Market Overview

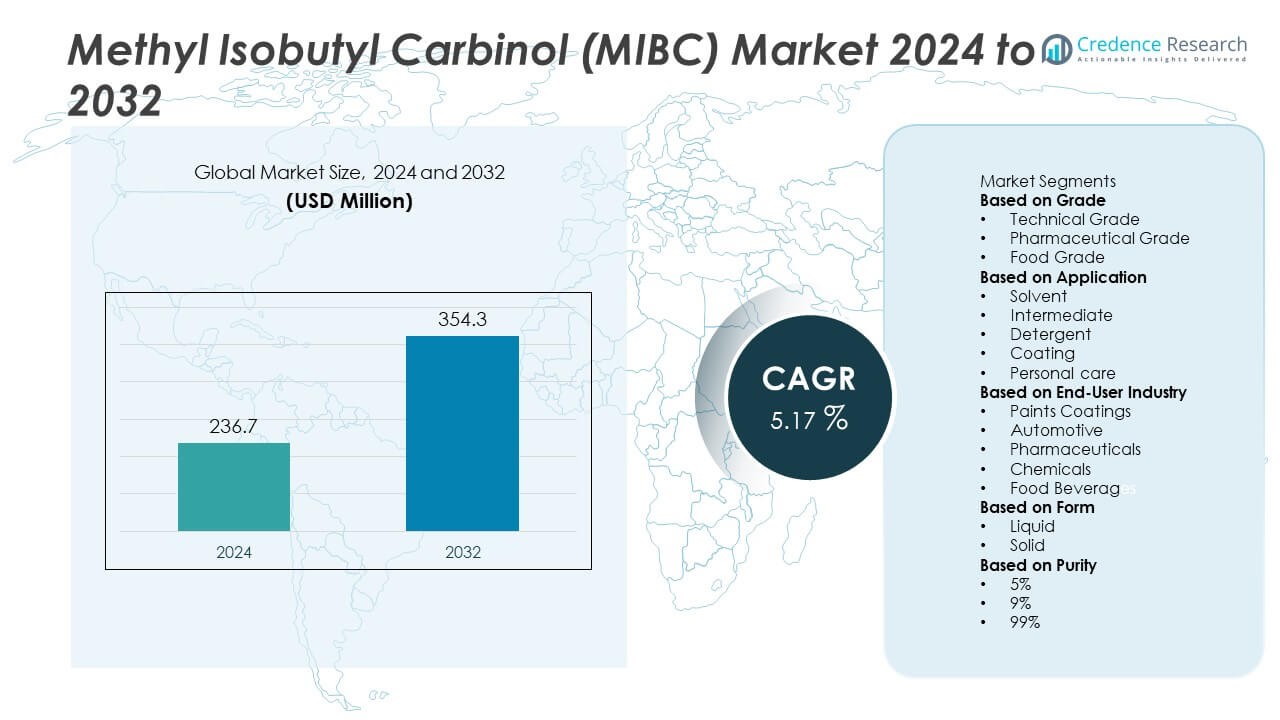

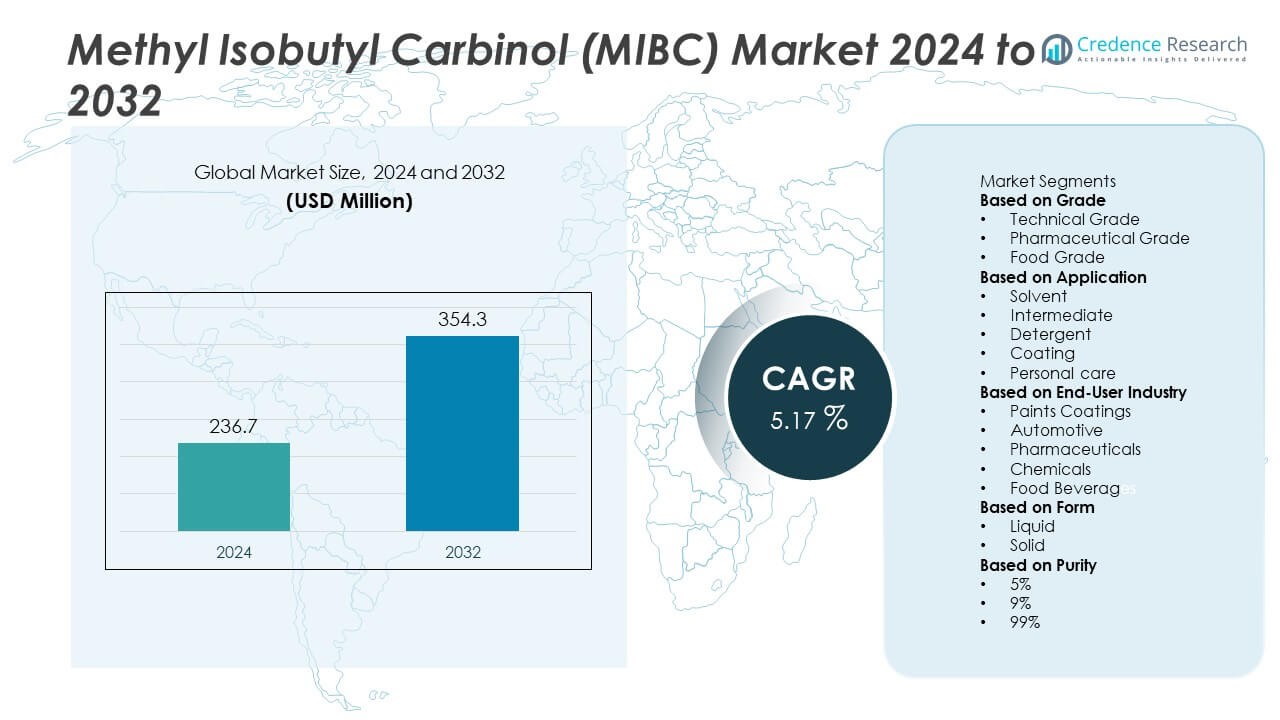

The Methyl Isobutyl Carbinol (MIBC) Market size was valued at USD 236.7 million in 2024 and is anticipated to reach USD 354.3 million by 2032, growing at a CAGR of 5.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Methyl Isobutyl Carbinol (MIBC) Market Size 2024 |

USD 236.7 Million |

| Methyl Isobutyl Carbinol (MIBC) Market, CAGR |

5.17% |

| Methyl Isobutyl Carbinol (MIBC) Market Size 2032 |

USD 354.3 Million |

The Methyl Isobutyl Carbinol (MIBC) Market grows on the back of rising demand in froth flotation for mineral processing, where it enhances selectivity and efficiency in copper, molybdenum, and rare earth extraction. Expanding applications in paints, coatings, adhesives, and rubber processing further strengthen its position across industrial sectors.

The Methyl Isobutyl Carbinol (MIBC) Market demonstrates strong geographical presence across Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific leads demand due to large-scale mining operations, rapid industrialization, and expanding construction sectors, with China, India, and Australia serving as key contributors. North America benefits from advanced mineral extraction and strong consumption in coatings and industrial applications, while Europe shows steady growth through specialty chemicals and high-performance coatings supported by strict regulatory frameworks. Latin America gains momentum from copper and mineral extraction in Chile, Peru, and Brazil, whereas the Middle East and Africa advance gradually with infrastructure expansion and mining activity. Prominent