Market Overview

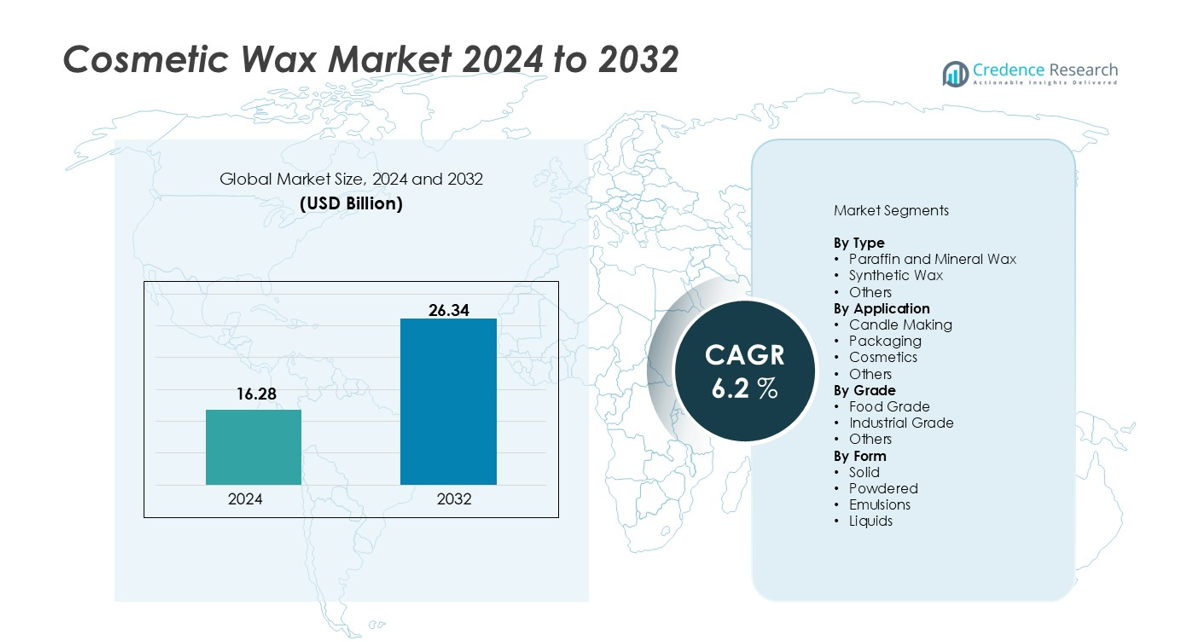

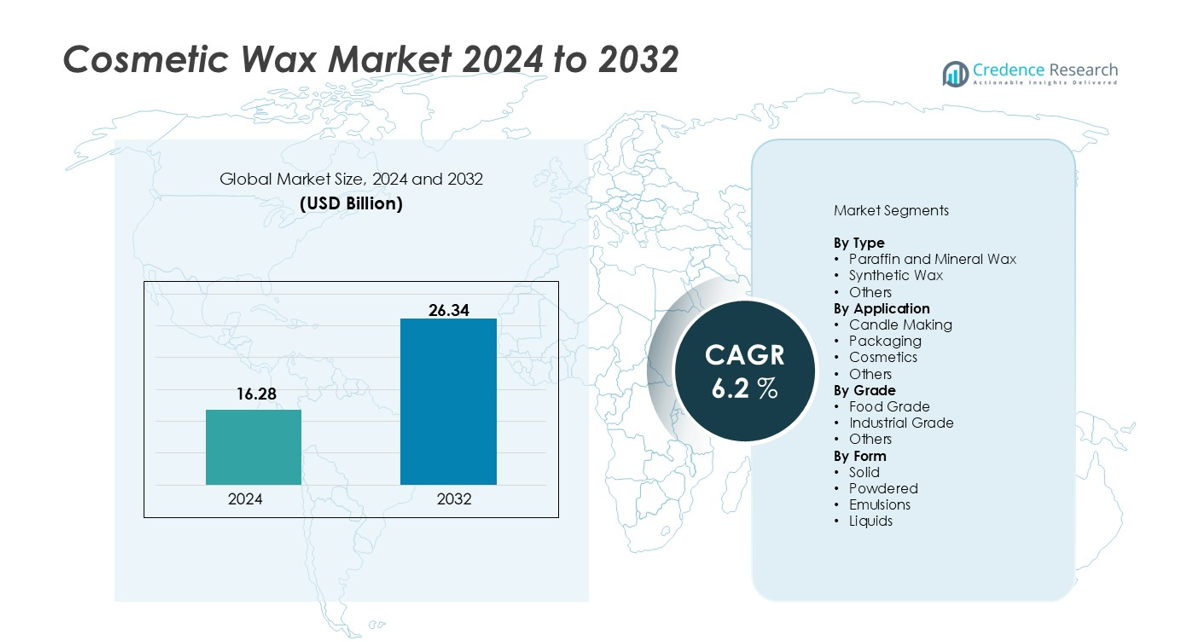

Cosmetic wax market size was valued at USD 16.28 billion in 2024 and is anticipated to reach USD 26.34 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Wax Market Size 2024 |

USD 16.28 billion |

| Cosmetic Wax Market, CAGR |

6.2% |

| Cosmetic Wax Market Size 2032 |

USD 26.34 billion |

The global cosmetic wax market is led by major players such as Royal Dutch Shell PLC, Exxon Mobil Corporation, Sasol Limited, Sinopec, Cargill, Inc., The International Group Inc., and DEUREX AG, which collectively account for a substantial share of global production and supply. These companies maintain competitive advantages through advanced refining technologies, diversified product portfolios, and strong distribution networks. Asia-Pacific dominates the market with an estimated 40% share, driven by robust demand from China, India, Japan, and South Korea. North America follows with about 31%, supported by established cosmetic brands and innovation in synthetic and bio-based waxes, while Europe holds nearly 27%, reflecting its preference for sustainable and natural ingredients in premium cosmetic formulations.

Market Insights

- The global cosmetic wax market was valued at USD 16.28 billion in 2024 and is projected to reach USD 26.34 billion by 2032, growing at a CAGR of 6.2% during the forecast period.

- Market growth is driven by increasing demand for wax-based skincare, lip care, and haircare products, alongside a rising preference for natural and sustainable ingredients in cosmetic formulations.

- Key trends include the rapid adoption of vegan and bio-based waxes, technological advancements in synthetic wax processing, and expanding use in premium beauty and personal care segments.

- The market is moderately consolidated, with major players such as Royal Dutch Shell PLC, Exxon Mobil, Sasol Limited, Sinopec, and Cargill, Inc. focusing on product innovation, R&D investment, and eco-friendly manufacturing.

