Market Overview

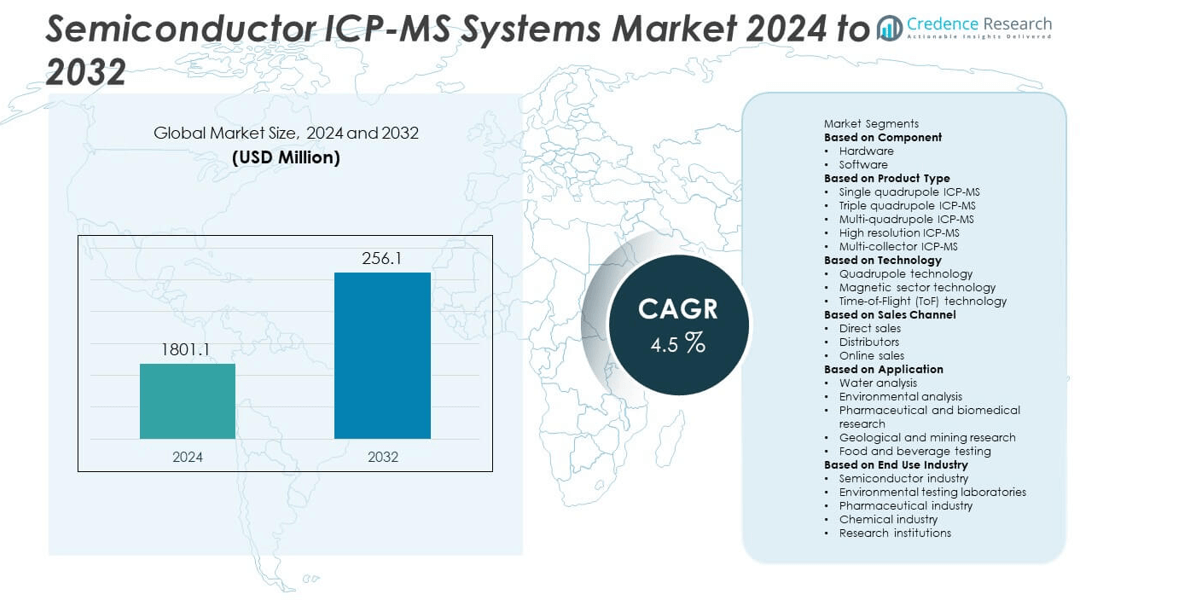

The Semiconductor ICP-MS Systems Market was valued at USD 180.1 million in 2024 and is anticipated to reach USD 256.1 million by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor ICP-MS Systems Market Size 2024 |

USD 180.1 million |

| Semiconductor ICP-MS Systems Market, CAGR |

4.5% |

| Semiconductor ICP-MS Systems Market Size 2032 |

USD 256.1 million |

The Semiconductor ICP-MS Systems Market grows with increasing demand for high-purity semiconductor materials and precise elemental analysis. It benefits from adoption in advanced semiconductor manufacturing, ensuring contamination control and quality assurance. Rising applications in power devices, memory chips, and microelectronics drive system deployment.

The Semiconductor ICP-MS Systems Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to advanced semiconductor manufacturing infrastructure, high R&D investment, and early adoption of cutting-edge technologies. Europe follows, supported by robust industrial bases and stringent quality standards. Asia-Pacific experiences rapid growth driven by expanding semiconductor fabrication facilities in China, Taiwan, South Korea, and Japan, catering to increasing demand for consumer electronics and automotive chips. Latin America and the Middle East & Africa witness gradual adoption, focused on industrial applications and academic research. Key players shaping the market include Thermo Fisher Scientific Inc., Agilent Technologies Inc., PerkinElmer Inc., and Shimadzu Corporation, all offering high-sensitivity systems and innovative solutions. These companies focus on enhancing detection limits, throughput, and automation capabilities, positioning themselves as leading providers in global semiconductor analysis and quality assurance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Semiconductor ICP-MS Systems Market was valued at USD 180.1 million in 2024 and is expected to reach USD 256.1 million by 2032, growing at a CAGR of 4.5%.

- Rising adoption of advanced consumer electronics, IoT devices, and electric vehicles drives demand for precise semiconductor analysis and quality control.

- Increasing need for high-sensitivity detection of trace metals and impurities supports market expansion across semiconductor fabrication and R&D sectors.

- Advancements in miniaturization, automation, and high-throughput ICP-MS technologies enable faster and more accurate semiconductor testing.

