Market Overview

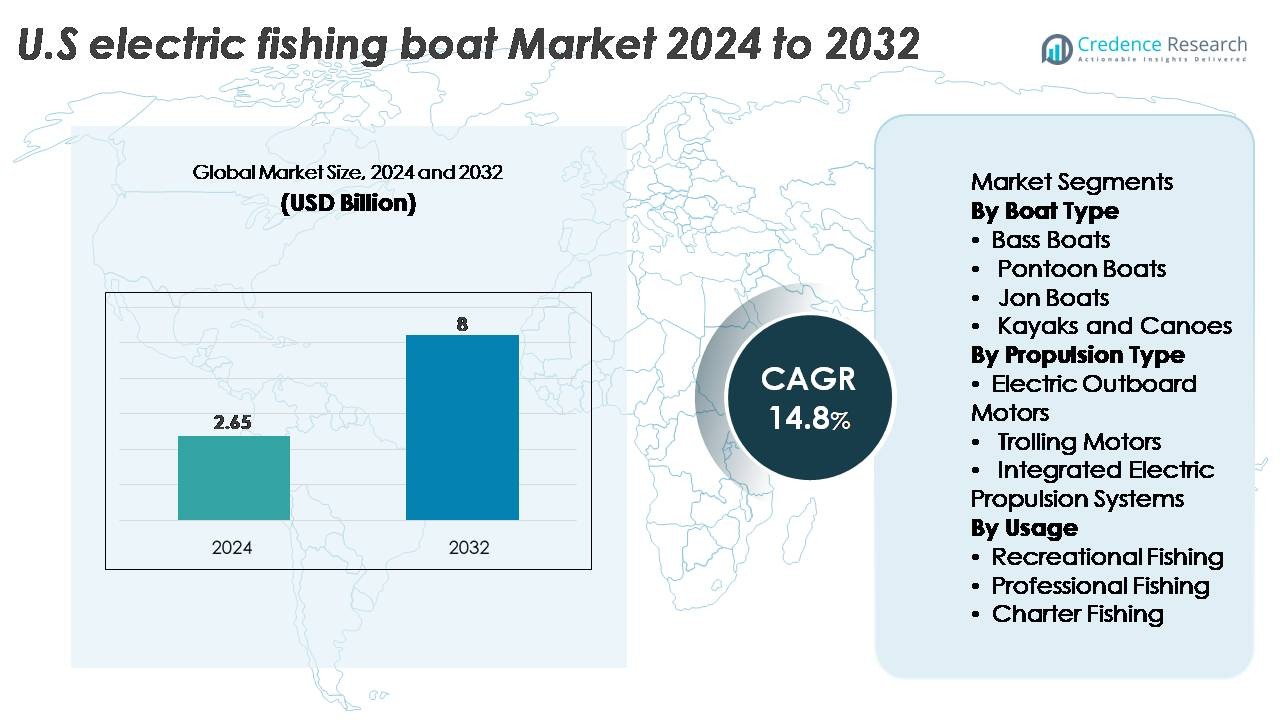

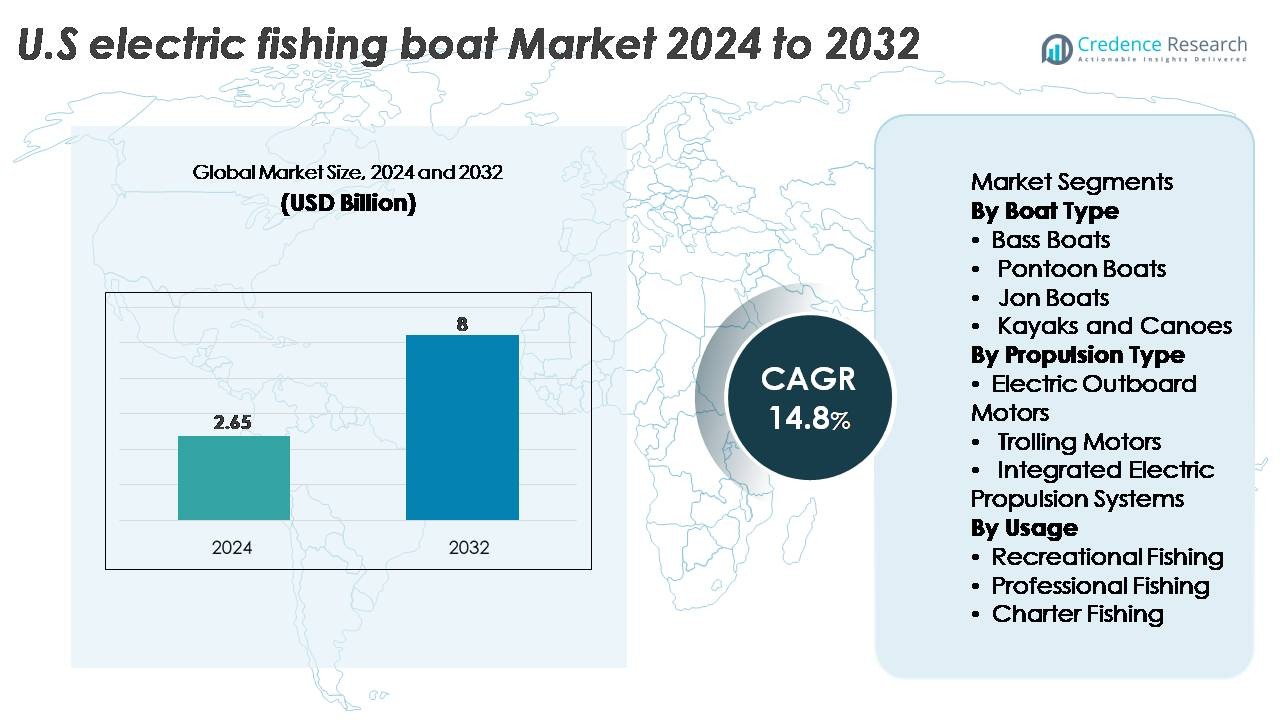

The U.S. electric fishing boat market was valued at USD 2.65 billion in 2024 and is projected to reach USD 8 billion by 2032, expanding at a CAGR of 14.8% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Electric Fishing Boat Market Size 2024 |

USD 2.65 Billion |

| U.S. Electric Fishing Boat Market, CAGR |

14.8% |

| U.S. Electric Fishing Boat Market Size 2032 |

USD 8 Billion |

The U.S. electric fishing boat market is shaped by a diverse group of leading manufacturers and technology innovators, including Greenline Yachts, Aquawatt Green Marine Technologies, Boesch Motorboote AG, Yamaha Motor Co., Ltd., Echandia Group AB, X Shore, Corvus Energy, Learboats USA, Inc., Grove Boats SA, and Torqeedo GmbH. These companies compete through advances in high-efficiency electric outboards, long-range battery systems, and lightweight hull designs tailored for freshwater angling. Regionally, the Midwest leads the market with a 33% share, driven by dense freshwater ecosystems and strong recreational fishing participation, followed by the South and Northeast with expanding adoption across lakes, reservoirs, and regulated waterways.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. electric fishing boat market reached USD 2.65 billion in 2024 and is projected to hit USD 8 billion by 2032, reflecting a 14.8% CAGR driven by rising recreational and eco-friendly boating adoption.

- Strong market drivers include growing demand for quiet, emission-free propulsion, expanding freshwater fishing participation, and rapid advancements in electric outboards and lithium-based battery systems that enhance thrust, range, and efficiency.

