Market Overview:

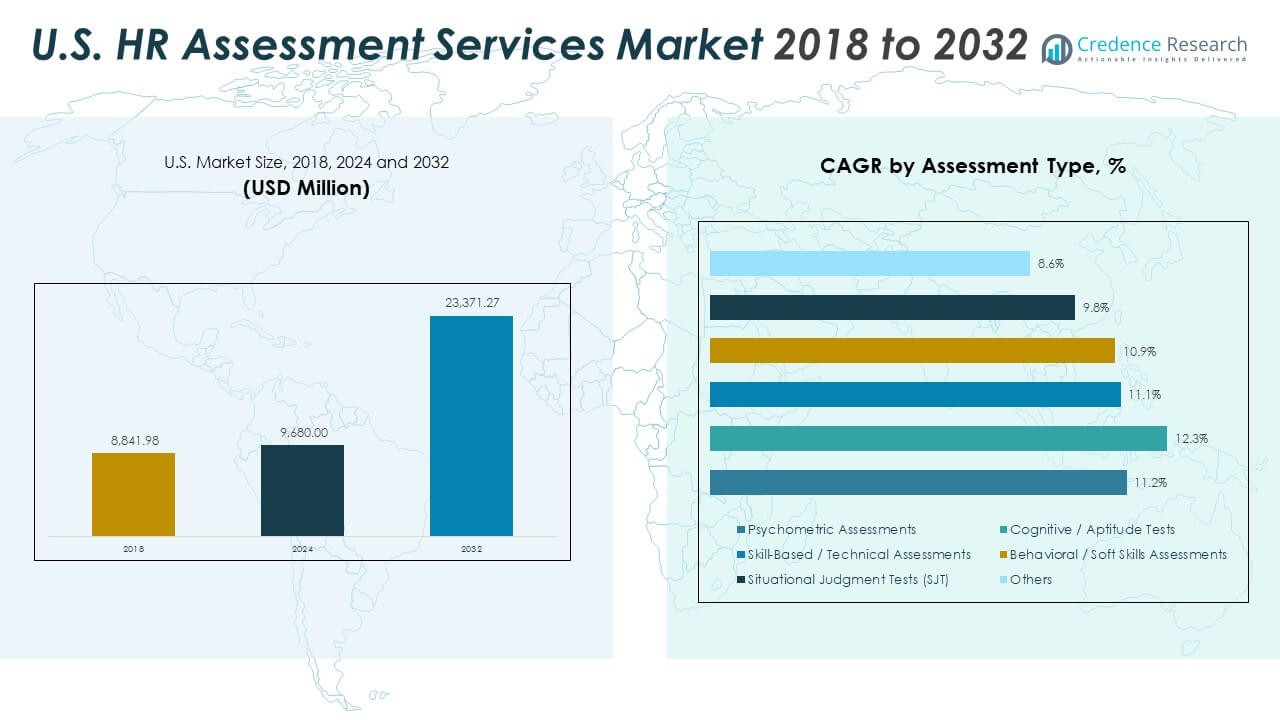

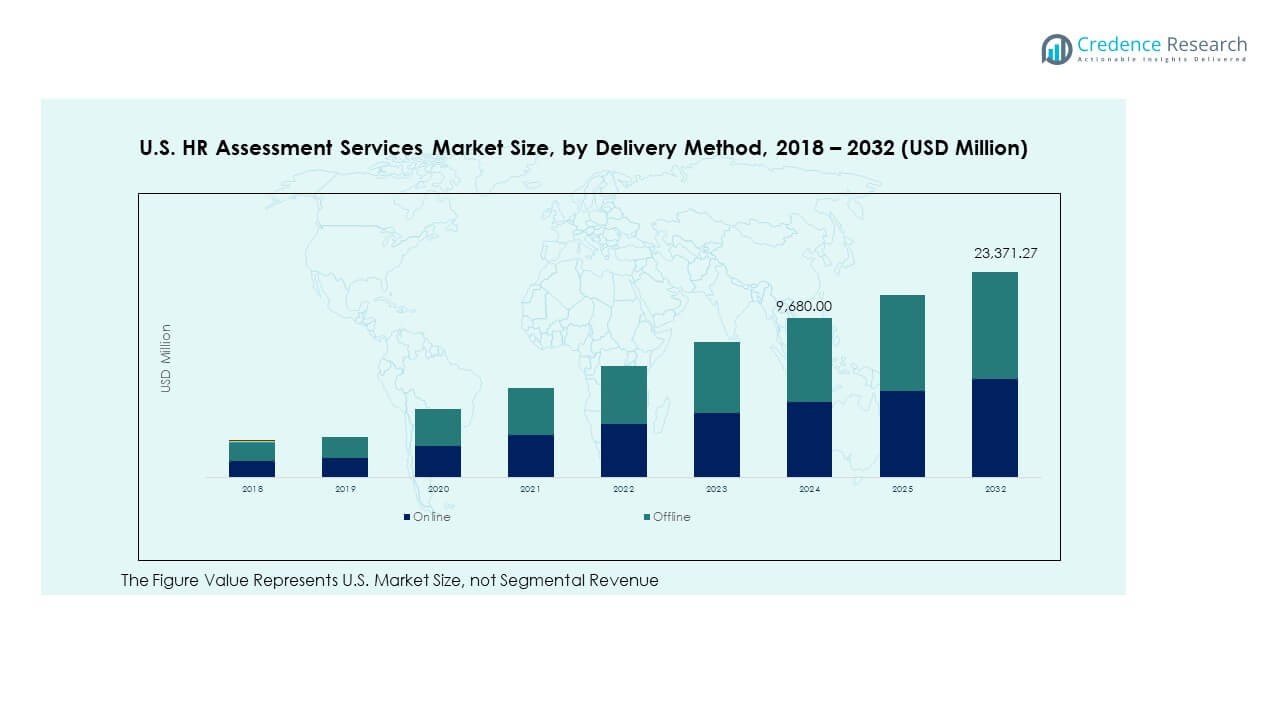

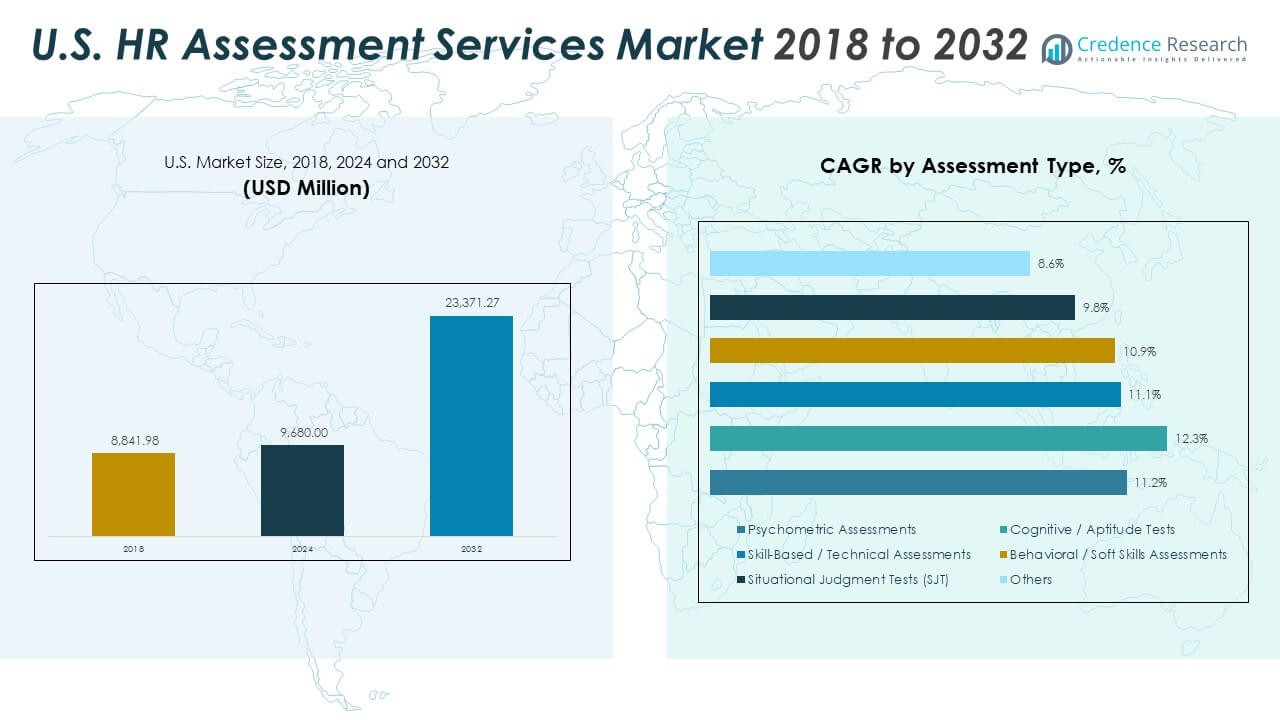

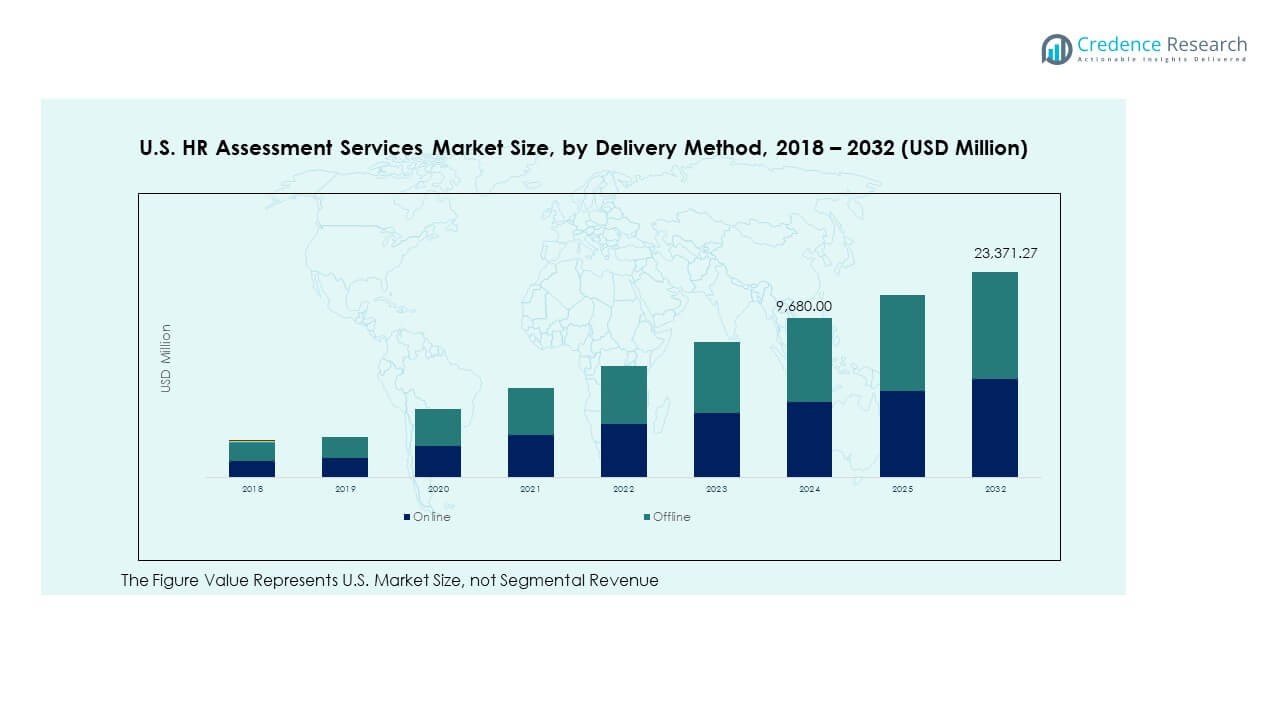

The U.S. HR Assessment Services Market size was valued at USD 8,841.98 million in 2018 to USD 9,680.00 million in 2024 and is anticipated to reach USD 23,371.27 million by 2032, at a CAGR of 11.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. HR Assessment Services Market Size 2024 |

USD 9,680.00 Million |

| U.S. HR Assessment Services Market, CAGR |

11.65% |

| U.S. HR Assessment Services Market Size 2032 |

USD 23,371.27 Million |

The market growth is driven by rising demand for data-driven talent acquisition and performance evaluation tools. Organizations are increasingly adopting digital assessment solutions to improve hiring accuracy, reduce bias, and enhance employee engagement. The integration of AI, psychometric analysis, and skill-based testing supports real-time decision-making, aligning workforce capabilities with business goals and improving retention rates across industries.