players shaping the competitive landscape include Reliance Industries, Sasol, Royal Dutch Shell, and Dow, each focusing on product innovation, supply chain expansion, and sustainable chemical solutions. Their strategic investments strengthen the global positioning of MIBC across industries and applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Methyl Isobutyl Carbinol (MIBC) Market was valued at USD 236.7 million in 2024 and is projected to reach USD 354.3 million by 2032, expanding at a CAGR of 5.17% during the forecast period.

- Growing demand in froth flotation for mineral processing drives the market, as MIBC enhances selectivity and efficiency in extracting copper, molybdenum, and rare earth elements while reducing energy costs.

- Expanding applications in paints, coatings, adhesives, lubricants, and rubber processing strengthen its adoption across diverse industries, with increasing demand for high-performance materials.

- Emerging trends include the shift toward sustainable and eco-friendly chemical solutions, technological advancements in mineral separation, and the adoption of high-performance industrial coatings in automotive and construction.

- Competitive analysis highlights the presence of key global players such as Reliance Industries, Sasol, Royal Dutch Shell, Dow, Sinopec, and TotalEnergies, which focus on innovation, supply chain expansion, and sustainable production technologies.

- Market restraints include stringent environmental regulations on chemical production, rising compliance costs, and volatility in raw material supply chains tied to petrochemical feedstock pricing and geopolitical risks.

