Market Overview

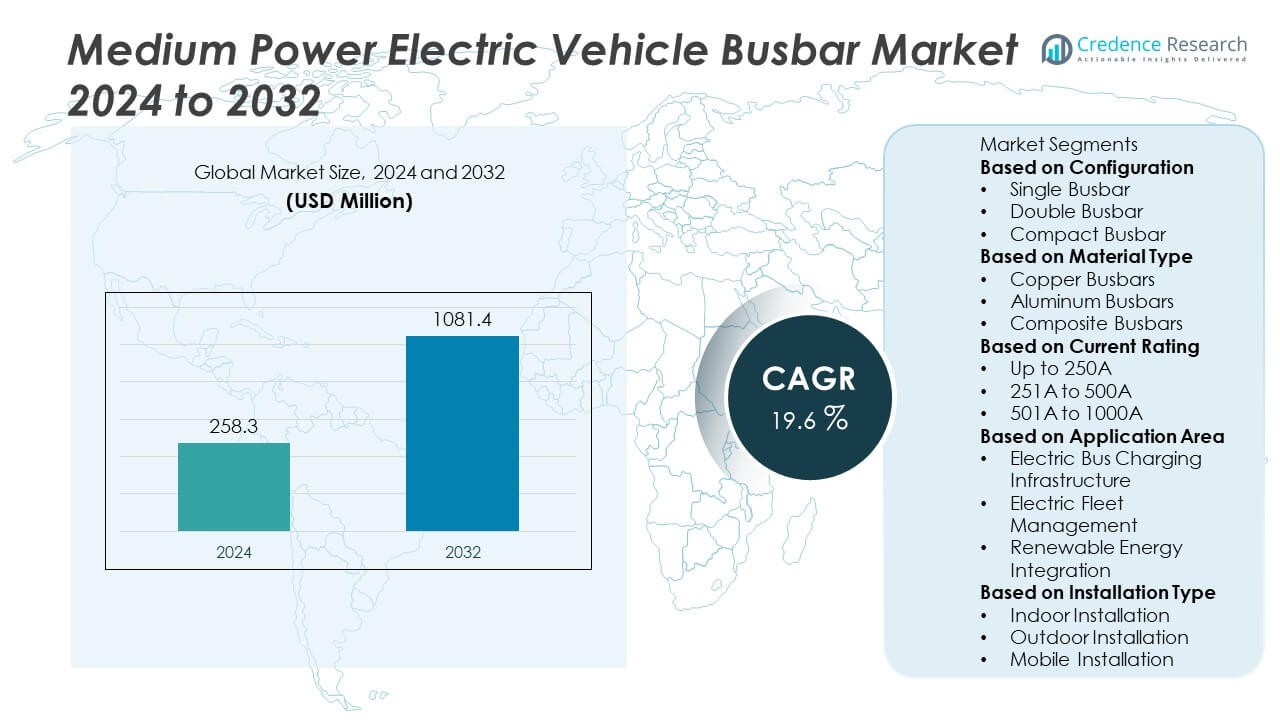

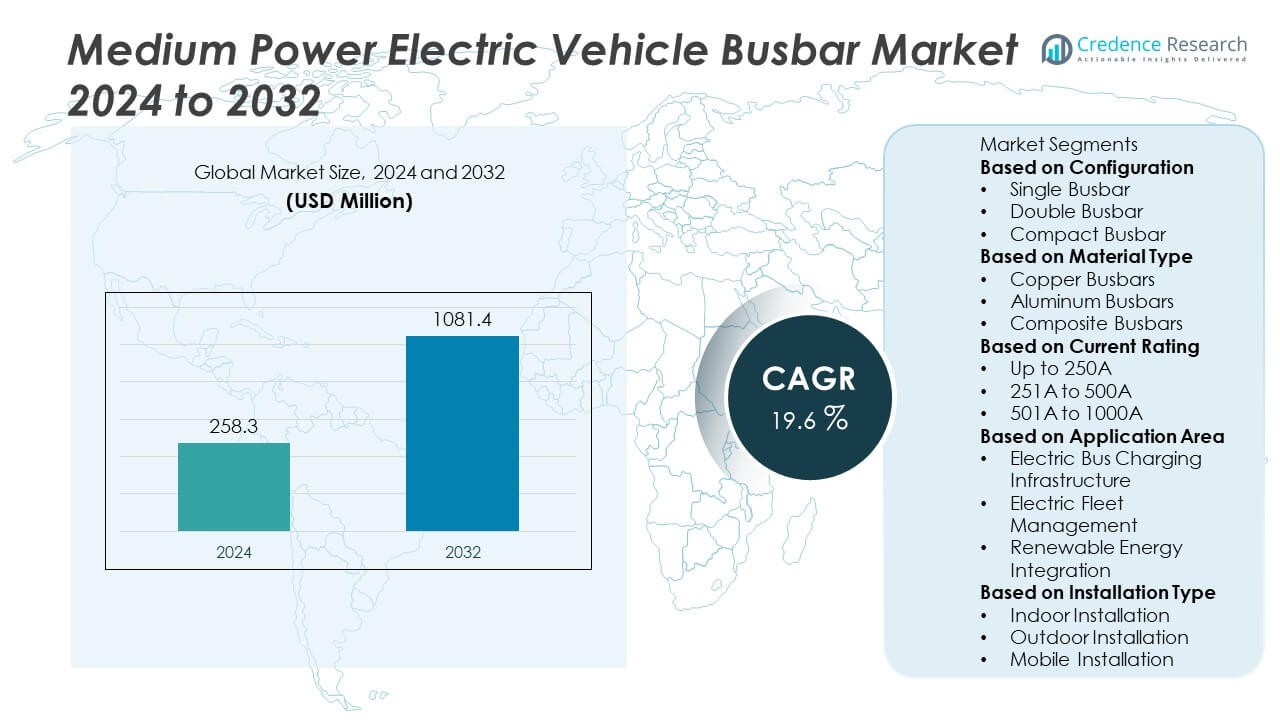

The Medium Power Electric Vehicle Busbar Market size was valued at USD 258.3 million in 2024 and is anticipated to reach USD 1,081.4 million by 2032, expanding at a CAGR of 19.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Power Electric Vehicle Busbar Market Size 2024 |

USD 258.3 Million |

| Medium Power Electric Vehicle Busbar Market, CAGR |

19.6% |

| Medium Power Electric Vehicle Busbar Market Size 2032 |

USD 1,081.4 Million |

The Medium Power Electric Vehicle Busbar Market grows on the back of rising adoption of electric buses and commercial EVs that require efficient current distribution and compact power management systems. Strong drivers include government-backed electrification programs, expansion of EV charging infrastructure, and the demand for lightweight, durable busbars that enhance performance and safety.

The Medium Power Electric Vehicle Busbar Market demonstrates strong geographical momentum across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each region shaped by its EV ecosystem. North America advances through government incentives and large-scale adoption of electric buses, supported by leading manufacturers and suppliers of advanced busbar systems. Europe emphasizes sustainability targets and strict emission norms, creating demand for lightweight and high-efficiency components in EV powertrains. Asia Pacific emerges as a high-growth hub due to rapid EV production in China, Japan, and South Korea, alongside strong government investments in charging infrastructure. Latin America and the Middle East & Africa show gradual growth with ongoing fleet electrification and renewable-driven mobility projects. Key players shaping the market include BYD, Volvo, Proterra, Mercedes Benz, and Zhengzhou Yutong Bus, each focusing on material innovation, modular design, and large-scale deployment to strengthen their competitive position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medium Power Electric Vehicle Busbar Market was valued at USD 258.3 million in 2024 and is projected to reach USD 1081.4 million by 2032, expanding at a CAGR of 19.6%.

