Market Overview:

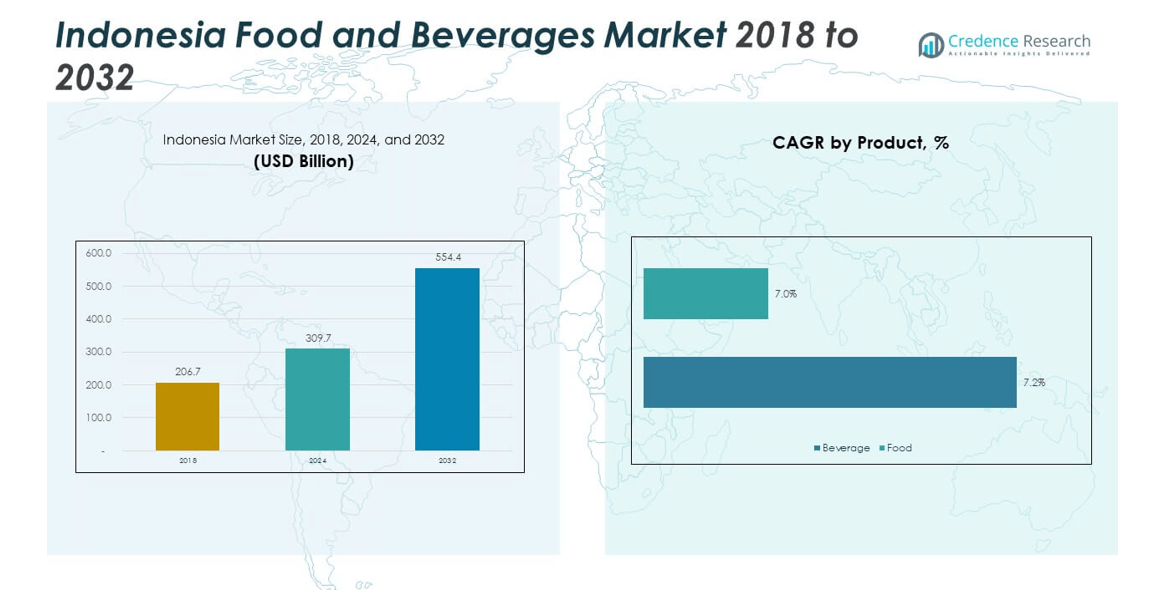

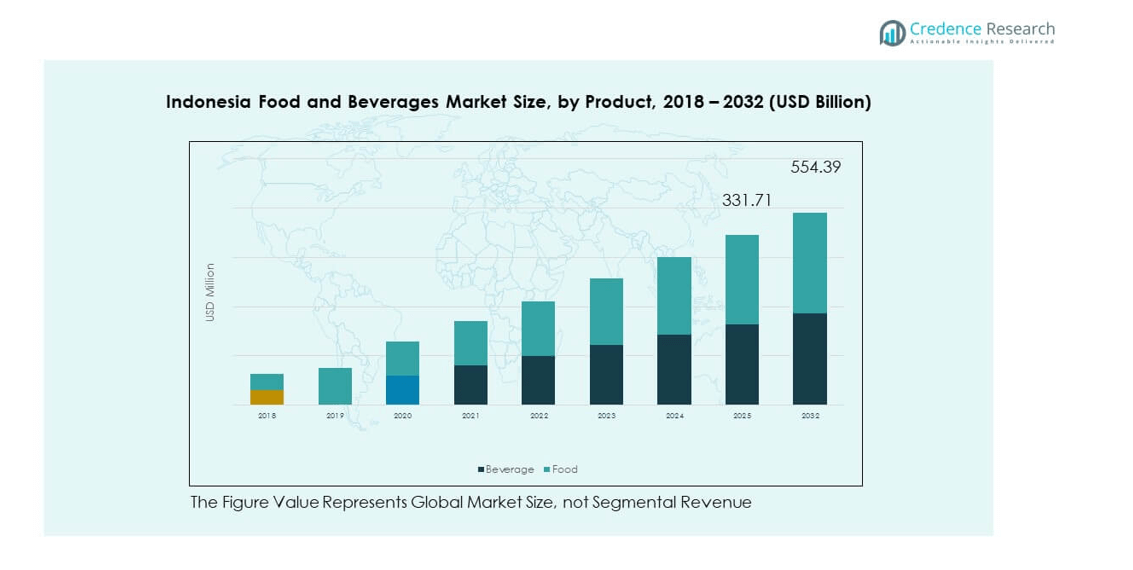

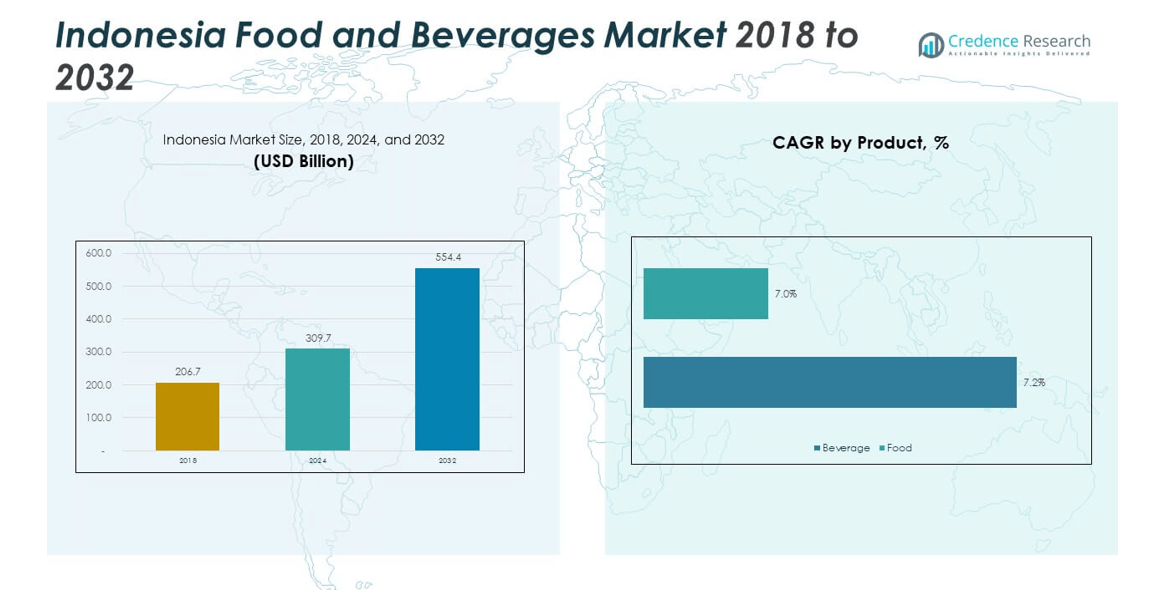

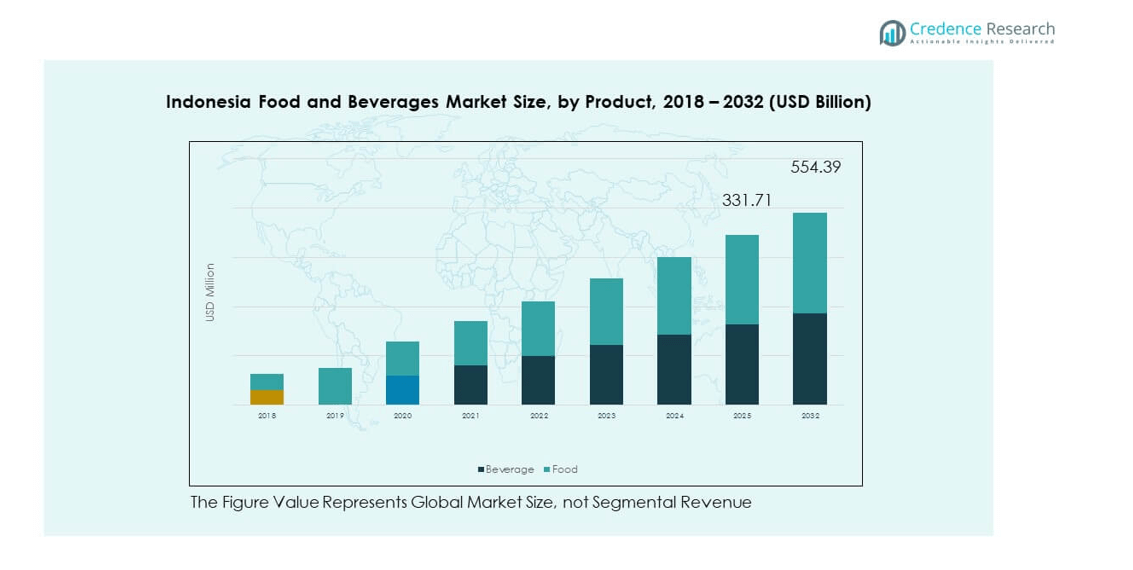

The Indonesia Food and Beverages Market size was valued at USD 206.7 billion in 2018 to USD 309.7 billion in 2024 and is anticipated to reach USD 554.4 billion by 2032, at a CAGR of 7.61% during the forecast period. This growth reflects strong consumer demand, evolving lifestyle preferences, and the expansion of both domestic and international food brands across the country. The market continues to attract significant investment, supported by Indonesia’s large population, rising disposable incomes, and a growing middle class seeking diverse, high-quality, and convenient food and beverage options.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Food and Beverages Market Size 2024 |

USD 309.7 billion |

| Indonesia Food and Beverages Market, CAGR |

7.61% |

| Indonesia Food and Beverages Market Size 2032 |

USD 554.4 billion |

The market’s expansion is driven by rapid urbanization, increasing consumer purchasing power, and a shift toward ready-to-eat, packaged, and premium products. Health-conscious consumption patterns are also gaining traction, with rising demand for functional foods, plant-based alternatives, and low-sugar beverages. The growth of modern retail formats, e-commerce penetration, and food delivery platforms further enhances product accessibility and