Market Overview

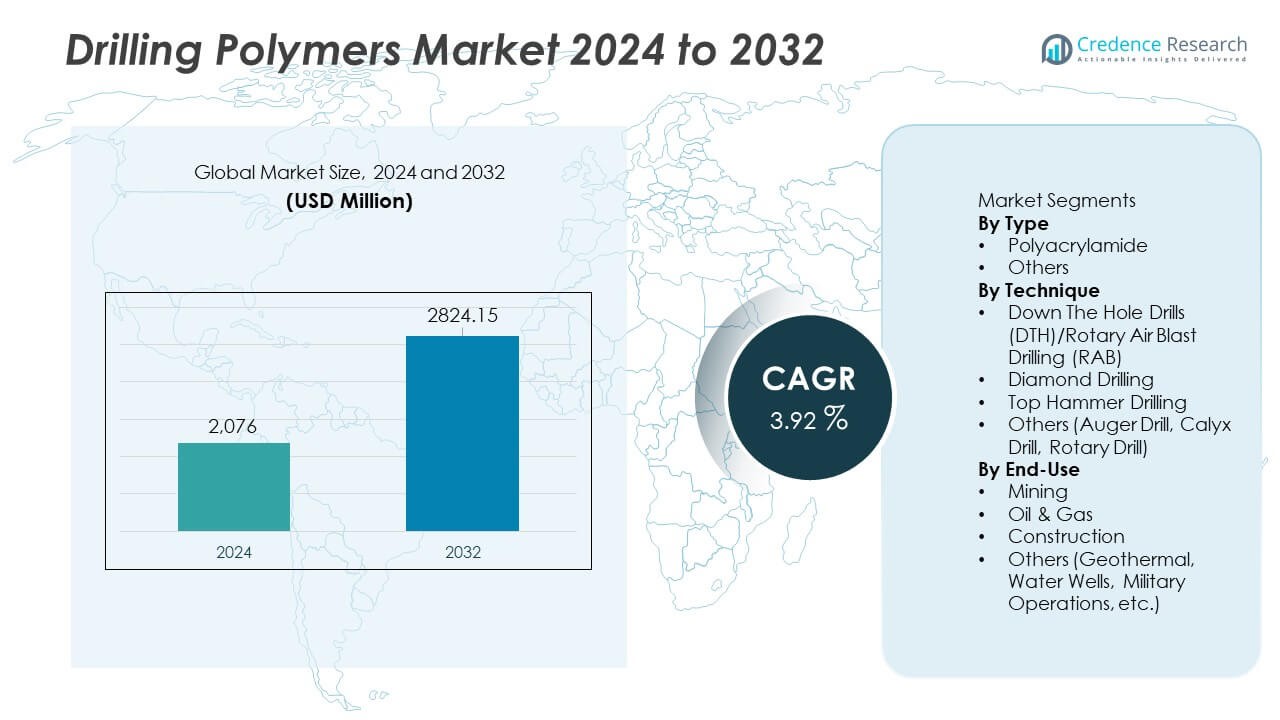

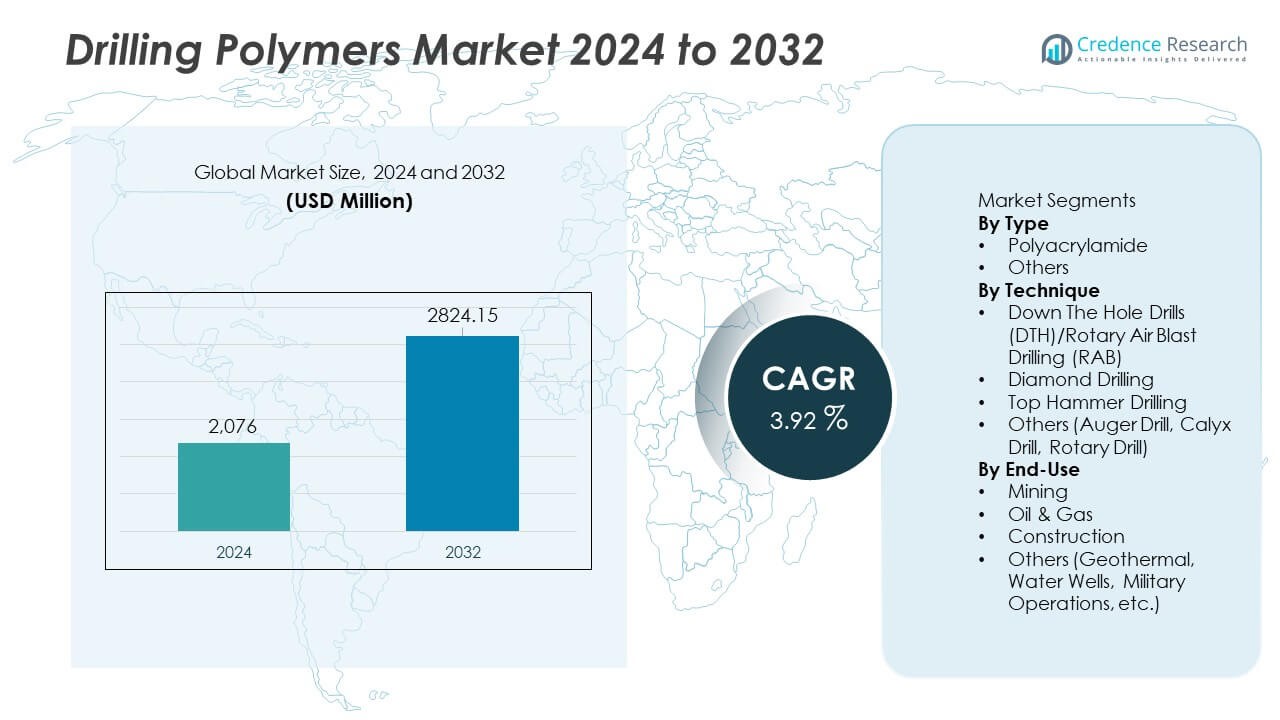

The Drilling Polymers Market was valued at USD 2,076 million in 2024 and is projected to reach USD 2,824.15 million by 2032, expanding at a CAGR of 3.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drilling Polymers Market Size 2024 |

USD 2,076 Million |

| Drilling Polymers Market, CAGR |

3.92% |

| Drilling Polymers Market Size 2032 |

USD 2,824.15 Million |

The Drilling Polymers market is shaped by leading players such as SNF Holding Company, BASF SE, Lubrizol Corporation, Schlumberger Limited, Halliburton Company, Kemira Oyj, Solvay S.A., Baroid Industrial Drilling Products, AMC Drilling Fluids, and Ashland Global Holdings, each focusing on advanced formulations that enhance drilling efficiency, cuttings transport, and wellbore stability. These companies strengthen competitiveness through innovation, environmental compliance, and partnerships with drilling service providers. North America leads the market with 37% share, driven by strong shale drilling and advanced exploration activities. Asia Pacific follows with 28% share, supported by growing oil, gas, and mining operations, while Europe holds 23% share, driven by offshore exploration and geothermal development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Drilling Polymers market reached USD 2,076 million in 2024 and will grow at a CAGR of 3.92% through 2032.

- Demand rises as drilling activities expand across oil, gas, and mining sectors, with operators adopting polymers to improve viscosity, cuttings transport, and wellbore stability.

- Polyacrylamide leads the type segment with 64% share, while DTH/RAB drilling dominates the technique segment with 41% share, driven by efficiency and versatility.

- Competition intensifies as major players invest in high-performance, eco-friendly formulations and form partnerships to enhance product reach and technical support.

- North America leads with 37% share, followed by Asia Pacific at 28% and Europe at 23%, supported by active exploration and rising adoption of advanced drilling technologies.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Polyacrylamide dominates the segment with 64% share, driven by its strong viscosity-enhancing, fluid-loss control, and shale-stabilizing properties. Industries rely on polyacrylamide for efficient drilling mud performance, especially in deep and complex wells where consistent rheology is essential. Its compatibility with both water-based and synthetic drilling fluids strengthens adoption across mining and oilfield operations. The “Others” category grows steadily as specialty polymers support niche drilling needs such as high-temperature and high-pressure environments. The dominance of polyacrylamide continues as operators prioritize cost-effective additives that improve drilling efficiency and reduce operational risks.

