Market Overview

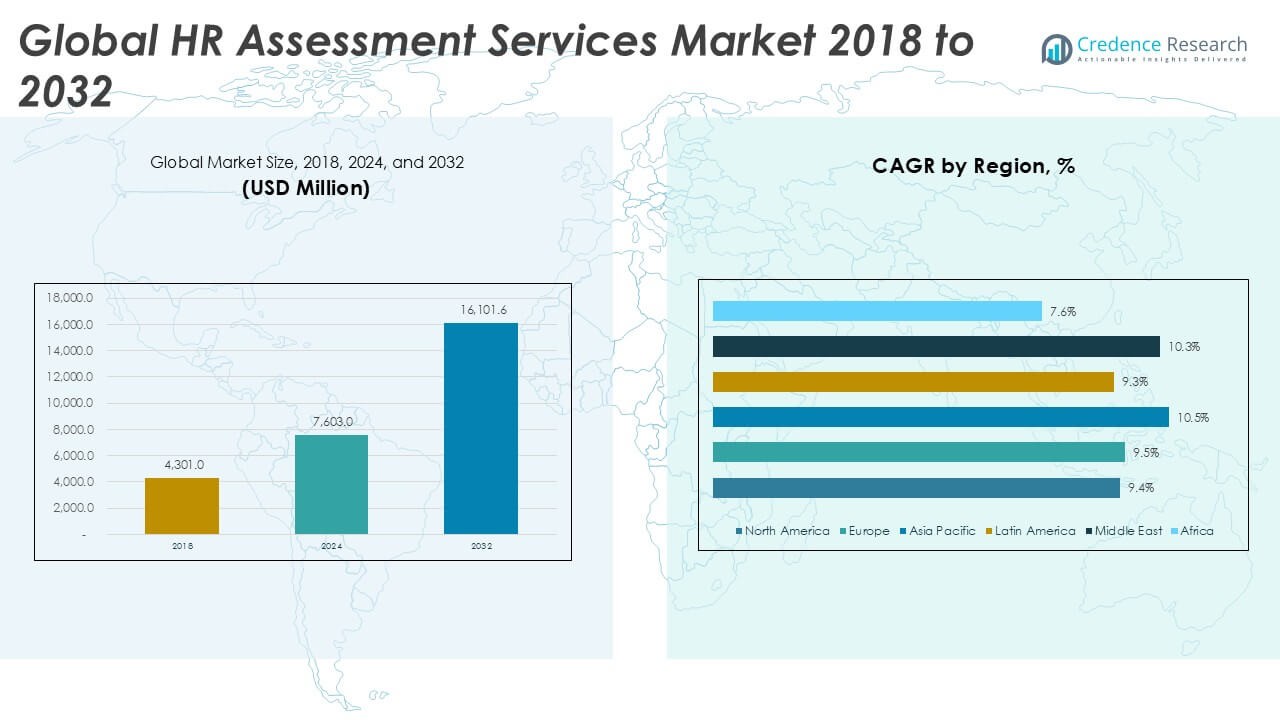

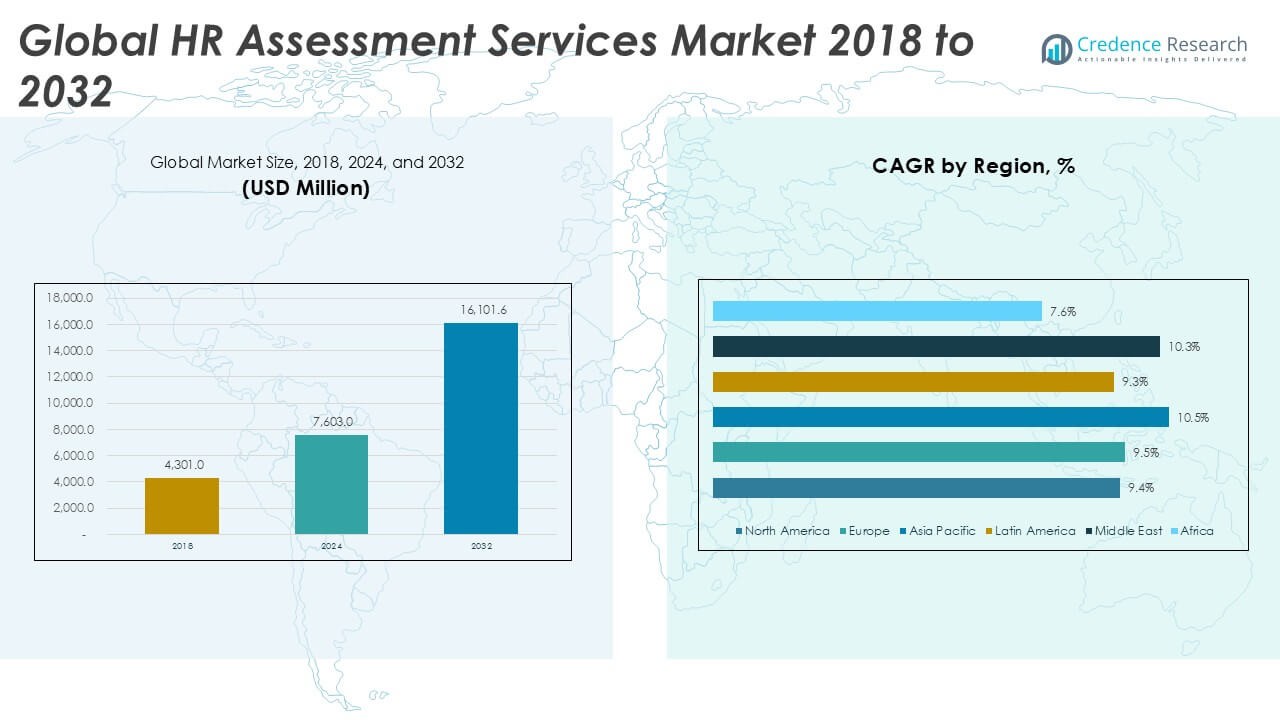

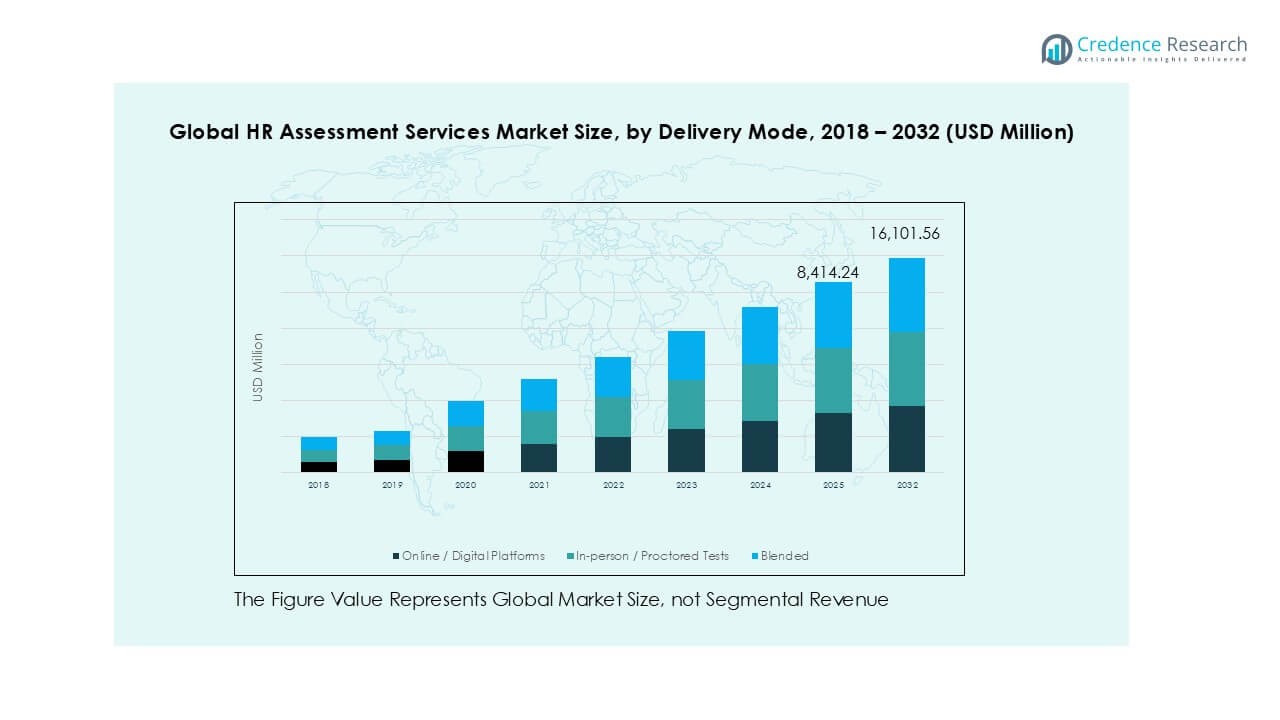

Global HR Assessment Services market size was valued at USD 4,301.0 million in 2018 to USD 7,603.0 million in 2024 and is anticipated to reach USD 16,101.6 million by 2032, at a CAGR of 9.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| HR Assessment Services Market Size 2024 |

USD 7,603.0 Million |

| HR Assessment Services Market, CAGR |

9.71% |

| HR Assessment Services Market Size 2032 |

USD 16,101.6 Million |

The global HR assessment services market is led by a mix of established consulting firms and digital assessment specialists, including Aon, Mettl, Zenger Folkman, Deel Inc., TestGorilla, Adaface, Exceptional HR Solutions, DeGarmo, and TMMi Foundation. Aon dominates large enterprise engagements through integrated talent advisory capabilities, while Mettl, TestGorilla, and Adaface gain share through scalable, cloud-based assessment platforms. Europe is the leading regional market, accounting for an exact market share of 33.8%, supported by strict hiring regulations and high adoption of structured assessments. North America follows with 27.4% share, driven by data-driven hiring and AI adoption. Asia Pacific shows the fastest growth but remains behind Europe in total share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 7,603.0 million in 2024 and is projected to hit USD 16,101.6 million by 2032, growing at a 9.71% CAGR.

- Demand rises from skills-based hiring, remote work adoption, and data-driven talent decisions across enterprises.

- Digital assessments lead delivery with over 60% share, while cognitive ability tests hold about 35% segment share.

- Competition remains fragmented, led by Aon, Mettl, TestGorilla, and Adaface, focused on AI, analytics, and scale.

- Europe leads with 33.8% regional share, followed by North America at 27.4% and Asia Pacific at 24.6%.