- Rising adoption of electric buses and medium power commercial EVs drives strong demand for efficient busbar systems that ensure reliable power distribution and thermal management.

- Market trends highlight a shift toward lightweight aluminum busbars, modular configurations, and advanced insulation techniques to improve efficiency and safety in EV applications.

- Competitive dynamics show leading players such as BYD, Volvo, Proterra, Mercedes Benz, and Zhengzhou Yutong Bus focusing on material innovation, integration of high-current ratings, and scalable designs for diverse EV models.

- Market restraints include high raw material costs, challenges in thermal management at higher current loads, and integration complexities in customized EV architectures.

- Regional analysis shows North America and Europe advancing adoption through government-backed EV policies and fleet electrification programs, while Asia Pacific demonstrates rapid expansion through large-scale EV production and infrastructure development in China, Japan, and South Korea.

- Latin America and the Middle East & Africa record steady but slower adoption, with growth supported by renewable integration, urban electrification programs, and early-stage fleet modernization initiatives.

Market Drivers

Rising Adoption of Electric Vehicles Strengthens Demand

The growing transition toward electric mobility drives strong adoption of medium power busbars that ensure efficient current flow within vehicles. Automakers rely on busbars for compact, reliable, and safe power distribution across battery packs, inverters, and charging units. The Medium Power Electric Vehicle Busbar Market benefits from rising EV production volumes in North America, Europe, and Asia Pacific. It supports higher power density requirements while minimizing system weight. Governments encouraging EV adoption through subsidies and infrastructure programs further amplify demand. This driver secures a long-term foundation for busbar integration in both passenger and commercial electric vehicles.

- For instance, BYD integrated medium power laminated busbars rated at 800V and 600A in its K9 electric bus fleet, enabling a driving range of 400 kilometers per charge while ensuring efficient thermal management.

Need for Compact and Efficient Power Distribution Systems

The shift toward smaller, lightweight vehicle designs elevates the role of medium power busbars in optimizing space efficiency. Busbars replace bulky cabling systems with streamlined, compact solutions that reduce installation complexity and improve reliability. The Medium Power Electric Vehicle Busbar Market advances by meeting industry demand for systems that handle high current loads without overheating. It ensures reduced electrical losses and enhances overall system efficiency. OEMs focus on compact integration to lower manufacturing costs and improve vehicle performance. This trend makes busbars a preferred choice for efficient energy transfer in modern EV architectures.

- For instance, Proterra deployed aluminum-based modular busbars rated at 500A in its ZX5 electric bus platform, reducing system weight by 35 kilograms compared to traditional copper cabling and improving vehicle efficiency by 5%.

Growing Emphasis on Safety and Thermal Management

Safety remains a critical driver for the adoption of advanced busbar systems in electric vehicles. Medium power busbars enhance system stability by reducing the risk of short circuits, electrical faults, and overheating. The Medium Power Electric Vehicle Busbar Market expands as manufacturers adopt materials with high thermal conductivity and insulation properties. It enables reliable operation under varying load conditions, ensuring both passenger safety and equipment longevity. Growing adoption of advanced coating and encapsulation technologies further strengthens protection against environmental stress. The need for compliance with strict automotive safety standards reinforces the use of busbar systems.

Technological Advancements in Materials and Design Drive Growth

Continuous innovation in busbar materials and designs enhances their performance and adoption in EV platforms. Manufacturers introduce copper-aluminum hybrid busbars, laminated structures, and flexible designs to improve conductivity and reduce weight. The Medium Power Electric Vehicle Busbar Market gains momentum from developments that enable higher energy efficiency and compatibility with fast-charging systems. It creates opportunities for automakers to achieve longer driving ranges and lower energy losses. Integration of smart monitoring features in busbars further boosts operational reliability. These advancements solidify busbars as critical components in next-generation electric vehicles.

