Market Overview

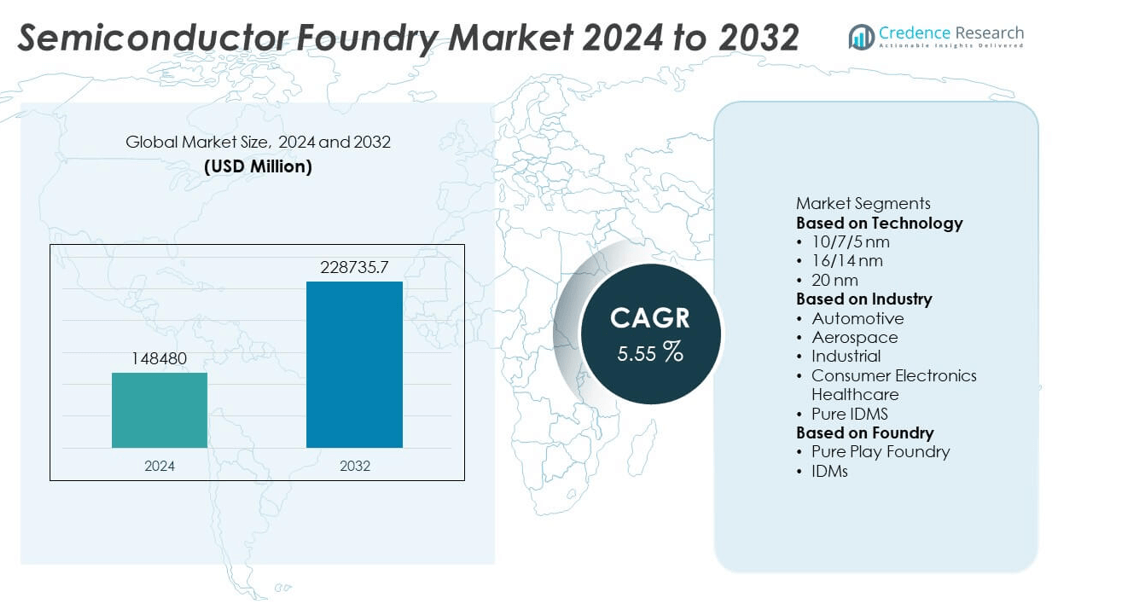

The Semiconductor Foundry Market was valued at USD 148,480 million in 2024 and is anticipated to reach USD 228,735.7 million by 2032, growing at a CAGR of 5.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Foundry Market Size 2024 |

USD 148,480 million |

| Semiconductor Foundry Market, CAGR |

5.55% |

| Semiconductor Foundry Market Size 2032 |

USD 228,735.7 million |

The Semiconductor Foundry Market grows through strong demand for advanced consumer electronics, automotive electronics, and emerging technologies such as AI and 5G. Foundries expand capacity for advanced process nodes, including 5nm and 3nm, to meet miniaturization and performance needs.

The Semiconductor Foundry Market demonstrates strong geographical presence across Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific dominates due to its large-scale manufacturing hubs in Taiwan, South Korea, China, and Japan, where major players lead advancements in advanced node technologies and high-volume production. North America shows strong momentum, supported by robust investments in R&D, government-backed initiatives for supply chain resilience, and demand from industries such as aerospace, defense, and advanced computing. Europe maintains steady growth through its focus on automotive semiconductors, renewable energy applications, and industrial automation. Latin America and the Middle East & Africa gradually expand their roles through industrial diversification and digital infrastructure development. Key players shaping the competitive landscape include Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Samsung Group, United Microelectronics Corporation (UMC), and Semiconductor Manufacturing International Corporation (SMIC), all of whom emphasize innovation, scale, and advanced packaging capabilities to maintain leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Semiconductor Foundry Market was valued at USD 148,480 million in 2024 and is projected to reach USD 228,735.7 million by 2032, growing at a CAGR of 5.55% during the forecast period.

- Strong demand from consumer electronics, automotive, and IoT devices fuels market growth as foundries deliver advanced chips for performance, energy efficiency, and miniaturization.

- Trends highlight the adoption of advanced process nodes such as 5nm and 3nm, heterogeneous integration, and 3D architectures, along with rising focus on sustainable and green manufacturing.

- The competitive landscape is shaped by leading players including TSMC, Samsung, UMC, SMIC, and GlobalFoundries, who invest in capacity expansion, advanced lithography, and innovative packaging solutions.