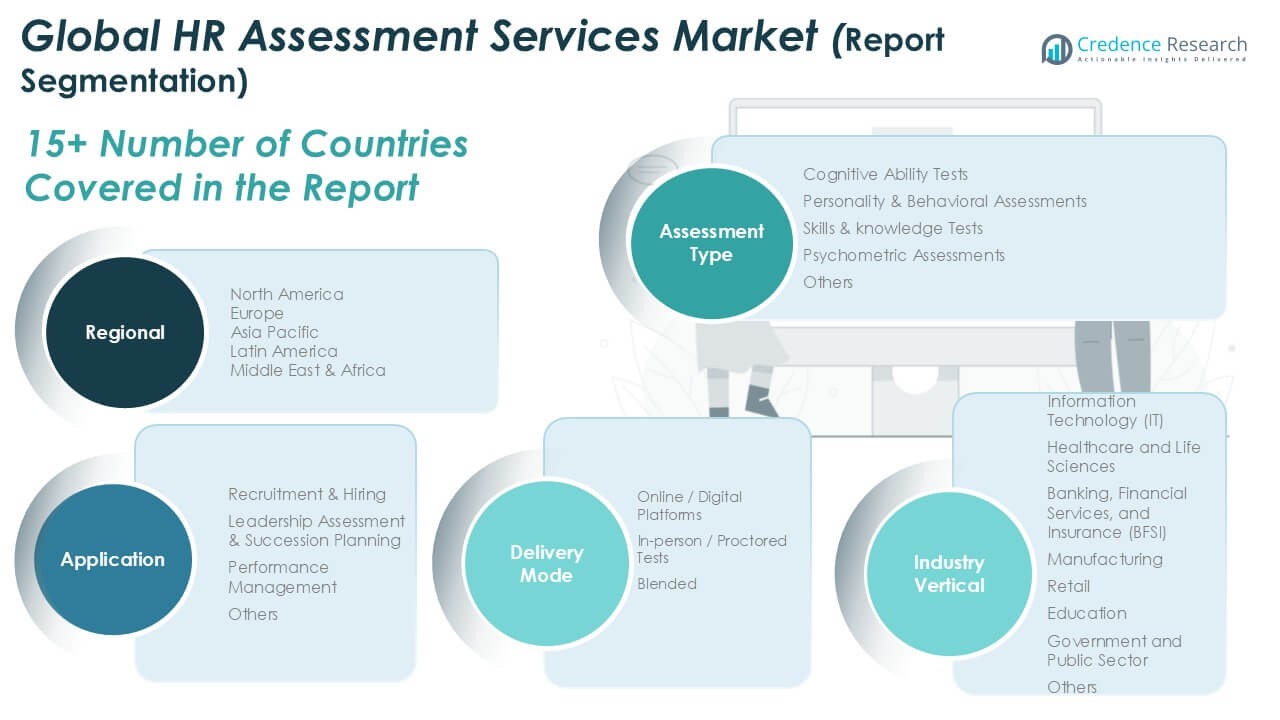

Market Segmentation Analysis:

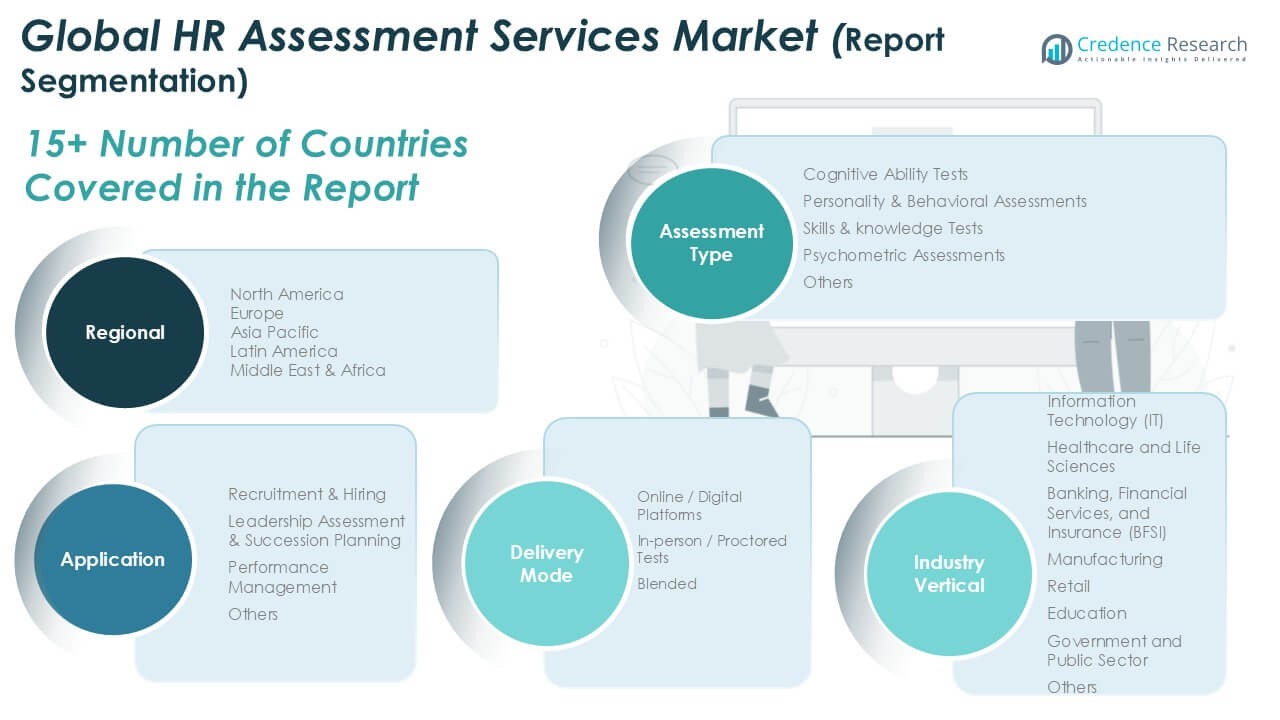

By Assessment Type

The assessment type segment is led by cognitive ability tests, which account for the largest market share, estimated at over 35%. Employers favor these tests due to their strong predictive validity for job performance and learning agility across roles. Cognitive tools support scalable, data-driven hiring and reduce bias in early screening. Personality and behavioral assessments follow, driven by cultural fit evaluation and soft-skill demand. Skills and knowledge tests gain traction for role-specific hiring, while psychometric assessments support holistic workforce evaluation in leadership and development programs.

- For instance, SHL reports that its cognitive ability assessments are used by more than 10,000 organizations worldwide and are validated across over 150 job families through large-scale performance correlation studies.

By Application Segment

Within application segments, recruitment and hiring dominate the market, holding approximately 40% of total revenue share. High-volume hiring, remote recruitment, and skill-based screening fuel demand for structured assessments. Organizations rely on these tools to improve hiring accuracy, reduce turnover, and shorten time-to-hire. Leadership assessment and succession planning show strong growth, supported by talent pipeline risks and aging leadership. Performance management adoption rises steadily as firms align assessments with continuous feedback, employee development, and outcome-based appraisal frameworks.

- For instance, HireVue states that its video-based and AI-supported assessment platform has been used to evaluate over 24 million job candidates, supporting structured hiring decisions across global enterprises.

