Market Overview

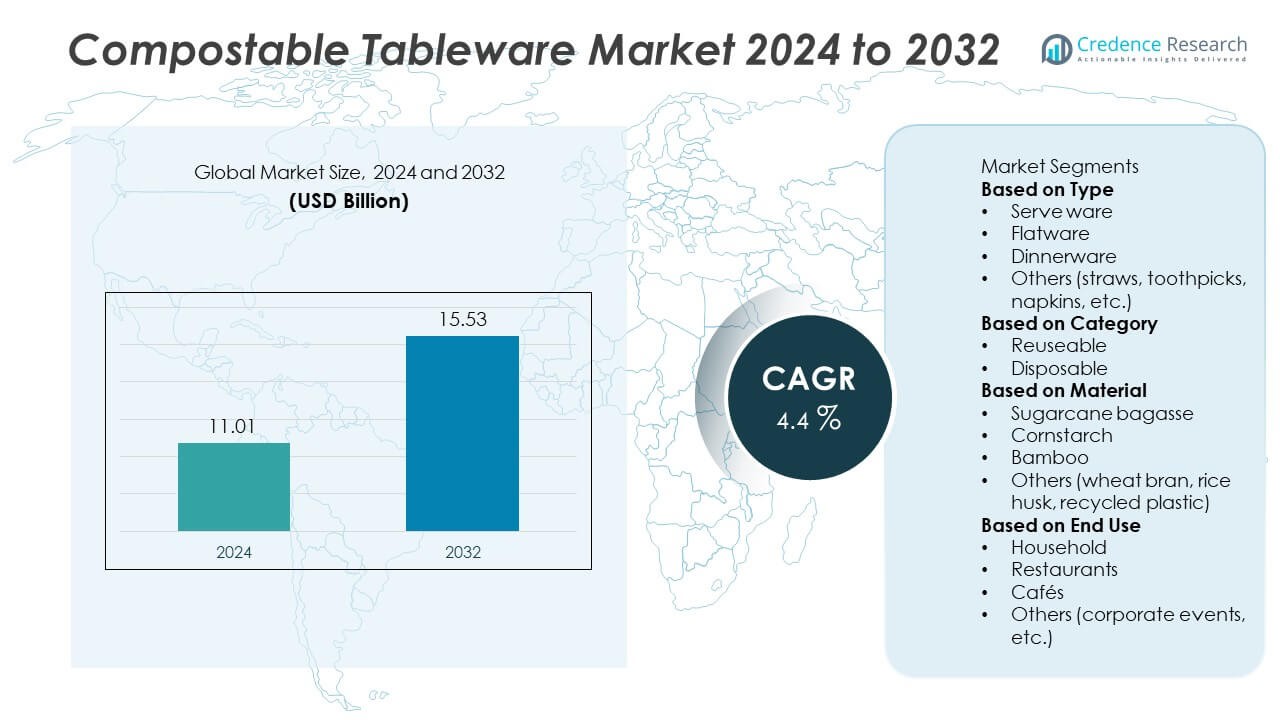

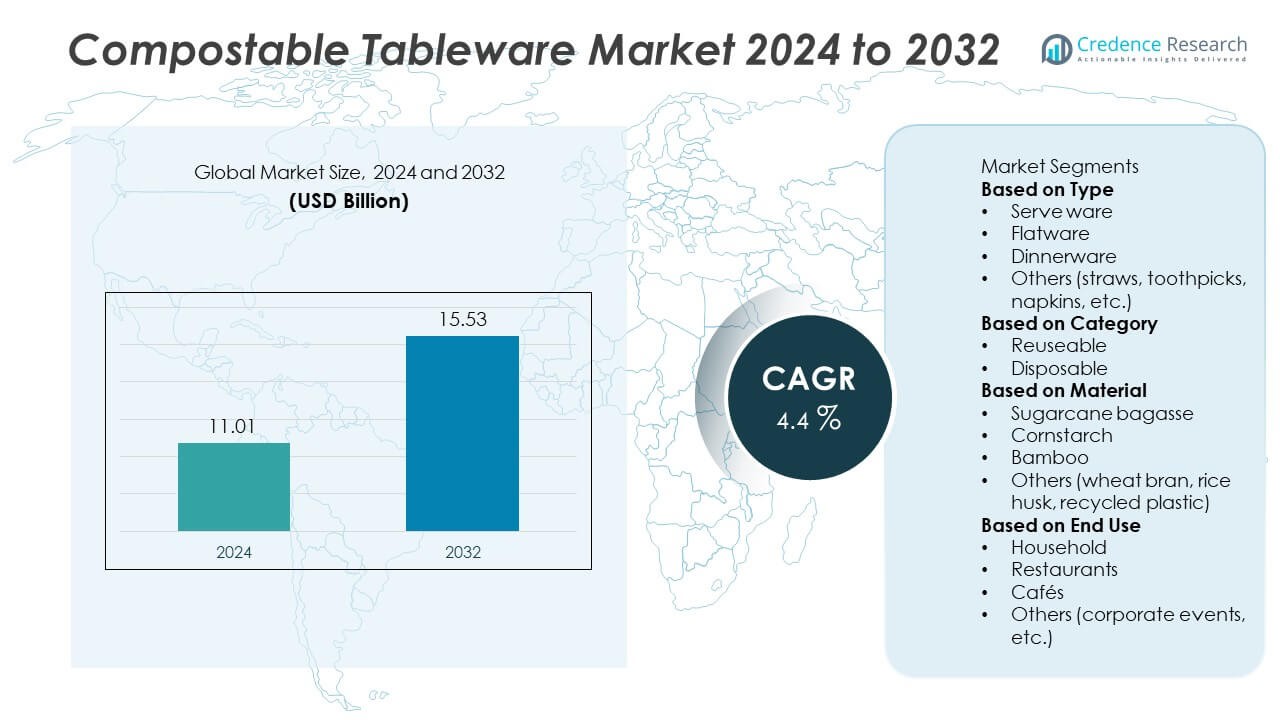

The Compostable Tableware Market was valued at USD 11.01 billion in 2024 and is projected to reach USD 15.53 billion by 2032, expanding at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compostable Tableware Market Size 2024 |

USD 11.01 Billion |

| Compostable Tableware Market, CAGR |

4.4% |

| Compostable Tableware Market Size 2032 |

USD 15.53 Billion |

The Compostable Tableware Market is led by major players such as Eco Guardian Inc, BioPak, Pactiv Evergreen Inc, PAPSTAR GmbH, Hotpack Packaging Industries LLC, Good Start Packaging, Dart Container Corporation, Eco Products, Biotrem, and Din Earth. These companies drive market growth through advanced eco-friendly designs and large-scale distribution networks. Asia-Pacific dominated the market in 2024, holding a 38% share, supported by growing foodservice demand and strong government initiatives promoting biodegradable packaging. Europe followed with 30%, driven by strict single-use plastic regulations, while North America accounted for 26%, fueled by high adoption of sustainable tableware across quick-service restaurants and catering services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Compostable Tableware Market was valued at USD 11.01 billion in 2024 and is projected to reach USD 15.53 billion by 2032, growing at a CAGR of 4.4%.

- Rising demand for sustainable packaging alternatives in foodservice and hospitality sectors is driving market growth worldwide.

- The market is witnessing strong trends toward plant-based materials such as sugarcane bagasse and bamboo for eco-friendly tableware production.

- Key players including BioPak, Eco Guardian Inc, and Pactiv Evergreen Inc focus on biodegradable innovation and recyclable product expansion to strengthen competitiveness.

- Asia-Pacific led with a 38% market share in 2024, followed by Europe at 30% and North America at 26%; by category, the disposable segment dominated with 57% share due to its growing use in quick-service restaurants and catering industries.