variety. In addition, tourism contributes to demand for diverse cuisines, while ongoing product innovations and promotional strategies strengthen brand engagement and market competitiveness in Indonesia’s evolving food and beverage landscape.

Geographically, major urban centers such as Jakarta, Surabaya, and Bandung lead market demand due to higher incomes, dense populations, and greater exposure to global food trends. Secondary cities and rural areas are emerging growth zones, driven by improving infrastructure, retail expansion, and increased consumer awareness of branded and premium products. International players are increasingly targeting these developing regions, adapting offerings to local tastes while leveraging modern distribution channels. This urban-rural consumption shift is expected to play a vital role in the sector’s sustained growth over the coming years.

Market Insights:

- The Indonesia Food and Beverages Market. was valued at USD 309.7 billion in 2024 and is expected to reach USD 554.4 billion by 2032, growing at a CAGR of 7.61%.

- Rising disposable incomes and a growing middle class are boosting demand for premium, packaged, and health-oriented products.

- Urbanization and retail expansion are increasing access to diverse product categories through modern trade and e-commerce platforms.

- Supply chain inefficiencies and logistical challenges in remote areas are restraining consistent product availability and freshness.

- Fluctuating raw material costs and regulatory compliance requirements are adding pressure to production and pricing strategies.

- Java dominates the market with a 58% share in 2024, driven by dense population, strong infrastructure, and advanced retail networks.

- Emerging regions such as Sumatra, Kalimantan, Sulawesi, and Bali are expected to register faster growth due to infrastructure improvements and expanding distribution channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Disposable Income and Expanding Middle-Class Population Fueling Consumption Growth

The Indonesia Food and Beverages Market benefits significantly from the steady growth in disposable income and the rapid expansion of the middle class. Higher earning capacity enables consumers to shift from basic staples to more premium and value-added products. Urban households increasingly demand packaged, ready-to-eat, and imported food options that align with their busy lifestyles. Rural markets also experience a shift toward branded goods as purchasing power improves. The market sees greater diversity in consumption patterns, with a preference for healthier, fresher, and more convenient products. Local manufacturers invest in product innovation to meet evolving tastes and quality expectations. It continues to attract foreign investment due to strong domestic consumption potential and favorable demographics. Rising consumer confidence strengthens the industry’s long-term growth trajectory.

