Market Overview:

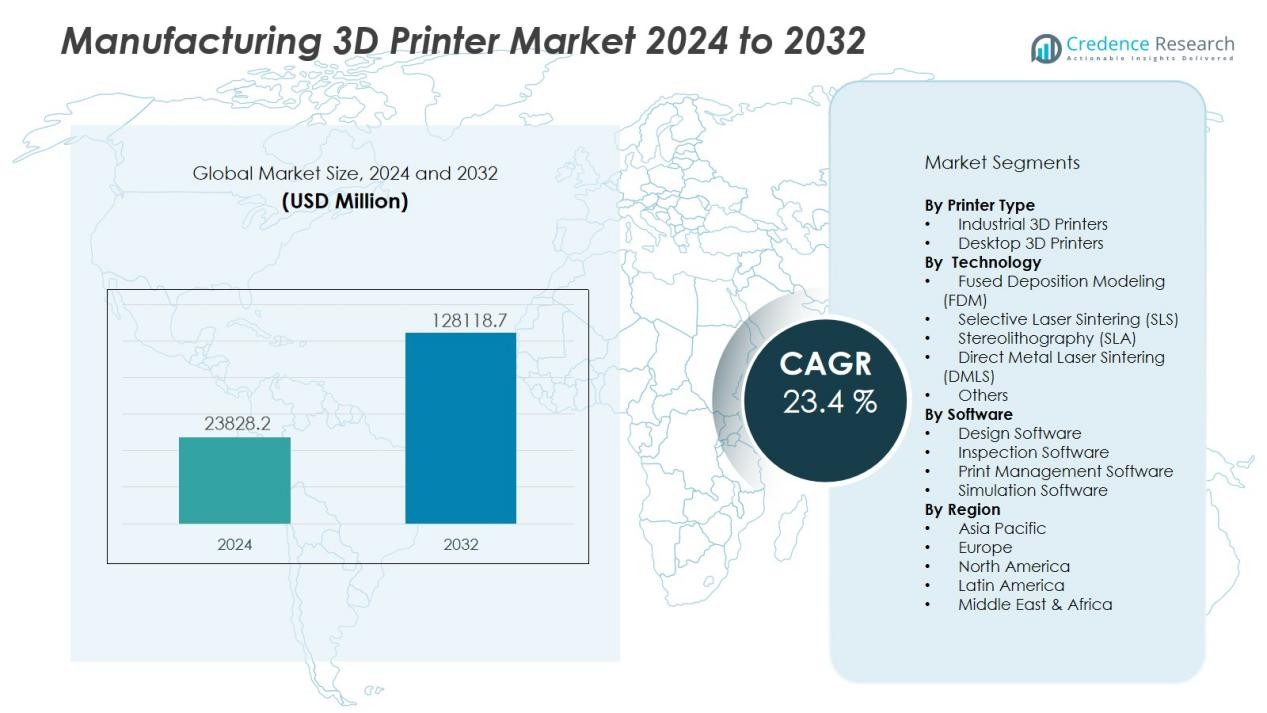

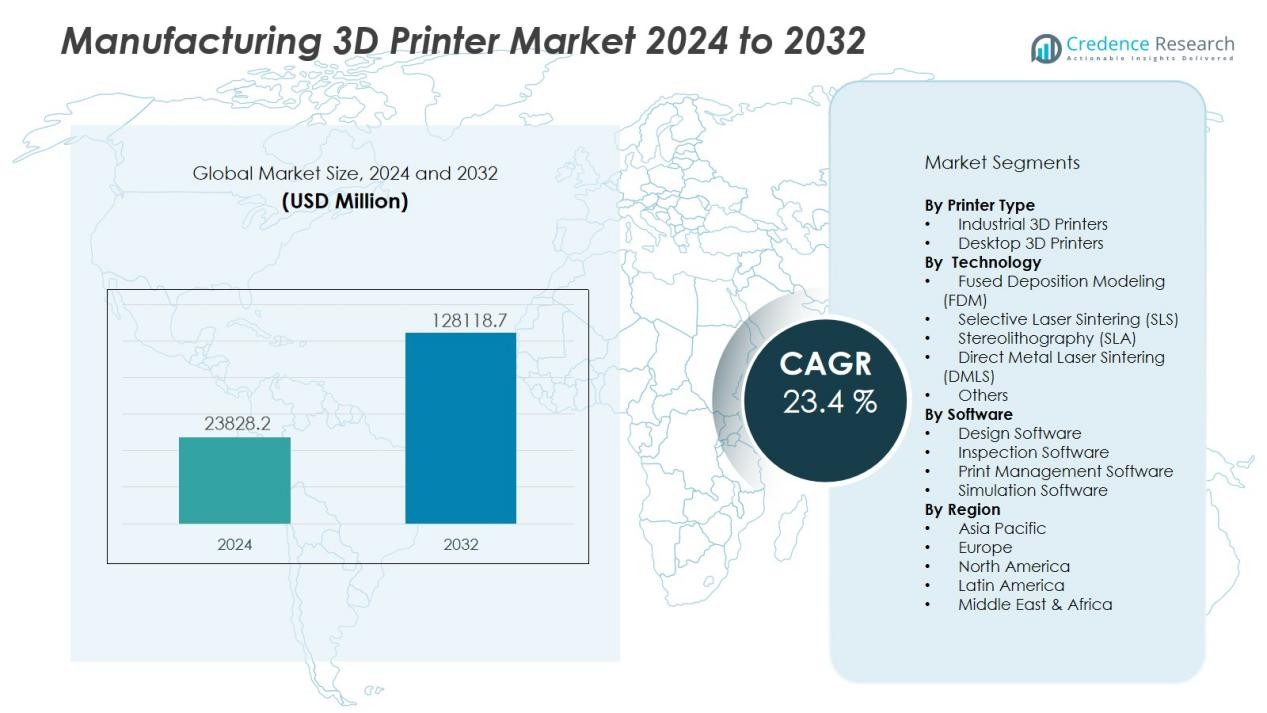

The manufacturing 3d printer market size was valued at USD 23828.2 million in 2024 and is anticipated to reach USD 128118.7 million by 2032, at a CAGR of 23.4 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Manufacturing 3D Printer Market Size 2024 |

USD 23828.2 Million |

| Manufacturing 3D Printer Market, CAGR |

23.4 % |

| Manufacturing 3D Printer Market Size 2032 |

USD 128118.7 Million |

Growth is fueled by rising demand for lightweight and complex components in automotive, aerospace, and healthcare industries, where design flexibility and customization are critical. The ability of 3D printers to enable rapid prototyping, on-demand production, and localized manufacturing supports efficiency and sustainability goals. Increasing adoption of Industry 4.0, coupled with integration of AI, automation, and advanced materials, further accelerates the market’s expansion.

Regionally, North America dominates the manufacturing 3D printer market, supported by strong R&D investments, advanced infrastructure, and early adoption by aerospace and automotive leaders. Europe follows closely with a focus on sustainability and industrial innovation, while Asia-Pacific is expected to record the fastest growth, driven by government-led initiatives, expanding manufacturing hubs in China, Japan, and South Korea, and rapid adoption in healthcare and consumer electronics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The manufacturing 3d printer market was valued at USD 23828.2 million in 2024 and is projected to reach USD 128118.7 million by 2032, growing at a CAGR of 23.4% during 2024–2032.

