Market Overview:

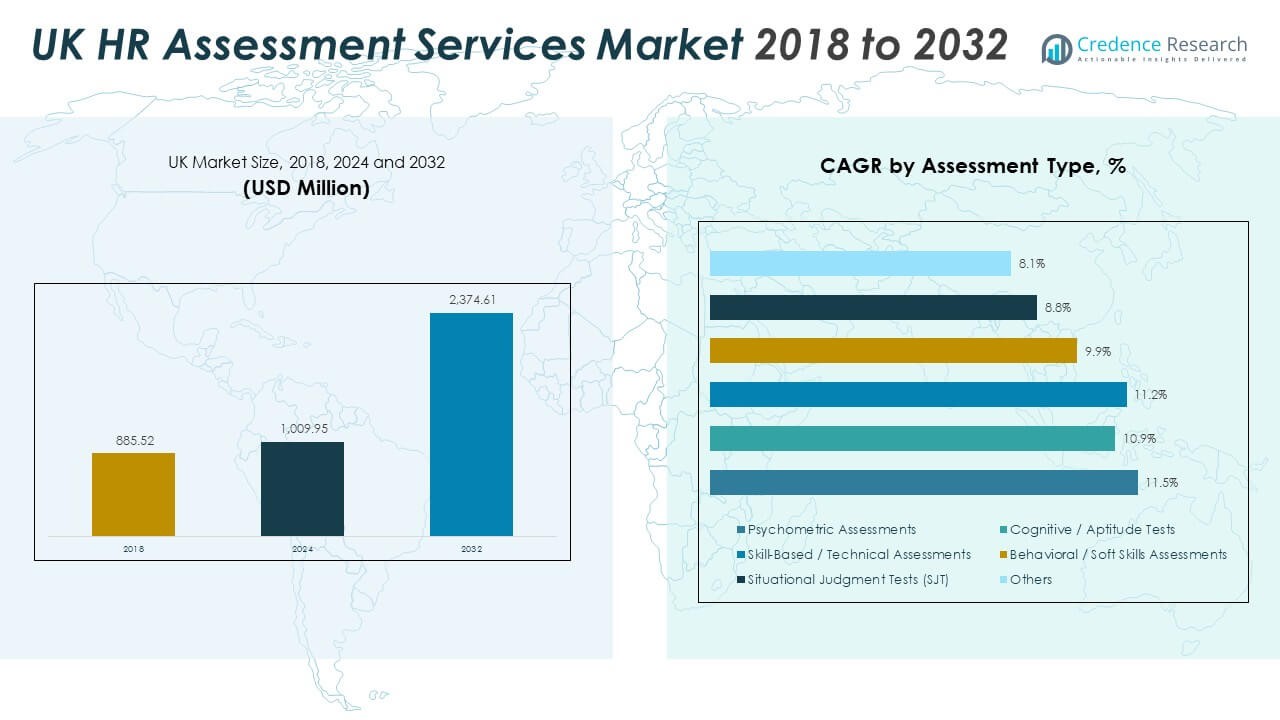

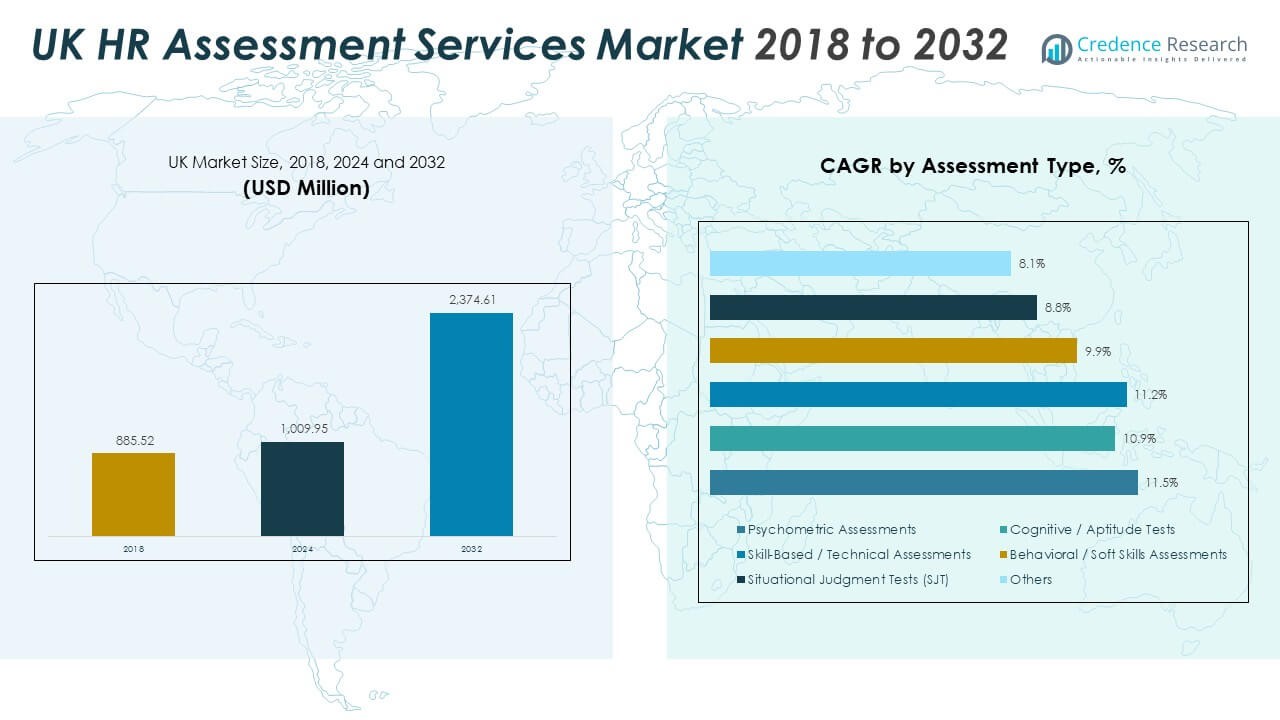

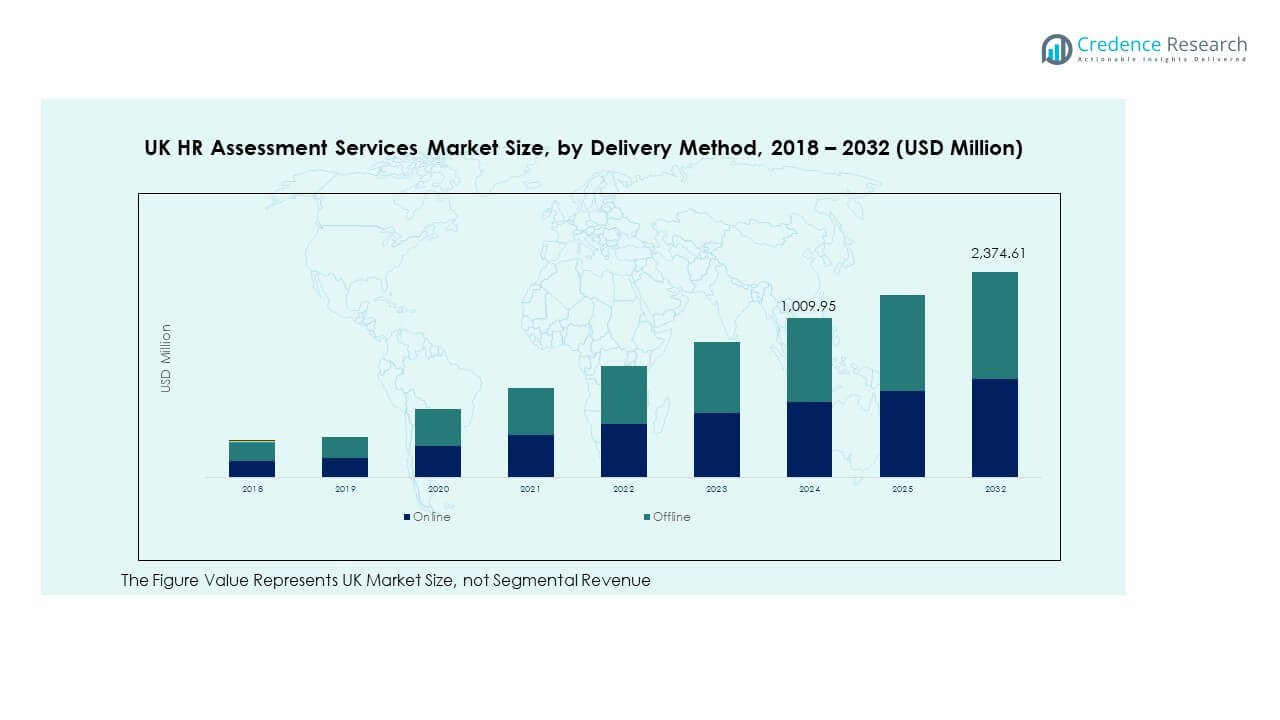

The UK HR Assessment Services Market size was valued at USD 885.52 million in 2018 to USD 1,009.95 million in 2024 and is anticipated to reach USD 2,374.61 million by 2032, at a CAGR of 11.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK HR Assessment Services Market Size 2024 |

