Market Overview

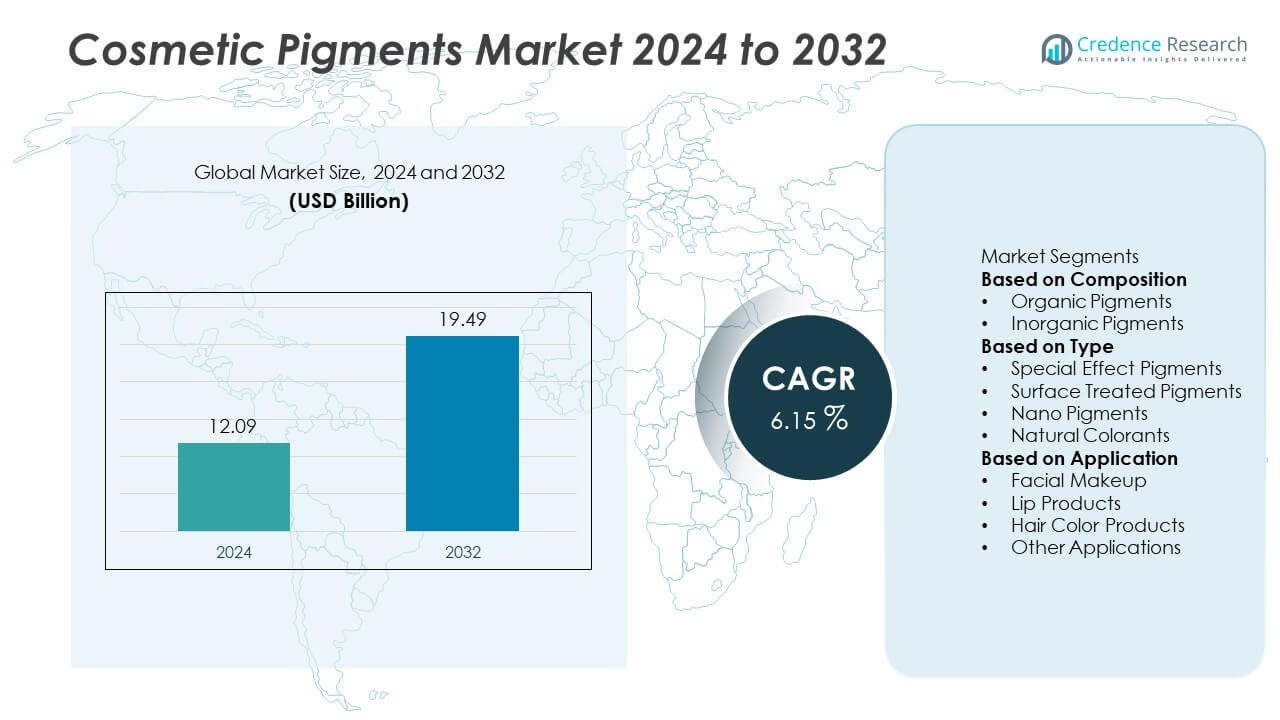

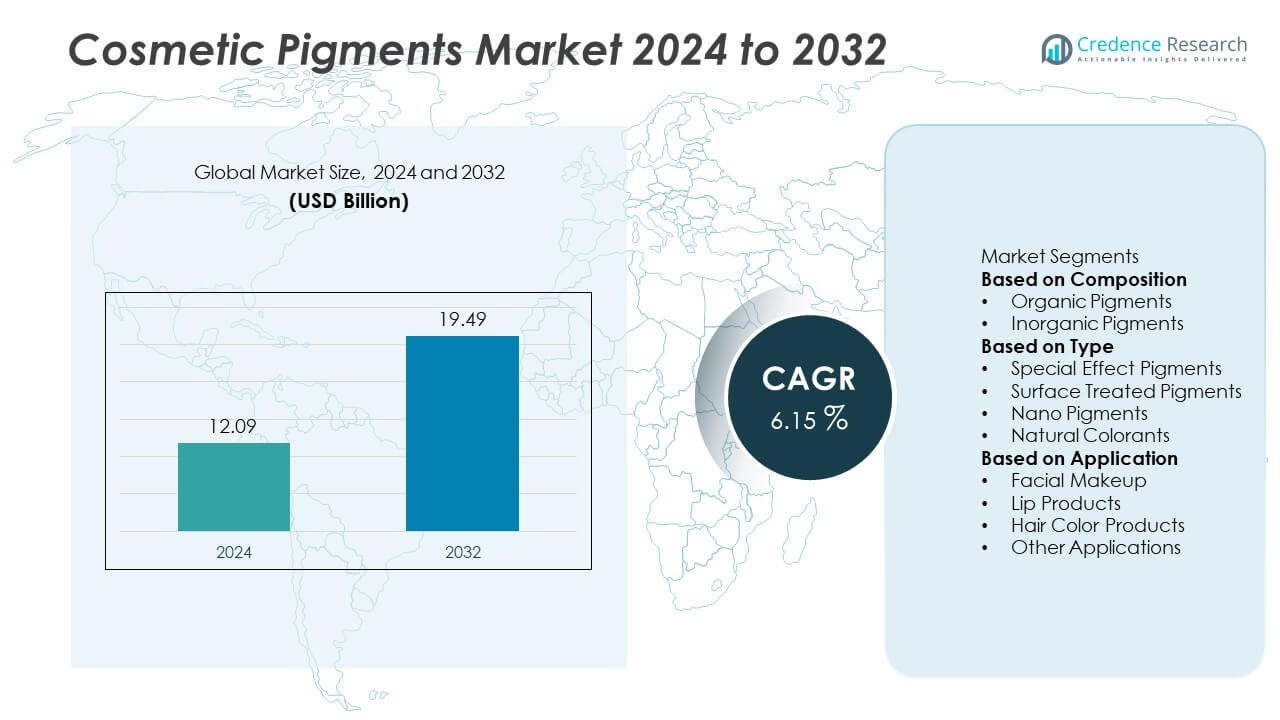

The Cosmetic Pigments Market was valued at USD 12.09 billion in 2024 and is projected to reach USD 19.49 billion by 2032, expanding at a CAGR of 6.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Pigments Market Size 2024 |

USD 12.09 Billion |

| Cosmetic Pigments Market, CAGR |

6.15% |

| Cosmetic Pigments Market Size 2032 |

USD 19.49 Billion |

The Cosmetic Pigments Market is led by major players such as Sun Chemical, Clariant, DIC Corporation, Sensient Cosmetic Technologies, Koel Colors Private Limited, Sudarshan Chemical, Neelikon Food Dyes and Chemicals Ltd., Kobo, LANXESS, and Ocres de France. These companies dominate through innovation in organic and inorganic pigment formulations tailored for various cosmetic applications. Asia-Pacific emerged as the leading region in 2024, holding a 37% market share, driven by high cosmetics production and growing consumer demand for color cosmetics. Europe followed with 31%, supported by strong regulations and preference for natural pigments, while North America accounted for 28% due to high adoption of premium and long-lasting cosmetic formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cosmetic Pigments Market was valued at USD 12.09 billion in 2024 and is projected to reach USD 19.49 billion by 2032, growing at a CAGR of 6.15%.

- Rising demand for vibrant and long-lasting makeup products is driving market growth, supported by global cosmetic brand expansion and pigment innovation.

- Trends include growing adoption of natural colorants, surface-treated pigments, and nano-pigments focused on sustainability and skin safety.

- Key players such as Sun Chemical, Clariant, DIC Corporation, and Sensient Cosmetic Technologies are developing eco-friendly and high-performance pigment solutions.

- Asia-Pacific led the market with a 37% share in 2024, followed by Europe at 31% and North America at 28%; by type, special effect pigments dominated with a 42% share due to their use in premium cosmetic lines.

