| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Food Market Size 2024 |

USD 1,94,051.10 Million |

| Luxury Food Market, CAGR |

15.01% |

| Luxury Food Market Size 2032 |

USD 5,93,436.64 Million |

Market Overview

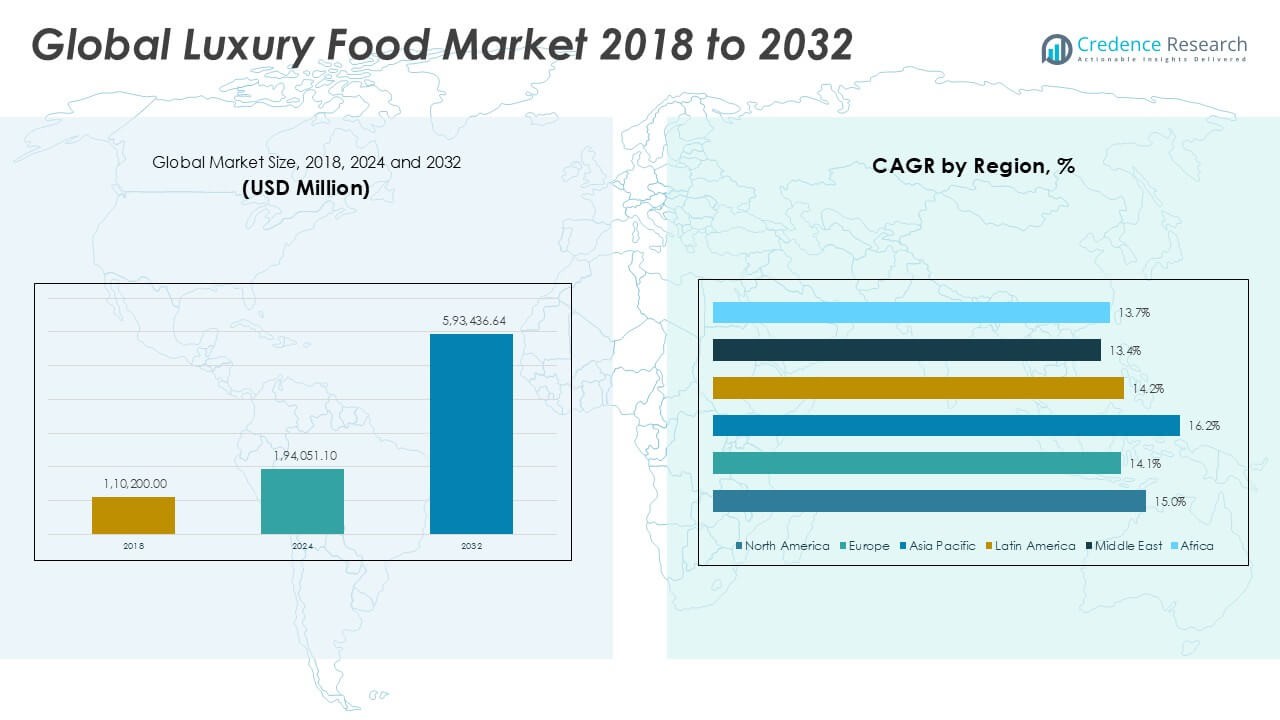

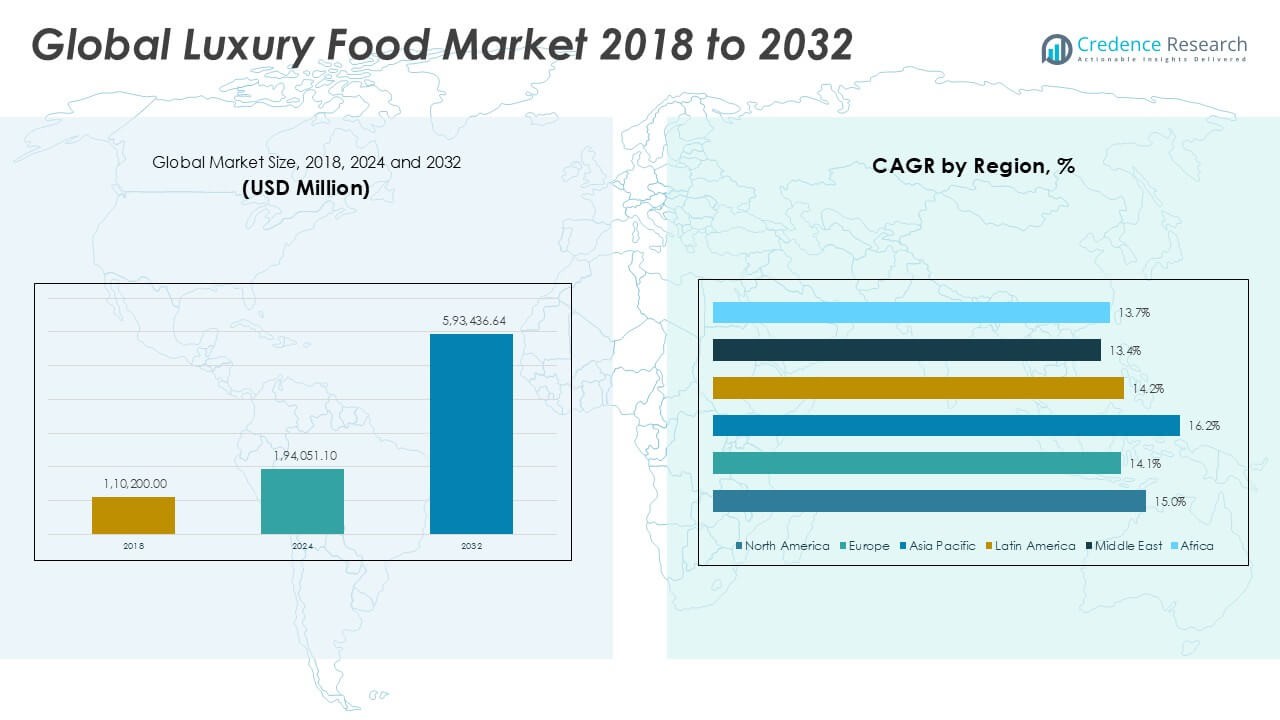

The Global Luxury Food Market is projected to grow from USD 1,94,051.10 million in 2024 to an estimated USD 5,93,436.64 million by 2032, registering a compound annual growth rate (CAGR) of 15.01% from 2025 to 2032.

Key drivers fueling the growth of the luxury food market include the increasing globalization of culinary cultures, growing demand for organic and sustainably sourced luxury products, and a surge in consumer preference for unique and artisanal food items. Emerging trends such as personalized dining, limited-edition products, and plant-based luxury alternatives are also gaining momentum. Additionally, the rising influence of social media and celebrity endorsements is significantly boosting consumer interest and market visibility.

Geographically, Europe holds a prominent share in the luxury food market, driven by its rich culinary heritage and the presence of several renowned premium food brands. North America is also a significant market, supported by high consumer spending and an expanding gourmet food sector. The Asia Pacific region is expected to witness the fastest growth due to rapid urbanization, increasing wealth, and rising demand for imported luxury food products. Key players operating in the global luxury food market include Nestlé S.A., Cargill, Incorporated, Dean & DeLuca, Godiva Chocolatier, Mars Incorporated, and Gualtiero Marchesi S.r.l., among others.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Luxury Food Market is projected to grow significantly, reaching over USD 5.9 trillion by 2032 with a CAGR of 15.01%, driven by rising consumer demand for premium food products.

- Increasing disposable incomes and shifting lifestyle preferences toward gourmet and exclusive food experiences act as key growth drivers for the market.

- Growing consumer focus on organic, sustainably sourced, and plant-based luxury foods supports innovation and product diversification in the market.

