Market Overview

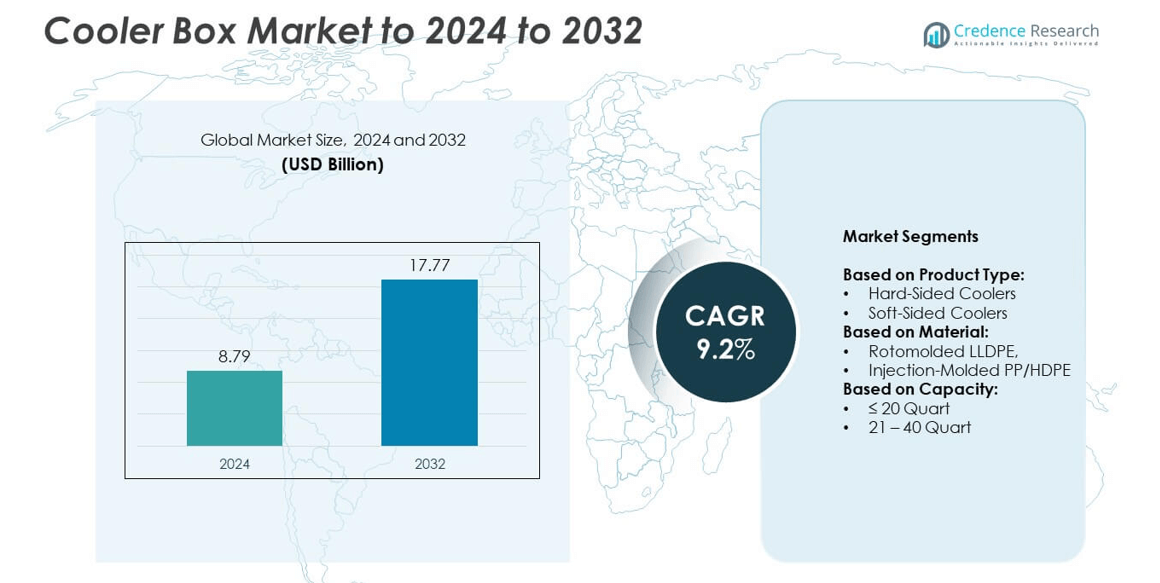

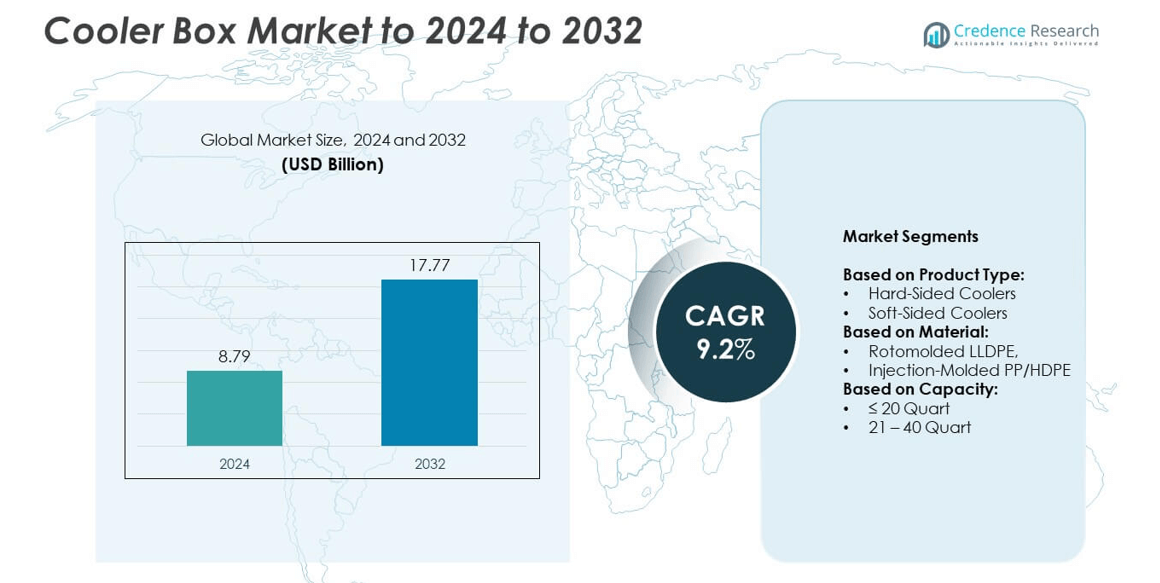

Cooler Box Market size was valued at USD 8.79 Billion in 2024 and is anticipated to reach USD 17.77 Billion by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooler Box Market Size 2024 |