- Regional analysis shows Asia-Pacific as the leading hub for demand due to mining and industrial expansion, North America benefiting from advanced mining and coatings consumption, Europe emphasizing specialty chemicals and sustainability, while Latin America and the Middle East & Africa show steady growth through mining projects and infrastructure development.

Market Drivers

Rising Demand in Froth Flotation for Mining Applications

The Methyl Isobutyl Carbinol (MIBC) Market grows steadily due to its critical role in froth flotation for mineral processing. It serves as a frother in copper, molybdenum, and rare earth metal extraction, where efficiency and recovery rates directly influence profitability. Mining companies adopt it to improve selectivity and reduce energy use, which strengthens its relevance in both established and emerging economies. Expanding infrastructure projects and industrialization boost the consumption of base metals, thereby increasing the demand for flotation chemicals. It gains further traction from the shift toward high-grade ores that require more efficient separation agents. Global resource exploration activity continues to reinforce the market outlook.

- For instance, Freeport-McMoRan reported copper production of 4.2 million metric tons in 2023, where optimized flotation processes using reagents such as MIBC were essential to achieving higher recovery rates.

Expanding Use in Chemical Intermediates and Industrial Formulations

Another driver for the Methyl Isobutyl Carbinol (MIBC) Market is its application as a solvent and intermediate in diverse chemical formulations. It is widely used in the production of lubricants, adhesives, and coatings, where strong solvency power and low surface tension improve performance. Manufacturers rely on it for creating high-quality specialty chemicals that meet demanding standards across automotive, construction, and packaging sectors. The compound supports advanced industrial coatings that enhance durability and resistance to harsh environments. It also provides versatility for blending with other alcohols and solvents. Expanding industrial demand sustains its steady growth path.

- For instance, Dow reported sales of USD 7.8 billion in its Coatings & Performance Materials segment in 2023, reflecting strong adoption of solvents and intermediates.

Growth in Paints, Coatings, and Rubber Processing Industries

The Methyl Isobutyl Carbinol (MIBC) Market benefits from its adoption in paints, coatings, and rubber applications, where product quality and process efficiency matter. It supports dispersion of pigments, stability of emulsions, and improved drying properties, making it valuable for premium formulations. The rise of construction activity, urban expansion, and automotive production creates continuous demand for advanced coating solutions. Rubber processing industries integrate it to optimize vulcanization processes and enhance mechanical strength. It meets the needs of both traditional industrial users and high-performance product developers. This strong presence across multiple end uses reinforces its market stability.

Support from Global Industrialization and Energy Sector Development

The Methyl Isobutyl Carbinol (MIBC) Market gains momentum from macroeconomic trends such as rapid industrialization and expanding energy production. Mining and energy-intensive sectors increase their reliance on efficient flotation reagents and solvents to optimize output. It remains aligned with global infrastructure investment programs that drive higher consumption of metals and related materials. The growth of renewable energy projects requiring copper and rare earth elements further strengthens its importance. Industrial policies in Asia-Pacific and Latin America create favorable demand conditions for specialty chemicals. It continues to play a strategic role in enabling efficiency and quality across resource-intensive industries.

Market Trends

Increasing Focus on Sustainable and Eco-Friendly Chemical Solutions

The Methyl Isobutyl Carbinol (MIBC) Market reflects a rising trend toward sustainability, with industries seeking greener chemical solutions that align with regulatory and environmental standards. Companies invest in developing processes that minimize emissions and reduce hazardous waste. It supports production methods that comply with global frameworks promoting responsible chemical use. Demand for eco-friendly flotation agents and solvents strengthens its position in markets with strict environmental guidelines. Regulatory compliance creates opportunities for innovation in formulation and application. This movement reinforces the role of MIBC in industries that prioritize environmental stewardship.

- For instance, Royal Dutch Shell announced that it reduced operational emissions by 10.3 million metric tons through adoption of low-carbon production technologies, including solvent optimization strategies that align with sustainable chemical initiatives.

Technological Advancements in Mining and Mineral Processing Efficiency

The Methyl Isobutyl Carbinol (MIBC) Market evolves with technological advancements in mining, where efficiency, selectivity, and cost optimization remain critical. Modern flotation techniques require chemicals that deliver high recovery rates while reducing energy consumption. It meets these requirements by improving separation efficiency and supporting more sustainable mining operations. Mining companies adopt advanced reagents to extract valuable minerals from complex ores. Global investment in exploration and the shift toward low-grade deposits amplify the importance of reliable flotation agents. This trend ensures consistent demand from the resource sector.

