Market Overview

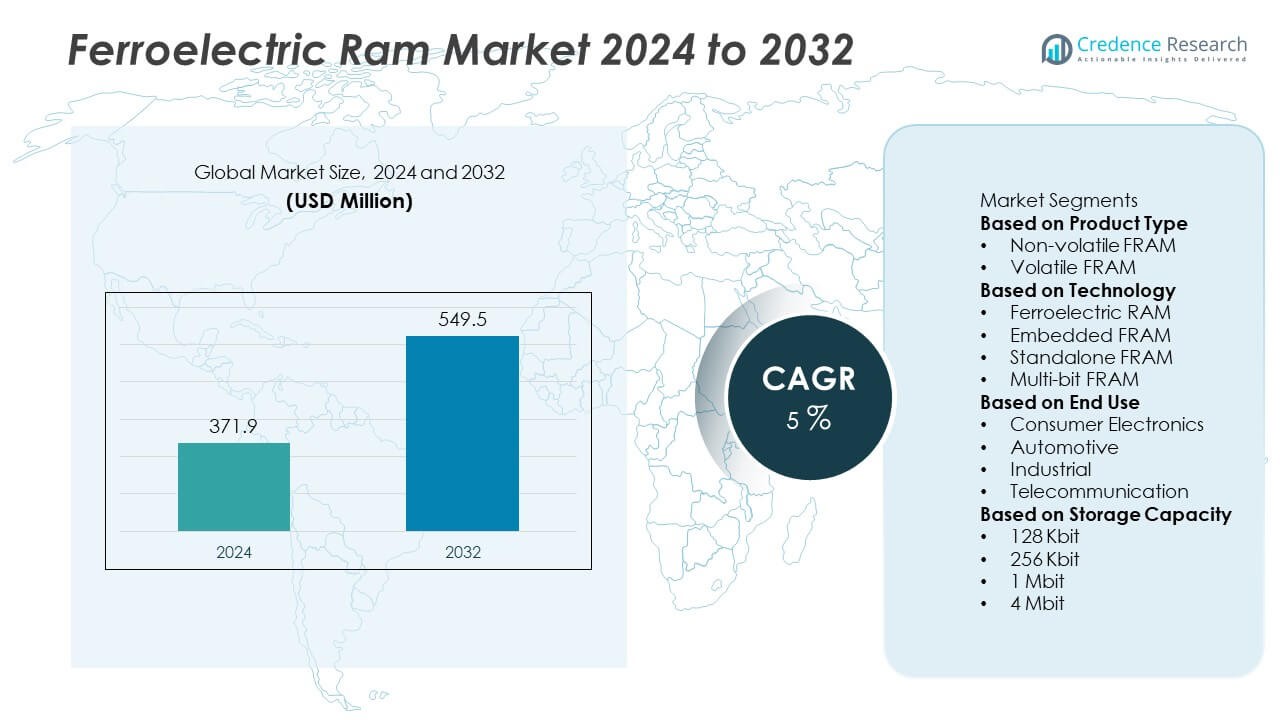

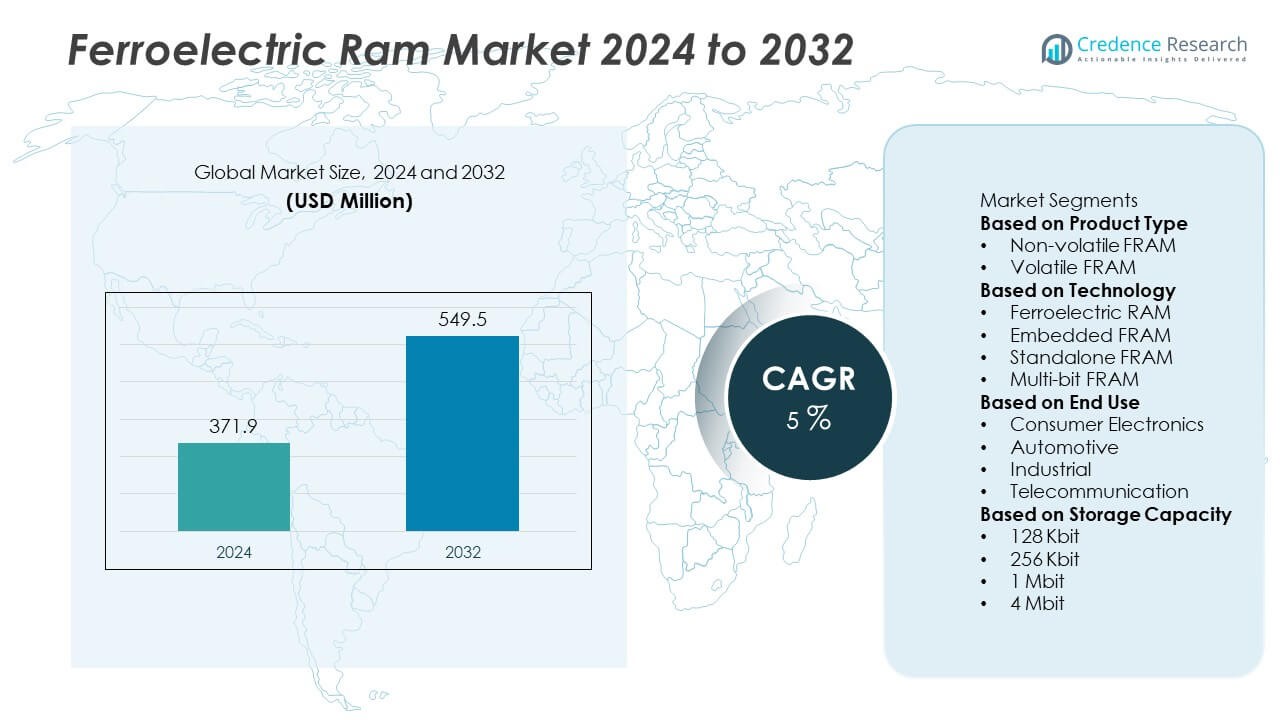

The Ferroelectric RAM Market was valued at 371.9 million in 2024 and is projected to reach 549.5 million by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ferroelectric RAM Market Size 2024 |

USD 371.9 Million |

| Ferroelectric RAM Market, CAGR |

5% |

| Ferroelectric RAM Market Size 2032 |

USD 549.5 Million |

The Ferroelectric RAM Market experiences strong growth driven by increasing demand for high-speed, low-power memory solutions in consumer electronics, automotive systems, and industrial applications. It benefits from the rising adoption of IoT devices, embedded systems, and advanced microcontrollers requiring non-volatile memory with rapid read/write capabilities. Continuous innovations in low-latency, energy-efficient ferroelectric memory technology enhance system performance and reliability.

The Ferroelectric RAM Market shows significant activity across North America, Europe, and Asia-Pacific, driven by advanced electronics adoption and strong semiconductor manufacturing capabilities. North America leads with extensive use in aerospace, defense, and industrial automation, supported by technological innovation and robust R&D infrastructure. Europe demonstrates steady growth due to automotive electronics, industrial automation, and regulatory support for energy-efficient devices. Asia-Pacific emerges as a rapidly expanding region, fueled by rising consumer electronics demand, increasing IoT adoption, and expanding semiconductor production in countries like Japan, South Korea, and China. Key players shaping the Ferroelectric RAM Market include Fujitsu Limited, Rohm Semiconductor, Cypress Semiconductor, and Texas Instruments, all of which focus on developing high-performance, energy-efficient memory solutions and expanding strategic partnerships to strengthen their global presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ferroelectric RAM Market was valued at USD 371.9 million in 2024 and is projected to reach USD 549.5 million by 2032, growing at a CAGR of 5% during the forecast period.

- Growing demand for high-speed, low-power memory solutions in consumer electronics, automotive, and industrial automation drives the Ferroelectric RAM Market, supporting energy-efficient and reliable performance in critical applications.

- Increasing adoption of LED-based displays, IoT devices, and embedded systems shapes market trends, encouraging manufacturers to integrate smaller, faster, and more durable memory components for optimized performance.