- High capital investment, complexity of advanced nodes, supply chain disruptions, and shortage of skilled professionals act as restraints that challenge broader adoption and capacity expansion.

- Asia-Pacific dominates with large manufacturing hubs in Taiwan, South Korea, China, and Japan, while North America and Europe expand through innovation, R&D, and automotive-focused demand.

- Latin America and the Middle East & Africa show gradual growth supported by industrial diversification, renewable energy adoption, and government initiatives to develop regional semiconductor infrastructure.

Market Drivers

Rising Demand for Advanced Consumer Electronics and IoT Devices

The Semiconductor Foundry Market grows with the increasing adoption of smartphones, tablets, wearables, and smart home devices. Foundries supply advanced chips that support higher performance, energy efficiency, and compact form factors. It enables integration of processors, sensors, and connectivity features into smaller devices. Consumer expectations for faster speeds and seamless experiences drive demand for leading-edge process nodes. The surge in IoT devices requires chips that balance low power consumption with connectivity. This demand continues to push foundries toward advanced lithography and miniaturization technologies.

- For instance, TSMC manufactured billions of advanced 3nm and 5nm wafers to serve demand for high-performance computing, smartphones, and IoT devices. The Apple A17 Pro processor, which contains 19 billion transistors, was produced on TSMC’s 3nm process and powers devices like the iPhone 15 Pro and iPhone 15 Pro Max. This market demand continues to push foundries toward advanced lithography and miniaturization technologies.

Expansion of Automotive Electronics and Electric Vehicles

The automotive industry accelerates semiconductor demand for infotainment, safety, and driver-assistance systems. The Semiconductor Foundry Market benefits as electric vehicles rely on advanced power devices and microcontrollers. It supports chip production for battery management, navigation, and autonomous driving technologies. Automakers seek reliable foundry partners that deliver consistent quality and scalability. Foundries respond with solutions designed for harsh automotive environments and long product lifecycles. The growth of EVs reinforces the role of foundries in powering sustainable mobility.

- For instance, In 2023, GlobalFoundries reported its automotive revenue surpassed $1 billion, tripling year-over-year. This significant growth was driven by demand for its automotive-qualified chips, such as MCUs, highlighting the foundry’s key role in supplying semiconductors for EVs and powering sustainable mobility.

Strong Growth in AI, 5G, and High-Performance Computing

Artificial intelligence, 5G networks, and data centers create strong demand for high-performance semiconductors. The Semiconductor Foundry Market supports advanced processors, GPUs, and memory chips required for these applications. It enables production of chips that handle high bandwidth, low latency, and energy efficiency. Foundries expand capacity for advanced nodes such as 5nm and 3nm to meet technology demands. Cloud computing and big data analytics further fuel requirements for scalable and efficient semiconductor solutions. Continuous investments in R&D strengthen foundries’ ability to deliver cutting-edge chips.

Rising Adoption of Outsourcing Models Across Industries

Companies without in-house fabrication turn to foundries for cost-effective and scalable chip production. The Semiconductor Foundry Market benefits from this outsourcing trend, as more firms rely on specialized manufacturing partners. It allows fabless companies to focus on design and innovation while leveraging foundry expertise. Outsourcing reduces capital expenditure and shortens time-to-market for new products. Foundries expand service portfolios to include advanced packaging and testing for integrated solutions. This model ensures long-term demand from both established and emerging technology players.

Market Trends

Shift Toward Advanced Process Nodes and Miniaturization

Manufacturers demand smaller, faster, and more energy-efficient chips to support next-generation technologies. The Semiconductor Foundry Market responds with investments in advanced nodes such as 5nm, 3nm, and ongoing development of 2nm. It enables higher transistor density and better performance in compact designs. This trend supports applications in AI, 5G, and advanced consumer electronics. Foundries enhance lithography and etching techniques to achieve precision at smaller geometries. Continuous innovation in miniaturization ensures competitive advantages for leading players.