Regionally, the market shows strong adoption in major U.S. states such as California, New York, and Texas, supported by large corporate sectors and advanced HR technology infrastructure. Midwestern and Southeastern regions are emerging growth hubs due to expanding enterprise digitization and the rise of small and medium-sized businesses investing in HR automation to improve workforce productivity and reduce operational inefficiencies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. HR Assessment Services Market was valued at USD 8,841.98 million in 2018, reached USD 9,680.00 million in 2024, and is projected to attain USD 23,371.27 million by 2032, registering a CAGR of 11.65% during the forecast period.

- The Western U.S. leads with 35% share, supported by advanced HR tech adoption and the concentration of global enterprises. The Northeastern region follows with 28%, driven by finance and healthcare industries, while the Midwestern region holds 22%, supported by manufacturing and engineering hubs.

- The Southern region, with a 15% share, is the fastest-growing area, driven by expanding digital infrastructure, rising enterprise investments, and adoption of AI-driven workforce assessment tools.

- Online delivery methods account for approximately 65% of the total market, favored for scalability, accessibility, and lower operational costs across corporate and SME users.

- Offline methods capture about 35% share, remaining essential for in-person evaluation, skill-based testing, and regulated industries emphasizing supervised assessments.

Market Drivers:

Growing Adoption of Data-Driven Talent Acquisition and Predictive Hiring Models

The U.S. HR Assessment Services Market is driven by the increasing shift toward data-based hiring decisions. Organizations are prioritizing objective evaluation tools to improve talent selection and reduce hiring errors. Predictive analytics help HR teams identify high-performing candidates and reduce turnover rates. The growing need for efficiency in recruitment across sectors such as IT, healthcare, and finance strengthens market expansion. Automation in assessment solutions minimizes time and cost for employers. Companies prefer integrated assessment platforms that align with digital recruitment systems. Demand for predictive insights continues to rise as competition for skilled workers intensifies.

- For instance, predictive analytics at U.S. staffing firms and healthcare organizations have helped reduce nurse turnover by analyzing candidate and employee data to identify factors linked to retention.

Integration of Artificial Intelligence and Automation in Assessment Tools

AI-driven technologies are transforming the scope of HR assessments across industries. It enables personalized evaluations, automates scoring, and improves the reliability of outcomes. Machine learning algorithms detect behavioral patterns and forecast employee success rates. Employers use AI tools to streamline screening and improve engagement levels among applicants. The market benefits from faster decision-making and reduced human bias during evaluations. Automation ensures standardization across different testing formats and departments. Adoption of AI tools in HR assessment services continues to accelerate with growing digital transformation investments.

Increasing Focus on Employee Retention and Performance Optimization

Organizations are emphasizing employee retention through skill-based assessments and continuous evaluation. The U.S. HR Assessment Services Market benefits from demand for behavioral and cognitive tools that measure growth potential. These tools help employers identify training needs and succession planning opportunities. Regular assessments also enhance motivation and transparency within the workforce. Companies are adopting customized evaluation frameworks to align with organizational goals. Performance assessment tools promote accountability and development among employees. This focus on optimizing workforce productivity fuels long-term market growth.

Rising Demand for Cloud-Based and Scalable Assessment Platforms

The shift to cloud-based HR systems supports accessibility and scalability for remote teams. Cloud infrastructure allows enterprises to conduct assessments globally with reduced technical barriers. It enhances security, data management, and integration with existing HR ecosystems. Small and medium enterprises adopt these platforms for cost efficiency and ease of deployment. The scalability of online solutions drives recurring demand in corporate training and recruitment. The U.S. HR Assessment Services Market is expanding with growing adoption of subscription-based models. Vendors continue to innovate cloud tools for greater analytics and real-time feedback.

Market Trends:

Emergence of Gamified and Interactive Assessment Experiences for Candidates

Gamification in HR assessments is gaining traction across industries seeking higher engagement levels. Interactive platforms improve candidate participation and reduce assessment fatigue. It helps employers evaluate problem-solving and cognitive skills in dynamic environments. The use of simulation-based assessments supports real-world performance analysis. Companies are leveraging this trend to enhance employer branding and candidate experience. Gamified solutions also appeal to younger demographics entering the workforce. The U.S. HR Assessment Services Market benefits from tools that combine engagement with accurate evaluation metrics.

- For instance, Harver’s gamified behavioral assessment system delivered a 98% candidate completion rate for a major U.S. retail client in 2024, as confirmed in official company communications and supporting case studies.