- Leading players such as Fujitsu Limited, Rohm Semiconductor, Cypress Semiconductor, and Texas Instruments strengthen market competition by launching advanced Ferroelectric RAM solutions, expanding production capabilities, and forming strategic alliances for global reach.

- High production costs, technological complexity, and limited compatibility with conventional CMOS processes act as key restraints, slowing adoption in price-sensitive and legacy system applications.

- North America maintains strong demand due to aerospace, defense, and industrial automation applications, while Europe grows steadily with automotive and industrial use. Asia-Pacific emerges as the fastest-growing region, supported by semiconductor manufacturing hubs in Japan, South Korea, and China, along with rising consumer electronics adoption.

- Market expansion opportunities exist in IoT, smart devices, and automotive electronics, where low-power, fast-access memory is critical, encouraging innovation and strategic partnerships among Ferroelectric RAM manufacturers to capture emerging industrial and consumer applications.

Market Drivers

Rising Demand for High-Speed, Low-Power Memory Solutions Across Electronics Sectors

The Ferroelectric RAM Market benefits from increasing adoption of high-speed, low-power memory solutions in industrial, automotive, and consumer electronics applications. It provides rapid read/write cycles while maintaining non-volatile data retention, making it suitable for real-time data processing and energy-efficient operations. Growing integration of IoT devices, smart sensors, and embedded systems drives the need for memory solutions that do not compromise performance or power efficiency. Manufacturers develop ferroelectric RAM modules with optimized architecture to support faster data access and reduced energy consumption. Demand in smart home devices and wearable electronics further strengthens its adoption. It supports reliable operations in edge computing applications where data stability is critical. Rising awareness of energy efficiency and device longevity reinforces the market’s growth trajectory.

- For instance, Cypress Semiconductor developed the 256 Kbit CY15B104Q ferroelectric RAM with 40-nanosecond access time and ultra-low active current of 10 mA, enabling high-speed data logging in low-power wearable and embedded systems.

Increasing Integration of Ferroelectric RAM in Automotive and Industrial Applications

Industrial automation and automotive electronics represent major growth areas for the Ferroelectric RAM Market. It enables secure data storage in harsh environments, including high temperatures, vibration, and electromagnetic interference conditions. Automotive applications such as advanced driver-assistance systems (ADAS), infotainment, and electric vehicle battery management systems rely on high-performance memory modules. Industrial machinery and process control systems utilize ferroelectric RAM to maintain real-time operational data with minimal latency. Manufacturers respond with customized memory solutions for these sectors, enhancing durability and reliability. Expanding automation initiatives in emerging economies further accelerate adoption. It provides an essential component for mission-critical industrial and automotive processes.

- For instance, ROHM Semiconductor’s MR44V064B, used in industrial PLCs, supports 64 Kbit density with a 15 ns access time and 10-year data retention at 85°C, making it ideal for high-frequency write conditions.

Advancements in Ferroelectric Materials and Memory Density Enhancing Market Adoption

Technological developments in ferroelectric materials and memory cell architectures drive the Ferroelectric RAM Market forward. It benefits from improved scalability and increased memory density, enabling integration into smaller devices without sacrificing performance. Research on novel ferroelectric compounds reduces voltage requirements and enhances operational lifespan, appealing to high-performance computing applications. Semiconductor companies collaborate with research institutes to implement advanced fabrication techniques for reliable, high-density memory chips. Rising focus on multi-bit storage and energy-efficient read/write cycles further supports deployment in diverse applications. It provides a competitive alternative to traditional volatile and non-volatile memory technologies. Ongoing innovations maintain market momentum and attract new industrial users.

Growing Need for Secure and Reliable Data Storage in Critical Systems

The Ferroelectric RAM Market experiences strong demand from sectors requiring high data integrity and security. It ensures non-volatile retention during power interruptions, preventing data loss in industrial automation, medical devices, and aerospace systems. Increasing regulatory standards and safety compliance requirements drive adoption in mission-critical environments. Manufacturers develop error-correcting memory modules and enhanced monitoring systems to meet stringent reliability benchmarks. It also supports backup and recovery applications in embedded computing platforms. Rising investments in smart infrastructure, robotics, and defense electronics highlight the critical role of ferroelectric RAM in maintaining operational continuity. Secure, high-performance memory remains a key driver for market expansion.

