Market Overview

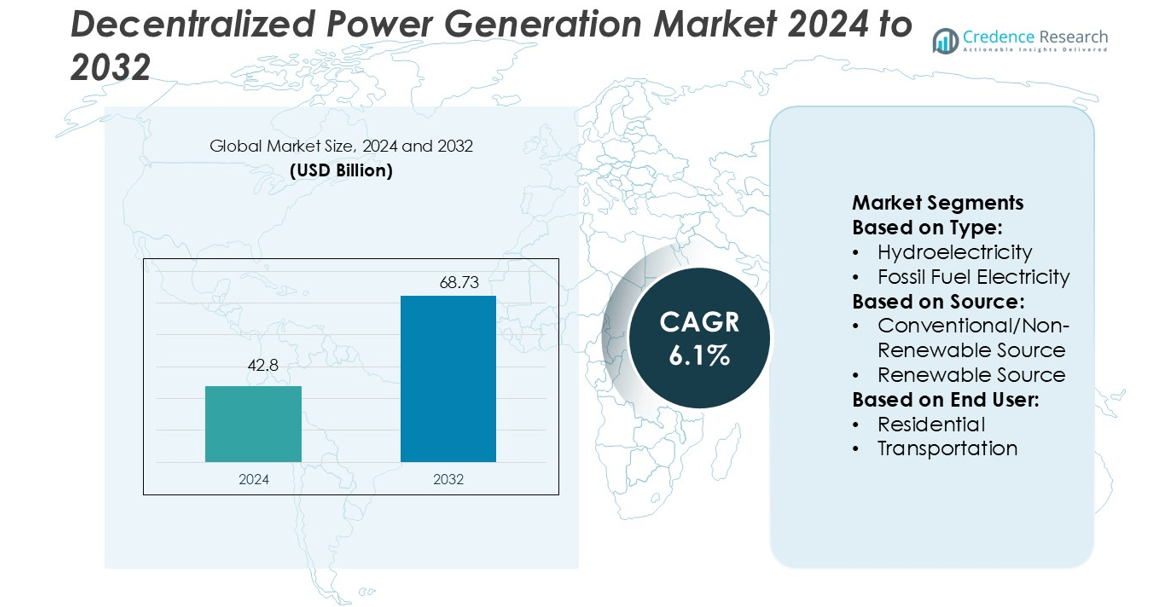

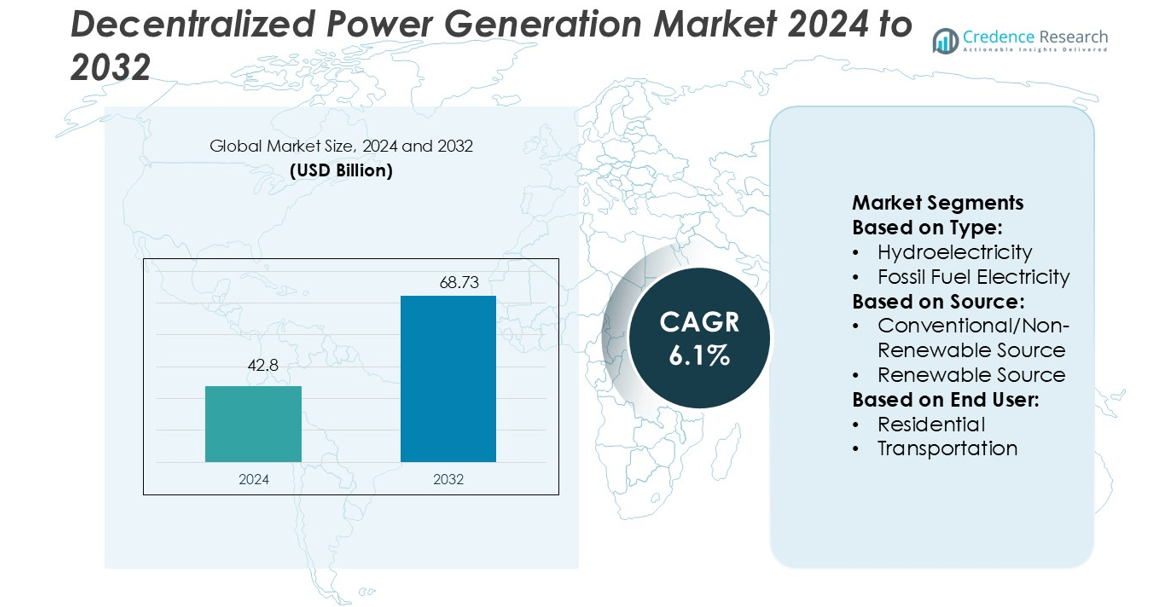

Decentralized Power Generation Market size was valued USD 42.8 billion in 2024 and is anticipated to reach USD 68.73 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decentralized Power Generation Market Size 2024 |