USD 8.79 Billion |

| Cooler Box Market, CAGR |

9.2% |

| Cooler Box Market Size 2032 |

USD 17.77 Billion |

The Cooler Box Market is led by major players such as YETI COOLERS, Pelican Products Inc., Igloo Products Corp., Coleman, Cold Chain Technologies Inc., and Sonoco ThermoSafe. These companies dominate through strong product portfolios, technological innovation, and global distribution networks. They focus on advanced insulation materials, durable rotomolded designs, and eco-friendly manufacturing to enhance performance and sustainability. North America emerged as the leading region in 2024, accounting for 36% of the global share, driven by high demand from outdoor recreation, healthcare cold chain logistics, and food transport applications, supported by strong consumer spending and product innovation.

Market Insights

- The Cooler Box Market was valued at USD 8.79 Billion in 2024 and is expected to reach USD 17.77 Billion by 2032, growing at a CAGR of 9.2%.

- Rising demand for cold chain logistics in pharmaceuticals and food transport is a major growth driver, supported by increased outdoor recreational activities.

- Technological advancements such as rotomolded LLDPE construction and energy-efficient insulation are key market trends improving durability and performance.

- The market is moderately competitive, with players focusing on product innovation, eco-friendly materials, and expansion in premium cooler categories.

- North America led the market with a 36% share in 2024, followed by Europe at 29% and Asia Pacific at 24%, while hard-sided coolers remained the dominant segment with 63% of total sales.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Hard-sided coolers dominated the market in 2024, accounting for around 63% share. Their sturdy design, longer ice retention, and superior insulation efficiency make them ideal for outdoor activities, medical transport, and logistics. These coolers are widely used in fishing, camping, and vaccine cold chain applications. Soft-sided coolers, though lighter and more portable, cater mainly to personal and short-term use. Increasing demand for rugged, high-performance cooling solutions and rising recreational tourism are driving the growth of hard-sided coolers across both commercial and consumer sectors.

- For instance, YETI’s Hopper soft cooler often holds ice for 24 to 48 hours in warm settings.

By Material

Rotomolded LLDPE coolers held the leading position in 2024, capturing nearly 58% of the market. This material offers exceptional impact resistance, uniform wall thickness, and enhanced thermal insulation compared to injection-molded PP/HDPE variants. Rotomolded coolers are favored in heavy-duty and professional-grade applications such as marine transport, food logistics, and outdoor expeditions. Manufacturers are focusing on UV-resistant and eco-friendly formulations to improve durability and sustainability. The dominance of rotomolded LLDPE coolers is supported by growing adoption in industrial and medical cold storage uses.

- For instance, rotomolded coolers from brands like YETI often have walls with up to 2–3 inches of insulation, contributing to superior ice retention and durability.

By Capacity

The 21–40 quart segment emerged as the dominant category in 2024, holding about 46% of the market share. This range offers the ideal balance between portability and storage capacity, meeting the needs of campers, travelers, and field service operators. These coolers are popular among outdoor enthusiasts and small businesses requiring moderate cold storage. Compact size, easy handling, and multi-purpose functionality are driving their adoption. Increasing demand from healthcare logistics and food delivery sectors further reinforces the 21–40 quart segment’s leadership in the global cooler box market.

Key Growth Drivers

Rising Demand for Cold Chain Logistics

The expansion of pharmaceutical, food, and beverage sectors is driving demand for efficient cold storage solutions. Cooler boxes play a vital role in maintaining temperature-sensitive goods during transport, especially vaccines, biologics, and frozen foods. The surge in last-mile delivery and e-commerce-based grocery distribution further boosts product adoption. Companies are investing in durable, high-performance cooler boxes to meet regulatory and quality requirements for cold chain management, making this the key growth driver in the global market.

- For instance, In March 2025, Cryoport sold CRYOPDP to DHL, with a press release at the time noting that CRYOPDP handled over 600,000 annual shipments.