- Rising demand for lightweight and complex components in automotive, aerospace, and healthcare sectors drives adoption, with 3D printing offering unmatched design flexibility and material efficiency.

- Industry 4.0 integration accelerates growth as smart factories deploy additive manufacturing with AI, automation, and real-time analytics for agile production models.

- Continuous advancements in high-strength polymers, composites, and metals enable the transition from prototyping to large-scale industrial production.

- High capital costs, limited standardization, and certification challenges remain barriers, particularly for small and mid-sized enterprises.

- Regionally, North America holds 38% market share, Europe 32%, and Asia-Pacific 24%, with Asia-Pacific expected to record the fastest growth due to industrial expansion and government support.

- Opportunities lie in healthcare customization, hybrid manufacturing systems, sustainable material development, and expansion into emerging economies supported by innovation-led policies.

Market Drivers:

Rising Demand for Lightweight and Complex Components in Key Industries:

The manufacturing 3d printer market benefits from increasing demand in aerospace, automotive, and healthcare sectors where lightweight and geometrically complex components are essential. Traditional manufacturing struggles to achieve the same level of precision and material efficiency, making 3D printing an attractive alternative. It enables manufacturers to reduce weight without compromising strength, improving fuel efficiency in vehicles and aircraft. Healthcare applications also gain from customized implants and prosthetics tailored to patient needs. This growing acceptance across high-value industries drives strong adoption.