- For instance, SNF Holding Company operates the largest polyacrylamide production network across its global plants, accounting for almost half of all global polyacrylamide production. The company also runs numerous manufacturing sites strategically located around the world, allowing stable supply for high-volume drilling projects and various other applications.

By Technique

Down The Hole (DTH)/Rotary Air Blast (RAB) drilling leads this segment with 41% share, supported by strong use in mining exploration and hard-rock drilling. These techniques benefit from drilling polymers that enhance cuttings transport, reduce friction, and stabilize boreholes in challenging terrains. Diamond drilling grows due to rising mineral exploration activities that require precise core extraction, while top hammer drilling expands in construction and quarrying applications. Other drilling methods gain traction for shallow or specialized operations. The leadership of DTH/RAB drilling reflects its versatility, lower operational cost, and ability to maintain efficiency in demanding geological conditions.

- For instance, Epiroc advanced DTH performance with its COP M-series hammers, which deliver drilling speeds up to 30% faster than earlier models.

By End-Use

Oil & gas dominates the end-use segment with 52% share, driven by the continuous demand for drilling polymers that support wellbore stability, lubricity improvement, and fluid-loss control in complex reservoirs. Exploration and development projects increasingly rely on high-performance polymers to enhance drilling speed and reduce non-productive time. Mining follows as the sector uses polymers for improved cuttings suspension and borehole integrity. Construction applications grow through their use in foundation drilling and tunneling projects, while geothermal and water-well drilling contribute to additional demand. The dominance of oil & gas remains strong as global drilling activities focus on safer, smoother, and more efficient well operations.

Key Growth Drivers

Rising Demand for Efficient Drilling Fluids

Growing focus on enhancing drilling performance drives strong adoption of drilling polymers across oil, gas, and mining operations. These polymers improve viscosity, cuttings transport, shale stabilization, and fluid-loss control, which reduces downtime and enhances safety. Complex drilling environments such as deepwater, horizontal, and high-pressure wells require advanced polymer-based additives to maintain consistent rheology. Operators rely on high-performance polymers to optimize drilling speed and reduce operational risks. As global drilling activities expand, the demand for reliable and efficient fluid additives continues to strengthen market growth.

- For instance, Schlumberger’s DRILPLEX HD polymer system improves hole-cleaning efficiency and cuttings transport in long horizontal wells, as demonstrated in field performance data.

Expansion of Mining and Mineral Exploration Activities

Increasing investment in mining exploration boosts the use of drilling polymers, especially for core drilling and hard-rock operations. These polymers help stabilize boreholes, suspend cuttings, and reduce equipment wear, which supports higher productivity and improved sample accuracy. Rising global demand for minerals used in energy storage, construction, and manufacturing drives continuous exploration efforts. Mining firms depend on polymer-enhanced drilling fluids to improve operational efficiency in diverse geological conditions. This expansion of exploration activities across emerging regions significantly boosts long-term market demand.

- For instance, Epiroc’s WL series core drilling tools support drilling depths exceeding 1,800 meters, which increases reliance on polymer-based stabilization systems.

Growing Adoption of Horizontal and Directional Drilling

Rising use of horizontal and directional drilling in oil and gas fields increases the need for advanced polymer-based drilling fluids. These wells require stable rheology, strong lubricity, and efficient cuttings removal, which drilling polymers provide. Operators depend on polymers to maintain borehole integrity and reduce friction in extended-reach wells. Growth in unconventional resources, including shale gas and tight oil, further strengthens demand. As more projects adopt complex drilling techniques, high-performance polymers become essential for ensuring operational efficiency and minimizing non-productive time.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Biodegradable Polymers

Environmental regulations and sustainability goals drive the development of biodegradable and low-toxicity drilling polymers. Companies invest in green formulations that offer strong performance while minimizing ecological impact, especially in offshore and environmentally sensitive areas. These eco-friendly polymers support compliance with stricter waste-disposal standards and reduce environmental risks. Demand rises as operators adopt sustainable drilling practices aligned with global environmental frameworks. The shift toward greener additives creates new opportunities for manufacturers offering high-performance, regulatory-compliant polymer solutions.