- Asia-Pacific leads the market with a 40% share, followed by North America (31%) and Europe (27%), while the paraffin and mineral wax segment holds the largest share by type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The cosmetic wax market is segmented into paraffin and mineral wax, synthetic wax, and others. The paraffin and mineral wax segment dominate the market due to its extensive use in skincare and cosmetic formulations for providing smooth texture, gloss, and emollient effects. Its affordability and easy availability make it a preferred choice among manufacturers. Additionally, paraffin’s compatibility with various cosmetic ingredients enhances formulation stability, driving its widespread adoption in lip balms, creams, and lotions. Continuous demand for cost-effective and high-performance cosmetic materials sustains growth in this segment.

- For instance, in 2023, the global paraffin wax market was valued at approximately $8.5 billion (USD). The candle industry is the largest market segment, holding a significant portion of the total market value.

By Application

Based on application, the market is categorized into candle making, packaging, cosmetics, and others. The cosmetics segment holds the largest share, driven by the increasing use of waxes in lip care, skincare, and decorative cosmetics. Their role in improving product consistency, moisture retention, and long-lasting texture has boosted demand. Growing consumer preference for premium and natural cosmetic products further fuels segment expansion. Moreover, the rise of multifunctional beauty products, such as tinted balms and wax-based foundations, strengthens the position of cosmetic applications as the dominant market driver.

- For instance, Beiersdorf’s R&D department in Hamburg, Germany, used the emulsifying agent Eucerit to create NIVEA Creme in 1911. This allowed for the first stable oil-and-water-based cream to be mass-produced. More recently, the company’s patented technology enabled the production of its Labello lip care sticks, which have been part of the Beiersdorf brand portfolio since 1909. Beiersdorf currently produces approximately 160 million lip care sticks per year.