Market Segmentation Analysis:

By Composition

The inorganic pigments segment dominated the Cosmetic Pigments Market in 2024, holding a 59% market share. Their dominance is attributed to superior opacity, stability, and non-reactive nature, making them ideal for long-lasting cosmetic formulations. These pigments provide vibrant coloration and UV resistance, essential for facial and lip makeup. Titanium dioxide, iron oxides, and zinc oxide are commonly used for achieving consistent shade performance. The growing demand for high-coverage, mineral-based cosmetics with safe and skin-friendly ingredients continues to drive the widespread use of inorganic pigments across global cosmetic brands.

- For instance, LANXESS produces synthetic iron oxide pigments at its Krefeld-Uerdingen facility, supplying red, yellow, and black oxides under the Bayferrox and Colortherm brands. The company is the world’s largest manufacturer of synthetic iron oxides. Some of its high-performance pigments, such as those used for plastics, are processed with calcination at temperatures up to 800 °C or even above 300 °C.

By Type

The surface-treated pigments segment led the Cosmetic Pigments Market in 2024 with a 41% share. These pigments are coated with functional materials such as silicates or silicones to enhance dispersibility, texture, and adhesion in cosmetic formulations. They improve water resistance, color intensity, and smooth application in liquid and powder-based products. Manufacturers are adopting advanced coating technologies to enhance pigment performance in long-wear foundations and lipsticks. The rising demand for multifunctional and high-performance beauty products supports the continued dominance of surface-treated pigments in the global market.

- For instance, Kobo Products Inc. develops treated pigments using proprietary surface modification technologies, processing more than 1,200 pigment and filler variants annually across hydrophobic, hydrophilic, and hybrid coatings.

By Application

The facial makeup segment accounted for the largest share of 38% in the Cosmetic Pigments Market in 2024. The segment’s leadership stems from strong demand for foundations, blushers, and highlighters that offer enhanced color depth and aesthetic appeal. Cosmetic brands are integrating high-purity pigments to achieve superior texture, brightness, and photostability. The growing popularity of premium and natural-looking makeup products, along with influencer-driven beauty trends, is boosting pigment usage in facial cosmetics. Expanding innovation in nano and organic colorants further supports growth within this dominant application segment.

Key Growth Drivers

Rising Demand for Premium and Long-Lasting Cosmetics

The growing consumer preference for high-quality and long-lasting beauty products is driving the Cosmetic Pigments Market. Premium brands increasingly use advanced pigments that offer enhanced color vibrancy, UV stability, and smooth texture. These pigments provide better coverage and durability in makeup formulations. Rising disposable income and expanding beauty retail networks globally are further fueling demand. The surge in luxury and professional-grade cosmetics continues to boost pigment innovation and application across facial, lip, and eye makeup segments.

- For instance, Sun Chemical developed the Chione Electric series, featuring high-chroma, metallic-like effect pigments based on synthetic mica substrates. The line offers enhanced chroma and UV stability, ensuring longevity in premium cosmetic formulations.

Shift Toward Clean and Natural Beauty Formulations

Increasing awareness about skin safety and environmental sustainability is pushing brands toward natural and non-toxic pigments. Manufacturers are developing eco-friendly and bio-based colorants derived from minerals and plants to meet consumer expectations. Regulatory focus on reducing heavy metal and synthetic dye content in cosmetics supports this transition. The clean beauty trend, especially in North America and Europe, is accelerating the use of organic pigments. This shift aligns with the growing popularity of vegan, cruelty-free, and hypoallergenic beauty products.

- For instance, Clariant AG launched its Vita range of natural-origin surfactants and polyethylene glycols (PEGs) made from renewable carbon sources, achieving up to 100% bio-based carbon content. These products, chemically equivalent to their fossil-based versions, help save up to 85% of CO2 emissions compared to conventional routes.

Technological Advancements in Pigment Engineering

Innovation in nanotechnology, surface modification, and encapsulation techniques is transforming pigment performance. Modern pigment engineering enhances color intensity, light reflection, and dispersion, improving the overall quality of cosmetics. Companies are investing in advanced coatings that increase pigment stability and compatibility with various formulations. These technologies also enable new visual effects, such as metallic and holographic finishes. The integration of high-performance pigments into multifunctional cosmetic products continues to drive market competitiveness and product differentiation.