- High product costs and limited accessibility in price-sensitive regions pose challenges that may restrict broader market penetration.

- Supply chain complexities and raw material sourcing issues create operational risks that luxury food companies must manage carefully.

- Europe and North America dominate the market due to established culinary traditions and high spending, while Asia Pacific shows the fastest growth potential driven by urbanization and wealth increases.

- Expansion of e-commerce and digital retail channels enhances consumer access to luxury food products, supporting market growth globally.

Market Drivers

Rising Disposable Income and Consumer Willingness to Spend on Premium Products

The Global Luxury Food Market benefits from the steady rise in disposable income among middle and upper-income consumers. Higher purchasing power enables consumers to explore premium food products without financial hesitation. Consumers now prioritize exclusive dining experiences and are more inclined to pay for quality, taste, and brand prestige. It has created a strong foundation for luxury food brands to expand their offerings. Growing economic stability in emerging markets further fuels this spending behavior. The increasing preference for specialty food over conventional alternatives positions the luxury food segment for long-term growth.

- For instance, a 2024 survey by the National Bureau of Economic Research found that among 15,000 consumers surveyed, the average annual increase in spending on premium food products was 1,200 USD per consumer.

Growing Demand for Organic and Sustainably Sourced Luxury Food

Consumers are showing heightened awareness of food origins and production methods, which drives demand in the Global Luxury Food Market for organic and sustainably sourced products. Ethical consumption plays a significant role in purchasing decisions, especially among younger demographics. It prompts luxury brands to offer traceable, environmentally friendly products with transparent sourcing practices. Consumers value certifications and sustainability labels that confirm product authenticity. The trend strengthens the premium appeal of luxury food items that align with these values. It encourages companies to innovate responsibly and build trust with their target audience.

- For instance, according to the Organic Trade Association in 2024, there were 8,500 organic luxury food products certified and 12,000 consumers identified as preferring sustainable products in their survey.

Influence of Celebrity Endorsements and Social Media on Consumer Choices

The Global Luxury Food Market experiences strong influence from social media trends and celebrity endorsements. Influencers and luxury chefs often introduce exclusive products to a broader audience, shaping consumer perceptions. It elevates the market’s visibility and makes premium food more aspirational. Consumers actively follow recommendations from trusted public figures, which accelerates product demand. Viral social media campaigns often dictate luxury food trends across different regions. It helps luxury food brands establish strong emotional connections with consumers and boosts brand loyalty.

Expansion of Global Travel and Cross-Cultural Culinary Experiences

The Global Luxury Food Market is growing due to the expansion of global travel and exposure to diverse culinary traditions. Travelers develop a taste for international luxury foods and seek the same experiences in their home countries. It stimulates demand for imported gourmet products and encourages retailers to diversify their premium offerings. Exposure to foreign cuisines increases the consumer base for niche and exotic luxury food categories. The growing popularity of international food festivals and culinary tourism also contributes to this demand. It supports continuous product innovation and market expansion.

Market Trends

Rising Popularity of Plant-Based and Health-Focused Luxury Food Products

The Global Luxury Food Market is witnessing a noticeable shift towards plant-based and health-oriented products. Consumers actively seek luxury food options that support wellness without compromising taste and exclusivity. It drives brands to introduce premium vegan, gluten-free, and low-sugar alternatives. High nutritional value combined with gourmet quality strengthens consumer interest in these offerings. Plant-based luxury chocolates, artisanal dairy alternatives, and organic superfoods are gaining significant shelf space. It creates new product categories and expands the market beyond traditional luxury items.

- For instance, in 2024, there were 350 new plant-based luxury food products launched globally, reflecting the rapid expansion and innovation in this segment.

Growing Demand for Limited-Edition and Customized Luxury Food Experiences

The Global Luxury Food Market is seeing a surge in demand for limited-edition products and bespoke culinary experiences. Consumers value exclusivity and are willing to pay for products that offer uniqueness and personalization. It motivates companies to launch time-sensitive collections and tailored dining services. Customized packaging, exclusive ingredients, and personal chef services are attracting high-spending customers. Seasonal luxury food releases and collaboration menus with renowned chefs further elevate market interest. It helps brands differentiate their offerings and secure consumer loyalty.