USD 1,009.95 Million |

| UK HR Assessment Services Market, CAGR |

11.28% |

| UK HR Assessment Services Market Size 2032 |

USD 2,374.61 Million |

The market growth is driven by the rising adoption of data-driven recruitment and talent analytics. Businesses are focusing on improving workforce quality, reducing hiring bias, and enhancing employee engagement. The integration of AI and psychometric testing tools is helping employers streamline candidate evaluation, predict job performance, and support better decision-making in both large organizations and SMEs.

Regionally, England dominates the UK HR Assessment Services Market due to the strong presence of multinational corporations and HR tech firms. Scotland and Wales are emerging growth areas, supported by expanding corporate sectors, digital transformation, and the increasing use of remote assessment solutions. Northern Ireland is showing gradual adoption as organizations prioritize workforce optimization and digital recruitment strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK HR Assessment Services Market was valued at USD 885.52 million in 2018, reached USD 1,009.95 million in 2024, and is projected to achieve USD 2,374.61 million by 2032, registering a CAGR of 11.28% during 2024–2032.

- England holds the dominant share of 68%, driven by its concentration of multinational corporations, financial institutions, and advanced HR technology adoption. Scotland follows with 18%, benefiting from digital transformation in IT and education, while Northern Ireland contributes 14% due to steady expansion in SMEs and financial services.

- Scotland is the fastest-growing region in the UK HR Assessment Services Market, supported by government-led digital initiatives, tech-driven recruitment, and adoption of behavioral and cognitive testing in public and private sectors.