Market Trends

Transition Toward Energy-Efficient and Low-Power Memory Solutions Across Industries

The Ferroelectric RAM Market shows a clear trend toward energy-efficient memory modules designed for low-power operation. It supports applications in portable electronics, IoT devices, and embedded systems where minimizing energy consumption is critical. Manufacturers focus on optimizing ferroelectric materials to reduce operating voltage and enhance write/read efficiency. Integration in battery-powered devices and edge computing platforms accelerates adoption. It enables designers to develop compact, high-performance solutions without compromising power budgets. Continuous improvements in circuit design and memory management enhance operational efficiency. The demand for sustainable, energy-conscious technology underlines this market trend.

- For instance, Infineon Technologies’ CY15B102Q 2-Mbit FRAM supports ultra-low power standby current of 1 µA and active current of 10 mA at 40 MHz, with 45 ns read/write speed, enabling efficient memory use in wearable health monitors and smart meters.

Increased Deployment in Automotive Electronics and Industrial Automation Systems

Adoption of ferroelectric RAM in automotive and industrial applications continues to rise, shaping market dynamics. It ensures reliable data retention in extreme conditions, including high temperatures, vibration, and electromagnetic interference. Applications in electric vehicles, advanced driver-assistance systems (ADAS), and robotics benefit from rapid read/write cycles. Industrial process control and automation systems utilize ferroelectric RAM to maintain operational continuity during power fluctuations. Manufacturers design sector-specific memory modules with enhanced durability and operational life. It enables the development of high-performance systems in demanding environments. Growing reliance on connected and autonomous technologies reinforces this trend.

- For instance, Fujitsu’s MB85RS2MT FRAM provides 2 Mbit density with an SPI interface, supports operation from –40°C to +125°C, and offers 10 trillion read/write cycles, making it ideal for event data recorders and industrial PLCs exposed to fluctuating power and harsh environmental stress.

Emergence of High-Density and Multi-Bit Memory Solutions

The Ferroelectric RAM Market trends toward higher memory density and multi-bit storage capabilities. It allows semiconductor companies to integrate larger data capacity into smaller form factors suitable for compact electronics. Technological advancements in ferroelectric materials improve scalability, reduce latency, and enhance data retention. Research in multi-level cell (MLC) architectures enables more efficient storage solutions. Manufacturers explore novel fabrication techniques to achieve reliable high-density chips. It supports applications in advanced computing, edge devices, and embedded systems. Rising demand for high-capacity memory in compact designs drives this market shift.

Integration of Intelligent Memory Systems with Enhanced Reliability Features

Intelligent memory systems represent a growing trend in the Ferroelectric RAM Market, focusing on enhanced reliability and data integrity. It incorporates error-correction mechanisms, predictive failure analysis, and secure data retention capabilities. Adoption in aerospace, defense, medical devices, and critical industrial systems highlights the importance of robust memory performance. Manufacturers emphasize real-time monitoring and diagnostic features to reduce downtime and maintenance costs. It ensures continuous operation under volatile conditions and prevents data corruption. Expanding applications in autonomous systems and smart infrastructure accelerate deployment. Strong focus on reliability and intelligence defines the market trajectory.

Market Challenges Analysis

High Production Costs and Complex Fabrication Processes Limiting Widespread Adoption

The Ferroelectric RAM Market faces challenges related to high manufacturing costs and intricate fabrication processes. It requires precise deposition of ferroelectric materials and advanced lithography techniques to ensure memory reliability and performance. Low yield rates in production increase overall costs and limit large-scale adoption, particularly for consumer electronics. Integration with standard CMOS processes poses technical hurdles that necessitate specialized equipment and expertise. Manufacturers must balance performance, density, and cost-efficiency while maintaining quality standards. Limited availability of skilled personnel and advanced fabrication facilities further constrains expansion. These cost and production barriers slow the adoption rate in cost-sensitive markets.

