Market Overview:

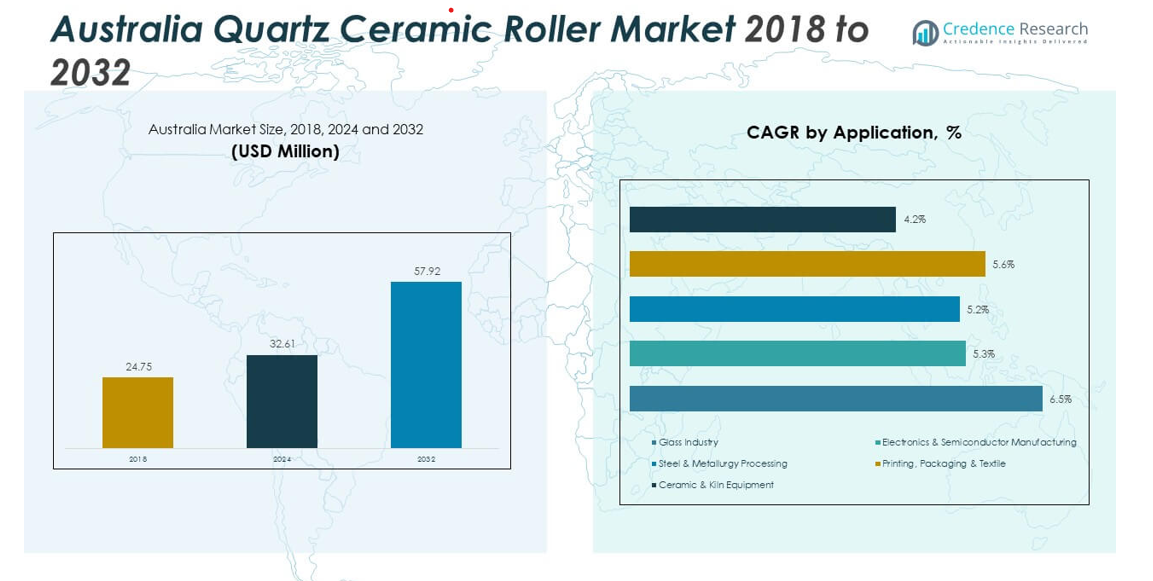

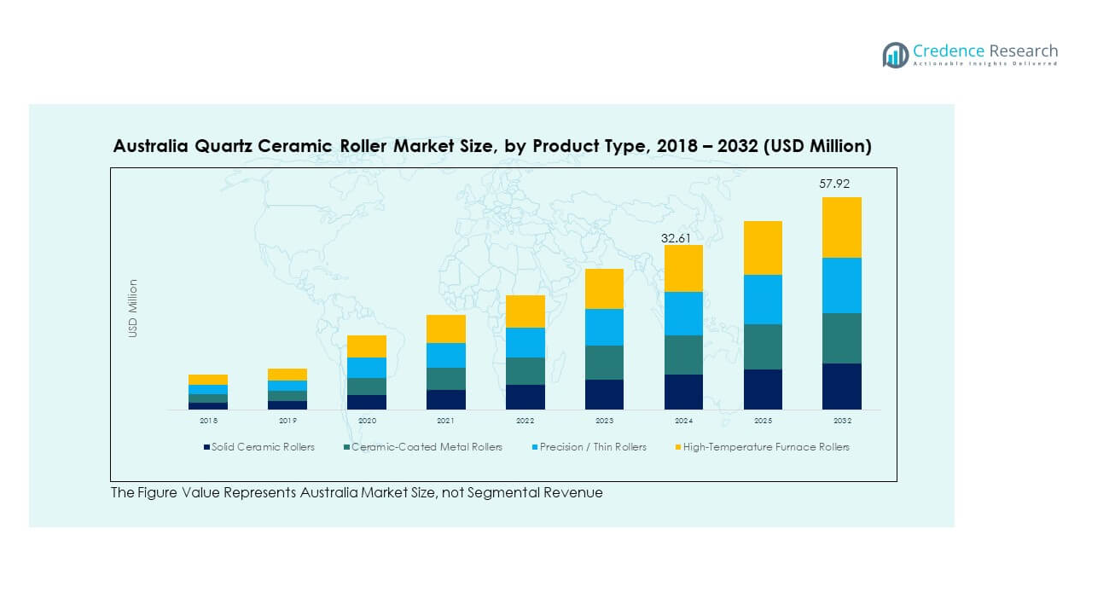

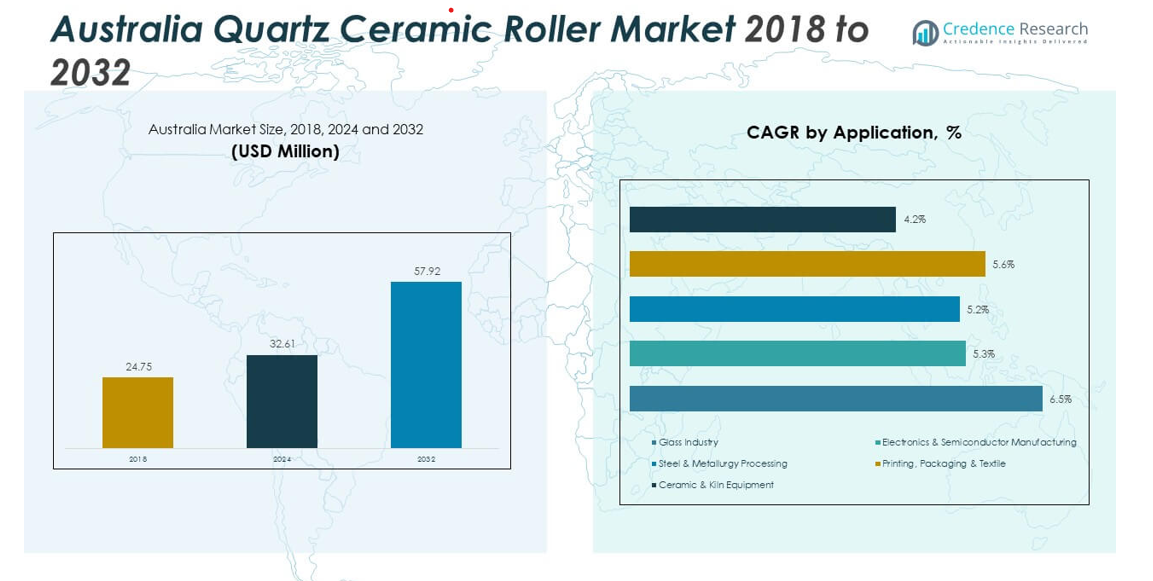

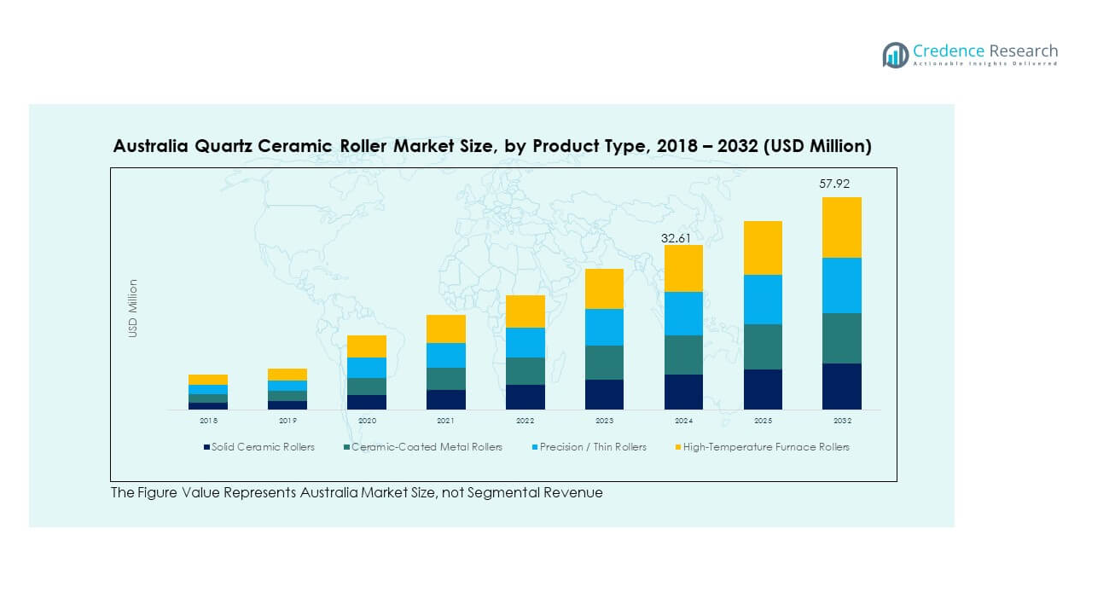

The Australia Quartz Ceramic Roller Market size was valued at USD 24.75 million in 2018 to USD 32.61 million in 2024 and is anticipated to reach USD 57.92 million by 2032, at a CAGR of 7.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Quartz Ceramic Roller Market Size 2024 |

UUSD 32.61 million |

| Australia Quartz Ceramic Roller Market, CAGR |

7.44% |

| Australia Quartz Ceramic Roller Market Size 2032 |

USD 57.92 million |

Growth in the market is driven by rising demand from glass, ceramics, and metallurgical industries. Increasing adoption of high-temperature resistant materials enhances productivity in glass tempering and industrial furnaces. Manufacturers focus on precision manufacturing, quality control, and durability to meet industrial standards. Expanding glass production capacity and the shift toward energy-efficient technologies further strengthen market growth across the country.

Regionally, New South Wales and Victoria lead the market due to strong industrial infrastructure and glass manufacturing clusters. Queensland and Western Australia are emerging markets with rising investments in building materials and metallurgical processes. Growing adoption of advanced ceramic technologies in industrial zones supports overall expansion across southern and eastern regions.

Market Insights:

- The Australia Quartz Ceramic Roller Market was valued at USD 24.75 million in 2018, increased to USD 32.61 million in 2024, and is expected to reach USD 57.92 million by 2032, growing at a CAGR of 7.44% during the forecast period.

- New South Wales held the largest share at 34%, followed by Victoria at 24% and Queensland at 16%. Their dominance stems from strong glass and ceramic manufacturing infrastructure and advanced industrial processing clusters.

- Western Australia emerged as the fastest-growing region with 11% share, driven by metallurgical expansion, renewable energy investments, and the setup of high-temperature material production facilities.

- By product type, Solid Ceramic Rollers accounted for 33% of total revenue in 2024, supported by their superior heat resistance and longer operational life.

- Ceramic-Coated Metal Rollers represented 27% of the market, showing steady adoption in industrial furnaces requiring improved durability and cost-effective thermal control.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from the Glass and Ceramic Manufacturing Industry

The Australia Quartz Ceramic Roller Market is driven by growing demand from glass and ceramic manufacturers seeking high-performance thermal materials. Quartz ceramic rollers deliver superior resistance to heat, corrosion, and wear during glass tempering and tile production. It benefits industries requiring precise temperature control and smooth surface finishing. The market gains strength from expanding architectural and automotive glass production. Rapid construction growth across urban centers increases glass demand in façades and interiors. Rising consumption of processed ceramic materials also boosts usage. Technological upgrades in furnace systems promote the replacement of metal rollers with ceramic alternatives.

- For instance, Walshs Glass in Western Australia upgraded its glass tempering lines with Glaston’s Roller Heat Control (RHC), resulting in measurable improvements in glass flatness and optical quality, as well as reduced roller wave—a key metric in glass manufacturing.

Shift Toward Energy Efficiency and Process Optimization

The market experiences strong growth from industries pursuing energy-efficient production processes. Quartz ceramic rollers reduce heat loss and improve furnace performance, supporting lower operational costs. It helps manufacturers optimize throughput and maintain consistent quality under extreme conditions. The adoption of automation in industrial furnaces increases roller demand with stable performance at high temperatures. Companies prioritize operational sustainability through reduced fuel use and emissions. Energy-conscious policies by the Australian government encourage adoption of advanced ceramics in manufacturing lines. This transition improves production precision and product life cycles.

- For instance, Visy commissioned a new A$150 million sustainable glass furnace in Sydney, featuring technology that cuts energy consumption by more than half compared to previous furnaces. This system enables enough energy savings to heat over 32,000 Sydney homes annually and supports large-scale recycled glass processing for more than 800 million glass containers each year.

