Market Overview

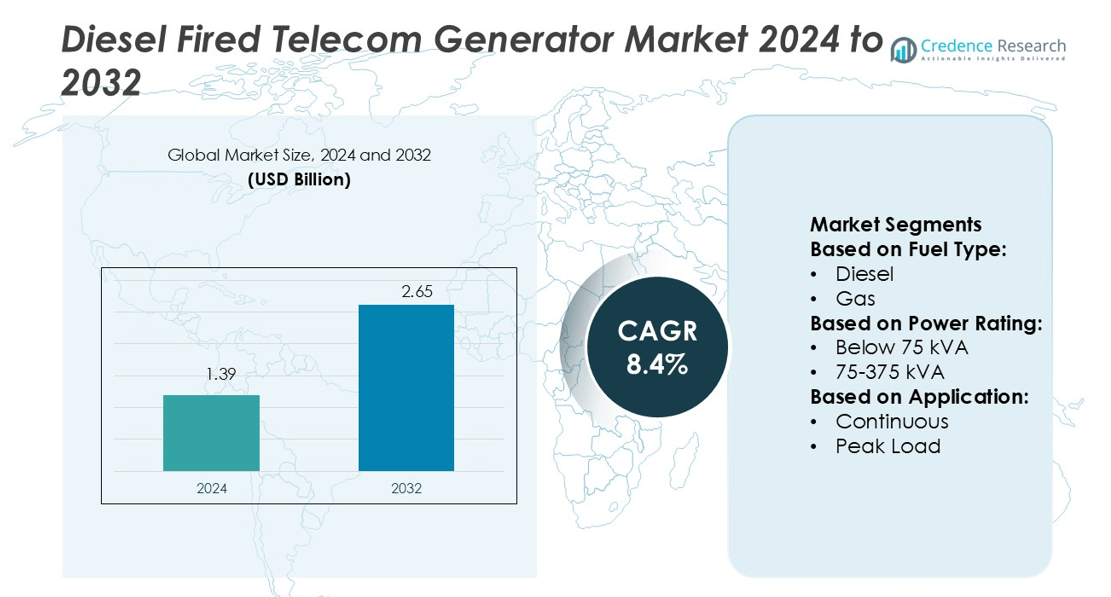

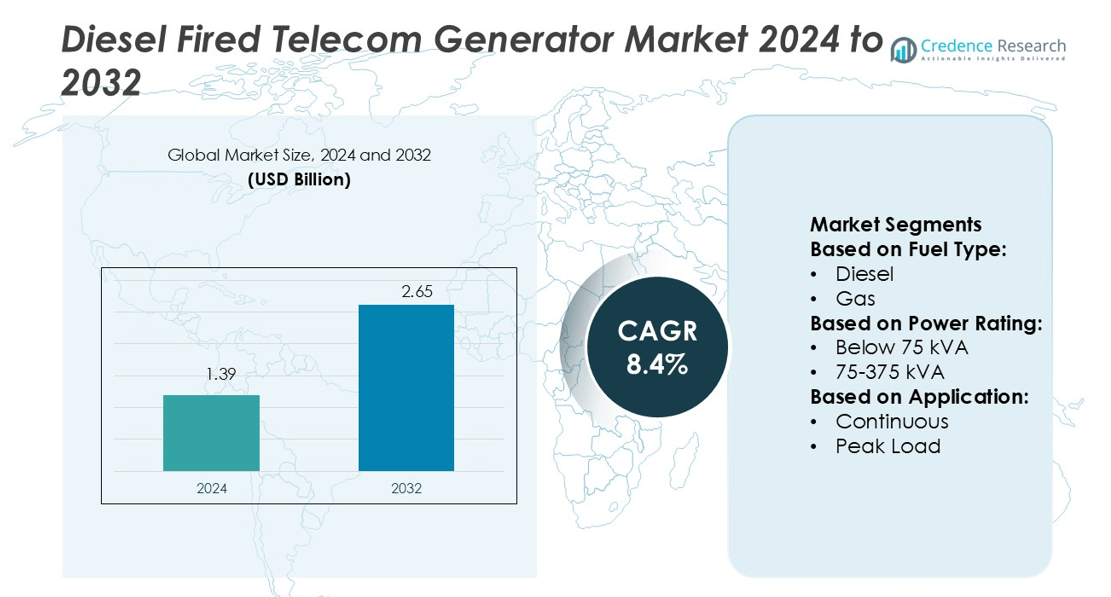

Diesel Fired Telecom Generator Market size was valued USD 1.39 billion in 2024 and is anticipated to reach USD 2.65 billion by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Fired Telecom Generator Market Size 2024 |

