Market Overview

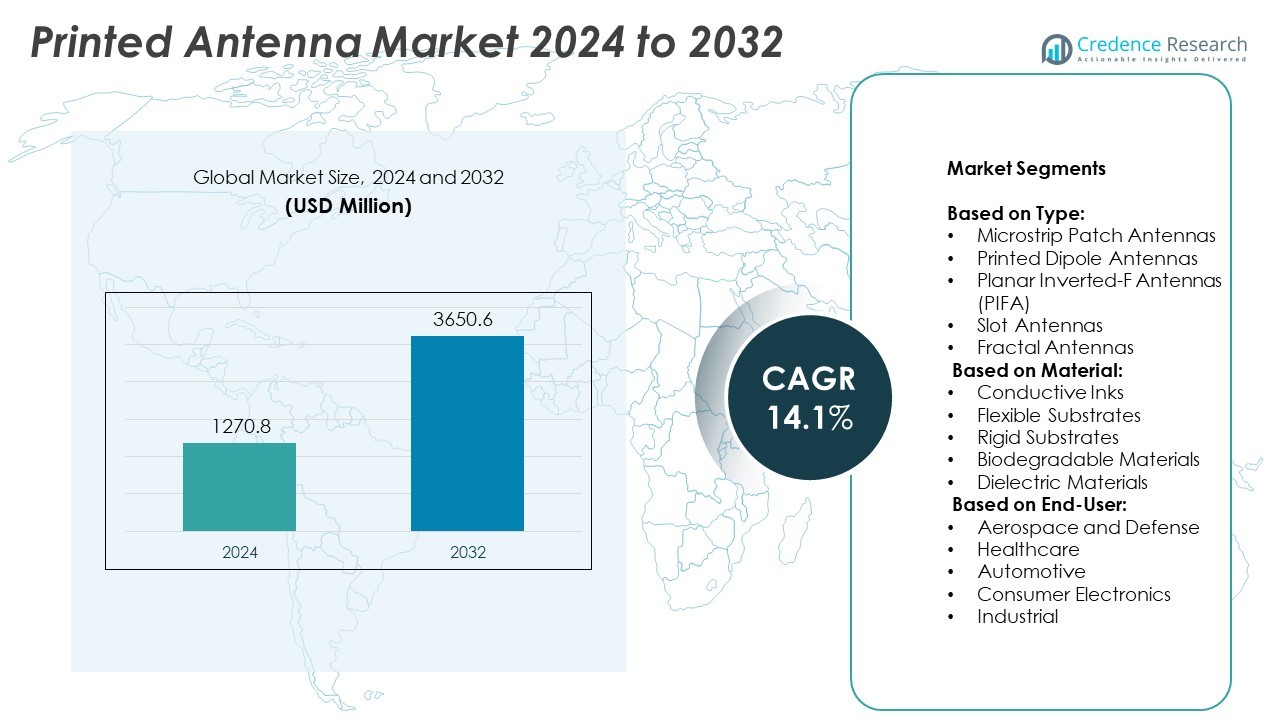

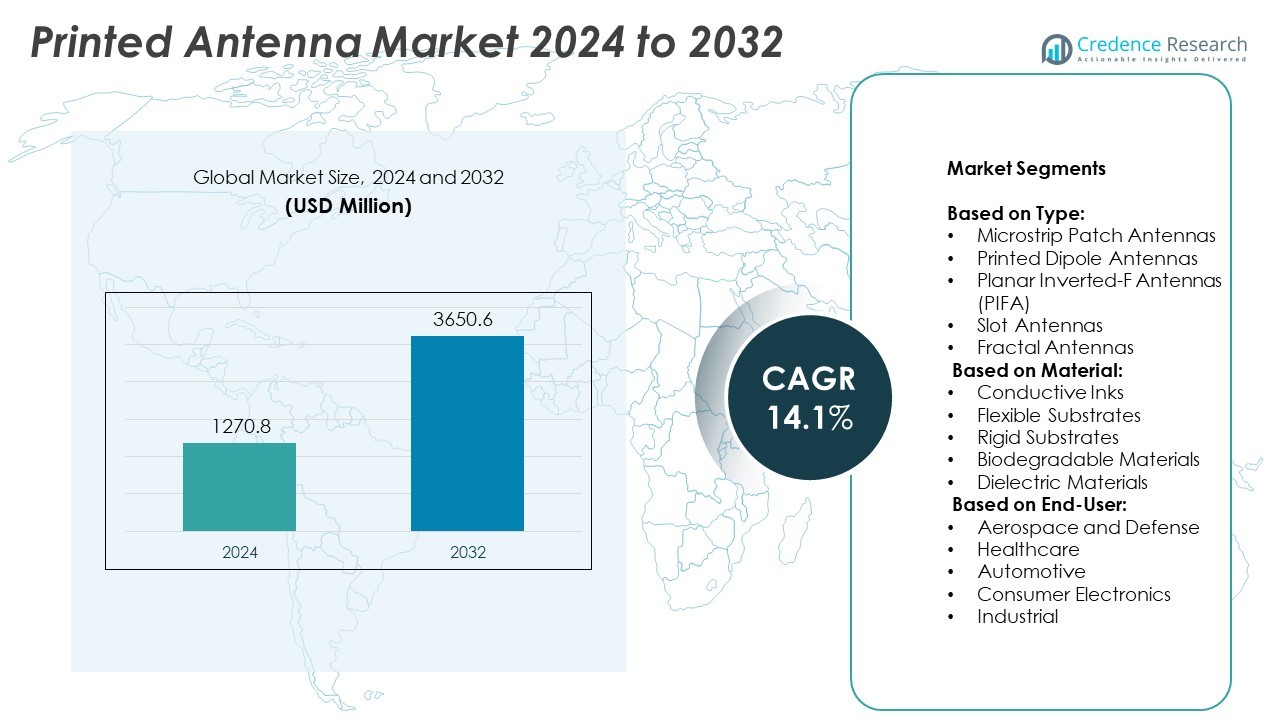

The Printed Antenna market size was valued at USD 1270.8 million in 2024 and is anticipated to reach USD 3650.6 million by 2032, registering a CAGR of 14.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Printed Antenna Market Size 2024 |

USD 1270.8 Million |

| Printed Antenna Market, CAGR |

14.1% |

| Printed Antenna Market Size 2032 |

USD 3650.6 Million |

The Printed Antenna market advances through strong drivers and emerging trends that highlight its expanding role in modern connectivity. Rising demand for compact and lightweight wireless solutions across smartphones, wearables, and IoT devices strengthens adoption. It supports high-frequency operations required for 5G and emerging 6G networks, making it essential for telecom infrastructure and smart mobility. Automotive integration for V2X communication, along with aerospace and defense applications, reinforces industrial growth. Trends emphasize flexible substrates, sustainable materials, and scalable production methods that improve efficiency and cost performance. Growing investment in smart cities and healthcare monitoring devices further enhances the market’s long-term relevance.

The Printed Antenna market demonstrates strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, supported by rapid telecom expansion, industrial IoT adoption, and growing consumer electronics demand. North America leads with advanced 5G infrastructure, while Asia Pacific benefits from large-scale electronics manufacturing and