By Grade

The market by grade includes food grade, industrial grade, and others. The industrial grade segment leads the market due to its wide application across cosmetic and personal care manufacturing, offering high stability and performance. These waxes are preferred for their consistent melting properties and excellent binding characteristics, which ensure quality and durability in finished products. Meanwhile, food grade waxes are gaining momentum, supported by growing use in natural and organic cosmetic lines where purity and safety are prioritized. Enhanced regulatory standards and clean-label trends are further boosting demand across both segments.

Key Growth Drivers

Rising Demand for Natural and Organic Cosmetics

The growing consumer inclination toward natural, organic, and sustainable beauty products is a major driver in the cosmetic wax market. Natural waxes such as beeswax, carnauba, and candelilla are increasingly preferred for their eco-friendly profiles, biodegradability, and skin-conditioning properties. Manufacturers are reformulating products to eliminate synthetic and petroleum-based ingredients, aligning with clean beauty standards. The surge in vegan and cruelty-free certifications has further boosted demand for plant-based waxes. As global consumers prioritize ingredient transparency and sustainability, the market is witnessing a significant shift toward renewable, non-toxic wax sources used in skincare, lip care, and decorative cosmetics.

- For instance, Koster Keunen is a global supplier of natural ingredients, including candelilla wax. For decades, the company has offered a variety of waxes, including naturally sourced options and sustainable versions, to meet the demand for natural ingredients.

Expanding Use of Wax in Skincare and Haircare Products

Cosmetic waxes play a vital role in product formulation, offering texture, consistency, and moisture retention in skincare and haircare applications. The expanding global beauty and personal care industry, supported by increasing disposable incomes and urban lifestyles, has significantly raised wax consumption. Waxes like paraffin, microcrystalline, and synthetic variants are extensively used in creams, lotions, and hair styling products to enhance spreadability and product stability. Moreover, the growing demand for long-lasting and protective formulations in cold creams, lip balms, and styling gels is fueling consistent growth. The versatility and functionality of waxes continue to drive their integration into innovative product formulations across the cosmetics sector.

- For instance, ExxonMobil is a major player in the wax industry, controlling significant wax refining capacity in North America and supplying products, including those for personal care.

Technological Advancements in Wax Processing and Formulation

Technological innovation in wax synthesis, refining, and blending has emerged as a key growth catalyst for the cosmetic wax market. The development of high-purity synthetic waxes, such as GTL (Gas-to-Liquid) and polymer-based waxes, has improved performance consistency and reduced impurities in cosmetic formulations. These advanced waxes offer enhanced stability, uniform melting points, and improved texture control. Additionally, ongoing R&D efforts toward bio-based and hybrid waxes are expanding formulation possibilities, addressing both performance and sustainability demands. Such advancements enable manufacturers to tailor wax properties to specific cosmetic applications, thereby enhancing product differentiation and expanding market opportunities.

Key Trends & Opportunities

Surge in Vegan and Cruelty-Free Cosmetic Formulations

The accelerating shift toward vegan and cruelty-free cosmetics is creating new growth opportunities for plant-derived waxes. Consumers are increasingly rejecting animal-origin ingredients, favoring vegetable-based alternatives such as soy, rice bran, and sunflower waxes. This trend is further supported by stringent ethical labeling and animal testing regulations across Europe and North America. Brands are leveraging this opportunity by launching vegan-certified skincare and color cosmetic lines that utilize natural waxes for stability and shine. The market’s future growth trajectory will be shaped by this ongoing transformation toward ethical, sustainable, and transparent product sourcing.

- For instance, Upwell Cosmetics has introduced an algae-derived wax sourced from microalgae, a renewable resource. This innovative wax is designed to replace petroleum-based waxes in products like lipstick, sunscreen, and deodorant, offering a more sustainable alternative for the cosmetics industry.

