| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RFID Inlays Market Size 2024 |

USD 10,626.2 million |

| RFID Inlays Market, CAGR |

9.46% |

| RFID Inlays Market Size 2032 |

USD 21,839.9 million |

Market Overview

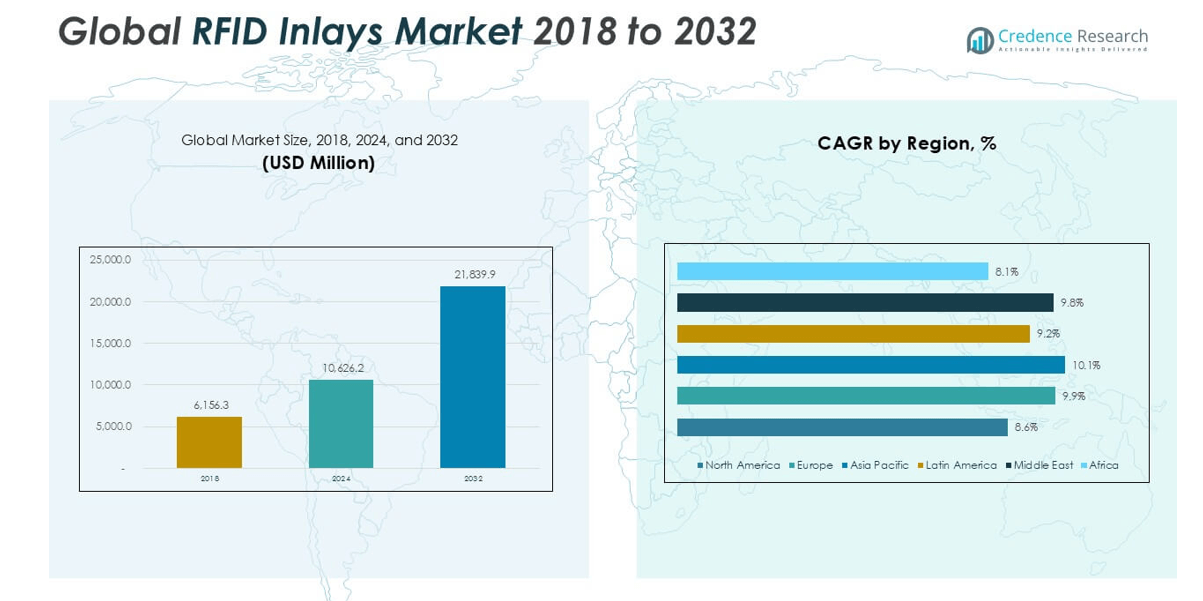

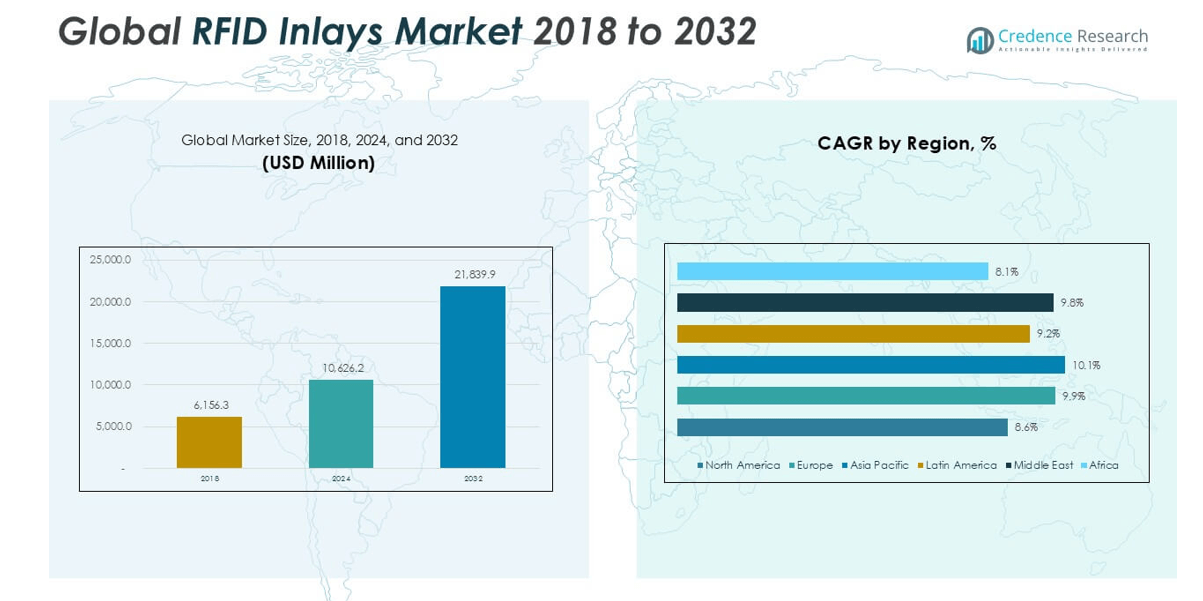

The Global RFID Inlays Market is projected to grow from USD 10,626.2 million in 2024 to an estimated USD 21,839.9 million by 2032, with a compound annual growth rate (CAGR) of 9.46% from 2025 to 2032.

Key drivers contributing to market growth include the rising adoption of IoT and automation technologies, which rely heavily on RFID systems for seamless integration and data collection. Additionally, the growing emphasis on supply chain transparency and security is encouraging companies to deploy RFID-enabled solutions. Trends such as the increasing use of passive RFID tags, enhanced read range, and integration with blockchain for secure tracking are influencing market dynamics positively. Environmental concerns and demand for sustainable packaging are also leading to innovations in eco-friendly RFID inlays.

Geographically, North America is expected to dominate the RFID inlays market due to widespread adoption across retail and healthcare industries, supported by advanced infrastructure and regulatory mandates. Asia Pacific is projected to register the fastest growth, driven by rapid industrialization, growing retail sectors, and government initiatives for smart manufacturing in countries like China, India, and Japan. Key players in the market include Avery Dennison Corporation, NXP Semiconductors, Alien Technology, Smartrac N.V., and Identiv Inc., among others.

Market Insights

- The Global RFID Inlays Market is expected to grow from USD 10,626.2 million in 2024 to USD 21,839.9 million by 2032, at a CAGR of 9.46% from 2025 to 2032.

- Market growth is driven by the expanding adoption of RFID inlays in retail, logistics, healthcare, and manufacturing for real-time asset tracking and inventory management.

- Rising integration of IoT and automation technologies is accelerating RFID usage in smart infrastructure and connected supply chains.

- High initial implementation costs and lack of standardization across regions limit adoption in cost-sensitive markets and small enterprises.

