Market Overview

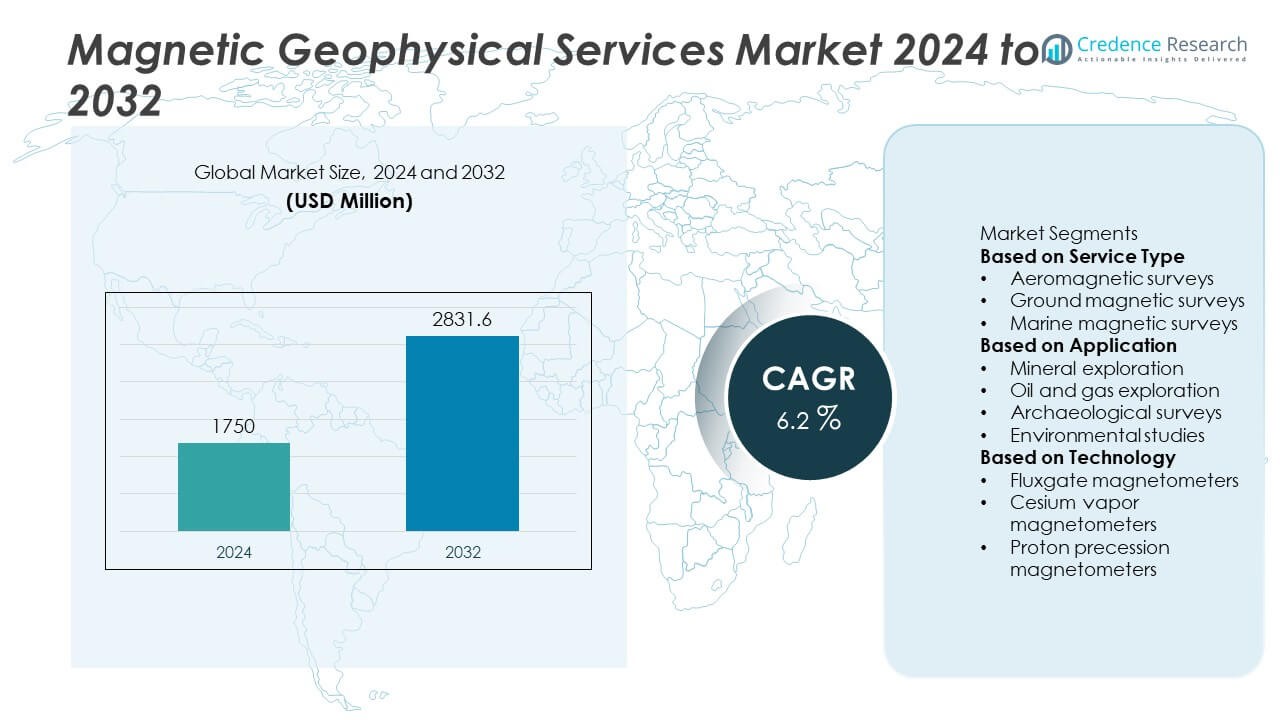

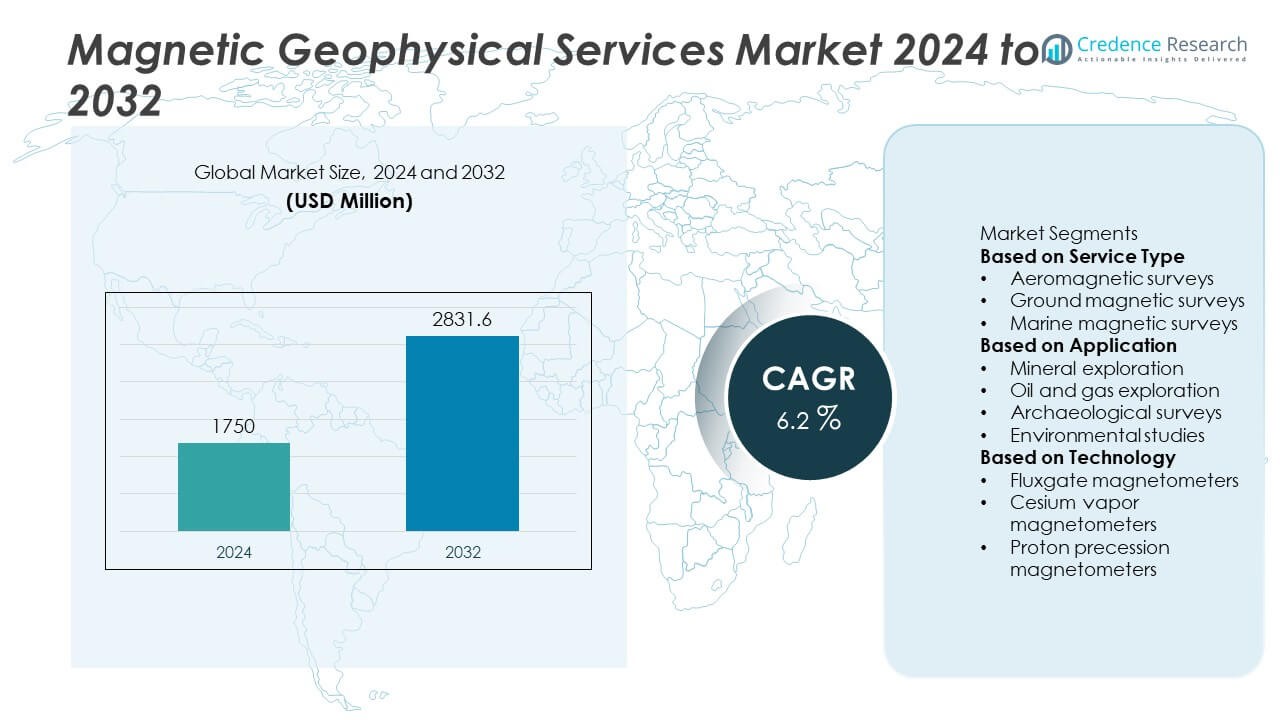

The Magnetic Geophysical Services market was valued at USD 1,750 million in 2024 and is projected to reach USD 2,831.6 million by 2032, expanding at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnetic Geophysical Services Market Size 2024 |

USD 1,750 Million |

| Magnetic Geophysical Services Market, CAGR |

6.2% |

| Magnetic Geophysical Services Market Size 2032 |

USD 2,831.6 Million |

The Magnetic Geophysical Services Market grows through strong drivers and evolving trends shaped by increasing demand for mineral exploration, oil and gas projects, and government-funded geological mapping programs. Rising global need for critical minerals and hydrocarbons strengthens reliance on advanced magnetic surveys.

The Magnetic Geophysical Services Market demonstrates a strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each region contributing through exploration programs and infrastructure development. North America maintains steady demand with large-scale mineral and oil exploration projects, while Europe emphasizes sustainable practices and advanced technology in geological mapping. Asia Pacific shows rapid growth supported by mining investments and government-backed resource surveys. Latin America focuses on copper, gold, and lithium exploration, and the Middle East & Africa expand through mining and oilfield projects. The market is shaped by leading players such as Fugro, Schlumberger, PGS, and Magseis Fairfield, who strengthen competitiveness through advanced data acquisition platforms, AI-powered interpretation tools, and integration of UAV-based magnetic surveys. Their ability to provide reliable, non-invasive solutions for both commercial and government projects reinforces their role in driving adoption across diverse applications and expanding market opportunities worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Magnetic Geophysical Services Market was valued at USD 1,750 million in 2024 and is projected to reach USD 2,831.6 million by 2032, growing at a CAGR of 6.2% during the forecast period.