USD 42.8 billion |

| Decentralized Power Generation Market, CAGR |

6.1% |

| Decentralized Power Generation Market Size 2032 |

USD 68.73 billion |

The decentralized power generation market is driven by major players including S&C Electric Company, Seeo, Inc., SMA Solar Technology AG, Greensmith Energy Management Systems, ABB Ltd., Schneider Electric, Beacon Power, LLC, Convergent Energy and Power Inc., Eos Energy Storage, and BYD Company Ltd. These companies lead in solar integration, advanced inverters, battery storage, and smart grid technologies. Their strategic investments in hybrid systems and digital platforms strengthen operational efficiency and market reach. Asia Pacific dominates the market with a 33.8% share, supported by large-scale renewable deployments, rapid urbanization, and strong government incentives. Continuous innovation and expanding project portfolios from these key players further accelerate the transition toward sustainable and decentralized energy infrastructure globally.

Market Insights

- The decentralized power generation market size was valued at USD 42.8 billion in 2024 and is projected to reach USD 68.73 billion by 2032, growing at a CAGR of 6.1%.

- Rising renewable adoption, energy security needs, and government incentives are driving strong demand across industrial, commercial, and residential sectors.

- Asia Pacific leads the market with a 33.8% share, supported by rapid urbanization, large-scale renewable deployments, and favorable policies, followed by North America and Europe.

- Solar electricity holds the largest segment share, driven by falling equipment costs, flexible installation options, and expanding hybrid projects.

- Strong competition among key players focuses on advanced inverters, battery storage, and digital grid solutions, while high initial capital costs and regulatory hurdles remain key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Solar electricity dominates the decentralized power generation market with a 33.5% share in 2024. Strong adoption is driven by falling photovoltaic costs, quick installation, and low operational expenses. Solar systems enable off-grid power generation and reduce dependency on centralized grids. Government incentives and net metering schemes boost adoption across rural and urban areas. Wind electricity holds the second-largest share, supported by large-scale onshore deployments. Hydroelectricity and biomass electricity also show steady growth due to stable generation capacity and sustainable energy policies.

- For instance, SMA’s Sunny Central FLEX inverter was awarded “PV Magazine Top Innovation 2024” for achieving rated power over 1,500 kW in a compact footprint. SMA’s inverters installed through the past 20 years reach a cumulative output of 132 GW, preventing over 70 million tons CO₂ emissions.

By Source

Renewable sources lead the decentralized power generation market with a 67.4% share in 2024. This growth is supported by global clean energy targets, feed-in tariffs, and rising energy security concerns. Solar, wind, and hydro power form the core of decentralized renewable generation. Declining equipment costs and improved storage solutions strengthen grid independence. Conventional sources, including fossil fuel-based generation, maintain relevance in remote and industrial sites due to reliability during peak loads. However, regulatory pressure and carbon reduction goals are shifting investments toward renewable options.

- For instance, Greensmith’s GEMS software has been integrated into numerous energy storage systems globally. The software, capable of processing over 100,000 data points per second, optimizes a wide array of energy assets, including renewables, storage, thermal generation, and grid loads, in real time.

By End-User

The industrial segment holds the dominant share of 45.2% in the decentralized power generation market in 2024. Industries adopt distributed systems to ensure uninterrupted power, reduce costs, and meet sustainability goals. Manufacturing, mining, and heavy industries rely on solar hybrid and cogeneration plants for energy resilience. The commercial segment follows, driven by office complexes and retail hubs using rooftop solar. Residential demand is growing due to smart inverters, home storage, and lower system prices. Transportation is emerging as a niche segment, supported by electric vehicle charging infrastructure.

Key Growth Drivers

Rising Demand for Energy Security

Decentralized power generation ensures stable and reliable energy supply during grid disruptions. Industries and communities are adopting distributed systems to reduce dependence on centralized infrastructure. The growing frequency of power outages and rising energy demand make decentralized generation attractive. Governments support these systems through subsidies and favorable regulations. Microgrids and hybrid power plants further enhance resilience and flexibility. This increased focus on energy security drives investment in decentralized solar, wind, and biomass projects, strengthening the market’s long-term growth potential.

- For instance, Schneider’s EcoStruxure Microgrid Flex is a standardized, modular microgrid system that uses configurable BESS modules with a power capacity from 60 kW to 2 MW, and is offered in standard 2-hour and 4-hour duration options.

Technological Advancements in Renewable Energy

Advances in solar PV, wind turbines, and energy storage improve the efficiency of decentralized systems. Modern inverters, smart grids, and battery technologies enable stable power supply and easy grid integration. Falling renewable equipment costs make decentralized generation more affordable for commercial and residential users. Digital monitoring and automation solutions enhance performance and lower maintenance costs. These innovations attract large-scale deployments in rural, remote, and industrial areas. As technology continues to evolve, it accelerates the global shift toward cleaner and distributed energy sources.

