Market Overview:

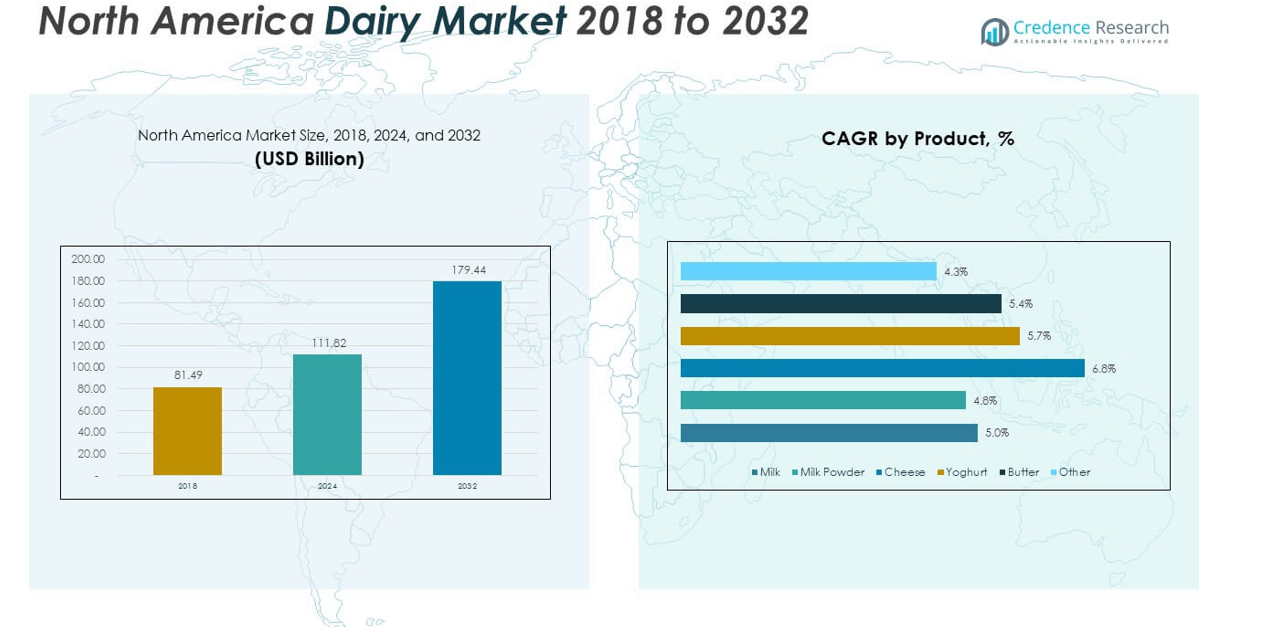

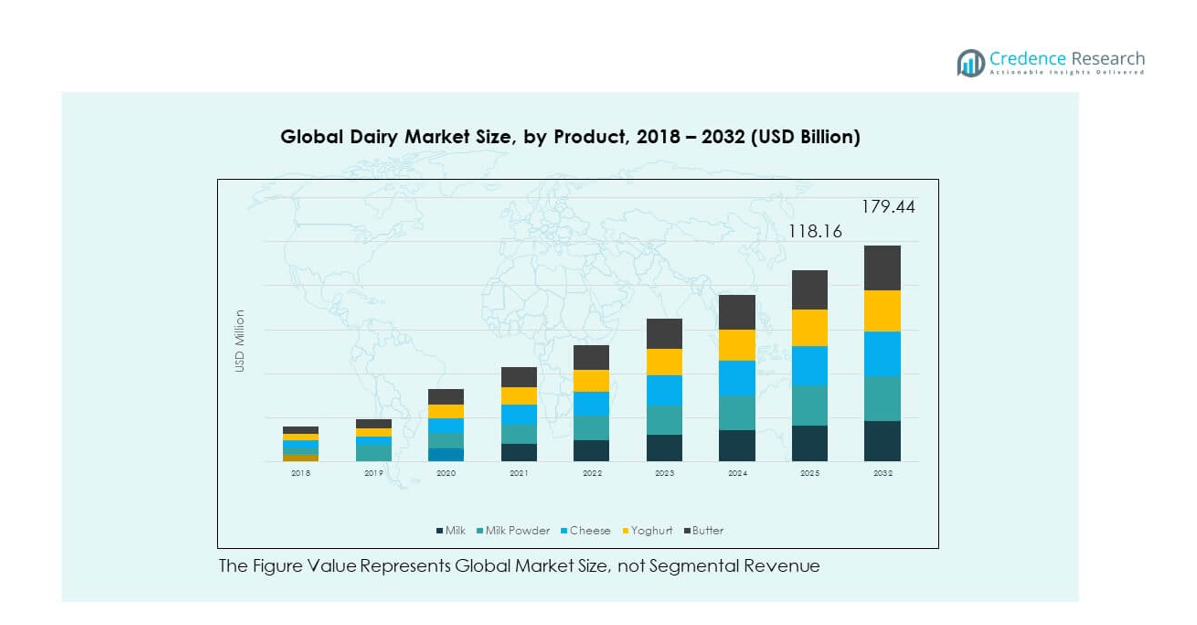

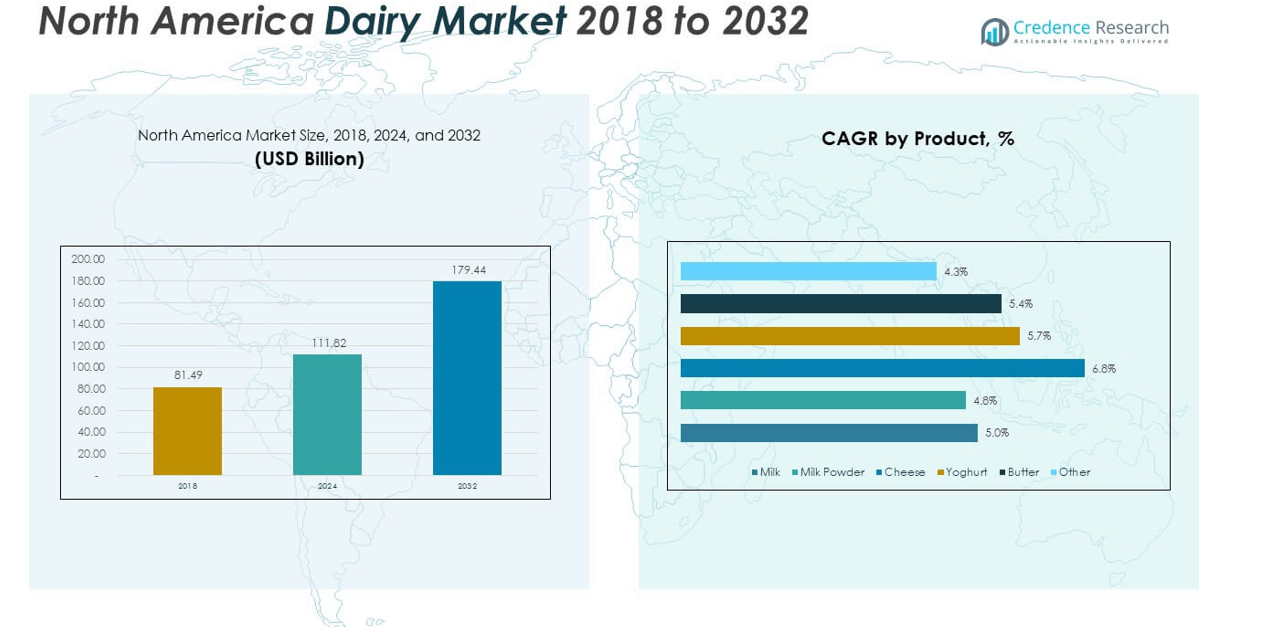

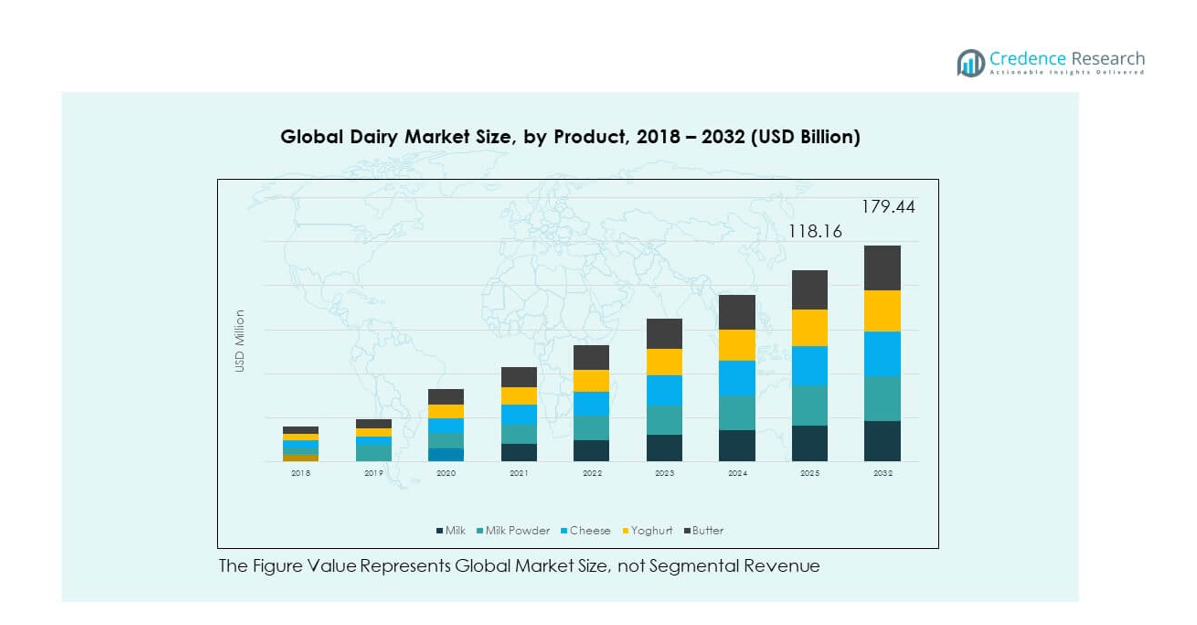

The North America Dairy Market size was valued at USD 81.49 billion in 2018 to USD 111.82 billion in 2024 and is anticipated to reach USD 179.44 billion by 2032, at a CAGR of 6.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Dairy Market Size 2024 |

USD 111.82 billion |

| North America Dairy Market, CAGR |

6.20% |

| North America Dairy Market Size 2032 |

USD 179.44 billion |

The market is driven by increasing consumer demand for nutrient-rich and high-quality dairy products, supported by rising health awareness and shifting dietary preferences toward protein-rich and functional foods. Growth in lactose-free and organic dairy offerings caters to evolving consumer needs, while innovation in