- For example, PT Sumber Alfaria Trijaya (Alfamart) had expanded its national footprint to approximately 19,638 outlets by June 2024.

Urbanization and Retail Expansion Creating Wider Access to Diverse Products

The Indonesia Food and Beverages Market experiences strong momentum from rapid urbanization, which drives demand for modern retail outlets and food service channels. Supermarkets, hypermarkets, and convenience stores expand aggressively in major cities, improving consumer access to a broad range of products. The rise of e-commerce platforms facilitates home delivery services, catering to time-conscious urban populations. Food courts, cafes, and quick-service restaurants also flourish, shaping new dining habits. Urbanization accelerates exposure to international cuisines, influencing domestic food trends and product innovation. It pushes suppliers to adopt advanced distribution networks to serve growing urban demand. Government infrastructure projects support better connectivity between cities and rural regions, enabling faster delivery and distribution. The urban retail landscape continues to transform the overall market environment.

Shifting Consumer Preferences Towards Health and Wellness Products

The Indonesia Food and Beverages Market experiences strong demand growth for health-oriented products, driven by rising consumer awareness about nutrition and wellness. Shoppers seek low-sugar, low-fat, and fortified food and beverages that support healthy lifestyles. Plant-based alternatives, organic offerings, and functional drinks gain popularity among health-conscious consumers. Fitness and wellness trends influence purchasing decisions, encouraging brands to reformulate products with natural and sustainable ingredients. This shift promotes the expansion of specialty stores and online platforms offering health-focused items. It motivates manufacturers to invest in research and development to create innovative product lines. Marketing strategies increasingly highlight health benefits to attract targeted consumer segments. The growing preference for healthier options reshapes product portfolios across multiple categories.

- For instance, PT Kalbe Farma reported consolidated net sales growth of 15.7% in the first nine months of 2024, supported by strong performance across its nutritionals and consumer health segments. The company continues to invest in research and development to drive innovation in functional food and wellness-oriented products, highlighting its commitment to meeting rising demand for healthier consumption choices in Indonesia.

Tourism and Culinary Diversity Boosting Product Demand

The Indonesia Food and Beverages Market gains a strong boost from the tourism sector, which encourages demand for a variety of culinary experiences. Tourists seek authentic local flavors as well as premium international offerings, prompting restaurants and hotels to source diverse ingredients. Popular tourist destinations stimulate growth in packaged snacks, beverages, and ready meals catering to travelers. Cultural diversity across the archipelago introduces a wide range of regional specialties, supporting the development of niche product categories. It creates opportunities for food producers to market traditional recipes to both domestic and international consumers. Events and food festivals further promote Indonesian cuisine globally. The synergy between tourism and the food sector enhances the visibility and value of local brands. Seasonal peaks in tourist arrivals contribute to higher sales volumes across multiple product categories.

Market Trends

Digital Transformation Accelerating E-Commerce and Online Food Delivery

The Indonesia Food and Beverages Market sees rapid adoption of e-commerce channels, fueled by the growing use of smartphones and internet connectivity. Online grocery platforms and food delivery applications expand their reach, offering consumers convenience and diverse product choices. Digital payment systems simplify transactions, boosting consumer confidence in online purchases. Brands increasingly partner with delivery services to enhance last-mile distribution. Social media platforms influence purchasing behavior through targeted advertising and influencer marketing. It prompts companies to develop direct-to-consumer models for better engagement and brand loyalty. Seasonal campaigns and promotional discounts further drive online sales. Digital integration across the supply chain improves operational efficiency and customer satisfaction.

Sustainability and Eco-Friendly Packaging Gaining Industry Attention

The Indonesia Food and Beverages Market is witnessing growing emphasis on sustainable production and eco-friendly packaging solutions. Environmental concerns encourage companies to adopt biodegradable, recyclable, and reusable packaging materials. Brands invest in reducing plastic use and optimizing packaging design to minimize waste. Consumer awareness of environmental impact influences purchasing choices, favoring businesses that demonstrate social responsibility. It motivates manufacturers to explore renewable energy and water conservation in their operations. Government regulations and environmental policies further accelerate this transition. Retailers promote products with sustainable labels to attract environmentally conscious customers. This focus on green practices becomes a competitive differentiator in the market.

