Market Overview

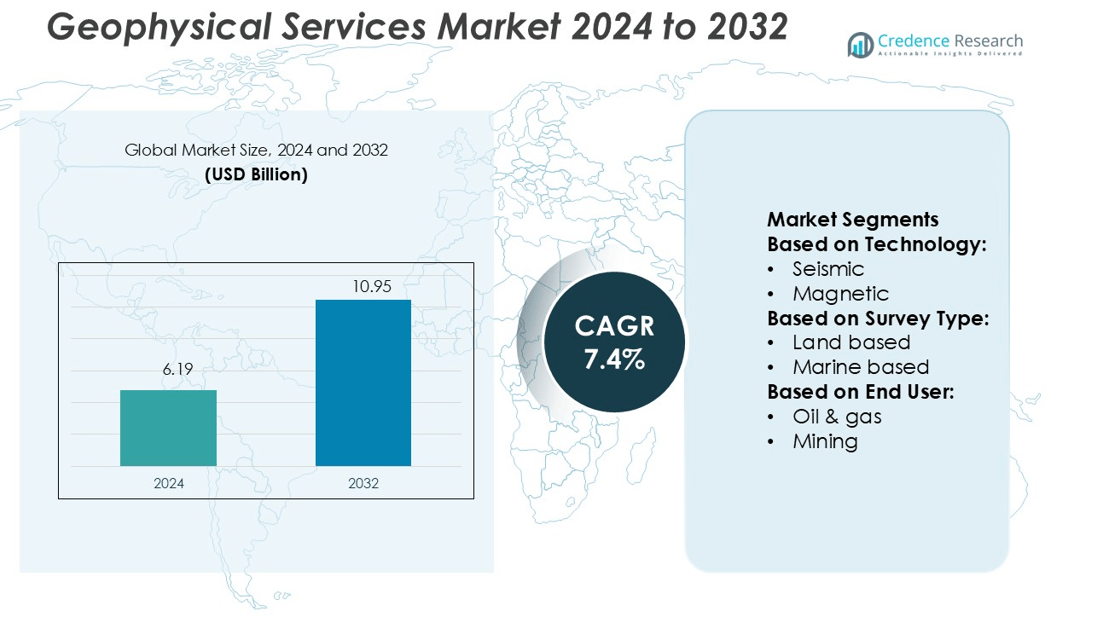

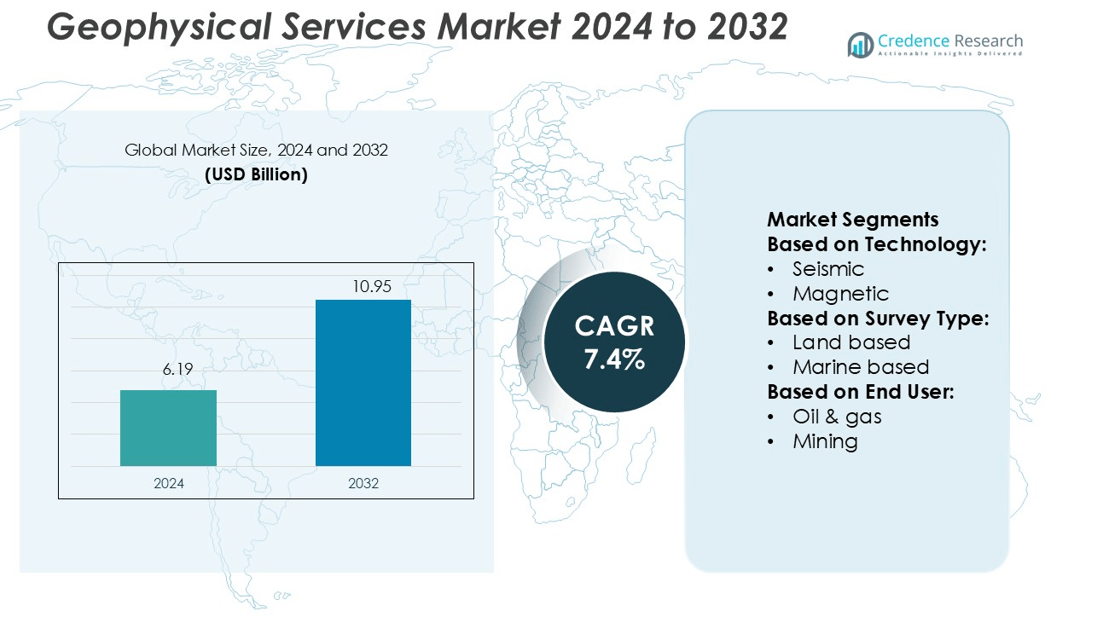

Geophysical Services Market size was valued USD 6.19 billion in 2024 and is anticipated to reach USD 10.95 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geophysical Services Market Size 2024 |