flavors, formats, and packaging further enhances appeal. Expanding retail channels, including e-commerce platforms, enable wider product accessibility. Additionally, advancements in cold chain logistics and sustainable production practices are strengthening the market’s resilience and growth potential.

Geographically, the United States dominates the market due to its strong dairy production infrastructure, established brands, and high per capita dairy consumption. Canada is emerging as a significant contributor, driven by increasing demand for premium and specialty dairy products. Mexico shows promising growth potential, supported by a rising middle-class population and expanding retail networks. The market’s regional dynamics are shaped by diverse consumer preferences, regulatory frameworks, and advancements in production technologies across these countries.

Market Insights:

- The North America Dairy Market was valued at USD 111.82 billion in 2024 and is expected to reach USD 179.44 billion by 2032, growing at a CAGR of 6.20%.

- The Global Dairy Market size was valued at USD 472.9 billion in 2018 to USD 665.6 billion in 2024 and is anticipated to reach USD 1,105.6 billion by 2032, at a CAGR of 6.61% during the forecast period.

- Rising consumer demand for nutrient-rich and functional dairy products is driving market expansion.

- Increasing adoption of lactose-free and premium dairy offerings is boosting product diversification.

- Fluctuating raw material costs and supply chain disruptions pose challenges to consistent profitability.

- The United States holds 68% of the regional share, supported by advanced dairy infrastructure and high per capita consumption.

- Canada’s 21% share is driven by premium dairy production and strong regulatory quality standards.