Adoption of Hybrid Assessment Models Combining Online and In-Person Evaluation

Organizations are increasingly blending digital and physical assessment formats to ensure flexibility and reliability. Hybrid models cater to remote hiring needs and traditional assessment standards. It enables HR teams to reach wider talent pools while maintaining evaluation depth. The approach supports inclusivity by removing geographic limitations. Employers favor hybrid formats for executive roles and large-scale recruitment drives. The U.S. HR Assessment Services Market is shifting toward platforms offering both modes seamlessly. Vendors are enhancing interoperability between virtual and in-person tools for efficiency.

- For instance, Korn Ferry’s 2024 annual report documents over 10,000 success profiles built for hybrid assessment platforms, supporting Fortune 500 companies in combining in-person executive interviews with AI-based remote evaluations for large-scale hiring.

Expansion of Skill-Based Assessments for Evolving Job Roles and Digital Skills

Skill-based testing is becoming a key component of workforce planning strategies. It ensures alignment between employee capabilities and changing job requirements. Employers use such assessments to validate technical expertise in AI, data analytics, and software fields. The market benefits from increased demand for certifications and upskilling programs. Assessment providers develop adaptive testing systems to match individual learning patterns. The U.S. HR Assessment Services Market continues to evolve with the growth of specialized roles. This trend supports long-term competitiveness in the digital economy.

Increased Use of Behavioral and Emotional Intelligence Assessment Tools

Organizations recognize the importance of emotional intelligence in leadership and team performance. Behavioral tools now evaluate communication, empathy, and adaptability under stress. It helps employers identify individuals who align with company culture and values. These assessments complement technical evaluations for holistic hiring decisions. Growing awareness of workplace wellness supports adoption of emotional intelligence testing. The U.S. HR Assessment Services Market is witnessing innovation in psychometric and personality-based models. This shift enhances predictive insights for employee success and leadership development.

Market Challenges Analysis:

Concerns Over Data Privacy, Bias, and Regulatory Compliance in HR Assessments

Data protection remains a major concern across digital HR platforms. Employers handling sensitive candidate data must ensure compliance with privacy regulations. The U.S. HR Assessment Services Market faces pressure to maintain transparency in AI-based evaluations. Bias in algorithms can lead to discrimination and reputational damage. Organizations must ensure ethical use of AI and fairness in decision-making. Compliance with federal and state laws demands continuous monitoring and audit mechanisms. Data breaches or misuse can affect user trust and adoption rates. Vendors must invest heavily in cybersecurity and ethical AI frameworks to mitigate risks.

Limited Integration and High Cost of Advanced Assessment Technologies

Integrating next-generation tools into legacy HR systems remains a key challenge. Small and medium-sized enterprises often face financial and technical barriers to adoption. The U.S. HR Assessment Services Market requires significant investment in infrastructure and digital literacy. Many organizations struggle with the complexity of data analytics and platform integration. Costly customization and training further slow deployment of advanced solutions. Vendor support and interoperability standards are still evolving across the industry. Enterprises need scalable models to ensure accessibility and return on investment. Slow adoption among smaller firms limits market reach and overall growth pace.

Market Opportunities:

Expansion of AI-Enabled Predictive Analytics for Workforce Planning

The use of predictive analytics in workforce management presents new growth prospects. It allows employers to anticipate skill shortages and plan training programs effectively. The U.S. HR Assessment Services Market gains value through data-driven workforce optimization. AI-enabled insights improve recruitment forecasting and employee engagement strategies. Businesses can leverage these tools to build resilient and adaptable teams. Increasing demand for performance analytics opens opportunities for tech-driven vendors. The focus on future-ready talent supports sustainable market expansion.

Rising Demand for Customizable and Industry-Specific Assessment Solutions

Organizations seek assessment tools tailored to industry standards and role-specific needs. Customizable platforms enhance relevance and accuracy in candidate evaluations. The U.S. HR Assessment Services Market benefits from this shift toward specialized assessments. Vendors offering modular designs and sector-based templates gain competitive advantage. Growth opportunities arise from healthcare, finance, and IT sectors with distinct competency frameworks. These solutions enable companies to improve hiring precision and workforce alignment. Demand for bespoke digital platforms continues to strengthen future growth potential.