- Key trends center on lightweight composite hulls, smart navigation integration, telematics-based energy monitoring, and growing adoption of modular electric platforms across bass boats, pontoons, kayaks, and Jon boats, with bass boats holding the largest segment share.

- Competitive intensity increases as Torqeedo GmbH, Yamaha Motor Co., X Shore, Aquawatt, Greenline Yachts, and others expand high-performance motors, premium electric models, and integrated propulsion systems, though high upfront battery and system costs remain restraints.

- Regionally, the Midwest leads with 33% share, followed by the South at 28%, the Northeast at 24%, and the West at 15%, reflecting differences in lake density, regulations, and fishing culture.

Market Segmentation Analysis:

By Boat Type

Bass boats represent the dominant sub-segment in the U.S. electric fishing boat market, accounting for the largest share due to their widespread use in freshwater sport fishing tournaments and recreational angling. Their compact hulls, shallow-water maneuverability, and compatibility with high-thrust electric outboards make them the preferred choice for anglers seeking precision and stealth. Pontoon boats continue gaining traction for family-oriented fishing due to their spacious layouts, while Jon boats and electric kayaks grow steadily among budget-conscious and eco-focused users who value portability and low-maintenance operation.

- For instance, “Torqeedo’s Cruise 12.0 R electric outboard, delivering 12 kW of continuous powerand producing thrust comparable to a 25 hp combustion engine, is a high-efficiency motor with a strong torque profile. It is a popular electric motor choice for a variety of vessels, including dinghies, sailboats up to 12 tons, and general motorboats.”