USD 6.19 billion |

| Geophysical Services Market, CAGR |

7.4% |

| Geophysical Services Market Size 2032 |

USD 10.95 billion |

The Geophysical Services Market is shaped by major players such as Gardline Limited, Paradigm Group B.V., CGG, Fugro, Dawson Geophysical Company, Getech Group plc, PGS, HESP, NUVIA Dynamics Inc., and EGS (International) Ltd. These companies focus on expanding their technological capabilities, strengthening service portfolios, and forming strategic partnerships to enhance competitiveness. Many are adopting advanced seismic and electromagnetic solutions supported by AI and UAV-based technologies to deliver faster, more accurate results. North America leads the global market with a 33% share in 2024, driven by extensive oil and gas exploration, strong mineral resource projects, and advanced digital infrastructure supporting large-scale geophysical surveys.

Market Insights

- The Geophysical Services Market was valued at USD 6.19 billion in 2024 and is expected to reach USD 10.95 billion by 2032, growing at a CAGR of 7.4%.

- Rising oil, gas, and mineral exploration activities drive demand for advanced seismic and electromagnetic technologies, improving resource identification and reducing operational risks.

- The market is shaped by strong competition as companies invest in AI, UAV-based surveys, and strategic partnerships to enhance service capabilities and global reach.

- High survey and operational costs remain key restraints, limiting adoption among smaller exploration firms and slowing expansion in developing regions.

- North America leads the market with a 33% share, followed by Asia Pacific at 29%, while seismic technology dominates with a 46% share, supported by expanding offshore exploration and growing renewable energy investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The seismic segment dominates the Geophysical Services Market with a 46% share in 2024. Seismic technology provides high-resolution subsurface data, making it the preferred method for oil, gas, and mineral exploration. Advanced 3D and 4D seismic surveys enhance imaging accuracy, supporting efficient drilling decisions and reducing operational risks. Magnetic and electromagnetic methods follow, offering rapid reconnaissance and mapping capabilities for mineral and groundwater surveys. Gradiometric techniques support fine-scale structural mapping, while other niche technologies address specialized environmental and geothermal applications, contributing to comprehensive resource assessment.

- For instance, Gardline Limited is equipped to deploy ultra-high-resolution streamers with 12.5 m spacing for 3D seismic surveys. This technology is used to improve subsurface imaging for offshore wind and oil and gas exploration projects.

By Survey Type

Land-based surveys lead the market with a 52% share in 2024. High adoption in oil and gas exploration, mining, and infrastructure development drives this dominance. Land surveys offer better accessibility, lower operational complexity, and integration with advanced seismic and electromagnetic methods for precise subsurface mapping. Marine-based surveys gain momentum with offshore energy and deep-sea mining investments, while aerial-based surveys support large-area mineral exploration and environmental monitoring. The growing use of UAVs and airborne geophysical systems is expanding aerial applications, improving data coverage and reducing survey time.

- For instance, Sercel, the Sensing & Monitoring unit of CGG (now Viridien), has delivered its 508XT land seismic acquisition system to customers for large-scale land surveys, including in the Middle East and India.

By End User

Oil and gas is the dominant end-user segment with a 57% share in 2024. Exploration companies rely on advanced seismic and electromagnetic surveys to identify hydrocarbon reserves with greater accuracy and lower exploration risks. Increased offshore drilling and unconventional resource development further strengthen demand. Mining follows, driven by global investments in critical minerals and rare earth elements. Agriculture and other sectors, including environmental studies and geothermal energy, are expanding their use of geophysical services to optimize resource management and support sustainable development initiatives.

Key Growth Drivers

Rising Oil and Gas Exploration Activities

Growing global energy demand is driving extensive oil and gas exploration, boosting geophysical service adoption. Advanced seismic and electromagnetic technologies help companies identify reserves more accurately and reduce drilling risks. Offshore and unconventional field developments, especially in North America and the Middle East, further strengthen this trend. National energy security goals and exploration in frontier basins increase demand for precise subsurface mapping. Major oil companies are investing in modern survey techniques to optimize production strategies and enhance exploration success rates.

- For instance, Fugro collects extensive marine seismic data through 2D, 3D, and ultra-high-resolution surveys across its global operations. This work supports exploration and development projects in complex offshore basins for industries like offshore wind and oil and gas.