- For instance, in 2024, there were 120 limited-edition luxury food product releases and 75 bespoke culinary experiences launched worldwide, underscoring the market’s focus on uniqueness and customization.

Increased Integration of Technology in Luxury Food Retail and Production

The Global Luxury Food Market benefits from the rising adoption of technology in product development and retail. Companies use advanced tracking systems to ensure supply chain transparency and product authenticity. It allows consumers to verify sourcing, quality, and production details through smart labels and QR codes. Luxury food brands also leverage e-commerce platforms and virtual reality experiences to offer immersive purchasing journeys. Online gourmet food marketplaces and direct-to-consumer models are becoming central to market strategies. It supports seamless consumer access and enhances the overall buying experience.

Emphasis on Storytelling and Brand Heritage to Build Consumer Trust

The Global Luxury Food Market is placing strong emphasis on storytelling and showcasing brand heritage. Consumers prefer brands that offer a meaningful history, craftsmanship, and cultural significance behind their products. It encourages luxury food companies to highlight artisanal methods, traditional recipes, and generational expertise. Marketing strategies now focus on sharing the origins and legacy of each product to deepen consumer engagement. High-end brands that communicate authenticity and exclusivity strengthen their market presence. It increases consumer trust and supports premium pricing strategies.

Market Challenges

High Product Costs and Limited Accessibility Restrain Consumer Reach

The Global Luxury Food Market faces significant challenges due to high product costs and limited accessibility. Premium pricing restricts the consumer base, especially in price-sensitive regions. It limits market penetration in developing countries where luxury food is often viewed as non-essential. Logistical complexities and high import duties further increase retail prices, reducing affordability. Consumers may hesitate to invest in luxury food when faced with economic uncertainties or inflationary pressures. It forces brands to balance exclusivity with broader market appeal to sustain growth.

- For instance, according to a 2024 survey by the Specialty Food Association, luxury food importers in India reported that average import duties and logistics fees added approximately $18,000 to the cost of a single container of premium cheese, making it unaffordable for many retailers and consumers.

Supply Chain Disruptions and Raw Material Sourcing Complexity Impact Stability

The Global Luxury Food Market struggles with supply chain disruptions and complex raw material sourcing. Seasonal availability, geopolitical tensions, and transportation issues can delay product delivery and impact quality. It puts pressure on companies to secure consistent supplies of rare and high-quality ingredients. Climate change and environmental factors also affect the availability of specialty food items. Brands risk losing consumer trust when supply inconsistencies compromise product authenticity. It challenges luxury food manufacturers to build resilient, diversified sourcing networks to maintain reliability.

Market Opportunities

Expanding Presence in Emerging Markets with Growing Middle-Class Population

The Global Luxury Food Market presents strong opportunities in emerging markets with rising middle-class populations. Increasing disposable incomes and shifting consumer preferences in countries like China, India, and Brazil create favorable conditions for luxury food brands. It offers companies the chance to introduce premium products to a broader consumer base seeking exclusive experiences. Local partnerships, targeted marketing, and culturally tailored offerings can accelerate brand growth in these regions. Consumers in emerging markets are becoming more open to gourmet and international cuisines. It supports long-term market expansion and brand diversification strategies.

Product Innovation and Diversification Across Health-Conscious Segments

The Global Luxury Food Market holds promising opportunities through product innovation focused on health-conscious consumers. Brands can develop new product lines that combine luxury with nutritional benefits, meeting growing demand for guilt-free indulgence. It opens space for premium organic snacks, sugar-free chocolates, and plant-based gourmet options. Consumers actively seek unique flavor profiles and ingredients that deliver both taste and health value. Introducing superfoods, rare spices, and functional ingredients into luxury categories can attract health-aware buyers. It allows companies to tap into evolving dietary trends and capture new customer segments.