- For instance, Rio Tinto reported processing 53.3 million metric tons of ore at its Kennecott copper operations in 2023, where integration of advanced flotation reagents improved copper recovery efficiency by more than 25,000 metric tons compared to the previous year.

Expanding Applications in High-Performance Coatings and Industrial Materials

The Methyl Isobutyl Carbinol (MIBC) Market benefits from expanding applications in high-performance coatings, adhesives, and industrial materials. It provides improved dispersion, enhanced adhesion, and superior stability, making it an integral part of advanced formulations. Automotive, aerospace, and construction industries demand coating solutions with durability and weather resistance. Manufacturers incorporate it into blends that enhance process performance and meet international quality benchmarks. Growing demand for industrial adhesives and resins further strengthens its position in the value chain. This diversification of applications broadens its market footprint across industries.

Rising Demand in Emerging Economies Driven by Industrial Growth

The Methyl Isobutyl Carbinol (MIBC) Market gains traction in emerging economies where industrialization, infrastructure expansion, and energy projects accelerate demand. Rapid urban growth drives higher consumption of base metals and advanced industrial products, creating consistent demand for flotation agents and solvents. It supports local industries aiming to meet rising domestic and export requirements. Governments in Asia-Pacific, Africa, and Latin America encourage investment in mining and manufacturing, which strengthens market expansion. Regional demand growth creates opportunities for both local suppliers and global producers. This trend secures long-term growth potential across developing markets.

Market Challenges Analysis

Stringent Regulatory Frameworks and Environmental Concerns

The Methyl Isobutyl Carbinol (MIBC) Market faces challenges from stringent regulatory standards imposed on chemical manufacturing and usage. Authorities in North America, Europe, and Asia-Pacific enforce strict compliance requirements related to emissions, waste management, and worker safety. It often encounters delays in product approvals due to extensive testing and documentation requirements. Companies struggle to balance compliance costs with competitive pricing in global markets. Rising awareness of environmental sustainability places added pressure on producers to adopt cleaner technologies and improve operational transparency. These factors create barriers that limit market expansion for both established and new entrants.

Volatility in Raw Material Supply and Competitive Pressures

The Methyl Isobutyl Carbinol (MIBC) Market also contends with raw material price volatility and supply chain instability. Dependence on petrochemical feedstocks exposes producers to fluctuating crude oil prices and geopolitical risks. It remains vulnerable to transportation bottlenecks and trade restrictions, which disrupt timely availability for downstream industries. Intense competition among regional and global players further challenges profitability, as buyers demand cost-effective and reliable supply. Substitutes and alternative frothers in mineral flotation add another layer of competitive risk. Companies must invest in diversification strategies and supply resilience to navigate these pressures effectively.

Market Opportunities

Rising Potential in Emerging Economies and Expanding Industrial Sectors

The Methyl Isobutyl Carbinol (MIBC) Market holds significant opportunities in emerging economies driven by infrastructure expansion, rapid industrialization, and growing energy needs. Mining operations in Asia-Pacific, Africa, and Latin America create strong demand for flotation agents to support mineral extraction. It also finds growth in local manufacturing industries that require solvents, lubricants, and coatings. Expanding construction activity in urban centers increases the demand for advanced paints and coatings where MIBC plays a critical role. Governments encouraging foreign investment in resource-based sectors further enhance prospects. These developments provide producers with strong opportunities to strengthen their presence across developing regions.

Innovation in Product Development and Sustainable Chemical Solutions

The Methyl Isobutyl Carbinol (MIBC) Market benefits from opportunities linked to innovation in sustainable product development and high-performance formulations. Companies that invest in eco-friendly production technologies gain a competitive edge by meeting regulatory standards and customer expectations. It enables creation of advanced chemical intermediates that deliver efficiency and reduced environmental impact. Demand for high-performance adhesives, coatings, and specialty chemicals creates scope for product diversification. Partnerships between global producers and regional industries open avenues for expanding supply networks and technology transfer. These opportunities position MIBC as a strategic enabler for both traditional and modern industrial applications.

Market Segmentation Analysis:

By Grade

The Methyl Isobutyl Carbinol (MIBC) Market divides into industrial grade and pharmaceutical grade, with industrial grade holding a dominant share. Industrial grade finds strong use in mining, paints, and coatings where large volumes and cost efficiency are critical. It supports flotation processes and enhances productivity in mineral extraction, making it indispensable for resource-driven industries. Pharmaceutical grade caters to specialized applications requiring higher purity, including chemical intermediates and certain formulations in healthcare-related sectors. It commands a smaller share but reflects steady demand from industries where product consistency and safety are non-negotiable. Producers continue to invest in refining processes to meet the growing requirements of both categories.