- For instance, Danone-AQUA, through its partnership with Reciki, collects an average of 15,842 metric tons of plastic waste annually across Java and Bali, supporting its circular packaging initiative. The company has also set targets to increase the use of recycled polyethylene terephthalate (rPET) in its bottles, aiming to reach 50% by 2025 as part of its broader sustainability commitment.

Premiumization Driving Demand for High-Quality and Specialty Products

The Indonesia Food and Beverages Market is experiencing a rise in premium product consumption, supported by higher incomes and aspirational lifestyles. Consumers are willing to pay more for artisanal, gourmet, and imported goods that offer unique flavors and superior quality. Specialty coffee, craft beverages, and premium confectionery categories record consistent growth. It encourages manufacturers to invest in product differentiation and storytelling to enhance perceived value. Packaging design and branding play a crucial role in attracting premium-seeking customers. Tourism-driven exposure to global dining trends further supports this shift. Retail shelves increasingly feature niche and luxury food products, appealing to both domestic and expatriate markets.

Technological Advancements Enhancing Food Processing and Quality Standards

The Indonesia Food and Beverages Market benefits from ongoing technological innovations that improve product safety, quality, and shelf life. Automation in manufacturing boosts efficiency while reducing operational costs. Advanced preservation techniques maintain freshness and extend distribution reach. Smart packaging with QR codes or freshness indicators enhances transparency for consumers. It allows brands to track and trace products more effectively, improving supply chain management. Food safety compliance becomes a stronger priority as global trade expands. Investments in R&D drive new flavor development and fortified product formulations. Technological upgrades position companies to compete effectively in both domestic and export markets.

- For instance, Indofood has integrated digital supply chain systems and warehouse automation in line with Indonesia’s “Making Indonesia 4.0” initiative, helping streamline distribution processes and improve operational efficiency. Wings Group has also strengthened its production and logistics capabilities through investments in modern facilities, supporting consistent quality and faster market reach.

Market Challenges Analysis

Supply Chain Inefficiencies and Logistics Constraints Impacting Distribution

The Indonesia Food and Beverages Market faces challenges in ensuring efficient distribution across its geographically diverse landscape. The archipelagic nature of the country creates logistical hurdles, especially in remote and underdeveloped regions. Transportation infrastructure limitations can lead to delays, increased costs, and compromised product freshness. Seasonal weather disruptions further affect supply chain reliability. It forces companies to invest in cold chain facilities, warehousing improvements, and optimized routing to maintain quality standards. Small-scale producers often struggle to access advanced logistics solutions, limiting their market reach. Urban areas benefit from better infrastructure, but rural supply remains inconsistent. Addressing these issues is crucial to sustaining long-term growth.

Rising Raw Material Costs and Regulatory Compliance Pressures

The Indonesia Food and Beverages Market is impacted by fluctuating prices of key raw materials such as grains, dairy, and imported ingredients. Currency volatility further increases procurement challenges for imported goods. Manufacturers face cost pressures while maintaining competitive pricing in a price-sensitive market. Compliance with evolving food safety regulations requires continuous investment in testing, certification, and process adjustments. Smaller businesses may find these requirements financially burdensome. It creates a competitive gap between large enterprises with strong resources and smaller players with limited capacity. Global trade dynamics and changing import-export policies add another layer of uncertainty. Balancing cost efficiency with compliance remains a significant challenge for industry stakeholders.

Market Opportunities

Growing Penetration of Modern Retail and E-Commerce Channels

The Indonesia Food and Beverages Market presents significant opportunities through the expansion of modern retail formats and online marketplaces. The spread of supermarkets, hypermarkets, and convenience stores into suburban and rural areas opens access to new customer segments. E-commerce platforms enable nationwide product availability, even in remote locations. It offers brands a chance to test niche products and gain direct consumer feedback. Partnerships between retailers and technology providers create innovative shopping experiences. This trend supports higher product visibility and consumer engagement across multiple channels.