Market Segmentation Analysis:

By Type

The serve ware segment dominated the Compostable Tableware Market in 2024, holding a 39% market share. Its leadership stems from high usage across catering, quick-service restaurants, and food delivery applications. Compostable serve ware such as trays, bowls, and cups are preferred due to their durability, lightweight structure, and compatibility with both hot and cold foods. Increasing adoption by event organizers and food chains aiming to replace single-use plastic alternatives drives segment growth. Rising consumer awareness and regulatory support for biodegradable packaging further strengthen demand for eco-friendly serve ware products globally.

- For instance, Pactiv Evergreen Inc manufactures compostable trays under its EarthChoice brand and supplies a broad range of products to large Quick Service Restaurant (QSR) chains across North America.

By Category

The disposable segment accounted for a 64% share of the Compostable Tableware Market in 2024. The segment’s dominance is attributed to its widespread use in takeout services, outdoor catering, and fast-food outlets. Disposable compostable products offer convenience, hygiene, and easy disposal, making them ideal for large-scale and on-the-go consumption. The growing popularity of quick-service restaurants and cloud kitchens supports steady expansion. Increasing government restrictions on conventional plastic disposables and growing corporate sustainability commitments continue to drive the adoption of biodegradable single-use tableware across global markets.

- For instance, Biotrem does produce biodegradable plates from wheat bran at its facility in Zambrow, Poland. These products are supplied to foodservice sectors and sold in more than 40 countries worldwide.

By Material

The sugarcane bagasse segment led the Compostable Tableware Market in 2024, capturing a 46% market share. Bagasse-based products are gaining traction for their strength, heat resistance, and biodegradability, making them suitable for plates, cups, and trays. Manufacturers prefer sugarcane residue due to its cost-effectiveness and renewable availability. The growing emphasis on agricultural waste utilization and eco-friendly production processes supports segment growth. Increasing adoption by large foodservice chains and environmentally conscious consumers continues to enhance market demand for bagasse-based compostable tableware worldwide.

Key Growth Drivers

Rising Demand for Sustainable and Eco-Friendly Products

Growing environmental awareness and strict bans on single-use plastics are driving the Compostable Tableware Market. Consumers and businesses are increasingly choosing biodegradable alternatives to reduce landfill waste and carbon emissions. Governments across Europe, North America, and Asia-Pacific are enforcing plastic reduction policies, creating strong demand for compostable plates, cups, and cutlery. Corporate sustainability programs and eco-label certifications are further supporting this shift, positioning compostable tableware as a key solution for sustainable consumption and waste reduction.

- For instance, Eco Guardian Inc operates a new facility in Ontario capable of producing 2 billion compostable cups annually, supporting North American plastic reduction mandates.

Expansion of Foodservice and Catering Industry

The growing foodservice and catering sectors are major contributors to market growth. Quick-service restaurants, event caterers, and delivery platforms prefer compostable tableware for hygiene, convenience, and compliance with eco-regulations. As outdoor dining and takeaway trends expand, demand for eco-friendly dinnerware and flatware continues to rise. Food chains are also switching to compostable products to enhance their green brand image, aligning with consumer preferences for sustainable packaging and reducing their environmental footprint.

- For instance, Dart Container Corporation produces a range of molded-fiber compostable dinnerware under its ProPlanet Seal for catering clients. This line of durable, PFAS-free dinnerware meets ASTM standards for commercial compostability.

Government Regulations Supporting Plastic Alternatives

Stringent global regulations on plastic usage are propelling the shift toward compostable materials. Countries implementing bans or taxes on plastic disposables are encouraging manufacturers to invest in bio-based product lines. Certifications such as ASTM D6400 and EN 13432 ensure quality and compostability, enhancing product trust and adoption. Public sector procurement policies promoting eco-friendly products also strengthen market demand. These initiatives collectively create a favorable regulatory environment supporting long-term market growth.