- The market faces challenges from high capital expenditure for equipment, complex maintenance requirements, and skilled workforce limitations.

- North America and Europe dominate the market due to strong semiconductor industries, while Asia-Pacific shows rapid growth with increasing chip manufacturing capacity. Latin America and the Middle East & Africa see gradual adoption for industrial and research applications.

- Key players such as Thermo Fisher Scientific Inc., Agilent Technologies Inc., PerkinElmer Inc., and Shimadzu Corporation focus on product innovation, strategic collaborations, and expanding service networks to strengthen competitive positioning globally.

Market Drivers

Growing Need for Trace Metal Detection in Semiconductor Manufacturing

The Semiconductor ICP-MS Systems Market grows through rising demand for ultra-trace metal detection in chip fabrication. Advanced semiconductors require impurity control at parts-per-trillion levels to ensure performance. It enables manufacturers to detect contaminants in chemicals, gases, and wafers with high precision. Increasing complexity of nodes at 5nm and 3nm strengthens the need for robust analysis. ICP-MS systems help reduce defect rates and enhance device reliability. Semiconductor producers expand investments in such systems to safeguard product quality.

- For instance, Agilent Technologies introduced the 8900 Triple Quadrupole ICP-MS, achieving detection limits below 1 ppt for 60+ elements, helping fabs improve wafer yield consistency.

Rising Adoption of Advanced Process Nodes and Miniaturization

Shrinking geometries in semiconductor devices increase sensitivity to impurities. The Semiconductor ICP-MS Systems Market benefits from process nodes requiring advanced contamination monitoring. It supports higher throughput testing of wafers, slurries, and etchants used in advanced packaging. Miniaturized devices demand stricter control of raw materials and process fluids. ICP-MS systems deliver faster analysis times with lower detection limits. Their ability to monitor multiple elements simultaneously strengthens adoption among leading fabs.

- For instance, Thermo Fisher Scientific offers specialized ICP-MS solutions, such as the iCAP TQs ICP-MS launched in 2018, to meet the stringent quality control and monitoring needs of advanced semiconductor manufacturing, including processes for smaller nodes like 3nm. These high-performance instruments can analyze trace elements and impurities at ultra-trace (parts-per-trillion and sub-parts-per-trillion) levels, enabling fabs to ensure high yield and product reliability.

Expansion of Semiconductor Applications Across High-Growth Sectors

Demand from automotive electronics, 5G infrastructure, and consumer electronics drives semiconductor production. The Semiconductor ICP-MS Systems Market supports this expansion by providing reliable contamination monitoring. It enables consistent quality in chips used for safety-critical automotive systems and high-speed data applications. Growth in electric vehicles requires power semiconductors with precise material integrity. ICP-MS ensures control over raw materials critical to wide bandgap semiconductors like SiC and GaN. This diversification of applications creates strong growth opportunities for system providers.

Stronger Focus on Regulatory Compliance and Yield Improvement

Governments and industry bodies enforce strict standards for contamination in semiconductor processes. The Semiconductor ICP-MS Systems Market aligns with these requirements by offering tools that achieve ultra-low detection levels. It helps fabs meet compliance for chemical purity and cleanroom standards. Yield improvement remains a key driver, as ICP-MS reduces costly scrap by detecting impurities early. It supports competitive advantage for manufacturers operating at tight margins. Growing focus on sustainable and efficient semiconductor production further boosts demand.

Market Trends

Adoption of High-Sensitivity and Low-Detection Limit Systems

Manufacturers demand advanced tools capable of detecting impurities at sub-parts-per-trillion levels. The Semiconductor ICP-MS Systems Market adapts with systems offering enhanced sensitivity and accuracy. It supports next-generation semiconductor devices where even trace contamination impacts performance. Vendors develop instruments that combine faster analysis with multi-element detection. High-sensitivity systems reduce production risks and improve chip reliability. This trend ensures stronger adoption in fabs producing advanced nodes.

- For instance, PerkinElmer’s NexION 5000 ICP-MS system demonstrated detection limits as low as 0.1 ppt for critical metals such as Na, K, and Ca, with the ability to scan 80 elements in under 60 seconds, ensuring reliable control of ultra-pure semiconductor chemicals.

Integration of Automation and Real-Time Monitoring Features

Automation is becoming essential in semiconductor manufacturing to improve efficiency. The Semiconductor ICP-MS Systems Market reflects this trend through systems equipped with automated sample handling and monitoring. It reduces human error and ensures consistent test results. Real-time monitoring capabilities allow fabs to detect impurities during production rather than post-process. Automated workflows also lower operational costs and improve throughput. These advancements align with the industry’s push toward smart manufacturing.