- North America leads the market with a 2024 share of approximately 32.7%, supported by strong infrastructure and regulatory compliance in retail and healthcare.

- Asia Pacific is expected to register the fastest growth, driven by rapid industrialization and government-backed digital transformation in China and India.

- Key players include Avery Dennison, NXP Semiconductors, Alien Technology, Smartrac N.V., and Identiv Inc., focusing on innovation, sustainable materials, and global expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Efficient Inventory Management and Asset Tracking

Businesses across logistics, retail, and manufacturing sectors increasingly adopt RFID inlays to streamline inventory management and asset tracking. These solutions offer real-time visibility, reduce manual errors, and support faster decision-making. Companies seek improved operational efficiency and cost reduction through automation, which RFID inlays help achieve. Retailers benefit from enhanced shelf management, stock accuracy, and reduced shrinkage. Warehousing and distribution centers also implement RFID systems to improve inbound and outbound logistics. The Global RFID Inlays Market benefits directly from this widespread operational demand, reinforcing its growth outlook.

- For instance, more than 1.1 billion sterile filtration units were supplied to biopharmaceutical manufacturers worldwide, supporting the production of over 400 million doses of monoclonal antibodies and vaccines that year

Adoption of IoT and Smart Technologies in Supply Chain Systems

The integration of IoT with supply chain operations has increased the utility of RFID inlays. These components act as vital data carriers, enabling seamless communication between objects and systems. Smart factories and connected logistics networks require consistent and reliable data transmission, which RFID supports. The need for responsive supply chains encourages investment in RFID-enabled technologies. Governments and enterprises invest in digital infrastructure to improve traceability and transparency. It supports process optimization and risk mitigation, driving interest in advanced RFID applications.

