Market Overview

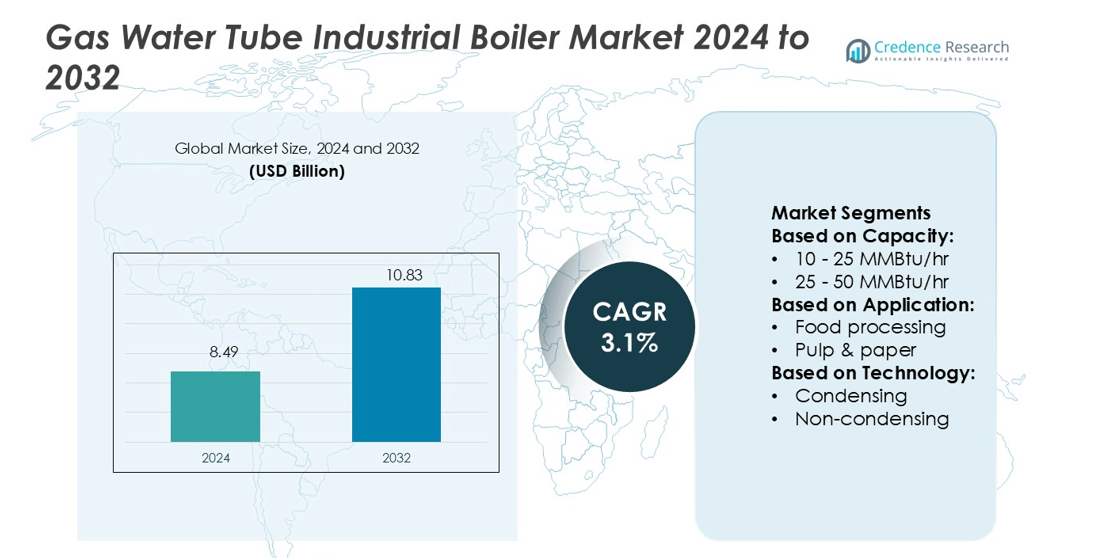

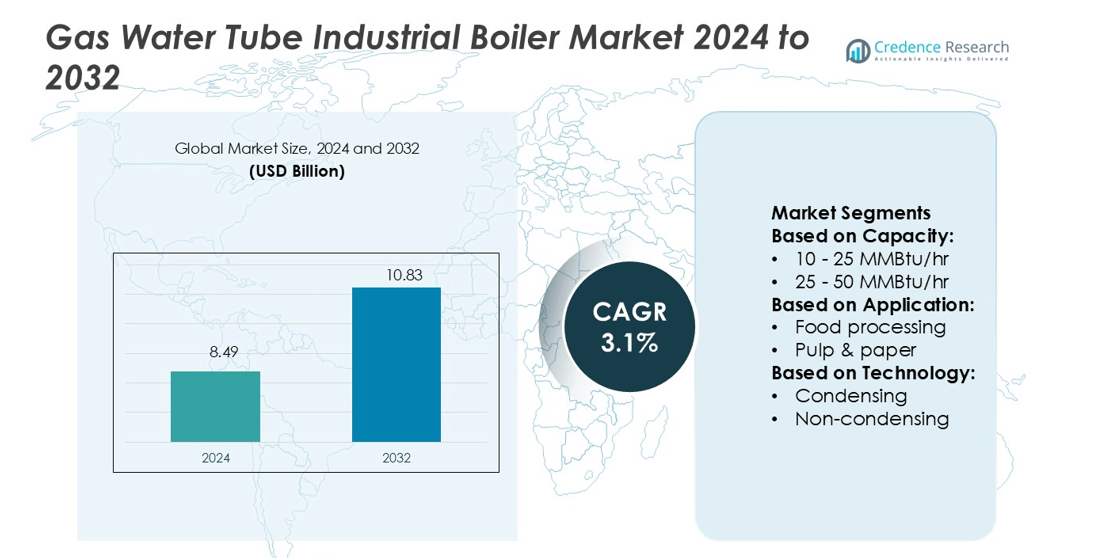

Gas Water Tube Industrial Boiler Market size was valued USD 8.49 billion in 2024 and is anticipated to reach USD 10.83 billion by 2032, at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Water Heater Market Size 2024 |

USD 8.49 billion |

| Gas Water Heater Market, CAGR |

3.1% |

| Gas Water Heater Market Size 2032 |

USD 10.83 billion |

The Gas Water Tube Industrial Boiler Market is highly competitive and driven by innovation, efficiency, and emission compliance. Companies are focusing on advanced technologies such as low-NOx combustion, modular designs, and digital monitoring systems to strengthen their market positions. Expanding service networks and strategic collaborations with energy-intensive industries help them maintain a global presence. Asia Pacific leads the market with a 34% share, supported by rapid industrialization, infrastructure development, and government initiatives promoting cleaner energy. Strong growth in chemical, refinery, and food processing sectors in this region continues to make it the most attractive market for both established and emerging manufacturers.