- For instance, In 2024, TSMC began risk production of its next-generation 2nm process. This follows its 3nm output in 2023, which was used for chips like Apple’s A17 Pro. Nvidia’s H100 GPU, which has 80 billion transistors, was produced earlier using TSMC’s 4N process

Integration of Heterogeneous Packaging and 3D Architectures

Advanced packaging technologies gain traction to meet demand for higher functionality in smaller footprints. The Semiconductor Foundry Market evolves with 3D stacking, system-in-package, and heterogeneous integration solutions. It allows combination of memory, logic, and sensors in a single chip package. These approaches improve efficiency, reduce power consumption, and strengthen performance in multifunctional devices. Foundries develop capabilities that support advanced interconnect density and thermal management. This trend positions packaging innovations as a key differentiator in the industry.

- For instance, Samsung’s X-Cube is a 3D integrated circuit (IC) packaging technology for high-performance applications. It stacks components like memory (SRAM) vertically with logic to boost performance and reduce size, particularly for high-performance computing (HPC) and artificial intelligence (AI).

Rising Focus on Sustainability and Green Manufacturing

Sustainability goals drive foundries to adopt energy-efficient processes and eco-friendly practices. The Semiconductor Foundry Market reflects this trend with reduced water and chemical usage in fabrication. It emphasizes carbon-neutral initiatives and recycling technologies to minimize environmental impact. Leading foundries invest in renewable energy sources for operations. Customers demand greener supply chains, pushing vendors to meet strict standards. Sustainable manufacturing strengthens long-term competitiveness and regulatory compliance across regions.

Expansion of Regional Manufacturing Hubs and Supply Chain Resilience

Geopolitical dynamics and supply chain risks drive investments in local semiconductor facilities. The Semiconductor Foundry Market adapts by expanding regional manufacturing hubs in Asia-Pacific, North America, and Europe. It reduces dependence on single-country supply chains and increases resilience. Governments support domestic production through subsidies and partnerships with leading foundries. These initiatives ensure secure access to critical chips for industries such as defense, automotive, and healthcare. Regional expansion reshapes global production networks and strengthens market stability.

Market Challenges Analysis

High Capital Investment and Rising Complexity of Advanced Nodes

The Semiconductor Foundry Market faces challenges due to the high costs of building and operating advanced fabs. It requires billions of dollars in investment for equipment, cleanroom facilities, and R&D to support nodes below 5nm. The increasing complexity of lithography, etching, and packaging technologies puts pressure on profitability. Smaller foundries struggle to keep pace with industry leaders due to financial and technical barriers. High entry costs limit competition and concentrate capabilities among a few large players. Balancing cost efficiency with innovation remains a critical challenge for sustainable growth.

Supply Chain Vulnerabilities and Workforce Shortages

Global supply chain disruptions highlight risks in sourcing raw materials, equipment, and critical components. The Semiconductor Foundry Market remains exposed to geopolitical tensions, export controls, and logistics constraints. It affects production timelines and delays product delivery across industries. Another significant challenge is the shortage of highly skilled engineers and technicians required for advanced semiconductor manufacturing. The workforce gap impacts operational efficiency and increases training requirements for foundries. Addressing these vulnerabilities is vital to maintaining global competitiveness and meeting growing demand.

Market Opportunities

Rising Demand from Emerging Technologies and New Applications

The Semiconductor Foundry Market gains opportunities from the rapid growth of artificial intelligence, 5G networks, and electric vehicles. It supports the development of advanced processors, power semiconductors, and RF devices that enable these technologies. Expanding use of edge computing, cloud infrastructure, and high-performance computing further drives demand for leading-edge nodes. Foundries that offer specialized processes for AI accelerators, automotive chips, and low-power IoT devices secure long-term contracts. Growing integration of semiconductors in healthcare devices and renewable energy systems also strengthens opportunities. This expansion across multiple industries enhances market resilience and scalability.

Expansion of Regional Manufacturing and Strategic Partnerships

Governments invest heavily in domestic semiconductor production to strengthen supply chain security. The Semiconductor Foundry Market benefits from subsidies, tax incentives, and partnerships aimed at boosting local manufacturing capacity. It creates opportunities for foundries to expand into North America and Europe while reinforcing leadership in Asia-Pacific. Strategic collaborations with fabless companies, research institutes, and equipment providers accelerate innovation. Foundries that develop regional hubs and leverage cross-industry partnerships strengthen their customer base. This opportunity supports sustainable growth while reducing dependency on single-region supply chains.