- For instance, a 2023 survey of leading pharmaceutical companies found that more than 320,000 single-use filtration assemblies with full regulatory validation were deployed in FDA- and EMA-regulated facilities, reflecting the market’s focus on compliance and innovation.

Expanding Applications Across Healthcare, Transportation, and Agriculture

RFID inlays find broader use in industries beyond retail and logistics, such as healthcare, public transportation, and agriculture. In healthcare, they help track medical equipment, manage patient data, and improve drug authentication. Transportation systems deploy RFID for fare collection, vehicle tracking, and traffic monitoring. The agriculture sector uses RFID inlays to monitor livestock and track crop conditions. These diverse applications demonstrate the versatility of RFID solutions. It increases demand across multiple verticals, strengthening the market base.

Technological Advancements Driving Innovation in RFID Inlays

Continuous improvements in chip design, antenna material, and read range capabilities enhance the performance of RFID inlays. Manufacturers focus on developing thinner, more flexible, and cost-effective inlays to meet evolving industry needs. Integration with cloud computing and blockchain solutions further enhances security and data accessibility. It helps users gain actionable insights from RFID-generated data. The Global RFID Inlays Market continues to evolve with these innovations, attracting investments from major players. Rising R\&D activities fuel competitive differentiation and product development.

Market Trends

Growing Shift Toward Passive RFID Inlays for Cost-Effective Scalability

Organizations increasingly prefer passive RFID inlays due to their lower cost, ease of integration, and maintenance-free operation. These inlays do not require a power source and activate only when in proximity to a reader. This makes them ideal for large-scale deployments across retail, logistics, and asset tracking. Retailers use passive RFID for item-level tagging, enabling efficient inventory audits and theft prevention. Businesses with high-volume operations favor passive options to reduce implementation costs. The Global RFID Inlays Market benefits from this cost-efficient trend, expanding its reach across mid-sized enterprises.

- For instance, 39.3 billion passive RFID tags were sold globally in 2023, up from 33 billion in 2022, with nearly 24 billion tags used in retail apparel alone

Emergence of Sustainable and Eco-Friendly RFID Inlay Materials

The market sees a rising focus on environmentally responsible RFID inlays using biodegradable or recyclable substrates. Companies aim to align with sustainability goals by adopting inlays made from paper-based or compostable materials. Regulations in Europe and North America encourage the development of green alternatives to traditional PET or plastic-based inlays. Brands with sustainability commitments seek packaging solutions that integrate seamlessly with RFID systems. It pushes manufacturers to innovate in design without compromising performance. This trend reshapes material sourcing practices across the Global RFID Inlays Market.

- For instance, independent laboratory testing showed that various RF and RFID inlays achieved a recyclability rate of at least 93.8% when applied to recyclable paper substrates, supporting the shift toward sustainable packaging in retail and logistics applications.

Integration of RFID Inlays with Cloud and Data Analytics Platforms

Businesses now link RFID inlays with cloud infrastructure and analytics tools to enhance data visibility and operational decision-making. Real-time data captured by RFID tags is stored and analyzed to gain insights into supply chain performance, inventory levels, and customer behavior. Retailers use this integration to track demand patterns and optimize stocking strategies. Manufacturers apply the data to monitor equipment usage and reduce downtime. It drives the convergence of hardware and software in RFID applications. The Global RFID Inlays Market continues to evolve toward more intelligent, insight-driven ecosystems.

Increased Use of RFID Inlays in Contactless and Secure Transactions

RFID inlays now support a wide range of contactless applications, including access control, payment systems, and identification. Governments deploy RFID-enabled ID cards and passports to improve security and speed in identity verification. Transport authorities adopt RFID-based fare collection systems to reduce physical contact and enhance user convenience. Retailers implement RFID tags in payment cards to support faster checkouts and reduce queue times. It promotes a seamless user experience and strengthens data protection efforts. The Global RFID Inlays Market reflects this growing demand for secure and frictionless transactions.