Rising Industrial Modernization and Product Customization Needs

Rapid modernization across industrial sectors drives strong adoption of quartz ceramic rollers. Manufacturers aim to upgrade outdated machinery and replace metal rollers with high-durability ceramic versions. It supports industries looking for precise alignment and consistent mechanical strength in production environments. The customization trend strengthens with companies demanding rollers designed for specific applications and furnace types. Growth in smart manufacturing accelerates the integration of sensor-based roller systems for better monitoring. The emphasis on extended service life and improved temperature uniformity influences buying preferences. Investments in research and design innovation further fuel adoption.

Expanding Infrastructure and Industrial Output in Emerging Sectors

The expanding infrastructure and industrial development in Australia propel roller demand across diverse applications. The construction, energy, and metallurgical sectors increase usage to improve product quality and production speed. It supports operations needing consistent high-temperature performance and reduced maintenance downtime. Strong investment in glass plants for residential and commercial projects reinforces demand stability. The government’s focus on advanced materials manufacturing also fosters innovation in roller production. Rising awareness of ceramic material benefits strengthens buyer confidence. Companies seek durable, corrosion-resistant products to support long-term industrial operations.

Market Trends:

Integration of Advanced Manufacturing and Precision Engineering Techniques

The Australia Quartz Ceramic Roller Market shows a strong trend toward adopting precision engineering and automated fabrication. Manufacturers invest in CNC and laser-based systems to achieve consistent roller dimensions and surface finishing. It ensures minimal thermal distortion and improved uniformity during high-temperature operations. The integration of digital control and AI-based monitoring enhances manufacturing efficiency. Demand for low-maintenance, high-endurance rollers supports design innovation. Companies utilize advanced sintering and coating processes for better durability. These developments elevate production standards and ensure repeatable quality across product lines.

Sustainability Focus and Shift to Eco-Friendly Manufacturing Practices

Growing emphasis on sustainable production influences the market toward low-emission and recyclable materials. Manufacturers are investing in cleaner processes to reduce energy use and waste output. It supports environmental compliance and brand differentiation in domestic and export markets. The introduction of eco-efficient furnaces complements the use of quartz ceramic rollers with extended lifespan. Green building standards further increase demand for glass processed using sustainable rollers. Suppliers align with circular economy goals by improving material reuse efficiency. The trend drives market evolution toward greener manufacturing ecosystems.

- For instance, Visy’s new facility in Penrith not only utilizes advanced recycled cullet preheating but also incorporates recycled content for an average of 70% across bottles, aligning with landfill avoidance and corporate sustainability commitments.

Rising Automation and Digital Monitoring in Production Processes

Automation and smart monitoring systems are transforming how rollers operate in industrial settings. Digital sensors embedded within quartz ceramic rollers monitor performance in real time. It improves process control, temperature balance, and production reliability. The adoption of Industry 4.0 practices enhances predictive maintenance and energy savings. Manufacturers integrate cloud analytics to optimize roller life cycles and detect early wear patterns. This digital shift supports precision-driven applications in glass and steel manufacturing. Demand for intelligent rollers grows rapidly among high-capacity production units.

Increased Investment in High-Temperature Applications Across Industries

Rising investment in advanced high-temperature processing systems stimulates demand for quartz ceramic rollers. Industries such as metallurgy, electronics, and solar glass rely on rollers capable of withstanding extreme thermal stress. It supports uniform heating and consistent product output. Continuous expansion of heat-treatment facilities boosts product consumption. Technological advances in refractory materials extend roller longevity. Manufacturers focus on developing compositions that enhance oxidation and creep resistance. These advancements solidify the market’s technological maturity and competitive edge.

Market Challenges Analysis:

High Production Costs and Limited Local Manufacturing Capabilities

The Australia Quartz Ceramic Roller Market faces constraints due to high material and production costs. Manufacturing involves complex sintering and shaping processes that require advanced equipment and skilled labor. It limits domestic output and raises dependency on imports from Asia and Europe. Fluctuating energy prices increase production expenses and affect pricing stability. The small number of specialized producers leads to longer supply cycles. Transportation costs for heavy ceramic components further elevate total project costs. These challenges restrict local competitiveness and hinder large-scale adoption.

