Market Overview

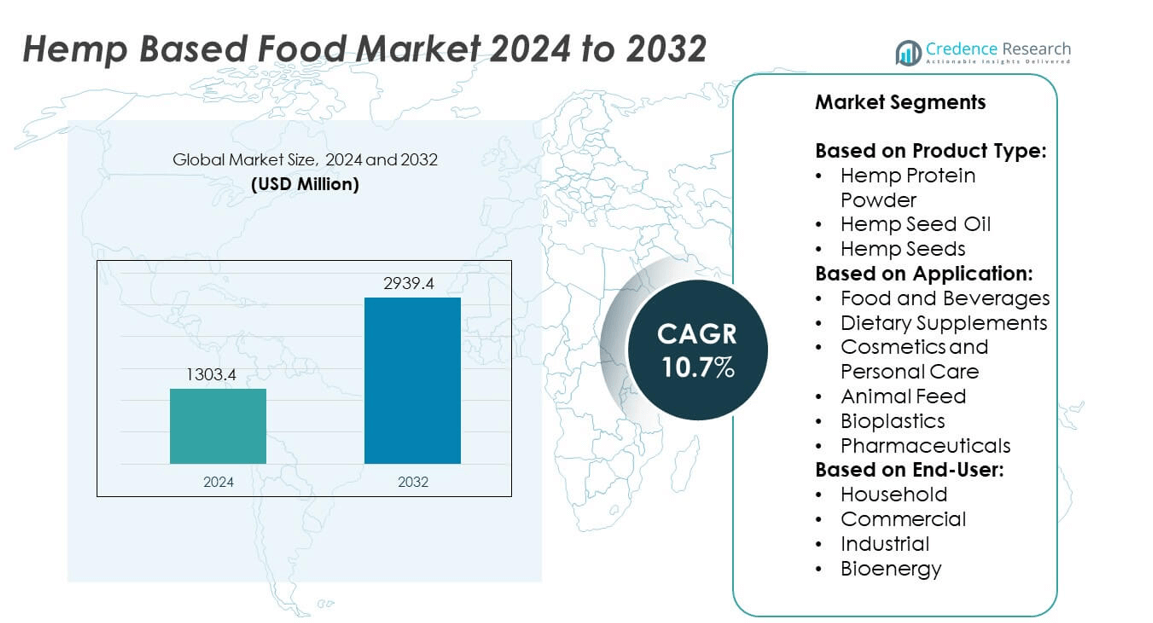

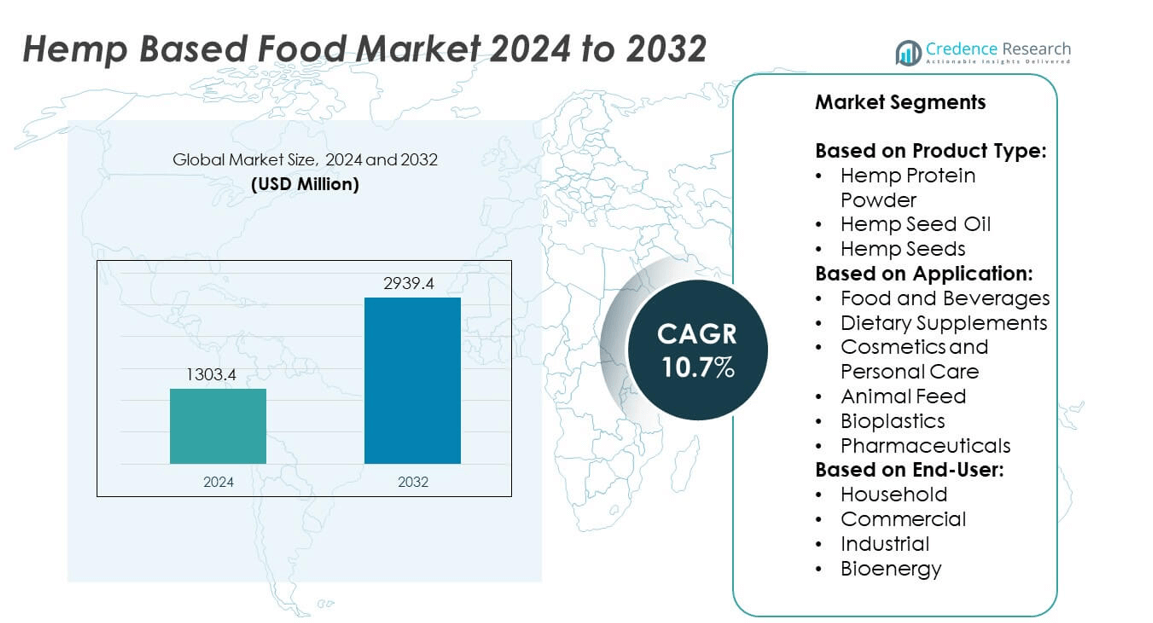

The hemp-based food market size was valued at USD 1303.4 million in 2024 and is anticipated to reach USD 2939.4 million by 2032, growing at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemp Based Food Market Size 2024 |

USD 1303.4 million |

| Hemp Based Food Market, CAGR |

10.7% |

| Hemp Based Food Market Size 2032 |

USD 2939.4 million |

The Hemp Based Food market is driven by rising demand for plant-based nutrition, increasing consumer awareness of hemp’s health benefits, and favorable regulatory reforms supporting hemp cultivation and commercialization. Consumers seek sustainable, allergen-free, and nutrient-rich alternatives, positioning hemp-based products as attractive options across food and supplement categories. Market trends include rapid product diversification, expansion into ready-to-eat and beverage formats, and growing adoption by major food brands. Clean-label transparency, traceable sourcing, and eco-conscious branding further enhance market visibility. The convergence of wellness, sustainability, and innovation continues to shape the growth trajectory of the hemp-based food industry.

The Hemp Based Food market demonstrates strong growth across North America and Europe, supported by regulatory clarity, consumer awareness, and advanced retail infrastructure. Asia-Pacific shows rising potential driven by health trends and evolving dietary preferences, while Latin America and the Middle East & Africa are gradually adopting hemp-based nutrition through niche health channels. Key players driving the global market include Canopy Growth Corporation, NuLeaf Naturals, and The Alkaline Water Company.

Market Insights

- The hemp based food market was valued at USD 1303.4 million in 2024 and is expected to reach USD 2939.4 million by 2032, growing at a CAGR of 10.7% during the forecast period.

- Hemp-based food products are gaining popularity due to their nutritional benefits, including high protein, essential fatty acids, and dietary fiber, driving their demand in health-conscious consumer segments.

- Product innovation is rising across categories such as hemp protein powders, seed oils, snacks, and beverages, with increased interest in clean-label, sustainable, and allergen-free food solutions.

- Leading companies such as Canopy Growth Corporation, NuLeaf Naturals, and The Alkaline Water Company focus on expanding distribution, enhancing brand visibility, and launching value-added products across multiple channels.

- Regulatory inconsistency and lingering consumer misconceptions related to hemp’s association with cannabis act as barriers to broader market adoption and limit sales in conservative or underregulated regions.

- North America and Europe lead market expansion due to strong consumer awareness and mature retail ecosystems, while Asia-Pacific and Latin America offer emerging opportunities through urbanization and rising demand for functional foods.

- Companies are investing in vertically integrated supply chains, certified sourcing, and eco-friendly packaging to align with evolving consumer values and ensure long-term competitiveness in a dynamic, regulation-sensitive market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Plant-Based Nutrition Across Health-Conscious Demographics

Consumers are increasingly shifting toward plant-based diets driven by growing awareness of health and environmental concerns. The Hemp Based Food market benefits from this shift due to hemp’s rich protein profile, fiber content, and essential fatty acids. It appeals to vegetarians, vegans, and flexitarians seeking nutrient-dense alternatives to animal products. Many consumers view hemp as a complete plant protein source, contributing to muscle recovery and cardiovascular health. The market sees strong adoption in protein powders, hemp milk, and nutrition bars. It captures a growing share of the wellness segment, reinforcing its position in global food retail.

- For instance, Manitoba Harvest reported sales of over 34 million units of its hemp food products in North America alone, including hemp hearts, protein powder, and bars, supported by its proprietary cold-milling process.

Policy Support and Legalization in Key Agricultural and Consumer Markets

Government initiatives supporting hemp cultivation and its integration into food supply chains play a critical role in market growth. Legal reforms in North America and Europe have reduced regulatory restrictions and enabled widespread commercialization. The Hemp Based Food market has expanded production and distribution due to simplified licensing and increased investor confidence. Hemp’s classification as a non-psychoactive agricultural commodity in several regions encourages farming communities to diversify crops. It benefits from state-backed research grants, agricultural subsidies, and clearer product labeling frameworks. Regulatory clarity accelerates retail entry and fuels product innovation.

- For instance, in Canada, the Agri-Food Pilot Program has aimed to address labor shortages, including those relevant to hemp, and has welcomed over 4,500 agri-food workers and their families.

Diverse Applications in Functional Foods and Dietary Supplements

Hemp ingredients are increasingly integrated into functional foods, contributing to joint health, digestion, and heart function. The Hemp Based Food market leverages this versatility to position its products in high-growth segments such as superfoods, fortified beverages, and clean-label snacks. Its compatibility with gluten-free, allergen-free, and non-GMO claims broadens consumer reach. Manufacturers incorporate hemp seeds, oils, and flours in multiple product formats without compromising taste or texture. The market supports clean eating habits and attracts premium health brands seeking differentiated ingredients. It aligns with nutritional trends that emphasize simplicity, efficacy, and traceability.

Sustained Retail Penetration Through E-commerce and Specialty Channels

Online retail and specialty organic stores provide effective platforms for new product launches and consumer engagement. The Hemp Based Food market finds success through direct-to-consumer sales, leveraging digital platforms to educate and convert target audiences. Product visibility increases through influencer partnerships, clean-label certifications, and targeted marketing. Retailers allocate shelf space in wellness aisles due to growing turnover and strong margins. It gains traction in North America, Europe, and parts of Asia-Pacific where digital infrastructure supports rapid scaling. Distribution agility and transparent branding remain critical to sustained market performance.

Market Trends

Increased Product Diversification Targeting Niche Consumer Segments

Brands are developing a broad range of hemp-based offerings tailored to specific dietary and lifestyle needs. The Hemp Based Food market now includes protein snacks, dairy alternatives, cereals, and baking ingredients formulated for keto, paleo, and gluten-free diets. It supports product innovation through R&D investments in flavor profiles, shelf stability, and nutrient density. Companies are launching premium SKUs in convenient formats for busy consumers prioritizing clean-label nutrition. Product differentiation remains a core strategy to capture market share in both mainstream and specialty retail. It helps brands respond to rapidly changing consumer expectations in the functional foods category.

- For instance, Hemp Foods Australia expanded its certified organic Hemp Gold® Seed Oil distribution in Woolworths stores—from an initial 100 stores to a total of 948 nationwide.

Rapid Expansion of Hemp Ingredients in Ready-to-Eat and Beverage Formats

Convenience-focused formats are reshaping how consumers engage with hemp-based foods. The Hemp Based Food market reflects this shift with rising demand for ready-to-drink hemp beverages, snack bars, and infused yogurts. It aligns with consumption habits favoring portability and time efficiency without sacrificing nutrition. Beverage brands incorporate hemp protein and oil to meet rising interest in plant-powered hydration and recovery. Retailers report strong movement in refrigerated and on-the-go categories featuring hemp-based SKUs. It benefits from collaborations with co-packers and food technologists to scale formulation and distribution.

- For instance, Nutiva Organic Hemp Protein Powder Pea Protein delivers One serving of our Organic Hemp Peak Protein provides 15 grams of organic protein, 10 grams of protein and 12 grams of fiber.

Mainstream Adoption Through Private Labels and Established Food Brands

Major food manufacturers and private-label retailers are integrating hemp ingredients into existing product lines. The Hemp Based Food market sees greater traction due to brand recognition, national distribution, and bundled pricing strategies. It gains visibility through multiproduct rollouts within plant-based sections of grocery chains. Large brands use their scale to promote awareness and trust, helping normalize hemp-based nutrition. Consumer trial rates increase when hemp products appear under familiar names, especially in cereals, spreads, and meat alternatives. It enables widespread reach beyond health-focused consumers.

Focus on Clean Label Transparency and Ingredient Traceability

Consumers demand clear labeling and sourcing information, prompting companies to emphasize ingredient origin and production processes. The Hemp Based Food market aligns with these expectations by promoting non-GMO, organic-certified, and minimally processed product claims. It supports blockchain-based tracking, QR-coded packaging, and third-party lab testing to enhance trust. Clean-label positioning strengthens brand equity in wellness-driven retail segments. Packaging and marketing communications highlight purity, sustainability, and ethical sourcing. It reinforces purchasing decisions among informed buyers seeking transparency in everyday foods.

Market Challenges Analysis

Regulatory Complexity and Consumer Misconceptions Limit Market Penetration

Ambiguity in hemp-related regulations continues to create hurdles for manufacturers and retailers across global markets. The Hemp Based Food market must navigate inconsistent guidelines on labeling, THC content, and ingredient approvals, especially in emerging economies. It faces challenges in product registration and cross-border distribution due to varying legal classifications of hemp-derived components. Consumer misconceptions linking hemp with psychoactive substances reduce adoption despite educational efforts. Retailers hesitate to onboard hemp-based products without clear regulatory assurances. It slows market expansion and deters investments in large-scale processing and branding initiatives.

Supply Chain Volatility and Quality Standardization Remain Unresolved

The limited availability of high-grade, food-safe hemp ingredients restricts consistent production for many food brands. The Hemp Based Food market depends on reliable sourcing and processing standards to maintain product safety and nutritional integrity. It struggles with fragmented supply chains lacking traceability and uniform certifications across regions. Weather variability, limited harvesting infrastructure, and underdeveloped processing technology further disrupt ingredient stability. Quality inconsistency affects product shelf life, sensory appeal, and regulatory compliance, impacting brand reputation. It forces companies to invest in vertical integration or partner with certified suppliers to reduce operational risk.

Market Opportunities

Rising Acceptance of Sustainable Nutrition Opens Strategic Growth Channels

Consumers are actively seeking food options that align with environmental values and long-term health benefits. The Hemp Based Food market stands to gain from hemp’s low resource requirements, carbon-sequestering properties, and soil-replenishing capabilities. It allows brands to position products as sustainable alternatives to animal-based and resource-intensive foods. Market players can highlight lifecycle advantages through carbon labeling, recyclable packaging, and regenerative farming certifications. Demand from climate-conscious consumers supports premium pricing and brand loyalty. It creates strong potential for expanding in markets where ecological impact influences purchasing behavior.

Untapped Potential in Emerging Markets and Nutritional Programs

Expanding health awareness and dietary transitions in developing regions present significant room for market entry. The Hemp Based Food market can address nutritional deficiencies through fortified products tailored to regional dietary gaps. It offers governments and NGOs a cost-effective option for supporting food security and protein intake. Public-private partnerships may facilitate access to school meal programs, disaster relief nutrition, and rural health initiatives. Local cultivation and processing initiatives can create jobs and reduce dependency on imported food ingredients. It opens long-term distribution and brand-building opportunities in underserved regions.

Market Segmentation Analysis:

By Product Type:

Hemp protein powder leads the product segment due to its high amino acid content and increasing use in sports nutrition and meal replacement products. The Hemp Based Food market capitalizes on this demand by offering protein-enriched snacks, shakes, and fortified blends. Hemp seed oil holds strong appeal in culinary and skincare applications, supported by its rich omega-3 and antioxidant profile. It finds use in cold-pressed dressings, therapeutic oils, and wellness formulations. Whole hemp seeds gain popularity in bakery, cereal, and granola applications, where texture and nutrient density matter. Each product type contributes to segment diversification and shelf presence across natural food retailers.

- For instance, Fresh Hemp Foods Ltd. submitted six GRAS notices to the FDA for product formats including hulled hemp seed, hemp seed oil, hemp flour, and protein powders with 43%, 50%, and 65% protein content.

By Application:

Food and beverages dominate the application segment with strong demand for functional, plant-based alternatives. The Hemp Based Food market responds with a wide range of hemp-based snacks, dairy substitutes, and baked goods. Dietary supplements represent a high-growth segment driven by interest in plant-based protein, fiber, and essential fats. Cosmetics and personal care leverage hemp’s moisturizing and anti-inflammatory properties, especially in premium skin care lines. Animal feed applications expand due to hemp’s digestibility and nutritional value for livestock and pets. Bioplastics and pharmaceutical applications remain niche but present long-term innovation opportunities for value-added processing.

- For instance, Germany announced to legalize cannabis, potentially marking a significant shift in the European hemp-based foods market dynamics. The regulatory change is anticipated to catalyze the hemp-based food sector in Europe, offering new opportunities for key players to serve the increase in consumption of hemp-derived products. The legalization initiative is projected to increase job creation, with approximately 27, 000 positions forecasted

By End-User:

Households represent the largest end-user segment, supported by e-commerce penetration and health-focused buying behavior. The Hemp Based Food market gains traction among urban consumers seeking clean-label, functional nutrition in daily diets. Commercial use includes restaurants, cafes, and nutrition-focused brands integrating hemp ingredients into product lines and menus. Industrial applications focus on high-volume hemp oil and seed processing for use in packaged foods and wellness categories. Bioenergy remains an emerging area, with limited but growing interest in hemp biomass for sustainable energy solutions. Each end-user segment supports growth across retail, foodservice, and specialty channels.

Segments:

Based on Product Type:

- Hemp Protein Powder

- Hemp Seed Oil

- Hemp Seeds

Based on Application:

- Food and Beverages

- Dietary Supplements

- Cosmetics and Personal Care

- Animal Feed

- Bioplastics

- Pharmaceuticals

Based on End-User:

- Household

- Commercial

- Industrial

- Bioenergy

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America dominates the global hemp-based food market, accounting for 38.5% of the total market share in 2024. The United States leads regional growth due to progressive legislation, high consumer awareness, and an expanding base of health-conscious buyers. Canada supports growth with a well-established regulatory framework and widespread retail penetration of hemp-derived food products. The region benefits from strong e-commerce infrastructure and early adoption of plant-based nutrition, which accelerates sales of hemp protein powders, hemp seed oil, and fortified food items. Key players such as Manitoba Harvest, Medterra, and NuLeaf Naturals operate extensive distribution networks and leverage brand recognition to consolidate market share. Increasing demand for clean-label, organic, and sustainable foods further supports long-term market potential. Commercial food producers in the U.S. are integrating hemp ingredients into mainstream grocery products, increasing visibility across all consumer segments.

Europe

Europe holds the second-largest market share, contributing 28.7% to the global hemp-based food market. The region emphasizes sustainability and clean-label nutrition, aligning well with hemp’s natural profile. Countries such as Germany, the Netherlands, and the United Kingdom have implemented regulatory frameworks that allow the controlled cultivation and commercial sale of hemp-derived foods. The market benefits from high consumer awareness regarding the environmental advantages of hemp, including lower water usage and regenerative farming potential. Companies like Canopy Growth Corporation, Tilray, and PureKana are expanding their presence through retail partnerships and private label agreements. Europe’s strong focus on circular food systems and organic certification enhances consumer trust and market stability. Investments in food innovation and regional supply chains contribute to steady growth across retail and specialty health channels.

Asia-Pacific

The Asia-Pacific region commands 17.2% of the global hemp-based food market, supported by expanding health trends and rising demand for plant-based alternatives. China, Australia, Japan, and South Korea are the key contributors to regional growth. While hemp food applications remain relatively new in the region, favorable government reforms and a shift toward nutritional wellness fuel expansion. Local startups and multinational brands are introducing hemp seed snacks, fortified beverages, and natural oils targeting fitness-conscious urban populations. Japan leads innovation in hemp-infused functional beverages, while Australia is developing supply chains for certified hemp-based nutrition. Regulatory developments across ASEAN countries indicate potential for market acceleration over the next few years. The region presents untapped opportunities for both domestic and international manufacturers aiming to scale through online and health-focused retail formats.

Latin America

Latin America represents 8.1% of the global hemp-based food market, with growth concentrated in Brazil, Chile, and Argentina. Shifting consumer preferences toward healthier, plant-based diets create a favorable environment for hemp-based food adoption. Regulatory progress remains fragmented, but pilot projects and startup-led initiatives are introducing hemp products into specialty and organic markets. Hemp Inc. and other regional players are actively collaborating with agricultural partners to establish local sourcing and production. Consumer education and government-backed nutritional programs are expected to improve long-term uptake. The region holds promise for value-added products and affordable protein solutions that can address both health and sustainability goals.

Middle East & Africa

The Middle East & Africa region holds the smallest share at 7.5%, but emerging awareness and wellness-oriented consumer trends offer modest growth opportunities. South Africa, the UAE, and Israel show early movement in legal reforms and niche health product demand. The hemp-based food market remains in its infancy here, with low retail penetration and limited public familiarity. However, imports of hemp-based dietary supplements and oils are increasing through online and specialty health retailers. Israel’s advanced biotech and agricultural technology sector provides a potential launchpad for hemp ingredient innovation. Governments are beginning to consider industrial hemp frameworks, which could support the regional development of plant-based food markets. Strategic investments and partnerships are critical for unlocking broader regional potential in the years ahead.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NuLeaf Naturals

- Canopy Growth Corporation

- Isodiol International Inc.

- PureKana

- Cronos Group

- Trulieve Cannabis Corp.

- Tilray

- The Alkaline Water Company

- Valens GroWorks Corp.

- Hemp Inc.

- Receptra Naturals

- Medterra

- WeedMD

- Aurora Cannabis

Competitive Analysis

Key players in the hemp based food market include Canopy Growth Corporation, NuLeaf Naturals, The Alkaline Water Company, Tilray, PureKana, and Medterra.These companies compete on product quality, distribution scale, branding, and regulatory compliance. They focus on developing high-protein, nutrient-rich hemp offerings that cater to growing consumer demand for plant-based and functional foods. Strategic collaborations with retail chains, e-commerce platforms, and health-focused outlets help increase market penetration. Product innovation remains a priority, with companies introducing hemp-infused snacks, beverages, and supplements tailored to specific dietary needs. Vertical integration allows better control over sourcing, quality assurance, and cost efficiency. Certifications such as non-GMO, organic, and gluten-free add credibility and consumer trust. Firms leverage sustainability in their marketing, aligning hemp’s environmental benefits with eco-conscious consumers. Competitive pricing, transparent labeling, and targeted digital campaigns further enhance customer retention. Players also monitor changing regulations to ensure compliance and accelerate international expansion. In a fragmented but rapidly evolving space, leadership depends on innovation, supply chain agility, and brand differentiation.

Recent Developments

- In 2023, Medterra Expanded its distribution by launching products on Amazon and taking part in Prime Day promotions.

- In August 2022, BioLife Sciences Inc., a prominent innovator in healthcare, beauty, and food & beverage technologies, introduced a product line of consumer products infused with cannabinoids to increase strengthen its product portfolio in hemp-based food products.

- In August 2022, TagZ Foods, an Indian snack food company, launched hemp-infused cookies to increase the product line of hemp-based food products.

Market Concentration & Characteristics

The Hemp Based Food market shows moderate concentration, with a mix of established cannabis-focused corporations, specialized wellness brands, and emerging food startups competing across global regions. It features strong product differentiation, driven by variations in formulation, nutritional positioning, and certification standards. Companies operate within a dynamic regulatory environment, requiring agility in compliance and market entry strategy. It benefits from growing consumer preference for plant-based, allergen-free, and sustainable food options, allowing premium positioning in health and specialty retail segments. Market characteristics include high innovation velocity, expanding SKUs across categories, and increasing reliance on e-commerce and direct-to-consumer channels. Distribution partnerships, clean-label claims, and traceable sourcing remain central to competitive strategy. It reflects a responsive supply chain structure where vertically integrated players can better manage cost, quality, and consistency. Demand is influenced by wellness trends, sustainability awareness, and regional legal frameworks, creating distinct patterns in product availability and pricing across markets.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to increasing demand for plant-based and allergen-free nutrition.

- Regulatory clarity in more countries will support wider adoption of hemp-based food products.

- Product innovation in beverages, snacks, and supplements will expand consumer appeal.

- Companies will invest in vertically integrated supply chains to ensure quality and cost control.

- E-commerce and direct-to-consumer channels will drive faster market penetration globally.

- Clean-label claims and sustainable packaging will influence purchasing decisions.

- Hemp seed oil and protein powder will remain key growth drivers across health and wellness segments.

- Strategic partnerships with retailers and foodservice providers will increase product visibility.

- Asia-Pacific and Latin America will emerge as high-potential regions for new entrants.

- Consumer education campaigns will reduce misconceptions and improve acceptance of hemp-based foods.