- For instance, Beacon Power’s flywheel energy storage systems feature rotors that spin at speeds of up to 16,000 rpm within a sealed vacuum chamber to minimize air resistance.

Government Policies and Financial Incentives

Strong policy support plays a key role in expanding decentralized generation capacity. Governments offer feed-in tariffs, net metering, tax benefits, and renewable energy targets to attract investment. Subsidies reduce installation costs, making renewable projects financially viable for households and businesses. Regulatory reforms encourage private participation in energy infrastructure. International climate commitments further accelerate policy adoption. These initiatives create a favorable ecosystem for small-scale renewable generation, supporting market expansion across both developed and emerging economies.

Key Trends & Opportunities

Integration of Energy Storage Solutions

Energy storage systems are becoming integral to decentralized generation projects. Advanced lithium-ion and flow batteries enable better load balancing and grid stability. Coupling solar and wind installations with storage ensures uninterrupted power supply during demand peaks. This integration improves operational efficiency and makes decentralized systems more attractive for industrial and residential applications. The rise in affordable storage technologies creates new investment opportunities. Governments and private firms are increasingly prioritizing hybrid renewable-plus-storage projects to enhance system reliability.

- For instance, Convergent’s Potomac Edison deployment comprises a 1.75 MW / 8.4 MWh battery energy storage system, capable of delivering backup power for up to five hours.

Growth of Microgrids and Hybrid Systems

Microgrids and hybrid energy systems are gaining strong market traction. These systems combine multiple renewable sources, storage, and smart controls to ensure flexible, local energy generation. Industries, campuses, and remote communities deploy microgrids to reduce costs and achieve energy independence. Improved control technologies enable seamless switching between grid and off-grid modes. The scalability and modular design of microgrids offer strong opportunities for rural electrification. Their growing adoption supports the transition to decentralized and sustainable energy networks worldwide.

- For instance, Eos will supply a 3 MW / 15 MWh zinc-based battery system to the Paskenta Band tribal microgrid. The project, currently in the design stage, is set to integrate the Eos battery with 3.5 MW of solar, a 1 MW fuel cell, and 6 MW of diesel backup.

Decentralization Through Digital Platforms

Digital platforms and IoT technologies are transforming decentralized energy management. Smart meters, remote monitoring, and predictive analytics enhance energy flow control and system optimization. Cloud-based software enables real-time coordination between multiple generation units. These digital tools improve transparency and operational efficiency, lowering overall costs. This trend supports peer-to-peer energy trading models and virtual power plants. Expanding digital infrastructure creates new revenue streams for utilities, startups, and end-users in the distributed energy ecosystem.

Key Challenges

High Initial Capital Costs

Decentralized power generation projects often face high upfront investment requirements. Solar panels, wind turbines, batteries, and smart grid infrastructure demand significant capital. While operational costs are lower in the long run, initial expenditures can deter small businesses and residential users. Financing gaps and lack of accessible credit add to the problem. Although subsidies and incentives help, the high capital barrier remains a major challenge for mass adoption. Innovative financing models and public-private partnerships are crucial to address this issue.

Regulatory and Grid Integration Barriers

Inconsistent policies and complex grid interconnection rules slow market expansion. Many regions lack clear frameworks for distributed generation integration. Utilities often face difficulties in standardizing connection procedures for small-scale producers. Limited grid flexibility further complicates the process. These regulatory gaps delay project approvals and discourage investors. Harmonized standards, streamlined permitting, and supportive grid modernization policies are necessary to overcome these barriers and ensure smooth integration of decentralized systems into existing power infrastructure.

Regional Analysis

North America

North America holds a 29.4% share in the decentralized power generation market in 2024. The U.S. leads with strong investments in solar, wind, and microgrid projects. Policy incentives, tax credits, and net metering schemes encourage widespread adoption across commercial and residential sectors. Canada focuses on renewable integration to support rural and off-grid communities. Technological innovation and advanced grid infrastructure enhance system efficiency and reliability. Industrial users drive demand to improve energy resilience and reduce operational costs. Growing investment in hybrid renewable and storage projects strengthens the region’s leadership in distributed energy solutions.

Europe

Europe accounts for 27.6% of the global decentralized power generation market in 2024. Germany, the UK, and France lead in integrating distributed renewable energy systems. Strong environmental regulations and ambitious carbon neutrality targets accelerate market growth. The region emphasizes decentralized wind and solar installations supported by smart grids and energy storage. Feed-in tariffs and renewable auction programs attract private investments. Industrial and commercial sectors adopt microgrids to reduce dependence on centralized grids. Europe’s advanced regulatory framework and focus on sustainability position it as a key driver of the global decentralized energy transition.