Supply Chain Dependence and Technological Barriers in Product Innovation

Strong reliance on imported raw materials and machinery creates supply vulnerabilities in the market. Delays in international logistics affect timely product delivery to end users. It slows project execution in glass and metallurgy sectors that depend on consistent roller availability. Limited in-house R&D capabilities hinder innovation in thermal coatings and design optimization. Smaller firms struggle to adopt new manufacturing technologies due to capital constraints. The absence of large-scale production hubs impacts standardization. Overcoming these barriers requires collaboration between industry and research institutions to build localized value chains.

Market Opportunities:

Expansion of Advanced Glass and Metal Processing Industries

The growing establishment of advanced glass and metal processing facilities in Australia creates new opportunities for quartz ceramic roller suppliers. The shift toward automation and energy-efficient systems enhances product demand in both new and retrofit projects. It encourages partnerships between domestic producers and international material technology firms. Rising investments in high-end construction and automotive sectors increase consumption of precision rollers. Emerging renewable energy applications, including solar glass manufacturing, further open profitable avenues for growth.

Development of Regional Manufacturing and Export Capabilities

Australia’s focus on strengthening local manufacturing and export capacity supports market expansion. Establishing new production plants for quartz ceramics can reduce import dependency. It allows for faster delivery times and improved quality assurance. Collaboration with research organizations can accelerate innovation in roller coatings and design. Regional production also enables cost control and tailored product development for nearby Asia-Pacific markets. This strategic shift positions Australia as a potential hub for advanced ceramic roller manufacturing.

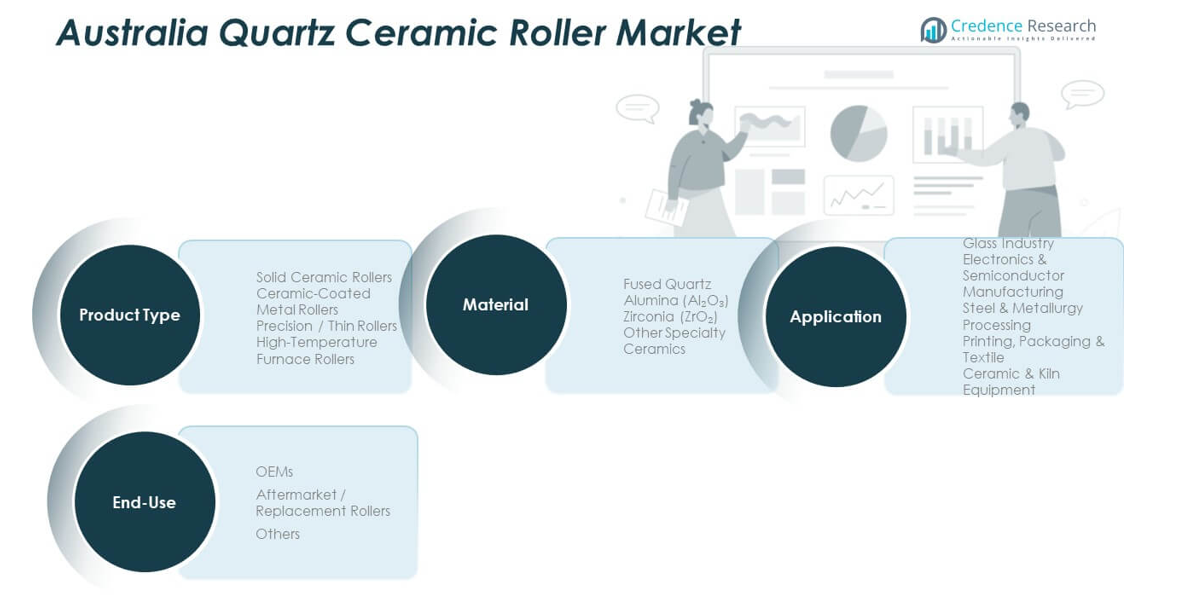

Market Segmentation Analysis:

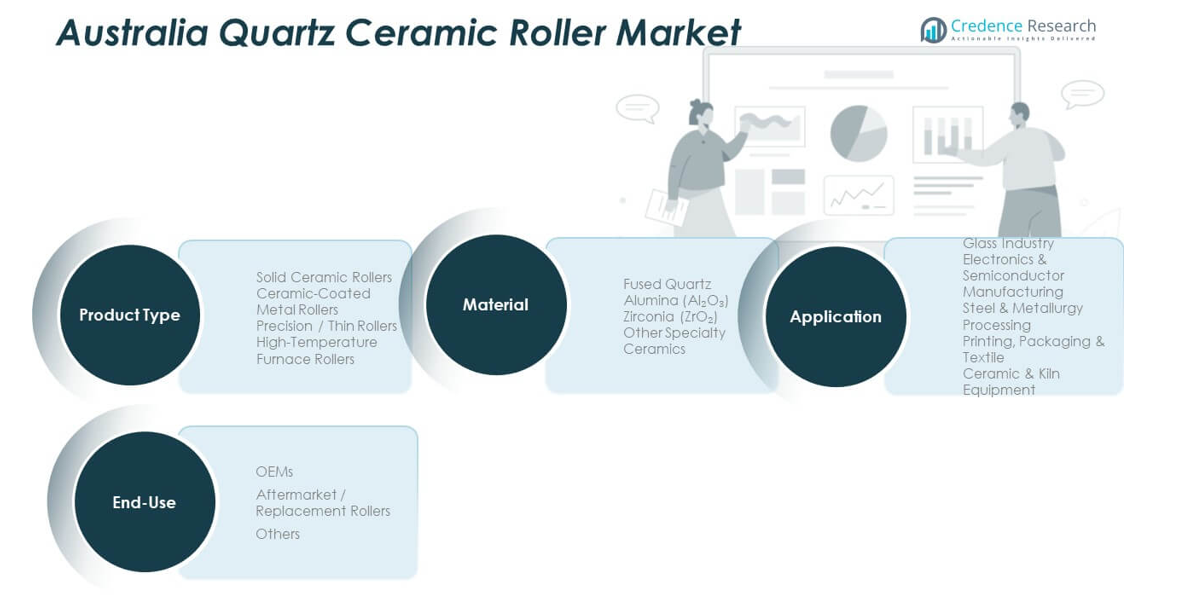

By Product Type

The Australia Quartz Ceramic Roller Market is segmented into Solid Ceramic Rollers, Ceramic-Coated Metal Rollers, Precision/Thin Rollers, and High-Temperature Furnace Rollers. Solid Ceramic Rollers dominate due to superior durability and high-temperature resistance in glass and metal processing. Ceramic-Coated Metal Rollers gain traction for their cost efficiency and corrosion protection. Precision/Thin Rollers cater to applications needing dimensional accuracy and smooth surface finishing. High-Temperature Furnace Rollers are preferred for continuous glass production lines requiring extreme heat stability and reduced maintenance downtime.

- For instance, global suppliers like Saint-Gobain and Morgan Advanced Materials deliver products for Australia with tailored properties for high-temperature, high-wear environments in glass and steel processing, supported by documented R&D in modular assemblies and process-specific roller solutions.

By Application

Key applications include the Glass Industry, Electronics & Semiconductor Manufacturing, Steel & Metallurgy Processing, Printing, Packaging & Textile, and Ceramic & Kiln Equipment. The Glass Industry leads due to expanding architectural and automotive glass production. Electronics and semiconductor segments show rising demand for rollers ensuring clean, contamination-free operations. Steel and metallurgy units utilize these rollers for thermal uniformity, while ceramics and textile industries benefit from their precision and long lifespan.

- For instance, TECHCET reported in 2025 that hot-fabricated quartz parts, including rollers, are increasingly adopted in semiconductor plants as they enable higher-precision, contamination-free handling crucial for advanced chip manufacturing.

By End-Use

End-use categories include OEMs, Aftermarket/Replacement Rollers, and Others. OEMs represent the major share with high-volume procurement for new furnace systems. The aftermarket segment is growing rapidly, driven by frequent replacement needs in high-use industrial environments.

By Material

By material, the market includes Fused Quartz, Alumina (Al₂O₃), Zirconia (ZrO₂), and Other Specialty Ceramics. Fused Quartz leads due to its thermal shock resistance and purity. Alumina offers high mechanical strength, while Zirconia supports extreme durability under repeated heating cycles. Specialty ceramics serve niche industrial applications requiring custom performance attributes.

