Market Overview

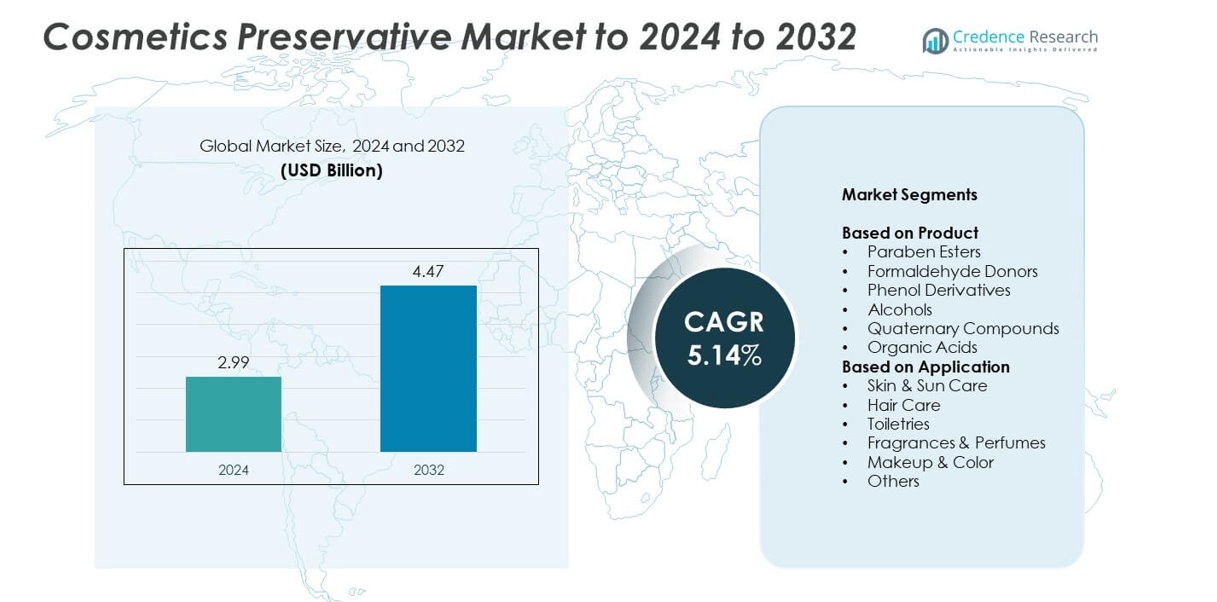

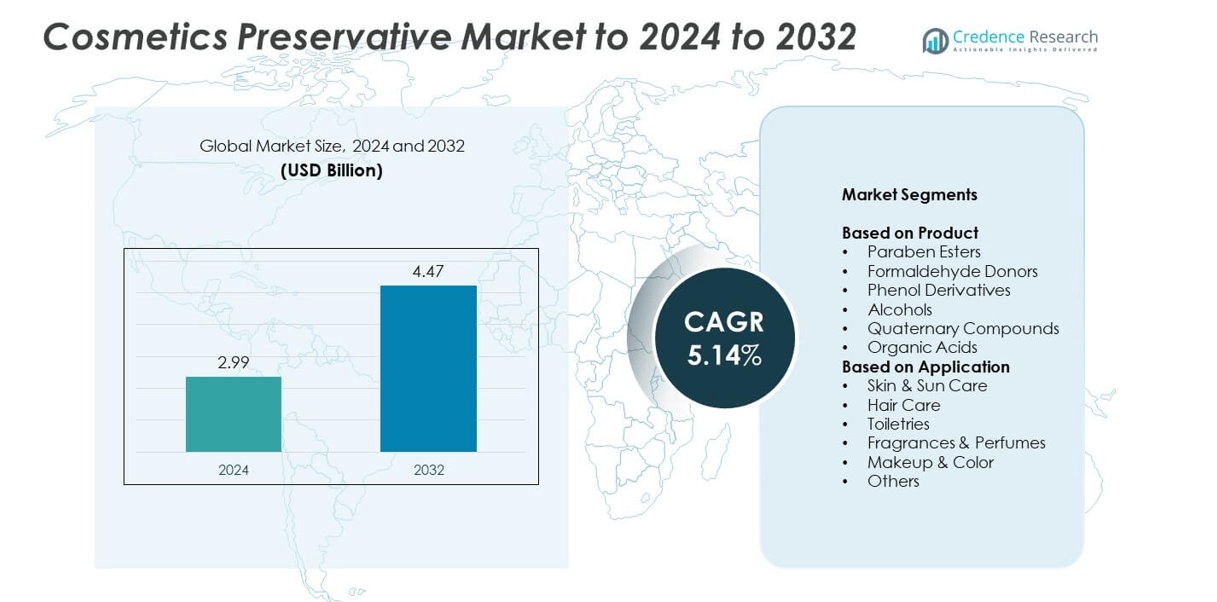

The Cosmetics Preservative Market size was valued at USD 2.99 billion in 2024 and is anticipated to reach USD 4.47 billion by 2032, at a CAGR of 5.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetics Preservative Market Size 2024 |

USD 2.99 billion |

| Cosmetics Preservative Market, CAGR |

5.14% |

| Cosmetics Preservative Market Size 2032 |

USD 4.47 billion |

The cosmetics preservative market is characterized by strong competition among leading companies such as BASF SE, Symrise, Dow, Clariant, Lonza, Arkema, Brenntag SE, THOR, CHEMIPOL S.A., Ashland, Evonik, and StruChem. These players focus on developing natural, multifunctional, and eco-friendly preservatives to meet the rising demand for clean-label and sustainable cosmetic formulations. Strategic investments in R&D and regional expansion enable them to strengthen market presence and regulatory compliance. In 2024, Asia Pacific led the global market with a 33% share, followed by North America at 29% and Europe at 27%, driven by strong personal care manufacturing bases and increasing adoption of advanced preservation technologies.

Market Insights

- The cosmetics preservative market was valued at USD 2.99 billion in 2024 and is projected to reach USD 4.47 billion by 2032, growing at a CAGR of 5.14%.

- Rising consumer preference for natural and safe ingredients drives strong demand for bio-based and multifunctional preservatives across skincare and haircare products.

- The market is witnessing trends toward clean-label formulations, biodegradable preservatives, and plant-derived antimicrobial agents that enhance sustainability.

- Leading companies focus on product innovation, regulatory compliance, and global expansion to maintain competitiveness, with paraben esters holding over 35% market share in 2024.

- Asia Pacific dominated the market with a 33% share, followed by North America at 29% and Europe at 27%, supported by expanding cosmetic manufacturing and increasing adoption of eco-friendly preservative systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Paraben esters dominated the cosmetics preservative market in 2024, accounting for over 35% of the total share. Their strong antimicrobial properties, cost-effectiveness, and broad compatibility