- For instance, Kemira developed its Superfloc® BioMB series using a mass-balanced approach that incorporates biobased and renewable feedstocks, which are chemically identical to traditional polyacrylamide flocculants and are not inherently biodegradable according to standard criteria, but offer a reduced environmental load by decreasing the carbon footprint of production.

Technological Advancements in High-Performance Polymers

Advances in polymer science enable the creation of drilling additives that perform well under extreme temperatures, pressures, and chemically reactive formations. New formulations provide improved thermal stability, enhanced lubricity, and superior cuttings suspension, supporting complex operations in deepwater, geothermal, and ultra-deep wells. Automation and real-time monitoring systems also increase demand for polymers capable of maintaining consistent fluid behavior. These innovations create strong opportunities for companies developing specialized additives tailored to advanced drilling applications.

- For instance, Halliburton’s ADAPTA filtration control agent provides secondary viscosity and is stable for use in fluid systems in challenging high-pressure, high-temperature wells. It offers reliable performance across a wide range of temperatures, including extreme downhole conditions.

Key Challenges

Volatility in Raw Material Prices

Fluctuating costs of raw materials used in polymer production create major challenges for manufacturers. Price instability affects production expenses, supply chain efficiency, and profit margins. Operators often delay procurement during periods of high cost, reducing short-term demand. Manufacturers must balance performance and cost-effectiveness to maintain competitiveness. This volatility pushes companies to diversify raw material sources and adopt more efficient production methods to ensure stability in supply and pricing.

Environmental and Regulatory Compliance Pressure

Stringent environmental regulations restrict the use of certain chemicals in drilling fluids, creating hurdles for polymer producers. Compliance requirements increase operational costs and limit formulation flexibility. Offshore drilling projects face particularly strict regulations regarding toxicity, biodegradability, and discharge control. Failure to meet environmental standards can delay approvals and restrict market access. Manufacturers must invest in research, testing, and certification processes to align products with evolving regulatory frameworks.

Regional Analysis

North America

North America leads the Drilling Polymers market with 37% share, driven by active oil and gas drilling operations, including shale exploration and unconventional resource development. The region benefits from advanced drilling technologies that require high-performance polymers for improved viscosity control, shale stabilization, and enhanced cuttings transport. Rising investments in horizontal and directional drilling further strengthen demand. Supportive regulatory frameworks and strong adoption of eco-friendly formulations encourage continuous innovation. Mining activities across the United States and Canada contribute additional consumption. The market grows steadily as operators prioritize efficiency, reduced downtime, and higher well productivity.

Europe

Europe holds 23% share, supported by sustained offshore drilling activities in the North Sea and increasing demand for efficient drilling fluids. Stringent environmental regulations encourage the use of biodegradable and low-toxicity polymers, pushing manufacturers to develop cleaner formulations. Rising geothermal exploration across Germany, Iceland, and France fuels additional demand for specialized polymers with high thermal stability. Mining operations across Eastern Europe also adopt advanced polymer-based fluids to enhance drilling accuracy and equipment performance. Strong focus on sustainable drilling practices shapes market growth, while ongoing energy transition efforts influence long-term project investment patterns.

Asia Pacific

Asia Pacific accounts for 28% share, driven by rapid expansion of oil and gas exploration in China, India, and Southeast Asian countries. Increasing mining activities in Australia and Indonesia further support strong consumption of drilling polymers. The region’s growing focus on deepwater and ultra-deepwater drilling raises the need for advanced additives with stable rheology under extreme conditions. Rising infrastructure development boosts construction-related drilling, expanding end-use demand. Investments in geothermal projects in Japan and the Philippines also contribute to market growth. Strong industrialization and large-scale resource extraction position the region as a key growth hub.