Growing Adoption of Sustainable Packaging and Eco-Labeling

Sustainability has become a key differentiator in the cosmetic wax industry, influencing both production processes and product positioning. Manufacturers are adopting eco-friendly packaging and promoting recyclable, biodegradable materials, including wax-coated paper and plant-based alternatives. Natural and synthetic waxes derived from renewable feedstocks are being integrated into packaging solutions that enhance moisture resistance while reducing carbon footprint. Additionally, the increasing adoption of eco-labels and certifications like COSMOS and USDA Organic is bolstering consumer confidence. This shift presents long-term opportunities for companies investing in circular economy practices and environmentally responsible wax manufacturing.

- For instance, Cargill’s NatureWax® Ultimate is a 100% plant-based candle wax that performs comparably to traditional paraffin wax. It is designed to burn cleanly and efficiently, aligning with the growing consumer demand for sustainable and eco-friendly products.

Expansion in Emerging Markets and Premium Beauty Segments

Emerging economies such as India, Brazil, and Indonesia are witnessing rapid growth in the beauty and personal care sector, driven by rising middle-class income and urbanization. This surge is expanding the demand for wax-based cosmetics, particularly in lip care, skincare, and hair styling products. Simultaneously, premium and luxury beauty brands are incorporating customized wax formulations that offer superior texture and sensory appeal. The growing influence of e-commerce and international brand penetration in developing regions is creating vast opportunities for cosmetic wax producers to expand their market presence and product portfolios.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatility in raw material prices, particularly petroleum-based waxes, poses a major challenge for market players. Dependence on crude oil derivatives directly impacts the production cost and profit margins of synthetic and paraffin wax manufacturers. Additionally, disruptions in global supply chains—driven by geopolitical tensions, logistics delays, or environmental regulations—further hinder consistent raw material availability. Manufacturers are responding by diversifying sourcing strategies and investing in renewable wax alternatives. However, maintaining cost competitiveness while ensuring quality and sustainability remains a persistent challenge in the evolving global cosmetic wax landscape.

Stringent Regulatory Standards and Product Compliance

The cosmetic wax market faces increasing scrutiny from regulatory authorities regarding ingredient safety, labeling, and environmental impact. Regions such as the EU and North America enforce strict compliance standards under REACH and FDA guidelines, limiting the use of certain synthetic and petroleum-derived substances. Meeting these regulations often requires costly testing, reformulation, and certification processes. Additionally, the growing consumer demand for transparency and “clean label” formulations pressures manufacturers to ensure full ingredient traceability. Balancing innovation with compliance while adhering to sustainability standards continues to be a complex and resource-intensive challenge for industry participants.

Regional Analysis

North America

North America commands a ~31 % share of the global cosmetic wax market as of 2024, driven by its mature cosmetics industry and high consumer expenditure on premium beauty products. The U.S. serves as the major contributor, backed by strong R&D capability, brand presence, and demand for specialized wax grades (low-odor, high-purity). Rising trends in clean beauty and vegan formulations are further shaping wax usage in lip and skincare lines. The region’s stable regulatory environment and established supply chains help sustain market leadership.

Europe

Europe holds a ~25-28 % share of the cosmetic wax market, supported by stringent regulations favoring low-PAH, sustainable waxes and the strong base of cosmetic manufacturers in Germany, France, and the UK. Consumer preference for certified natural ingredients and transparency enforces demand for beeswax, carnauba, and refined synthetic waxes. Regulatory compliance (e.g. REACH) and innovation in bio-based waxes further strengthen Europe’s competitive edge in specialty cosmetic waxes.

Asia-Pacific

Asia-Pacific leads the market with ~35-45 % share in 2024, owing to rapid growth in consumer beauty demand across China, India, Japan, and Southeast Asia. The region boasts extensive cosmetic manufacturing infrastructure and low-cost supply of raw materials. Rising disposable incomes, urbanization, and the influence of K-beauty and J-beauty trends magnify wax consumption in skincare, lip care, and haircare products. Manufacturers are scaling up local production of both natural and synthetic waxes to meet regional demand.

Latin America

Latin America accounts for a ~5-8 % share of the cosmetic wax market. Brazil and Mexico, in particular, drive growth via abundant natural wax resources (e.g., carnauba) and growing domestic cosmetics demand. International brands expanding regional operations and partnerships support wax usage in beauty products. Yet infrastructure constraints and import dependency on advanced wax grades somewhat temper further expansion.