Market Insights

- The Gas Water Tube Industrial Boiler Market was valued at USD 8.49 billion in 2024 and is projected to reach USD 10.83 billion by 2032, growing at a CAGR of 3.1%.

- Rising demand from chemical, refinery, and food processing industries is driving steady market expansion across developed and emerging economies.

- Adoption of low-NOx combustion, modular boiler systems, and digital monitoring is a key trend enhancing operational efficiency and regulatory compliance.

- High installation and maintenance costs remain a restraint, limiting adoption in smaller industries and cost-sensitive markets.

- Asia Pacific holds a 34% share, leading the market due to rapid industrialization, while the 25–50 MMBtu/hr capacity segment dominates with strong demand from medium-scale processing facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

The 10–25 MMBtu/hr capacity segment holds the dominant market share of 28% in 2024. This range offers high operational efficiency and cost-effectiveness for medium-scale industrial users. Food processing, pulp and paper, and chemical industries prefer this capacity due to its flexible operation and easy maintenance. Compact design and stable steam generation make it suitable for plants with moderate energy demand. The increasing adoption of energy-efficient boilers in mid-size facilities further drives growth. Government support for cleaner combustion systems enhances demand in this segment.

- For instance, Jaquar India has expanded its small-capacity water heater portfolio with models that combine high thermal efficiency and compact dimensions. The Elena Prime 25 L model features a 25-liter glass-lined inner tank, a 2 kW heating element, and an 0.8 MPa pressure rating designed for high-rise apartments.

By Application

The chemical segment leads the market with a 31% share in 2024. Chemical plants require high-pressure steam for processing, heating, and distillation operations. Water tube boilers support continuous steam output and provide enhanced safety in chemical environments. The segment benefits from rising investments in specialty chemicals and petrochemicals. Growing chemical exports from Asia Pacific and North America strengthen equipment demand. Energy efficiency regulations and modernization of aging boiler systems also contribute to the segment’s leadership.

- For instance, Heatrae Sadia’s Multipoint Instantaneous 9 kW model supports efficient water heating for single or dual outlets in compact homes with zero standing heat loss. The actual flow rate is dependent on the desired temperature rise but can be up to 4.5 liters per minute under typical conditions.

By Technology

The non-condensing segment accounts for 57% of the total market share in 2024. This technology remains dominant due to lower initial investment and simple operation. It is widely used in industries requiring steady steam supply without the need for advanced heat recovery. Non-condensing boilers have strong penetration in pulp and paper, primary metal, and food processing applications. Many facilities prefer retrofitting existing non-condensing units rather than full system replacement. However, stricter emission norms are gradually driving interest toward condensing systems for improved efficiency.

Key Growth Drivers

Rising Demand from Process Industries

Process industries such as chemicals, refineries, and pulp and paper are driving strong demand for gas water tube industrial boilers. These industries rely on high-capacity steam generation for continuous operations and efficient heat transfer. Boilers with large capacity support faster production cycles and better fuel utilization. Expanding chemical and petrochemical facilities across Asia Pacific and North America are accelerating installations. Strict emission standards and the shift toward natural gas further strengthen market growth. These factors collectively increase the adoption of advanced water tube boiler systems in critical process applications.

- For instance, A. O. Smith offers the Vertex™ High-Value Condensing gas heater (HV model) in a 50-gallon version. These models are ENERGY STAR® certified and can achieve a Uniform Energy Factor (UEF) of 0.90, though the first-hour rating will vary depending on the specific model’s BTU input.

Shift Toward Cleaner Energy Sources

Growing focus on low-emission technologies is encouraging industries to replace coal-fired boilers with gas water tube systems. Natural gas combustion generates fewer greenhouse gases, aligning with stricter environmental regulations. Several regions have implemented emission norms that push industries toward cleaner alternatives. Gas water tube boilers offer better thermal efficiency and lower maintenance compared to solid-fuel systems. This shift is supported by supportive policy frameworks and carbon reduction initiatives. These advantages position gas-fired boilers as preferred equipment in both existing and greenfield industrial facilities.

- For instance, Haier’s M8 heat pump water heater uses dual-power heating—1,200 W heat pump plus auxiliary electric support—to ensure output under low ambient temperatures.