with various formulations drive their wide adoption. Formaldehyde donors and phenol derivatives follow due to their effective preservation against bacteria and fungi. However, rising demand for natural and safer alternatives is encouraging manufacturers to develop organic acid-based preservatives. Increasing regulatory scrutiny on synthetic ingredients further pushes innovation in alcohols and quaternary compounds, fostering the growth of mild, multifunctional preservatives across cosmetic formulations.

- For instance, Arxada recommends Geogard® 221 at 0.2–1.1% in cosmetics.

By Application

Skin and sun care products held the largest share, representing nearly 40% of the cosmetics preservative market in 2024. The segment benefits from growing consumer awareness about product safety, shelf life, and microbial protection in creams, lotions, and sunscreens. Hair care and toiletries also show steady growth due to higher consumption of shampoos and conditioners with extended stability requirements. Rising use of natural and multifunctional preservatives in fragrances, perfumes, and makeup further expands market reach, driven by increasing premiumization and the demand for long-lasting, contamination-free formulations.

- For instance, LANXESS lists phenoxyethanol use at 0.4–0.6% typically, max 1%.

Key Growth Drivers

Rising Demand for Natural and Safe Preservatives

Consumers are increasingly seeking clean-label and non-toxic cosmetic formulations, driving the adoption of natural preservatives such as organic acids and plant-based antimicrobials. Stringent regulatory norms against parabens and formaldehyde donors have accelerated this transition. Brands are investing in bio-based preservatives that maintain efficacy while ensuring skin compatibility. This shift toward safety and sustainability significantly boosts innovation and product differentiation, making the demand for natural preservatives a primary growth driver for the cosmetics preservative market.

- For instance, Evonik’s dermosoft® 1388 eco has a recommended usage range of 2.0–4.0% for emulsions and surfactant-based products, with a specified effective pH range of 4.0–5.5. However, Evonik advises combining it with boosting co-actives for full antimicrobial protection in emulsions, as the product’s effectiveness is pH-dependent and can vary with the formula.

