Market Overview

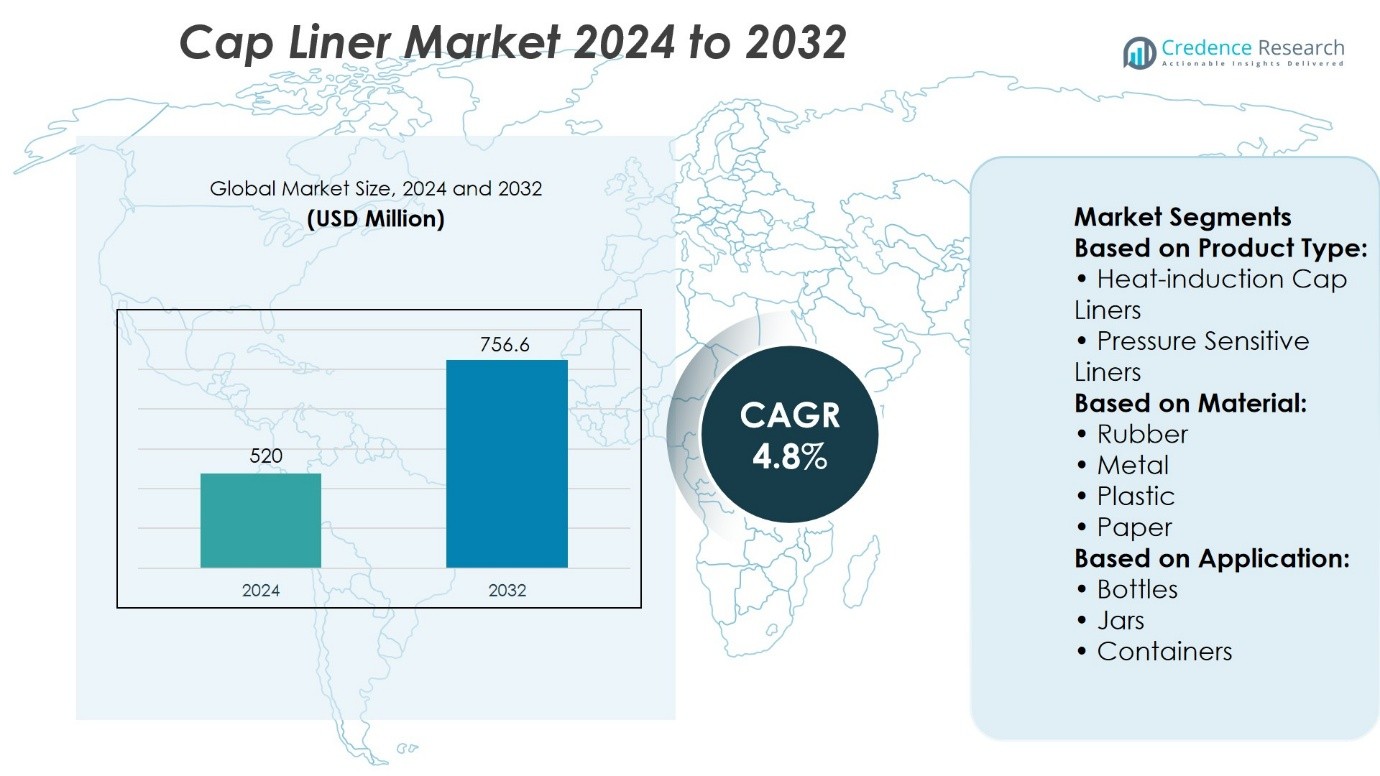

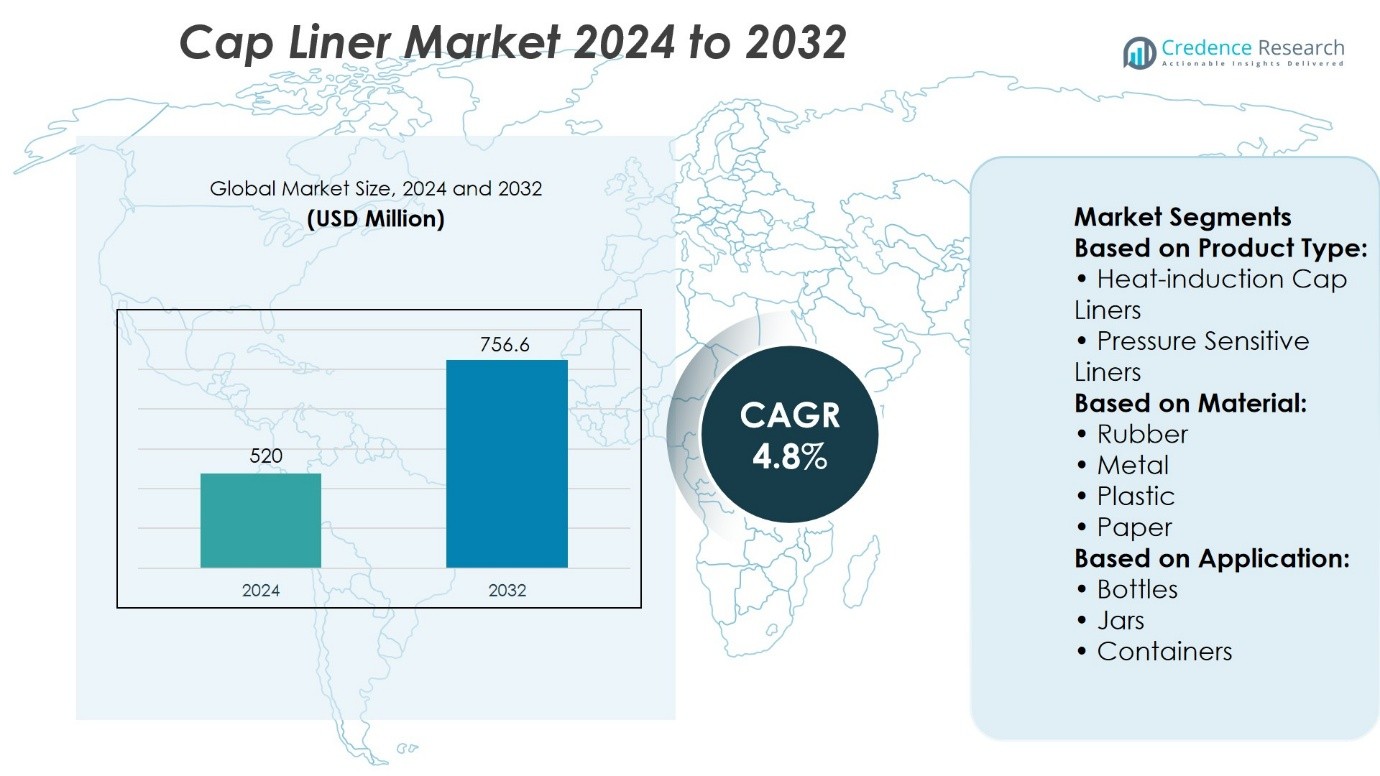

Cap Liner Market size was valued at USD 520 million in 2024 and is anticipated to reach USD 756.6 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cap Liner Market Size 2024 |

USD 520 Million |

| Cap Liner Market, CAGR |

4.8% |

| Cap Liner Market Size 2032 |

USD 756.6 Million |

The Cap Liner Market grows on strong drivers such as rising demand for tamper-evident, leak-proof, and safe packaging across food, beverage, and pharmaceutical sectors, supported by stricter regulatory compliance and consumer focus on product integrity. It benefits from expanding applications in healthcare and personal care, where secure closures remain critical. The market also reflects key trends including adoption of recyclable and biodegradable materials, wider use of induction sealing for enhanced protection, and increasing customization to support brand differentiation. Integration of automation and smart packaging features further defines its direction, shaping a dynamic landscape focused on safety, efficiency, and sustainability.

The Cap Liner Market shows strong geographical presence, with North America and Europe leading through advanced packaging infrastructure and strict regulations, while Asia-Pacific emerges as the fastest-growing region driven by urbanization, rising consumption, and e-commerce expansion. Latin America and the Middle East & Africa display steady adoption supported by food, beverage, and healthcare demand. Key players such as Selig Sealing Inc., Amcor, DuPont Teijin Films, Tekni-Plex Ltd., and regional specialists compete through innovation, sustainability initiatives, and global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cap Liner Market size was valued at USD 520 million in 2024 and is projected to reach USD 756.6 million by 2032, at a CAGR of 4.8%.

- Rising demand for tamper-evident, leak-proof, and safe packaging across food, beverage, and pharmaceutical sectors drives consistent growth.

- Growing adoption of recyclable, biodegradable, and mono-material liners reflects the industry’s focus on sustainability.

- Competitive dynamics are shaped by innovation, product differentiation, and global presence of established players alongside regional specialists.

- Market restraints include volatile raw material costs, supply chain disruptions, and regulatory complexities in packaging compliance.

- North America and Europe lead with advanced infrastructure and strict regulations, while Asia-Pacific emerges as the fastest-growing region supported by urbanization and e-commerce.

- Latin America and the Middle East & Africa show gradual but steady adoption through food, beverage, and healthcare packaging demand.

Market Drivers

Rising Consumer Demand for Safe and Reliable Packaging

The Cap Liner Market benefits from consistent demand in food, beverage, and pharmaceutical sectors where safety and product integrity remain critical. Consumers seek assurance that products stay fresh and uncontaminated until opened. It supports tamper-evidence, leak prevention, and extended shelf life, which strengthen trust in packaged goods. The growth of packaged food and ready-to-drink segments reinforces this trend. Rising global consumption patterns push companies to adopt advanced liner solutions. This driver positions cap liners as an indispensable part of modern packaging systems.

- For instance, Amcor reported producing 1,280 million closures and liners in 2023 through its Specialty Containers division, supplying major beverage and pharmaceutical companies with tamper-evident solutions.

Expanding Pharmaceutical and Healthcare Applications

Pharmaceutical and healthcare industries accelerate adoption of cap liners to maintain compliance with strict regulatory standards. It ensures protection against contamination, moisture ingress, and chemical interaction. With the increase in prescription and over-the-counter drug distribution, packaging safety requirements intensify. The Cap Liner Market gains traction from demand for child-resistant and senior-friendly closures. Growth in nutraceuticals further boosts the adoption of specialized liners. This driver highlights the essential role of liners in ensuring patient safety and product reliability.

- For instance, Tekni-Plex Healthcare manufactured 2.15 billion induction-sealing and closure liners in 2023 across its eight global facilities, supplying pharma companies with FDA-compliant solutions for blister packs, vials, and sterile containers.

Increasing Emphasis on Sustainability and Eco-Friendly Packaging

Sustainability shapes investment decisions, pushing manufacturers to develop recyclable and biodegradable liner materials. It aligns with corporate commitments to reduce carbon footprints and meet consumer expectations for eco-friendly products. The Cap Liner Market reflects these pressures through innovations in liner design that balance safety with sustainability. Advances in paper-based and compostable liners create alternatives to conventional plastic options. Growing regulatory focus on reducing single-use plastics adds momentum to this shift. This driver emphasizes the industry’s transition toward greener packaging solutions.

Technological Advancements in Material Science and Manufacturing

Advances in polymers, adhesives, and sealing technologies enhance liner performance and efficiency. It allows companies to design liners that withstand extreme temperatures, aggressive formulations, and varied distribution channels. Automation and precision in liner manufacturing improve consistency and reduce production costs. The Cap Liner Market benefits from developments in induction sealing, pressure-sensitive liners, and advanced barrier coatings. High-performance liners strengthen brand value by preventing leakage and spoilage. This driver underscores the role of innovation in maintaining competitiveness and meeting evolving packaging requirements.

Market Trends

Growing Shift Toward Sustainable and Recyclable Liner Materials

The Cap Liner Market demonstrates a clear movement toward sustainable materials that align with corporate and regulatory goals. It reflects a transition from multi-layer plastic structures to recyclable mono-materials and biodegradable alternatives. Paper-based and compostable liners attract strong interest from both manufacturers and consumers. Governments enforce stricter packaging waste directives that accelerate adoption of eco-friendly options. Brands invest in circular economy initiatives to improve recyclability across supply chains. This trend strengthens market positioning by combining safety with environmental responsibility.

- For instance, Amcor reported producing 1.05 billion recyclable and bio-based packaging units in 2023, including cap liners developed from mono-material polyethylene and bio-derived polymers to meet EU and FDA recyclability standards.

Rising Adoption of Induction Sealing and Advanced Barrier Technologies

Induction sealing gains traction for its ability to provide leak-proof, tamper-evident closures across diverse industries. The Cap Liner Market sees growing use of liners engineered with advanced barrier coatings that withstand moisture, oxygen, and chemical exposure. It enhances product safety and extends shelf life in food, pharmaceutical, and agrochemical applications. Manufacturers introduce multilayer foil structures to improve seal integrity. Growth in e-commerce logistics raises demand for packaging that can withstand handling stress. This trend drives consistent innovation in sealing technologies to match evolving product needs.

- For instance, Tekni-Plex introduced its ProTecSeals® Recyclable Induction Heat-Seal (IHS) liners in January 2024. These paper-based liners are 100 percent recyclable in paper streams, while offering the same moisture and oxygen barrier, leak-resistance, tamper-evidence, and shelf-life extension as traditional induction liners.

Increasing Customization and Brand Differentiation in Packaging Solutions

Brands leverage customized liners to enhance consumer engagement and strengthen shelf appeal. The Cap Liner Market incorporates printed liners, embossed seals, and specialty colors that provide both branding and security functions. It enables companies to protect products while reinforcing brand recognition at the point of use. Personalization meets rising consumer preference for unique and premium packaging formats. Growth in competitive consumer goods markets amplifies this requirement. This trend highlights the role of liners as both protective barriers and marketing tools.

Expanding Role of Automation and Smart Packaging Integration

Automation in liner production and application improves efficiency, consistency, and scalability for large-scale packaging operations. The Cap Liner Market benefits from integration of smart packaging technologies, including QR codes and digital authentication features. It supports traceability and consumer interaction in industries such as pharmaceuticals and premium beverages. Automated inspection systems further ensure liner accuracy and reduce wastage. Advances in robotics enable high-speed application with minimal human intervention. This trend reflects the industry’s direction toward intelligent, technology-driven packaging solutions.

Market Challenges Analysis

Rising Raw Material Costs and Supply Chain Constraints

The Cap Liner Market faces pressure from volatile raw material costs, particularly polymers, aluminum foils, and specialty adhesives. It often depends on global supply chains that experience disruptions due to trade restrictions, geopolitical tensions, or freight delays. Fluctuations in energy prices also increase production expenses, creating uncertainty for manufacturers. Smaller producers struggle to balance competitive pricing with rising input costs, limiting their ability to scale. Unstable supply channels reduce flexibility in meeting high-volume demand from food, beverage, and pharmaceutical industries. This challenge underscores the market’s vulnerability to external economic and logistical pressures.

Stringent Regulatory Requirements and Environmental Compliance Barriers

Strict regulations on packaging safety, sustainability, and chemical usage create compliance challenges for market participants. The Cap Liner Market must align with evolving standards that govern recyclability, tamper-evidence, and child-resistant features. It requires continuous investment in R&D to redesign liners that meet environmental mandates without compromising performance. Manufacturers face barriers in transitioning from multi-material structures to eco-friendly alternatives due to cost and technical limitations. Inconsistent regulations across regions add further complexity, particularly for companies operating globally. This challenge highlights the ongoing need for innovation, adaptability, and compliance-driven strategies within the industry.

Market Opportunities

Expansion in Emerging Economies and Growth Across End-Use Industries

The Cap Liner Market presents significant opportunities in emerging economies where urbanization and rising disposable income fuel packaged goods demand. It benefits from strong growth in food, beverage, and pharmaceutical sectors that require secure and tamper-evident packaging. Rapid expansion of retail and e-commerce platforms in Asia-Pacific, Latin America, and Africa supports wider adoption of advanced liner solutions. Manufacturers can capitalize on these regions by establishing local production facilities and distribution networks. Increasing healthcare access in developing nations further boosts pharmaceutical packaging demand. This opportunity positions cap liners as essential components in supporting global consumer safety and convenience.

Innovation in Sustainable Materials and Smart Packaging Integration

Advances in recyclable, biodegradable, and mono-material liners create strong growth prospects for market players. The Cap Liner Market can leverage sustainability-driven product innovation to align with global environmental policies and consumer preferences. It also gains from integration of smart packaging features such as QR codes, tamper indicators, and authentication seals that enhance product transparency. Companies adopting these innovations can differentiate themselves in highly competitive markets. Investments in R&D and collaboration with packaging technology providers accelerate adoption of such solutions. This opportunity highlights how innovation in material science and digital features can reshape future industry competitiveness.

Market Segmentation Analysis:

By Product Type

The Cap Liner Market divides strongly by product type, with heat-induction cap liners holding a leading position due to their superior sealing properties and tamper-evidence features. It offers strong resistance against leakage, contamination, and oxygen ingress, making it highly suitable for food, beverage, and pharmaceutical applications. Pressure-sensitive liners also show consistent demand as they provide ease of application without special equipment. These liners are particularly preferred by small- and medium-scale manufacturers seeking cost-effective sealing options. Their convenience in resealing containers adds to their value in household and personal care products. This segment reflects a balance between high-performance solutions and cost-efficient alternatives.

- For instance, Selig Sealing Inc. reported producing over 2.45 billion induction heat seal liners in 2023 for global food, beverage, and pharmaceutical clients, supported by their proprietary EdgePull™ technology, which improves removal force.

By Material

The market further segments by material type, including rubber, metal, plastic, and paper-based liners. Plastic liners dominate usage due to their versatility, durability, and adaptability across varied product categories. It provides effective moisture and chemical resistance, supporting extended product shelf life. Metal-based liners, particularly those using aluminum, are widely adopted for induction sealing where barrier properties and secure closure are essential. Rubber liners, though limited in adoption, maintain importance in niche applications requiring flexibility and sealing strength. Paper-based liners gain traction in line with sustainability goals, offering eco-friendly alternatives to traditional multi-layer structures. This segment highlights ongoing material innovation to balance performance with environmental compliance.

- For instance, Tekni-Plex Ltd. manufactures more than 1.2 billion plastic cap liners annually across its global facilities, with its ProTec™ multilayer liners.

By Application

In terms of application, the Cap Liner Market shows strong utilization across bottles, jars, and containers. Bottles remain the most prominent category, driven by extensive use in beverages, pharmaceuticals, and household chemicals. It ensures tamper-proof protection and preserves product freshness, which is critical in consumable products. Jars follow closely, supported by food packaging demand for spreads, sauces, and nutraceutical powders. Containers, including industrial and specialty packaging, also represent a notable segment where chemical resistance and leakage prevention are crucial. This application segmentation demonstrates the versatility of cap liners in serving both consumer-focused and industrial packaging needs.

Segments:

Based on Product Type:

- Heat-induction Cap Liners

- Pressure Sensitive Liners

Based on Material:

- Rubber

- Metal

- Plastic

- Paper

Based on Application:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 32% in the global Cap Liner Market, reflecting its advanced packaging infrastructure and high regulatory standards. The region benefits from strong demand in pharmaceuticals, beverages, and personal care industries that prioritize safety and product integrity. It continues to invest in induction sealing technologies and premium liner solutions, reinforcing its leadership in innovation. The United States remains the key driver, supported by a well-established healthcare sector and a strong base of multinational packaging companies. Canada contributes through growing demand for eco-friendly packaging aligned with sustainability goals, while Mexico benefits from its expanding food and beverage sector. The region’s emphasis on quality and compliance ensures steady growth and positions North America as a reliable consumer of advanced cap liner solutions.

Europe

Europe accounts for a market share of 28%, shaped by strict regulations on packaging safety, recyclability, and environmental compliance. Countries such as Germany, France, and the United Kingdom lead in adoption of high-performance liners, particularly in food, cosmetics, and pharmaceutical sectors. It places significant focus on developing sustainable liners that align with the European Union’s directives on single-use plastics and waste reduction. The region demonstrates strong demand for paper-based and recyclable plastic liners, reflecting both consumer and regulatory pressure. Eastern European countries add to growth by expanding manufacturing activities and increasing packaged goods demand. Europe’s commitment to eco-friendly innovation positions it as a hub for sustainable packaging development within the cap liner industry.

Asia-Pacific

Asia-Pacific holds a dominant market share of 30%, driven by rapid urbanization, population growth, and expansion of consumer goods markets. China, India, and Japan represent the largest contributors, with rising demand for packaged food, beverages, and pharmaceuticals. It benefits from large-scale manufacturing capabilities, cost-efficient production, and strong government support for modern packaging infrastructure. Growing middle-class consumption patterns and the rise of e-commerce further accelerate demand for tamper-proof and secure packaging solutions. Southeast Asian countries, including Indonesia and Vietnam, strengthen regional adoption by increasing local production and expanding export capacity. Asia-Pacific’s blend of scale, cost competitiveness, and innovation positions it as the fastest-growing region in the cap liner landscape.

Latin America

Latin America contributes a market share of 6%, supported by rising demand in food, beverage, and pharmaceutical packaging. Brazil and Mexico represent the key growth centers, benefiting from urban development and expanding healthcare access. It shows growing adoption of pressure-sensitive liners due to cost efficiency and ease of use in small- and medium-scale production. Demand for sustainable packaging alternatives is increasing, particularly in markets with growing consumer awareness of environmental issues. The region faces supply chain challenges but continues to attract investment from global packaging players seeking to expand their footprint. Latin America’s steady progress indicates long-term potential, although growth remains gradual compared to more mature regions.

Middle East & Africa

The Middle East & Africa region holds a market share of 4%, with packaging demand led by food, beverage, and personal care industries. The United Arab Emirates and Saudi Arabia drive adoption through advanced retail and cosmetics markets, while South Africa supports growth with a developing healthcare sector. It demonstrates growing potential for heat-induction liners in premium beverages and pharmaceuticals, where tamper-evidence is a priority. Economic diversification efforts across Gulf countries encourage investments in packaging and manufacturing. Africa contributes through increasing consumption of packaged goods in urban centers, though infrastructure limitations restrain rapid expansion. This region’s smaller share highlights early-stage adoption, but future opportunities remain promising with rising consumer markets and industrial investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Cap Liner Market include Selig Sealing Inc., Amcor, DuPont Teijin Films, M.F.I. Capliners, Bluemay Weston Limited, B&B Cap Liners LLC, Pres-On Corporation, Multipack Labels, Tekni-Plex Ltd., and Geraldiscos Ltd. The Cap Liner Market reflects a highly competitive landscape where companies prioritize innovation, sustainability, and performance-driven solutions. Market participants focus on developing advanced liner technologies that ensure tamper-evidence, leak prevention, and extended shelf life across food, beverage, and pharmaceutical applications. Sustainability remains a central strategy, with investments directed toward recyclable, biodegradable, and mono-material liners that meet regulatory and consumer expectations. Firms also strengthen their competitiveness by expanding global distribution networks and enhancing manufacturing capabilities to serve diverse regional demands. Strategic collaborations, product differentiation through branding integration, and continuous research in material science shape the industry’s progression. The market’s competitive intensity highlights the importance of adaptability and innovation in sustaining leadership and capturing new growth opportunities.

Recent Developments

- In January 2024, TekniPlex introduced recyclable paper-based induction heat seal liners for bottles and jars. These liners, made from tree pulp, offer standard protective properties. They enabled brand messaging and tamper evidence features, aiming to promote sustainability and counteract product waste.

- In January 2024, TekniPlex Consumer Products developed a series of paper-based, recyclable induction heat seal liners called ProTecSeals Recyclable IHS Liners.

- In August 2023, Multotec expanded its manufacturing facility with new press installations for mill liners in Spartan, South Africa. The manufacturing capacity is expected to meet the increasing mill liner demand.

- In November 2023, Metso Corporation expanded its product portfolio of mill lining by introducing rubber-based mill liner, Skega Life that offers up to 25% longer durability and wear life enabling sustainability, and safety for operators.

Market Concentration & Characteristics

The Cap Liner Market demonstrates moderate concentration, with a mix of global leaders and regional specialists shaping competition through innovation, compliance, and customer-focused solutions. It reflects characteristics of a mature industry where established players dominate high-value segments such as pharmaceuticals, premium beverages, and personal care, while smaller firms compete in cost-sensitive categories with pressure-sensitive and paper-based options. The market emphasizes safety, tamper-evidence, and shelf-life extension, which remain critical requirements across applications in bottles, jars, and containers. It also shows strong alignment with sustainability trends, as companies invest in recyclable, biodegradable, and eco-friendly materials to address regulatory pressures and consumer preferences. Technological advancement in induction sealing, barrier films, and automation supports efficiency and performance, reinforcing the role of liners as indispensable components of modern packaging. The balance between consolidation by large players and adaptability of regional firms defines the market’s competitive character, creating a landscape driven by innovation, regulation, and evolving end-user demand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cap Liner Market will expand with rising demand for tamper-evident and leak-proof packaging in food, beverage, and pharmaceuticals.

- It will see greater adoption of recyclable and biodegradable liners driven by global sustainability targets.

- Advances in induction sealing and barrier technologies will strengthen liner performance across industries.

- E-commerce growth will increase demand for secure packaging solutions that withstand logistics challenges.

- It will benefit from rising healthcare access in emerging economies, boosting pharmaceutical packaging adoption.

- Customization and brand-focused liner designs will gain traction as companies seek differentiation.

- Automation in liner production and application will improve efficiency and reduce operational costs.

- Integration of smart packaging features such as QR codes and digital authentication will expand.

- It will face ongoing pressure to comply with evolving global regulations on packaging safety and sustainability.

- Partnerships and investments in R&D will shape competitive advantage and drive innovation in the industry.