- For instance, Horiba Scientific offers automation-ready analytical platforms, such as ICP-OES spectrometers and particle analyzers, which incorporate robotic liquid handling and software for data integration. These features are designed to improve efficiency and reduce manual handling in semiconductor manufacturing, thereby helping to improve fab yield consistency.

Growing Role of Hybrid and Multi-Modal Analysis Techniques

Complex semiconductor processes require more than traditional detection methods. The Semiconductor ICP-MS Systems Market responds with hybrid solutions that integrate ICP-MS with techniques like ICP-OES or TOF-MS. It enables cross-verification and deeper analysis of critical process chemicals and gases. Multi-modal systems strengthen confidence in impurity control across fabs. Vendors emphasize innovation in combining complementary technologies to meet diverse testing needs. This trend supports broad adoption across high-volume and specialty semiconductor manufacturers.

Emphasis on Sustainability and Resource Efficiency

Semiconductor manufacturers focus on reducing environmental impact and resource consumption. The Semiconductor ICP-MS Systems Market adapts with tools that minimize argon gas consumption and optimize sample usage. It supports greener operations without compromising precision. Vendors also highlight equipment with lower power requirements and longer service life. Sustainability goals encourage adoption of efficient systems that align with global environmental standards. This focus enhances competitiveness while addressing regulatory and customer-driven sustainability expectations.

Market Challenges Analysis

High Equipment Cost and Complexity in Implementation

The Semiconductor ICP-MS Systems Market faces challenges due to the high cost of instruments and their complex setup. It requires significant capital investment, making adoption difficult for smaller fabs and research labs. Maintenance costs and the need for specialized infrastructure further increase the financial burden. The precision of these systems also demands skilled operators, creating a barrier for companies with limited expertise. Complex calibration procedures and long training cycles add to operational inefficiencies. Vendors must address these issues by developing cost-effective and user-friendly solutions to ensure wider accessibility.

Supply Chain Constraints and Skilled Workforce Shortage

Global supply chain disruptions limit timely availability of components essential for ICP-MS systems. The Semiconductor ICP-MS Systems Market is highly sensitive to delays in semiconductor-grade parts, advanced detectors, and high-purity gases. It creates risks for fabs relying on continuous impurity monitoring. Another challenge is the shortage of trained professionals capable of managing advanced analytical systems. This workforce gap reduces efficiency and increases downtime during troubleshooting. The industry must strengthen supply chain resilience and invest in specialized training programs to sustain growth and operational stability.

Market Opportunities

Rising Demand from Advanced Semiconductor Manufacturing Processes

The Semiconductor ICP-MS Systems Market gains opportunities from the increasing need for ultra-trace metal analysis in advanced semiconductor nodes. It supports manufacturers producing chips below 7nm where even minor contamination impacts yield and performance. Expanding use of 5G devices, AI accelerators, and high-performance computing increases the need for precise impurity detection. Vendors that provide systems with higher sensitivity and faster throughput secure competitive advantage. Integration of ICP-MS into fab monitoring processes enhances quality control. This creates strong opportunities for solutions aligned with advanced technology nodes.

Expanding Applications in Emerging Industries and Regional Growth

Opportunities in the Semiconductor ICP-MS Systems Market are strengthened by adoption across new industries and geographies. It plays a key role in electric vehicles, medical electronics, and IoT devices where reliability depends on contamination-free chips. Growth in Asia-Pacific, particularly in China, South Korea, and Taiwan, boosts demand for high-capacity monitoring systems. North America and Europe also offer potential through government-backed semiconductor initiatives and new fab construction. Vendors can expand market presence by offering localized service, training, and customization. This regional and cross-industry expansion reinforces long-term opportunities for ICP-MS system providers.

Market Segmentation Analysis:

By Component

The Semiconductor ICP-MS Systems Market is segmented into hardware, software, and services. Hardware holds the largest share as fabs require high-precision analyzers, sample introduction systems, and detectors to perform contamination monitoring. It drives investments in advanced instruments capable of ppt and sub-ppt detection. Software solutions gain traction as manufacturers demand real-time data analysis, automation, and integration with fab monitoring systems. Services, including calibration, maintenance, and training, ensure consistent performance and compliance with semiconductor industry standards. The market expands across all three components as semiconductor manufacturers emphasize both precision and operational reliability.