Rising Demand for Functional and Specialty Food Products

The Indonesia Food and Beverages Market is set to benefit from the increasing interest in functional, fortified, and specialty food items. Consumers seek products that offer health benefits beyond basic nutrition, including immunity-boosting ingredients and energy-enhancing formulations. Specialty and ethnic foods also gain popularity among younger demographics seeking variety. It encourages manufacturers to diversify product lines and target niche consumer groups. Local and international brands can capitalize on this demand by introducing innovative, culturally adapted offerings. Growing exposure to global food trends through travel and media further supports this segment’s expansion.

Market Segmentation Analysis:

The Indonesia Food and Beverages Market is segmented

By product into beverages and food, catering to diverse consumer demands across the country. The beverage segment includes alcoholic and non-alcoholic beverages, with non-alcoholic products such as bottled water, carbonated drinks, juices, and ready-to-drink teas dominating due to widespread daily consumption. Alcoholic beverages maintain steady demand, driven by tourism, hospitality, and urban lifestyle shifts. The food segment encompasses bakery and confectionery, frozen food, dairy products, breakfast cereals, and meat, poultry, and seafood. Bakery and confectionery products benefit from urban snacking trends, while frozen food gains traction among busy households. Dairy products remain a staple, supported by rising health awareness, and meat, poultry, and seafood products are essential to the national diet, with growing demand for processed and value-added formats.

- For instance, Mayora’s Beng-Beng ranks among the leading chocolate bar brands in Indonesia’s confectionery segment, competing strongly with global names like SilverQueen and Cadbury. Indofood’s flagship instant noodle brand, Indomie, has achieved iconic status as Indonesia’s largest instant noodle producer, becoming a household staple across the nation.

By distribution channel, the market is classified into supermarkets/hypermarkets, convenience stores, and online platforms. Supermarkets and hypermarkets lead the segment, offering extensive product variety and competitive pricing under one roof. Convenience stores hold a strong position in urban and semi-urban areas, catering to on-the-go purchases and immediate consumption needs. The online segment is expanding rapidly, driven by e-commerce adoption, digital payment systems, and efficient delivery networks. It offers consumers greater accessibility to niche and premium products, particularly in regions with limited physical retail infrastructure. The segmentation highlights the market’s diverse product portfolio and evolving retail landscape, with both traditional and modern channels playing critical roles in meeting the needs of Indonesia’s growing and increasingly sophisticated consumer base.

- For example, Indomaret leads with approximately 22,000 stores nationwide, while Alfamart operates around 18,000 stores, together enabling extensive consumer access across Indonesia.

Segmentation:

By Product

- Beverage

- Alcoholic Beverages

- Non-alcoholic Beverages

- Food

- Bakery and Confectionery

- Frozen Food

- Dairy Products

- Breakfast Cereals

- Meat, Poultry, and Seafood

By Distribution Channel

- Supermarkets / Hypermarkets

- Convenience Stores

- Online

Regional Analysis:

The Indonesia Food and Beverages Market demonstrates strong regional variations, with Java holding the largest share of 58% in 2024. Java’s dominance is driven by its dense population, higher income levels, and concentration of urban centers such as Jakarta, Surabaya, and Bandung, which serve as major consumption and distribution hubs. Modern retail formats, e-commerce penetration, and international foodservice brands are more prevalent in this region, contributing to diversified product availability. The demand for premium, health-oriented, and convenience-based products is high, influenced by exposure to global trends and fast-paced lifestyles. Strong infrastructure and logistics networks enable efficient distribution across urban and suburban areas. It remains a focal point for both domestic and multinational food and beverage companies seeking market leadership.

Sumatra accounts for 18% of the market share, benefiting from its growing urban centers and a diverse agricultural base that supports local production. The region’s food consumption patterns blend traditional preferences with increasing demand for packaged and processed goods. Industrial and economic development in cities such as Medan and Palembang is driving retail expansion and boosting household purchasing power. Modern trade channels are steadily growing, though traditional markets still play a major role in distribution. Tourism in coastal and cultural destinations further stimulates demand for a wide range of food and beverage products. It presents opportunities for companies to strengthen brand presence through both retail and foodservice sectors.