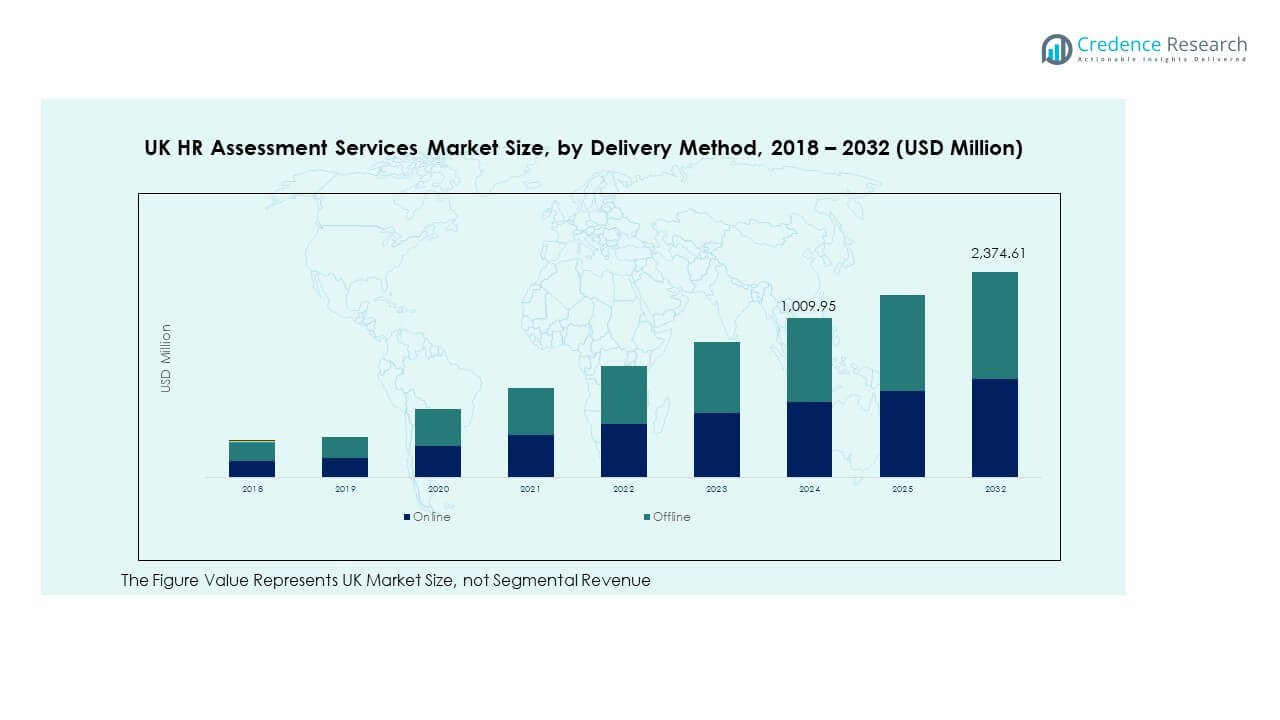

- In 2024, online delivery methods accounted for 64% of total market revenue, supported by remote assessments, scalability, and AI-based analytics platforms.

- Offline assessments held a 36% share, remaining vital for industries requiring proctored environments, compliance validation, and high-security evaluation formats.

Market Drivers:

Rising Emphasis on Talent Optimization and Workforce Efficiency

The UK HR Assessment Services Market is expanding with strong demand for efficient hiring and retention solutions. Organizations are using advanced assessment tools to match candidates with job roles and reduce turnover. Employers are also prioritizing long-term employee engagement by integrating behavioral and cognitive assessments. These tools help identify high-potential talent and support workforce planning. Companies are investing in analytics-driven assessment methods to improve decision-making and productivity. The adoption of such tools aligns with the growing need to manage hybrid workforces. It helps businesses build agile teams capable of adapting to dynamic work environments.

- For instance, SHL launched its Mobilize solution, not in May 2024, but in September 2020. The company leverages data from over 45 years of assessments to support workforce management and talent mobility, which includes using proprietary predictive analytics to improve decision accuracy for roles, including hybrid ones. The mention of “45 million global candidate profiles” is a misleading reference to SHL’s vast and historical data bank, which contains billions of data points, rather than a specific feature count of the Mobilize platform itself.

Integration of Artificial Intelligence and Predictive Analytics in Assessments

AI-based assessment solutions are transforming recruitment across industries. Firms are leveraging predictive analytics to measure personality, problem-solving ability, and job readiness. The UK HR Assessment Services Market benefits from automation that minimizes human bias in evaluation. AI algorithms analyze large datasets to provide precise candidate insights. These technologies enable HR departments to make faster and more reliable talent decisions. Many organizations deploy adaptive testing and gamified assessments for better engagement. It enhances accuracy and aligns hiring outcomes with organizational goals. The integration of AI strengthens transparency and data-backed recruitment efficiency.

- For instance, based on an archived 2008 case study, SHL helped Vodafone UK’s contact centers use an assessment tool to identify candidates who were more likely to be high performers. The study found that those with high scores were three times more likely to be high performers than those with low scores.

Increasing Focus on Skills-Based Hiring and Employee Development

Employers are shifting from qualification-based hiring to skills-based assessment models. The trend supports equitable opportunities for diverse talent pools. The UK HR Assessment Services Market supports this shift through tools that measure technical and soft skills. Companies use such assessments to map individual learning needs and plan career growth. Training modules linked with assessment outcomes boost employee retention. HR teams rely on ongoing evaluations to monitor performance improvement. Skills-based approaches also address future skill gaps and promote workforce adaptability. It allows companies to stay competitive in changing business environments.

Growing Demand from SMEs and Expanding Adoption in Education Sector

Small and medium enterprises are emerging as key users of assessment services. These firms aim to improve hiring accuracy without expanding HR teams. The UK HR Assessment Services Market is gaining traction among SMEs seeking affordable and scalable digital tools. Cloud-based platforms make assessments accessible and easy to integrate with HR software. Educational institutions are also using assessment tools for career counseling and aptitude evaluation. These applications strengthen the bridge between academia and industry readiness. Continuous adoption across sectors is broadening the client base for service providers. It ensures steady growth and consistent demand for innovative solutions.

Market Trends:

Expansion of Remote and Virtual Assessment Platforms

The rise of hybrid work models is reshaping assessment delivery formats. Organizations are increasingly using cloud-based and virtual platforms for hiring and evaluation. The UK HR Assessment Services Market is witnessing strong demand for remote testing tools that support large-scale recruitment. These platforms enable real-time monitoring, video-based interviews, and secure test environments. Virtual assessments help companies reduce travel and operational costs while reaching diverse candidates. Providers are focusing on enhanced data security and seamless user experience. It supports scalability and consistency in evaluating candidates across different regions.