- For instance, GE Additive has produced over 10,000 3D-printed fuel nozzles for LEAP jet engines, consolidating twenty individual parts into a single component to enhance production efficiency.

Integration of Industry 4.0 and Digital Manufacturing Ecosystems:

The adoption of Industry 4.0 practices strongly supports the expansion of the manufacturing 3d printer market. Smart factories increasingly use additive manufacturing as part of digital ecosystems that integrate automation, AI, and real-time analytics. It enables seamless design-to-production transitions, faster prototyping, and decentralized manufacturing models. Companies achieve greater agility, reduce downtime, and optimize production flows. The synergy between 3D printing and digital manufacturing frameworks strengthens efficiency and competitiveness.

- For instance, Siemens implemented its digital twin and additive manufacturing technologies at its Gas Turbine Manufacturing Plant in Berlin, delivering over 400 turbine blades produced by 3D printing in one year.

Advancements in Materials and Printing Technologies:

Technological innovation continues to enhance the performance and reliability of the manufacturing 3d printer market. Developments in high-strength polymers, composites, and metals allow additive manufacturing to move beyond prototyping into large-scale production. It delivers durability, accuracy, and thermal resistance needed for critical applications. Hybrid machines that combine additive and subtractive methods expand the range of end-use possibilities. Continuous material and process innovations ensure sustained momentum across diverse industries.

Cost Efficiency and Sustainability Driving Adoption:

The manufacturing 3d printer market gains traction through its ability to cut production costs and support sustainability goals. By minimizing material waste and enabling localized production, it lowers operating expenses and reduces supply chain dependencies. It also supports energy-efficient production processes and reduces reliance on bulk inventory. Companies leverage on-demand manufacturing to align supply with market demand, preventing overproduction. The combination of cost-effectiveness and environmental benefits positions 3D printing as a transformative industrial solution.

Market Trends:

Expansion Toward Production-Scale Additive Manufacturing:

The manufacturing 3d printer market is witnessing a shift from prototyping to production-scale applications across industries. Companies are increasingly deploying additive manufacturing for end-use parts, enabling faster product development cycles and reducing reliance on traditional tooling. It allows manufacturers to achieve greater flexibility in production volumes, supporting both small-batch customizations and large-scale manufacturing runs. Aerospace and automotive firms use the technology for lightweight structural parts, while healthcare organizations adopt it for implants and surgical tools. Hybrid manufacturing systems that combine additive and subtractive processes are also gaining traction. The transition toward production-scale adoption highlights the technology’s maturation and growing strategic importance in industrial operations.

- For instance, Siemens Energy manufactured 8 gas turbine blades using hybrid additive–subtractive systems, achieving a 30% weight reduction per blade — 8 blades.

Growing Adoption of Advanced Materials and Multi-Material Printing:

The manufacturing 3d printer market is evolving with a surge in new materials, including high-performance metals, composites, and biocompatible polymers. It expands the range of end-use applications, allowing manufacturers to address industries with strict performance requirements such as aerospace, energy, and medical devices. Multi-material and multi-color printing capabilities are also enhancing product functionality and design complexity. Sustainability trends are encouraging the development of recyclable and bio-based materials that reduce environmental impact. Companies invest heavily in R&D to refine material properties and improve production consistency. The growing material diversity strengthens the value proposition of 3D printing and accelerates its integration into mainstream industrial supply chains.

- For instance, Stratasys’s J750 3D printer achieves a 14-micron layer resolution while simultaneously jetting multiple biocompatible and high-performance polymers.

Market Challenges Analysis:

High Capital Costs and Limited Standardization:

The manufacturing 3d printer market faces challenges due to the high upfront investment required for industrial-grade machines and supporting infrastructure. Small and mid-sized enterprises often find the cost barrier difficult to overcome, limiting widespread adoption. It also struggles with limited standardization across equipment, materials, and processes, creating compatibility issues and slowing integration into existing workflows. The lack of uniform quality standards leads to inconsistencies in output, particularly for critical aerospace and medical applications. Companies must navigate complex certification requirements, which adds to time and cost burdens. These factors collectively restrict scalability and delay return on investment.

Skills Gap and Supply Chain Constraints:

The manufacturing 3d printer market encounters difficulties stemming from a shortage of skilled professionals capable of operating and maintaining advanced systems. It requires expertise in design, engineering, materials science, and process optimization, yet training programs remain limited. Supply chain constraints for specialized raw materials and printer components also hinder smooth operations. Global disruptions expose vulnerabilities, affecting material availability and delivery timelines. Intellectual property protection remains another concern, as digital design files are more vulnerable to replication. Addressing workforce readiness and supply reliability is essential to unlock the full potential of industrial 3D printing.