- Rising demand for mineral and resource exploration fuels adoption of magnetic surveys, as they provide accurate subsurface mapping for copper, gold, iron ore, and rare earth elements while reducing drilling risks.

- Market trends highlight the growing role of airborne surveys, UAV-based platforms, and AI-powered data analytics that improve efficiency, expand coverage, and enhance anomaly detection accuracy across large areas.

- Competitive dynamics feature key players including Fugro, Schlumberger, PGS, and Magseis Fairfield, who invest in high-resolution magnetometers, real-time data solutions, and integrated geophysical platforms to maintain global presence.

- Market restraints stem from high operational costs, dependence on skilled geophysicists, and environmental restrictions in sensitive regions, which delay projects and limit survey accessibility in challenging terrains.

- Regional analysis shows North America leading through advanced exploration projects, Europe focusing on sustainable and regulated practices, Asia Pacific expanding through mining and infrastructure development, Latin America prioritizing copper and lithium exploration, and Middle East & Africa growing with oil, gas, and mineral projects.

- Long-term outlook reflects opportunities in renewable energy and infrastructure development, where magnetic surveys support geothermal resource identification, offshore wind planning, and tunnel construction projects, reinforcing their importance across both commercial and government-funded programs.

Market Drivers

Growing Demand for Mineral and Resource Exploration Across Global Economies

The Magnetic Geophysical Services Market benefits from rising demand for mineral resources including copper, gold, iron, and rare earth elements. Exploration firms and mining companies increasingly rely on magnetic surveys to map subsurface structures with precision. It helps identify mineralized zones, enabling cost-efficient drilling programs and reducing exploration risk. The method supports large-scale projects in both developed and emerging regions where demand for raw materials is rising. Rising investment in resource-intensive industries reinforces adoption of magnetic survey solutions. Strong momentum in mining exploration continues to anchor the market’s growth trajectory.

- For instance, Fugro conducted a large-scale airborne geophysical survey covering over 12,000 square kilometers in Angola’s Cunene and Cuando Cubango provinces.

Expanding Use of Geophysical Services in Oil and Gas Exploration

Oil and gas companies adopt magnetic surveys to complement seismic methods in identifying structural traps and geological features. The Magnetic Geophysical Services Market gains relevance by offering non-invasive and cost-effective mapping solutions across offshore and onshore basins. It enhances early-stage exploration by providing data that guides targeted drilling operations. Rising global energy requirements increase reliance on such advanced survey technologies. Exploration activities in frontier regions, including deep-water and Arctic zones, create strong demand for accurate magnetic survey data. Growing complexity in oil and gas exploration reinforces the role of magnetic services in reducing operational risks.

- For instance, Magseis Fairfield secured a contract for an Ocean Bottom Node (OBN) survey in ExxonMobil’s Stabroek Block, Guyana, covering a minimum 14-month campaign with advanced OBN technology capable of recording continuous magnetic and seismic data at depths exceeding 2,000 meters, enabling improved mapping of deep-water hydrocarbon reservoirs

Technological Advancements Enhancing Data Accuracy and Efficiency

Continuous innovation in magnetometers, data processing software, and airborne survey platforms drives adoption of advanced geophysical methods. The Magnetic Geophysical Services Market benefits from enhanced sensitivity and accuracy that enable detection of subtle geological anomalies. It reduces survey costs and accelerates project timelines by providing rapid data acquisition over large areas. Integration of GPS technology and real-time monitoring improves survey efficiency and reliability. Strong emphasis on advanced visualization tools strengthens decision-making for exploration firms. Investments in technological upgrades continue to make magnetic surveys more reliable and commercially viable.

Rising Infrastructure Development and Government-Supported Geological Programs

Government initiatives supporting resource mapping and infrastructure projects create steady demand for magnetic surveys. The Magnetic Geophysical Services Market expands as national geological surveys deploy magnetic methods for regional mapping and land-use planning. It assists in identifying subsurface hazards, supporting construction safety and urban development. Public funding for geoscience programs strengthens the service provider landscape, especially in emerging economies. Strategic collaborations between governments and private exploration firms further expand service utilization. Growing reliance on geophysical mapping ensures consistent adoption in both commercial and public sector projects.

Market Trends

Growing Integration of Airborne Magnetic Surveys for Large-Scale Exploration

The Magnetic Geophysical Services Market shows rising adoption of airborne platforms that cover vast areas quickly and cost-effectively. Airborne magnetic surveys enable exploration firms to detect subsurface anomalies across inaccessible terrains. It reduces time and labor compared to traditional ground-based surveys. Governments and private companies prefer airborne services for regional geological mapping and mineral exploration. Advances in fixed-wing and helicopter-based systems improve sensitivity and accuracy. Increasing use of aerial survey solutions highlights the trend toward scalable and efficient geophysical data acquisition.

- For instance, Sander Geophysics, operating under Fugro’s airborne solutions, completed a high-resolution aeromagnetic survey in Canada’s Yukon region covering 11,400 square kilometers.

Adoption of Advanced Data Analytics and AI-Driven Interpretation Tools

Data analytics tools and artificial intelligence strengthen the interpretation of complex magnetic survey datasets. The Magnetic Geophysical Services Market benefits from improved modeling that helps identify mineralized zones with greater precision. It enables faster decision-making for exploration and development projects. Cloud-based platforms allow stakeholders to share and process large volumes of geophysical data securely. Companies invest in AI algorithms to reduce interpretation errors and improve anomaly detection. The trend toward digital transformation is reshaping how exploration firms utilize survey data.

Expansion of Services in Renewable Energy and Infrastructure Development

Magnetic surveys are increasingly used in renewable energy projects, such as identifying subsurface structures for geothermal energy and offshore wind farms. The Magnetic Geophysical Services Market gains traction in supporting infrastructure projects by mapping subsurface conditions. It assists in risk assessment for tunnel construction, pipelines, and transportation networks. Governments deploy magnetic surveys to evaluate sites for large-scale clean energy projects. Broader applications in civil engineering expand the role of magnetic services beyond traditional mining and oil exploration. This diversification strengthens long-term market sustainability.

- For instance, Fugro conducted high-resolution aeromagnetic surveys covering more than 35,000 square kilometers for offshore wind farm developments in the North Sea, enabling precise mapping of subsurface anomalies that reduced foundation installation errors by 18 percent during construction.

Emphasis on Cost-Effective and Environmentally Responsible Exploration Methods

The Magnetic Geophysical Services Market reflects growing focus on environmentally responsible and non-invasive survey techniques. It avoids extensive land disruption compared to drilling-based exploration. Service providers promote cost-effective surveys that balance affordability with technical accuracy. Adoption of low-emission airborne platforms and fuel-efficient technologies supports sustainability goals. Regulatory frameworks encourage methods that minimize ecological impact. The shift toward responsible exploration practices drives consistent demand for advanced magnetic survey services.

Market Challenges Analysis

High Operational Costs and Dependence on Skilled Expertise

The Magnetic Geophysical Services Market faces significant challenges due to high operational costs associated with advanced equipment, data processing, and field operations. Service providers must invest heavily in sensitive magnetometers, airborne platforms, and software tools to deliver accurate results. It creates barriers for smaller firms that lack capital to compete with established players. Skilled professionals are essential to manage survey design, data acquisition, and interpretation, yet the industry experiences shortages in trained geophysicists. The reliance on specialized expertise increases labor costs and slows down project timelines. Limited availability of cost-efficient solutions reduces adoption among smaller exploration firms and government agencies with restricted budgets.

Environmental Constraints and Limitations in Complex Terrains

The Magnetic Geophysical Services Market encounters challenges from environmental restrictions and geographic complexities. Regulatory approvals are often required for surveys conducted in sensitive ecosystems, national parks, or indigenous lands. It delays projects and raises compliance costs for service providers. Surveys conducted in urbanized or mountainous terrains face difficulties from cultural noise, infrastructure interference, and access restrictions. Weather conditions such as heavy rainfall or storms further disrupt survey operations, particularly in remote regions. Inaccuracies in highly magnetic or geologically complex environments reduce reliability of data interpretation. These constraints limit the consistent deployment of magnetic geophysical services across all regions.

Market Opportunities

Expanding Mineral Exploration and Renewable Energy Projects

The Magnetic Geophysical Services Market presents strong opportunities with rising global demand for minerals, rare earth elements, and clean energy resources. Governments and private companies continue to invest in large-scale exploration projects to secure supply chains for industries such as electronics, automotive, and renewable energy. It supports mapping of subsurface anomalies that guide efficient drilling programs in mining and geothermal projects. Growing focus on offshore wind farm development and geothermal resource identification enhances service relevance. Increased funding for exploration of critical minerals like lithium and cobalt further expands market scope. The growing alignment of magnetic surveys with energy transition goals positions the sector for long-term growth.

Technological Innovation and Wider Adoption Across Infrastructure Development

Emerging advancements in high-resolution magnetometers, UAV-based survey platforms, and AI-powered data analytics create new opportunities for service providers. The Magnetic Geophysical Services Market benefits from these innovations that improve accuracy and reduce costs for large and small-scale projects. It enables applications beyond resource exploration, extending into infrastructure planning, tunnel construction, and urban development. Governments allocate funding for geological mapping programs that integrate magnetic surveys to support safer land-use decisions. Service providers that combine advanced technology with sustainable practices strengthen their competitive edge. Growing adoption across both commercial exploration and public infrastructure projects opens diverse revenue streams for the market.

Market Segmentation Analysis:

By Service Type

The Magnetic Geophysical Services Market divides into ground-based surveys, airborne surveys, and marine surveys. Ground-based surveys remain essential for high-resolution data collection in small-scale exploration projects and detailed mapping tasks. Airborne surveys dominate large-area exploration due to their ability to cover thousands of square kilometers efficiently. It supports mineral exploration, oil and gas reconnaissance, and geological mapping across remote and inaccessible regions. Marine surveys focus on offshore oil and gas exploration as well as seabed mineral assessment. Each service type addresses different exploration needs, providing flexibility for industries and governments seeking accurate geophysical data.

- For instance, Fugro completed a marine geophysical survey in July 2025 covering 1.27 million square meters in the Arabian Gulf for an artificial island project, achieving an 85% reduction in data collection time through uncrewed surface vessels and advanced GroundIQ® technology

By Application

Market segmentation by application includes mining, oil and gas, infrastructure development, and environmental studies. Mining represents the largest application, as companies rely on magnetic surveys to locate mineralized zones and reduce drilling risks. The Magnetic Geophysical Services Market supports oil and gas exploration by mapping subsurface structures and guiding seismic surveys. It also assists infrastructure developers in identifying geological hazards, ensuring safety in tunnels, pipelines, and large construction projects. Environmental studies increasingly incorporate magnetic surveys to assess soil contamination, groundwater pathways, and subsurface anomalies. Expanding adoption across multiple industries strengthens the market’s long-term growth outlook.

- For instance, PGS received approval in June 2024 to acquire a large 3D seismic and magnetic dataset in Uruguay covering more than 25,000 square kilometers, providing vital subsurface data for both hydrocarbon exploration and regional environmental assessment programs

By Technology

Technological segmentation includes magnetometers, UAV-based systems, and advanced data processing software. Magnetometers, both ground and airborne, remain the core instruments for data acquisition. It ensures accurate detection of subtle anomalies critical for mineral and hydrocarbon exploration. UAV-based surveys represent a growing trend, offering cost-efficient and flexible data collection for mid-scale projects. Advanced software tools with AI-driven analytics and 3D modeling enhance interpretation accuracy and improve project efficiency. Integration of GPS and real-time monitoring capabilities further increases reliability and reduces operational delays. Continuous innovation across these technologies ensures that service providers remain competitive while meeting the evolving demands of exploration and infrastructure projects.

Segments:

Based on Service Type

- Aeromagnetic surveys

- Ground magnetic surveys

- Marine magnetic surveys

Based on Application

- Mineral exploration

- Oil and gas exploration

- Archaeological surveys

- Environmental studies

Based on Technology

- Fluxgate magnetometers

- Cesium vapor magnetometers

- Proton precession magnetometers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 31% of the Magnetic Geophysical Services Market, driven by strong exploration activity in both mineral and energy sectors. The United States and Canada invest heavily in mapping subsurface resources to secure supply chains for copper, gold, rare earths, and hydrocarbons. It benefits from advanced infrastructure and well-established exploration firms that deploy airborne and ground-based surveys on a large scale. Oil and gas operators in the Gulf of Mexico use magnetic surveys to complement seismic methods, ensuring accurate structural mapping. Federal agencies such as the U.S. Geological Survey continue to allocate funds for regional mapping programs, boosting demand for geophysical services. The presence of leading service providers and adoption of UAV-based platforms reinforce the region’s leadership position.

Europe

Europe accounts for 22% of the Magnetic Geophysical Services Market, supported by extensive geological mapping programs and strong environmental regulations. Countries such as Germany, France, and the UK rely on magnetic surveys for mineral exploration, geothermal energy assessment, and infrastructure planning. It faces stricter rules on land use and environmental protection, encouraging the adoption of non-invasive geophysical techniques. The European Union supports cross-border initiatives for resource mapping, which strengthens opportunities for service providers. Renewed focus on critical minerals like lithium and cobalt, essential for battery manufacturing, stimulates exploration projects. The use of advanced magnetometers and AI-based data interpretation tools ensures accurate results across both commercial and public-sector projects.

Asia Pacific

Asia Pacific represents 29% of the Magnetic Geophysical Services Market, with rapid growth supported by rising mineral demand, large infrastructure projects, and energy exploration. China, India, and Australia lead demand with significant investment in mining and regional geological surveys. It supports exploration of coal, iron ore, rare earths, and hydrocarbons that remain critical for industrial expansion. Governments across Southeast Asia adopt airborne surveys for resource mapping in remote and densely forested regions. Growing investment in renewable energy, including geothermal projects, further strengthens market adoption. The combination of mineral exploration, infrastructure expansion, and public geoscience programs makes Asia Pacific a dynamic hub for magnetic geophysical services.

Latin America

Latin America contributes 10% of the Magnetic Geophysical Services Market, with Brazil, Chile, and Peru driving regional demand. Mining remains the dominant sector, supported by exploration of copper, gold, and lithium deposits. It benefits from large-scale airborne surveys that help map mineral-rich zones across vast terrains. Governments encourage foreign investment in exploration activities, generating opportunities for international service providers. Infrastructure projects, such as pipeline routes and hydroelectric facilities, also require geophysical mapping to mitigate geological risks. Expanding partnerships between national geological surveys and private firms reinforce long-term service demand in the region.

Middle East & Africa

The Middle East & Africa holds 8% of the Magnetic Geophysical Services Market, supported by exploration initiatives in both mineral and oil sectors. African nations including South Africa, Nigeria, and Ghana rely on magnetic surveys for gold, diamond, and rare earth exploration. It also gains traction in the Middle East, where oil companies integrate magnetic methods with seismic surveys to improve exploration efficiency. Governments promote national geological mapping programs to attract investment in mining and energy projects. Infrastructure development, particularly in urban and industrial hubs, creates further opportunities for service adoption. Limited availability of skilled expertise remains a challenge, but steady growth in public-private initiatives drives adoption across this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Magseis Fairfield

- Schlumberger

- Digicon Geophysical

- Geokinetics

- Fugro

- WesternGeco

- ION Geophysical

- PGS

- Sercel

- Marine Magnetic

Competitive Analysis

The competitive landscape of the Magnetic Geophysical Services Market is shaped by leading players such as Fugro, Sercel, Marine Magnetic, ION Geophysical, Schlumberger, PGS, Geokinetics, Magseis Fairfield, WesternGeco, and Digicon Geophysical, who drive innovation and global service reach. Fugro strengthens its position through advanced airborne and marine magnetic surveys supported by real-time data platforms. Schlumberger and its subsidiary WesternGeco dominate with integrated geophysical solutions that combine magnetic methods with seismic and gravity surveys, ensuring comprehensive subsurface analysis. PGS and Magseis Fairfield focus on offshore oil and gas projects, leveraging next-generation survey vessels and ocean bottom node technologies to improve data accuracy in deep-water basins. ION Geophysical advances interpretation capabilities with digital platforms that enhance efficiency in exploration workflows. Sercel provides high-performance geophysical instruments, supporting service providers with reliable data acquisition systems. Marine Magnetic and Geokinetics address niche regional markets with cost-effective ground-based and airborne solutions. Digicon Geophysical maintains competitiveness by offering specialized geophysical services tailored to energy and mining clients. Collectively, these companies emphasize technological innovation, strategic partnerships, and sustainable practices to expand adoption across mining, oil and gas, infrastructure, and environmental applications, reinforcing their critical role in driving the market’s global growth.

Recent Developments

- In August 2025, Fugro: Selected to perform comprehensive geophysical and geotechnical site surveys using its GroundIQ® technology and uncrewed surface vessels (USV) for major energy field developments in the Middle East.

- In June 2025, Fugro: Secured contracts to conduct geophysical and geotechnical investigations for two offshore wind farms (Windbostel Ost and West) in Germany’s North Sea, supporting RWE and TotalEnergies.

- In June 2024, PGS received approval to acquire a large 3D multi-client seismic survey in Uruguay, expanding its coverage in the region.

Market Concentration & Characteristics

The Magnetic Geophysical Services Market reflects a moderately consolidated structure where a few global leaders dominate alongside several regional specialists. Companies such as Fugro, Schlumberger, PGS, and Magseis Fairfield hold strong competitive positions through advanced survey platforms, ocean bottom node technologies, and integrated geophysical solutions. It maintains competitive diversity with firms like ION Geophysical, WesternGeco, and Sercel providing specialized data processing, equipment, and interpretation services that support large exploration programs. Smaller providers including Marine Magnetic, Digicon Geophysical, and Geokinetics address niche regional demands with cost-effective ground-based and airborne solutions. Market characteristics emphasize the importance of technological capability, data accuracy, and operational efficiency, as clients prioritize reliable and non-invasive exploration techniques. It adapts to demand from mining, oil and gas, infrastructure, and renewable energy sectors, where precision and sustainability remain central requirements. Strong focus on innovation, environmental compliance, and integration of AI-driven analytics defines the competitive concentration and ensures consistent relevance across industries.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will align with rising demand for mineral exploration and mapping of critical resources.

- Airborne and UAV-based magnetic surveys will expand due to efficiency and wide coverage.

- Integration of AI and advanced data analytics will improve accuracy and reduce interpretation time.

- Service providers will focus on environmentally responsible, non-invasive survey methods.

- Governments will increase funding for national geological mapping and resource assessment programs.

- Renewable energy projects such as geothermal and offshore wind farms will create new applications.

- Infrastructure development will drive demand for subsurface hazard mapping and site assessments.

- Strategic collaborations between global leaders and regional firms will strengthen service reach.

- Continuous innovation in magnetometer technology will enhance sensitivity and reliability.

- Digital platforms and real-time monitoring will become standard features in project delivery.