- For instance, Mercer Mettl’s remote proctoring technology is capable of high-volume assessments, supporting over 100,000 proctored sessions in a single day for IIMB across 190 countries. The company’s automated proctoring uses an AI system with a reported 95% accuracy rate for identifying suspicious activities and claims GDPR-compliant security with policies reviewed annually.

Adoption of Gamified and Interactive Assessment Solutions

Gamified assessments are becoming a preferred choice for modern recruiters. They offer immersive experiences that reveal behavioral and cognitive abilities in realistic settings. The UK HR Assessment Services Market is benefiting from the growing interest in engaging and user-friendly formats. Companies use game-based testing to evaluate problem-solving, adaptability, and teamwork. This approach reduces test anxiety and improves candidate participation rates. Interactive simulations provide valuable insights into decision-making under pressure. Service providers are refining gamified designs to align with corporate branding. It enhances employer reputation and candidate satisfaction during recruitment.

Increased Customization and Industry-Specific Assessment Tools

Organizations are demanding tailored assessment tools aligned with their operational needs. The UK HR Assessment Services Market is evolving to include solutions designed for specific industries such as healthcare, finance, and technology. Customized tools measure technical skills, compliance awareness, and cultural fit. This flexibility helps employers reduce irrelevant evaluations and improve result accuracy. Companies also integrate assessments with learning management systems to streamline onboarding. Vendors are using AI-driven analytics to continuously refine test relevance. It allows HR teams to achieve better predictability in employee performance outcomes. Customization strengthens engagement and enhances assessment credibility across industries.

- For instance, a company like Cut-e (Aon Assessment Solutions) might tailor assessments for a client like HSBC to improve recruitment metrics, such as reducing irrelevant results or expediting onboarding.

Growing Emphasis on Continuous Learning and Development Assessments

Employers are extending assessments beyond recruitment toward employee upskilling. The UK HR Assessment Services Market is adapting to continuous development models that track performance growth. Regular assessments identify skill gaps and training needs in evolving job roles. Organizations use these insights to design targeted learning programs. The approach fosters employee loyalty and internal mobility. Assessments linked to development plans enhance workforce adaptability in changing markets. It promotes a data-driven HR culture focused on measurable outcomes. Continuous evaluation is becoming a strategic tool for sustainable workforce development.

Market Challenges Analysis:

Data Privacy Concerns and Integration Complexity in Digital Assessments

The UK HR Assessment Services Market faces challenges related to data privacy and system integration. Organizations handle sensitive personal data during assessments, raising concerns about cybersecurity compliance. Strict regulations like GDPR increase the need for secure data storage and handling practices. Integrating assessment platforms with existing HR management systems often requires technical expertise and investment. Smaller enterprises struggle with the costs of platform upgrades and maintenance. Data breaches or mishandling incidents can damage employer credibility. Limited interoperability across platforms complicates data synchronization. It restricts seamless user experience and slows down adoption among cautious organizations.

Resistance to Change and Skill Gaps in HR Technology Adoption

The transition to technology-driven HR assessments encounters resistance within traditional organizations. The UK HR Assessment Services Market must overcome limited awareness about the benefits of automated assessments. Many HR professionals lack the digital skills needed to implement new tools effectively. Budget constraints and uncertainty about return on investment discourage adoption in smaller firms. Inadequate training also affects the quality of insights derived from assessment data. Vendors face the challenge of demonstrating measurable performance outcomes to build trust. It limits market expansion among late adopters who rely on conventional hiring methods. Continuous education and support are essential to address these barriers.

Market Opportunities:

Expansion of AI-Driven and Cloud-Based Assessment Platforms

The UK HR Assessment Services Market holds strong potential for AI-driven and cloud-enabled solutions. Organizations are looking for scalable tools that deliver faster and unbiased hiring results. Cloud technology offers flexibility, remote access, and lower operational costs for HR departments. AI algorithms enhance accuracy in candidate analysis and workforce planning. Startups and established firms are developing predictive models for better talent alignment. Growing digital transformation across sectors will accelerate platform adoption. It creates new opportunities for service providers to offer secure, integrated, and analytics-based products.