Market Segmentation Analysis:

By Technology

The Semiconductor Foundry Market is segmented by technology into planar CMOS, FinFET, and FD-SOI processes. FinFET leads demand, driven by its ability to deliver high performance, low leakage, and power efficiency for advanced chips. It dominates applications in AI, 5G, and high-performance computing that require cutting-edge node production. Planar CMOS maintains relevance at larger nodes, supporting legacy and cost-sensitive applications in industrial and consumer electronics. FD-SOI gains traction due to its flexibility, lower power consumption, and suitability for IoT and automotive systems. It ensures foundries can serve both leading-edge and legacy markets through diversified technology offerings.

- For instance, GlobalFoundries (GF) manufactures FD-SOI wafers at its Dresden fab for low-power applications like IoT and automotive. As of early 2024, the Dresden facility had an annual capacity of 850,000 wafers, a figure that reflects the fab’s total capacity across all its nodes, not just FD-SOI. The FD-SOI technology is specifically beneficial for power-efficient chips in markets like automotive, 5G, and the Internet of Things.

By Industry

The Semiconductor Foundry Market serves industries such as consumer electronics, automotive, telecommunications, industrial, and healthcare. Consumer electronics generate the largest demand, supported by high-volume production of processors, memory, and sensors for smartphones and computing devices. Automotive applications are expanding as electric vehicles and driver-assistance systems require advanced chips for safety and energy management. Telecommunications demand rises with the global rollout of 5G and increasing network equipment requirements. Industrial and healthcare sectors add further growth, using foundry-manufactured semiconductors in automation systems, renewable energy, and medical imaging. It highlights the market’s ability to meet diverse and critical industry requirements.

- For instance, In 2023, Samsung shipped approximately 226.6 million smartphones, making it one of the top global brands despite a decline in shipments. STMicroelectronics’ silicon carbide (SiC) revenue in 2023 was $1.2 billion, which represented a 71% year-on-year increase and highlighted its strong position in this rapidly growing market.

By Foundry

The Semiconductor Foundry Market is categorized into pure-play foundries and integrated device manufacturers (IDMs) offering foundry services. Pure-play foundries dominate the landscape, with companies like TSMC and GlobalFoundries providing large-scale capacity for fabless semiconductor firms. It supports innovation by enabling fabless companies to focus on design while outsourcing fabrication. IDMs such as Samsung and Intel expand foundry services selectively to leverage advanced node capabilities and diversify revenue streams. This dual structure creates competition and collaboration, driving continuous investments in technology and capacity. The balance between pure-play and IDM models ensures market growth across global supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Technology

Based on Industry

- Automotive

- Aerospace

- Industrial

- Consumer Electronics Healthcare

- Pure IDMS

Based on Foundry

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for around 23% of the Semiconductor Foundry Market in 2024, reflecting its strong role in innovation and high-value semiconductor demand. The region benefits from a mature ecosystem that supports advanced computing, data centers, and aerospace applications. It also leads in design through numerous fabless companies that depend on foundry services for manufacturing. The United States drives growth with large-scale investments in next-generation nodes and government-backed initiatives to strengthen domestic semiconductor supply chains. Foundries in the region focus on delivering high-performance chips for AI, automotive, and defense applications. This emphasis ensures North America maintains a competitive edge despite reliance on global supply networks.

Europe

Europe holds about 15% of the Semiconductor Foundry Market in 2024, supported by its strong automotive and industrial base. The region demonstrates consistent demand for semiconductors used in electric vehicles, renewable energy systems, and industrial automation. Germany, France, and Italy lead adoption as they expand electronics integration into automotive platforms and manufacturing equipment. Foundries in Europe focus on specialized processes such as FD-SOI, which suits applications in IoT and low-power systems. Public initiatives, including the European Chips Act, encourage new capacity investments and partnerships with leading foundries. The region’s balanced approach to sustainability, innovation, and compliance strengthens its role in the global market.

Asia-Pacific

Asia-Pacific dominates with nearly 52% of the Semiconductor Foundry Market in 2024, making it the largest regional contributor. The region is home to global leaders such as TSMC, Samsung, and SMIC, which drive capacity for advanced nodes and legacy production alike. Taiwan and South Korea remain critical hubs, producing the majority of the world’s cutting-edge semiconductors. China expands rapidly, with growing investments in domestic foundry capacity to reduce reliance on imports. Japan adds strength with its expertise in specialty semiconductors and memory. Asia-Pacific’s dominance stems from large-scale production, skilled workforce availability, and government-backed initiatives that ensure continued leadership in global supply.