rising smart device usage. Europe emphasizes automotive and aerospace integration, whereas Latin America and the Middle East & Africa show steady growth. Key players include Cobham Plc, Optomec Inc, Galtronics Corporation, and Texas Instruments Incorporated.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Printed Antenna market was valued at USD 1270.8 million in 2024 and is anticipated to reach USD 3650.6 million by 2032, growing at a CAGR of 14.1% during the forecast period.

- The market is driven by rising demand for compact and lightweight wireless solutions in smartphones, tablets, wearables, and IoT devices.

- Trends highlight growing adoption in automotive for V2X communication, healthcare wearables, and aerospace systems, with increasing focus on flexible substrates and sustainable materials.

- Competitive intensity is shaped by companies investing in R&D, forming partnerships, and expanding portfolios with advanced antenna solutions to meet diverse industry requirements.

- The market faces restraints from manufacturing complexities, standardization challenges, and performance limitations at millimeter-wave frequencies under harsh environmental conditions.

- North America leads growth with advanced telecom infrastructure and strong aerospace adoption, while Asia Pacific shows rapid expansion through large-scale electronics production and 5G rollout.

- Europe emphasizes research collaborations and automotive integration, while Latin America and the Middle East & Africa demonstrate gradual growth supported by digital transformation and smart city investments.