Key Trends & Opportunities

Growing Adoption of Biobased and Agricultural Waste Materials

Manufacturers are increasingly using renewable materials like sugarcane bagasse, cornstarch, bamboo, and wheat bran in compostable tableware. These materials offer strength, durability, and complete biodegradability under industrial composting conditions. Innovations in bio-composite processing are helping reduce costs and improve performance. The trend aligns with circular economy goals and promotes sustainable sourcing by transforming agricultural waste into valuable eco-products for the foodservice and hospitality industries.

- For instance, Good Start Packaging sources plant fiber blends and bamboo residues for its product lines, offering over 150 certified compostable SKUs supplied to eco-conscious restaurants and catering firms.

Rising Influence of Green Packaging and Branding Initiatives

Sustainability has become a key differentiator in consumer purchasing decisions. Brands are adopting compostable tableware and green packaging to appeal to eco-conscious customers. Foodservice companies highlight biodegradable products as part of their sustainability and CSR strategies. Natural-looking designs, earthy tones, and minimalistic aesthetics are gaining popularity. This shift enhances brand reputation while reinforcing the connection between responsible consumption and environmental stewardship.

- For instance, Hotpack Global has a Bio & Compostable Division in Malaysia, which integrates biodegradable branding across its products, such as those made from bagasse. In 2022, Hotpack also announced plans for a series of biodegradable packaging plants in Malaysia with an anticipated output of 70 million units of sustainable packaging annually upon the first plant’s completion.

Key Challenges

High Production and Material Costs

The cost of manufacturing compostable tableware remains higher than that of traditional plastic products. Expensive raw materials like PLA, bagasse, and bamboo, along with specialized processing equipment, contribute to elevated production expenses. This limits affordability for small businesses and low-income markets. Manufacturers are investing in technological advancements and scale efficiencies to reduce costs without compromising product quality, which will be crucial for mass adoption.

Limited Composting Infrastructure and Awareness

Insufficient composting facilities and lack of awareness about biodegradable waste management restrict market penetration. In many regions, compostable products are disposed of with regular waste, preventing effective degradation. Consumers and businesses often lack knowledge of proper disposal practices. Governments and private organizations are gradually expanding composting networks and educational programs, but slow implementation continues to hinder the full environmental benefits of compostable tableware adoption.

Regional Analysis

North America

North America held a 33% share of the Compostable Tableware Market in 2024. The region’s dominance is driven by strict environmental regulations, growing awareness of plastic pollution, and strong consumer preference for sustainable products. The United States leads demand due to widespread adoption in quick-service restaurants, catering services, and corporate cafeterias. Increasing bans on single-use plastics in several states are encouraging businesses to switch to compostable alternatives. The presence of established manufacturers and expanding commercial composting infrastructure further supports market growth and the transition toward a circular economy.

Europe

Europe accounted for a 31% share of the Compostable Tableware Market in 2024. Growth is primarily supported by stringent EU directives on plastic reduction and the region’s emphasis on sustainable product development. Countries such as Germany, France, and the United Kingdom lead adoption across hospitality and retail sectors. Government subsidies for biodegradable products and robust waste management infrastructure are driving large-scale usage. Rising popularity of eco-labeled and certified tableware among consumers enhances the regional market outlook. Ongoing investments in material innovation and recycling systems continue to strengthen Europe’s leadership in compostable packaging solutions.

Asia-Pacific

Asia-Pacific dominated the Compostable Tableware Market in 2024 with a 28% market share. The region’s rapid urbanization, expanding foodservice industry, and growing middle-class population are key demand drivers. Countries such as China, India, and Japan are adopting eco-friendly tableware to reduce waste and meet sustainability targets. Government initiatives banning plastic disposables are fueling market expansion. Local manufacturers are introducing affordable compostable products made from bagasse, bamboo, and cornstarch. The increasing popularity of online food delivery and quick-service restaurants further enhances demand, positioning Asia-Pacific as a fast-growing hub for green packaging innovation.