Market Segmentation Analysis

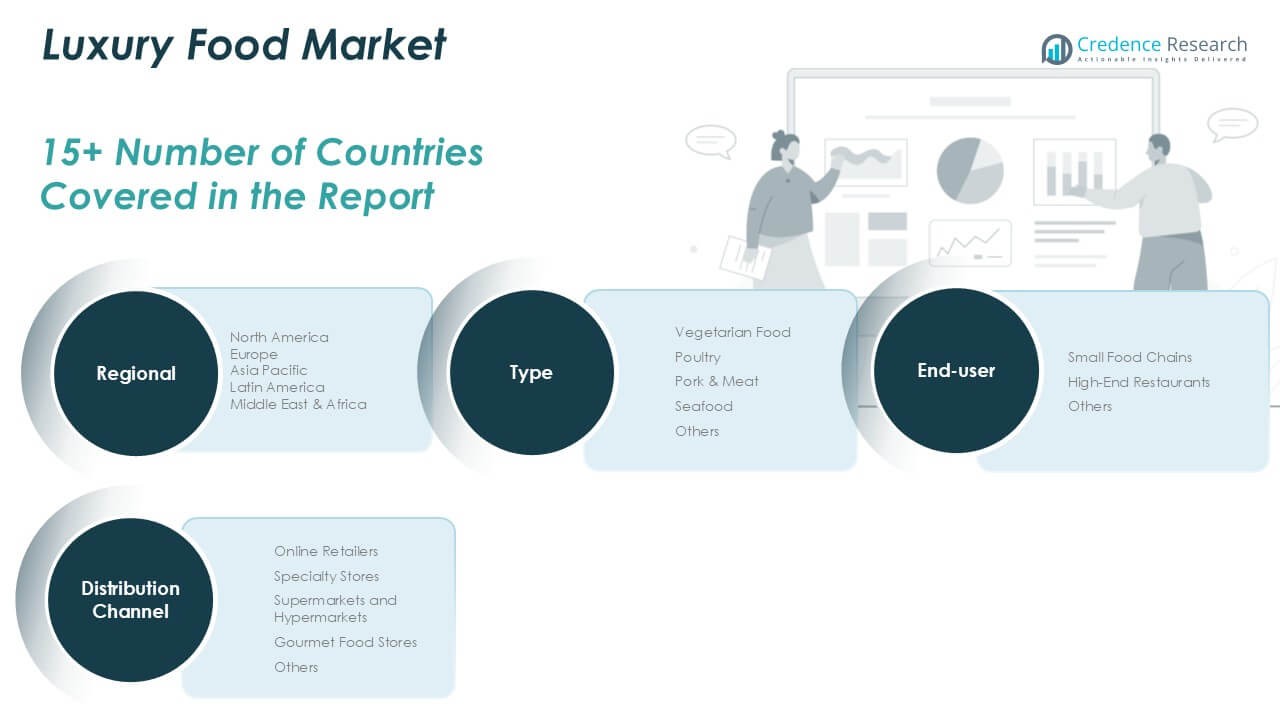

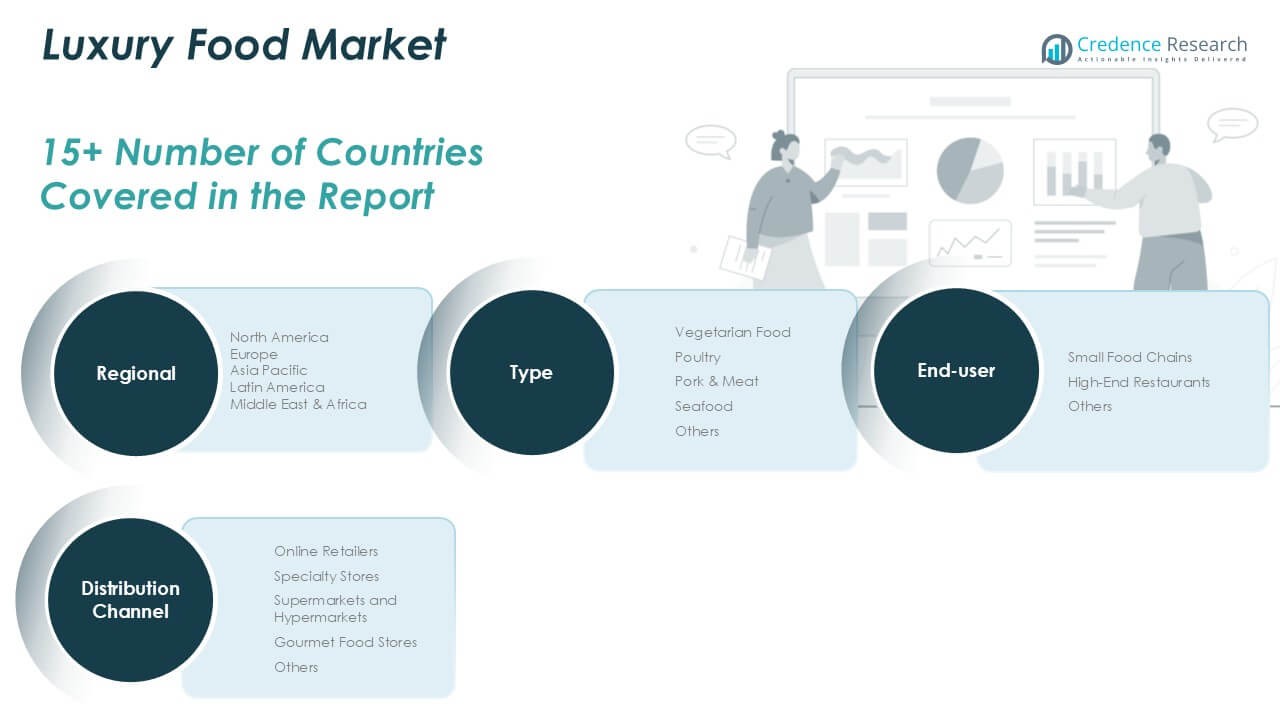

By Type

The Global Luxury Food Market is segmented by type into vegetarian food, poultry, pork and meat, seafood, and others. Vegetarian food is gaining strong consumer interest due to rising health awareness and plant-based dietary preferences. Poultry and seafood segments attract consumers looking for premium protein sources with unique preparation methods and flavors. Pork and meat maintain steady demand in regions where gourmet meat cuts and exclusive processing techniques are valued. Seafood remains popular in luxury dining due to its freshness and association with high-end culinary experiences. The ‘others’ segment includes specialty products that cater to niche tastes and regional preferences, offering unique growth opportunities.

- For instance, according to a 2024 survey by the Specialty Food Association, over 1,200 new vegetarian luxury food products were launched in North America in 2023, reflecting strong innovation and consumer demand within this segment.

By End-User

The Global Luxury Food Market is categorized by end-user into small food chains, high-end restaurants, and others. High-end restaurants dominate the market, driven by consumer demand for exclusive dining experiences and chef-curated luxury menus. Small food chains are gaining market share by offering premium food selections in more accessible settings. It creates a pathway for broader consumer reach without diluting brand exclusivity. The ‘others’ category includes luxury catering services, boutique hotels, and private events, which continue to support market growth by focusing on personalized and high-quality food offerings.

- For instance, data from the National Restaurant Association shows that in 2023, more than 8,500 high-end restaurants in the United States featured luxury food items such as truffle-based dishes, wagyu beef, and premium seafood on their menus.