By Propulsion Type

Electric outboard motors hold the dominant market share, driven by their higher thrust capacity, extended range, and suitability for larger fishing boats such as bass and pontoon models. Recent technological improvements—including longer-lasting lithium-iron phosphate batteries and higher-efficiency brushless motors—strengthen adoption across both recreational and professional fleets. Trolling motors remain essential for precise low-speed maneuvering during freshwater angling, sustaining strong penetration among sport fishermen. Integrated electric propulsion systems are emerging as a premium segment, offering seamless power management and quieter operation, particularly appealing to eco-tourism and specialty fishing applications.

- For example, Yamaha’s HARMO system uses a 3.7 kW rim-drive electric motor paired with a steering unit offering 140-degree articulation, enabling smooth and precise low-speed navigation. The setup supports quiet operation in marinas and freshwater zones where controlled maneuvering is vital.

By Usage

Recreational fishing is the largest usage segment, capturing the dominant market share thanks to rising participation in freshwater angling, expanding lake-access facilities, and growing consumer interest in quiet, emissions-free boating. Electric propulsion’s low operating cost and minimal maintenance further accelerate adoption among hobbyist anglers and families. Professional fishing sees steady uptake in regulated lakes where combustion engines face restrictions, while charter fishing operators increasingly deploy electric-powered boats to reduce fuel expenses and provide quieter, more environmentally responsible excursions that appeal to sustainability-minded tourists.

Key Growth Drivers

Rising Demand for Eco-Friendly and Low-Emission Fishing Vessels

Growing environmental awareness and stricter local waterway regulations are accelerating the transition from gasoline-powered boats to electric fishing vessels across the U.S. Anglers increasingly prefer quiet, emission-free operation to avoid disturbing fish habitats and to comply with restrictions on combustion engines in protected lakes and reservoirs. State agencies are expanding incentives that support clean recreational boating, while manufacturers introduce high-efficiency electric powertrains that deliver improved torque, longer run times, and faster charging. The growing adoption of lithium-based battery systems enhances weight distribution, safety, and energy density, enabling longer fishing excursions without range anxiety. As eco-tourism expands and outdoor recreation participation strengthens nationwide, electric fishing boats gain broader appeal among both casual and dedicated anglers. The cumulative push toward sustainability continues to reinforce electric platforms as a practical, compliant, and future-ready alternative to traditional gasoline-powered vessels.

· For example, X Shore’s Eelex 8000 features a 126 kWh battery and a 170 kW electric motor, offering up to 100 nautical miles of range at slow displacement speeds of about 5–7 knots. This design supports quiet, low-emission operation that appeals to anglers and recreational users seeking sustainable boating.

Advancements in Electric Propulsion Technologies and Battery Systems

Rapid innovation in electric propulsion systems stands as a major catalyst for market expansion, with manufacturers investing heavily in brushless motors, hydrodynamic propeller designs, and digitally controlled power management systems. Modern electric outboards now deliver higher thrust levels, improved acceleration, and greater endurance, making them suitable for larger vessel classes such as bass and pontoon boats. Parallel advancements in battery technology—specifically lithium-iron phosphate (LFP) and nickel-manganese-cobalt (NMC) chemistries—provide extended cycle life, enhanced safety profiles, and faster charging times. Integrated onboard energy-monitoring interfaces allow anglers to track consumption in real time, optimizing performance during long freshwater trips. Additionally, the expansion of marine charging infrastructure at marinas and recreational lakes reduces refueling limitations and supports wider adoption. As these technologies mature, electric fishing boats achieve performance capabilities that rival, and in some cases surpass, traditional internal combustion alternatives.

- For instance, Torqeedo’s Deep Blue 50R outboard delivers 50 kW of continuous electric power and integrates a 40 kWh BMW i battery module designed for more than 3,000 full charge cycles. This pairing offers proven durability and strong energy-storage performance for electric fishing and recreational boats.

Expanding Recreational Fishing Participation and Lifestyle-Oriented Boating

The growing popularity of recreational fishing in the U.S. strongly supports electric vessel adoption, especially as younger demographics enter the angling community and prioritize environmentally conscious outdoor activities. Electric fishing boats align with lifestyle preferences for low-noise, low-maintenance, and user-friendly operation, making them attractive to first-time buyers and families. Increasing investments in freshwater access points, fishing parks, and lake facilities further facilitate the use of electric-powered craft. Tournament circuits and sport-fishing communities are also encouraging electrification by adopting eco-compliant rules and showcasing electric-powered bass boats with high-thrust motors capable of competitive performance. The affordability of compact electric vessels—such as kayaks, canoes, and Jon boats—broadens market accessibility for casual anglers. The convergence of recreational expansion, infrastructure growth, and evolving consumer lifestyles continues to elevate the demand for electric fishing boats nationwide.