USD 1.39 billion |

| Diesel Fired Telecom Generator Market, CAGR |

8.4% |

| Diesel Fired Telecom Generator Market Size 2032 |

USD 2.65 billion |

The Diesel Fired Telecom Generator Market is shaped by major players such as FG Wilson, Kirloskar Electric, Atlas Copco, Generac Power Systems, Aggreko, Caterpillar, HIMOINSA, Cummins, AGG POWER TECHNOLOGY, and Deere & Company. These companies lead through strong product portfolios, advanced emission control technologies, and reliable service networks. Their focus on fuel-efficient, durable, and IoT-enabled generator systems strengthens their position in both developed and emerging markets. Asia Pacific holds the leading regional share at 34.7% in 2025, driven by large-scale telecom infrastructure expansion, weak grid reliability in rural areas, and growing 4G and 5G deployments.

Market Insights

- The Diesel Fired Telecom Generator Market was valued at USD 1.39 billion in 2024 and is expected to reach USD 2.65 billion by 2032, growing at a CAGR of 8.4%.

- Rising telecom network expansion and increasing demand for reliable backup power solutions are driving strong market growth.

- Integration of hybrid power systems and IoT-enabled monitoring solutions is emerging as a key market trend.

- Asia Pacific leads the market with a 34.7% share, supported by rural network expansion and 5G deployments, while North America holds 27.6% and Europe 24.1%.

- The diesel fuel type segment dominates with a 71.2% share, driven by high efficiency and durability, while the 75–375 kVA power rating segment leads with 48.5% share, reflecting strong demand for medium-capacity generators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fuel Type

The diesel segment holds the dominant share of the Diesel Fired Telecom Generator Market, accounting for 71.2% in 2025. Diesel generators offer high fuel efficiency, durability, and stable power supply, making them ideal for remote telecom towers. Their fast response time and ease of maintenance drive strong adoption across developing and developed markets. Gas and other fuel types are gaining traction, but their limited infrastructure restricts large-scale deployment. Regulatory support for cleaner diesel technologies further strengthens this segment’s position in the telecom power ecosystem.

- For instance, FG Wilson offers a broad diesel generator portfolio ranging from 6.8 kVA to 2,500 kVA, covering both standby and prime power applications for telecom operators. Many models feature Perkins-powered engines and advanced Deep Sea Electronics (DSE) control panels, enabling remote monitoring and rapid fault detection.

By Power Rating

The 75–375 kVA segment dominates the market with a 48.5% share in 2025. This power range effectively supports medium to large telecom tower loads, ensuring uninterrupted operation during grid outages. Telecom operators prefer this segment due to its balance of power capacity and operational efficiency. Modern diesel generators in this range integrate advanced load management and remote monitoring features, enhancing reliability. Increased deployment of 4G and 5G base stations in rural and semi-urban zones continues to drive demand for this rating segment.

- For instance, QAS 625 T4F model uses a Volvo Tier-4 Final 6-cylinder diesel engine, and supports paralleling of up to 32 units, enabling aggregated output up to 20 MVA for large telecom or utility sites.

By Application

The standby segment leads the market with a 52.7% share in 2025. Diesel standby generators are essential for ensuring uninterrupted network availability during power failures. Their quick start-up time, long service life, and lower operating cost make them a preferred choice for telecom operators. Peak load and continuous segments serve niche applications, but the majority of telecom infrastructure relies on standby power to maintain uptime. Growing investments in network modernization and rural connectivity projects further support strong demand in this segment.

Key Growth Drivers

Rising Telecom Network Expansion

The rapid expansion of telecom networks is a major growth driver for the Diesel Fired Telecom Generator Market. The increasing number of 4G and 5G base stations demands reliable backup power to ensure uninterrupted service. Rural and remote areas often lack stable grid connectivity, making diesel generators the primary power source. Their fast response time, low maintenance, and proven durability support critical telecom infrastructure. Investments in network modernization by operators and governments further accelerate diesel generator installations across emerging and developed markets.

- For instance, Generac Industrial Power offers stationary diesel units such as the SD100, delivering 100 kW (125 kVA) standby power from a 6.7-litre engine. SD750 series, the engine is sized at 18.1 L, producing up to 750 kW standby output, with factory tests covering internal vibration isolation and circuit separation features.

Growing Demand for Reliable Backup Power

Telecom operators are prioritizing network uptime, driving the demand for reliable backup solutions. Diesel generators offer consistent power during outages, ensuring minimal service disruption. Their compatibility with remote monitoring and load management systems enhances operational efficiency. Increasing data traffic, fueled by rising smartphone use, pushes operators to strengthen power reliability. In regions prone to grid instability or harsh weather, diesel generators remain the preferred choice. This growing reliance on dependable backup power is boosting the adoption of diesel generator systems.