Growing Demand from Public Sector and Educational Institutions

Public organizations and academic institutions are exploring structured assessments for recruitment and development. The UK HR Assessment Services Market is expanding as government agencies adopt transparent evaluation systems. Universities and colleges are implementing assessments to align education outcomes with industry needs. This growing participation from non-corporate users broadens market scope. Service providers can tailor solutions for civil services, academia, and vocational training programs. Increasing public funding in digital education and employment initiatives will support future growth. It reinforces the market’s position as a vital enabler of objective talent evaluation.

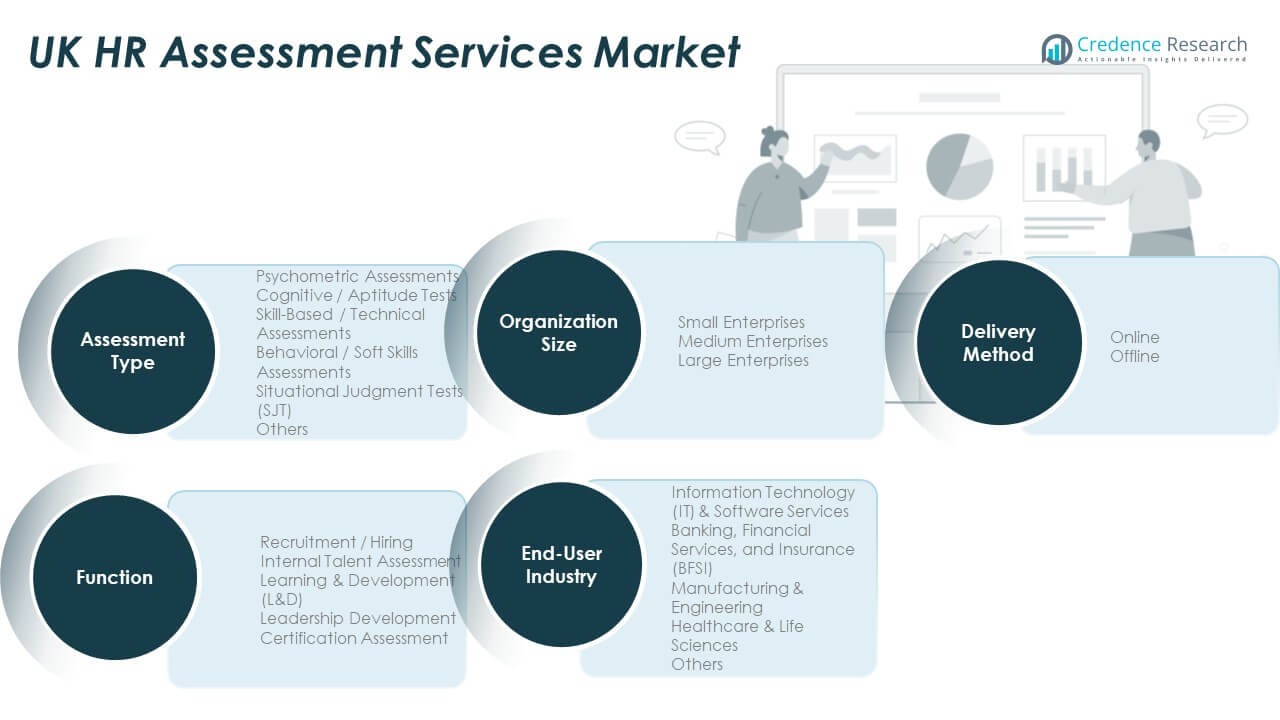

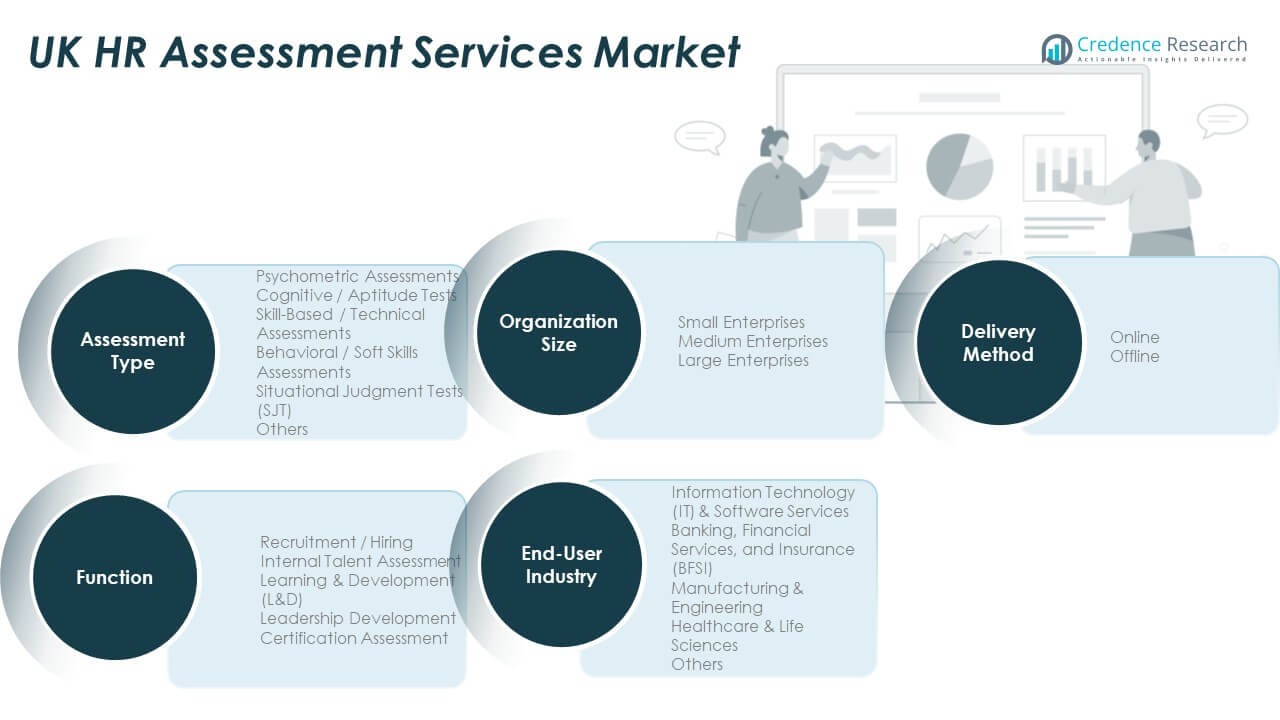

Market Segmentation Analysis:

By Assessment Type

The UK HR Assessment Services Market is segmented into psychometric assessments, cognitive or aptitude tests, skill-based or technical assessments, behavioural or soft skills assessments, situational judgment tests (SJT), and others. Psychometric and cognitive tests hold a strong share due to their effectiveness in evaluating personality and problem-solving abilities. Skill-based assessments are gaining traction among technical industries focusing on role-specific competencies. Behavioural and SJT tools are increasingly used for leadership and managerial roles. This mix supports comprehensive evaluation of both hard and soft skills across workforce levels.

By Delivery Method

The market is divided into online and offline assessment methods. Online assessments dominate due to higher accessibility, faster processing, and data analytics integration. It enables remote evaluations and seamless scalability for organizations of all sizes. Offline assessments remain relevant in sectors requiring secure or supervised test environments. Digital transformation across enterprises continues to strengthen online adoption and reduce manual dependency.

- For instance, Capita has been implementing digital transformation initiatives to improve its recruitment and onboarding processes for UK public sector clients. These efforts, which leverage new technologies like AI, are intended to speed up hiring.

By End-User Industry

Key end users include IT and software services, BFSI, manufacturing and engineering, healthcare and life sciences, and others. IT and BFSI lead due to structured hiring processes and continuous talent development programs. Manufacturing and healthcare sectors are adopting assessments to ensure safety compliance and technical competency.

By Function and Organization Size

Functional segmentation covers recruitment or hiring, internal talent assessment, learning and development, leadership development, and certification assessment. Recruitment holds a major share, while learning and leadership programs drive recurring demand. By organization size, large enterprises dominate adoption, while SMEs are rapidly expanding their use of cost-effective digital assessment tools.