- For instance, Sasol sold more than 6.1 million metric tons of chemical products through its Chemicals division in 2023, including those meeting high-purity standards required for pharmaceutical intermediates.

By Application

The Methyl Isobutyl Carbinol (MIBC) Market demonstrates high demand in froth flotation, where it functions as a frother in mineral processing. Mining companies depend on it for the separation of copper, molybdenum, and rare earth elements, creating a strong and stable demand base. It also finds application in paints and coatings, where it improves surface quality, pigment dispersion, and resistance to environmental conditions. Industrial lubricants and adhesives use MIBC as a solvent to enhance performance and extend durability. Expanding use in rubber processing and specialty chemicals further strengthens its application portfolio. The diversity of applications positions MIBC as a versatile solution across multiple industrial needs.

- For instance, Vale processed 315 million metric tons of iron ore in 2023, where flotation agents such as MIBC were critical in achieving higher recovery rates in complex ore deposits.

By End-User Industry

The Methyl Isobutyl Carbinol (MIBC) Market caters to a broad range of industries including mining, construction, automotive, chemicals, and energy. Mining leads demand due to its reliance on flotation reagents for ore processing and metal recovery. It also supports the construction and automotive sectors through its use in coatings and adhesives, which improve product quality and durability. The chemical industry leverages MIBC as a solvent and intermediate in the production of specialty compounds. Energy and infrastructure projects indirectly boost demand by increasing the need for metals and coatings. This wide end-user base ensures consistent demand and underscores the importance of MIBC in both mature and emerging industries.

Segments:

Based on Grade

- Technical Grade

- Pharmaceutical Grade

- Food Grade

Based on Application

- Solvent

- Intermediate

- Detergent

- Coating

- Personal care

Based on End-User Industry

- Paints Coatings

- Automotive

- Pharmaceuticals

- Chemicals

- Food Beverages

Based on Form

Based on Purity

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 22% of the global Methyl Isobutyl Carbinol (MIBC) Market, supported by advanced mining operations and steady demand from coatings and industrial sectors. The United States accounts for the majority of consumption, driven by copper and molybdenum extraction projects and the presence of major chemical manufacturers. It also gains momentum from the automotive and construction industries, which use high-performance coatings and adhesives. Canada contributes significantly through its resource-based economy, sustaining demand for flotation reagents in mineral processing. Regulatory frameworks encourage companies to invest in cleaner production technologies, enhancing environmental compliance. North America’s stable market share highlights its consistent industrial base and established infrastructure that secures long-term demand.

Europe

Europe represents about 18% of the global Methyl Isobutyl Carbinol (MIBC) Market, supported by industrial coatings, specialty chemicals, and automotive manufacturing. Germany, France, and the United Kingdom lead consumption, with strong emphasis on performance-driven products that meet stringent EU chemical regulations. It benefits from demand in high-performance coatings for construction and aerospace sectors. The region shows moderate reliance on flotation reagents, given its limited mineral extraction compared to resource-rich geographies. Producers focus on sustainable solutions, aligning with Europe’s regulatory framework on environmental protection and chemical safety. Europe’s market share reflects stable demand driven by quality standards, sustainability initiatives, and technological innovation.

Asia-Pacific

Asia-Pacific dominates with nearly 40% of the global Methyl Isobutyl Carbinol (MIBC) Market, supported by rapid industrialization, expanding mining operations, and urbanization. China leads the region with extensive copper, molybdenum, and rare earth mining projects, which drive high consumption of flotation reagents. India strengthens growth with rising demand for paints, coatings, and adhesives, supported by infrastructure development. Australia contributes through its strong mineral export base, while Southeast Asia adds further growth through expanding industrial applications. It also benefits from supportive government initiatives promoting chemical production and mining expansion. Asia-Pacific’s large share underscores its position as the global hub for both production and consumption, with long-term dominance projected to continue.