Expanding Mineral Exploration for Critical Resources

Increasing demand for critical minerals like lithium, copper, and rare earth elements is accelerating mineral exploration worldwide. Geophysical methods such as magnetic and electromagnetic surveys enable accurate deposit location and resource estimation. Government-backed exploration programs and rising private investments are supporting this expansion. The electrification of transport and renewable energy projects create sustained demand for mineral resources. This trend directly benefits geophysical service providers by increasing large-scale survey projects across key mining regions in Australia, Africa, and South America.

- For instance, Dawson Geophysical has invested in Geospace Pioneer™ ultralight seismic nodes, acquiring nodes weighing less than 0.5 kg, each with continuous recording capability up to 50 days, to expand its channel count for high-resolution surveys.

Technological Advancements in Surveying Techniques

Continuous advancements in seismic imaging, UAV-based aerial surveys, and real-time data processing are transforming geophysical services. Modern sensors improve data accuracy, while AI and machine learning enhance interpretation speed. Integrated 3D and 4D seismic technologies enable better reservoir visualization and decision-making. These innovations reduce exploration time and cost, increasing the appeal of geophysical solutions for both energy and non-energy applications. Enhanced automation also improves survey efficiency, supporting broader adoption across oil, gas, mining, and environmental monitoring projects.

Key Trends & Opportunities

Growing Use of Airborne and UAV-Based Surveys

Airborne and UAV-based geophysical surveys are gaining traction due to their cost efficiency and wide coverage. UAV platforms allow quick deployment in remote and inaccessible regions, enabling faster data collection. These surveys are increasingly applied in mineral exploration, agriculture, and environmental studies. Integration with high-resolution sensors and AI analytics improves survey precision and speed. The trend offers significant opportunities for service providers to expand applications beyond traditional oil and gas markets, particularly in emerging economies with untapped resource potential.

- For instance, PGS, through its strategic partnership with and assistance to its subsidiary, OFG (Ocean Floor Geophysics), enabled the acquisition of the P-Cable ultra-high-resolution 3D seismic system from NCS Subsea.

Integration of AI and Advanced Analytics

Geophysical service providers are integrating AI and data analytics to enhance subsurface imaging and interpretation. Automated algorithms reduce manual processing time and improve accuracy in identifying anomalies and structural features. This integration allows faster decision-making in exploration and development activities. It also supports predictive modeling and reservoir simulation, improving project efficiency. The growing adoption of digital tools creates opportunities for technology-driven companies to expand market share and develop customized solutions for energy, mining, and environmental applications.

- For instance, NUVIA Dynamics developed the IMPAC-M airborne data acquisition console that supports up to 8 cesium magnetometer sensors, sampling internally at 1,200 Hz with a resolution of 0.2 pT per reading.

Rising Investments in Renewable and Geothermal Projects

The shift toward clean energy is driving interest in geothermal exploration and related geophysical surveys. These projects require accurate subsurface imaging to identify geothermal reservoirs. Governments and private players are increasing funding for sustainable energy exploration, opening new revenue streams for service providers. Advanced geophysical tools support the early identification of viable sites, reducing project risks. This trend diversifies the market beyond conventional oil and gas and aligns with global decarbonization goals.

Key Challenges

High Survey and Operational Costs

Geophysical surveys require significant investments in equipment, skilled labor, and data processing technologies. Offshore seismic and airborne surveys involve high logistical expenses, which limit adoption among smaller exploration companies. Fluctuating energy and commodity prices also impact project budgets and exploration timelines. High operational costs can delay or scale down exploration programs, especially in low-margin projects. This cost barrier remains a major challenge for market expansion in developing regions with limited funding.

Regulatory and Environmental Restrictions

Strict environmental regulations and permitting procedures often delay or restrict exploration activities. Sensitive ecosystems, coastal zones, and protected areas require additional assessments, raising project timelines and costs. Noise and disturbance from seismic surveys also attract regulatory scrutiny, especially offshore. These constraints can limit the scope of large-scale surveys and discourage investment. Compliance with evolving international environmental standards remains a critical challenge for service providers seeking to operate in multiple jurisdictions.

Regional Analysis

North America

North America holds a 33% share of the Geophysical Services Market in 2024. The region benefits from extensive oil and gas exploration activities in the U.S. and Canada, including offshore Gulf operations and unconventional resource development. Advanced seismic and electromagnetic survey technologies are widely adopted to enhance exploration efficiency. High investment levels in mineral exploration for lithium and rare earth elements further boost demand. Strong regulatory frameworks, advanced data analytics, and established service providers give North America a competitive edge, making it a major hub for geophysical innovations and large-scale exploration projects.