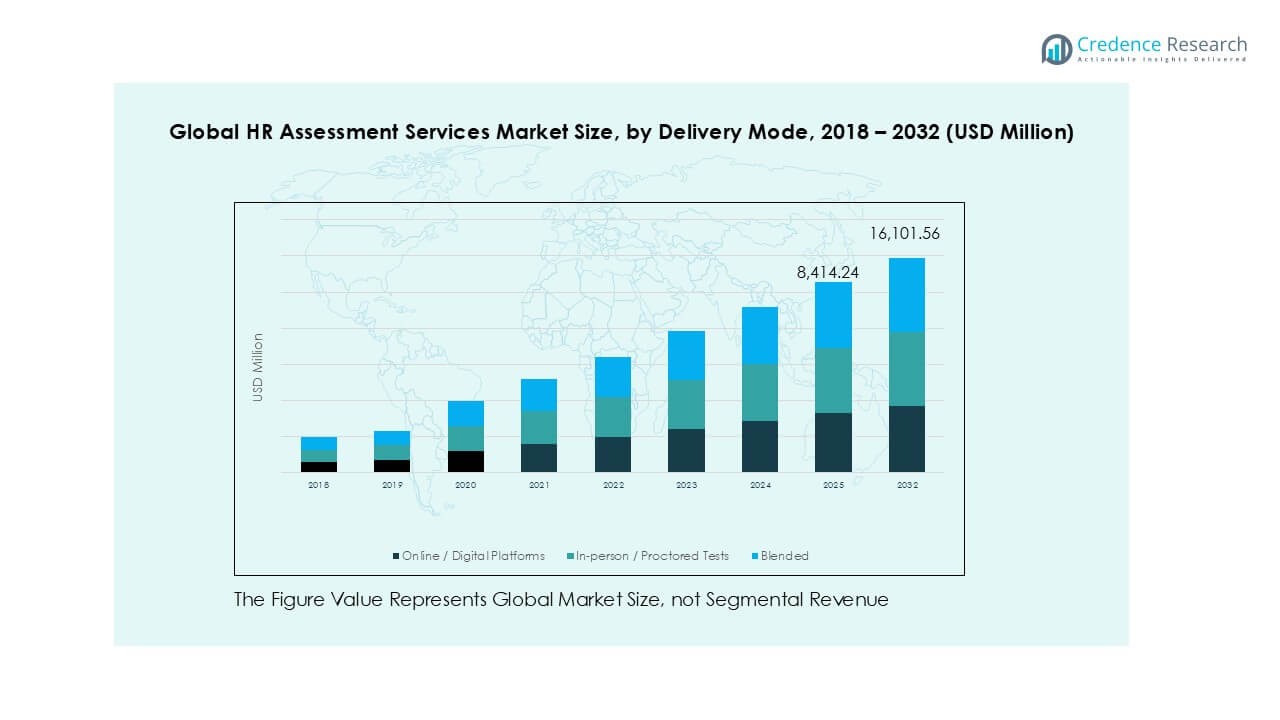

By Delivery Mode

The delivery mode segment is led by online and digital platforms, representing more than 60% of market share. Cloud-based assessments offer scalability, cost efficiency, and global reach, making them ideal for distributed workforces. AI-driven analytics, remote proctoring, and real-time reporting strengthen adoption. In-person and proctored tests retain relevance in regulated roles and high-stakes evaluations. Blended models gain momentum as enterprises combine digital efficiency with supervised validation, balancing flexibility, credibility, and compliance requirements across diverse hiring and development use cases.

Key Growth Drivers

Shift Toward Skills-Based and Data-Driven Hiring

Enterprises increasingly replace credential-based hiring with skills-based evaluation, driving strong demand for HR assessment services. Employers seek objective tools to measure cognitive ability, job-ready skills, and behavioral traits that directly link to performance outcomes. Digital assessments reduce reliance on resumes and interviews, which often introduce bias and inconsistency. Large-scale hiring, especially in IT, BFSI, and services, further accelerates adoption of standardized testing. Data analytics embedded in assessment platforms helps HR teams improve hiring accuracy, reduce attrition, and shorten time-to-hire. Regulatory focus on fair hiring practices also supports structured assessments. As workforce competition intensifies, organizations view assessment tools as essential infrastructure rather than optional HR add-ons.

- For instance, SHL reports that its skills and cognitive assessments are used by over 10,000 organizations and have been validated using datasets covering more than 200 million test takers globally.

Expansion of Remote and Hybrid Work Models

The global shift toward remote and hybrid work significantly expands the HR assessment services market. Distributed workforces require scalable, location-independent evaluation tools for hiring, onboarding, and development. Online assessments enable consistent candidate screening across geographies without physical testing centers. Remote proctoring technologies enhance test integrity, supporting high-stakes evaluations. Employers also assess digital collaboration skills, self-management, and adaptability, which are critical in virtual work settings. Hybrid work models increase assessment frequency beyond hiring, including internal mobility and performance reviews. This structural change in work organization creates sustained demand for flexible, cloud-based assessment solutions.

- For instance, Mercer | Mettl states that its remote proctoring system supports over 5 million online assessments annually, using AI-based monitoring combined with human review to ensure test integrity across global locations.

Rising Focus on Leadership Development and Succession Planning

Organizations face growing leadership gaps due to retirements, expansion into new markets, and faster business cycles. HR assessment services play a central role in identifying high-potential employees and supporting succession planning. Psychometric and behavioral assessments help evaluate leadership traits, decision-making styles, and emotional intelligence. Companies increasingly use assessment centers and simulation-based tools for senior roles. Investors and boards also demand stronger leadership risk management, reinforcing structured evaluation. As talent pipelines become strategic assets, enterprises allocate higher budgets to leadership assessments, supporting long-term market growth.