Infrastructure Expansion and Industrialization

Rapid infrastructure growth and industrial expansion are key demand catalysts. Heavy industries, including metals, food processing, and petrochemicals, require high-pressure steam for production. Emerging economies are investing heavily in manufacturing facilities, energy projects, and large-scale processing plants. Modern boiler technologies help reduce downtime and energy costs, boosting operational efficiency. The development of power plants, refineries, and industrial clusters drives bulk orders for high-capacity gas water tube systems. This industrial expansion strongly supports long-term growth of the global market.

Key Trends & Opportunities

Integration of Advanced Control Systems

Manufacturers are integrating smart control technologies, including IoT-enabled monitoring and automation, into boiler systems. These solutions enable real-time performance tracking, predictive maintenance, and automated temperature regulation. Industrial plants are adopting such systems to optimize fuel use and extend equipment life. Advanced controls also help reduce downtime, operational costs, and emissions. This trend is opening strong opportunities for companies offering connected, energy-efficient boiler solutions across multiple industry verticals.

- For instance, Havells unveiled a Made-in-India heat pump water heater that can produce up to 129 litres of hot water and maintain outlet temperatures up to 75 °C under ambient conditions.

Focus on Energy Efficiency and Retrofits

Energy efficiency is becoming a critical factor for industrial buyers. Companies are upgrading existing infrastructure with high-efficiency gas water tube boilers to reduce operational costs and meet compliance requirements. Retrofitting old systems with modern condensing technologies supports better heat recovery and reduced fuel consumption. Government incentives for energy-efficient equipment also boost adoption. This creates growth opportunities for manufacturers offering retrofit solutions, digital upgrades, and high-efficiency designs.

- For instance, Thermal conductivities across these product lines can vary from approximately 1.10 to 3.50 W/m·K, with corresponding lap shear strengths ranging from under 1 MPa (for thermal gap fillers) to over 20 MPa (for structural adhesives).

Expansion in Emerging Economies

Emerging markets in Asia Pacific, Latin America, and the Middle East are witnessing rapid industrialization and infrastructure growth. Increasing investments in manufacturing, refining, and process industries are driving demand for high-capacity boiler systems. These regions offer low-cost production bases and strong energy demand growth. Expanding gas pipeline infrastructure further supports wider adoption of gas-fired boiler systems. Market players are targeting these regions to build long-term growth pipelines and establish local production capabilities.

Key Challenges

High Initial Investment Costs

The high capital cost of gas water tube industrial boilers is a major barrier for small and mid-scale industries. Installation involves advanced equipment, safety systems, and regulatory compliance, increasing upfront expenses. This often limits adoption to large industries with higher financial capacity. Maintenance and training costs also add to the total investment burden. Cost-sensitive buyers in developing markets may delay or avoid upgrading, which restrains short-term market growth.

Fuel Price Volatility and Supply Issues

Natural gas prices are subject to global fluctuations and geopolitical risks, which can increase operating costs. Supply chain disruptions and infrastructure limitations in certain regions affect consistent gas availability. This creates uncertainty for industries relying heavily on gas boilers for critical operations. High volatility in energy pricing discourages some manufacturers from adopting gas-based systems. Ensuring stable fuel access and cost management remains a key challenge for market expansion.

Regional Analysis

North America

North America holds a 31% share in the Gas Water Tube Industrial Boiler Market in 2024. The region benefits from strong demand across the food processing, chemical, and pulp and paper industries. High energy efficiency standards and decarbonization goals are driving the replacement of outdated boiler systems. Major investments in refinery expansions and sustainable energy projects further support market growth. The U.S. leads the region due to rapid adoption of low-NOx and high-efficiency boilers. Technological innovations, government incentives, and strict emission norms continue to enhance product demand, creating favorable conditions for both new installations and retrofits.

Europe

Europe accounts for 29% of the global market share, supported by strict environmental regulations and carbon reduction policies. The region’s industrial sectors, including chemicals, refineries, and metal processing, are increasingly adopting energy-efficient water tube boilers. Countries such as Germany, France, and the UK drive demand through modernization of industrial heating systems. The EU’s emphasis on green energy transitions is pushing industries to replace traditional steam boilers with gas-fired alternatives. Integration of digital monitoring technologies enhances operational control and reliability. These factors collectively strengthen the adoption of advanced boiler systems across European industries.