Expanding Personal Care and Beauty Industry

The rapid growth of the personal care sector, fueled by urbanization and changing lifestyles, continues to propel preservative demand. Expanding product portfolios in skincare, haircare, and makeup categories increase the need for reliable microbial protection and longer shelf life. The global rise in grooming awareness and higher disposable incomes further strengthen market expansion. This growing beauty and personal care consumption across developing economies remains a central growth driver supporting preservative adoption.

- For instance, the SharoSENSE™ Plus 181-N is recommended for use at 0.7–1.0%. Other products in the SharoSENSE™ line, particularly some of the blends based on natural-like ingredients such as maltol, offer broad-spectrum protection at a “reduced level of use” or “less than a 1% level of use”, the SharoSENSE™ Plus 785 blend, which is based on natural maltol, sorbic acid, and sodium benzoate, is also recommended for use at 0.7–1.0%.

Regulatory Influence and Product Reformulation

Global cosmetic safety regulations, including those from the EU and FDA, are driving companies to reformulate products with compliant preservatives. These guidelines promote transparency and restrict potentially harmful chemicals, creating opportunities for advanced and eco-friendly alternatives. Manufacturers are introducing multifunctional preservatives that meet both performance and regulatory standards. This compliance-driven reformulation acts as a strong market growth driver, ensuring consumer trust and product safety across global cosmetic brands.

Key Trends & Opportunities

Shift Toward Multifunctional Preservative Systems

Cosmetic formulators are adopting multifunctional preservatives that offer both antimicrobial and sensory benefits. These systems enhance product texture, stability, and fragrance while reducing the need for traditional synthetics. This trend supports cleaner labels and aligns with consumer preferences for minimal ingredient lists. Companies integrating multifunctional compounds are positioned to capture premium product segments, especially within skincare and organic cosmetics.

- For instance, Symrise reports SymOcide® PT achieves >3-log kill in 2–7 days.

Growth of Sustainable and Biodegradable Formulations

The industry is witnessing a strong shift toward eco-friendly and biodegradable preservative systems. Rising sustainability goals encourage the use of naturally derived components that reduce environmental impact without compromising product performance. R&D efforts focus on developing bio-based solutions from essential oils and plant extracts. This trend opens new opportunities for cosmetic manufacturers to align with green beauty standards and attract environmentally conscious consumers.

- For instance, Clariant’s Velsan® Flex shows RCI 93% and up to 50% preservative-load reduction.

Key Challenges

Formulation Compatibility and Stability Issues

Natural preservatives often face challenges related to stability and compatibility with complex cosmetic formulations. Factors such as pH sensitivity and limited spectrum protection restrict their effectiveness in certain applications. Manufacturers must invest in formulation science to balance preservation efficacy with sensory appeal. These technical constraints slow down market adoption of greener alternatives despite rising consumer demand.

Regulatory Restrictions on Synthetic Preservatives

Strict global regulations continue to limit the use of widely adopted synthetic preservatives, including parabens and formaldehyde donors. Reformulation to comply with these restrictions increases production costs and development time. Constantly evolving safety standards further complicate approval processes, especially for international launches. These regulatory pressures remain a key challenge, requiring continuous adaptation and investment from market players.

Regional Analysis

North America

North America held a market share of around 29% in the cosmetics preservative market in 2024. The region benefits from high consumer awareness, stringent safety regulations, and strong demand for premium personal care products. The United States leads due to advanced formulation technologies and growing preference for paraben-free and natural preservatives. The rising popularity of clean-label beauty and organic skincare brands supports steady market expansion. Canada also contributes through its growing cosmetic manufacturing sector and sustainable ingredient sourcing, driving consistent adoption of multifunctional and eco-friendly preservatives across product categories.

Europe

Europe accounted for approximately 27% of the global cosmetics preservative market in 2024. The region’s growth is driven by strict cosmetic ingredient regulations under the European Commission and strong consumer demand for clean and vegan beauty products. Countries like Germany, France, and the United Kingdom are major contributors due to well-established personal care industries and innovation in natural preservatives. Increasing focus on sustainability and reduced use of formaldehyde donors fosters product reformulation. The region’s emphasis on ethical and cruelty-free cosmetics further accelerates the adoption of organic and biodegradable preservative systems.