Segmentation:

- By Product Type

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

- By Application

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

- By End-Use

- OEMs

- Aftermarket / Replacement Rollers

- Others

- By Material

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

Regional Analysis:

Dominance of New South Wales and Victoria

The Australia Quartz Ceramic Roller Market is led by New South Wales and Victoria, which together account for nearly 58% of the total market share in 2024. These regions host major glass and ceramic manufacturing facilities supported by strong industrial infrastructure. It benefits from high investment in construction and architectural glass projects that rely on precision thermal components. Proximity to key urban centers such as Sydney and Melbourne enables efficient distribution and supply chain management. The presence of international and domestic manufacturers encourages steady product innovation. Government-backed industrial modernization programs further enhance adoption of advanced ceramic rollers across multiple processing sectors.

Emerging Growth in Queensland and Western Australia

Queensland and Western Australia collectively represent about 27% of the market share, showing strong growth potential. Expanding metallurgical and energy industries drive rising demand for high-temperature-resistant rollers. It also supports the development of new glass manufacturing units in regional industrial corridors. The growing emphasis on sustainable infrastructure and renewable energy facilities contributes to the rising need for precision rollers in processing lines. Western Australia’s mining and metallurgical base provides a stable customer segment for heat-treatment applications. Local government initiatives to diversify industrial output foster private investment in advanced materials production.

Steady Expansion in South Australia and Tasmania

South Australia and Tasmania together hold nearly 15% of the Australia Quartz Ceramic Roller Market, characterized by steady but consistent demand. These regions focus on high-value manufacturing, specialty ceramics, and research-driven material innovation. It gains momentum through university collaborations promoting advanced ceramic development and furnace efficiency testing. Smaller-scale industries in these regions prefer cost-effective ceramic rollers for limited but high-precision production processes. Growth in local manufacturing clusters enhances access to technical expertise and custom engineering services. Regional expansion is supported by strategic partnerships with national suppliers and growing export-oriented manufacturing initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M Company

- CTS Corporation

- Imerys

- Advanced Ceramic Materials

- CeramTec GmbH

- Kyocera Corporation

- NGK Insulators, Ltd.

- Saint-Gobain S.A.

Competitive Analysis:

The Australia Quartz Ceramic Roller Market is moderately consolidated, with a mix of global and domestic manufacturers competing through innovation and product differentiation. It is characterized by strong R&D investment and strategic alliances to enhance manufacturing efficiency and temperature resistance. Key players focus on expanding local distribution networks and offering customized roller solutions for glass, metallurgy, and electronics applications. Companies such as 3M, Imerys, CeramTec, Kyocera, and Saint-Gobain maintain a dominant presence through advanced material technology and sustainable production initiatives. Increasing collaboration between industry and research institutes also supports continuous product improvement.

Recent Developments:

- In September 2025, Kyocera Corporation entered into a significant partnership agreement with Kyoto Fusioneering to co-develop advanced ceramic materials for next-generation energy systems. This collaboration reflects Kyocera’s commitment to expanding its expertise in high-performance ceramics relevant to advanced manufacturing markets, such as those in Australia.

- In September 2025, NGK Insulators announced multiple partnerships focused on ceramic-based climate technologies, including collaboration with global firms for renewable energy storage and carbon capture using proprietary ceramic membrane solutions. These efforts illustrate the company’s broader strategy to innovate and expand the reach of ceramic technologies in industrial markets, including Australia.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-use, and material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising industrial modernization will expand roller demand in glass and metallurgy sectors.

- Development of energy-efficient furnaces will increase the adoption of high-temperature ceramic rollers.

- Local manufacturing capabilities are expected to reduce import dependency across Australia.

- Growing sustainability regulations will drive the shift toward eco-friendly production processes.

- Advancements in coating technology will improve roller performance and lifespan.

- Expanding semiconductor and electronics manufacturing will create new application areas.

- Strategic alliances between domestic and international firms will strengthen market competitiveness.

- Automation and precision engineering will enhance product quality and production speed.

- Continuous R&D investment will fuel innovation in fused quartz and zirconia-based rollers.

- Rising infrastructure and construction activity will sustain long-term market growth.