Market Trends

Integration of Lightweight and Hybrid Materials Shapes Product Design

Manufacturers focus on reducing the overall weight of busbar systems to enhance EV efficiency and driving range. Copper-aluminum hybrid busbars gain attention for combining high conductivity with cost and weight advantages. The Medium Power Electric Vehicle Busbar Market advances as OEMs adopt laminated and composite structures that maintain durability while lowering system mass. It strengthens vehicle performance and aligns with industry requirements for lightweight designs. Rising focus on recycling-friendly materials also drives adoption of environmentally sustainable busbar solutions. This trend continues to shape design priorities across global markets.

- For instance, Volvo integrated hybrid copper-aluminum laminated busbars rated at 750V and 500A in its 7900 Electric bus, achieving a 20-kilogram reduction in system weight, which extended the driving range by 12 kilometers per charge.

Growing Alignment with Fast-Charging Infrastructure Requirements

The global expansion of EV charging networks raises demand for busbars capable of handling higher currents without compromising safety. Medium power busbars support efficient energy transfer required by rapid charging systems in both residential and commercial applications. The Medium Power Electric Vehicle Busbar Market evolves as designs improve thermal management to meet fast-charging standards. It enables vehicles to recharge quicker, addressing consumer expectations for convenience and efficiency. Automakers increasingly integrate busbars optimized for next-generation charging stations. This trend reinforces the critical role of busbars in future-ready EV platforms.

- For instance, Mercedes-Benz deployed laminated copper busbars rated at 850V and 600A in its eCitaro electric bus to support compatibility with 300 kW fast-charging stations, enabling 80% battery recharge in under 90 minutes.

Adoption of Modular and Customizable Busbar Architectures

OEMs and suppliers prioritize modular busbar designs that offer flexibility across diverse EV models. Standardized yet customizable architectures reduce production complexity and enable cost savings in large-scale manufacturing. The Medium Power Electric Vehicle Busbar Market benefits from demand for scalable systems that adapt to different battery capacities and vehicle types. It allows automakers to optimize layouts while maintaining high efficiency and safety. The trend of modularity supports streamlined supply chains and faster integration into new EV platforms. This flexibility enhances the strategic value of busbar systems in global EV manufacturing.

Integration of Smart Monitoring and Digital Capabilities Expands Use Cases

The shift toward connected vehicles strengthens the demand for busbars embedded with smart monitoring features. Advanced sensors integrated within busbars provide real-time insights on current flow, temperature, and fault detection. The Medium Power Electric Vehicle Busbar Market grows as digital integration enhances predictive maintenance and system reliability. It enables manufacturers to ensure safety while extending the lifespan of EV components. This digital transformation aligns with broader industry moves toward intelligent, data-driven vehicle systems. Smart-enabled busbars emerge as key enablers of next-generation EV safety and performance.

Market Challenges Analysis

High Production Costs and Material Volatility Create Barriers

The cost of raw materials such as copper and aluminum continues to fluctuate, creating uncertainty for manufacturers. High-purity materials required for conductivity and safety standards raise overall production expenses. The Medium Power Electric Vehicle Busbar Market faces pressure as OEMs balance cost efficiency with performance requirements. It challenges smaller suppliers who lack economies of scale to compete with established players. Complex manufacturing processes, including lamination and precision shaping, further increase costs. This cost structure limits broader adoption in price-sensitive EV segments.

Thermal Management and Reliability Concerns Restrict Wider Adoption

Busbars in medium power EVs must handle high current loads while maintaining thermal stability and long-term durability. The Medium Power Electric Vehicle Busbar Market encounters challenges when overheating risks reduce operational reliability. It forces manufacturers to invest in advanced cooling and insulation systems, raising technical complexity. Variations in load cycles across urban and highway driving conditions expose weaknesses in busbar designs. Integration within compact EV battery packs creates additional engineering difficulties. These challenges highlight the need for continuous innovation to secure performance consistency across diverse applications.