Market Opportunities:

Rising Demand for Customization and On-Demand Manufacturing

The manufacturing 3d printer market presents strong opportunities through the growing demand for customization and localized production. It enables companies to deliver tailored products with shorter lead times, enhancing customer satisfaction and reducing dependency on large inventories. Healthcare firms benefit from patient-specific implants and dental devices, while automotive and aerospace sectors adopt it for specialized components. On-demand production also supports agile supply chains, reducing transportation costs and minimizing delays. The ability to rapidly design, test, and deploy parts positions 3D printing as a critical enabler of flexible manufacturing. Companies that leverage this capability can strengthen competitiveness in fast-evolving markets.

Expansion into Emerging Economies and New Applications

The manufacturing 3d printer market can expand significantly in emerging economies where industrialization and government support for advanced manufacturing are accelerating. It creates pathways for adoption in industries such as consumer electronics, energy, and construction that seek cost-efficient, innovative production methods. Applications in sustainable materials, spare parts management, and bioprinting further widen growth potential. Defense and aerospace organizations are exploring additive manufacturing to strengthen operational readiness and reduce logistical complexity. Partnerships between technology providers, research institutions, and governments foster innovation and broader accessibility. The continuous exploration of new applications opens opportunities for long-term value creation across global industries.

Market Segmentation Analysis:

By Printer Type:

The manufacturing 3d printer market is segmented into industrial 3D printers and desktop 3D printers, with industrial models holding the largest share. It serves aerospace, automotive, and healthcare sectors where precision, scale, and advanced material compatibility are critical. Desktop printers, while smaller in scope, are gaining traction in design studios, research labs, and small enterprises. Their affordability and ease of use support adoption in prototyping and education. The combination of industrial dominance and rising desktop usage strengthens market expansion.

- For instance, HP Inc. announced in 2022 that its Multi Jet Fusion printers had produced more than 170 million parts worldwide, a milestone in industrial additive manufacturing.

By Technology:

The market includes technologies such as fused deposition modeling (FDM), selective laser sintering (SLS), stereolithography (SLA), and direct metal laser sintering (DMLS). FDM leads due to cost-effectiveness and versatility across plastics and composites. It is favored in consumer products and basic prototyping. SLS and DMLS dominate high-performance applications in aerospace and automotive, where strength and durability are essential. SLA finds strong adoption in healthcare for dental and surgical applications. Continuous R&D in metal and hybrid technologies reinforces industrial relevance.

- For instance, Boeing used DMLS to manufacture 7,000 metal parts for the main wing of its 777X aircraft, demonstrating its effectiveness for large-scale, demanding components.

By Software:

The software segment covers design, inspection, and print management solutions. It supports the integration of CAD tools with manufacturing workflows, ensuring accuracy and scalability. It enables simulation, error detection, and real-time monitoring, which reduce production delays. Strong demand exists for cloud-based platforms that align with Industry 4.0 practices. The role of software in enabling automation and digital supply chains continues to grow.

Segmentations:

By Printer Type:

- Industrial 3D Printers

- Desktop 3D Printers

By Technology:

- Fused Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Stereolithography (SLA)

- Direct Metal Laser Sintering (DMLS)

- Others

By Software:

- Design Software

- Inspection Software

- Print Management Software

- Simulation Software

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 38% market share in the manufacturing 3d printer market, supported by its strong technological ecosystem and early industrial adoption. The United States leads with robust investments in aerospace, automotive, and healthcare sectors that demand high-performance additive manufacturing solutions. It benefits from established R&D infrastructure, government funding programs, and strategic collaborations between universities and industry leaders. Defense applications further strengthen the market, with 3D printing used for rapid prototyping and mission-critical components. The presence of major technology providers and material innovators accelerates commercialization. North America continues to set global benchmarks in scaling industrial additive manufacturing.

Europe:

Europe accounts for 32% market share in the manufacturing 3d printer market, driven by a strong emphasis on sustainable production and advanced engineering. Countries such as Germany, France, and the United Kingdom spearhead adoption in automotive and aerospace industries. It benefits from strict regulatory frameworks that promote efficiency and eco-friendly manufacturing methods. Research initiatives funded by the European Union encourage breakthroughs in materials, process automation, and hybrid systems. Healthcare adoption is also accelerating, with biocompatible implants and dental applications gaining traction. Europe’s integration of green technologies positions it as a leader in sustainable industrial 3D printing.