Latin America

Latin America holds 7% share, supported by expanding oil and gas drilling in Brazil, Argentina, and Mexico. The region’s deepwater exploration and shale resource development increase reliance on high-performance drilling polymers for improved stability and fluid efficiency. Mining operations across Chile and Peru generate additional demand, especially for polymers that enhance core drilling and reduce equipment wear. Economic development fuels infrastructure and construction drilling activities. Although regulatory constraints and cost pressures exist, rising exploration projects and foreign investments strengthen market prospects across the region.

Middle East & Africa

Middle East & Africa account for 5% share, driven by extensive oil and gas activities across Saudi Arabia, the UAE, Kuwait, and offshore African regions. High drilling intensity and challenging geological conditions require polymers that ensure optimal viscosity, lubrication, and borehole stability. The region’s growing focus on enhanced recovery techniques increases demand for advanced fluid additives. Mining operations in South Africa and emerging exploration in East Africa also support consumption. While environmental regulations vary by country, increasing adoption of modern drilling technologies strengthens long-term demand for high-performance drilling polymers.

Market Segmentations:

By Type

By Technique

- Down The Hole Drills (DTH)/Rotary Air Blast Drilling (RAB)

- Diamond Drilling

- Top Hammer Drilling

- Others (Auger Drill, Calyx Drill, Rotary Drill)

By End-Use

- Mining

- Oil & Gas

- Construction

- Others (Geothermal, Water Wells, Military Operations, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Drilling Polymers market features strong competition among key players such as SNF Holding Company, BASF SE, Lubrizol Corporation, Schlumberger Limited, Halliburton Company, Kemira Oyj, Solvay S.A., Baroid Industrial Drilling Products, AMC Drilling Fluids, and Ashland Global Holdings. Companies focus on delivering high-performance polymers that enhance viscosity control, reduce fluid loss, and improve wellbore stability in both oil and gas and mining operations. Many players invest in advanced formulations designed for extreme drilling conditions, including high-temperature and high-pressure environments. Strategic partnerships with drilling contractors and service providers help expand product reach and strengthen technical support. Firms also prioritize environmentally compliant and biodegradable polymer solutions to meet rising regulatory expectations. Continuous investment in research, testing, and application-specific customization supports differentiation, while global expansion strategies enable companies to serve emerging drilling markets. The competitive environment remains dynamic as innovation and operational efficiency become key success factors.

Key Player Analysis

- SNF Holding Company

- BASF SE

- Lubrizol Corporation

- Schlumberger Limited

- Halliburton Company

- Kemira Oyj

- Solvay S.A.

- Baroid Industrial Drilling Products

- AMC Drilling Fluids

- Ashland Global Holdings

Recent Developments

- In November 2025, BASF SE commissioned a new high-performance dispersant production line at its plant in Nanjing, China — potentially improving supply of polymer-based dispersants used across applications.

- In August 2024, SNF Holding Company signed an agreement to acquire PfP Industries and Ace Fluid Solutions — a move strengthening SNF’s water-soluble polymer and drilling-fluid additive portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technique, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance drilling polymers will rise as complex wells become more common.

- Polyacrylamide use will expand due to its strong efficiency in viscosity control and fluid stability.

- Eco-friendly and biodegradable polymer formulations will gain stronger market acceptance.

- Advanced polymers for high-temperature and high-pressure drilling will see increased development.

- Mining and mineral exploration growth will boost adoption of specialized drilling additives.

- Digital monitoring of drilling fluids will drive demand for polymers with stable rheological behavior.

- Offshore and deepwater projects will require more durable and thermally stable polymer solutions.

- Emerging markets will adopt drilling polymers as exploration activities expand.

- Partnerships between polymer manufacturers and drilling service companies will increase.

- Regulatory pressure will push companies to innovate cleaner, safer polymer-based drilling additives.

Market Segmentation Analysis:

Market Segmentation Analysis: