Market Overview:

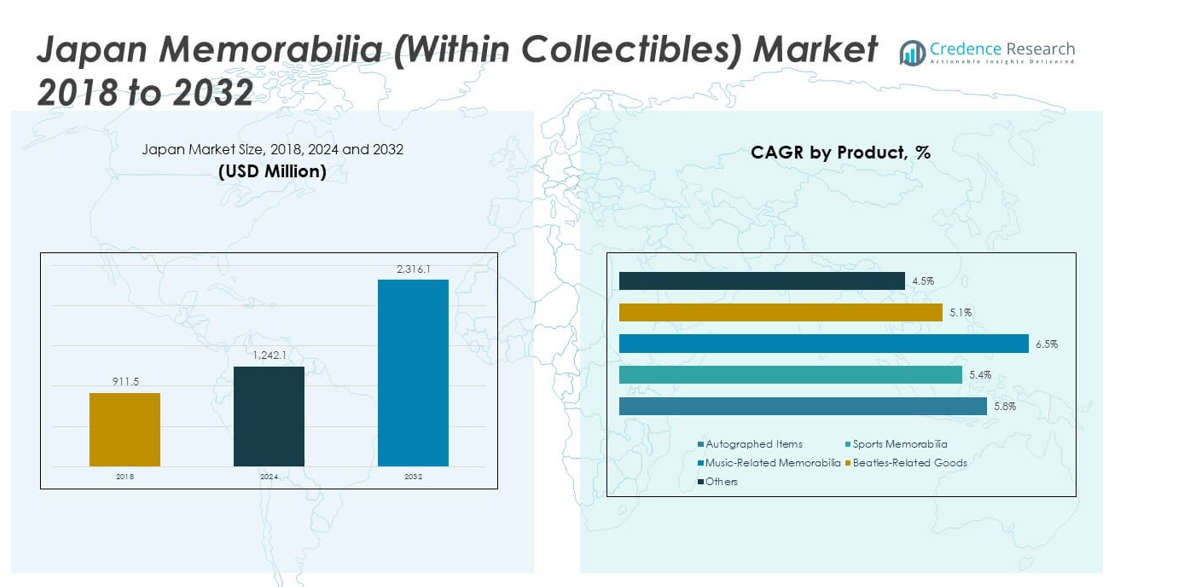

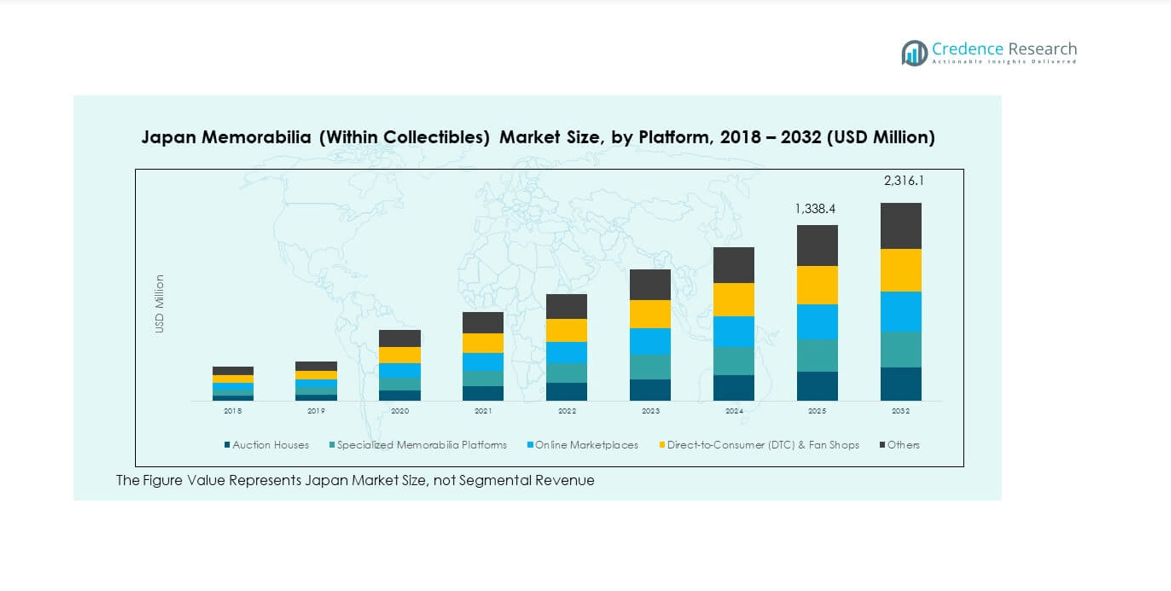

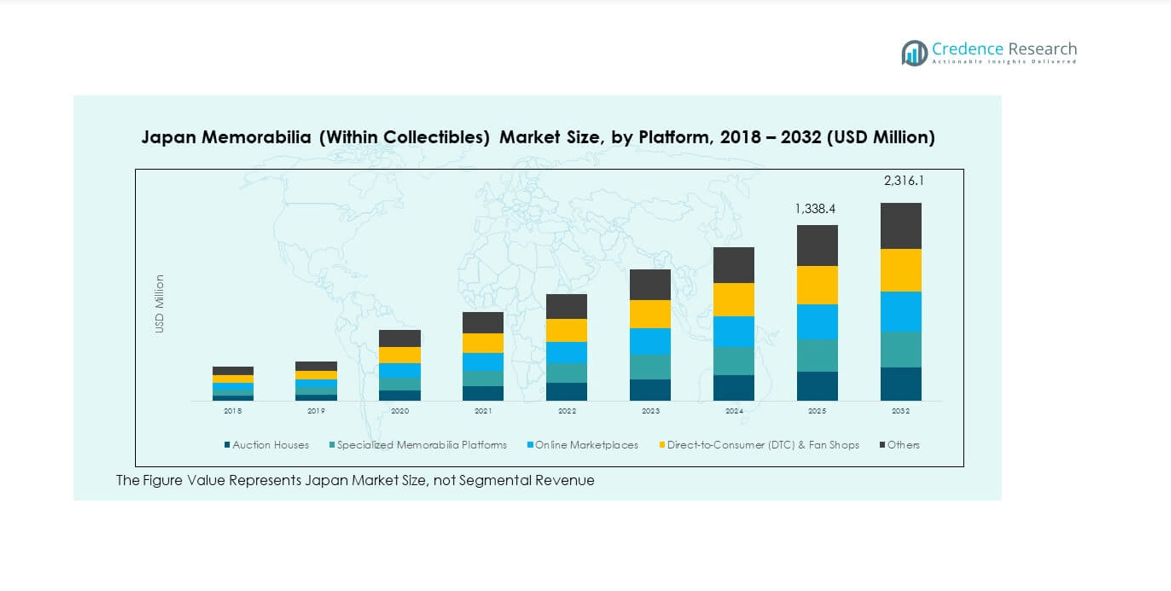

The Japan Memorabilia (Within Collectibles) Market size was valued at USD 911.5 million in 2018 to USD 1,242.1 million in 2024 and is anticipated to reach USD 2,316.1 million by 2032, at a CAGR of 7.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Memorabilia (Within Collectibles) Market Size 2024 |

USD 1,242.1 million |

| Japan Memorabilia (Within Collectibles) Market, CAGR |

7.30% |

| Japan Memorabilia (Within Collectibles) Market Size 2032 |

USD 2,316.1 million |

It is experiencing strong momentum due to a combination of cultural pride, growing interest in nostalgia, and the rising influence of pop culture both domestically and globally. Collectors are increasingly seeking rare and authenticated items across sports, music, and entertainment categories, fueling consistent demand. The growth of online platforms has further facilitated access to a wider buyer base, enhancing market liquidity and engagement.

Demand is being driven by heightened consumer enthusiasm for limited-edition releases, autographed items, and pop culture artifacts. Japan’s rich entertainment heritage, spanning anime, manga, music icons, and historical sporting achievements, is creating a robust collectibles ecosystem. The market is also benefiting from strong domestic consumer purchasing power and a rising trend of international buyers investing in Japanese memorabilia. These factors, combined with increased participation from younger demographics, are expanding the market’s depth and diversity.

Market Insights:

- The Japan Memorabilia (Within Collectibles) Market size was valued at USD 911.5 million in 2018 to USD 1,242.1 million in 2024 and is projected to reach USD 2,316.1 million by 2032, at a CAGR of 7.30%.

- Strong demand is fueled by cultural pride, global influence of Japanese pop culture, and the investment appeal of rare collectibles.

- Counterfeiting and authenticity concerns remain key restraints, requiring robust verification systems.

- Domestic sales are supported by strong purchasing power, while global exports benefit from pop culture’s international reach.

- Tokyo dominates domestic sales due to its concentration of auction houses, events, and collector communities.

- Younger demographics are driving growth in anime, esports, and fashion-crossover memorabilia.

- Niche markets such as vintage gaming merchandise and sports memorabilia are expanding steadily.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Cultural Pride and Heritage Preservation:

The Japan Memorabilia (Within Collectibles) Market is significantly driven by the country’s deep-rooted cultural pride and commitment to preserving historical and pop culture heritage. It benefits from Japan’s vast portfolio of globally recognized cultural exports, including anime, manga, traditional arts, and historical sports events. Consumers, both domestic and international, are motivated to acquire memorabilia that connects them to Japan’s rich traditions and modern cultural milestones. Events such as international anime conventions, sports tournaments, and music festivals amplify awareness and create spikes in demand for related collectible merchandise.

- For instance, JTB Corporation, one of Japan’s largest travel and memorabilia providers, curated more than 500 exclusive tours to UNESCO World Heritage sites and traditional festivals in 2024, featuring authentic collectible merchandise such as signed artisan crafts and certified event memorabilia.

Expansion of Pop Culture Influence Beyond Borders:

The global reach of Japanese pop culture is a powerful growth catalyst. International audiences have embraced Japanese entertainment, from gaming franchises to J-pop and sports icons, increasing cross-border demand for memorabilia. This influence is amplified by streaming platforms, social media, and online fan communities, which continuously engage audiences and promote collectible items. Strategic collaborations between Japanese creators and global brands are introducing limited-edition items that appeal to both seasoned collectors and new entrants, boosting both domestic and export sales.

- For instance, Coca-Cola collaborated with anime franchises like Attack on Titan to release limited-edition cans and merchandise in Japan, Thailand, and the U.S.; the 2025 campaign resulted in merchandise selling out within 72 hours of launch across multiple major markets.

Rising Investment Appeal of Memorabilia:

Memorabilia is increasingly being recognized as an alternative investment class in Japan, attracting a wider base of high-net-worth individuals and specialized collectors. The market benefits from the appreciation potential of rare and authenticated items, especially those linked to significant cultural or sporting moments. Auction houses and specialized memorabilia platforms are witnessing rising participation from investors seeking portfolio diversification. The allure of tangible, unique assets with both emotional and financial value is sustaining long-term demand.

Digital Platforms and E-commerce Acceleration:

The rapid expansion of digital sales channels has revolutionized market accessibility. Specialized online platforms, social media commerce, and live-streamed auctions are enabling broader engagement with memorabilia. Sellers can now reach international buyers without geographic limitations, while authentication technologies such as blockchain are strengthening buyer confidence. Digital marketing campaigns and virtual exhibitions are expanding consumer reach, particularly among tech-savvy younger demographics who are increasingly engaging in online collectible trading.

Market Trends:

Integration of Authentication Technology:

The Japan Memorabilia (Within Collectibles) Market is witnessing the adoption of advanced authentication technologies, including blockchain-based certificates and AI-powered image verification. These solutions address the growing concern over counterfeit products, offering buyers confidence and transparency. Authentication services are becoming standard practice among auction houses and online marketplaces, creating a competitive edge for platforms that prioritize trust and verification.

- For instance, Artory and Verisart introduced blockchain-backed digital certificates of authenticity for Japanese collectibles and artworks in 2025, creating unique tamper-proof records of provenance for over 35,000 high-value art and memorabilia transactions during the year.

Collaborations Between Entertainment and Fashion Brands:

Cross-industry collaborations are shaping new collectible categories. Japanese entertainment franchises are partnering with luxury fashion labels, streetwear brands, and lifestyle companies to release limited-edition products that blend memorabilia with functional use. This trend not only expands the customer base but also elevates the perceived value of collectibles, making them appealing to both fashion-conscious consumers and dedicated collectors.

- For instance, Onitsuka Tiger released the first-ever Astro Boy collaboration collection in January 2024, producing only 100 limited-edition pieces—each item sold out within four days of launch, underscoring the crossover demand between streetwear collectors and anime fans.

Growth in Experience-Based Collectibles:

The market is experiencing a shift toward memorabilia linked to unique experiences. Items connected to live events, backstage access, or limited fan experiences are gaining popularity. Collectors are valuing not only the physical item but also the personal story and exclusivity it represents. This trend is especially strong among younger buyers who prioritize experiential consumption over purely material acquisitions.

Sustainability and Ethical Sourcing in Memorabilia Production:

Sustainability is becoming a differentiator in the collectibles space. Producers and event organizers are increasingly using eco-friendly materials and ethical sourcing practices for memorabilia manufacturing. This approach resonates with environmentally conscious consumers and aligns with Japan’s broader sustainability goals, adding a responsible dimension to the emotional appeal of collectibles.

Market Challenges Analysis:

Prevalence of Counterfeits and Authenticity Concerns:

The proliferation of counterfeit memorabilia poses a significant challenge to the Japan Memorabilia (Within Collectibles) Market. High-value collectibles, especially autographed items and rare editions, are often targeted by counterfeiters, undermining buyer confidence. The issue is exacerbated by online sales channels where physical inspection before purchase is limited. While authentication services are improving, the market must continuously invest in verification technology and educate consumers to ensure trust and protect long-term growth.

Economic Sensitivity and Discretionary Spending:

Memorabilia purchases are largely discretionary, making the market sensitive to economic fluctuations. During economic slowdowns or periods of uncertainty, consumers may deprioritize collectible purchases in favor of essential spending. This sensitivity impacts both high-value auctions and mass-market memorabilia sales. Price volatility and changing consumer priorities can limit growth momentum, particularly in the export segment where currency fluctuations also influence buying behavior.

Market Opportunities:

Global Expansion Through E-commerce and Cross-Border Trade:

The Japan Memorabilia (Within Collectibles) Market can capitalize on the rising global appetite for Japanese pop culture by expanding cross-border sales. Partnerships with international marketplaces, targeted marketing to overseas fan communities, and localized product offerings can significantly boost export revenues. Leveraging Japan’s reputation for quality and authenticity will strengthen international positioning.

Emergence of Niche Collectible Categories:

Opportunities exist in exploring niche collectible segments, such as esports memorabilia, vintage gaming merchandise, and exclusive anime artwork. These segments cater to passionate micro-communities willing to pay a premium for unique items. By diversifying product offerings and engaging with these communities, market players can capture untapped demand and foster long-term customer loyalty.

Market Segmentation Analysis:

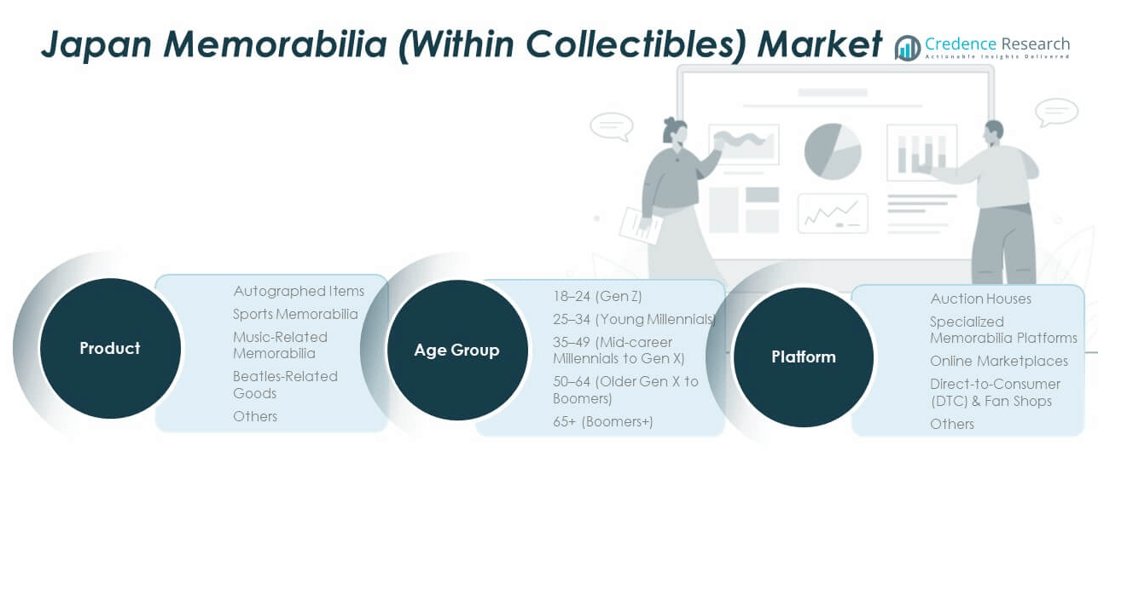

By Product

The Japan Memorabilia (Within Collectibles) Market is diverse, with demand spread across autographed items, sports memorabilia, music-related collectibles, Beatles-related goods, and other niche categories. Autographed items remain highly sought after due to their rarity and personal connection to notable figures. Sports memorabilia benefits from Japan’s strong baseball, soccer, and Olympic heritage. Music-related memorabilia, including limited-edition merchandise and signed albums, attracts both domestic fans and international buyers. Beatles-related goods maintain a niche but loyal audience, supported by Japan’s historic connection with the band. Other categories, such as film props and anime merchandise, add depth to the product mix.

- For instance, Tamino Autographs documented 25 sales of rare Beatles-signed items through Tokyo auctions in 2024, including Paul McCartney’s 1966 concert setlist and original tour posters, each with certified provenance.

By Age Group

Collectors span all age brackets, but demand patterns vary. The 18–24 Gen Z group drives interest in anime, gaming, and esports memorabilia, often favoring online marketplaces. The 25–34 segment is an active buyer base for both pop culture and investment-grade collectibles. Middle-aged collectors (35–49) often focus on sports, music, and high-value historical memorabilia. Older demographics, particularly those above 50, lean towards rare cultural artifacts and nostalgic items. This distribution allows sellers to target distinct buyer profiles with tailored offerings.

By Platform

Sales channels include auction houses, specialized memorabilia platforms, online marketplaces, and direct-to-consumer (DTC) outlets such as fan shops. Auction houses remain the preferred channel for high-value, authenticated items, while specialized platforms cater to niche collectors. Online marketplaces have broadened access, attracting younger buyers and international customers. DTC and fan shops thrive during live events and product launches, offering exclusive merchandise tied to specific experiences. A mix of traditional and digital platforms ensures strong market accessibility across demographics.

Segmentation:

By Product

- Autographed Items

- Sports Memorabilia

- Music-Related Memorabilia

- Beatles-Related Goods

- Others

By Age Group

- 18–24 (Gen Z)

- 25–34 (Young Millennials)

- 35–49 (Mid-career Millennials to Gen X)

- 50–64 (Older Gen X to Boomers)

- 65+ (Boomers+)

By Platform

- Auction Houses

- Specialized Memorabilia Platforms

- Online Marketplaces

- Direct-to-Consumer (DTC) & Fan Shops

- Others

Regional Analysis:

North America

The North America Japan Memorabilia (Within Collectibles) Market size was valued at USD 234.9 million in 2024 and is anticipated to reach USD 438.4 million by 2032, at a CAGR of 7.3% during the forecast period. North America holds an estimated 19% share of the Japan memorabilia export market, driven by strong demand for anime, manga, music collectibles, and rare sports-related items tied to Japanese athletes in baseball and the Olympics. The United States dominates the region’s imports, with Canada contributing to niche segments such as vintage music memorabilia. The presence of established auction houses and Japanese culture festivals in cities like Los Angeles, New York, and Toronto further stimulates buying activity. Collectors in North America tend to value authenticity and investment-grade items, leading to a strong preference for certified memorabilia.

Europe

The Europe Japan Memorabilia (Within Collectibles) Market size was valued at USD 198.7 million in 2024 and is projected to reach USD 370.6 million by 2032, growing at a CAGR of 7.3%. Europe accounts for roughly 16% of Japan’s memorabilia exports, with the UK, France, and Germany being major importers. Demand is concentrated on music-related memorabilia, particularly Beatles-related goods, given the strong cultural connection between Japan and British music history. Collectors also show interest in limited-edition anime artwork, gaming merchandise, and sports memorabilia. European buyers often engage through international auction platforms and specialized dealer networks, with a growing trend toward purchasing via online marketplaces to access exclusive Japanese releases.

Asia-Pacific (Excluding Japan)

The Asia-Pacific Japan Memorabilia (Within Collectibles) Market size was valued at USD 560.4 million in 2024 and is anticipated to reach USD 1,044.5 million by 2032, at a CAGR of 7.3%. Asia-Pacific (excluding Japan) holds the largest export market share at approximately 45%, fueled by strong demand from China, South Korea, Singapore, and Australia. Regional proximity and cultural affinity with Japan make access to memorabilia easier, supported by shared pop culture trends such as anime, gaming, and music. Cross-border collaborations in entertainment further boost demand, while e-commerce integration ensures faster delivery and improved buyer confidence. The segment benefits from affluent collectors willing to pay premiums for limited-edition and early-release items.

Latin America

The Latin America Japan Memorabilia (Within Collectibles) Market size was valued at USD 74.5 million in 2024 and is projected to reach USD 138.8 million by 2032, registering a CAGR of 7.3%. Latin America accounts for about 6% of Japan’s memorabilia exports. Brazil and Mexico lead the demand, driven by the popularity of Japanese anime, manga, and gaming culture. Collectibles tied to Japanese motorsports and martial arts also enjoy a dedicated audience. The market is still in a growth phase, with opportunities to expand through partnerships with regional distributors and participation in pop culture conventions.

Middle East

The Middle East Japan Memorabilia (Within Collectibles) Market size was valued at USD 37.3 million in 2024 and is forecasted to reach USD 69.4 million by 2032, at a CAGR of 7.3%. Holding a 3% market share, the region’s demand is driven by affluent collectors in the UAE and Saudi Arabia. Anime and luxury-brand collaborations appeal strongly to younger high-income buyers. Limited-edition collectibles linked to motorsports and exclusive events also contribute to demand. Growth is supported by the increasing number of Japanese cultural exhibitions in the Gulf region.

Africa

The Africa Japan Memorabilia (Within Collectibles) Market size was valued at USD 37.3 million in 2024 and is projected to reach USD 69.4 million by 2032, at a CAGR of 7.3%. Africa holds around 3% of the export share, with South Africa and Nigeria showing the highest demand for Japanese pop culture merchandise. Access to collectibles is improving through online platforms, though shipping and import costs remain barriers. Interest is strongest among younger buyers influenced by global streaming platforms and gaming communities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Toudoukan

- Mandarake

- Kaiyodo

- Bandai Namco Holdings

- Sanrio

- Bushiroad

- Heritage Auctions

- Christie’s Japan

- Sotheby’s

Competitive Analysis:

The Japan Memorabilia (Within Collectibles) Market features a competitive mix of domestic specialists, international auction houses, and hybrid e-commerce platforms. Key domestic players such as Toudoukan, Mandarake, and Kaiyodo have built strong reputations for authenticity and rare inventory, catering to both local collectors and global buyers. Large entertainment companies like Bandai Namco Holdings, Sanrio, and Bushiroad leverage their intellectual property to release exclusive memorabilia, often tied to popular franchises. International firms including Heritage Auctions, Christie’s Japan, and Sotheby’s operate in the high-value segment, attracting affluent buyers seeking investment-grade collectibles. The competitive landscape is shaped by brand heritage, authenticity assurance, strategic partnerships, and the ability to capitalize on emerging pop culture trends.

Recent Developments:

- In August 2025, Toudoukan participated as a pop-up shop at the INOKI EXPO in Shinjuku, a major event celebrating the 65th anniversary of Antonio Inoki’s wrestling debut. The company also hosted special memorabilia events in August and September 2025, including the “World Pro Wrestling History Lecture” on September 14 and exclusive discussions featuring renowned wrestling personalities, showcasing its ongoing leadership in curated Japanese sports collectibles.

- On July 24, 2025, Bandai Namco Holdings and Sony Group Corporation entered a landmark strategic partnership. As part of this alliance, Sony acquired approximately 16 million shares (2.5% of equity) of Bandai Namco for ¥68 billion (about $464 million). The collaboration aims to co-develop content, expand cross-media storytelling, and intensify the global promotion of Japanese intellectual property across music, games, anime, and collectibles.

- In June 2025, Sanrio unveiled a collaboration with Moonbug Entertainment to launch a global partnership featuring crossover content between Sanrio characters (such as Hello Kitty and Cinnamoroll) and CoComelon, with a new series premiering in early 2026. Separately, Sanrio launched Expo 2025 Osaka-Kansai merchandise, with top-selling items like Hello Kitty and Kuromi in Myaku-Myaku costumes, debuting official products such as mini towels, clear files, and acrylic charms in June 2025.

- In May 2025, Kaiyodo launched the Amazing Yamaguchi Revoltech Marvel Cable Version 1.5 and Deadpool (Version 2.5) figures, offering enhanced articulation, new face and hand sculpts, and expanded accessory sets. Another major release is the Yamaguchi anime character figure, hitting shops in January 2025, which features advanced joint systems and multiple effect parts for dynamic posing, strengthening Kaiyodo’s reputation in the high-end action figure segment.

Market Concentration & Characteristics:

The Japan Memorabilia (Within Collectibles) Market is moderately concentrated, with a few established players dominating high-value and niche segments while a wide range of smaller sellers serve mass-market and specialty categories. It operates on a dual structure where major auction houses and licensed producers secure premium sales, while online platforms enable broader access for casual collectors. The market is highly brand-driven, with authenticity and provenance serving as key differentiators. Seasonal demand peaks during major sporting events, entertainment releases, and anniversary celebrations.

Report Coverage:

The research report offers an in-depth analysis based on product segments, age groups, and platforms.It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of cross-border e-commerce will broaden global buyer access to Japanese memorabilia.

- Growth in anime, gaming, and esports collectibles will capture younger demographics.

- Adoption of blockchain authentication will enhance buyer trust.

- Collaborations between Japanese pop culture brands and luxury fashion houses will create high-value collectibles.

- Sustainability in memorabilia production will appeal to eco-conscious buyers.

- Digital auctions and virtual exhibitions will reach larger audiences.

- Investment interest in rare memorabilia will continue to rise among high-net-worth individuals.

- Regional conventions and fan events will boost direct-to-consumer sales.

- Demand for experience-linked collectibles will increase.

- Emerging markets in Latin America, the Middle East, and Africa will contribute to export growth.