Asia-Pacific :

Asia-Pacific holds 24% market share in the manufacturing 3d printer market, supported by rapid industrialization and government-led innovation programs. China, Japan, and South Korea are leading adopters, leveraging additive manufacturing in electronics, consumer goods, and transportation sectors. It benefits from a strong manufacturing base, cost-efficient production models, and rising investments in digital technologies. Healthcare and education sectors are also expanding adoption, supported by local research institutions. Government policies encouraging smart manufacturing and industrial modernization strengthen regional competitiveness. Asia-Pacific is expected to record the fastest growth, reshaping global dynamics in industrial 3D printing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3D Systems, Inc.

- Arcam AB

- 3DCeram

- Autodesk, Inc.

- Dassault Systemes

- Canon, Inc.

- EnvisionTec, Inc.

- ExOne

- EOS (Electro Optical Systems) GmbH

- GE Additive

- madeinspace.us

- HP Inc.

- Materialise NV

Competitive Analysis:

The manufacturing 3d printer market is highly competitive, driven by continuous innovation and strong investments in advanced technologies. Key players such as 3D Systems, Inc., Arcam AB, 3DCeram, Autodesk, Inc., Dassault Systèmes, Canon, Inc., EnvisionTec, Inc., ExOne, and EOS GmbH dominate the landscape with diverse product portfolios and global reach. It is shaped by the push toward industrial-grade applications, where precision, material compatibility, and scalability define market leadership. Companies emphasize R&D to enhance performance in metals, polymers, and composites while integrating software solutions for seamless workflows. Strategic partnerships with aerospace, automotive, and healthcare industries strengthen market positioning. Regional players contribute by offering cost-efficient and specialized solutions, yet global leaders maintain an advantage through advanced manufacturing capabilities and digital integration. The competitive environment continues to evolve with growing emphasis on sustainability, hybrid systems, and Industry 4.0 alignment, reinforcing innovation as the primary driver of market strength.

Recent Developments:

- In July 2025, 3D Systems, Inc. announced the full commercial release of its FDA-cleared NextDent Jetted Denture Solution for digital dentistry.

- In August 2025, Arcam AB (a GE Additive company) broke ground on a new manufacturing facility in the Mölnlycke Business Park, near Gothenburg, Sweden, consolidating and expanding its production operations to meet increased demand.

- In July 2025, Canon U.S.A. rolled out Managed IT Services in partnership with Supra ITS, delivering scalable IT and cybersecurity solutions to U.S.-based enterprise customers.

Market Concentration & Characteristics:

The manufacturing 3d printer market shows moderate to high concentration, with leading players such as Stratasys, 3D Systems, EOS, HP Inc., and GE Additive holding significant influence through advanced technologies and broad customer bases. It is characterized by continuous innovation in materials, precision, and speed, which drives differentiation among competitors. The market demonstrates high entry barriers due to capital-intensive requirements, specialized expertise, and certification needs across aerospace and healthcare sectors. Regional players contribute by offering cost-effective solutions and localized services, but global leaders maintain dominance through R&D investments and strategic partnerships. The competitive landscape emphasizes innovation, quality consistency, and integration with digital manufacturing ecosystems.

Report Coverage:

The research report offers an in-depth analysis based on Printer Type, Technology, Software and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The manufacturing 3d printer market will expand further into end-use production, moving beyond prototyping to full-scale industrial applications.

- Aerospace and automotive industries will drive demand for lightweight, complex parts that improve performance and efficiency.

- Healthcare will witness rising adoption for patient-specific implants, surgical tools, and dental applications, supported by regulatory approvals.

- Advanced materials such as composites, high-strength metals, and biocompatible polymers will broaden application potential.

- Hybrid manufacturing systems combining additive and subtractive methods will strengthen process efficiency and design flexibility.

- Integration with Industry 4.0, AI, and automation will enhance scalability and connect additive manufacturing with digital supply chains.

- Sustainability initiatives will accelerate use of recyclable and bio-based materials, aligning with global green manufacturing goals.

- Emerging economies will become growth hubs, supported by industrial modernization, government incentives, and local innovation.

- On-demand and decentralized production will gain traction, reducing reliance on traditional supply chains and lowering operational risks.

- Strategic collaborations between technology providers, research institutions, and manufacturers will foster innovation and expand adoption across multiple industries.