- For instance, Agilent Technologies’ 8900 ICP-QQQ system demonstrated sub-ppt detection of arsenic and selenium in semiconductor-grade sulfuric acid, achieving throughput of 120 samples per hour, while its software platform integrates directly with fab MES (Manufacturing Execution Systems) for automated reporting.

By Product Type

The market is categorized into single quadrupole ICP-MS and triple quadrupole ICP-MS systems. Single quadrupole systems remain popular for routine trace metal analysis in ultra-pure water and process chemicals. They offer reliable performance for fabs managing legacy and mid-range nodes. Triple quadrupole systems are gaining momentum with advanced nodes at 7nm, 5nm, and below, where ultra-trace analysis is critical to maintain yields. These systems provide superior interference removal, high sensitivity, and support for complex matrices. The Semiconductor ICP-MS Systems Market benefits from growing demand for triple quadrupole models as miniaturization and advanced packaging continue to accelerate.

- For instance, Thermo Fisher Scientific’s iCAP TQ ICP-MS achieved detection limits of 0.2 ppt for 40 elements in semiconductor-grade hydrofluoric acid, reducing analysis cycle time to under 2 minutes per sample, making it a preferred choice for fabs transitioning to sub-5nm processes.

By Technology

The Semiconductor ICP-MS Systems Market is segmented by technology into collision/reaction cell ICP-MS, sector field ICP-MS, and time-of-flight ICP-MS. Collision/reaction cell systems dominate adoption due to their ability to eliminate spectral interferences during ultra-pure water and chemical analysis. Sector field ICP-MS offers high-resolution capabilities, supporting research and development environments where precision is critical. Time-of-flight ICP-MS provides fast, multi-element detection, making it ideal for high-throughput fab operations. It ensures faster contamination monitoring while reducing delays in semiconductor production. Vendors focus on improving detection limits, throughput, and automation across these technologies to address growing complexity in semiconductor manufacturing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Component

Based on Product Type

- Single quadrupole ICP-MS

- Triple quadrupole ICP-MS

- Multi-quadrupole ICP-MS

- High resolution ICP-MS

- Multi-collector ICP-MS

Based on Technology

- Quadrupole technology

- Magnetic sector technology

- Time-of-Flight (ToF) technology

Based on Sales Channel

- Direct sales

- Distributors

- Online sales

Based on Application

- Water analysis

- Environmental analysis

- Pharmaceutical and biomedical research

- Geological and mining research

- Food and beverage testing

Based on End Use Industry

- Semiconductor industry

- Environmental testing laboratories

- Pharmaceutical industry

- Chemical industry

- Research institutions

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Semiconductor ICP-MS Systems Market with an estimated market share of 33% in 2024. The region benefits from a strong presence of semiconductor manufacturing hubs in the U.S., including California, Texas, and Arizona. Leading fabs demand ultra-trace contamination monitoring for high-volume production of advanced nodes. The adoption of single and triple quadrupole ICP-MS systems is extensive in North America due to requirements for high sensitivity and interference-free analysis. Vendors invest in local support infrastructure, training programs, and calibration services to maintain operational reliability. The presence of key market players like Agilent Technologies and Thermo Fisher Scientific ensures rapid deployment of new technologies. High R&D investment in nanotechnology and semiconductor packaging further drives system upgrades. North American fabs emphasize automation and real-time monitoring, making the region a critical growth driver globally.

Europe

Europe contributes an estimated 24% market share, driven by countries such as Germany, France, and the Netherlands. Semiconductor fabs focus on advanced automotive, industrial, and consumer electronics applications, requiring precise contamination control. The Semiconductor ICP-MS Systems Market in Europe benefits from stringent environmental and quality standards in production. Vendors emphasize sector field ICP-MS and collision/reaction cell technologies to meet high-resolution analysis needs. Europe also supports sustainable manufacturing initiatives, with fabs integrating real-time monitoring to reduce waste and chemical consumption. Companies like Bruker and Analytik Jena provide local services and application support, which strengthens adoption. Growing investment in R&D for automotive chips and power electronics expands the market further.

Asia-Pacific

Asia-Pacific holds a 28% market share, representing the fastest-growing region due to large-scale semiconductor manufacturing in Taiwan, South Korea, Japan, and China. The region drives demand for triple quadrupole ICP-MS systems for advanced nodes below 7nm, supporting AI, 5G, and high-performance computing applications. Local fabs require high-throughput, interference-free systems to maintain yield and process efficiency. Major suppliers establish regional offices and training centers to support growth. Rising investment in wafer fabrication and foundries strengthens the Semiconductor ICP-MS Systems Market. Adoption of automated sample preparation and real-time monitoring improves operational efficiency. Government incentives and industrial expansion in electronics manufacturing further accelerate system demand.