Data Retention Limitations and Integration Complexities in High-Performance Systems

The Ferroelectric RAM Market encounters challenges in achieving long-term data retention and seamless integration into complex systems. It experiences degradation of ferroelectric properties over multiple write cycles, impacting memory reliability in critical applications. Compatibility with existing memory architectures and embedded systems requires careful design adjustments. Industrial, automotive, and aerospace sectors demand rigorous testing to meet performance and safety standards. Manufacturers must address voltage scaling, thermal stability, and endurance issues to ensure dependable operation. Limited standardization across ferroelectric RAM modules complicates system-level deployment. These technical and integration challenges affect adoption in high-performance and mission-critical environments.

Market Opportunities

Expansion in Automotive and Industrial Applications Driving New Adoption Prospects

The Ferroelectric RAM Market presents opportunities through growing demand in automotive and industrial sectors. It offers high-speed, non-volatile memory solutions that enhance system reliability in electric vehicles, advanced driver-assistance systems, and industrial automation equipment. Manufacturers can leverage its low power consumption and fast write-read cycles to optimize embedded systems and real-time control applications. Rising adoption of smart factories and connected machinery creates demand for memory technologies capable of handling frequent data updates under harsh conditions. Expansion of autonomous vehicle platforms and industrial IoT devices further strengthens growth potential. Companies investing in durable and energy-efficient ferroelectric RAM solutions gain a competitive edge in these high-growth applications.

Integration with Emerging Consumer Electronics and Edge Computing Devices Creating Market Potential

The Ferroelectric RAM Market benefits from opportunities in emerging consumer electronics and edge computing applications. It provides reliable non-volatile memory for wearable devices, smartphones, and portable medical equipment, where performance and energy efficiency are critical. Edge computing platforms require fast memory with low latency for real-time data processing, creating demand for ferroelectric RAM integration. Advances in miniaturization and 3D stacking technologies allow developers to implement high-density memory in compact devices. Expansion of smart homes, connected healthcare solutions, and portable electronics accelerates adoption. Manufacturers focusing on scalable and versatile ferroelectric RAM modules can capture significant opportunities in these evolving technology segments.

Market Segmentation Analysis:

By Product Type

The Ferroelectric RAM Market segments by product type into discrete memory chips and embedded modules. Discrete ferroelectric RAM devices provide flexible integration in existing hardware platforms, allowing manufacturers to enhance system memory without extensive redesigns. Embedded ferroelectric RAM modules find adoption in compact devices requiring efficient non-volatile memory, such as wearables, medical equipment, and IoT applications. It supports high-speed read and write operations, which improves overall device performance while maintaining energy efficiency. Growing demand for miniaturized electronics encourages manufacturers to focus on embedded solutions capable of sustaining frequent data access under limited power constraints.

- For instance, Texas Instruments’ MSP430FR5994 MCU integrates 256 KB embedded FRAM with 100 trillion write endurance, an active current of 100 µA/MHz, and wake-up time under 6 µs, enabling reliable high-speed data handling in portable biosensors and edge analytics devices.

By Technology

The market divides by technology into traditional capacitor-based ferroelectric RAM and ferroelectric field-effect transistor (FeFET) technology. Capacitor-based ferroelectric RAM continues to dominate in applications requiring proven stability and endurance, particularly in industrial and automotive environments. FeFET-based RAM provides higher scalability, lower power consumption, and faster operation, making it suitable for next-generation computing devices, AI accelerators, and high-performance embedded systems. It ensures data retention even during power interruptions, supporting mission-critical applications across multiple sectors. Continuous research into material engineering and process optimization enhances performance and integration potential.

- For instance, GlobalFoundries and Fraunhofer IPMS demonstrated a 28 nm FeFET memory integrated on standard CMOS with write latency below 10 ns, read access time of 6 ns, and data retention exceeding 10⁵ seconds at 85°C, showing strong potential for embedded non-volatile memory in AI accelerators and edge processors.