Key Trends & Opportunities

Integration of Smart Navigation, Telematics, and Connected Marine Systems

The increasing integration of onboard digital technologies—such as GPS-enabled fish finders, smart propulsion controls, and wireless energy-monitoring dashboards—presents a major opportunity for market growth. Manufacturers are deploying advanced telematics that enable real-time diagnostics, motor health monitoring, and predictive maintenance alerts, reducing downtime and enhancing user convenience. Bluetooth-enabled throttle systems, over-the-air firmware updates, and app-based battery analytics are becoming standard features in modern electric fishing vessels. As connectivity improves, anglers benefit from better route planning, optimized power consumption, and enhanced fishing precision. Growth in recreational electronics spending further accelerates adoption of digitally equipped boats. The trend toward smart, data-driven fishing experiences aligns closely with the capabilities of electric propulsion, offering a compelling value proposition and differentiating modern electric vessels from legacy gas-powered craft.

- For instance, X Shore’s Eelex 8000 includes a connected digital interface capable of monitoring over 150 onboard data points, including motor load, battery temperature, and energy draw in real time, with remote access enabled via a 4G telematics module.

Expansion of Lightweight Hull Materials and Modular Electric Platforms

Manufacturers are increasingly adopting lightweight composite materials—such as carbon fiber, fiberglass hybrids, and marine-grade aluminum—to reduce vessel weight and maximize electric motor efficiency. These materials enhance hydrodynamics, extend battery range, and improve maneuverability in shallow waters. Modular electric platforms represent a significant opportunity as they allow consumers to upgrade powertrains, swap battery packs, or add trolling systems without structural modifications. This adaptability appeals to anglers who require flexible configurations for different fishing environments. As OEMs introduce scalable electric architectures and customizable layouts for kayaks, pontoons, and sport boats, the market sees a surge in consumer interest driven by performance optimization and long-term value.

- For instance, Vision Marine Technologies’ E-Motion 180E platform pairs a 180 hp (≈134 kW) electric outboard with a modular battery architecture that supports dual 70 kWh packs, enabling configurable energy capacity for different fishing conditions. The paired hulls used by OEM partners such as Four Winns leverage lightweight composite structures that cut overall vessel weight by roughly 10–15%, improving hydrodynamic efficiency and extending real-world electric range.

Emergence of Rental and Shared Electric Fishing Boat Services

Growing demand for eco-friendly recreational activities is accelerating the expansion of electric boat rental programs at lakes, marinas, and state parks. Electric propulsion’s low maintenance requirements and simplified operation make these vessels ideal for rental fleets, reducing operational costs and improving safety for inexperienced boaters. Tourism operators increasingly prefer electric boats to comply with noise and emission regulations while offering quiet, wildlife-friendly excursions. As shared-access models gain traction—similar to the rise of e-bike and kayak rentals—new users are introduced to electric fishing platforms without upfront purchase costs, generating a strong opportunity for long-term conversion to private ownership.

Key Challenges

Limited Charging Infrastructure and Range Constraints in Remote Fishing Areas

Despite improvements in battery capacity, charging infrastructure remains uneven across fishing destinations, especially in remote lakes, reservoirs, and backcountry angling spots. Many recreational sites lack high-capacity marine chargers or shoreline power connections, creating uncertainty for anglers planning extended trips. Battery depletion risks limit usage on larger water bodies where long-distance travel is required. Although portable charging units and solar-based auxiliary systems are emerging, they remain insufficient for high-thrust motors used in competitive or professional fishing. Until widespread charging networks are established, range anxiety and logistical planning continue to constrain broader market adoption, particularly among traditional gasoline-boat users transitioning to electric.

Higher Upfront Cost of Electric Propulsion Systems Compared to Gasoline Alternatives

The initial cost of electric propulsion—driven by premium battery packs, digital control systems, and advanced motor technologies—remains a significant barrier for budget-sensitive anglers. While operational expenses are lower over the vessel’s lifecycle, many consumers perceive electric fishing boats as costlier than traditional gasoline models, especially in the bass boat and pontoon categories where high-thrust electric outboards are required. Replacement battery expenses also add to long-term ownership considerations. Limited economies of scale and fluctuating battery-material costs further challenge affordability. Until prices stabilize and production volumes increase, upfront investment concerns will continue to hinder adoption among price-conscious segments, slowing market penetration.