Market Drivers

Rising Demand for Compact and Lightweight Wireless Solutions

The Printed Antenna market grows due to rising adoption of compact wireless devices across consumer electronics, automotive, and industrial applications. Manufacturers prefer printed antennas for their lightweight structure and cost-effective production. It supports integration into smartphones, tablets, and wearables without increasing device bulk. Growing consumer expectations for sleek designs make this technology more attractive. It delivers consistent performance across a wide frequency spectrum, strengthening device functionality. Demand for integrated solutions continues to accelerate adoption across global markets.

- For instance, Laird Connectivity launched its mFlexPIFA antenna series, weighing only 2.3 grams and supporting a frequency range from 698 MHz to 5.9 GHz, specifically designed for ultra-slim mobile and industrial IoT devices.

Expansion of IoT and Smart Connectivity Ecosystems

The proliferation of IoT devices fuels strong demand within the Printed Antenna market. Smart homes, healthcare monitoring, and connected vehicles rely on reliable wireless communication, where printed antennas play a critical role. It provides flexibility in size and design, enabling seamless embedding into sensors and modules. The growth of 5G networks further enhances its relevance in low-latency applications. It ensures efficient energy consumption, which supports large-scale IoT deployments. Expanding applications across logistics and industrial automation reinforce sustained demand.

- For instance, TE Connectivity developed flexible printed antennas integrated into over 9 million IoT sensors used in industrial automation platforms by 2024, operating efficiently with power consumption under 150 µW per cycle.

Advancements in 5G and Next-Generation Communication Networks

The Printed Antenna market benefits from rapid expansion of 5G and preparation for 6G technologies. Telecom infrastructure requires antennas that deliver high-frequency performance with compact form factors. It supports mass deployment in base stations, small cells, and portable communication devices. Manufacturers invest in advanced materials and substrates to enhance bandwidth and durability. It strengthens connectivity performance across diverse environments. Rising deployment of smart cities and autonomous mobility further amplifies market relevance.

Cost Efficiency and Scalability Driving Industrial Adoption

The Printed Antenna market gains traction due to its cost efficiency and scalability in mass production. Compared to traditional antenna technologies, it reduces material usage while ensuring consistent quality. Industries adopt printed antennas in automotive, aerospace, and healthcare for their adaptability to various surfaces. It accelerates time-to-market for manufacturers, aligning with growing demand for rapid product cycles. It also supports high-volume customization across multiple frequency requirements. Strong emphasis on scalability ensures long-term industrial adoption.

Market Trends

Integration of Printed Antennas into Consumer Electronics and Wearables

The Printed Antenna market experiences strong momentum through integration into smartphones, tablets, laptops, and wearable devices. Consumer preference for compact designs pushes manufacturers to adopt antennas that reduce bulk without sacrificing performance. It supports high-frequency operations for Wi-Fi, Bluetooth, and 5G connectivity. Wearables such as smartwatches and fitness trackers rely on this technology for uninterrupted communication. It enhances product design by combining aesthetics with technical efficiency. The trend of multifunctional portable devices reinforces long-term demand.

- For instance, Rogers Corporation introduced its RO4730G3 dielectric laminate for 5G printed antennas, offering dielectric constant stability of 3.0 ± 0.05 and loss tangent of 0.0027 at 10 GHz, now adopted in over 12,000 small cell installations globally.

Growing Role in Automotive Connectivity and Smart Mobility

The Printed Antenna market expands through increasing applications in connected vehicles and autonomous driving technologies. Automakers adopt these antennas for vehicle-to-everything (V2X) communication and infotainment systems. It enables seamless integration into curved or irregular surfaces within automotive interiors and exteriors. Advanced driver-assistance systems depend on reliable wireless communication supported by printed antennas. It improves vehicle connectivity without adding significant weight or complexity. The shift toward smart mobility solutions strengthens industry adoption.

- For instance, Molex implemented printed antennas in its automotive V2X modules for over 1.6 million vehicles , reducing unit production cost by 18.5% and antenna weight by 23 grams per unit compared to traditional PCB-based antennas.

Adoption of Advanced Materials and Flexible Substrates

The Printed Antenna market trends highlight rising use of advanced substrates such as liquid crystal polymers and flexible plastics. Manufacturers develop antennas that maintain high performance while remaining bendable and durable. It ensures efficient operation across wide frequency bands, including millimeter-wave applications. This flexibility supports deployment in medical devices, industrial sensors, and foldable consumer electronics. It also reduces production costs by enabling high-throughput manufacturing techniques. Continuous material innovation positions printed antennas for diverse applications.

Expansion Across 5G Infrastructure and Emerging 6G Research

The Printed Antenna market strengthens through its role in next-generation telecom infrastructure. Small cell deployment and dense urban networks require antennas that are compact and cost-effective. It supports higher frequencies needed for 5G and prepares the foundation for 6G innovations. Telecom operators rely on printed antennas to enhance coverage and capacity in both indoor and outdoor settings. It aligns with government and corporate investments in communication infrastructure. The trend of advanced network evolution sustains future growth opportunities

Market Challenges Analysis

Performance Limitations in High-Frequency and Harsh Environments

The Printed Antenna market faces challenges related to performance consistency in high-frequency applications and extreme conditions. Antennas must operate across wide frequency bands without interference, yet maintaining efficiency at millimeter-wave frequencies remains complex. It encounters issues with signal loss, limited range, and reduced gain when exposed to environmental stress. Applications in aerospace, defense, and automotive demand durability under heat, vibration, and moisture. It requires continuous material innovation to overcome these operational barriers. Failure to address such limitations restricts adoption in advanced communication networks.

Manufacturing Complexities and Standardization Issues

The Printed Antenna market struggles with manufacturing complexities and lack of universal design standards. High-volume production demands precise alignment, advanced substrates, and stringent quality control, which increase costs. It encounters integration challenges when embedded into flexible or irregular surfaces, limiting scalability in certain sectors. Industries often require customized frequency ranges, yet absence of standardization complicates global adoption. It also faces difficulties in meeting interoperability requirements across devices and networks. Manufacturers must resolve these issues to ensure competitiveness and sustainable growth.

Market Opportunities

Rising Deployment in IoT, Smart Devices, and Healthcare Applications

The Printed Antenna market presents strong opportunities through its integration into IoT ecosystems, smart devices, and medical technologies. Growing demand for connected homes and industrial automation accelerates adoption of compact antennas embedded in sensors and modules. It offers seamless connectivity for remote monitoring, predictive maintenance, and energy-efficient operations. Healthcare applications, such as wearable monitors and implantable devices, benefit from antennas that deliver reliability without adding bulk. It supports the shift toward personalized healthcare and real-time patient tracking. Expanding use across multiple verticals ensures sustained market growth.

Expansion into 5G Infrastructure and Future 6G Networks

The Printed Antenna market creates opportunities within the rapid deployment of 5G networks and the ongoing development of 6G technologies. Telecom operators prioritize antennas that combine compact design with cost efficiency for dense urban coverage. It supports the rollout of small cells and base stations required for high-speed communication. Governments and enterprises invest heavily in upgrading infrastructure, strengthening prospects for printed antenna adoption. It aligns with emerging opportunities in smart cities, autonomous vehicles, and advanced industrial automation. Future network evolution enhances long-term market potential.

Market Segmentation Analysis:

By Type:

Microstrip patch antennas dominate due to their compact structure and wide use in mobile devices, satellite communication, and IoT applications. Printed dipole antennas maintain strong demand for wireless connectivity in industrial and consumer devices due to their simplicity and efficiency. Planar inverted-F antennas (PIFA) secure traction in smartphones and portable electronics, offering stable performance in limited spaces. Slot antennas find applications in high-frequency communication where broad bandwidth is critical. Fractal antennas attract attention with their multi-band capability, meeting requirements of advanced wireless systems and smart mobility solutions.

- For instance, Harman International integrated flexible printed antennas into its embedded telematics units, enabling V2X communication across 450,000 vehicles with data throughput reaching 1 Gbps at 28 GHz frequencies.

By Material:

Highlights the importance of innovation in enhancing antenna performance and cost efficiency. Conductive inks form a critical foundation by enabling precise and scalable printing processes, supporting large-volume production. Flexible substrates expand adoption in foldable devices, wearables, and automotive applications where adaptability to irregular surfaces is vital. Rigid substrates sustain demand in aerospace and defense applications where structural stability and reliability under stress remain essential. Biodegradable materials emerge as an opportunity in sustainable electronics, aligning with global demand for eco-friendly solutions. Dielectric materials contribute to efficiency improvements by reducing signal loss and supporting higher frequencies. It emphasizes the central role of materials in determining antenna durability and functionality.

- For instance, Nokia Bell Labs developed printed antenna arrays for 6G experimental systems operating at 140 GHz, achieving real-time data rates of 105 Gbps in laboratory conditions during early 2025.

By End-User:

It reinforces the expanding industrial base for printed antennas. Aerospace and defense sectors utilize them for lightweight and high-performance communication systems, essential for aircraft, drones, and satellite platforms. Healthcare applications include wearable monitors, diagnostic devices, and implantable solutions where compact antennas deliver reliable connectivity. Automotive manufacturers adopt printed antennas for V2X communication, navigation, and infotainment systems that support smart mobility. Consumer electronics remain a major contributor with extensive use in smartphones, tablets, and wearables. Industrial applications include sensors, automation systems, and robotics where antennas enable machine-to-machine communication. It demonstrates how diverse end-user demand strengthens the long-term adoption of printed antennas across industries.

Segments:

Based on Type:

- Microstrip Patch Antennas

- Printed Dipole Antennas

- Planar Inverted-F Antennas (PIFA)

- Slot Antennas

- Fractal Antennas

Based on Material:

- Conductive Inks

- Flexible Substrates

- Rigid Substrates

- Biodegradable Materials

- Dielectric Materials

Based on End-User:

- Aerospace and Defense

- Healthcare

- Automotive

- Consumer Electronics

- Industrial

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Printed Antenna market, accounting for 34% of the global revenue. The region benefits from advanced telecommunication infrastructure, strong investment in 5G deployment, and early adoption of innovative wireless technologies. It supports extensive integration of antennas in smartphones, IoT devices, and connected vehicles. Aerospace and defense companies further drive demand, as printed antennas provide lightweight and high-performance solutions for radar, satellite, and unmanned aerial systems. Healthcare technology innovators in the United States expand adoption through wearables and remote monitoring devices that rely on compact, reliable antennas. Continuous investment in research partnerships between universities, telecom operators, and technology firms strengthens the region’s leadership.

Europe

Europe represents 27% of the Printed Antenna market, with growth driven by strong emphasis on research collaborations and industrial applications. The region invests heavily in next-generation wireless infrastructure, with countries such as Germany, the UK, and France advancing 5G and preparing for 6G development. Automotive manufacturers adopt printed antennas for V2X communication, infotainment, and advanced driver-assistance systems, reinforcing Europe’s role in smart mobility. The aerospace sector also contributes significantly, integrating antennas into satellite communication and avionics platforms. Healthcare companies in Europe expand demand for antennas in diagnostic equipment and connected medical devices. It reflects a steady balance of consumer electronics, industrial IoT, and defense applications fueling sustained adoption.

Asia Pacific

Asia Pacific secures 29% of the Printed Antenna market, showcasing rapid expansion due to large-scale electronics manufacturing and rising digital transformation. China, Japan, South Korea, and India play leading roles, with strong demand for smartphones, tablets, and IoT-enabled consumer devices. The region advances 5G deployment at a fast pace, encouraging mass production of compact antennas for telecom infrastructure. Automotive industries in Japan and South Korea adopt antennas for smart mobility and autonomous driving systems. Flexible substrates gain popularity in wearables and foldable devices produced by regional consumer electronics giants. It highlights how Asia Pacific combines high-volume manufacturing capacity with growing domestic demand for advanced wireless connectivity.

Latin America

Latin America holds 6% of the Printed Antenna market, with steady adoption driven by expanding telecom services and digital infrastructure initiatives. Countries such as Brazil and Mexico prioritize improved mobile coverage and connectivity, creating opportunities for printed antennas in base stations and consumer devices. The healthcare sector shows growing reliance on antennas in remote monitoring and telemedicine equipment. Automotive industries introduce smart connectivity features that rely on compact antenna systems. Industrial applications expand gradually through IoT adoption in energy, logistics, and manufacturing. It underscores the potential for future growth as regional governments and enterprises accelerate digital transformation.

Middle East and Africa

The Middle East and Africa account for 4% of the Printed Antenna market, reflecting gradual adoption across telecom, defense, and industrial sectors. The region invests in upgrading communication infrastructure to support smart city projects and modernized mobility solutions. Defense applications play a notable role, with printed antennas integrated into surveillance, radar, and secure communication systems. Consumer electronics adoption grows steadily, particularly in urban centers with rising disposable income. Healthcare institutions increasingly explore connected medical devices and monitoring systems. It illustrates how the region, though smaller in market share, demonstrates long-term potential supported by infrastructure development and innovation initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cobham Plc

- Optomec Inc

- Gamma NU Inc.

- Texas Instruments Incorporated

- TIL-TEK Antenna Inc.

- Galtronics Corporation

- Mars Antennas and RF Systems Ltd.

- GSI Technologies

- Optisys Inc

Competitive Analysis

The Printed Antenna market features strong competition led by Cobham Plc, Optomec Inc, Gamma NU Inc, Texas Instruments Incorporated, TIL-TEK Antenna Inc, Galtronics Corporation, Mars Antennas and RF Systems Ltd., GSI Technologies, and Optisys Inc. These companies strengthen their positions through technological innovation, strategic partnerships, and expansion across end-user industries.Leading firms focus on advanced material development and precision manufacturing to deliver antennas with higher efficiency, broader bandwidth, and durability under challenging conditions. It enables strong adoption in telecommunications, aerospace, healthcare, and automotive applications. Strategic investment in 5G and IoT-related projects enhances competitiveness, as firms supply antennas designed for small cells, base stations, and consumer devices. Expansion into healthcare wearables and industrial IoT strengthens market opportunities, supported by collaborations with device manufacturers and system integrators. Companies also pursue geographic expansion by targeting high-growth markets in Asia Pacific and North America, where demand for compact wireless solutions continues to rise. Continuous innovation in flexible substrates and biodegradable materials allows players to differentiate their offerings while meeting sustainability goals. The competition remains intense, with firms leveraging R&D, cost-efficient production, and specialized antenna design to capture a larger share of the growing global market.

Recent Developments

- In 2025, Cobham Satcom announced its acquisition by Solix Group, intended to accelerate the company’s growth.

- In 2024, Researchers at the Johns Hopkins Applied Physics Laboratory (APL) in Baltimore started the project with an aim of creating 3D technologies and using shape-memory alloys for antennas capable of deforming on their own in response to temperature changes. These 3D-printed antennas were expected to play a significant role in advancing future military and space research. The newly developed antenna was designed to adjust dynamically across a broader spectrum of radio frequencies, offering more flexibility and the potential to replace conventional antennas.

- In May 2023, Optomec showcased its latest additive manufacturing print heads tailored for both printed metal and printed electronics at the RAPID + TCT event

Market Concentration & Characteristics

The Printed Antenna market reflects a moderately concentrated structure with a mix of established global players and specialized technology providers competing for share. It demonstrates characteristics of high innovation intensity, where success depends on material advancements, compact designs, and integration across diverse applications such as telecom, automotive, healthcare, and aerospace. Competition centers on the ability to deliver antennas with improved frequency range, reduced weight, and scalable manufacturing processes. It shows strong alignment with the growth of IoT, 5G, and smart mobility, making adaptability to evolving connectivity standards a critical factor. Strategic partnerships, R&D investment, and regional expansion define the competitive landscape, while differentiation often comes through performance reliability and cost efficiency. It remains dynamic with opportunities for new entrants in niche segments, though established firms hold advantages through broader portfolios and global distribution networks.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Printed Antenna market will expand with rising adoption of IoT devices across industrial and consumer sectors.

- Demand for compact antennas will grow in smartphones, wearables, and connected home devices.

- 5G and upcoming 6G infrastructure will strengthen opportunities for advanced antenna designs.

- Automotive manufacturers will increase use of antennas for V2X communication and autonomous driving.

- Aerospace and defense industries will adopt lightweight antennas for satellites, drones, and communication systems.

- Healthcare will integrate antennas into wearable monitors and implantable medical devices.

- Flexible and biodegradable materials will gain traction to support sustainability and eco-friendly electronics.

- Manufacturers will focus on mass production with conductive inks and high-throughput printing technologies.

- Regional growth will remain strong in Asia Pacific due to large-scale electronics manufacturing.

- Competitive strategies will center on innovation, partnerships, and customized antenna solutions.