Growth in Outdoor Recreation and Travel Activities

Increasing participation in camping, boating, fishing, and outdoor sports is boosting cooler box demand worldwide. Consumers prefer portable, lightweight, and durable cooling solutions to preserve food and beverages during long trips. Rising disposable incomes and lifestyle changes, particularly in North America and Europe, are fueling recreational spending. The growing popularity of adventure tourism and organized outdoor events continues to create consistent demand for both hard- and soft-sided cooler boxes.

- For instance, for the 2024 Cape Town Cycle Tour, the official hydration partner, Coca-Cola Peninsula Beverages, supplied 50,000 liters of Powerade, 100,000 liters of Coca-Cola, 100,000 liters of water, and 100 tons of ice to ensure thousands of riders remained hydrated.

Technological Advancements in Product Design

Manufacturers are integrating advanced insulation materials, smart cooling technologies, and energy-efficient designs into modern cooler boxes. Rotomolded and vacuum-insulated coolers offer extended ice retention, while digital temperature control systems enhance functionality. These innovations improve product performance and user convenience across applications. Companies like YETI and Pelican are focusing on premium-grade, long-lasting models that appeal to both professionals and consumers seeking advanced cooling efficiency.

Key Trends & Opportunities

Eco-Friendly and Sustainable Materials Adoption

The shift toward eco-friendly designs presents a major opportunity for cooler box manufacturers. The use of recyclable plastics, bio-based insulation, and reduced carbon footprint processes aligns with global sustainability goals. Consumers are increasingly preferring reusable and non-toxic materials over traditional plastic-based models. This trend supports regulatory compliance and brand differentiation, positioning sustainable cooler boxes as a fast-growing product category in both developed and emerging markets.

- For instance, Newell Brands, the parent company of Coleman, is actively working to reduce its global carbon emissions and aims for carbon neutrality by 2040 for its Scope 1 and 2 emissions.

Expansion of Medical and Vaccine Storage Applications

Rising global vaccination drives and temperature-controlled medical supply chains are increasing the need for advanced cooler boxes. Healthcare organizations rely on highly insulated boxes for transporting blood samples, vaccines, and diagnostic materials. Portable cold storage solutions are essential for maintaining temperature stability in remote areas. Manufacturers are responding with WHO-approved, lightweight medical cooler boxes offering extended thermal protection, opening strong opportunities in emerging healthcare markets.

- For instance, Sure Chill vaccine refrigerators maintain safe 2–8 °C for over 10 days without power.

Key Challenges

High Product Costs and Limited Affordability

Premium-grade rotomolded cooler boxes and smart cooling systems often carry high production and retail costs. These prices limit adoption among budget-conscious consumers, especially in developing regions. The use of advanced insulation and electronic temperature control adds to overall manufacturing expenses. Balancing affordability with durability remains a major challenge for producers aiming to expand market reach without compromising performance or quality.

Availability of Low-Cost Alternatives

The presence of cheaper, low-quality substitutes hampers growth in several regional markets. Unorganized manufacturers offer basic plastic coolers at reduced prices, affecting sales of branded products. These alternatives often lack durability and thermal efficiency, yet attract price-sensitive customers. Market leaders must emphasize product quality, longevity, and brand reputation to maintain competitiveness and counter the effects of inferior substitutes in both retail and institutional segments.

Regional Analysis

North America

North America led the global cooler box market in 2024 with a 36% share. Strong demand from outdoor recreation, camping, and fishing activities drives regional growth. The U.S. and Canada dominate due to high consumer spending and advanced product adoption. Expanding pharmaceutical cold chain logistics and widespread use in food delivery strengthen market presence. Leading brands such as YETI, Pelican, and Igloo focus on durable, premium-grade models to meet rising quality expectations. Government initiatives supporting vaccine distribution and medical cold storage continue to enhance product utilization across industries.

Europe

Europe accounted for around 29% of the global cooler box market in 2024. The region’s demand is driven by sustainability-focused consumer preferences and stringent food safety regulations. Countries such as Germany, France, and the U.K. lead in adopting eco-friendly and rotomolded cooler boxes. Growth in recreational tourism, outdoor festivals, and mobile catering services supports steady sales. The European Union’s environmental policies encourage recyclable materials and low-carbon designs, stimulating product innovation. Expanding logistics and healthcare applications also contribute to Europe’s consistent market growth and technological advancement.