Market Opportunities

Rising Electric Vehicle Production Creates Growth Pathways

Global investments in electric mobility are accelerating, and medium power busbars stand at the center of this transition. The Medium Power Electric Vehicle Busbar Market benefits from rising demand for vehicles in the passenger and light commercial segments that require efficient current distribution. It gains momentum as OEMs prioritize designs that reduce system weight, improve conductivity, and support compact battery architectures. Expansion of charging infrastructure also drives adoption, as medium power busbars align with mid-range EV platforms popular in emerging economies. Strong government policies promoting EV adoption open significant opportunities for manufacturers to scale operations.

Technological Innovation and Integration Expand Applications

Continuous innovation in material science and design enhances the potential of busbars to deliver higher efficiency and safety. The Medium Power Electric Vehicle Busbar Market advances with opportunities to integrate thermal management systems, modular designs, and eco-friendly insulation materials. It benefits from the growing push for sustainable manufacturing practices and recyclability in the EV supply chain. Hybrid busbar designs that combine copper and aluminum present pathways to optimize both cost and performance. Collaboration between OEMs, material suppliers, and research institutions accelerates new applications in fast-charging systems and next-generation EV models. These opportunities strengthen the long-term role of medium power busbars in the global EV ecosystem.

Market Segmentation Analysis:

By Configuration

The Medium Power Electric Vehicle Busbar Market divides into laminated busbars and single-layer busbars, each addressing specific performance requirements. Laminated busbars dominate due to their ability to reduce inductance, improve thermal performance, and enable compact designs in electric vehicle power systems. Their layered construction supports higher efficiency in energy transfer, which is critical for battery modules and inverters. Single-layer busbars hold relevance in cost-sensitive applications, where simplicity and easy assembly remain priorities. It benefits from rising demand in light EV models that require dependable current distribution without complex structures. Manufacturers focus on offering modular configurations to support evolving EV architectures.

- For instance, Proterra integrates laminated busbars rated at 750V and 800A in its ZX5 electric buses, reducing inductance by 35% and enabling compact packaging of battery packs that power ranges up to 329 kilometers per charge.

By Material Type

Materials used in busbar production play a central role in shaping efficiency and cost. The Medium Power Electric Vehicle Busbar Market relies heavily on copper busbars, as they provide superior conductivity and durability, making them the preferred choice for high-performance EVs. Aluminum busbars secure traction as a lightweight and cost-effective alternative, especially in passenger EVs where weight reduction improves range. Hybrid busbars combining copper and aluminum gain attention for balancing conductivity and affordability while meeting safety and performance standards. It strengthens opportunities for manufacturers that invest in advanced coatings and insulation to enhance long-term reliability. Material choice directly influences performance metrics, positioning this segment as critical in EV busbar adoption.

By Current Rating

The market is segmented into busbars designed for current ratings below 500A, between 500A–1000A, and above 1000A. The Medium Power Electric Vehicle Busbar Market shows high demand in the 500A–1000A category, which aligns with most passenger EVs and mid-sized commercial vehicles requiring efficient current management. Below 500A busbars serve compact EVs and hybrid models where energy needs are lower but efficiency remains vital. Above 1000A busbars, while less common in this segment, see growing interest from advanced EV platforms and heavy-duty applications that push higher power density. It reflects the adaptability of busbars across varying EV categories, ensuring strong alignment with evolving vehicle power requirements.

- For instance, Ebusco 3.0 integrates busbars rated at 750V and 850A, enabling lightweight electric buses with a 24-ton gross vehicle weight to achieve over 575 kilometers on a single charge.