Latin America

Latin America accounts for about 12% of the global Methyl Isobutyl Carbinol (MIBC) Market, primarily driven by mining-intensive economies. Chile, Peru, and Brazil serve as major consumers due to their copper and mineral extraction industries. It also gains from infrastructure development across the region, which boosts demand for coatings and adhesives. The presence of multinational companies investing in local supply chains supports steady market growth. Mining exports to global markets sustain regional demand for flotation reagents, while industrialization further expands opportunities. Latin America’s share highlights its rising importance in the global market, fueled by rich resource availability and growing industrial sectors.

Middle East and Africa

The Middle East and Africa hold around 8% of the global Methyl Isobutyl Carbinol (MIBC) Market, with steady growth supported by mining and construction activity. South Africa dominates consumption with its large-scale gold, platinum, and mineral processing operations. It also finds demand in Gulf countries, where infrastructure expansion and construction projects increase the use of coatings and adhesives. North Africa contributes modestly through industrial adoption of specialty chemicals. The region experiences gradual growth but offers significant long-term potential with rising mining investments and modernization efforts. Global players view Africa as an emerging opportunity, positioning it as a future growth contributor despite its smaller current share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Methyl Isobutyl Carbinol (MIBC) Market is shaped by the presence of leading players including Reliance Industries, Sasol, Royal Dutch Shell, Sinopec, Ineos, TotalEnergies, Dow, Gazprom, Indian Oil Corporation, and Chevron Phillips Chemical. These companies maintain strong market positions through diversified product portfolios, global distribution networks, and continuous investment in research and development. They focus on strengthening supply chain resilience, improving production efficiency, and aligning with sustainability goals to meet tightening regulatory standards. Innovation in eco-friendly formulations and advanced solvent technologies helps them cater to rising demand across mining, coatings, adhesives, and specialty chemicals. Regional expansion strategies remain central, with players increasing their presence in Asia-Pacific and Latin America to capitalize on industrial growth and large-scale mining activities. Partnerships, mergers, and acquisitions enhance their global footprint while ensuring long-term competitiveness. Collectively, these strategies reinforce their role in driving efficiency, sustainability, and growth in the MIBC market.

Recent Developments

- In August 2025, Chevron Phillips Chemical: Completed a low-viscosity polyalphaolefins (PAO) production expansion in Belgium. This signals their ongoing investment in specialty chemical capacity.

- In May 2025, Aster Chemicals & Energy initiated the acquisition of Chevron Phillips Singapore Chemicals, which operates a 400,000 tpy polyethylene facility on Jurong Island. The acquisition marks a strategic move to expand capabilities and customer offerings.

- In May 2024, Chevron Phillips Chemical earned top recognition in a national polyethylene supplier survey, securing the No. 1 supplier award for customer loyalty and satisfaction.

- In January 2024, Eastman Chemical Company, Launched a sustainability enhancement program for their MIBC manufacturing process.

Market Concentration & Characteristics

The Methyl Isobutyl Carbinol (MIBC) Market exhibits a moderately concentrated structure with a mix of global chemical giants and regional producers competing for market share. Leading players such as Reliance Industries, Sasol, Royal Dutch Shell, Sinopec, Dow, TotalEnergies, and Chevron Phillips Chemical dominate through integrated production capacities, global distribution, and strong relationships with mining and industrial sectors. It reflects characteristics of a specialized chemical market, where demand is highly linked to mining operations, industrial coatings, adhesives, and rubber processing. The market is shaped by technological capabilities, regulatory compliance, and the ability to deliver consistent product quality at competitive costs. It demonstrates steady growth driven by industrialization in emerging economies, while mature regions focus on sustainability and advanced formulations. Competition is further defined by strategic expansions, partnerships, and innovations in eco-friendly production methods, positioning the market as both resource-driven and innovation-led within the global chemical industry.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-User Industry, Form, Purity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow alongside expansion in mining and infrastructure projects across emerging regions.

- Manufacturers will invest in eco-efficient production methods to meet tighter environmental regulations.

- Technological advancement will enhance the efficiency and selectivity of froth flotation processes.

- Application diversity will increase, especially in specialty coatings, adhesives, and high-performance industrial formulations.

- Regional production capabilities will shift, with Asia-Pacific strengthening its role as both top consumer and producer.

- Suppliers will reinforce supply chain robustness to manage raw material volatility and geopolitical risks.

- Collaborative partnerships will emerge between producers and end users to accelerate innovation in sustainable applications.

- Alternative flotation agents and solvent technologies will challenge MIBC in certain niche applications.

- Value-added grades with improved performance characteristics will gain traction among advanced industrial sectors.

- Investments in capacity expansion and strategic alliances will shape long-term global market structure.