Key Trends & Opportunities

Integration of AI and Advanced Analytics

AI-driven assessment platforms represent a major growth opportunity in the HR assessment services market. Machine learning models analyze large candidate datasets to predict performance, retention, and cultural fit. Natural language processing enhances video and situational judgment assessments. These technologies improve personalization and reduce manual HR effort. Vendors also offer predictive dashboards for workforce planning and internal mobility. As AI models mature and gain regulatory acceptance, adoption accelerates across mid-sized and large enterprises. This trend creates opportunities for vendors to differentiate through accuracy, transparency, and explainable AI capabilities.

- For instance, HireVue reports that its AI-powered assessment platform has analyzed more than 70 million candidate interviews and over 200 million candidate engagements, using structured models to evaluate competencies such as problem solving, communication, and role readiness at scale.

Growing Demand from Emerging Markets and SMEs

Emerging economies and small-to-medium enterprises present untapped growth opportunities. Rapid digital adoption and workforce formalization increase demand for structured hiring tools. Cloud-based subscription models lower entry barriers for SMEs with limited HR teams. Localized assessments support multilingual and culturally adapted hiring. Governments and educational institutions also adopt assessments for employability programs. As talent competition intensifies in Asia-Pacific, Latin America, and parts of Africa, vendors expand regional offerings. This trend supports long-term volume growth and market diversification.

- For instance, Mercer | Mettl states that its assessment platform is used in more than 80 countries and supports delivery in over 20 languages, enabling standardized hiring and skill evaluation for SMEs and public-sector programs in emerging markets.

Key Challenges

Data Privacy, Bias, and Regulatory Compliance

Data privacy and algorithmic bias remain critical challenges for HR assessment providers. Assessments handle sensitive personal and behavioral data, increasing exposure to privacy regulations such as GDPR and regional labor laws. Employers face scrutiny over fairness, transparency, and adverse impact in automated decision-making. AI-driven tools require continuous validation to prevent discriminatory outcomes. Compliance costs and legal risks can slow adoption, especially in regulated industries. Vendors must invest heavily in secure infrastructure, auditability, and bias mitigation to maintain trust and market credibility.

Resistance to Change and Integration Complexity

Despite clear benefits, some organizations resist adopting formal assessment tools. Hiring managers often prefer traditional interviews and subjective judgment. Integrating assessment platforms with existing HR systems can be complex and resource-intensive. Poor change management reduces utilization and ROI. Smaller firms may lack internal expertise to interpret assessment data effectively. These barriers limit adoption speed and create uneven market penetration. Vendors must provide strong implementation support, training, and user-friendly interfaces to overcome organizational inertia and maximize value realization.

Regional Analysis

North America:

North America represents a major share of the global HR assessment services market, holding about 27.4% market share in 2024. The market was valued at USD 1,199.54 million in 2018 and reached USD 2,084.31 million in 2024. It is projected to reach USD 4,312.00 million by 2032, growing at a CAGR of 9.4%. Strong adoption of data-driven hiring supports growth. High demand from IT, BFSI, and healthcare sectors drives scale. Mature HR technology ecosystems and early AI adoption strengthen regional leadership.

Europe:

Europe leads the global market with the largest share of about 33.8% in 2024. The regional market stood at USD 1,471.36 million in 2018 and expanded to USD 2,571.99 million in 2024. It is forecast to reach USD 5,365.04 million by 2032, at a CAGR of 9.5%. Strong labor regulations encourage structured assessments. Emphasis on fair hiring and compliance drives demand. Widespread use across corporate hiring, public sector recruitment, and leadership development supports sustained growth.

Asia Pacific:

Asia Pacific accounts for approximately 24.6% of global market share in 2024. The market grew from USD 1,008.58 million in 2018 to USD 1,866.97 million in 2024. It is expected to reach USD 4,191.24 million by 2032, registering the highest CAGR of 10.5%. Rapid workforce expansion fuels adoption. Digital hiring growth in India, China, and Southeast Asia accelerates demand. Increasing focus on skills-based hiring and large graduate recruitment programs supports strong long-term expansion.