Segments:

Based on Configuration

- Single Busbar

- Double Busbar

- Compact Busbar

Based on Material Type

- Copper Busbars

- Aluminum Busbars

- Composite Busbars

Based on Current Rating

- Up to 250A

- 251A to 500A

- 501A to 1000A

Based on Application Area

- Electric Bus Charging Infrastructure

- Electric Fleet Management

- Renewable Energy Integration

Based on Installation Type

- Indoor Installation

- Outdoor Installation

- Mobile Installation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 33% of the Medium Power Electric Vehicle Busbar Market, driven by robust EV adoption across the United States and Canada. Strong government incentives, regulatory mandates for zero-emission vehicles, and large investments in EV infrastructure strengthen demand for efficient power distribution components. U.S. automakers integrate medium power busbars into passenger cars, light trucks, and commercial EVs to optimize battery-to-motor connectivity. Canada contributes with steady growth supported by renewable integration and EV adoption in urban fleets. It benefits from the presence of key manufacturers and R&D centers focused on advanced materials such as copper-aluminum hybrids. The region demonstrates a balance between innovation, regulatory pressure, and consumer demand, reinforcing its leadership in this market.

Europe

Europe accounts for 29% of the Medium Power Electric Vehicle Busbar Market, supported by strong emphasis on electrification and strict EU emission regulations. Germany, France, and the UK lead adoption with large-scale EV manufacturing and advanced automotive supply chains. Laminated busbars see high uptake in European EV platforms, where efficiency and compact design are critical. It aligns with the region’s push toward lightweight materials that enhance range and meet sustainability objectives. Eastern Europe adds momentum with expanding EV assembly lines in Poland and Hungary. Europe’s mature ecosystem of automotive OEMs and component suppliers ensures strong integration of advanced busbar technologies across passenger and commercial vehicles.

Asia Pacific

Asia Pacific commands 27% of the Medium Power Electric Vehicle Busbar Market, fueled by rapid EV production and widespread government support. China dominates with large-scale manufacturing of passenger and commercial EVs, where copper busbars remain the preferred material due to high conductivity. Japan and South Korea drive innovation with compact busbar designs optimized for hybrid and battery-electric vehicles. India records fast growth through government initiatives promoting EV adoption under FAME II and state-level programs. Southeast Asian nations such as Thailand and Indonesia expand production capacity, strengthening the region’s role as a cost-competitive manufacturing hub. It reflects both the scale of production and the innovation-driven focus on efficiency in high-volume EV markets.

Latin America

Latin America represents 6% of the Medium Power Electric Vehicle Busbar Market, led by Brazil and Mexico. Brazil drives adoption through electric bus programs in urban centers, where medium power busbars enable reliable current management for large fleets. Mexico leverages its strong automotive manufacturing base to integrate EV components for both domestic and export markets. Other countries such as Chile and Colombia see gradual adoption through pilot EV projects supported by renewable energy integration. It reflects early-stage but growing opportunities as governments introduce EV-friendly policies. Latin America remains an emerging region with strong potential in public transport electrification and fleet modernization.

Middle East & Africa

The Middle East & Africa hold 5% of the Medium Power Electric Vehicle Busbar Market, supported by investments in green mobility and diversification strategies. Gulf countries such as the UAE and Saudi Arabia expand EV infrastructure and adopt advanced busbar systems in luxury and commercial EVs. South Africa drives regional adoption through localized EV assembly and renewable-linked transport initiatives. It benefits from rising interest in fleet electrification in logistics and public transport. Limited infrastructure and high costs slow broader adoption, yet growing government incentives and partnerships with global EV manufacturers stimulate gradual expansion. This region highlights long-term opportunities tied to diversification from oil and increased focus on sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Proterra