Key Trends & Opportunities

Growing Popularity of Special Effect and Customized Pigments

Cosmetic brands are increasingly adopting special effect pigments to offer products with unique visual appeal. Metallic, pearlescent, and iridescent pigments are being used to create shimmer and multidimensional effects. The trend toward personalized makeup and skincare products is also driving customized pigment solutions. Consumers’ interest in self-expression through color and texture is encouraging brands to launch limited-edition and custom-blend formulations, expanding opportunities in niche and premium beauty categories.

- For instance, Sudarshan Chemical Industries Ltd. produces metallic and pearlescent effect pigments under its Sumicos brand. This range includes products based on natural and synthetic mica technology. Sudarshan uses advanced coating techniques involving titanium dioxide and other metal oxides on mica to create a variety of visual effects, including superior gloss, shimmer, and chromatic shift for customized cosmetic applications.

Expansion of Digital Beauty and E-Commerce Platforms

The rapid growth of online beauty retailing is boosting pigment demand across cosmetic manufacturers. Digital platforms enable brands to reach wider audiences and promote visually appealing formulations. The rise of influencer marketing and virtual try-on tools encourages consumers to experiment with color-rich products. As online channels favor vibrant, photogenic products, pigment manufacturers are focusing on developing high-performance shades optimized for digital engagement. This trend continues to reshape marketing strategies and pigment selection in cosmetics.

- For instance, Sensient Cosmetic Technologies has innovation centers globally that develop pigments for cosmetics, including micronized iron oxides known for their color consistency. The company offers a broad portfolio of cosmetic ingredients and color solutions, enabling the creation of high-definition, camera-friendly makeup.

Key Challenges

Stringent Regulatory Compliance and Safety Standards

Cosmetic pigment manufacturers face strict regulatory requirements from agencies such as the FDA and the European Commission. Regulations limit the use of certain dyes and heavy metals, increasing the need for extensive testing and certification. Compliance adds to production costs and can delay new product launches. Maintaining safety while achieving high color intensity remains a key challenge for global suppliers, especially in emerging markets with varying regulatory frameworks.

Fluctuating Raw Material Prices and Supply Constraints

Volatility in raw material prices, particularly for titanium dioxide and iron oxides, affects production costs and market stability. Dependence on specific mineral sources and refining processes creates supply chain risks. Disruptions in mining, energy costs, or trade policies can impact pigment availability. Manufacturers are adopting recycling and alternative sourcing strategies to mitigate these challenges. However, maintaining consistent quality and affordability amid fluctuating costs remains a persistent concern across the pigment production ecosystem.

Regional Analysis

North America

North America held a 34% share of the Cosmetic Pigments Market in 2024. The region’s dominance is driven by strong demand for premium cosmetics and advanced formulations across the United States and Canada. High consumer awareness of product safety, coupled with strict regulatory standards, encourages the adoption of high-purity pigments. The presence of major beauty brands and ongoing innovation in clean and vegan colorants further boost market growth. Expanding e-commerce sales and influencer-led marketing continue to support pigment consumption in facial and lip product segments across the region.

Europe

Europe accounted for a 29% share of the Cosmetic Pigments Market in 2024. The region benefits from a mature cosmetics industry and strict EU regulations favoring sustainable, non-toxic formulations. Countries such as Germany, France, and Italy lead pigment consumption, driven by demand for luxury and natural beauty products. Growing preference for eco-friendly and biodegradable pigments aligns with the region’s strong sustainability goals. Innovation in special effect pigments for premium makeup lines and skincare hybrids further strengthens Europe’s role as a global hub for cosmetic color development.

Asia-Pacific

Asia-Pacific dominated the Cosmetic Pigments Market in 2024, capturing a 31% share. Rising disposable incomes, urbanization, and the expanding beauty and personal care industry in China, Japan, and South Korea are key growth drivers. The region’s dynamic consumer base favors vibrant, long-lasting, and skin-safe cosmetics. Local manufacturers are increasingly investing in pigment innovation and clean-label formulations to meet global standards. The rapid expansion of online retail platforms and social media-driven beauty trends continues to enhance pigment demand across mass and premium cosmetic segments.

