy firms, airports, and logistics groups. Airlines join regional alliances to expand access across major routes. Producers collaborate with waste management firms to unlock new feedstock streams. Governments align funding programs with airport expansion plans. Ports integrate renewable systems that support fuel processing. Carriers adopt joint procurement models that raise demand consistency. It encourages faster infrastructure expansion and stronger supply guarantees. Industry groups work together to accelerate clean aviation across emerging markets.

Market Segmentation Analysis:

Fuel Type

The Sustainable Aviation Fuel Market covers biofuel, hydrogen fuel, power-to-liquid, and gas-to-liquid categories. Biofuel leads due to wide feedstock access and strong certification support. Hydrogen fuel gains interest through long-term decarbonization goals. Power-to-liquid strengthens momentum through synthetic pathways that reduce lifecycle emissions. Gas-to-liquid remains niche but attracts attention in regions with strong gas reserves. Airlines evaluate each fuel type based on blending needs and operational efficiency. Producers expand capacity to supply certified grades. It supports broader adoption across global fleets.

- For instance, World Energy operates the world’s first commercial SAF refinery producing up to 15 million gallons of SAF annually for global airlines. It supports broader adoption across global fleets.

Technology

HEFA-SPK holds the dominant position due to proven performance and stable feedstock supply. FT-SPK expands its presence through strong interest in waste-based conversion. ATJ-SPK gains traction through improved alcohol conversion technology. Other pathways such as HFS-SIP, CHJ, and co-processing contribute to diversification. Producers invest in multi-pathway plants to manage feedstock variation. Airlines value certified technologies that meet strict engine and safety standards. Technology providers refine catalysts that raise overall efficiency. The Sustainable Aviation Fuel Market benefits from continuous innovation across all pathways.

- For instance, LanzaJet’s ATJ technology produces SAF with 70% lower lifecycle emissions and its Freedom Pines Fuels plant targets 10 million gallons annually. The Sustainable Aviation Fuel Market benefits from continuous innovation across all pathways.

Application

Commercial aviation drives the highest demand due to large fleet sizes and strict emission targets. Business and general aviation adopt SAF to meet corporate sustainability goals. Military aviation tests multiple blends to reduce operational carbon intensity. Unmanned aerial aviation explores lighter blends for long-range missions. Airports prepare fueling systems that support wider application diversity. Producers align supply models to meet each segment’s operational needs. Carriers evaluate performance across routes to optimize blending strategies. It strengthens application-wide adoption across global aviation markets.

Segmentation:

Fuel Type

- Biofuel

- Hydrogen Fuel

- Power-to-Liquid

- Gas-to-Liquid

Technology

- HEFA-SPK

- FT-SPK

- ATJ-SPK

- Others (HFS-SIP, CHJ, Co-processing)

Application

- Commercial Aviation

- Business and General Aviation

- Military Aviation

- Unmanned Aerial Aviation / UAV

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Sustainable Aviation Fuel Market with an estimated 45%. Strong policy support and airline commitments drive regional leadership. Producers expand biorefineries to meet rising demand across major hubs. Airports integrate SAF infrastructure to support continuous supply on high-traffic routes. Airlines sign long-term offtake contracts to secure volumes and meet emission targets. Technology developers introduce advanced pathways to raise production efficiency. It strengthens North America’s influence on global SAF deployment.

Europe

Europe accounts for roughly 30% of the global share supported by strict emission rules and strong regulatory frameworks. Countries adopt blending mandates that drive steady demand across regional carriers. Airports enhance storage and distribution systems to ensure reliable supply. Producers expand synthetic fuel pathways linked to renewable power projects. Airlines adopt aggressive sustainability plans to align with EU climate targets. Governments encourage partnerships that accelerate commercial-scale projects. The Sustainable Aviation Fuel Market gains strong momentum through coordinated regional action.