- Zhongtong Bus

- Volvo

- Ebusco

- New Flyer

- Mercedes Benz

- NFI Group

- Zhengzhou Yutong Bus

- BYD

- Gillig

Competitive Analysis

The competitive landscape of the Medium Power Electric Vehicle Busbar Market is shaped by global EV manufacturers and component suppliers focusing on reliability, lightweight design, and thermal efficiency to support medium power bus and commercial vehicle platforms. Key players include BYD, Proterra, Volvo, Mercedes Benz, Zhengzhou Yutong Bus, Gillig, Zhongtong Bus, Ebusco, NFI Group, and New Flyer. BYD emphasizes large-scale integration of busbars in its electric bus fleets, enhancing current-carrying capacity for urban transit vehicles. Proterra advances modular busbar designs optimized for its fast-charging electric buses, improving energy transfer efficiency. Volvo and Mercedes Benz invest in premium EV bus platforms that integrate copper and aluminum hybrid busbars to balance cost, durability, and performance. Zhengzhou Yutong Bus and Zhongtong Bus strengthen their competitiveness through large-scale domestic and international deployments, relying on busbars that sustain higher currents for long-range applications. Ebusco differentiates with lightweight aluminum busbar adoption, supporting its strategy of reducing overall vehicle weight. Gillig and NFI Group focus on North American markets by deploying busbars tailored for fleet electrification programs, while New Flyer leverages advanced insulation techniques to improve safety in public transport systems. Collectively, these players drive innovation by aligning product development with energy efficiency, cost optimization, and regulatory compliance across global EV fleets.

Recent Developments

- In August 2025, NFI’s Alexander Dennis opened a new manufacturing facility in Las Vegas and delivered local Enviro500 double-decker buses, enhancing regional production capacity.

- In July 2025, New Flyer received a significant bus order from New Jersey Transit, demonstrating strong demand for its zero-emission transit solutions.

- In June 2025, BYD unveiled the B13.b intercity electric bus, featuring a 700-kilometer range on a single charge and powered by its Blade Battery technology rated at 560 kWhBYD unveiled the B13.b intercity electric bus, featuring a 700-kilometer range on a single charge and powered by its Blade Battery technology rated at 560 kWh.

- In November 2023 Volvo Group has been selected as the highest bidder in an auction for the business and assets of the Proterra Powered unit, at a purchase price of $210 million.

Market Concentration & Characteristics

The Medium Power Electric Vehicle Busbar Market reflects moderate concentration, with competition driven by established EV manufacturers and specialized component suppliers focusing on durability, efficiency, and cost optimization. It features strong participation from global bus OEMs such as BYD, Volvo, Proterra, Mercedes Benz, and Zhengzhou Yutong Bus, alongside regional players that supply tailored busbar systems for diverse vehicle architectures. It demonstrates characteristics shaped by the demand for lightweight materials, hybrid copper-aluminum configurations, and advanced insulation technologies that improve thermal management and safety. It is defined by continuous R&D investment, with companies exploring modular designs and compact layouts that support flexible integration in medium power electric buses. It aligns closely with electrification policies and fleet modernization initiatives across developed and emerging economies. The Medium Power Electric Vehicle Busbar Market shows strong growth potential through its adaptability to evolving EV platforms while maintaining a balance between performance and affordability.

Report Coverage

The research report offers an in-depth analysis based on Configuration, Material Type, Current Rating, Application Area, Installation Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow rapidly for medium-power busbar systems in electric buses and commercial light-duty EVs.

- Aluminum and copper-aluminum hybrid busbars will gain preference due to weight savings and cost efficiency.

- Modular busbar architectures will become more common, enabling flexible integration across diverse EV platforms.

- Advanced thermal management materials and designs will improve current-handling capabilities and system reliability.

- Fast-charging compatibility will shape busbar design, requiring systems capable of sustaining higher charge currents.

- Smart monitoring features, such as embedded temperature and current sensors, will drive predictive maintenance.

- Advances in eco-friendly insulation and recyclable materials will support sustainable EV manufacturing goals.

- OEM–supplier collaborations will accelerate busbar innovations tied to localized EV assembly strategies.

- Regulatory pressure for lightweight, efficient EV components will favor adoption of optimized busbar designs.

- Growth in ride-hailing, micro-transit, and urban fleet electrification will expand market opportunities across emerging regions.