Middle East & Africa

Middle East & Africa represent about ~3-5 % share of the global cosmetic wax market. The region is emerging, fueled by rising beauty awareness, growth in premium and organic cosmetics, and expansions of retail and e-commerce channels. Gulf countries (UAE, Saudi Arabia) serve as hubs for luxury cosmetics distribution. Climatic demands for long-wear formulations and increasing investments by global brands create new opportunities for wax suppliers in this region.

Market Segmentations:

By Type

- Paraffin and Mineral Wax

- Synthetic Wax

- Others

By Application

- Candle Making

- Packaging

- Cosmetics

- Others

By Grade

- Food Grade

- Industrial Grade

- Others

By Form

- Solid

- Powdered

- Emulsions

- Liquids

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global cosmetic wax market features a moderately consolidated competitive landscape, with key players focusing on technological innovation, sustainability, and strategic partnerships to strengthen their market presence. Major companies such as Royal Dutch Shell PLC, Exxon Mobil Corporation, Sasol Limited, Sinopec, and Cargill, Inc. dominate through extensive product portfolios and global distribution networks. These players invest heavily in R&D to develop high-purity, bio-based, and specialty waxes tailored for advanced cosmetic formulations. Regional manufacturers like Kerax Limited, DEUREX AG, and Numaligarh Refinery Limited contribute to market diversity through customized offerings and niche product innovations. Strategic initiatives, including capacity expansions, mergers, and supply chain collaborations, are common across the industry. Increasing demand for sustainable and vegan-friendly ingredients is prompting manufacturers to shift toward renewable and hybrid waxes. Overall, competition is driven by product quality, innovation in formulation compatibility, and the ability to meet evolving regulatory and consumer sustainability expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Royal Dutch Shell PLC (Netherlands)

- Exxon Mobil Corporation (USA)

- Sinopec (China)

- Sasol Limited (South Africa)

- The International Group Inc. (Canada)

- Petróleo Brasileiro S.A. (Brazil)

- The PJSC Lukoil Oil Company (Russia)

- PDVSA (Petróleos de Venezuela, S.A.) (Venezuela)

- Cargill, Inc. (USA)

- Numaligarh Refinery Limited (India)

- NIPPON SEIRO CO. LTD. (Japan)

- DEUREX AG (Germany)

- Kerax Limited (UK)

- Poth Hille & Co Ltd. (UK)

Recent Developments

- In April 2025, Clariant announces the launch of Ceridust 1310, an innovative wax solution designed to address the increasing supply chain complexities facing formulators who rely on carnauba wax for printing ink applications. This development demonstrates Clariant’s understanding of market challenges and commitment to providing reliable solutions for its customers.

- In April 2024, ExxonMobil Launches New Wax Product Brand: Prowaxx™. The launch of Prowaxx demonstrates a strategic intent to invest in the future of wax, creating a naming convention that is scalable for new offerings. Prowaxx serves as an anchor for the product portfolio with differentiation across wax types and greater clarity tailored to customer decision making.

- In March 2022, Sasol sold its Germany-based subsidiary, Sasol Wax GmbH, to AWAX S.p.A., a company focused on the production, development, and distribution of wax products.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Grade, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cosmetic wax market will continue to expand steadily with rising global demand for skincare, haircare, and lip care products.

- Manufacturers will increasingly shift toward natural, vegan, and bio-based waxes to meet sustainability goals.

- Advancements in synthetic and hybrid wax technologies will enhance formulation performance and texture quality.

- Growing consumer awareness of ingredient transparency will drive innovation in clean-label cosmetic formulations.

- Premium and luxury beauty brands will adopt specialty waxes to improve product aesthetics and sensory appeal.

- Expansion of e-commerce and digital retail channels will boost the accessibility of wax-based cosmetic products.

- Asia-Pacific will remain the fastest-growing region due to increasing cosmetic production and consumer spending.

- Strategic collaborations between cosmetic brands and raw material suppliers will strengthen product development pipelines.

- Regulations promoting eco-friendly and safe cosmetic ingredients will shape future manufacturing practices.

- Continuous R&D investments will focus on improving wax purity, functionality, and environmental compatibility.