By End Use

The Ferroelectric RAM Market segments by end use into consumer electronics, automotive, industrial, and aerospace sectors. Consumer electronics adopt ferroelectric RAM for smartphones, wearables, and portable medical devices that require compact, high-speed, and low-power memory solutions. Automotive applications focus on advanced driver-assistance systems, electric vehicles, and autonomous platforms that rely on rapid non-volatile memory access for real-time decision-making. Industrial applications deploy ferroelectric RAM in automation systems, robotics, and smart factory setups where reliability under extreme conditions is critical. Aerospace and defense segments leverage its radiation-hardened characteristics for mission-critical electronics. It strengthens market adoption by offering versatile performance across diverse, high-demand environments.

Segments:

Based on Product Type

- Non-volatile FRAM

- Volatile FRAM

Based on Technology

- Ferroelectric RAM

- Embedded FRAM

- Standalone FRAM

- Multi-bit FRAM

Based on End Use

- Consumer Electronics

- Automotive

- Industrial

- Telecommunication

Based on Storage Capacity

- 128 Kbit

- 256 Kbit

- 1 Mbit

- 4 Mbit

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 32% of the Ferroelectric RAM Market, led by the United States and Canada. It benefits from a strong semiconductor manufacturing ecosystem, advanced electronics R&D infrastructure, and early adoption of next-generation memory technologies. Major tech hubs in California, Texas, and Ontario house companies investing in high-performance memory solutions for consumer electronics, automotive, and defense sectors. It experiences consistent demand from data centers and AI-driven applications that require low-latency, non-volatile memory solutions. Government initiatives supporting innovation in electronics and memory technology further strengthen adoption. Companies in this region focus on integrating ferroelectric RAM into IoT devices and high-speed computing platforms. North America remains a key driver for market development and technological advancement.

Europe

Europe captures around 25% of the market, with Germany, France, and the United Kingdom leading adoption. Industrial automation, automotive electronics, and smart manufacturing systems drive demand for ferroelectric RAM. It supports electric vehicle platforms, advanced driver-assistance systems, and renewable energy infrastructure with reliable, low-power memory solutions. European manufacturers prioritize energy-efficient and durable memory devices that comply with stringent regional standards. Research investments in FeFET-based and embedded ferroelectric RAM further stimulate technological adoption. The presence of semiconductor clusters in Germany and the Netherlands enhances production capabilities. Europe maintains steady market growth with a focus on high-performance and safety-critical applications.

Asia-Pacific

Asia-Pacific holds an estimated 30% market share, fueled by China, Japan, South Korea, and India. It benefits from rising smartphone penetration, increasing consumer electronics production, and government-backed semiconductor initiatives. It supports high-volume manufacturing of embedded ferroelectric RAM for smartphones, IoT devices, wearables, and automotive electronics. The region experiences strong growth due to large-scale investments in memory manufacturing facilities and research collaborations. Japanese and South Korean companies lead in technological innovations for high-speed, energy-efficient ferroelectric RAM modules. China focuses on self-reliance in memory technology, enhancing local production and adoption. Asia-Pacific remains the most dynamic region, driving global market expansion.

Latin America

Latin America accounts for roughly 7% of the market, concentrated in Brazil, Mexico, and Argentina. It primarily adopts ferroelectric RAM in industrial automation, telecom infrastructure, and energy management systems. It benefits from modernization projects in manufacturing plants and expansion of smart grid solutions. Companies focus on delivering cost-effective, reliable memory solutions for remote and harsh operating conditions. Partnerships with global memory manufacturers enhance technology transfer and market penetration. Latin America continues to adopt ferroelectric RAM selectively, targeting niche high-reliability applications.

Middle East & Africa

The Middle East & Africa region holds approximately 6% market share, led by the UAE, Saudi Arabia, and South Africa. It relies on industrial automation, oil and gas, and defense applications for ferroelectric RAM adoption. It supports mission-critical electronics where reliability under extreme temperatures and power interruptions is essential. Regional governments promote smart manufacturing and defense technology initiatives, encouraging adoption. Collaborations with international memory solution providers drive technology integration. The region gradually strengthens its position through infrastructure modernization and strategic investments in electronics manufacturing.