Market Challenges

High Initial Implementation Costs and Infrastructure Limitations

Many businesses hesitate to adopt RFID inlays due to the high upfront costs associated with hardware, software, and integration. Establishing a reliable RFID ecosystem requires investment in readers, antennas, middleware, and network systems. Small and medium enterprises often struggle to justify the expenditure without immediate returns. Limited technical expertise and lack of standardization across industries further complicate deployment. Some environments, such as metal surfaces or liquids, interfere with signal accuracy, requiring specialized solutions. The Global RFID Inlays Market faces resistance from cost-sensitive sectors, slowing adoption in emerging economies.

- For instance, in 2024, a leading industry survey reported that more than 6,500 small and medium-sized enterprises in Asia and Latin America postponed or canceled RFID inlay deployments due to initial setup costs exceeding $80,000 per site, with over 1,200 companies citing technical integration challenges as a primary barrier to adoption, according to company procurement data and government technology adoption reports.

Data Privacy Concerns and Interoperability Challenges Across Applications

Widespread use of RFID inlays raises concerns about data privacy and unauthorized tracking. Consumers and regulatory bodies question the potential misuse of personal or proprietary information collected through RFID systems. Businesses must ensure compliance with evolving data protection laws while maintaining system transparency. Interoperability issues across different RFID standards and frequencies create additional complications, especially in cross-border applications. It forces companies to invest in customized solutions that may limit scalability. The Global RFID Inlays Market must overcome these regulatory and compatibility hurdles to sustain long-term growth.

Market Opportunities

Rising Demand Across Emerging Economies and Untapped Industry Verticals

Emerging markets in Asia Pacific, Latin America, and the Middle East offer significant growth potential for RFID inlays. Rapid industrialization, expanding retail sectors, and increasing digital transformation initiatives create favorable conditions. Governments invest in smart infrastructure, logistics modernization, and public sector digitization, all of which rely on RFID systems. Untapped industries such as agriculture, waste management, and mining present new avenues for RFID adoption. These sectors seek efficient tracking and monitoring solutions to improve productivity and compliance. The Global RFID Inlays Market stands to benefit from strategic entry into these underserved regions and verticals.

Technological Innovations Enabling New Product Formats and Applications

Ongoing innovation in chip miniaturization, flexible substrates, and battery-free designs unlock new applications for RFID inlays. Wearables, smart labels, and interactive packaging now integrate RFID for enhanced user engagement and traceability. Developers also explore new frequency bands and multi-protocol support to improve performance in complex environments. It creates opportunities for companies to differentiate through advanced product offerings. Growing interest in digital twins, smart shelves, and IoT ecosystems further expands the potential use cases. The Global RFID Inlays Market is well-positioned to capitalize on these advancements and extend its application landscape.