- Mexico’s growing middle class and expanding retail networks are accelerating demand for packaged dairy products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Driver

Rising Demand for Nutrient-Dense and Functional Dairy Products

The North America Dairy Market benefits from the growing consumer preference for nutrient-rich foods that contribute to health and wellness. Consumers are increasingly aware of the role dairy plays in providing essential proteins, calcium, and vitamins. It is also supported by the shift toward functional foods that offer added health benefits, such as probiotics in yogurts. The rise in fitness culture and sports nutrition trends has boosted demand for high-protein dairy snacks and beverages. Companies are innovating with fortified milk and low-fat dairy products to align with these health trends. Urban populations with busy lifestyles seek convenient, ready-to-consume dairy options. This has increased the adoption of portable dairy-based drinks and snack packs. The rising health-conscious population ensures consistent growth in premium dairy segments.

- For example, Nestlé has developed a proprietary protein aggregation technology that lowers the fat content in milk powder by up to 60% while maintaining its taste, texture, and creamy mouthfeel, enabling the production of healthier, lower-calorie dairy products.

Expansion of Lactose-Free and Plant-Integrated Dairy Alternatives

The market is gaining from the rising number of lactose-intolerant consumers seeking digestible dairy options. Producers have introduced lactose-free milk, cheese, and yogurt variants to meet this demand. The North America Dairy Market has also adapted by blending plant-based ingredients with dairy to create hybrid products. It is attracting consumers who want the nutritional profile of dairy but reduced lactose content. Retailers are increasing shelf space for these premium alternatives, boosting visibility and accessibility. The growth of health-oriented grocery chains further strengthens this segment. Product diversification within lactose-free offerings, including flavored options, is expanding the consumer base. This diversification helps brands capture both health-focused and taste-driven buyers.

Technological Advancements in Dairy Processing and Cold Chain Infrastructure

Advances in dairy processing technologies have improved product shelf life, safety, and flavor retention. The North America Dairy Market leverages automation in production to increase efficiency and maintain consistent quality. It benefits from innovations in cold chain logistics that ensure products reach consumers in optimal condition. Enhanced packaging technologies have extended freshness, supporting wider distribution across the region. Producers can now explore more export opportunities due to these logistical improvements. Retailers rely on temperature-controlled supply chains to stock a broader range of fresh dairy products. These advancements help reduce waste, improve customer satisfaction, and enhance profitability. Continuous investment in automation and preservation ensures competitiveness in the global dairy sector.

Growth in Retail Distribution and E-Commerce Platforms

The expansion of retail networks and online grocery platforms has transformed product accessibility. The North America Dairy Market now reaches consumers through multiple channels, including supermarkets, convenience stores, and direct-to-consumer models. It benefits from the rising popularity of subscription-based dairy delivery services. E-commerce enables brands to showcase niche and premium products to a broader audience. Online platforms also facilitate consumer education through detailed product descriptions and nutritional information. Smaller dairy producers gain visibility by listing on digital marketplaces. Retail chains are investing in refrigerated logistics for online orders, ensuring freshness on delivery. This omni-channel approach supports consistent sales growth and brand loyalty.

- For instance, Amazon Fresh provides same-day delivery of perishable products, including dairy, in over 1,000 U.S. cities and aims to expand service to more than 2,300 cities by the end of the year.

Market Trends

Premiumization of Dairy Products with Gourmet and Specialty Offerings

The North America Dairy Market is experiencing an increase in demand for gourmet and specialty dairy products. Consumers are seeking artisanal cheeses, premium butter, and heritage milk varieties. It benefits from the rising interest in authentic, locally sourced, and traditionally crafted products. Farmers and small-scale producers are capitalizing on this trend by marketing origin-specific dairy goods. This shift encourages brands to invest in storytelling and transparent sourcing. Specialty stores and upscale supermarkets are dedicating more space to such premium items. The trend supports higher profit margins while appealing to food enthusiasts. The growth in food tourism and culinary experimentation further fuels this premium segment.

- For instance, Marin French Cheese Company, the oldest continuously operating cheese producer in the United States, reflects this trend, with Marin and Sonoma counties producing nearly 8 million pounds of artisan cheese annually across 22 commercial plants, each generating between 1,500 and 3 million pounds.