Kalimantan, Sulawesi, Bali, and other regions collectively contribute 24% of the market share, with Bali standing out due to its tourism-driven demand for diverse and premium products. Kalimantan and Sulawesi are experiencing steady growth supported by infrastructure improvements, industrial projects, and rising consumer awareness of branded products. The expansion of supermarkets, convenience stores, and online retail channels is improving product accessibility in these emerging markets. Local food culture remains strong, but urban migration is increasing the appeal of modern and packaged products. Seasonal tourist influx in Bali boosts demand for both domestic and imported food and beverage items. It is expected that these regions will see accelerated growth as distribution networks strengthen and consumer preferences evolve toward higher-value product categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Indofood Sukses Makmur

- Wings Food

- PT Mayora Indah

- Nestlé

- PepsiCo

- Coca-Cola

- Kido Group

- Potami Food

- Prima Food Solutions

- AIMFOOD

- Other Key Players

Competitive Analysis:

The Indonesia Food and Beverages Market features a competitive landscape led by established domestic companies such as Indofood Sukses Makmur, Wings Food, and PT Mayora Indah, alongside global players like Nestlé, PepsiCo, and Coca-Cola. These companies leverage extensive distribution networks, strong brand recognition, and diverse product portfolios to maintain market leadership. Local manufacturers hold a significant advantage in catering to traditional tastes while adapting to evolving consumer preferences for premium and health-focused products. Multinational corporations compete by introducing innovative offerings and investing in localized production to align with Indonesian market demands. The competitive environment is marked by frequent product launches, brand collaborations, and aggressive marketing campaigns aimed at expanding market share. E-commerce partnerships and expansion into rural areas are increasingly central to competitive strategies. It remains a market where differentiation through quality, pricing, and cultural relevance plays a crucial role in sustaining long-term success.

Recent Developments:

- In May 2025, DailyCo, Indonesia’s fastest-growing multi-brand food and beverage operator, completed the acquisition of Waku, a leading B2B catering and canteen management service provider for corporate and government clients. This deal expands DailyCo’s operational scale significantly, giving it access to Waku’s impressive client roster, which includes over 658 corporate and government customers across 20 cities, and an annual meal output exceeding 10 million.

- In August 2025, Vietnam and Indonesia announced a strengthened regional partnership aimed at boosting trade between the two countries to $18 billion by 2028, with a particular focus on developing closer ties in the food industry. This initiative highlights the strategic role of cross-border partnerships in driving innovation and market expansion in the Indonesian food and beverage sector.

Market Concentration & Characteristics:

The Indonesia Food and Beverages Market is moderately concentrated, with a mix of large domestic conglomerates and multinational corporations dominating high-volume categories. It features a broad spectrum of players ranging from mass-market producers to niche specialty brands. Market leaders benefit from economies of scale, advanced manufacturing capabilities, and extensive retail reach, enabling them to influence pricing and distribution standards. Competitive intensity is heightened by continuous product innovation and aggressive promotional activities. Consumer loyalty is shaped by brand trust, consistent quality, and adaptability to local tastes. The presence of both modern and traditional trade channels ensures diverse entry points for market participants. It continues to evolve as emerging players introduce specialized products to capture targeted consumer segments, driving a dynamic and competitive business environment.

Report Coverage:

The research report offers an in-depth analysis based on Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of modern retail and e-commerce platforms will strengthen nationwide product accessibility and enhance distribution efficiency.

- Health and wellness trends will influence product innovation, driving demand for low-sugar, plant-based, and functional offerings.

- Technological advancements in food processing and packaging will improve shelf life, safety, and overall product quality.

- Rising tourism will boost demand for premium, specialty, and internationally inspired food and beverage products.

- Increased investment in cold chain infrastructure will support the growth of frozen and perishable product categories.

- Local brands will focus on premiumization strategies to compete with global players in high-value market segments.

- Sustainability initiatives will shape packaging choices, encouraging eco-friendly materials and waste reduction measures.

- Regional market expansion into secondary cities will create new growth opportunities for both domestic and multinational companies.

- Stronger regulatory frameworks on food safety and labeling will enhance consumer confidence and market credibility.

- Strategic collaborations between manufacturers, retailers, and technology providers will accelerate product reach and market penetration.