Market Segmentation Analysis

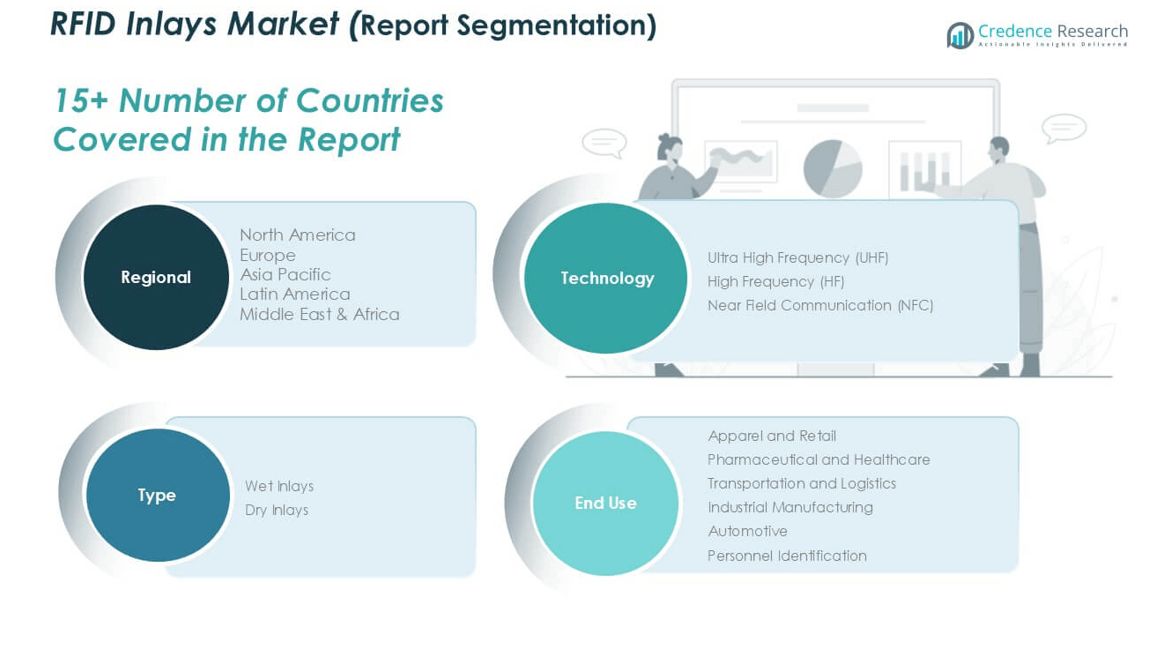

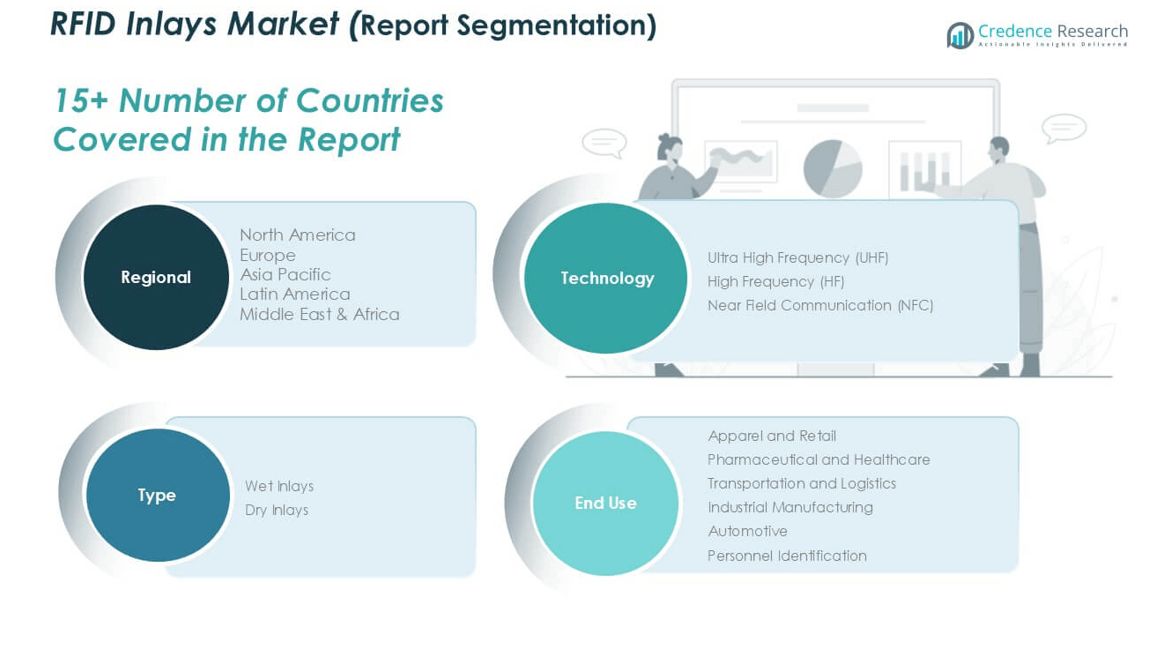

By Technology

The Global RFID Inlays Market is segmented by technology into Ultra High Frequency (UHF), High Frequency (HF), and Near Field Communication (NFC). UHF inlays hold the largest revenue share due to their extended read range and rapid data transfer capabilities, making them suitable for supply chain, logistics, and inventory tracking. HF inlays are preferred in library systems, ticketing, and access control applications due to their reliability and moderate range. NFC, a subset of HF, continues to gain traction in mobile payment systems and consumer engagement through smart packaging. It supports secure, short-range communication, driving adoption in retail and consumer electronics.

- For instance, Avery Dennison reported shipping over 20,000,000,000 RFID inlays globally in 2024, with UHF inlays accounting for the majority of shipments to supply chainand logistics customers.