By Distribution Channel

The Global Luxury Food Market is segmented by distribution channel into online retailers, specialty stores, supermarkets and hypermarkets, gourmet food stores, and others. Online retailers are expanding rapidly due to consumer preference for convenience and direct access to luxury food products. Specialty stores maintain strong relevance by providing curated selections and personalized service. Supermarkets and hypermarkets attract consumers by offering premium food ranges in a wider retail network. Gourmet food stores remain essential for offering rare and imported luxury items that appeal to niche buyers. The ‘others’ segment includes exclusive brand outlets and private distribution networks that sustain the luxury positioning of these products.

Segments

Based on Type

- Vegetarian Food

- Poultry

- Pork & Meat

- Seafood

- Others

Based on End-user

- Small Food Chains

- High-End Restaurants

- Others

Based on Distribution Channel

- Online Retailers

- Specialty Stores

- Supermarkets and Hypermarkets

- Gourmet Food Stores

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Luxury Food Market

The North America Luxury Food Market is projected to grow from USD 73,350.15 million in 2024 to USD 2,23,321.48 million by 2032, holding the largest regional market share of 37.63% in 2024. It benefits from strong consumer purchasing power and a mature luxury retail landscape. High demand for premium dining and gourmet products in the United States and Canada drives consistent growth. It remains supported by the region’s preference for organic, sustainably sourced, and personalized luxury food items. North America’s advanced supply chain infrastructure further strengthens product availability. The market continues to attract innovation through celebrity partnerships and social media-driven food trends.

Europe Luxury Food Market

The Europe Luxury Food Market is expected to grow from USD 43,520.36 million in 2024 to USD 1,24,771.63 million by 2032, accounting for 23.20% of the regional market share in 2024. It is supported by Europe’s deep-rooted culinary traditions and strong demand for artisanal, locally produced luxury food items. Countries like France, Italy, and Switzerland drive sales through their reputation for gourmet excellence. It remains highly competitive with established premium food brands and exclusive product launches. European consumers actively seek heritage products with clear sourcing and craftsmanship. Tourism and the region’s luxury hospitality sector continue to strengthen market growth.

Asia Pacific Luxury Food Market

The Asia Pacific Luxury Food Market is projected to rise from USD 55,119.40 million in 2024 to USD 1,82,981.92 million by 2032, representing 28.29% of the regional market share in 2024. Rapid urbanization, increasing middle-class wealth, and growing interest in gourmet food contribute to its expansion. China, Japan, and India remain key markets driving luxury food consumption. It is witnessing a surge in demand for imported premium products and health-oriented luxury options. Cultural openness to international cuisines supports further market penetration. Asia Pacific shows strong growth potential across both retail and high-end dining segments.

Latin America Luxury Food Market

The Latin America Luxury Food Market is set to grow from USD 9,545.37 million in 2024 to USD 27,416.77 million by 2032, holding 4.90% of the regional market share in 2024. Brazil, Argentina, and Mexico are key contributors to market growth in this region. It gains momentum through increasing disposable income and growing consumer interest in exclusive food experiences. Local cuisines are blending with international luxury food trends, creating unique market opportunities. Consumers show rising preference for high-quality seafood, premium meats, and specialty chocolates. Retailers are expanding luxury food offerings to meet evolving consumer expectations.

Middle East Luxury Food Market

The Middle East Luxury Food Market is projected to grow from USD 6,363.61 million in 2024 to USD 17,390.96 million by 2032, with a regional market share of 3.27% in 2024. The market benefits from the region’s growing hospitality sector, luxury tourism, and premium food culture. Countries like the UAE and Saudi Arabia lead in luxury food consumption through exclusive dining, hotel experiences, and gourmet retail outlets. It continues to attract high-spending consumers looking for imported luxury food products. Demand for organic and halal-certified premium items strengthens regional sales. Investment in high-end retail infrastructure supports further market development.