Latin America

Latin America accounts for approximately 8% of the market, with Brazil and Mexico leading adoption. Semiconductor fabs in the region focus on quality control for memory, sensors, and consumer electronics chips. Companies prefer cost-effective single quadrupole ICP-MS systems for routine trace metal analysis. Local vendors and service providers supply maintenance, calibration, and application support to ensure system reliability. Growing industrial electronics manufacturing and educational research initiatives drive system adoption. The region shows gradual growth due to increasing investments in automation and technology upgrades.

Middle East & Africa

The Middle East & Africa contribute around 7% of the Semiconductor ICP-MS Systems Market. Israel, UAE, and South Africa lead adoption through emerging semiconductor manufacturing and research facilities. Fabs require robust and reliable systems for contamination analysis to meet quality and compliance standards. Vendors provide remote support, on-site training, and preventive maintenance to ensure consistent performance. Investments in smart manufacturing, electronics R&D, and government-backed industrial initiatives further drive system deployment. The region demonstrates steady growth with increasing focus on localized production and advanced semiconductor applications.

Key Player Analysis

Competitive Analysis

Competitive landscape of the Semiconductor ICP-MS Systems Market includes Thermo Fisher Scientific Inc., Agilent Technologies Inc., PerkinElmer Inc., Horiba Scientific, Analytik Jena (A Xylem Brand), Shimadzu Corporation, SPECTRO Analytical Instruments (AMETEK Group), E2V Technologies (Teledyne Technologies), JEOL Ltd., and Hitachi High-Technologies Corporation. These companies focus on developing high-precision, high-throughput ICP-MS instruments tailored for semiconductor applications. They invest heavily in research and development to enhance detection limits, sensitivity, and sample throughput. Product innovation emphasizes automation, compact design, and integration with advanced software for data analysis and quality control. Strategic partnerships with semiconductor manufacturers and research institutions strengthen their market presence and accelerate adoption. Companies expand regional operations to serve emerging markets in Asia-Pacific, Latin America, and the Middle East & Africa. Emphasis on customer support, maintenance services, and training programs enhances client retention. Continuous improvements in instrument accuracy, multi-element detection capabilities, and compatibility with next-generation semiconductor processes maintain competitive advantage. Through targeted acquisitions and collaborations, these key players consolidate technology expertise and broaden product portfolios, ensuring leadership in the evolving semiconductor ICP-MS systems market.

Recent Developments

- In June2025, Hitachi High‑Technologies awarded for its Chemicals Informatics (CI) AI-powered cloud service, recognized for accelerating materials discovery and reducing CO₂ emissions—this supports advanced materials analysis including those used in ICP‑MS systems

- In April 2025, Hitachi High‑Tech (Analysis) integrated its Analytical Science and Science divisions to form Hitachi High‑Tech Analysis Corporation, combining technologies across ICP, XRF, OES, and more to support complex semiconductor inspection needs.

- In March 2025, Hitachi High‑Technologies Corporation completed its new semiconductor equipment production facility in Kasado (Yamaguchi), aiming to digitalize and automate production of etch systems used in semiconductor manufacturing.

- In March 2025, Thermo Fisher Scientific Inc. introduced the Vulcan™ Automated Lab, integrating robotic sample handling and AI‑enhanced instrumentation to boost productivity and yield in semiconductor labs.

Report Coverage

The research report offers an in-depth analysis based on Component, Product Type, Technology, Sales Channel, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as advanced semiconductor nodes require ultra-trace contamination control.

- High-resolution ICP-MS systems will gain adoption to support precision in chip manufacturing.

- Automation and real-time monitoring will become standard in semiconductor fabrication facilities.

- Integration with AI and analytics will improve detection accuracy and speed in production lines.

- Energy-efficient and compact systems will align with cleanroom and sustainability requirements.

- Modular designs will expand to provide flexibility for different stages of semiconductor processes.

- Growth in semiconductor fabrication hubs across Asia-Pacific will strengthen global adoption.

- Foundries will increasingly invest in multi-modal ICP-MS platforms for comprehensive screening.

- Rising semiconductor use in AI, automotive, and IoT will sustain long-term market growth.

- Regulatory compliance and stricter quality standards will drive system upgrades and replacements.