By Type

Based on type, the market is categorized into wet inlays and dry inlays. Wet inlays dominate the segment due to their ease of application and adhesive backing, which simplifies integration into labels and packaging. These inlays are widely used in retail, logistics, and asset management. Dry inlays, lacking adhesive layers, are preferred for custom tag conversion and embedding into durable tags. It offers cost benefits in high-volume manufacturing environments. Both types cater to different industrial needs, supporting market flexibility.

- For instance, more than 12,000,000,000 wet inlays were integrated into retail and logistics labels worldwide, highlighting their widespread adoption for rapid deployment in packaging and inventory applications

By End Use

The end use segment includes apparel and retail, pharmaceutical and healthcare, transportation and logistics, industrial manufacturing, automotive, and personnel identification. Apparel and retail represent the largest share, driven by inventory automation, theft reduction, and omnichannel retail models. Pharmaceutical and healthcare sectors use RFID for drug authentication, equipment tracking, and patient safety. Transportation and logistics rely on it for real-time asset monitoring and shipment verification. Industrial and automotive sectors adopt RFID for production tracking and component traceability. Personnel identification uses it in secure access systems and government-issued IDs, supporting broad market penetration.

Segments

Based on Technology

- Ultra High Frequency (UHF)

- High Frequency (HF)

- Near Field Communication (NFC)

Based on Type

Based on End Use

- Apparel and Retail

- Pharmaceutical and Healthcare

- Transportation and Logistics

- Industrial Manufacturing

- Automotive

- Personnel Identification

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America RFID Inlays Market

North America held a market value of USD 3,472.95 million in 2024 and is projected to reach USD 6,722.32 million by 2032, expanding at a CAGR of 8.6%. It accounted for approximately 32.7% of the global RFID Inlays Market share in 2024. The region benefits from widespread adoption across retail, healthcare, and logistics sectors. Companies in the U.S. and Canada invest heavily in digital infrastructure and supply chain automation. RFID inlays support asset tracking, patient safety, and compliance in pharmaceutical operations. Strong regulatory frameworks and tech-driven innovation continue to drive demand.

Europe RFID Inlays Market

Europe reached a market size of USD 2,369.95 million in 2024 and is forecast to grow to USD 5,023.18 million by 2032, with a CAGR of 9.9%. It represented approximately 22.3% of the global market in 2024. The region shows strong growth due to rising adoption in industrial automation, transport, and healthcare applications. Countries like Germany, France, and the UK lead RFID deployments across public and private sectors. Smart city initiatives and digital ID programs drive further demand. It benefits from supportive EU regulations on product traceability and data protection.

Asia Pacific RFID Inlays Market

Asia Pacific accounted for USD 2,932.23 million in 2024 and is projected to reach USD 6,333.57 million by 2032, growing at the fastest CAGR of 10.1%. It held about 27.6% of the global market share in 2024. The region sees rapid growth in retail, manufacturing, and logistics sectors, especially in China, India, Japan, and South Korea. Government-backed digital transformation projects support adoption in public services and transportation. RFID inlays are increasingly used for inventory control, smart packaging, and contactless payments. It offers strong opportunities for expansion due to large-scale infrastructure and mobile penetration.

Latin America RFID Inlays Market

Latin America registered a market value of USD 1,060.19 million in 2024 and is estimated to reach USD 2,140.31 million by 2032, growing at a CAGR of 9.2%. The region contributed approximately 10% to the global RFID Inlays Market in 2024. Brazil and Mexico lead in deploying RFID across retail, logistics, and agriculture. Companies seek better inventory visibility and supply chain transparency. Public sector use in identification and asset management is increasing. It benefits from improving connectivity and industrial digitization efforts.

Middle East RFID Inlays Market

The Middle East recorded a market size of USD 586.11 million in 2024 and is projected to reach USD 1,238.32 million by 2032, growing at a CAGR of 9.8%. It held around 5.5% of the global market share in 2024. RFID adoption is increasing across sectors such as oil and gas, transportation, and healthcare. Governments invest in smart city initiatives and infrastructure upgrades. Demand for secure access control and automated logistics drives technology deployment. It reflects rising interest in intelligent tracking solutions across Gulf countries.