Asia Pacific

Asia Pacific held nearly 24% of the cooler box market in 2024, showing strong growth potential. Rapid urbanization, increased outdoor activities, and expansion in food delivery services boost product use. China, Japan, and India are key markets, with rising demand from pharmaceuticals and e-commerce cold chains. Affordable product availability and growing disposable incomes strengthen consumer adoption. Manufacturers are introducing lightweight, cost-effective models tailored to regional climate conditions. Expanding medical cold storage networks and organized retail growth continue to accelerate cooler box market expansion across Asia Pacific.

Latin America

Latin America represented about 7% of the cooler box market in 2024. Brazil and Mexico lead regional adoption, driven by outdoor recreation, fishing, and beverage transport applications. The region benefits from the growth of cold chain logistics supporting the food and healthcare industries. Increasing tourism and event-based outdoor activities enhance product demand. However, limited product affordability and the presence of unorganized manufacturers restrict market penetration. Companies are targeting mid-range cooler models to attract cost-conscious consumers and improve regional distribution networks for steady long-term growth.

Middle East & Africa

The Middle East & Africa accounted for nearly 4% of the global cooler box market in 2024. High temperatures and expanding outdoor leisure culture drive the need for durable cooling solutions. The Gulf nations lead regional consumption, supported by growing hospitality and catering sectors. Healthcare and vaccine storage applications are increasing due to international aid and government health initiatives. Market growth is slower compared to other regions due to limited product awareness and higher costs. However, rising tourism and improved logistics networks are supporting future demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type:

- Hard-Sided Coolers

- Soft-Sided Coolers

By Material:

- Rotomolded LLDPE,

- Injection-Molded PP/HDPE

By Capacity:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cooler box market features a competitive landscape led by companies such as YETI COOLERS, LLC., Pelican Products Inc., Igloo Products Corp., Coleman, Cold Chain Technologies Inc., Sonoco ThermoSafe, va-Q-tec Thermal Solutions GmbH, Sofrigam Group, B Medical System, FEURER Group GmbH, Eurobox Logistics, WILD Coolers, K2Coolers, Blowkings, Bison Coolers, and Cool Ice Box Company. The market is marked by product innovation, material advancements, and a strong focus on durability and thermal efficiency. Leading manufacturers emphasize premium-grade insulation, sustainable materials, and ergonomic designs to enhance user convenience. Intense competition encourages continuous investment in R&D to develop high-performance, lightweight, and eco-friendly solutions catering to both consumer and industrial needs. Companies are also expanding through strategic collaborations and regional distribution networks to improve market penetration. Additionally, the rising adoption of temperature-sensitive logistics in pharmaceuticals and food sectors continues to create opportunities for differentiation through technology and customization.

Key Player Analysis

- YETI COOLERS, LLC.

- Pelican Products Inc.

- Igloo Products Corp.

- Coleman

- Cold Chain Technologies Inc.

- Sonoco ThermoSafe

- va-Q-tec Thermal Solutions GmbH

- Sofrigam Group

- B Medical System

- FEURER Group GmbH

- Eurobox Logistics

- WILD Coolers

- K2Coolers

- Blowkings

- Bison Coolers

- Cool Ice Box Company

Recent Developments

- In 2025, Coleman introduced the new Coleman Pro Cooler line, a collection of hard coolers available in 25, 45, and 55 QT size designed for extreme durability and longer ice retention.

- In 2023, Cold Chain Technologies Inc. Acquired Exeltainer, an international provider of isothermal packaging solutions for the pharmaceutical industry, to expand its market presence.

- In 2022, B Medical System Announced the establishment of a new manufacturing factory in Gujarat, India, to cater to the increasing demand for certified vaccine cold chain products

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cooler box market will continue expanding with rising demand from cold chain logistics.

- Growth in outdoor leisure and adventure tourism will sustain consumer product demand.

- Adoption of eco-friendly and recyclable materials will become a major manufacturing focus.

- Technological innovations will enhance thermal efficiency and product durability.

- Expanding healthcare and vaccine distribution will drive medical-grade cooler box adoption.

- Smart and temperature-controlled cooler boxes will gain popularity in premium segments.

- Manufacturers will focus on lightweight, portable models to meet urban consumer needs.

- Asia Pacific will emerge as the fastest-growing regional market during the forecast period.

- Brand differentiation will rely on sustainability, design innovation, and digital features.

- Strategic partnerships in logistics and healthcare will boost long-term global market growth.