Sustainability and Ethical Production Driving Consumer Preferences

Sustainability initiatives are influencing purchasing patterns across the dairy sector. The North America Dairy Market is seeing increased adoption of eco-friendly packaging and ethical sourcing practices. It benefits from consumer demand for products produced with reduced environmental impact. Dairy farms are adopting renewable energy, water conservation methods, and waste reduction systems. Certification labels highlighting ethical treatment of animals and sustainable farming practices add brand value. Retailers are promoting these attributes as part of their marketing strategies. This shift is creating a competitive edge for brands with transparent sustainability commitments. Environmentally conscious buyers are becoming a loyal customer base for these responsible producers.

- For instance, Hilmar Cheese Company reuses 250,000 gallons of water daily at its processing facility through an advanced reclamation system, while Perry’s Ice Cream Company has boosted fleet fuel efficiency by 36% since 2010 under the EPA’s SmartWay Transport Partnership.

Innovation in Flavors, Formats, and Nutritional Profiles

Product innovation is diversifying consumer choices and boosting market engagement. The North America Dairy Market is introducing unique flavors and novel formats in milk, yogurt, and cheese. It is experimenting with superfood-infused dairy and exotic fruit blends. High-protein, low-sugar, and fortified dairy options cater to specific health needs. Seasonal and limited-edition offerings create excitement and drive repeat purchases. Innovative packaging, such as single-serve pouches and resealable cartons, enhances convenience. These innovations also help brands differentiate in a competitive marketplace. The approach encourages consumer trial and builds brand identity through creativity.

Digital Marketing and Consumer Engagement Shaping Brand Loyalty

Digital platforms are playing a pivotal role in shaping dairy consumption patterns. The North America Dairy Market is leveraging social media campaigns, influencer partnerships, and interactive content to connect with consumers. It is using digital tools to educate buyers about nutritional benefits and product origins. Personalized recommendations based on purchase history are enhancing customer experiences. Online contests, recipe sharing, and loyalty programs drive engagement. Brands are using analytics to track trends and tailor marketing efforts effectively. E-commerce integration with targeted advertising ensures visibility among the right audiences. This digital shift is strengthening relationships between dairy brands and their customers.

Market Challenges Analysis

Fluctuating Raw Material Costs and Supply Chain Disruptions

The North America Dairy Market faces challenges from volatility in feed, energy, and labor costs. It is impacted by weather-related disruptions affecting milk production volumes. Price fluctuations in raw milk can affect profit margins for producers and processors. Supply chain interruptions, including transportation delays, can hinder timely product delivery. Import-export restrictions and regulatory shifts also create uncertainty. Dairy producers must navigate these challenges while maintaining competitive pricing. The complexity of sourcing high-quality ingredients adds further strain on operational efficiency. Cost management strategies and diversified sourcing are essential for stability in this market.

Shifting Consumer Preferences and Competitive Pressure from Alternatives

The rise of plant-based milk and dairy alternatives is reshaping consumer purchasing habits. The North America Dairy Market must adapt to evolving dietary choices and ethical concerns. It is under pressure to offer innovative products that meet health-conscious and sustainability-driven demands. Competition from non-dairy segments reduces market share for traditional dairy categories. Brands must invest in R&D to stay relevant and differentiate their offerings. Misconceptions about dairy nutrition in some consumer segments can hinder growth. Effective communication of health benefits is essential to counter these trends. The market’s ability to adapt will determine its resilience in the long term.

Market Opportunities

Expansion in Functional and Health-Oriented Dairy Segments

The North America Dairy Market has opportunities in developing products that address specific health needs. It is positioned to introduce dairy enriched with probiotics, omega-3, and vitamins targeting wellness-focused consumers. Growing interest in immune health, gut health, and active lifestyle support presents growth potential. Functional dairy beverages and snacks can attract new demographics, including younger health-conscious buyers. Retailers are receptive to stocking these premium and value-added offerings. Product differentiation in this space can create strong brand positioning. Partnerships with nutritionists and fitness influencers can further enhance market penetration.