Africa RFID Inlays Market

Africa’s RFID Inlays Market stood at USD 204.78 million in 2024 and is expected to reach USD 382.20 million by 2032, with a CAGR of 8.1%. It accounted for approximately 1.9% of the global market in 2024. RFID applications are growing in agriculture, education, and public administration. Countries such as South Africa and Kenya adopt RFID for livestock monitoring and smart ID programs. Budget constraints and limited infrastructure challenge market penetration. It presents long-term potential with increasing digital adoption and foreign investment in technology sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Avery Dennison

- SHANGHAI RFIDHY TECH. CO., Ltd.

- ZHANFENG SMART CARD CO., LTD

- Invengo Technology Pte. Ltd

- Alien Technology LLC

- SMARTRAC N.V

- CAEN RFID S.r.l.

- Confidex Ltd

- SkyRFID, Inc.

- Identiv, Inc

Competitive Analysis

The Global RFID Inlays Market features a competitive landscape with established players and regional specialists competing on innovation, scale, and pricing. Companies like Avery Dennison and SMARTRAC N.V lead with extensive product portfolios and strong global distribution networks. Emerging players such as SHANGHAI RFIDHY TECH and ZHANFENG SMART CARD focus on cost-effective and customized solutions, particularly for Asian markets. Identiv and Invengo Technology continue to invest in R\&D to enhance chip performance and integration capabilities. It encourages strategic collaborations, acquisitions, and product diversification to strengthen market position. Firms differentiate through advancements in material design, read range, and sustainable inlay formats, targeting high-growth sectors such as retail, logistics, and healthcare.

Recent Developments

- In June 2025, Avery Dennison introduced the first RFID label recognized by the Association of Plastic Recyclers (APR) for compatibility with North America’s PET recycling stream. This innovative label utilizes CleanFlake adhesive technology, allowing for clean separation of the label from PET containers during the recycling process, reducing contamination and promoting higher quality recycled PET flakes.

Market Concentration and Characteristics

The Global RFID Inlays Market shows moderate to high market concentration, with a few major players holding significant shares through global reach, advanced R&D capabilities, and extensive product portfolios. It features a mix of multinational corporations and regional manufacturers, each focusing on specific application areas and customization. The market is characterized by rapid technological advancements, growing demand for sustainability, and strong competition in pricing and innovation. Barriers to entry remain moderate due to the need for specialized manufacturing equipment and compliance with global standards. It continues to evolve through partnerships, acquisitions, and investments in flexible, high-performance inlay designs tailored for diverse industries.

Report Coverage

The research report offers an in-depth analysis based on Technology, Type, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global RFID Inlays Market will continue to grow with rising demand from retail, logistics, healthcare, and manufacturing. Broader industry acceptance will support long-term market stability.

- Ongoing improvements in chip size, sensitivity, and antenna materials will enhance performance. These innovations will support integration in smaller and more complex environments.

- Market players will focus on developing eco-friendly inlays using recyclable or biodegradable substrates. Sustainability requirements will drive material innovation and design shifts.

- Rapid urbanization and digitization in Asia Pacific, Latin America, and Africa will accelerate RFID deployment. Government-backed initiatives will support infrastructure development and market penetration.

- Hospitals and pharmaceutical companies will adopt RFID for patient safety, equipment tracking, and drug authentication. Regulatory compliance and asset visibility will drive growth in these sectors.

- RFID inlays will become integral to IoT ecosystems and smart infrastructure applications. The convergence of sensors, cloud computing, and RFID will create intelligent data-driven systems.

- Consumer preference for contactless technologies will fuel demand in payment systems, ID verification, and transportation. RFID-enabled products will support safe and efficient user experiences.

- Vendors will develop tailored RFID inlays for applications such as agriculture, automotive, and industrial manufacturing. Custom solutions will meet technical and environmental demands across verticals.

- The market will emphasize secure data transmission and encryption in RFID systems. Rising concerns about data misuse will shape product development and compliance strategies.

- Major players will pursue mergers, acquisitions, and strategic alliances to expand capabilities and market presence. Collaborations will support innovation, supply chain optimization, and global scalability.