- For instance, Aggreko launched a 400 kW Tier 4 Final diesel generator, trailer-mounted on a dual-axle system, leveraging EPA Tier 4 Final compliance and integrated remote monitoring into its “Greener Upgrades” line.

Advancements in Fuel-Efficient Technologies

Technological innovations in diesel engine design and power management are improving generator efficiency and lowering emissions. Modern diesel generators consume less fuel, produce fewer emissions, and operate at higher efficiency levels. Features such as auto-start, hybrid power integration, and smart monitoring make these systems more attractive to telecom operators. These advancements also help meet regulatory standards on emissions, supporting long-term use. Enhanced fuel efficiency reduces operational costs, strengthening the economic viability of diesel generator installations for telecom operators globally.

Key Trends & Opportunities

Integration of Hybrid Power Systems

The integration of diesel generators with renewable energy sources is emerging as a key trend. Hybrid systems combine diesel with solar or battery storage, optimizing fuel use and cutting emissions. Telecom operators are adopting these solutions to lower operational costs and comply with sustainability goals. Hybrid power systems also extend generator life by reducing runtime. This trend presents strong opportunities for manufacturers to offer advanced, integrated energy solutions tailored to telecom infrastructure in off-grid and weak-grid locations.

- For instance, Caterpillar offers the Cat® ETS (Energy Time Shift) module, designed for telecom DC loads, which provides 24 kW DC output and supports up to 150 kWh of storage in an IP55 outdoor enclosure.

Remote Monitoring and IoT Adoption

The use of IoT-enabled monitoring systems is transforming the management of telecom power infrastructure. Smart diesel generators equipped with sensors allow real-time performance tracking, predictive maintenance, and fault detection. This technology improves operational efficiency and reduces downtime. Telecom operators can remotely monitor multiple sites, lowering maintenance costs and improving response times. As networks scale in size and complexity, IoT-based power management is becoming an attractive opportunity for both equipment suppliers and service providers.

- For instance, HIMOINSA’s CE8 family of controllers (CEM8, CEA8, CEC8) enables real-time remote access, programming, and diagnostics across its generator lines. HIMOINSA’s NEURON cloud-based platform, supporting communication via USB, CAN, Modbus TCP/IP, Modbus RS-485, SNMP, and modem links.

Growing Deployment in Emerging Markets

Emerging economies in Asia Pacific, Africa, and Latin America are witnessing a surge in telecom infrastructure development. Rural electrification gaps create opportunities for diesel generator deployment to support tower operations. Expanding mobile user bases and government-backed connectivity initiatives drive demand further. The lack of stable power grids positions diesel generators as a cost-effective and reliable energy solution. These markets present significant growth opportunities for manufacturers and suppliers offering fuel-efficient, low-maintenance diesel generator systems.

Key Challenges

Rising Environmental Regulations

Stringent environmental regulations on diesel emissions pose a major challenge to the market. Governments are enforcing strict standards to reduce carbon and particulate emissions from diesel engines. This forces manufacturers to invest in advanced emission control technologies, increasing costs. Telecom operators may face compliance challenges, especially in markets with limited infrastructure for cleaner fuels. These regulations are pushing the industry toward alternative power solutions, potentially slowing traditional diesel generator demand in some regions.

High Fuel and Maintenance Costs

The high operational costs associated with diesel fuel and maintenance remain a barrier to wider adoption. Fluctuating fuel prices directly impact telecom operators’ operating budgets, especially for sites in remote locations. Regular servicing is required to ensure reliable performance, adding to total costs. These factors can make diesel generators less competitive compared to hybrid or renewable alternatives. Cost pressures are driving telecom operators to seek more fuel-efficient models or explore alternative power sources to optimize long-term expenditure.

Regional Analysis

North America

North America holds a 27.6% share of the Diesel Fired Telecom Generator Market in 2025. The region’s strong network infrastructure and increasing 5G rollout drive high demand for reliable backup power. The U.S. leads this market with extensive deployments in rural and suburban areas to ensure uninterrupted network availability. Frequent weather-related power outages further boost generator adoption. Advanced emission compliance and fuel-efficient technologies are widely implemented to meet environmental standards. The presence of established telecom operators and supportive energy policies strengthens the market position, ensuring steady long-term growth in this region.

Europe

Europe accounts for a 24.1% share of the Diesel Fired Telecom Generator Market in 2025. The region focuses on modernizing telecom networks with stringent emission regulations, encouraging the adoption of cleaner diesel technologies. Countries like Germany, France, and the UK lead deployments, supported by advanced infrastructure and growing 5G expansion. Backup power remains crucial for critical network operations in rural and industrial zones. Investment in hybrid systems that combine diesel with renewables is rising. The strong regulatory framework and ongoing network upgrades position Europe as a stable and mature market for diesel generator solutions.