Asia Pacific

Asia Pacific dominates the global decentralized power generation market with a 33.8% share in 2024. China, India, and Japan invest heavily in solar, wind, and hybrid renewable systems. Rapid urbanization, rising power demand, and grid stability needs drive strong adoption. Government subsidies and rural electrification programs boost off-grid solutions in developing countries. Industrial zones rely on decentralized systems to manage peak loads and lower energy costs. Technological advancements and declining equipment prices make deployment more affordable. Asia Pacific’s large population base and expanding renewable infrastructure solidify its market leadership position.

Latin America

Latin America holds a 5.8% share of the decentralized power generation market in 2024. Brazil, Mexico, and Chile lead regional growth with rising renewable investments. Decentralized solar and biomass projects play a key role in electrifying remote communities. Supportive government programs and public-private partnerships drive adoption. The commercial and residential sectors embrace rooftop solar systems to reduce energy costs and improve reliability. While infrastructure development is slower than in other regions, ongoing grid modernization efforts strengthen future growth potential. Latin America presents attractive opportunities for distributed energy expansion over the forecast period.

Middle East & Africa

The Middle East & Africa region accounts for 3.4% of the global decentralized power generation market in 2024. The UAE, Saudi Arabia, and South Africa drive regional activity with solar and hybrid microgrid projects. Energy diversification strategies reduce dependence on fossil fuels and strengthen grid reliability. High solar irradiation and government-led renewable programs make distributed generation cost-effective. Industrial and rural electrification initiatives support market expansion. Although infrastructure challenges remain in several African countries, increasing investment and policy reforms are improving deployment rates. The region is expected to record steady growth over the coming years.

Market Segmentations:

By Type:

- Hydroelectricity

- Fossil Fuel Electricity

By Source:

- Conventional/Non-Renewable Source

- Renewable Source

By End User:

- Residential

- Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The decentralized power generation market is shaped by key players such as S&C Electric Company, Seeo, Inc., SMA Solar Technology AG, Greensmith Energy Management Systems, ABB Ltd., Schneider Electric, Beacon Power, LLC, Convergent Energy and Power Inc., Eos Energy Storage, and BYD Company Ltd. The decentralized power generation market is becoming increasingly competitive, driven by rapid innovation and strong investment in renewable technologies. Companies are focusing on integrating solar, wind, and hybrid systems with advanced energy storage and smart grid infrastructure. Digital platforms, real-time monitoring tools, and predictive analytics enhance operational efficiency and system reliability. Strategic collaborations between energy developers, technology providers, and utilities are accelerating the deployment of distributed systems. Growing emphasis on flexible generation, grid resilience, and sustainable energy transitions further intensifies competition. This dynamic landscape encourages continuous technological advancement and wider adoption of decentralized power solutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- S&C Electric Company

- Seeo, Inc.

- SMA Solar Technology AG

- Greensmith Energy Management Systems

- ABB Ltd.

- Schneider Electric

- Beacon Power, LLC

- Convergent Energy and Power Inc.

- Eos Energy Storage

- BYD Company Ltd.

Recent Developments

- In May 2025, CATL announced the rollout of the world’s first 9MWh ultra-large capacity TENER Stack Energy Storage System Solution, which aims to revolutionize the energy storage landscape.

- In December 2024, SSE and Siemens Energy have announced a partnership “Mission H2 Power,” aimed at advancing gas turbine technology to operate on 100% hydrogen. This initiative supports the decarbonization of SSE’s Keadby 2 Power Station, which currently utilizes natural gas.

- In March 2024, Korea Western Power Co. (KOWEPO) and EDF Renewables entered a joint development agreement for a 1.5 GW solar farm in Khazna, United Arab Emirates (UAE). They are also in advanced talks with Abu Dhabi’s Emirates Water and Electricity Co. (EWEC) for a similar project in the Al-Ajban area.

- In January 2024, GE Vernova and IHI Corporation have initiated the next phase of their collaboration to develop a gas turbine combustion system capable of burning 100% ammonia, potentially transforming natural gas fired electricity generation

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with growing renewable energy integration.

- Energy storage adoption will enhance grid flexibility and reliability.

- Microgrid and hybrid system deployments will increase across industrial zones.

- Digital platforms will improve real-time monitoring and control efficiency.

- Rural electrification projects will drive growth in developing economies.

- Policy support and incentives will continue to attract private investment.

- Declining equipment costs will make decentralized systems more accessible.

- Smart grid upgrades will accelerate distributed generation integration.

- Corporate sustainability goals will boost renewable energy adoption.

- Global energy transitions will strengthen long-term market opportunities.