Latin America

Latin America held a 5% share of the Compostable Tableware Market in 2024. Market growth is supported by rising environmental awareness and government initiatives aimed at reducing plastic waste. Brazil, Mexico, and Chile are leading adopters, with growing use of eco-friendly tableware in hospitality, tourism, and corporate events. Expanding food delivery platforms are also driving product demand. Local startups are investing in affordable bioplastic and plant-based materials to cater to domestic needs. However, limited composting infrastructure and high product costs still challenge large-scale adoption, though policy reforms continue to encourage gradual market growth.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the Compostable Tableware Market in 2024. Growth is fueled by expanding hospitality and catering industries, particularly in Gulf Cooperation Council (GCC) countries. Nations such as the United Arab Emirates and Saudi Arabia are implementing sustainability initiatives that promote the use of biodegradable tableware in food services and events. In Africa, rising urbanization and environmental awareness are gradually increasing adoption. Government-backed environmental campaigns and corporate sustainability programs are encouraging a shift from plastic disposables toward eco-friendly and compostable alternatives across the region.

Market Segmentations:

By Type

- Serve ware

- Flatware

- Dinnerware

- Others (straws, toothpicks, napkins, etc.)

By Category

By Material

- Sugarcane bagasse

- Cornstarch

- Bamboo

- Others (wheat bran, rice husk, recycled plastic)

By End Use

- Household

- Restaurants

- Cafés

- Others (corporate events, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Compostable Tableware Market features key players such as Eco Guardian Inc, BioPak, Pactiv Evergreen Inc, PAPSTAR GmbH, Hotpack Packaging Industries LLC, Good Start Packaging, Dart Container Corporation, Eco Products, Biotrem, and Din Earth. These companies dominate the market through continuous innovation in biodegradable materials, sustainable packaging solutions, and wide product portfolios covering plates, bowls, cutlery, and cups. Major players are investing in renewable raw materials such as sugarcane bagasse, bamboo, and cornstarch to meet global sustainability standards. Strategic collaborations with foodservice providers and retailers are strengthening market reach. Companies are also focusing on expanding manufacturing capacities and developing region-specific compostable product lines to meet growing consumer demand. The competitive environment is driven by eco-friendly branding, regulatory compliance, and technological advancements in compostable material processing, positioning these companies at the forefront of the transition toward sustainable food packaging and single-use alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eco Guardian Inc

- BioPak

- Pactiv Evergreen Inc

- PAPSTAR GmbH

- Hotpack Packaging Industries LLC

- Good Start Packaging

- Dart Container Corporation

- Eco Products

- Biotrem

- Din Earth

Recent Developments

- In February 2025, Eco Guardian Inc announced the construction of a new sustainable packaging facility in Ontario, designed to produce 2 billion compostable cups annually, supporting large-scale North American supply for foodservice brands.

- In 2025, Good Start Packaging launched a new tableware collection using sugarcane, PLA, and bamboo fiber blends.

- In March 2024, PAPSTAR GmbH collaborated with FSC-certified suppliers to roll out a new line of compostable palm-leaf tableware, achieving compliance with DIN EN 13432 standards for home and industrial compostability.

- In February 2024, Dart Container Corporation introduced its ProPlanet Seal molded fiber dinnerware line.

Report Coverage

The research report offers an in-depth analysis based on Type, Category, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as governments enforce bans on single-use plastics globally.

- Growing consumer preference for sustainable dining products will boost product demand.

- Technological innovation will improve the strength and heat resistance of compostable materials.

- Manufacturers will invest in cost-efficient production to compete with conventional plastics.

- Quick-service restaurants and catering sectors will remain major users of compostable tableware.

- Asia-Pacific will continue leading due to strong manufacturing capacity and export growth.

- Europe will strengthen adoption driven by circular economy and EU green policies.

- Product customization and branding will become key differentiators for market players.

- Partnerships between food chains and eco-friendly packaging firms will drive large-scale deployment.

- Expanding composting infrastructure will support large-scale adoption of biodegradable tableware solutions.