Asia Pacific

Asia Pacific dominates the Diesel Fired Telecom Generator Market with a 34.7% share in 2025. The region’s rapid telecom expansion in countries like India, China, and Indonesia fuels strong demand for diesel generators, especially in rural and semi-urban areas with unstable grid supply. Growing mobile subscriber bases and 5G rollouts intensify backup power needs. Diesel generators offer cost-effective, reliable energy for tower operations. Governments and private operators are investing heavily in connectivity infrastructure. While sustainability initiatives are emerging, diesel remains the primary power source for many telecom installations in developing economies.

Latin America

Latin America captures a 4.7% share of the Diesel Fired Telecom Generator Market in 2025. Brazil and Mexico dominate regional demand, supported by ongoing 4G and 5G network deployments. Frequent grid instability and underdeveloped rural infrastructure increase reliance on diesel generators for backup power. Telecom operators favor these systems for their durability and low setup cost. Governments are encouraging connectivity expansion to underserved areas, further supporting adoption. While the market is smaller compared to other regions, its steady infrastructure investments and operational needs ensure consistent growth opportunities for diesel generator suppliers.

Middle East & Africa

The Middle East & Africa region holds an 8.9% share of the Diesel Fired Telecom Generator Market in 2025. Rural electrification gaps and challenging grid conditions make diesel generators vital for telecom tower operation. Countries like Saudi Arabia, UAE, Nigeria, and South Africa lead demand due to expanding telecom infrastructure. The region’s climate-related grid disruptions further emphasize the need for reliable backup systems. Rising investments in hybrid and off-grid power solutions are complementing diesel deployments. The combination of rapid network growth and limited grid reliability drives stable market opportunities in this region.

Market Segmentations:

By Fuel Type:

By Power Rating:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Diesel Fired Telecom Generator Market is shaped by key players including FG Wilson, Kirloskar Electric, Atlas Copco, Generac Power Systems, Aggreko, Caterpillar, HIMOINSA, Cummins, AGG POWER TECHNOLOGY, and Deere & Company. The Diesel Fired Telecom Generator Market is becoming increasingly competitive, driven by rapid technological innovation and shifting industry dynamics. Manufacturers are focusing on improving fuel efficiency, reducing emissions, and integrating smart monitoring systems to enhance reliability. Hybrid power solutions that combine diesel with renewable sources are gaining strong traction, especially in off-grid and rural telecom deployments. Companies are also expanding their service networks to offer faster maintenance and improved uptime for telecom operators. Regulatory compliance, operational cost optimization, and advanced automation remain key competitive factors. Continuous innovation and strategic collaborations with telecom infrastructure providers are shaping long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FG Wilson

- Kirloskar Electric

- Atlas Copco

- Generac Power Systems

- Aggreko

- Caterpillar

- HIMOINSA

- Cummins

- AGG POWER TECHNOLOGY

- Deere & Company

Recent Developments

- In January 2025, AGG strengthened its strategic partnership with Cummins through high-level discussions aimed at expanding their generator product lineup. Representatives from the Chongqing Cummins Engine Company Ltd. and Cummins Investment Company Ltd. shared detailed cooperation efforts to promote innovation as well as new market opportunities for AGG-Cummins generator series.

- In September 2024, Scania unveiled its advanced 13-litre DI13 marine engine, designed for both propulsion and auxiliary use. The new engine sets a high standard for performance and reliability, offering improved fuel efficiency and significant CO2 emission reductions.

- In April 2024, Wärtsilä inaugurated its newly positioned Excellence Center in India to render remote help to its clients in the energy and marine sectors from the Middle East and Asia. This Excellence Center will function as a core operational hub that consolidates all known data sources to improve service capabilities.

- In March 2024, Sudhir Power Limited and Cummins jointly completed a mega roadshow in India, featuring CPCB IV+ compliant gensets. The event brought out the unique aspects and functionality of Cummnis powered gensets ensuring firsthand experience on their efficiency and sustainability

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Power Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with ongoing 4G and 5G network expansions worldwide.

- Hybrid systems integrating diesel with renewable energy will gain wider adoption.

- IoT-enabled monitoring will enhance operational efficiency and reliability.

- Manufacturers will focus on lowering emissions to meet stricter regulations.

- Fuel-efficient and low-maintenance models will dominate procurement strategies.

- Emerging markets will remain key growth hubs due to weak grid infrastructure.

- Upgrades in telecom tower power systems will boost replacement demand.

- Strategic collaborations will expand distribution and service networks globally.

- Digital control systems will improve power management and performance.

- Sustainability goals will accelerate innovation in cleaner diesel technologies.