Regional Analysis

Northeast

The Northeast holds approximately 24% of the U.S. electric fishing boat market, supported by strong adoption in states such as New York, Pennsylvania, and Massachusetts where smaller inland lakes and regulated waters increasingly restrict gasoline engines. Anglers prefer quiet, emission-free propulsion for trout, bass, and freshwater recreational fishing. State-led clean boating initiatives and expanding shore-power infrastructure at marinas accelerate regional penetration. Growing participation in weekend lake fishing and steady demand for kayaks, canoes, and compact bass boats further strengthens the region’s position in electric vessel adoption.

Midwest

The Midwest accounts for the largest share at 33%, driven by its dense concentration of freshwater fishing destinations, including the Great Lakes, Mississippi River Basin, and numerous inland lakes. Electric outboards and trolling motors remain highly popular due to their silent operation, which is advantageous for bass and walleye fishing. States such as Minnesota, Wisconsin, and Michigan show high electrification rates due to extensive recreational angling communities and supportive clean-water policies. Demand is further boosted by tournament fishing circuits and increased consumer preference for low-maintenance, lightweight electric boats suitable for varied freshwater terrains.

South

The South represents about 28% of the market, supported by strong fishing cultures in Florida, Texas, Alabama, and Georgia. The region benefits from year-round fishing seasons, extensive freshwater reservoirs, and growing restrictions on combustion engines in sensitive ecosystems. Electric pontoons and bass boats see strong uptake among leisure and sport fishermen who value quiet operation for shallow-water angling. Expanding lake tourism, increased marina electrification, and rising interest in eco-friendly boating packages from rental operators contribute to sustained market growth across the southern states.

West

The West accounts for roughly 15% of market share, driven primarily by adoption in California, Washington, and Oregon, where environmental regulations and sustainability-oriented boating policies are more stringent. The region’s electric boat demand is supported by high environmental awareness, expanding electric marina infrastructure, and growth in recreational fishing around reservoirs and mountain lakes. Kayaks, canoes, and lightweight electric platforms show strong traction due to their portability and suitability for diverse water conditions. Although limited by fewer large freshwater fishing zones compared to the Midwest or South, the region exhibits steady year-over-year electrification momentum.

Market Segmentations:

By Boat Type

- Bass Boats

- Pontoon Boats

- Jon Boats

- Kayaks and Canoes

By Propulsion Type

- Electric Outboard Motors

- Trolling Motors

- Integrated Electric Propulsion Systems

By Usage

- Recreational Fishing

- Professional Fishing

- Charter Fishing

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. electric fishing boat market is characterized by a mix of established marine manufacturers, electric propulsion specialists, and emerging innovators accelerating product advancements. Key players focus on expanding electric outboard portfolios, integrating high-thrust brushless motors, and improving battery systems to deliver longer run times and higher torque suitable for bass boats, pontoons, and specialized freshwater vessels. Companies invest heavily in lithium-based energy solutions, lightweight hull materials, and smart onboard electronics to enhance operational efficiency and user experience. Partnerships between boat builders and electric propulsion manufacturers are becoming more common, enabling optimized vessel–motor integration. Competitors also target niche categories such as electric kayaks and compact fishing platforms to capture growing recreational demand. As environmental regulations tighten and consumer interest in sustainable boating accelerates, leading companies differentiate through performance upgrades, durable marine-grade components, and expanded charging support networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Greenline showcased its hybrid-electric propulsion (6G H-Drive) line at a major in-water boat show, underscoring the firm’s push toward electric and hybrid solutions.

- In August 2024, Echandia opened its first U.S.-based production facility in Marysville, Washington, establishing a 20,000-square foot plant for heavy-duty maritime battery manufacturing. The facility supports production of LTO-based marine batteries optimized for rapid charging and robust cycle life.

Report Coverage

The research report offers an in-depth analysis based on Boat type, Propulsion type, Usage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric propulsion will become the preferred choice for freshwater anglers as silent operation and zero emissions gain broader acceptance.

- Adoption of high-thrust brushless electric outboards will accelerate, enabling larger fishing boats to transition fully from gasoline engines.

- Battery technology will advance toward higher energy density and faster charging, extending range for long-distance freshwater fishing.

- Smart navigation, telematics, and app-based energy management will become standard features across mid- and high-end fishing boats.

- Tournament circuits and regulated lakes will increasingly mandate or encourage electric propulsion, boosting compliance-driven demand.

- Lightweight composite hull designs will expand, improving efficiency and maneuverability for electric-powered vessels.

- Rental fleets and shared-access electric fishing boats will grow across marinas, state parks, and tourism hubs.

- Manufacturers will scale modular electric platforms that support powertrain upgrades and interchangeable battery packs.

- Partnerships between boat builders and electric motor companies will intensify to optimize integrated propulsion systems.

- Regional adoption will broaden as marina charging networks expand and state-level clean boating policies strengthen.