Africa Luxury Food Market

The Africa Luxury Food Market is expected to increase from USD 6,152.21 million in 2024 to USD 17,553.89 million by 2032, contributing 3.16% of the regional market share in 2024. South Africa, Nigeria, and Egypt remain key markets driving regional demand. It gains traction through expanding urban centers and rising middle-income groups seeking premium food experiences. The availability of imported luxury food products in major cities supports consumer interest. The market faces supply chain challenges but shows potential through growing e-commerce adoption. Consumers are beginning to explore gourmet, organic, and sustainably sourced luxury food options, creating long-term growth opportunities.

Key players

- Caviar House & Prunier

- Petrossian

- Fauchon

- Fortnum & Mason

- Harrods Food Halls

- Dean & DeLuca

- Valrhona

- Godiva

- Maison Ladurée

- Hediard

- Pierre Hermé

- Williams Sonoma

- Eataly

- D’Artagnan

Competitive Analysis

The Global Luxury Food Market features intense competition driven by brand reputation, exclusive product offerings, and international presence. Companies focus on maintaining product quality, heritage, and innovation to strengthen their market positions. Leading players such as Caviar House & Prunier, Godiva, and Valrhona hold significant brand equity and command strong consumer loyalty. It encourages competitors to expand premium portfolios and introduce limited-edition products to capture niche demand. High-end retailers like Harrods Food Halls and Fortnum & Mason continue to set industry standards through curated luxury food selections. Companies are enhancing their global distribution networks and investing in flagship stores to build visibility. Growth strategies often center on expanding in emerging markets and leveraging digital platforms for direct consumer engagement.

Recent Developments

- In June 2025, Godiva made a limited-edition return to UK supermarkets, specifically through Tesco, after a five-year absence, with a Dubai-style chocolate bar. This “Dubai chocolate” trend involves a pistachio and kadayif-filled milk chocolate bar. The move marks a shift for the brand, known for its upscale retailers, to target a wider mainstream audience in Tesco.

- In March 2024, Caviar House & Prunier launched its first City of London restaurant at Threadneedles Hotel, marking its first central London opening in nearly a decade

- In April 2024, Pladis integrated Godiva into its portfolio and appointed Steve Lesnard (formerly of Nike, The North Face, and Sephora) as President of Godiva, effective May 1

Market Concentration and Characteristics

Market Concentration and Characteristics

The Global Luxury Food Market shows moderate to high market concentration with a few dominant players holding significant shares. It is characterized by strong brand loyalty, limited product substitutes, and high entry barriers due to stringent quality standards and established consumer expectations. Leading companies focus on exclusivity, premium sourcing, and heritage branding to maintain their positions. The market emphasizes product authenticity, artisanal craftsmanship, and unique taste profiles. It caters to a selective consumer base that values premium quality over price sensitivity. Seasonal demand, limited-edition offerings, and customized experiences are key features that shape purchasing behavior. It continues to prioritize product innovation, ethical sourcing, and global distribution expansion to sustain growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, End-user, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global Luxury Food Market will continue to expand rapidly, driven by rising disposable incomes and growing consumer demand for premium experiences.

- Increasing health consciousness will prompt brands to develop innovative luxury food products with organic, plant-based, and functional ingredients.

- Emerging markets in Asia Pacific, Latin America, and Africa will offer significant growth opportunities due to urbanization and changing lifestyle preferences.

- Digital transformation will enhance direct-to-consumer sales channels, with online retail becoming a critical platform for luxury food distribution.

- Sustainability will become a core focus, leading companies to adopt environmentally friendly sourcing, packaging, and production practices.

- Personalization and customization of luxury food products will grow, meeting consumers’ desire for unique and tailored culinary experiences.

- Collaborations between luxury food brands and celebrity chefs or influencers will boost market visibility and drive new consumer engagement.

- Technological advances, including blockchain and IoT, will improve supply chain transparency and product traceability, building greater consumer trust.

- Experiential marketing through luxury food events, tastings, and culinary tourism will play a key role in brand differentiation and loyalty.

- Regulatory frameworks around food safety, quality, and labeling will tighten globally, requiring luxury brands to maintain strict compliance and standards.

Market Concentration and Characteristics

Market Concentration and Characteristics