Leveraging Export Potential and Premium Global Demand

International markets are showing interest in high-quality North American dairy products. The North America Dairy Market can benefit from promoting its strong safety standards and quality control. It is well-placed to expand exports of premium cheese, butter, and milk powders. Trade agreements and improved logistics open new distribution channels abroad. Targeting markets with growing middle-class populations offers long-term opportunities. Brand recognition for authenticity and quality can support global expansion. Diversifying export portfolios reduces reliance on domestic demand cycles. Strategic branding can position North American dairy as a premium choice in international markets.

Market Segmentation Analysis:

The North America Dairy Market is segmented

By product into milk, milk powder, cheese, yoghurt, butter, and other dairy products. Milk holds a dominant share due to its widespread consumption in households and foodservice channels, supported by innovations in flavored, fortified, and lactose-free variants. Milk powder is in demand for its extended shelf life and use in confectionery, bakery, and infant nutrition. Cheese consumption is rising, driven by premium artisanal varieties and strong integration into culinary traditions. Yoghurt growth is supported by the popularity of probiotic-rich and high-protein formulations, while butter benefits from demand in bakery and gourmet cooking. The ‘other’ category includes value-added products such as cream, condensed milk, and dairy-based desserts, catering to niche and specialty markets.

- For example, Fairlife milk, Coca-Cola’s ultra‑filtered, high‑protein, and lactose‑free dairy product, reached an estimated 34 million U.S. households in 2023, representing approximately 25% of all U.S. households

By animal segment, the market is divided into cow, buffalo, goat, camel, and sheep milk products. Cow milk dominates due to its large-scale production, established supply chains, and broad consumer acceptance. Buffalo milk is gaining traction in premium dairy categories, particularly in mozzarella production. Goat milk appeals to consumers seeking easier digestibility and unique flavor profiles. Camel milk is emerging as a niche segment with functional health benefits and increasing availability through specialty retailers. Sheep milk supports high-value dairy applications, including specialty cheeses and yoghurts. The diversity in animal sources allows producers to cater to evolving dietary needs, expand premium offerings, and strengthen product differentiation in competitive retail and export markets.

- For example, in the U.S., artisanal producers like Ramini Mozzarella harness water buffalo herds that yield only about 6 to 7 liters of milk per day, compared to Holstein cows, which produce around 28 liters daily.

Segmentation:

By Product Segment

- Milk

- Milk Powder

- Cheese

- Yoghurt

- Butter

- Other

By Animal Segment

- Cow

- Buffalo

- Goat

- Camel

- Sheep

By Region Segment

Regional Analysis:

The United States holds the largest share of the North America Dairy Market, accounting for 68% of the regional revenue. Its dominance is supported by advanced dairy farming infrastructure, strong processing capabilities, and a well-established distribution network. It benefits from high per capita dairy consumption and a diversified product portfolio that includes premium, functional, and organic dairy offerings. The U.S. market is also driven by strong brand presence, continuous innovation, and active adoption of sustainable production practices. Expanding exports, particularly in cheese, milk powder, and whey products, further strengthen its global position. Demand for lactose-free and value-added dairy products is steadily growing, creating new opportunities for both domestic and international brands.

Canada accounts for 21% of the North America Dairy Market, supported by its robust dairy management system and emphasis on quality over volume. It maintains strict regulatory standards that ensure premium product quality, enhancing consumer trust. It has a strong presence in niche dairy categories, including artisanal cheeses and specialty yoghurts. Seasonal demand variations influence production planning, with peak consumption during colder months. Growing interest in sustainable and locally sourced dairy is boosting sales in urban markets. Export potential is expanding, particularly in high-value dairy categories catering to health-conscious global consumers.

Mexico holds 11% of the North America Dairy Market, with growth fueled by rising middle-class incomes and changing dietary preferences. It benefits from increasing urbanization and the expansion of modern retail chains, which improve access to packaged dairy products. Demand is particularly strong for cheese, milk, and yoghurt, driven by both traditional and modern food culture influences. It faces challenges related to cold chain infrastructure in rural areas, but ongoing investments are improving supply chain efficiency. Local production is complemented by imports from the U.S., ensuring a diverse product offering. The market is also seeing growth in flavored dairy beverages and fortified products targeting younger demographics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé S.A.