Asia Pacific, Middle East & Africa, and South America

Asia Pacific holds nearly 20% of the share and records rapid expansion supported by rising air traffic and growing fleet modernization. Countries invest in large-scale plants that tap agricultural and waste-based feedstock. Middle East and Africa represent close to 3% of the share but show the fastest growth due to strong energy investments and diversification plans. South America holds about 2% and benefits from abundant biomass and supportive regional initiatives. Airports across these regions upgrade SAF handling systems to meet future demand. Airlines explore long-haul deployment to cut operational emissions. It builds a strong foundation for wider global adoption across emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SkyNRG B.V.

- Fulcrum BioEnergy

- Gevo

- Aemetis Inc.

- AVFUEL CORPORATION

- Preem AB

- Sasol Limited

- TotalEnergies

- LanzaTech

- Neste

- World Energy, LLC

Competitive Analysis:

The Sustainable Aviation Fuel Market features strong competition driven by producers, energy majors, and aviation stakeholders. Companies expand biorefinery capacity to secure long-term offtake contracts with global airlines. Technology developers refine certified pathways that improve yield and cut lifecycle emissions. Airlines work with suppliers to stabilize procurement across high-traffic routes. Energy firms enter strategic partnerships to scale synthetic and waste-based fuels. Airports invest in storage and handling systems to support integrated supply networks. Regulators influence competitive positioning through blending rules and policy incentives. It gains steady momentum through coordinated advancements across the value chain.

Recent Developments:

- In November 2025, Gevo’s Q3 2025 performance exceeded expectations with $43.6 million in revenue and positive EBITDA. The company’s North Dakota facility demonstrated substantial output, producing 17 million gallons of low-carbon ethanol, generating 46,000 tons of protein and corn oil co-products, sequestering 42,000 tons of carbon dioxide, and producing 92,000 MMBtu of renewable natural gas. Notably, Gevo’s Carbon Capture and Sequestration system has now stored over 560,000 metric tons of CO2 since its launch in June 2022, making it the world’s first ethanol dry mill to achieve commercial-scale carbon storage.

- In November 2025, Gevo and Biorecro North America LLC progressed their partnership by delivering the first batch of carbon dioxide removal credits (CORCs) issued under the Puro.earth standard from Gevo’s ethanol production and carbon capture facilities in North Dakota. The companies signed a sales agreement in September 2025 under which Gevo is expected to deliver CORCs over the following five years, with potential expansion beyond that period.

- In October 2025, Neste extended its long-standing partnership with United Airlines, expanding SAF supply to three major U.S. airports. The partnership began with deliveries starting in July 2025 at George Bush Intercontinental Airport (IAH) in Houston, continuing until October 2025. Additionally, in September 2025, Neste initiated SAF deliveries to Newark Liberty International Airport (EWR) and Dulles International Airport (IAD), with supplies set to continue through the end of 2025. The fuel is delivered through existing pipeline infrastructure from Neste’s SAF terminal facilities in Houston.

- As of July 2025, Shell had expanded its delivery capabilities to more than 80 locations across 18 countries and became one of the world’s largest traders and suppliers of sustainable aviation fuel in 2024, capturing close to 20% of total sales in Europe and North America. The company’s strategic positioning has been achieved through long-term agreements with producers, strong customer relationships, and strategic investments in logistics around key terminals and airports.

Report Coverage:

The research report offers an in-depth analysis based on Fuel Type, Technology, Application, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- SAF adoption will rise as airlines scale long-term commitments to meet global emission targets.

- Next-generation pathways will expand, supporting stronger use of synthetic and hydrogen-based fuels.

- Biorefinery investments will grow in regions with strong feedstock availability and policy support.

- Airports will adopt integrated fuel delivery and monitoring systems for reliable blending operations.

- Governments will introduce tighter regulations that encourage higher annual SAF blending levels.

- Corporate travel initiatives will drive premium demand for cleaner aviation options.

- Energy companies will expand cross-sector alliances to accelerate production expansion.

- Digital tracking systems will gain acceptance for certifying lifecycle carbon reductions.

- Emerging markets will expand SAF capacity through diversified feedstock programs.

- Airlines will adopt multi-pathway strategies to stabilize year-round supply security.