Market Overview

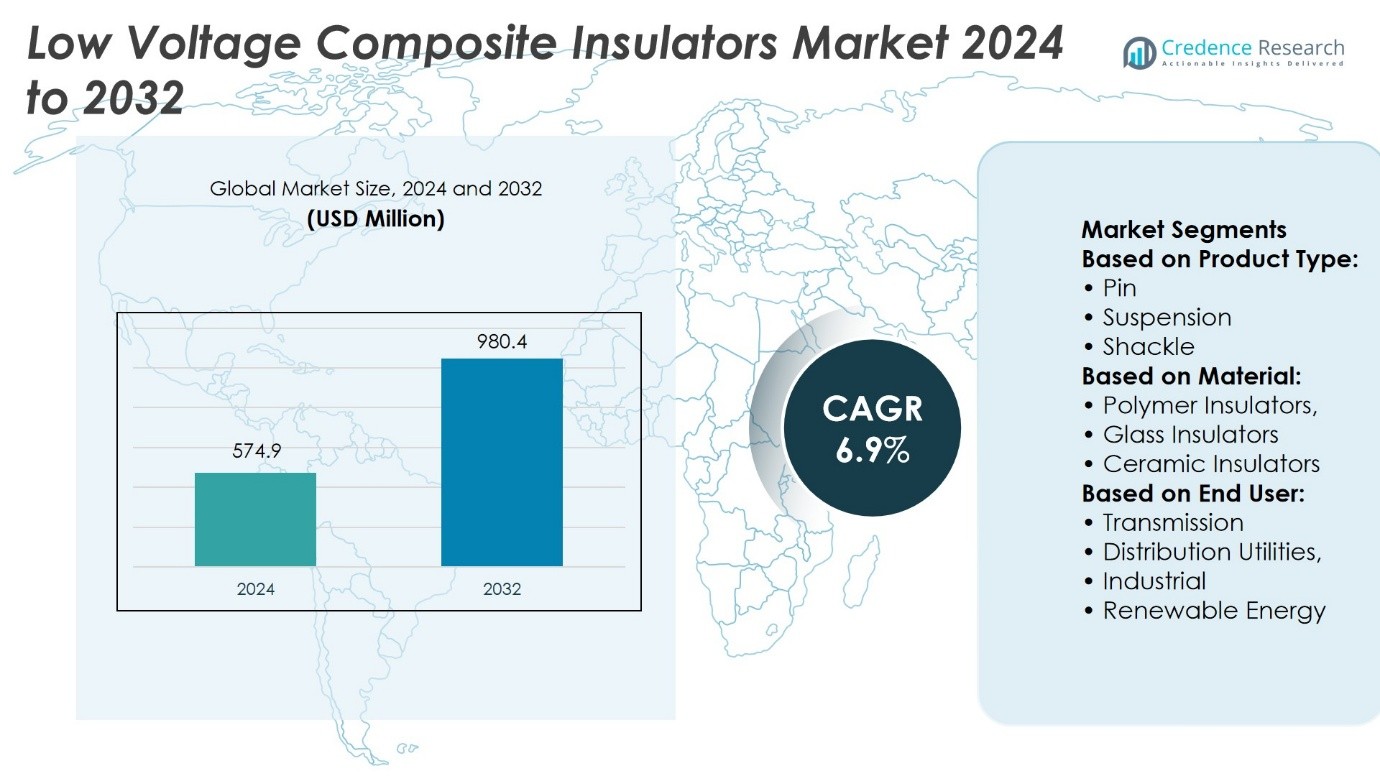

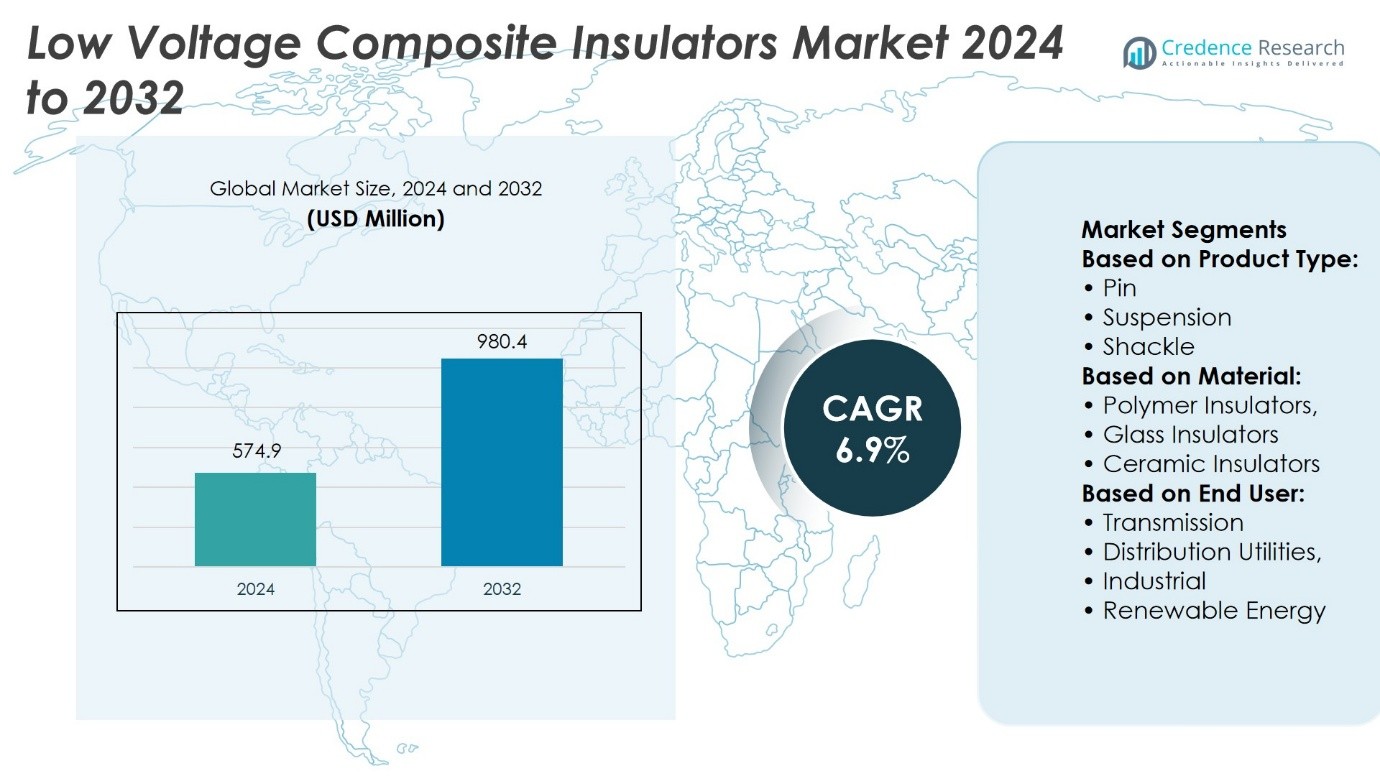

Low Voltage Composite Insulators Market size was valued at USD 574.9 million in 2024 and is anticipated to reach USD 980.4 million by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Voltage Composite Insulators Market Size 2024 |

USD 574.9 Million |

| Low Voltage Composite Insulators Market , CAGR |

6.9% |

| Low Voltage Composite Insulators Market Size 2032 |

USD 980.4 Million |

The Low Voltage Composite Insulators Market advances through strong drivers and evolving trends that reshape its growth trajectory. Rising demand for reliable grid infrastructure and expanding electrification programs increase adoption across residential, commercial, and industrial networks. It benefits from superior durability, lightweight design, and reduced maintenance compared with traditional materials. The market aligns with renewable energy integration, where composite insulators ensure efficiency in solar, wind, and distributed power projects. Smart grid development and sustainability goals encourage investment in advanced polymers and eco-friendly designs. Emerging economies strengthen opportunities through urbanization and infrastructure expansion, positioning the market for sustained global relevance.

The Low Voltage Composite Insulators Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific and North America holding leading shares due to extensive grid modernization and electrification initiatives. Europe sustains growth through stringent safety standards and renewable integration, while emerging economies in Latin America and Africa create new opportunities. Key players include Hitachi Energy, Hubbell, ENSTO, Bonomi, CYG Insulator, Deccan Enterprises, CTC Insulator, Gipro, Kuvag, and Izoelektro, driving innovation and regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Low Voltage Composite Insulators Market was valued at USD 574.9 million in 2024 and is projected to reach USD 980.4 million by 2032, growing at a CAGR of 6.9%.

- Rising demand for reliable power distribution and expanding electrification programs drive market adoption across residential, commercial, and industrial sectors.

- The market trends highlight growing use of lightweight, durable, and eco-friendly materials that reduce maintenance and extend service life.

- Competitive dynamics are shaped by global leaders and regional players focusing on advanced polymer technology, innovation, and partnerships with utilities.

- Market restraints include high initial costs, complex manufacturing processes, and limited standardization across regions.

- Asia-Pacific and North America dominate market share due to grid modernization, while Europe follows with strong renewable integration; Latin America and Africa show emerging potential.

- Key players such as Hitachi Energy, Hubbell, ENSTO, Bonomi, CYG Insulator, Deccan Enterprises, CTC Insulator, Gipro, Kuvag, and Izoelektro drive innovation and expansion.

Market Drivers

Rising Demand for Grid Reliability and Efficient Distribution

The Low Voltage Composite Insulators Market gains traction through the growing need for reliable and resilient power distribution networks. Utilities adopt these insulators to minimize outages, improve load management, and ensure consistent energy supply. It enhances grid performance by reducing the risk of flashovers, mechanical failures, and environmental degradation. The adoption of composite insulators supports modern distribution lines that require lighter, safer, and more durable solutions. Growing electricity demand in urban and rural areas further drives the requirement for advanced insulation systems. Infrastructure modernization projects strengthen the role of composite insulators in meeting grid stability standards.

- For instance, the U.S. government announced the new initiative of 331 million to increase grid capacity by more than 2,000 megawatts, implementing a final reform to transmission permitting which shall unlock unprecedented growth in the Western region of the grid powered infrastructure system capable of fueling 2.5 million households.

Expanding Adoption in Renewable Energy and Smart Grid Projects

The transition toward renewable energy projects drives significant demand for low-voltage composite insulators. Solar and wind installations rely on lightweight and high-performance insulators that can withstand diverse environmental stresses. It ensures efficiency in integrating renewable power into distribution lines with minimal transmission losses. The rise of smart grid technologies increases the need for reliable insulation to support automated monitoring and digital control. Composite designs reduce the burden on towers and lines in remote renewable projects. This driver aligns strongly with global goals to expand clean and distributed energy generation.

- For instance, Hitachi Energy successfully tested a groundbreaking 765 kV/400 kV, 250 MVA single-phase transformer filled with biodegradable ester oil. This is the first of its kind at this voltage and power level, offering a safer, environmentally friendly option for ultra-high-voltage grids. Such transformers are vital for expanding transmission capacity, supporting long-distance energy transfer, and enhancing grid stability.

Strong Advantages in Durability and Maintenance Efficiency

The market benefits from the superior performance characteristics of composite insulators compared with porcelain or glass alternatives. Their hydrophobic properties enhance resistance to pollution, moisture, and salt deposits, reducing cleaning requirements. It extends service life while lowering maintenance costs for utilities and industries. Lightweight designs simplify handling and installation, especially in challenging terrain. High mechanical strength supports performance under stress from wind, ice, or vibration. These features ensure reliability, making composite insulators a preferred choice for modern low-voltage networks.

Growing Investment in Urban Infrastructure and Industrial Projects

The Low Voltage Composite Insulators Market advances with rising investment in urban power distribution systems and industrial electrification. Governments emphasize reliable and safe networks to meet rising demand from residential and industrial consumers. It supports smart city initiatives where energy efficiency and safety remain priorities. Expanding industrial facilities require advanced insulators for machinery, control panels, and distribution lines. Rapid urbanization in emerging economies increases the demand for durable, low-maintenance solutions. Infrastructure expansion projects across utilities, transportation, and manufacturing sectors sustain long-term market growth.

Market Trends

Increasing Shift Toward Lightweight and Compact Designs

The Low Voltage Composite Insulators Market observes a strong trend toward lightweight and compact solutions that simplify handling and installation. Utilities and industrial users adopt designs that reduce the overall load on poles, towers, and distribution lines. It enables easier replacement and faster deployment in expanding grids. Compact designs also support growing urban networks where space and structural capacity remain limited. Manufacturers focus on innovative materials that deliver higher strength-to-weight ratios. This trend supports efficiency in both logistics and field operations.

- For instance, as per the IEA (International Energy Agency) study published insufficient grid capacity poses major challenges for achieving international climate and energy targets. Addressing this complex issue, estimates indicate that more than 80 million kilometers of grid infrastructure, either new or upgraded, must be developed globally by 2040. This amount is roughly double the current total length of existing power grids worldwide, highlighting the scale of the task ahead.

Rising Integration with Smart Grid Infrastructure

The adoption of smart grid technologies creates a clear trend toward composite insulators designed for digital compatibility. Utilities require insulation systems that align with real-time monitoring and advanced grid management. It improves performance by reducing electrical losses and enabling seamless integration with automated control systems. The trend highlights the role of composite insulators in enhancing safety and reliability under evolving load conditions. Increasing demand for remote inspection tools further strengthens the integration of advanced insulators into smart distribution networks. These developments align with the global transformation of energy infrastructure.

- For instance, India planned to reach 500 GW of non-fossil fuel capacity by 2030, majorly through expanding solar and wind energy. To address challenges from their variability, the Central Electricity Authority (CEA) recommended co-located energy storage systems with solar projects to boost grid stability, reduce costs, and ensure reliable power during low renewable output or peak demand.

Growing Emphasis on Sustainable and High-Performance Materials

The market trends reflect a rising focus on eco-friendly and high-durability materials in insulator production. Manufacturers invest in polymers and composites that reduce environmental impact while maintaining high electrical resistance. It ensures strong protection against UV exposure, chemical pollution, and extreme weather. Sustainability goals push the industry to adopt recyclable materials that extend product lifecycle benefits. Continuous innovation in material science enhances hydrophobic properties and mechanical stability. This direction supports long-term adoption across utilities and industrial projects.

Expanding Applications Across Emerging Economies

The Low Voltage Composite Insulators Market experiences a growing trend of adoption in emerging economies undergoing rapid electrification. Expanding distribution networks in Asia-Pacific, Africa, and Latin America demand insulators capable of withstanding diverse climates and operating environments. It supports rural electrification programs that require cost-effective yet durable solutions. Urbanization drives large-scale infrastructure projects, further fueling adoption in industrial and residential settings. The trend demonstrates strong reliance on composite technology to meet rising energy needs. This growth highlights the importance of advanced insulation in building resilient power systems.

Market Challenges Analysis

High Initial Costs and Complex Manufacturing Processes

The Low Voltage Composite Insulators Market faces challenges linked to higher upfront costs and complex production techniques. Manufacturers must invest in advanced polymer materials, precision molds, and specialized curing processes that raise capital requirements. It creates barriers for small-scale producers who struggle to compete with established global players. The complexity of quality assurance and performance testing also slows down market entry. End-users in cost-sensitive regions hesitate to adopt composite insulators when traditional porcelain or glass alternatives appear more affordable. These factors limit faster penetration in markets that prioritize cost over long-term performance.

Limited Standardization and Concerns Over Field Performance

Another challenge emerges from the lack of universal standards and field-testing benchmarks for composite insulators across regions. Variations in material quality, design specifications, and installation practices affect consistency in performance. It creates uncertainty among utilities that require proven reliability under harsh environmental conditions. Concerns over premature aging, surface erosion, and resistance to pollution further limit adoption in certain geographies. The absence of harmonized guidelines for testing and certification complicates procurement decisions for utilities and industrial users. These hurdles restrain the ability of composite insulators to achieve uniform acceptance in global distribution networks.

Market Opportunities

Expanding Role in Renewable and Distributed Energy Projects

The Low Voltage Composite Insulators Market holds strong opportunities through the rapid expansion of renewable and distributed energy systems. Solar farms, wind projects, and community microgrids require durable and lightweight insulators that can operate reliably in varied environmental conditions. It supports safe integration of renewable power into local distribution networks where consistent insulation is critical. Growth in rooftop solar and decentralized energy adoption further expands the demand for low-voltage composite solutions. Manufacturers can position advanced insulators with improved hydrophobicity and pollution resistance to meet these evolving requirements. This creates long-term opportunities aligned with global clean energy transition strategies.

Rising Infrastructure Investment in Emerging Economies

Another major opportunity arises from large-scale electrification and infrastructure projects in developing markets. Rapid urbanization in Asia-Pacific, Africa, and Latin America drives strong demand for reliable power distribution networks. It enables the deployment of composite insulators in residential, industrial, and transportation projects where performance and low maintenance are priorities. Governments and utilities focus on upgrading outdated systems, which opens space for wider adoption of advanced polymer-based insulators. Emerging economies present opportunities for cost-effective solutions that withstand high humidity, dust, and pollution levels. These conditions strengthen the market outlook for companies offering innovative and region-specific designs.

Market Segmentation Analysis:

By Product Type

The Low Voltage Composite Insulators Market divides into pin, suspension, shackle, and other product categories. Pin insulators remain widely adopted in low-voltage distribution networks due to their cost-effectiveness and simple installation features. Suspension insulators gain preference in projects that require greater flexibility and mechanical strength for line support. Shackle insulators serve in low-voltage networks, especially in distribution lines across urban and rural regions, where compact and robust solutions are essential. It strengthens demand by addressing varying mechanical and electrical requirements across applications. Other specialized designs cater to niche projects that demand tailored insulation solutions for reliability and safety.

- For instance, the Netherlands is developing new HVDC projects and advanced management methods to address grid congestion. TenneT, responsible for the high-voltage network (110-380 kV), cross-border interconnections, manages the national grid, aiming to enhance grid capacity and reliability.

By Material

The Low Voltage Composite Insulators Market divides by material into polymer, glass, and ceramic insulators. Polymer insulators lead demand due to lightweight properties, superior hydrophobicity, and lower maintenance needs. Their resistance to pollution and vandalism makes them suitable for urban and coastal networks. Glass insulators maintain a stable presence, valued for mechanical strength and long service life, particularly in areas with minimal contamination. Ceramic insulators continue to serve in legacy systems and high-temperature environments, where thermal endurance supports grid reliability. Each material segment addresses distinct performance requirements, creating a balanced product landscape.

- For instance, The U.S. Department of Energy (DOE) has disclosed almost 2 billion spanning across 38 projects intended for enhancing the protection of the U.S. power grid against the dangers posed by extreme weather, economically unfriendly spending for communities, and enabling additional capacity of grid to serve the demand that is expected to rise due to growing industries including manufacturing, data centers, and electrification.

By End-User

Transmission and distribution utilities account for the largest share. The segment relies heavily on composite insulators to modernize grid infrastructure and ensure uninterrupted power supply. It emphasizes cost efficiency and reduced downtime, which insulators enable through longer service life and lower replacement frequency. Industrial users adopt insulators to safeguard electrical equipment in manufacturing facilities and critical infrastructure, where operational reliability is paramount. The renewable energy sector demonstrates rising adoption, as solar and wind projects deploy composite insulators for efficient integration into distributed generation networks. It supports clean energy expansion by providing durable, weather-resistant solutions for variable operating conditions.

Segments:

Based on Product Type:

Based on Material:

- Polymer Insulators,

- Glass Insulators

- Ceramic Insulators

Based on End User:

- Transmission

- Distribution Utilities,

- Industrial

- Renewable Energy

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Low Voltage Composite Insulators Market at around 32%. The region benefits from major investments in grid modernization, smart grid adoption, and renewable energy integration. The United States leads demand with large-scale distribution upgrades and adoption of polymer-based insulators for better reliability. Canada also contributes with infrastructure reinforcement projects and renewable energy expansion. Utilities in this region prioritize products that reduce maintenance costs and extend service life. Strong government focus on energy resilience and sustainability further sustains North America’s leadership position.

Europe

Europe accounts for roughly 22% of the Low Voltage Composite Insulators Market. The region’s growth is driven by strict grid safety standards and ambitious sustainability targets. Countries like Germany, France, and the UK adopt composite insulators to modernize aging infrastructure. Strong emphasis on renewable energy, including offshore wind and urban solar, creates new opportunities for durable insulators. Utilities prioritize polymer-based designs that offer long service life and reduce environmental impact. Europe maintains its share by aligning with regulatory frameworks and sustainability mandates.

Asia-Pacific

Asia-Pacific captures about 29% of the Low Voltage Composite Insulators Market, making it the second-largest regional segment. China dominates with extensive power distribution networks and ongoing urban electrification. India follows with rural electrification programs and growing demand for reliable low-voltage distribution. Japan and Southeast Asian nations contribute with strong renewable adoption, particularly in solar and wind energy projects. Composite insulators are favored for their durability in challenging climates, including humidity, heat, and pollution. Expanding industrialization and rapid urbanization continue to strengthen Asia-Pacific’s position.

Latin America

Latin America represents about 9% of the Low Voltage Composite Insulators Market. Brazil leads regional demand through extensive investments in power distribution and rural electrification programs. Argentina and Colombia follow with smaller but growing adoption across residential and industrial projects. Composite insulators are increasingly selected for their performance in rural and remote areas. Utilities adopt them for cost-effective solutions that improve reliability and minimize losses. Infrastructure expansion across urban and rural grids supports steady growth in Latin America’s market share.

Middle East & Africa

The Middle East & Africa hold nearly 8% of the Low Voltage Composite Insulators Market. The Gulf states invest heavily in renewable energy projects, including large solar farms, which require durable and lightweight insulators. North African countries expand transmission and distribution networks to meet growing urban and industrial demand. Sub-Saharan Africa prioritizes electrification projects that drive adoption of cost-efficient composite solutions. Harsh climatic conditions such as heat, dust, and humidity make polymer-based insulators essential. This region, though smaller in share, represents a high-growth frontier for future adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Low Voltage Composite Insulators Market ompanies such as Bonomi, CYG Insulator, CTC Insulator, Deccan Enterprises, ENSTO, Gipro, Hitachi Energy, Hubbell, Izoelektro, and Kuvag. The Low Voltage Composite Insulators Market remains highly competitive, with companies focusing on innovation, product reliability, and regional expansion to strengthen their positions. Manufacturers invest in advanced polymer materials and hydrophobic coatings that enhance durability, reduce maintenance, and extend service life. Strong emphasis on sustainability drives development of recyclable materials and eco-friendly production methods. Global players leverage broad distribution networks and partnerships with utilities to secure large contracts, while regional firms differentiate through cost-effective solutions tailored to local environmental conditions. Continuous investment in research and development ensures adaptability to varied climates, from high-pollution industrial areas to humid or desert environments. The market also reflects rising collaboration between manufacturers and grid modernization initiatives, where performance, safety, and regulatory compliance remain key differentiators.

Recent Developments

- In June 2025, at the South Asia Expo in Kunming, Jiangxi Johnson Electric Co., Ltd., a prominent insulator manufacturer, showcased its latest high-voltage insulators and smart grid solutions. The company introduced three product lines including composite, porcelain, and glass insulators designed for ultra-high voltage lines.

- In February 2025, TE Connectivity announced the acquisition of Richards Manufacturing, enhancing its position in energy utilities and underground grid connectivity solutions.

- In December 2024, PFISTERER is set to strengthen its international operations and solidify its foothold in Japan with its intent to increase collaborations with Japanese systems provider Nippon Katan Co., Ltd. Both companies have signed a joint venture cooperation contract to manufacture and promote composite insulators for overhead power lines in Japan.

- In January 2024, Ensto announced the manufacturing of the SDI82.2M20 composite line post insulator, designed for medium voltage overhead grids. This innovative insulator features a unique neck structure for easy and fast installation, reducing the need for tools and work phases.

Market Concentration & Characteristics

The Low Voltage Composite Insulators Market shows moderate concentration with a mix of global leaders and regional manufacturers competing for share. It reflects strong technological focus, where material innovation, hydrophobic performance, and durability standards determine competitiveness. Large multinational firms dominate through established distribution networks, advanced research, and long-term partnerships with utilities. Regional companies strengthen their presence by offering cost-effective products tailored to specific environmental conditions and regulatory frameworks. The market is characterized by consistent demand from grid modernization projects, renewable energy integration, and expanding electrification initiatives. It demonstrates resilience due to its essential role in power distribution networks, with product adoption influenced by performance reliability, low maintenance needs, and compliance with safety standards. Competitive dynamics encourage continuous product improvement, strategic alliances, and regional diversification, ensuring the market maintains steady growth momentum.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising investments in power distribution and grid modernization.

- Renewable energy projects will create stronger demand for durable and lightweight composite insulators.

- Manufacturers will focus on recyclable materials and eco-friendly production methods.

- Adoption will increase in emerging economies with expanding electrification programs.

- Utilities will prioritize products that offer longer service life and reduced maintenance needs.

- Advanced polymers with improved hydrophobic properties will shape future product development.

- Integration with smart grid infrastructure will enhance the role of composite insulators.

- Urbanization and industrialization will drive adoption in residential and commercial networks.

- Regional players will expand through cost-effective solutions tailored to local conditions.

- Strategic partnerships with utilities and governments will strengthen competitive positioning.