Europe

Europe accounts for 22% of the Geophysical Services Market in 2024. Countries such as Norway, the UK, and Germany lead exploration for oil, gas, and renewable energy resources. Offshore North Sea exploration and geothermal project development drive geophysical survey demand. Governments emphasize sustainable exploration practices and environmental monitoring, creating opportunities for advanced survey solutions. The region’s strong focus on clean energy accelerates the use of geophysical methods for geothermal mapping. Europe’s well-developed infrastructure and high technology adoption support steady market growth despite tightening environmental regulations.

Asia Pacific

Asia Pacific leads the Geophysical Services Market with a 29% share in 2024. Expanding exploration in China, Australia, and India fuels market growth. Strong investments in mineral exploration, including copper, lithium, and gold, drive demand for magnetic and electromagnetic surveys. The oil and gas sector in Southeast Asia continues to adopt advanced seismic techniques for offshore fields. Governments support large-scale energy and infrastructure projects, further boosting geophysical survey activities. Rapid industrialization, resource availability, and technology upgrades position the region as a key growth engine.

Latin America

Latin America captures 9% of the Geophysical Services Market in 2024. Countries like Brazil, Chile, and Peru invest heavily in mineral exploration, especially for copper and lithium. Expanding offshore oil and gas projects in Brazil increase seismic survey adoption. Supportive mining regulations and foreign investments create favorable conditions for service providers. Although infrastructure gaps remain, UAV-based and airborne surveys offer cost-effective solutions for remote exploration. Growing interest in renewable energy and geothermal projects is expected to strengthen the region’s market position further.

Middle East & Africa

The Middle East & Africa hold a 7% share of the Geophysical Services Market in 2024. Strong oil and gas exploration in Saudi Arabia, UAE, and offshore Africa drives demand for seismic and electromagnetic technologies. Increasing mineral exploration in Africa, particularly in South Africa and Zambia, supports additional growth. The region is also exploring geothermal potential, aligning with diversification goals. Political instability and regulatory challenges in parts of Africa pose limitations. However, rising investments in exploration and infrastructure modernization are expected to enhance regional market expansion.

Market Segmentations:

By Technology:

By Survey Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Geophysical Services Market is characterized by strong competition among key players, including Gardline Limited, Paradigm Group B.V., CGG, Fugro, Dawson Geophysical Company, Getech Group plc, PGS, HESP, NUVIA Dynamics Inc., and EGS (International) Ltd. The Geophysical Services Market is highly competitive, driven by rapid technological advancements and rising exploration investments across multiple industries. Companies are focusing on expanding their service capabilities, improving operational efficiency, and integrating digital technologies to strengthen their market position. Advanced seismic and electromagnetic solutions, combined with UAV-based surveys, enable faster and more precise data acquisition. Strategic collaborations and capacity expansions support global reach and competitiveness. The increasing adoption of AI-driven analytics enhances data interpretation, reducing exploration risks and costs. Growing demand from oil and gas, mining, and renewable energy sectors continues to shape the market’s dynamic and innovation-driven landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March of 2025, Geological Survey of India (GSI) aims to incorporate artificial intelligence (AI) and machine learning (ML) techniques in the exploration of minerals. The proposed work aims to enhance the precision of resource finding via advanced data analytics and prediction with 4D geological modeling.

- In March 2025, GPR WaveSense’s ground penetrating radar (GPR) technology will be integrated into NovAtel’s SPAN GNSS+INS solution, as per the MOU with GPR. The aim of the collaboration is to improve positioning in difficult environments by integrating sonar-based mapping with GNSS and inertial data for civil mapping and autonomous vehicle systems.

- In January 2025, Amazon Web Services (AWS) has integrated MDIO seismic streaming from the OSDU Data Platform to improve AI and ML features. This allows for faster processing of seismic data and enhances subsurface imaging needed in energy exploration. The solution improves efficiency and scalability while providing real-time analytics to geophysical applications in the oil and gas industry.

- In January 2024, COSL achieved a historic milestone by winning its first geophysical surveying contract in North America. This framework agreement from Mexico is an important step towards the company’s market entry and improves COSL‘s regional strategic presence. This partnership reinforces COSL’s intentions to increase its global brand recognition and prove its dedication in providing value-added bespoke services

Report Coverage

The research report offers an in-depth analysis based on Technology, Survey Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising oil, gas, and mineral exploration projects.

- Adoption of advanced seismic and electromagnetic technologies will increase.

- AI and machine learning will enhance data processing and interpretation speed.

- UAV and drone-based surveys will become more common in remote areas.

- Renewable energy exploration will create new revenue opportunities.

- Offshore survey activities will grow due to increasing deepwater projects.

- Governments will support exploration through favorable policies and investments.

- Digital transformation will improve operational efficiency and reduce costs.

- Demand for sustainable and low-impact survey solutions will rise.

- Strategic partnerships and acquisitions will strengthen global market presence.Top of Form