Segmentation:

By Assessment Type

- Psychometric Assessments

- Cognitive / Aptitude Tests

- Skill-Based / Technical Assessments

- Behavioural / Soft Skills Assessments

- Situational Judgment Tests (SJT)

- Others

By Delivery Method

By End-User Industry

- Information Technology (IT) & Software Services

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing & Engineering

- Healthcare & Life Sciences

- Others

By Function

- Recruitment / Hiring

- Internal Talent Assessment

- Learning & Development (L&D)

- Leadership Development

- Certification Assessment

By Organization Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Regional Analysis:

Dominance of England in Market Revenue Contribution

England holds the largest share of the UK HR Assessment Services Market, accounting for nearly 68% of total revenue in 2024. The region benefits from the presence of major corporations, financial institutions, and technology firms that actively adopt data-driven assessment tools. It also leads in digital transformation and early integration of AI-powered HR technologies. London and surrounding business hubs such as Manchester and Birmingham drive consistent demand for psychometric and cognitive testing solutions. The strong presence of multinational HR tech companies and consultancies supports innovation and competition. It continues to attract high investment from vendors seeking scalability and enterprise-level partnerships.

Growing Adoption in Scotland and Wales

Scotland contributes around 18% of the market share, driven by expanding IT, education, and public administration sectors. Organizations in Edinburgh and Glasgow are increasing their reliance on structured assessment platforms to enhance recruitment efficiency and reduce turnover. The UK HR Assessment Services Market is experiencing growing adoption in Wales, supported by emerging digital businesses and skill development initiatives. Regional institutions are using behavioral and skill-based tests to strengthen workforce readiness. Continuous investment in digital infrastructure is supporting HR technology integration. It enhances the region’s ability to attract new players and foster talent innovation.

Emerging Potential Across Northern Ireland

Northern Ireland represents about 14% of the UK HR Assessment Services Market, reflecting gradual but consistent adoption. The market is driven by growing demand among small and medium enterprises seeking affordable and efficient hiring solutions. Belfast acts as the primary commercial hub, hosting several technology and financial service firms. Government-led initiatives promoting employment and workforce training are strengthening adoption. Increasing awareness about AI-driven and remote assessment platforms supports future growth. It is expected to witness steady expansion supported by ongoing digitalization and HR modernization programs across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK HR Assessment Services Market is characterized by strong competition among global and regional players focusing on digital innovation and product expansion. Leading companies such as SHL, Thomas International, Mercer, Hogan Assessments, and Korn Ferry are strengthening their portfolios through AI-driven platforms and psychometric solutions. It is witnessing a rise in partnerships between HR tech providers and enterprise clients to enhance scalability and integration. Companies are also emphasizing analytics, automation, and customized solutions to meet evolving client needs. The market’s competitive landscape is defined by continuous innovation, high service differentiation, and strong brand reputation among established vendors.

Recent Developments:

- In September 2025, SHL announced a strategic partnership with Grünenthal PRO to offer final assembly services for Molly® autoinjectors, enhancing speed-to-market and contract manufacturing capacity for pharmaceutical clients. The partnership expands Grünenthal PRO’s assembly capabilities and introduces new automated lines, solidifying SHL’s comprehensive solutions in advanced drug delivery systems. Furthermore, in March 2025, SHL inaugurated a new $220 million manufacturing facility in North Charleston, USA to meet growing demand for autoinjectors and reinforce their global leadership in self-injection therapies.

- Saville Assessment continues to build on its growth trajectory, following its acquisition by tech investor Tenzing in April 2023. The combination with Tenzing is primed to accelerate product innovation and expand the reach of their award-winning psychometric and aptitude assessment tools, particularly the Wave platform. Saville remains WTW’s preferred software partner, underpinning its scientific rigor and commitment to cutting-edge assessment solutions.

- In April 2025, Hogan Assessments formed a strategic partnership with Coaching.com to integrate predictive personality insights directly into coaching enablement platforms, elevating executive coaching outcomes for clients. Additionally, in August 2025, Assessment Systems, an authorized distributor of Hogan, was acquired by wellness leader Mavie Work, creating Central Europe’s first holistic provider for corporate health solutions—blending psychological assessments with employee well-being programs.

Report Coverage:

The research report offers an in-depth analysis based on assessment type, delivery method, end-user industry, function, and organization size. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for AI-driven assessment platforms will strengthen digital hiring ecosystems.

- Adoption of remote and mobile-based assessments will increase across industries.

- Data privacy and compliance will shape product innovation and vendor strategies.

- Gamified assessments will gain traction for improving candidate engagement.

- Skill-based evaluation will dominate hiring and training processes.

- Public sector digital transformation will create new market opportunities.

- Integration with HR analytics software will improve performance insights.

- Continuous learning assessments will support workforce adaptability.

- SMEs will drive demand for cost-effective cloud-based solutions.

- Sustainability and inclusion goals will influence future HR assessment frameworks.