- Fonterra Cooperative Group

- Royal FrieslandCampina N.V.

- Arla Foods amba

- Danone S.A.

- Lactalis Group

- Ausnutria Dairy Corporation Ltd.

- Emmi Group

- Goat Partners International Inc.

- Holle Baby Food AG

- St Helen’s Farm

- Hewitt’s Dairy

- Woolwich Dairy Inc.

- Xi’an Baiyue Goat Dairy Group Co. Ltd.

- Courtyard Farms

- Other Key Players

Competitive Analysis:

The North America Dairy Market features a mix of multinational corporations, regional cooperatives, and specialized producers competing across product segments. Leading players such as Nestlé S.A., Fonterra Cooperative Group, Danone S.A., Lactalis Group, and Arla Foods amba dominate through strong brand portfolios, advanced processing facilities, and extensive distribution networks. It is characterized by continuous product innovation, with companies launching fortified, lactose-free, and premium dairy products to meet evolving consumer preferences. Strategic mergers, acquisitions, and partnerships are expanding market reach and diversifying product offerings. Investments in sustainable farming practices, eco-friendly packaging, and supply chain optimization are enhancing competitive positioning. Digital marketing and e-commerce integration are further strengthening brand visibility and consumer engagement.

Recent Developments:

- In August 2025, Dairy Farmers of America (DFA) acquired W&W Dairy, a Wisconsin-based business specializing in Hispanic cheeses. The move, which includes all W&W Dairy brands and operations, is set to expand DFA’s footprint in one of the fastest-growing cheese categories in the U.S., responding to the increasing demand for diverse dairy offerings.

- In June 2025, the US Dairy Export Council (USDEC) and the National Milk Producers Federation (NMPF) joined forces with major Mexican dairy sector organizations to renew a comprehensive partnership at their annual summit in Madison, Wisconsin. The renewed agreement targets key areas such as the defense of common cheese names, science-based trade policies, enhancing animal health coordination, and driving sustainability across both industries.

- In May 2025, Nestlé S.A. expanded its North American portfolio by launching a new line under its DiGiorno brand: wood fired style crust pizzas, aimed at catering to changing consumer demands for premium at-home meal experiences. Around the same period, Nespresso (a Nestlé brand) unveiled its summer 2025 collection in North America, featuring new coffee flavors and limited-edition accessories, reflecting the company’s focus on product innovation and consumer personalization.

Market Concentration & Characteristics:

The North America Dairy Market exhibits moderate to high concentration, with top players controlling a significant share of overall revenue. It is shaped by a combination of large-scale industrial producers and niche artisanal brands catering to premium segments. Strong regulatory frameworks, high-quality standards, and established cold chain infrastructure support consistent product availability. Competitive differentiation is driven by innovation, sustainability commitments, and regional sourcing strategies. Consumer loyalty is influenced by brand reputation, product quality, and health-oriented offerings. Growth potential remains strong in specialized dairy categories, driven by changing dietary preferences and export opportunities.

Report Coverage:

The research report offers an in-depth analysis based on Product and Animal. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Dairy Market is expected to witness sustained growth driven by rising demand for functional and fortified dairy products.

- Expansion in lactose-free and plant-integrated dairy offerings will broaden the consumer base across health-conscious demographics.

- Technological advancements in processing and preservation will enhance product quality, shelf life, and export potential.

- E-commerce and direct-to-consumer models will strengthen distribution efficiency and improve access to niche dairy categories.

- Increasing focus on sustainable farming practices and eco-friendly packaging will boost brand loyalty among environmentally conscious buyers.

- Premiumization trends will accelerate demand for artisanal cheeses, specialty butters, and heritage milk products.

- Export opportunities will grow in regions seeking high-quality dairy products with strong safety and quality standards.

- Product innovation featuring unique flavors, functional ingredients, and convenient formats will attract younger consumers.

- Strategic mergers and acquisitions will enable market consolidation and portfolio diversification.

- Growing urban populations and evolving dietary patterns will support steady consumption across multiple dairy categories.