Asia Pacific

Asia Pacific dominates the Gas Water Tube Industrial Boiler Market with a 34% share in 2024. Rapid industrialization, urbanization, and infrastructure growth drive high demand across China, India, and Southeast Asia. Expanding manufacturing and processing facilities in the food, chemical, and refinery sectors fuel strong market growth. Government initiatives promoting cleaner fuels and energy-efficient technologies further accelerate adoption. Local manufacturers focus on cost-efficient production and innovative heat recovery solutions. Rising investments in large-scale industrial plants and power facilities make Asia Pacific the key growth engine for the market during the forecast period.

Latin America

Latin America holds a 4% market share, supported by growing energy demand and industrial expansions. Brazil and Mexico are major contributors, driven by pulp and paper, food processing, and refinery operations. Modernization of old thermal systems to meet emission standards creates steady replacement demand. Economic reforms and infrastructure investments enhance industrial output, boosting boiler installations. Although adoption remains lower than in mature markets, increasing focus on energy-efficient and gas-fired solutions is improving regional competitiveness. Local and international players are also investing in service networks to strengthen after-sales support and operational reliability.

Middle East & Africa

The Middle East & Africa region captures a 2% share of the Gas Water Tube Industrial Boiler Market. The demand is led by oil and gas, petrochemical, and power generation industries. Countries like Saudi Arabia, the UAE, and South Africa are investing in modernizing their industrial infrastructure. Gas-fired boilers are preferred due to fuel availability and lower emissions compared to coal-fired alternatives. Industrial diversification and refinery expansions further drive installations. However, slower adoption in smaller economies limits overall market size. International manufacturers are expanding their footprint through partnerships and localized service offerings to boost regional growth.

Market Segmentations:

By Capacity:

- 10 – 25 MMBtu/hr

- 25 – 50 MMBtu/hr

By Application:

- Food processing

- Pulp & paper

By Technology:

- Condensing

- Non-condensing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gas Water Tube Industrial Boiler Market is shaped by key players including Indeck Power Equipment Company, Hoval, Clayton Industries, Hurst Boiler & Welding Co, Inc., Babcock Wanson, Fulton, Kawasaki Thermal Engineering Co., Ltd., FERROLI S.p.A, Cleaver-Brooks, and Babcock & Wilcox Enterprises, Inc. The Gas Water Tube Industrial Boiler Market is defined by strong technological advancement, strategic expansions, and service-focused offerings. Manufacturers are investing heavily in high-efficiency and low-emission boiler systems to meet global sustainability standards. Many companies are enhancing product performance through smart control systems, modular configurations, and waste heat recovery solutions. Expansion into high-growth regions like Asia Pacific strengthens their global footprint, while partnerships with energy-intensive industries improve operational reach. Service excellence through maintenance contracts, digital monitoring, and rapid delivery models provides a competitive edge. This combination of innovation and strategic positioning drives intense market competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Indeck Power Equipment Company

- Hoval

- Clayton Industries

- Hurst Boiler & Welding Co, Inc.

- Babcock Wanson

- Fulton

- Kawasaki Thermal Engineering Co., Ltd.

- FERROLI S.p.A

- Cleaver-Brooks

- Babcock & Wilcox Enterprises, Inc.

Recent Developments

- In April 2025, Essency, the prominent manufacturer of the award-winning Essency EXR water heater, announced a partnership with The Blumenauer Corporation as its new manufacturer’s representative for the state of Florida.

- In February 2025, Cleaver-Brooks launch Boiler Room, a digital platform that simplifies boiler room operations by offering centralized access to critical tools and information. The platform provides features such as equipment documentation, parts tracking, and user training resources in one place.

- In May 2024, Nationwide Boiler Inc. was named Hurst Boiler exclusive representative in California and Greater Houston. This collaboration expands access to Hurst’s boiler systems and engineered solutions across major industrial sectors and enhances service reach by combining Hurst’s product range with Nationwide regional expertise.

- In January 2024, AO Smith launched the Adapt Premium Condensing Gas Tankless Water Heaters equipped with X3 Scale Prevention Technology. They key features include an integrated recirculation pump, patented heat exchanger, enhanced installation flexibility and highly efficient performance.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth due to rising industrial energy demand.

- Advanced digital monitoring will improve efficiency and reduce downtime.

- Strict emission norms will drive the adoption of low-NOx boiler systems.

- Modular and compact designs will support flexible industrial applications.

- Energy-efficient solutions will gain preference across all end-use industries.

- Asia Pacific will remain the key growth region for new installations.

- Refineries and chemical industries will lead demand expansion globally.

- Manufacturers will increase investments in R&D for cleaner technologies.

- Service-based business models will strengthen customer retention.

- Global decarbonization efforts will accelerate the shift toward gas-fired systems.