Latin America:

Latin America holds nearly 7.3% of the global market share in 2024. The regional market was valued at USD 320.42 million in 2018 and reached USD 552.74 million in 2024. It is projected to grow to USD 1,131.94 million by 2032, at a CAGR of 9.3%. Economic formalization supports assessment adoption. Multinational companies drive structured hiring demand. Growing SME digitalization and cloud-based platforms improve access. Talent competition in urban centers further strengthens market growth.

Middle East:

The Middle East accounts for about 4.8% of global market share in 2024. The market increased from USD 200.86 million in 2018 to USD 367.12 million in 2024. It is forecast to reach USD 811.52 million by 2032, growing at a CAGR of 10.3%. Workforce nationalization programs boost assessments. Demand rises across government, energy, and services sectors. Digital hiring reforms support adoption. Investments in education and leadership development also expand assessment service usage.

Africa:

Africa represents the smallest share, at roughly 2.1% of the global market in 2024. The market was valued at USD 100.21 million in 2018 and reached USD 159.88 million in 2024. It is expected to grow to USD 289.83 million by 2032, at a CAGR of 7.6%. Gradual HR formalization supports demand. Growth centers around South Africa and Nigeria. International employers drive adoption. Expanding digital access improves long-term assessment market potential.

Market Segmentations:

By Assessment Type

- Cognitive Ability Tests

- Personality & Behavioral Assessments

- Skills & Knowledge Tests

- Psychometric Assessments

- Others

By Application Segment

- Recruitment & Hiring

- Leadership Assessment & Succession Planning

- Performance Management

- Others

By Delivery Mode

- Online / Digital Platforms

- In-person / Proctored Tests

- Blended

By Industry Vertical

- Information Technology (IT)

- Healthcare and Life Sciences

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Retail

- Education

- Government and Public Sector

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global HR assessment services market features a competitive and moderately fragmented landscape, with a mix of global consulting firms, specialized assessment providers, and digital-first platforms. Large players such as Aon and Mercer leverage deep analytics, global reach, and integrated talent advisory services to secure enterprise contracts. Technology-driven firms, including Mettl, TestGorilla, and Adaface, compete through scalable online platforms, rapid deployment, and AI-enabled assessments. Niche specialists like Zenger Folkman and DeGarmo focus on leadership and behavioral evaluation. Competition centers on assessment accuracy, data security, and platform usability. Vendors increasingly invest in AI, remote proctoring, and analytics to differentiate offerings. Strategic partnerships, geographic expansion, and subscription-based pricing models shape market positioning and long-term competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exceptional HR Solutions

- Mettl

- Aon

- Zenger Folkman

- DeGarmo

- TMMi Foundation

- Deel Inc.

- TestGorilla

- Adaface

Recent Developments

- In September 2025, SHL Medical announced a strategic partnership with Lyophilization Technology, Inc. (LTI), combining SHL’s autoinjector platform with LTI’s expertise in dual-chamber cartridges to drive innovation in lyophilized drug delivery solutions, and advancing their alliance partnership framework to support clinical development for global healthcare clients.

- In August 2025, Mavie Work GmbH announced its acquisition of Assessment Systems, a partner of Hogan Assessments in Central and Eastern Europe. This move has strengthened Mavie’s footprint and Hogan’s regional presence, combining corporate health expertise with evidence-driven employee and leadership development tools.

Report Coverage

The research report offers an in-depth analysis based on Assessment Type, Application Segment, Delivery Mode, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as organizations prioritize skills-based and objective hiring practices.

- Digital assessment platforms will gain wider adoption across small and large enterprises.

- AI-driven analytics will improve prediction accuracy for performance and retention.

- Remote and hybrid work models will sustain demand for online assessments.

- Cognitive and behavioral testing will remain central to recruitment strategies.

- Leadership and succession assessments will see steady enterprise investment.

- Integration with HR software ecosystems will become a standard requirement.

- Data privacy and bias controls will shape product design and compliance focus.

- Emerging markets will contribute increasing volumes of new users.

- Vendors will compete on usability, transparency, and measurable hiring outcomes.