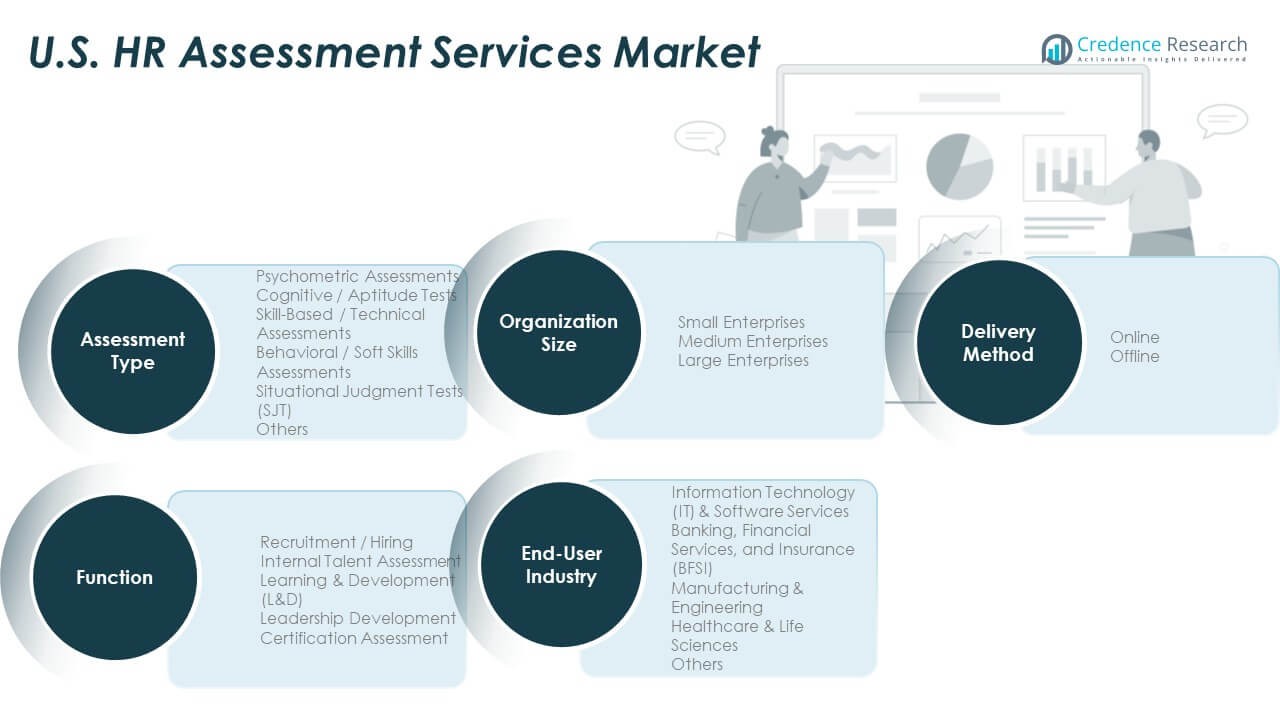

Market Segmentation Analysis:

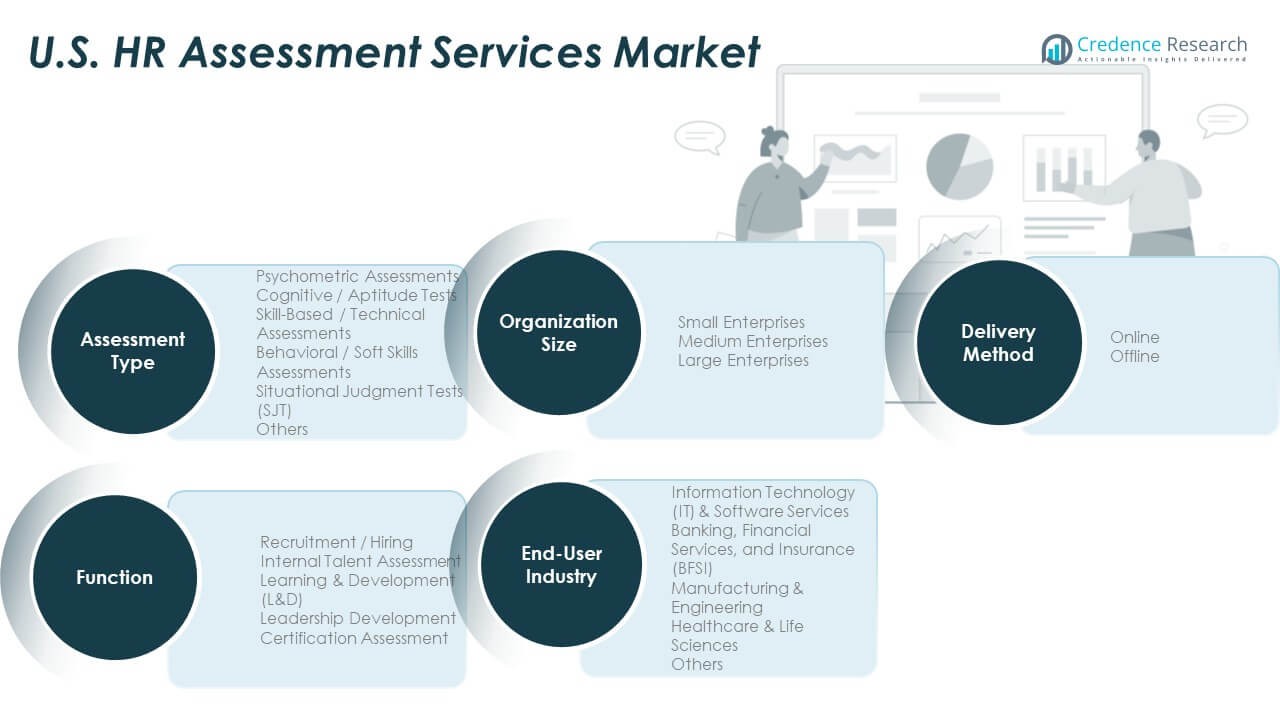

By Assessment Type

The U.S. HR Assessment Services Market includes diverse assessment formats tailored to different organizational needs. Psychometric and cognitive tests dominate due to their accuracy in evaluating personality traits and problem-solving skills. Skill-based and technical assessments are gaining traction among IT, engineering, and manufacturing employers to validate core competencies. Behavioural and soft skill evaluations play a vital role in leadership and team-based hiring. Situational judgment tests are increasingly used to measure practical decision-making under workplace scenarios. Other customized assessments address industry-specific roles and niche job functions. This diversification enhances precision and adaptability in workforce evaluation.

- For instance, Korn Ferry platforms have administered more than 100 million cognitive, psychometric, and skills-based tests globally across its history, including use among STEM and engineering employers to evaluate job fit with validated predictive scoring.

By Delivery Method

Online assessments hold a dominant share supported by flexibility, scalability, and cost efficiency. The digital mode allows remote hiring, faster feedback, and AI-based analytics for better insights. Offline methods remain relevant in industries emphasizing in-person supervision and practical skill verification. It reflects a balanced approach, with hybrid models gaining preference for large-scale recruitment and internal training.

- For instance, in the first half of 2024, HireVue and similar AI assessment solutions facilitated millions of interviews and assessments for enterprises across various sectors, not just U.S. tech and finance. For its verified clients, the use of these AI tools has resulted in documented reductions in time-to-hire.

By End-User Industry

IT and software services lead adoption due to constant demand for high-skilled professionals. BFSI and healthcare sectors rely on assessments for compliance, integrity, and cognitive accuracy. Manufacturing and engineering industries prioritize skill-based testing, while emerging sectors adopt customized solutions for evolving job roles.

By Function and Organization Size

Recruitment and internal talent assessment remain core applications, followed by learning, leadership, and certification uses. Large enterprises dominate usage, though adoption among small and medium enterprises is expanding with affordable digital platforms. The market reflects growing integration across all organizational tiers.

Segmentation:

By Assessment Type

- Psychometric Assessments

- Cognitive / Aptitude Tests

- Skill-Based / Technical Assessments

- Behavioural / Soft Skills Assessments

- Situational Judgment Tests (SJT)

- Others

By Delivery Method

By End-User Industry

- Information Function (IT) & Software Services

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing & Engineering

- Healthcare & Life Sciences

- Others

By Function

- Recruitment / Hiring

- Internal Talent Assessment

- Learning & Development (L&D)

- Leadership Development

- Certification Assessment

By Organization Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Regional Analysis:

Dominance of Western U.S. in HR Assessment Adoption

The western region holds the largest share of the U.S. HR Assessment Services Market, accounting for nearly 35% of the total revenue. California leads due to the presence of major technology firms and innovation-driven HR practices. The high concentration of startups and corporate headquarters promotes early adoption of AI-based and psychometric assessment tools. The region’s focus on remote workforce management and digital recruitment supports continued expansion. It benefits from strong investment in HR technology infrastructure and access to advanced analytics solutions. Major cities like San Francisco, Seattle, and Los Angeles drive demand for scalable online platforms that improve hiring precision and reduce operational costs.