Key Player Analysis

- Winbond Electronics

- Infineon Technologies

- Cypress Semiconductor

- Texas Instruments

- NXP Semiconductors

- Alliance Memory

- Fujitsu Limited

- Rohm Semiconductor

- Silicon Storage Technology

- Nippon Electric Glass

Competitive Analysis

The Ferroelectric RAM Market demonstrates intense competition among leading players including Nippon Electric Glass, Rohm Semiconductor, Fujitsu Limited, Silicon Storage Technology, Cypress Semiconductor, Winbond Electronics, Infineon Technologies, NXP Semiconductors, Alliance Memory, and Texas Instruments, who focus on technological innovation, product differentiation, and strategic collaborations to maintain a competitive edge. These companies invest in advanced fabrication techniques, low-power designs, and high-speed memory solutions to serve consumer electronics, automotive, industrial automation, and IoT applications. Fujitsu Limited leads in high-reliability memory for industrial and automotive sectors, leveraging rigorous quality control and R&D initiatives. Rohm Semiconductor develops scalable Ferroelectric RAM architectures for embedded systems, enabling energy-efficient performance. Texas Instruments and Cypress Semiconductor integrate Ferroelectric RAM with microcontrollers and SoCs, enhancing compatibility. Nippon Electric Glass supplies substrate and material technologies that improve device stability. Winbond Electronics and Silicon Storage Technology offer cost-effective solutions for emerging markets, while Infineon Technologies and NXP Semiconductors focus on automotive and industrial control systems. Alliance Memory targets specialized applications requiring high endurance and reliability.

Recent Developments

- In May 2025, NXP launched a new FeRAM product with enhanced radiation tolerance for aerospace applications, achieving data retention over 15 years under extreme conditions.

- In November 2024, Texas Instruments unveiled a 4 Mb FeRAM chip with ultra-low standby power of 2 µA, specifically designed for medical device applications requiring non-volatile memory.

- In July 2024, Infineon introduced a FeRAM solution targeting automotive safety systems, featuring 2 Mb density and ultra-fast write speeds of 150 ns, optimized for high-temperature environments.

Market Concentration & Characteristics

The Ferroelectric Ram Market exhibits a moderately concentrated structure, dominated by a mix of global semiconductor leaders and specialized memory solution providers. It is characterized by high technological intensity, where innovation in low-power consumption, high-speed write/read cycles, and enhanced endurance determines competitive advantage. Companies focus on developing FeRAM modules for diverse applications, including automotive, industrial automation, IoT devices, and aerospace systems, reflecting the market’s broad end-use spectrum. Strategic collaborations and licensing agreements play a key role in accelerating product development and expanding geographic reach. Continuous investments in research and development drive miniaturization, improved reliability, and higher integration with microcontrollers. The market demonstrates dynamic competition, with incumbents leveraging established manufacturing capabilities while new entrants adopt niche strategies targeting specific application segments. Regulatory compliance and standardization of interfaces further influence market behavior, guiding product designs and ensuring compatibility across industries. Overall, the Ferroelectric Ram Market combines technological sophistication with strategic partnerships, creating a landscape where innovation, reliability, and application-specific optimization shape growth and market positioning.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, End Use, Storage Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Ferroelectric Ram Market will continue to grow with rising demand for low-power, high-speed memory solutions.

- Increasing adoption in automotive electronics will drive further market expansion.

- Integration with IoT devices will enhance the need for reliable non-volatile memory.

- Continuous innovation in high-density FeRAM chips will support advanced industrial applications.

- Collaboration between semiconductor manufacturers will accelerate new product development.

- Expansion in emerging markets will create new adoption opportunities across industries.

- Miniaturization and integration with microcontrollers will improve device performance and efficiency.

- Growing use in aerospace and defense systems will strengthen market demand.

- Regulatory compliance and standardization will guide product designs and industry adoption.

- Rising focus on energy-efficient and sustainable memory solutions will shape future market trends.