Latin America

Latin America contributes about 6% of the Semiconductor Foundry Market in 2024, reflecting gradual yet steady adoption. Brazil and Mexico anchor demand, supported by industrial growth, automotive production, and consumer electronics assembly. Foundry activity in the region focuses on collaboration with global players rather than local capacity dominance. Increasing foreign investments in digital infrastructure and industrial diversification support semiconductor demand. The region’s expanding role in automotive semiconductors provides long-term growth opportunities. Latin America’s smaller but stable share highlights its emerging potential in the global foundry landscape.

Middle East & Africa

The Middle East & Africa account for roughly 4% of the Semiconductor Foundry Market in 2024, making it the smallest regional contributor. Demand is driven by sectors such as telecommunications, oil and gas, and industrial automation. Countries in the Gulf Cooperation Council (GCC) invest heavily in technology diversification to reduce reliance on energy exports. South Africa contributes through industrial and renewable energy adoption, requiring advanced semiconductors for efficiency. Regional initiatives aim to build semiconductor research and production ecosystems, though capacity remains limited. Despite its small share, ongoing infrastructure projects and government-backed technology zones suggest steady progress over the forecast period.

Key Player Analysis

- STMicroelectronics NV

- United Microelectronics Corporation (UMC)

- TowerJazz (Tower Semiconductor Limited)

- Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- Samsung Group

- MagnaChip

- Semiconductor Manufacturing International Corporation (SMIC)

- Fujitsu Semiconductor Limited

- Foundries

- GlobalFoundries

Competitive Analysis

The competitive landscape of the Semiconductor Foundry Market is defined by Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Samsung Group, United Microelectronics Corporation (UMC), Semiconductor Manufacturing International Corporation (SMIC), GlobalFoundries, Fujitsu Semiconductor Limited, TowerJazz (Tower Semiconductor Limited), STMicroelectronics NV, MagnaChip, and Foundries. Market leadership is shaped by advancements in process nodes, large-scale capacity expansion, and integration of advanced packaging technologies. Leading-edge production below 5nm drives momentum in consumer electronics, AI, and 5G applications, while specialty technologies such as RF, power management, and mixed-signal solutions strengthen presence in automotive, industrial, and IoT sectors. Heavy investment in EUV lithography, sustainability initiatives, and smart manufacturing enhances competitiveness, with emphasis on energy-efficient and scalable production models. Strategic collaborations with fabless firms and system companies ensure resilience in global supply chains, while regional diversification supports supply security and reduced dependency on single hubs. Innovation, efficiency, and customer alignment remain the defining factors guiding competition across the foundry ecosystem.

Recent Developments

- In July 2025, TSMC delivered a record second-quarter profit with a 60% jump, driven by AI chip demand, and raised its 2025 revenue outlook by around 30%.

- In June 2025, GlobalFoundries Announced a USD 16 billion U.S. expansion plan, including investments in manufacturing and advanced packaging across New York and Vermont.

- In April 2025, UMC celebrated the grand opening of its Singapore fab expansion, expecting volume production to begin in 2026 and increasing total capacity to over 1 million wafers annually.

- In May 2024, STMicroelectronics announced a EUR 5 billion plan (with EUR 2 billion from Italy’s government via the EU Chips Act) to build the world’s first fully integrated 200 mm SiC power-device fab and testing campus in Catania, targeting start of production in 2026.

Report Coverage

The research report offers an in-depth analysis based on Technology, Industry, Foundry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Technology advancement will drive adoption of 2 nm and smaller nodes, enabling higher density and efficiency.

- Global foundry capacity will expand rapidly with multiple new fabrication plants starting construction worldwide.

- Demand for AI and high-performance computing workloads will push foundries to boost throughput.

- Sustainability initiatives will lead to greener manufacturing practices and reduced carbon emissions.

- Regional diversification will increase, with more fabs built in North America and Europe for supply chain resilience.

- Strong capital investments will continue, with long-term commitments to large-scale fabs through the next decade.

- Heterogeneous packaging and 3D integration will become standard, blending wafer fabrication with advanced packaging.

- Government incentives and subsidies will accelerate domestic foundry growth and innovation.

- Smart manufacturing will spread, integrating automation, robotics, and AI-driven predictive maintenance.

- Advanced-node leadership will shift toward gate-all-around and next-generation architectures for future competitiveness.