Asia Pacific

Asia Pacific dominated the global market with a share of about 33% in 2024. Rapid urbanization, expanding middle-class populations, and rising grooming awareness drive strong demand for preserved skincare and haircare products. China, Japan, South Korea, and India lead production and consumption due to thriving cosmetic manufacturing sectors. Local and international brands are adopting advanced antimicrobial agents to meet growing regulatory and consumer expectations. The trend toward multifunctional and plant-based preservatives also expands the market across emerging economies, positioning Asia Pacific as the fastest-growing region for cosmetics preservation solutions.

Latin America

Latin America captured around 6% of the cosmetics preservative market in 2024. The region’s growth is fueled by increasing cosmetic production in Brazil and Mexico, supported by evolving consumer preferences for personal hygiene and skincare. Growing awareness about product safety and shelf life enhances demand for effective preservative systems. While synthetic preservatives remain prevalent due to lower cost, the gradual shift toward natural alternatives is noticeable. Expanding e-commerce beauty channels and regional manufacturing capacities are encouraging new product launches, promoting the use of multifunctional preservatives across affordable and mid-range cosmetics.

Middle East & Africa

The Middle East and Africa accounted for nearly 5% of the global cosmetics preservative market in 2024. Growth is driven by expanding urban populations, increasing disposable incomes, and rising demand for premium beauty and personal care products. Countries such as the United Arab Emirates and South Africa are leading markets due to strong retail networks and growing awareness of product safety standards. The shift toward halal-certified and sustainable cosmetics fosters innovation in mild, natural preservatives. The gradual establishment of local manufacturing hubs also strengthens market presence and regional product diversity.

Market Segmentations:

By Product

- Paraben Esters

- Formaldehyde Donors

- Phenol Derivatives

- Alcohols

- Quaternary Compounds

- Organic Acids

By Application

- Skin & Sun Care

- Hair Care

- Toiletries

- Fragrances & Perfumes

- Makeup & Color

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cosmetics preservative market is highly competitive, featuring leading participants such as BASF SE, Symrise, Dow, Clariant, Lonza, Arkema, Brenntag SE, THOR, CHEMIPOL S.A., Ashland, Evonik, and StruChem. These companies compete through continuous product innovation, regulatory compliance, and expanding portfolios that address the growing demand for natural and multifunctional preservatives. Firms focus on enhancing product efficacy, stability, and compatibility with modern formulations to meet evolving consumer expectations for clean and safe beauty products. Strategic collaborations and acquisitions strengthen global reach, while investments in biotechnology and green chemistry support the transition toward sustainable preservation systems. Manufacturers also emphasize R&D to develop mild, broad-spectrum antimicrobial agents suitable for paraben-free and eco-certified products. The industry’s competitive intensity is further shaped by regional production expansions, targeted marketing strategies, and adoption of advanced formulation technologies to maintain long-term market relevance and brand differentiation in an evolving personal care landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Symrise

- Dow

- CLARIANT

- Lonza

- Arkema

- Brenntag SE

- THOR

- CHEMIPOL, S.A.

- Ashland

- Evonik

- StruChem

Recent Developments

- In 2023, BASF launched Tinomax CC, a natural-based particle designed to optimize sunscreen formulations while also reducing stickiness and greasiness.

- In 2023, Ashland introduced Sensiva PA 40, a new bio-based preservative for natural and organic cosmetics, offering broad-spectrum protection and meeting clean-label requirements.

- In 2023, Symrise introduced two tropolone-based products, SymDiol 68T and SymOcide PT, which offer broad-spectrum antimicrobial properties.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cosmetics preservative market will expand with growing demand for natural and safe formulations.

- Companies will invest in bio-based and multifunctional preservatives to meet clean-label expectations.

- Regulatory restrictions will encourage reformulation using eco-friendly and compliant ingredients.

- Rising skincare and haircare product consumption will drive continuous preservative demand.

- Advances in formulation technology will improve preservative stability and compatibility.

- Asia Pacific will remain the fastest-growing region due to strong manufacturing capacity.

- Sustainable and biodegradable preservatives will become key product development priorities.

- Collaboration between cosmetic brands and suppliers will enhance innovation and quality.

- Growth in online cosmetic sales will increase the need for long-lasting formulations.

- Consumer focus on safety and ingredient transparency will define future market trends.