Strong Market Presence Across the Northeastern and Midwestern Regions

The northeastern region captures about 28% of the market share, driven by its financial, healthcare, and educational institutions. States such as New York, Massachusetts, and Pennsylvania are key adopters of data-driven HR solutions. These industries require continuous evaluation to ensure compliance, productivity, and leadership development. The U.S. HR Assessment Services Market continues to expand in this region with the integration of behavioral and cognitive testing tools. The midwestern region follows closely with a 22% share, supported by manufacturing, engineering, and service sectors focusing on workforce optimization. Urban centers like Chicago and Detroit are investing in hybrid assessment models to manage growing remote and in-person workforce needs.

Emerging Growth in Southern States and Rural Workforce Regions

The southern region holds nearly 15% of the market share and is emerging as a high-growth area due to increasing enterprise digitalization. States like Texas, Florida, and Georgia are adopting online assessment platforms for large-scale recruitment. The growing presence of multinational firms and regional headquarters boosts demand for AI-based and scalable solutions. It reflects a shift toward performance-based assessment strategies and leadership evaluation. Expanding infrastructure, improved internet accessibility, and workforce training programs support adoption in semi-urban and rural areas. This regional diversification strengthens the national footprint of HR assessment solutions and enhances overall market resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aon

- Korn Ferry

- SHL

- Hogan Assessments

- IBM (Kenexa)

- Mercer

- Oracle (Taleo)

- SAP (SuccessFactors)

- Criteria Corp

- The Predictive Index

- HireVue

- Modern Hire

Competitive Analysis:

The U.S. HR Assessment Services Market is highly competitive, driven by innovation and continuous digital transformation. Leading players such as Aon, Korn Ferry, SHL, Mercer, and Hogan Assessments dominate through strong product portfolios and advanced analytics capabilities. It emphasizes integration of AI, machine learning, and predictive models to enhance accuracy and candidate experience. Companies focus on mergers, partnerships, and regional expansion to strengthen market presence. The growing demand for customized, cloud-based assessment platforms fuels competition among technology-driven vendors. Pricing flexibility and solution scalability remain key differentiators across enterprises.

Recent Developments:

- In April 2025, Aon launched its People Insights talent assessment platform. This new product empowers organizations to streamline talent acquisition and development by integrating psychometric assessments and behavioral simulations, focusing on agility, curiosity, and learnability as core competencies for future workforce success.

- In November 2024, Korn Ferry announced the release of the “Talent Suite” platform and the R2 product launch for 2025. The suite provides comprehensive AI-driven assessments for skill acquisition, personalized leadership development, and seamless HRIS integrations, aiming to foster adaptable, high-performing teams and deliver real-time insight to accelerate hiring and development.

- In April 2025, SHL unveiled a data-driven talent mobility solution to reshape strategic HR decision-making, offering organizations analytics-backed workforce planning and insights to support ongoing transformation. Additionally, SHL continues to expand strategic partnerships, such as its collaboration with IBMs Kenexa platform for talent assessment continuity.

- On April 22, 2025, Hogan Assessments entered a strategic partnership with Coaching.com to integrate predictive personality assessment insights into executive coaching programs. In August 2025, Hogan’s distributor Assessment Systems was acquired by Mavie Work, boosting reach and complementing Hogan’s holistic approach to workforce health and psychology.

Report Coverage:

The research report offers an in-depth analysis based on assessment type, delivery method, end-user industry, function, and organization size. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing use of AI-driven assessments will enhance decision accuracy and candidate experience.

- Cloud-based assessment platforms will dominate corporate recruitment processes nationwide.

- Integration of behavioral analytics will strengthen leadership and performance evaluations.

- Demand from small and medium enterprises will expand through affordable digital tools.

- Hybrid assessment formats combining online and in-person testing will gain wider acceptance.

- Industry-specific customization will emerge as a key differentiator for assessment providers.

- Emotional intelligence and personality evaluation tools will see growing adoption in HR functions.

- Strategic partnerships among HR tech firms and analytics providers will accelerate innovation.

- Focus on workforce upskilling and continuous evaluation will create recurring revenue streams.

- Expansion across southern and midwestern states will support nationwide market penetration.