Latin America

Latin America held a 4% share of the Cosmetic Pigments Market in 2024. The region’s growth is supported by increasing consumer spending on personal care and color cosmetics in Brazil, Mexico, and Argentina. Demand for natural and affordable beauty products is driving the use of mineral-based pigments. Expanding local cosmetic manufacturing and partnerships with global brands are strengthening market access. Growing social media influence and the popularity of regional beauty trends are further encouraging pigment adoption across makeup and skincare formulations in Latin America.

Middle East & Africa

The Middle East & Africa region accounted for a 2% share of the Cosmetic Pigments Market in 2024. Growth is driven by rising urbanization, improving living standards, and the growing popularity of premium beauty products in Gulf Cooperation Council (GCC) countries. Local consumers increasingly favor luxury cosmetics with vibrant and long-lasting pigments. In Africa, expanding beauty retail networks and international brand penetration are fueling market demand. Ongoing investments in manufacturing facilities and the shift toward halal-certified and safe pigment formulations support gradual market expansion across the region.

Market Segmentations:

By Composition

- Organic Pigments

- Inorganic Pigments

By Type

- Special Effect Pigments

- Surface Treated Pigments

- Nano Pigments

- Natural Colorants

By Application

- Facial Makeup

- Lip Products

- Hair Color Products

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cosmetic Pigments Market features key players such as Sun Chemical, Neelikon Food Dyes and Chemicals Ltd., Clariant, Koel Colors Private Limited, Sudarshan Chemical, DIC Corporation, Sensient Cosmetic Technologies, Kobo, LANXESS, and Ocres de France. These companies dominate the market through extensive product portfolios, advanced pigment technologies, and global distribution networks. Leading manufacturers focus on developing high-purity, sustainable, and non-toxic pigments that meet stringent cosmetic safety regulations. Strategic collaborations with cosmetic brands, investments in nano and surface-treated pigment innovations, and expansion into natural colorants are key competitive priorities. Companies are increasingly adopting eco-friendly production methods and digital formulation tools to enhance color consistency and reduce environmental impact. Continuous product innovation, customization capabilities, and compliance with FDA and EU cosmetic directives remain central to maintaining competitiveness and capturing growing demand from the global beauty and personal care industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Sun Chemical launched two new metallic effect pigments, Chione Electric Scarlet SR90D and Chione Electric Sienna SC90D, with high-chroma red and copper hues that are non-staining, UV-stable, and approved for cosmetics.

- In 2025, Sun Chemical introduced Chione Electric Amber SB90D, a mica-based shimmering amber pigment for vegan cosmetics, with enhanced chroma, UV stability, and non-bleeding performance.

- In 2025, LANXESS will showcase new heat-stable inorganic pigments and colorants at K 2025 in Düsseldorf, targeting demanding applications such as polymers and cosmetics.

- In 2025, Sun Chemical announced the Paliocrom Premium Orange L 2900 effect pigment (thin aluminum flake coated with iron oxide) and Lumina HD Sienna S3903V for high-definition effects, offering excellent chroma and sparkle in makeup applications.

Report Coverage

The research report offers an in-depth analysis based on Composition, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for color-rich and durable cosmetic formulations.

- Natural and bio-based pigments will gain traction as consumers shift toward sustainable beauty products.

- Nano-pigment technology will enhance texture, finish, and color intensity in high-end cosmetics.

- Manufacturers will focus on allergen-free and skin-safe pigment formulations to meet regulatory standards.

- Asia-Pacific will continue leading due to expanding beauty industries and rising disposable incomes.

- Innovation in hybrid pigments will support multifunctional cosmetic products with skincare benefits.

- E-commerce growth will boost demand for digitally marketed and customized color products.

- Collaboration between pigment producers and cosmetic brands will accelerate product development.

- Environmental regulations will encourage the replacement of heavy-metal pigments with eco-friendly alternatives.

- Continuous R&D investments will drive advancements in optical effects and long-wear pigment technologies.